Scrutiny & audit under GST - Dr Sanjiv Agarwal

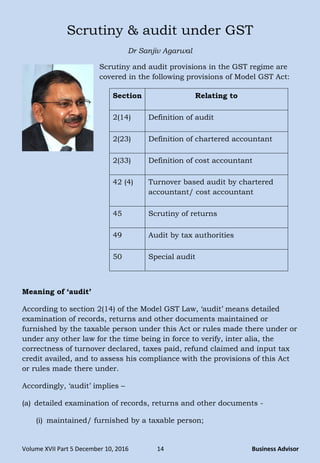

- 1. Volume XVII Part 5 December 10, 2016 14 Business Advisor Scrutiny & audit under GST Dr Sanjiv Agarwal Scrutiny and audit provisions in the GST regime are covered in the following provisions of Model GST Act: Section Relating to 2(14) Definition of audit 2(23) Definition of chartered accountant 2(33) Definition of cost accountant 42 (4) Turnover based audit by chartered accountant/ cost accountant 45 Scrutiny of returns 49 Audit by tax authorities 50 Special audit Meaning of ‘audit’ According to section 2(14) of the Model GST Law, ‗audit‘ means detailed examination of records, returns and other documents maintained or furnished by the taxable person under this Act or rules made there under or under any other law for the time being in force to verify, inter alia, the correctness of turnover declared, taxes paid, refund claimed and input tax credit availed, and to assess his compliance with the provisions of this Act or rules made there under. Accordingly, ‗audit‘ implies – (a) detailed examination of records, returns and other documents - (i) maintained/ furnished by a taxable person;

- 2. Volume XVII Part 5 December 10, 2016 15 Business Advisor (ii) under GST law/ any other law or rules. (b) Verification of correctness of - (i) turnover declared; (ii) taxes paid; (iii) refund claimed; and (iv) input tax credit availed. (c) Assessment of compliances with provisions of GST law and rules. Scrutiny and audit The scope of audit would include the first two which aid in the conduct of audit. The purpose of preliminary scrutiny of returns includes: ensuring the completeness of the information furnished in the return; arithmetic correctness of the amount computed as tax and its timely payment; and timely submission of the return and identification of non-filers and stop- filers. Scrutiny of documents, viz. ledger accounts, returns of tax, compliances etc. is nothing but a strong compliance verification procedure or mechanism. For example, in the case of a return, the purpose of detailed scrutiny of returns is to ensure the correctness of the assessment made by the assessee. Such scrutiny plan only supplements the audit programme. It is expected that, for an effective scrutiny, it shall follow the best audit practices. The scope of audit, on the other hand, is to inspect the financial records of a company for a complete financial year in order to identify non-compliance issues and to evaluate the assessee‘s internal control system. The two processes of audit and scrutiny are, in fact, complementary to each other. Audit based on turnover According to section 42(4) of the Model GST Law, every registered taxable person whose turnover during a financial year exceeds the prescribed limit

- 3. Volume XVII Part 5 December 10, 2016 16 Business Advisor shall get his accounts audited by a chartered accountant or a cost accountant and shall submit to the proper officer a copy of the audited statement of accounts, the reconciliation statement along with annual return under sub-section (2) of section 30 and such other documents in the form and manner as may be prescribed in this behalf. According to section 42(4), following features of turnover based GST audit are important – (a) Audit provision is applicable to every registered taxable person (not meant for unregistered assessees). (b) Audit will be required in cases where turnover during a financial year exceeds the limit which will be prescribed. (c) Taxable person is required to get its/ his accounts audited by a chartered accountant or cost accountant who will be appointed as well as remunerated by the taxable person only. (d) Taxable person shall be required to submit the following to the proper officer of GST – (i) Copy of audited statement of accountants; (ii) Reconciliation statement required u/s 30(2) of the GST Act (i.e. annual return); (iii) Other prescribed documents (to be prescribed). (e) Reconciliation statement should contain reconciliation of the value of supplies declared in the return furnished with the audited financial statements. Statements required to be furnished along with annual return According to section 30 of the GST law, every taxable person who is required to get his accounts audited under sub-section (4) of section 42 shall furnish, electronically, the annual return along with the audited copy of the annual accounts and a reconciliation statement, reconciling the value of supplies declared in the return furnished for the year with the audited annual financial statement, and such other particulars as may be prescribed. Scrutiny

- 4. Volume XVII Part 5 December 10, 2016 17 Business Advisor Section 45 of the Model GST Law authorises the proper officer to scrutinise the return for verification of correctness of the return and, if any discrepancies are noticed by the officer he shall inform about the same to the taxable person. Where the explanation regarding such discrepancies are found acceptable, no further action shall be taken against the assessee, but where no explanation is furnished or the explanation furnished is not satisfactory, the proper officer may initiate appropriate action against such taxable person. According to provisions of scrutiny of returns – scrutiny shall be done by the proper officer; scrutiny shall be done of return and related particulars furnished by taxable person; purpose of said scrutiny shall be to verify the correction of return; manner of scrutiny of return will be prescribed; proper officer shall inform the taxable person (assessee) about the discrepancies noticed during the course of scrutiny; by such intimation, explanation is sought from the assessee; where explanation furnished by assessee is found acceptable, no further action shall be required and assessee be informed accordingly. Action by proper officer against assessee According section 45(4) of the Model GST Law, where – no explanation is furnished, or explanation furnished is not found satisfactory, or taxable person fails to take corrective action/ measures after accepting the discrepancies, the proper officer may initiate appropriate action against such taxable person which may include– audit by tax authorities u/s 49; special audit u/s 50;

- 5. Volume XVII Part 5 December 10, 2016 18 Business Advisor inspection, search or seizure u/s 60; proceed to determine tax and other dues u/s 51A or 51B of the Act providing for recovery of dues. According to section 45(2) of the Model GST Law, where the explanation given by the taxpayer in response to discrepancies informed by the proper officer is found acceptable, the taxable person shall be informed accordingly, and no further action shall be taken in this regard by the proper officer. Audit by tax authorities According to section 49 of the Model GST Law, in relation to audit in GST regime, the following points are worth noting: (i) who can authorise/ conduct audit – Commissioner of CGST or Commissioner of SGST or officer authorised by him by an order (general or specific); (ii) audit of what – business transactions of any taxable person; (iii) audit when - after at least 15 days advance notice; (iv) how audit will be done – to be carried out in a transparent manner; period to be covered, frequency and manner to be prescribed; (v) where audit may be conducted - at place of business of taxable person or their office (revenue department); (vi) audit period to be completed - within three months of date of commencement of audit (may be extended by further period of six months); (vii) what is expected from auditee taxable person – auditee is required: (a) to afford the officer auditing the necessary facility to verify books of accounts/ other documents as he may require at such place; (b) to furnish information which he may require; (c) to render assistance for timely completion of audit. (viii) what auditing officer should do on completion of audit – to inform the taxable person about – (a) audit findings without delay;

- 6. Volume XVII Part 5 December 10, 2016 19 Business Advisor (b) taxable person‘s rights and obligations; (c) reasons for audit findings. ‗Commencement of audit‘ shall imply that date on which the records and other documents, called for by the tax authorities, are made available by the taxable person, or date of actual institution of audit at the place of business, whichever is later. The period of three months can be extended by six months for reasons to be recorded in writing. On completion of audit u/s 49, proper officer is required to do the following without delay – (a) inform the audit findings to the taxable person whose records have been audited; (b) Inform the taxable person of his rights and obligations; (c) Inform the taxable person the reasons for the audit findings; (d) Initiate action u/s 51, i.e., determination of tax not paid or short paid or erroneously refunded, if the audit results in detection of (i) tax not paid or short paid, or (ii) tax erroneously refunded, or (iii) input tax credit erroneously availed. Audit u/s 49 is a discretionary audit and shall be carried out only in cases where such audit of business transaction as is deemed proper, in the given set of facts and circumstances. Section 49 only provides for audit of business transactions of a taxable person. Only when the audit results in detection of tax evasion or wrong input credit availed, proper officer may initiate action u/s 51 of the GST law. Section 51 provides for determination of tax in the following situations – (a) Determination of tax not paid or short paid or erroneously refunded or input tax credit wrongly availed or utilised for any reason other than fraud or any willful misstatement or suppression of facts; (b) Determination of tax not paid or short paid or erroneously refunded or input tax credit wrongly availed or utilised by reason of fraud or any willful-misstatement or suppression of facts. Special audit

- 7. Volume XVII Part 5 December 10, 2016 20 Business Advisor Special audit is a tool provided to the revenue to order for special audit under section 50 of the Model GST Law to be carried out by a chartered accountant or a cost accountant on the directions of Deputy or Assistant Commissioner with prior approval of the Commissioner, if such officer is of the opinion that the assessee has not declared the value correctly or credit availed is not within the normal limits. The Deputy/ Assistant Commissioner should consider the following factors before taking a decisions to direct special audit u/s 50 of the Model GST law: (a) nature and complexity of the case; (b) Interest of revenue. These principles should guide his opinion that – (a) Value has not been correctly declared, or (b) Credit availed is not within the normal limits, i.e., there are instances of abnormal variation in credit amount. Special audit u/s 50 of Model GST Law can be ordered or directed – (i) with prior approval of the Commissioner; (ii) by Deputy or Assistant Commissioner; (iii) in writing to the auditee taxpayer; (iv) to get records including books of account examined and audited; (v) to get audit done by a chartered accountant or cost accountant nominated by Commissioner (not by Deputy or Assistant Commissioner). The auditor appointed for carrying out special audit is required to submit audit report duly signed and certified by him, within ninety days to the Deputy/ Assistant Commissioner. The report shall also contain other particulars in the report as may be specified in his terms of reference.

- 8. Volume XVII Part 5 December 10, 2016 21 Business Advisor The Deputy/ Assistant Commissioner may relax or extend the period by up to another ninety days in the following situations – (a) on application by taxable person, or (b) on application by chartered accountant/ cost accountant, or (c) for any other material and sufficient reasons. The discretion to extend time rests with the Deputy/ Assistant Commissioner. Where the special audit conducted results in detection of tax not paid or short paid or erroneously refunded, or input tax credit erroneously availed, the proper officer may initiate action under section 51 of the Model GST Law. The expenses of, and incidental to, the examination and audit of records, including the remuneration of such chartered accountant or cost accountant, shall be determined and paid by the Commissioner and that such determination shall be final. The taxpayer shall not bear such expenses. (Dr Sanjiv Agarwal is Partner, Agarwal Sanjiv & Company, Jaipur.)