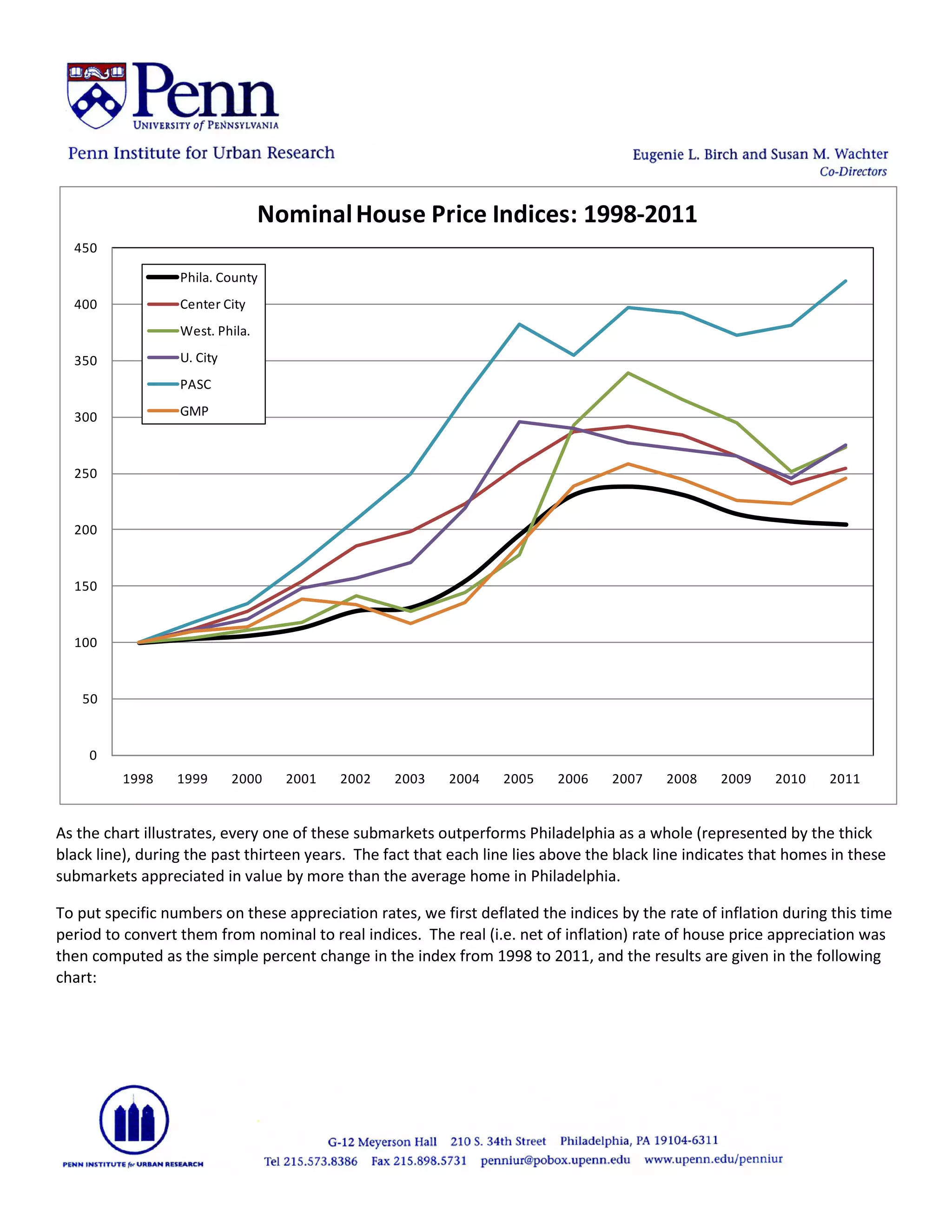

The document discusses the performance of university-supported housing in West Philadelphia, highlighting its significant appreciation in value compared to the broader Philadelphia market from 1998 to 2011. Initiatives from the University of Pennsylvania, such as the university city district and the guaranteed mortgage program, have contributed to improved homeownership and quality of life, resulting in notable increases in home values, especially in neighborhoods directly benefiting from these programs. The analysis demonstrates that homes in the targeted submarkets outperformed Philadelphia's overall housing market, with the Penn Alexander catchment area seeing a remarkable 211.5% increase in real house prices during the examined period.