Income tax-notes [compatibility mode]

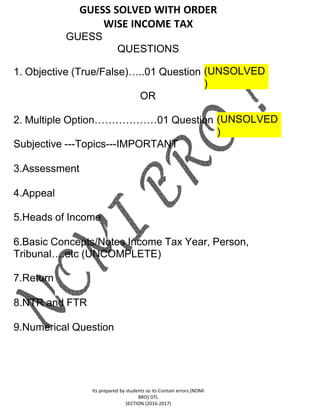

- 1. GUESS SOLVED WITH ORDER WISE INCOME TAX GUESS QUESTIONS Its prepared by students so its Contain errors (NOMI BRO) DTL SECTION (2016-2017) 1. Objective (True/False)…..01 Question (UNSOLVED ) OR 2. Multiple Option………………01 Question (UNSOLVED ) Subjective ---Topics---IMPORTANT 3.Assessment 4.Appeal 5.Heads of Income 6.Basic Concepts/Notes Income Tax Year, Person, Tribunal….etc (UNCOMPLETE) 7.Return 8.NTR and FTR 9.Numerical Question

- 2. GUESS SOLVED WITH ORDER WISE INCOME TAX 1 ASSESSMENT SEC 120 INCOPME TAX ORDINANCE 2001ASSESSMENT sec 120 INCOME TAX A charge imposed by government on the annual gains of a person, corporation, or other taxable unit derived through work, business pursuits, investments, property dealings, and other sources determined in accordance with the internal revenue code or state law. ASSESSMENT SEC 120 Sec(120) Assessments means , Where a taxpayer has furnished a complete return of income (other than a revised return under sub-section (6) of section 114) for a tax year ending on or after the 1st day of July, 2002,- the Commissioner shall be taken to have made an assessment of taxable income for that tax year, and the tax due thereon, equal to those respective amounts specified in the return; and The return shall be taken for all purposes of this Ordinance to be an assessment order issued to the taxpayer by the Commissioner on the day the return was furnished. ASSESSMENT SEC 120 Where the return of income furnished is not complete, the Commissioner shall issue a notice to the taxpayer informing him of the deficiencies (other than incorrect amount of tax payable on taxable income, as specified in the return, or short payment of tax payable) and directing him to provide such information, particulars, statement or documents by such date specified in the notice. Where a taxpayer fails to fully comply, by the due date, with the requirements of the notice under sub-section (3), the return furnished shall be treated as an invalid return as if it had not been furnished BEST JUDGMENT ASSESSMENT, SEC 121 (1) Where a person fails to Furnish a statement as required by a notice under sub-section (5) of section 115; or Furnish a return as required under section 143 or section 144; or Furnish the statement as required under section 116; or produce before the Commissioner, or any person employed by a firm of chartered accountants 4[or a firm of cost and management accountants] under section 177, accounts, documents and records required to be maintained under section 174, or any other relevant document or evidence that may be required by him for the purpose of making assessment of income and determination of tax due thereon, The Commissioner may, based on any available information or material and to the best of his judgment, make an assessment of the taxable income 5[or income] of the person and the tax due thereon. As soon as possible after making an assessment under this section, the Commissioner shall issue the assessment order to the taxpayer stating— The taxable income the amount of tax due SELF ASSESSMENT Its prepared by students so its Contain errors (NOMI BRO) DTL SECTION (2016-2017)

- 3. GUESS SOLVED WITH ORDER WISE INCOME TAX The concept of Universal Self Assessment is embodied in section 120 of the Income Tax Ordinance, 2001. Accordingly, all returns of income, other than the revised returns under sub-section (6) of section1 4, f led for the tax year 2003 onwards shall be returns of Universal Self Assessment. In view of clause (b) of section 120, return qualifying for acceptance under Universal Self Assessments shall be deemed to be the assessment order made and issued by the Commissioner on the date the return was furnished". ASSESSMENT OF PERSONS WHO HAVA NOT FURNISHED A RETURN, SEC 121 Its prepared by students so its Contain errors (NOMI BRO) DTL SECTION (2016-2017) (1) Where a person required by the Commissioner through a notice] to furnish a return of income for a tax year fails todo so by the due date, the Commissioner may, based on any available information and to the best of the Commissioner's judgment, make an assessment of the taxable income of the person and the tax due thereon for the year. As soon as possible after making an assessment under this section, the Commissioner shall issue, in writing, an assessment order to the taxpayer stating the taxable income of the taxpayer for the year; The amount of tax due; The amount of tax paid, if any; and The time, place, and manner of a appealing the assessment Order. (3) An assessment order shall only be issued within five years after the end of the tax year, or the income year, to which it relates. AMENDMENT OF ASSESSMENTS, SEC 122 The Commissioner has power to amend an assessment by making such alteration or additions as the Commissioner considers necessary to ensure that the taxpayer is liable for the correct amount of tax. An assessment order can only be amended within five years from the end of the financial year in which the Commissioner has issued or is treated as having issued the original assessment order. The Commissioner has power to make further amendments as many times as may necessary within the later of 5 years from the end of financial year 1 year from the end of the financial year in which amendment was made ♦ AMENDED ORDER Where a person does not produce accounts and records, or details of expenditure, assets and liabilities or any other information required for the purposes of audit under section 177, or does not file wealth statement under section 116, the Commissioner may, based on any available information and to the best of his judgment; make an amended assessment. Subject to sub-section (9), the Commissioner may amend, or further amend, an assessment order, if he considers that the assessment order is erroneous in so far it is prejudicial to the interest of revenue. Any amended assessment order under sub-section (5A) may be passed within the time-limit specified in sub-section (2) or sub-section (4), as the case may be. The following points needs to be remembered for amended assessment:

- 4. GUESS SOLVED WITH ORDER WISE INCOME TAX An amended assessment order is to be treated in all respects as an assessment order the purpose of this Ordinance, other than for the purposes of sub-section(1) of section 122 PROVISIONAL ASSESSMENT, SEC 122C Where in response to a notice under sub-section (3) or sub-section (4) of section 114 a person fails to furnish return of income for any tax year, the Commissioner may, based on any available information or material and to the best of his judgment, make a provisional assessment of the taxable income or income of the person and issue a provisional assessment order specifying the taxable income or income assessed and the tax due thereon. Its prepared by students so its Contain errors (NOMI BRO) DTL SECTION (2016-2017) Notwithstanding anything contained in this Ordinance, the provisional assessment order completed under sub-section (1) shall be treated as the final assessment order after the expiry of sixty days from the date of service of order of provisional assessment and the provisions of this Ordinance shall apply accordingly PROVISIONAL ASSESSMENT IN CERTAIN CASES, SEC 123 Where a concealed asset of any person is impounded by any department or agency of the Federal Government or a Provincial Government, the Commissioner may, at any time before issuing any assessment order under section 121 or any amended assessment order under section 122, issue to the person a provisional assessment order or provisional amended assessment order, as the case may be, for the last completed tax year of the person taking into account the concealed asset. The Commissioner shall finalize a provisional assessment order or a provisional amended assessment order as soon as practicable In this section, concealed asset means any property or asset which, in the opinion of the Commissioner, was acquired from any income subject to tax under this Ordinance ASSESSMENT IN RELATION TO DISPUTED PROPERTY, SEC 125 Where the ownership of any property the income from which is chargeable to tax under this Ordinance is in dispute in any Civil Court in Pakistan, an assessment order or amended assessment order in respect of such income may be issued at any time within one year after the end of the financial year in which the decision of the Court is made. EVIDENCE OF ASSESSMENT The production of an assessment order or a certified copy of an assessment order shall be conclusive evidence of the due making of the assessment and, except in proceedings relating to the assessment, that the amount and all particulars of the assessment are correct. Any of assessment or other document purporting to be made, issued, or executed under this Ordinance may not be •Quashed or deemed to be void or voidable for want of form; or •Affected by reason of any mistake, defect, or omission therein, if it is, in substance and effect, in conformity with this Ordinance and the person assessed, or intended to be assessed or affected by the document, is designated in it according to common understanding

- 5. GUESS SOLVED WITH ORDER WISE INCOME TAX Rectification of mistakes sec 221 Its prepared by students so its Contain errors (NOMI BRO) DTL SECTION (2016-2017) Point of PAKISTAN INDIA comparison Types of Income 1. Salary 1. Salary 2. House Property 2. House Property 3. Business / Profession 3. Business / Profession 4. Capital Gain 4. Capital Gain 5. Other Sources 5. Other Sources 1. Sec 140 A - Self Types of 1. Best Judgment Assessment, Assessment Assessment Sec 121 2. Sec 143 (3) - Regular / 2. Amendment of assessments , Scrutiny Assessment Sec 122 3. Sec 144 - Best Judgment 3. Provisional assessment ,Sec Assessment 122C 4. Sec 147 - Assessment / 4. Assessment Of Persons Who Have Not Furnished A Return , Reassessment of Income sec(121) 5. Escaping Assessment 5. Self assessment

- 6. GUESS SOLVED WITH ORDER WISE INCOME TAX Its prepared by students so its Contain errors (NOMI BRO) DTL SECTION (2016-2017) Point of comparison PAKISTAN INDIA HUF / Firm / LLP / Cooperative / Company / AOP / BOI / Artificial Juridical Person Normal Procedure ofThe usual process of T axation is: The usual process of Taxation Taxation 1) The assessee earns income is: 2) He deposits 1) The assesses earns income 3) The assesses fills Income Tax 2) He deposits tax - based on Return (IT R) self calculation - or as determined by his T ax Consultant 3) T he assessee fils Income T ax Return (IT R) Assessee The 'Person' who is under The 'Person' who is under assessment is called the Assessee assessment is called the Assessee. The Person / Assessee can be an Individual /

- 7. GUESS SOLVED WITH ORDER WISE INCOME TAX Point of PAKISTAN INDIA comparison Evidence of The production of an assessment order The production of an assessment or a certified copy of an assessment assessment order or a order shall be conclusive evidence of certified copy of an the due making of the assessment and, assessment order shall be except in proceedings relating to the conclusive evidence of the due Assessment, That the amount and all making Of the assessment particulars of the assessment are and, except in proceedings correct. Relating to the assessment, that the amount and all particulars of the assessment are correct CASE LAW REGARDING ASSESSMENT AQEEL AHMED ABBASI, J. ~ Being aggrieved and dissatisfied with the order dated 30-102009 passed by the Income Tax Appellate Tribunal in I.T.A. No.281/KB/2008 (Tax Year 2004), whereby the appeal filed by the applicant was dismissed. The applicant has filed immediate e Reference Application under section 133(1) of Income Tax Ordinance, 2001 and has wished d- For the following two questions of law, which according to learned counsel for the applicant arise from the impugned order passed by the Tribunal and require authoritative pronounce mint by this Court •Whether in terms of section 133(2A) of the Income Tax Ordinance, 2001 on the date of hearing of appeal on 10-102009 when more than six months had gone since the filing of appeal on 12-4-2008; the Appellate Tribunal ceased to have jurisdiction to hear and decide the e appeal and the relief wanted in the grounds of appeal by the appellant/tax payer shall be deemed to have been allowed to the tax payer? •Whether clause 3A of Part IV of the Second Schedule to the Income Ta x Ordinance, 2001 inserted through Finance Act, 2004, is in the nature of corer act/beneficial legislation and is applicable to tax year 2004 and the applicant/ tax payer is entitled for exemption claimed? Its prepared by students so its Contain errors (NOMI BRO) DTL SECTION (2016-2017)

- 8. GUESS SOLVED WITH ORDER WISE INCOME TAX Its prepared by students so its Contain errors (NOMI BRO) DTL SECTION (2016-2017) Brief facts as recorded by the Appellate Tribunal and stated by the learned d advice for the applicant in the instant reference application are that the taxpayer filed return of income for tax year 2004 declaring income of Rs. 814,064. he assessment was deemed to have been finalized under the p revisions of section 120 of the Income Tax Ordinance, 2001. The Additio l Commissioner of Income Tax found the deemed assessment wrong in s o far as damaging to the interest of revenue and he issued show- Cause notice to the taxpayer as under:-- "On examination of your case record for the Tax Year 2004 open the at you have declared income f om score amounting to Rs.42,766,374 and claimed its exemption under State Bank of Pakistan, Circ0ular No.29 of 2 002. The exemption claimed under State Bank of Pakistan, Circular is not allowable under Income Tax Ordinance and same is to be disallowed und err section 70 of Income Tax Ordinance, 2001 and mark up is be treated an d taxed income from business." The explanation furnished was not found satisfactory by the taxpayer, Learned advocate for the applicant has pressed question No. 2 only which h according to learned advocate is an important question of law which airs as from the order passed by the learned tribunal in the instant case. While e giving the brief history of the case, it has been contended by learned co unseal that for the tax year 2004 the applicant could not file return of Inco me within due date i.e. 30th September 2004 On the other hand, learned advocate for the respondent has controverter the submissions made by the learned advocate for the applicant and has supported the imp geed order passed by the Income Tax Appellate Tribunal in the instant case. I t has been contended by the learned advocate for the respondent that on the expiry of last date for filing of return for the tax year 2004 i.e. 30th September r 2004, the matter became past and closed transaction for the tax year 2004, whereas the applicant was required to furnish the return of total income keep ing in view the provision of law as existed on the closing date of the tax year i. e. 30th June 2004 We have heard both the learned counsel and perused the record. S nice the learned counsel for the applicant has pressed question No .2 only which relates to prospective or retrospective Application of Clause (3A) of Part- IV of the Second Schedule, therefore, will be advantageous to reproduce the provision of Clause (3A) of Part IV of the Second Schedule, section 34 and section 70 of the Income Tax Ordinance, 2001 . If we may examine the provision of Clause 3A of Part IV of the Second Schedule to the Income Tax Ordinance, 2001, it can be seen them at the said provisions are remedial and beneficial in nature as certain in relief has been given to the tax payers by excluding its benefit d derived by way of waiver of profit and debt or the debt itself, from t he chargeability to tax In view of hereinabove facts and by applying the ratio of afore cite d judgments, we are of the opinion that the Provision of Clause (3 A) of Part IV of the Second Schedule of Income Tax Ordinance, 200 1 inserted through Finance Act, 2004 are remedial and beneficial I n nature, hence will apply retrospectively, whereas its benefit may also be extended to the case of the present applicant for the tax ye are 2004, which was pending and not finalized in terms of section 1 20(1) of the Income Tax Ordinance, 2001. Accordingly, instant reef fence application is allowed and the question No.2 as proposed he rein above through instant reference application is answered in affix amative in favor of the applicant. Since the learned counsel for the e applicant has not pressed question No.1 nor advanced any argue mints in this regard, therefore, we would not answer such question n, which otherwise, appears to be a question of law. Conclusion 2 FORUM OF APPEALS UNDER THE INCOME TAX LAWS OF PAKISTAN WHAT IS AN APPEAL: According to Black's Law Dictionary, an appeal is a “proceeding undertaken to have a decision reconsidered by bringing it to a higher authority, especially the submission of a lower court's decision to a higher court, for review and possible reversal". The party complaining is called the appellant and the defending party a respondent. There is no inherent right of appeal. If a right of appeal is not given by the statute, no appeal would lie. This right must be given by express enactment. It cannot be implied. INCOME TAX APPELLATE AUTHORITIES:

- 9. GUESS SOLVED WITH ORDER WISE INCOME TAX Its prepared by students so its Contain errors (NOMI BRO) DTL SECTION (2016-2017) The Income Tax Ordinance, 2001 lays down the scheme of appeals etc. at various levels. If a tax payer is aggrieved with an order of the Income Tax Authorities, he is entitled to seek remedy in the form of appeal or reference Under this Ordinance, the following are the appellate authorities: Commissioner (Appeals); Income Tax Appellate Tribunal; High Court; and Supreme Court of Pakistan. Sections 127 to 134 of the Income Tax Ordinance, 2001 specifically grant the right of appeal and revision. Against the order of the Commissioner, the tax payer can go into appeal to the Commissioner (Appeals). The order of the Commissioner (Appeals) is further appealable. The party aggrieved, whether a tax payer or the Income Tax Department, may appeal against his order to the Appellate Tribunal. An appeal against the order of the Appellate Tribunal lies to High Court but only on point of law. The order of the High Court can be challenged in the Supreme Court which is the final authority in this chain. Appeal to the Commissioner (Appeals): An appeal against the following orders of the Commissioner of Income Tax or a taxation officer mentioned in section 127 lies to Commissioner (Appeals): Procedure for filing an appeal: No appeal can be filed unless the taxpayer has paid the amount of tax due on the basis of return. Appeal should be: In the prescribed manner; Verified in the prescribed manner; State precisely the grounds upon which the appeal is made; Be accompanied by prescribed fee; and Be lodged with the Commissioner (Appeals) within the time set out for it. The prescribed fee against an assessment shall be lesser of one thousand rupees or ten percent of the tax assess; or In other case: Where the appellant is a company, one thousand rupees; or Where the appellant is not a company, two hundred rupees Time limit for filing an appeal: The appeal shall be filed within 30 days of the following dates: Where the appeal relates to any assessment or penalty, the date of service of the demand notice relating to the said assessment or penalty order; or In any other case, the date on which intimation of the order to be appealed against is served. Extension of time for filing an appeal: The appellate authority is empowered to admit an appeal after the expiry of above mentioned period if he is satisfied that the appellant was prevented by sufficient cause from presenting the appeal within that period. Procedure in appeal: The Commissioner (Appeals): Shall give notice of the day fixed for hearing of the appeal to the appellant as well as to the Commissioner against whose order the appeal has been made.

- 10. GUESS SOLVED WITH ORDER WISE INCOME TAX May adjourn the hearing of appeal from time to time. May allow the appellant to file new grounds of appeal (other than those already filed) if he is satisfied that omission of the ground of appeal was not willful or unreasonable. Can call for any particulars required for deciding the issue rose in the appeal and can order the Commissioner of Income Tax to make further enquiry. Shall not admit any documentary material or evidence which was not produced before the assessing off cer, unless he is satisfied that the appellant was prevented by sufficient cause from producing such material or evidence before the assessi officer. Decision in appeal: While disposing of an appeal lodged under section 127, the Commissioner (Appeals): A. Incase of an appeal against an assessment order may: Set aside assessment order and direct that a new assessment order be made; or Confirm, modify or annual the assessment order; or In any other case, make such order as he may think fit. Shall not increase the amount of an assessment order or decrease the amount of any refund unless the appellant has been given a reasonable opportunity of showing cause against such increase or decrease. Where, as a result of appeal, any change is made in the assessment or new assessment is made in regard to AOP, he may authorize amendment accordingly within the time limit. Shall serve his order on the appellant and the Commissioner as soon as possible. If he does not make an order on an appeal before expiry of three months from the end of the month in which the appeal was lodged, (excluding the period the appeal is adjourned on the request of the appellant), and the relief sought by the appellant in the appeal shall be treated to have been given. This provision of shall not apply unless a notice by the appellant stating that no such order has been made is personally served by the appellant on the Commissioner (Appeals) not less than thirty days before the expiration of the period of three months. Appointment of the Appellate Tribunal: The Appellate Tribunal is constituted by the Federal Govt. and functions under the Ministry of Law and Justice. It consists of two classes of Members, (I) Judicial Members, and (ii) Accountant Members. It is headed by a chairperson. Qualifications of members: A Judicial member shall be a person who: Has exercised the powers of a District Judge and is qualified to be a Judge of a High Court; or Is or has been an advocate of a High Court and is qualified to be Judge of the High Court. An Accountant Member may be a person who is an officer of the Income Tax Group equivalent in rank to that of a Regional Commissioner. Federal Govt. appoints a member of the Appellate Tribunal as Chairperson of the Tribunal and, except in special circumstances, the person appointed should be a judicial member. The Appellate Tribunal is empowered to regulate its own procedure and the procedure of its Benches in all matters arising out of the discharge of its functions including the places at which Its prepared by students so its Contain errors (NOMI BRO) DTL SECTION (2016-2017)

- 11. GUESS SOLVED WITH ORDER WISE INCOME TAX If Benches differ on any point, the same will be decided according to the opinion of the majority. In case the members are equally divide on a point, it shall be referred to the Chairperson. Reference to the High Court: Its prepared by students so its Contain errors (NOMI BRO) DTL SECTION (2016-2017) Appeal to the Appellate Tribunal: Procedure for filing an appeal: Where the tax payer or the Commissioner objects to an order passed by the Commissioner (Appeals), they can file an appeal against the order of the Appellate Tribunal. An appeal shall be: In the prescribed form; Verified in the prescribed manner; Accompanied by the prescribed fee (except in case of Commissioner); and Filed within 60 days from the date of the communication of impugned order to the party concerned. Fee payable for filing an appeal: The appeal should be accompanied by a fee of Rs. 2500 in the case of companies and Rs. 500 in other cases. The Commissioner is not required to pay any appeal fee. Extension of time limit for filing an appeal: The Appellate Tribunal is empowered to admit an appeal after the specified time if it is satisfied that the appellant was prevented by sufficient cause from presenting the appeal within that period. Income Tax payable unless stayed: Unless the recovery of income tax has been stayed by the Appellate Tribunal, it shall be payable in accordance with the assessment made in the case. Where the recovery has been stayed by the order of Appellate Tribunal it shall cease to have effect on the expiry of three months following date on which it is made, unless the appeal is decided or such order is withdrawn. Disposal of appeals by the Appellate Tribunal: Call for particulars: The Appellate Tribunal, before disposing an appeal, may call for required particulars in respect of matters in appeal or cause further enquiry to be made by the Commissioner. Dismissal of appeal in default: Opportunity of being heard will be provided to the parties and in case any party does not appear on the date of hearing, the appeal may be dismissed or the Appellate Tribunal may precede ex-parte. In an appeal relating to an assessment order, the Appellate Tribunal may: Affirm modify or annul the assessment order; or Set it aside and issue direction for making a new assessment; Remand the case to the Commissioner/Commissioner (Appeals) for making enquiry or taking such action as it may direct. Parties to be heard The Appellate Tribunal shall not increase the amount of any assessment or penalty or decrease the amount of any refund unless the taxpayer has been given a reasonable opportunity of showing cause against such increase or decrease, as the case may be. Where, as a result of appeal, any change is made in the assessment or new assessment is made in regard to AOP, the Appellate Tribunal may authorize amendments accordingly within the specified time limit. Finality of order: The order of the Appellate Tribunal shall be communicated to the taxpayer and the Commissioner and except as provided in section 133, its decision in an appeal shall be final.

- 12. GUESS SOLVED WITH ORDER WISE INCOME TAX Its prepared by students so its Contain errors (NOMI BRO) DTL SECTION (2016-2017) Procedure in Appellate Tribunal: If the tax payer or the Commissioner is aggrieved by the order of the Appellate Tribunal, they can require the Appellate Tribunal, through an application in the prescribed form and accompanied by th prescribed documents, to refer any question of law arising out of such order to High Court. Application has to be made within 90 days of the service of the Appellate Tribunal's order. If the Appellate Tribunal is satisfied that a question of law arises out of its order, it shall within 90 days of receipt of application, draw up a s at ment of the case and refer it to the High Court. Procedure in High Court: If the Appellate Tribunal refuses to state the case, the aggrieved party may, within 120 days of service of notice of refusal, apply to the High Court and it may frame a question of law for its consideration. However, in case the High Court is unable to determine the question of law raised, it can refer the case back to the Appellate Tribunal for modification. The reference to the High Court shall be heard by a Bench of not less than two Judges of the High Court and provisions of section 98 CPC shall , so far as may be, apply in the case. The High Court shall decide the questions of law raised and deliver judgment thereon containing the grounds on which such decision is based. A copy of such Judgment shall be sent under the seal of the Court and the signatures of the Registrar to the Appellate Tribunal who shall pass orders to dispose of the case according to such judgment. Where a reference relates to an assessment, the tax due under the assessment shall be payable in accordance with the assessment, unless recovery of the tax has been stayed by the High Court. Costs: The costs of a reference to the High Court shall be at the discretion of the Court. Limitation: Section 5 of the Limitation Act, 1908 shall apply to application under sub-section (1). Fee payable: An application under sub-section (1) by a person other than the Commissioner shall be accompanied by a fee of Rs. 100. Appeal to Supreme Court: An appeal lies to the Supreme Court from any judgment of the High Court delivered on a reference made on question of law framed under section 133 in any case which the High Court certifies to be a fit case for appeal to the Supreme Court. The provisions of CPC relating to appeals to Supreme Court shall apply as if it were an appeal from the decree of High Court. If the judgment of the High Court is varied or reversed in appeal, effect shall be given to the order of the Supreme Court. Alternate Dispute Resolution - A parallel Appellate System: This new section has been introduced in the Ordinance through the Finance Act 2004. This section provides an appellate system parallel to conventional system. The mechanism of alternate dispute resolution (ADR as it is commonly called) has been provided for the first time in the income tax law. Simply put, any aggrieved person in connection with any matter of income tax pertaining to liability of income tax, admissibility of refund, waiver or fixation of penalty or fine, realization of any time period or procedural and technical condition may apply to Central Board of Revenue (CBR) for the appointment of a committee for the resolution of any hardship or dispute mentioned in detail in the application. The CBR will then form a committee (consisting of Income Tax Officers, Chartered or Cost Accountants, Advocates and Income Tax Practitioners or reputable tax payers) which will examine the issue raised and the CBR may, on the recommendation of this committee, pass appropriate orders. Upon payment of income tax etc. as determined by CBR, all decisions, orders and judgments shall stand modified and all proceedings shall abate. In case the aggrieved person is not satisfied with the orders of the CBR, he may file an appeal or reference with the appropriate forum, tribunal or court under the relevant provision of this Ordinance within a period of 60 days of communication of order to him.

- 13. GUESS SOLVED WITH ORDER WISE INCOME TAX Its prepared by students so its Contain errors (NOMI BRO) DTL SECTION (2016-2017) Burden of proof: In any appeal by a taxpayer under this Part, the burden shall be on the taxpayer to prove, on the balance of probabilities: In the case of an assessment order, the extent to which the order does not correctly reflect the xpayer's tax liability for the tax year; Or In the case of any other decision, that the decision is erroneous 3 Heads of income.- For the purposes of the imposition of tax and the computation of total income, all income shall be classified under the following heads, namely:- Salary; Income from Property; Income from Business; Capital Gains; and Income from Other Sources. Subject to this Ordinance, the income of a person under a head of income for a tax year shall be the total of the amounts derived by the person in that year that are chargeable to tax under the head as reduced by the total deductions, if any, allowed under this Ordinance to the person for the year under that head. Subject to this Ordinance, where the total deductions allowed under this Ordinance to a person for a tax year under a head of income exceed the total of the amounts derived by the person in that year that are chargeable to tax under that head, the person shall be treated as sustaining a loss for that head for that year of an amount equal to the excess. A loss for a head of income for a tax year shall be dealt with in accordance with Part VIII of this Chapter. The income of a resident person under a head of income shall be computed by taking into account amounts that are Pakistan-source income and amounts that are foreign-source income. The income of a non-resident person under a head of income shall be computed by taking into account only amounts that are Pakistan- source income.

- 14. GUESS SOLVED WITH ORDER WISE INCOME TAX Its prepared by students so its Contain errors (NOMI BRO) DTL SECTION (2016-2017) 4 Administrative Tribunals Lecture INTRODUCTION Tribunals have been defined as "Bodies outside the hierarchy of the courts with administrative or judicial functions" (Curzon, Dictionary of Law, 1994, p387). Administrative tribunals resolve disputes between, for example, the citizen and an officer of a government agency or between individuals in an area of law in which the government has legislated the conduct of their relations. REASONS FOR EXISTENCE Administrative tribunals have been established by statute, in the main, to resolve: Disputes between a private citizen and a central government department, such as claims to social security benefits; Disputes which require the application of specialized knowledge or expertise, such as the assessment of compensation following the compulsory purchase of land; and Other disputes which by their nature or quantity are considered unsuitable for the ordinary courts, such as fixing a fair rent for premises or immigration appeals. The main reasons for the creation of administrative tribunals may be identified as: The relief of congestion in the ordinary courts of law (the courts could not cope with the case-load that is now borne by social security tribunals, employment tribunals and the like); The provision of a speedier and cheaper procedure than that afforded by the ordinary courts (tribunals avoid the formality of the ordinary courts); and

- 15. GUESS SOLVED WITH ORDER WISE INCOME TAX Its prepared by students so its Contain errors (NOMI BRO) DTL SECTION (2016-2017) The desire to have specific issues dealt with by persons with an intimate knowledge and experience of the problems involved (which a court with a wide general jurisdiction might not acquire). Note: a distinction must be drawn between administrative tribunals and domestic tribunals. Domestic tribunals are bodies appointed within an organization to decide disputes, egg, the Disciplinary Committee of the General Medical C uncil, which controls the professional activities of doctors. CLASSIFICATION OF TRIBUNALS Administrative tribunals are sets of tribunals which adjudicate on specialist civil disputes outside of the court system. Derbyshire has reported (2008) that there are over 130 such bodies in the UK covering a vast array of areas. Until recently each tribunal was separate and in 1996 the list of administrative tribunals included: agricultural land tribunals, child support appeal tribunals, the Civil Aviation Authority and the Director General of Fair Trading in their licensing functions, criminal injuries adjudicators, the Data Protection Registrar, education appeal committees, immigration adjudicators and the Immigration Appeal tribunal, industrial tribunals (renamed employment tribunals), the two Lands Tribunals, mental health review tribunals,

- 16. GUESS SOLVED WITH ORDER WISE INCOME TAX the Comptroller-General of Patents, war pensions appeal tribunals, rent assessment committees, social security appeal tribunals and the Social Security Commissioners, disability and medical appeal tribunals, the general and special commissioners of income tax, traffic commissioners, valuation and community charge tribunals, and VAT tribunals. However, these tribunals have now been incorporated into the unified Tribunals System which includes all admin strative tribunals with the exceptions of Patent Office tribunals and the Investigatory Powers Tribunal. GENERAL CONSIDERATIONS Some tribunals may be composed of a lawyer alone, but commonly there will be a lawyer 'chair' (called a ’tribunal judge') and two lay people who may be drawn from the relevant industry. The Judicial Appointments Commission is now in control of the selection process. Appointments are usually made for a fixed period of years. Many tribunals, like the Lands Tribunal and the commissioners of income tax, exercise strictly judicial functions. Some, like the Civil Aviation Authority, base their decisions on wider aspects of policy, exercising regulatory functions in a judicial form. In 1997, legal aid was available before the Lands Tribunal, the Commons Commissioners and the Employment Appeal Tribunal; legal assistance by way of representation was available before mental health review tribunals and for certain proceedings before the Parole Board. Legal advice and assistance without representation can be obtained in connection with all tribunal proceedings (Part III, Legal Aid Act 1988). In general, tribunals are not bound by the rules of evidence observed in courts and could not reach decision simply and speedily if they were. Some tribunals follow procedures that are essentially inquisitorial rather than adversary, but minimum standards of evidence and proof must be observed by tribunals if justice is to be done. The legal profession has no monopoly of the right to represent those appearing before tribunals. This fact alone makes tribunals more accessible to the public than the courts, since an individual's case may often be presented effectively by a trade union official, an accountant, a surveyor, a doctor, a social worker or a friend. Its prepared by students so its Contain errors (NOMI BRO) DTL SECTION (2016-2017) The Administrative Justice and Tribunals Council This body supervises tribunals and replaces the Council on Tribunals. Its aim is to aid in making tribunals fair and accessible by keeping them under review. The Council reports directly to the Ministry of Justice. Currently (2011), a consultation process is underway which may result in the abolition of the Council. Legit Review of Tribunals In 2000 the Legit Review was set up to look into the operation of administrative tribunals. The Review found that each tribunal had its own processes and standards and were not accessible to users. It also raised concerns about the level of independence of tribunals and the long delays which users faced in having their dispute resolved by the tribunals. The Legit Review recommended that a new independent tribunal service be set up so that the relevant sponsoring government departments could no longer be seen as influencing the individual tribunals and that a composite two-tier tribunal structure should be adopted. Tribunals, Courts and Enforcement Act 2007 Ultimately, the Legit Review Recommendations were adopted by the government in the form of the Tribunals, Courts & Enforcement Act 2007 (TCEA 2007).

- 17. GUESS SOLVED WITH ORDER WISE INCOME TAX The TCEA 2007 created a new structure for tribunals. There are now two tribunals in the unified tribunals system with generic rules of procedure, a system of appeals and one Senior Precedent. The two tribunals are the First-tier Tribunal and the Upper Tribunal. All the previously existing tribunals (with the exception of Patent Office tribunals and the Investigatory Powers Tribunal) are now contained within the unified tribunals. It should be noted that the Employment Tribunal and the Employment Appeal Tribuna are t within the unified structure; however these are not in essence administrative tribunals but deal mainly with private issues. The First-tier Tribunal is a fact-finding tribunal which hears appeals directly from decision makers. Thus, if an individual is unsatisfied by a decision made egg by a Secretary of State he may appeal to the First-tier Tribunal. The First-tier Tribunal is divided into Chambers, with each Chamber having its own President and its own area of law egg social security. This separation into legal-area Chambers allows the system to continue to provide specialist judges with relevant experience to the area in question in each individual case. The Upper Tribunal is mainly an appellate tribunal to hear appeals from the First-Tier tribunal. However, it also has primary jurisdiction to hear certain matters including finance and tax matters. Tribunal Procedure Section 22 TCEA 2007 requires that Tribunal Procedure Rules are made by the Tribunal Procedure Committee and states that the objectives of the rules are that: justice is done; the tribunal system is accessible and fair; proceedings are handled quickly and efficiently; the rules are both simple and simply expressed; and that the rules where appropriate confer on members of the relevant Tribunal responsibility for ensuring that the proceedings are handled quickly and efficiently. There are variations in procedure depending on the area of law involved. However, each set of procedures must follow the basic objectives listed above. Schedule 5 TCEA 2007 provides the rules relating to the tribunal procedures. Part 1 sets out that the procedural rules may contain certain provisions relating egg to time limits, whether hearings should be in public or private, representation, evidence, witnesses and notice. The Tribunal Procedure Committee is in charge of creating the individual sets of procedural rules. So far several sets of procedural rules have been devised including those relating to social entitlement, health and education. Generally, the procedural rules do not require leave for the commencement of proceedings, but normally the applicant should send an application within 28 days of the decision in dispute. The respondent must then state the grounds, if any, on which the application will be opposed. A hearing will then normally take place, with the general rule being that these are in public except in relation to mental health issues and some educational issues. Each party may have a representative, who may be legally qualified or not, and the tribunal has wide powers to control the way in which evidence is given and the amount of evidence which may be presented. Once a decision has been reached the Tribunal must provide written reasons for it and notification of any rights of review or appeal. Appeal The First-tier Tribunal is capable of reviewing its own decisions on application by a dissatisfied party. Decisions reached by the First-tier Tribunal may be appealed to the Upper Tribunal. Beyond this, the next point of appeal is the Court of Appeal, rather than the High Court as was previously the case. ADVANTAGES AND DISADVANTAGES The advantage of a tribunal is that it is: Quick with no long waits for the case to be heard and it is dealt with speedily; Cheap, as no fees are charged; Staffed by experts who specialize in particular areas? Characterized by an informal atmosphere and procedure; Allowed not to follow its own precedents, although tribunals do have to follow court precedents. Its prepared by students so its Contain errors (NOMI BRO) DTL SECTION (2016-2017)

- 18. GUESS SOLVED WITH ORDER WISE INCOME TAX They are not always independent of the Government, although the Independent Tribunal Service now reco Lord Chancellor; Some tribunals act in private; Its prepared by students so its Contain errors (NOMI BRO) DTL SECTION (2016-2017) ends possible chairmen to the They do not always give reasons, although under s10 of the Tribunals and Inquiries Act 1992, tribunals listed in t A t must give a written or oral statement of reasons, if asked to; Legal aid is not generally available, except for the Lands Tribunal, the Employment Appeal Tribunal and the Mental Health Review Tribunal; There is no general right of appeal to the courts: it all depends on the particular statute creating the tribunal. The 1992 Act gives a right of appeal on a point of law to the High Court from specified tribunals. EVALUATION OF TRIBUNALS According to T. Blakemore and B. Greene, Law for Legal Executives, 1996, p95: They do a useful job in taking some types of work away from the courts and dealing with specialized matters, less valuable claims and matters involving the exercise of discretion. It has been estimated that they deal with over one million cases a year (Parrington, Martin, ’The Future of Tribunals’, Legal Action, May 1993, p9). Problems remain over lack of standard rights, like the right of appeal, and procedures. In many instances they make important decisions affecting people’s livelihoods and quality of life. The Council on Tribunals has begun to investigate the use of precedent, the establishment of a standard complaints procedure. Training for tribunal members is provided in association with the Tribunals Committee of the Judicial Studies Board. The Council on Tribunals has proposed setting up a Tribunals Association as a representative body for all tribunals. Its influence is hampered through lack of funds and having part time members. Some tribunals, for example the Lands Tribunal, have a backlog as large as the ordinary courts. Following the Gann Report (’Effectiveness of Representation at Tribunals’) the Council on Tribunals believes that legal aid should be available at tribunal hearings. Although the Woolf Report pays little attention to tribunals, some see them as offering an alternative to the courts in certain cases and a way of solving the problems of access to the civil justice system identified by the Woolf Report, as tribunals are cheap, informal and quicker than the ordinary courts (Zuckerman and Cranston (ends), Reform of Civil Procedure; Roy Sainsbury and Hazel Gann, Access to Justice: Lessons from Tribunals, Clarendon Press, 1995). What is Tax? Let us begin by understanding the meaning of tax. Tax is a fee charged by a Government on a Product, income or activity. There are two types of taxes - direct taxes and indirect taxes. Direct Taxes: If tax is levied directly on the income or wealth of a person, then, it is a direct tax e.g. income-tax. Indirect Taxes: If tax is levied on the price of a good or service, then, it is an indirect tax e.g. Goods and Services Tax (GST) or Custom Duty. In the case of indirect taxes, the person paying The tax passes on the incidence to another person. Why are Taxes Levied? The reason for levy of taxes is that they constitute the basic source of revenue to the Government. Revenue so raised is utilized for meeting the expenses of Government like defence, provision of education, health-care, infrastructure facilities like roads, dams etc. Levy of Income-tax Income-tax is a tax levied on the total income of the previous year of every person (Section 4). A person includes an individual, Hindu Undivided Family (HUF), Association of Persons (AOP), Body of Individuals (BOI), a firm, a company etc.

- 19. GUESS SOLVED WITH ORDER WISE INCOME TAX Its prepared by students so its Contain errors (NOMI BRO) DTL SECTION (2016-2017) Total Income and Tax Payable Income-tax is levied on an assessor’s total income. Such total income has to be computed as per the provisions contained in the Income-tax Act, 1961. Let us go step by step to understand the procedure for computation of total income of an individual for the purpose of levy of income-tax - Step 1 - Determination of residential status The residential status of a person has to be determined to ascertain which income is to be included in computing the total income. Step 2 - Classification of income under different heads There is a charging section under each head of income which defines the scope of income chargeable under that head. These heads of income exhaust all possible types of income that can accrue to or be received by the tax payer. Accordingly, the income is classified as follows: Salary, pension earned is taxable under the head "Salaries". House Rental income is taxable under the head "Income from house property". Income derived from carrying on any business or profession is taxable under the head "Profits and gains from business or profession". Profit from sale of a capital asset (like land) is taxable under the head "Capital Gains". The fifth head of income is the residuary head. The income which is not taxable under the first four heads will be taxed under the head "Income from other sources". The tax payer has to classify the income earned under the relevant head of income. Step 3- Computation of income under each head Income is to be computed in accordance with the provisions governing a particular head of income. Exemptions: There are certain incomes which are wholly exempt from income-tax e.g. agricultural income. These incomes have to be excluded and will not form part of Gross Total Income. Also, some incomes are partially exempt from income-tax e.g. House Rent Allowance. These incomes are excluded only to the extent of the limits specified in the Act. The balance income over and above the prescribed exemption limits would enter computation of total income and have to be classified under the relevant head of income. Deductions: There are deductions and allowances prescribed under each head of income. For example, while calculating income from house property, interest on loan is allowed as deduction. Similarly, deductions and allowances are prescribed under other heads of income. These deductions etc. have to be considered before arriving at the net income chargeable under each head. Step 4 - Clubbing of income of spouse, minor child etc. In case of individuals, income-tax is levied on a slab system on the total income. The tax system is progressive i.e. as the income increases, the applicable rate of tax increases. Some taxpayers in the higher income bracket have a tendency to divert some portion of their income to their spouse, minor child etc. to minimize their tax burden. In order to prevent such tax avoidance, clubbing provisions have been incorporated in the Act, under which income arising to certain persons (like spouse, minor child etc.) have to be included in the income of the person who has diverted his income for the purpose of computing tax liability.

- 20. GUESS SOLVED WITH ORDER WISE INCOME TAX Step 5 - Set-off or carry forward and set-off of losses An assesses may have different sources of income under the same head of income. He might have profit from one source and loss from the other. For instance, an assesses may have profit from his textile business and loss from his printing business. This loss can be set-off against the profits of textile business to arrive at the net income chargeable under the head “Profits and gains of business or profession". Similarly, anassessee can have loss under one head of income, say, Income from house property and profits under another head of income, say, profits and gains of business or profession. There are provisions in the Income-tax Act, 1961 for allowing inter-h ad adjustment in certain cases. However, there are also restrictions in certain cases, like business loss is not allowed to be set-off against salary income. Further, losses which cannot be set-off in the current year due to inadequacy of eligible profits can be carried forward for set-off in the ubsequent years as per the provisions contained in the Act. Step 6 - Computation of Gross Total Income The final figures of income or loss under each head of income, after allowing the deductions, allowances and other adjustments, are then aggregated, after giving effect to the provisions for clubbing of income and set-off and carry forward of losses, to arrive at the gross total income. Step 7 - Deductions from Gross Total Income There are deductions prescribed from Gross Total Income. Step 8 - Total income The income arrived at, after claiming the above deductions from the Gross Total Income is known as the Total Income. It should be rounded off to the nearest multiple of Rs. 10/- (Section 288A). Step 9 - Application of the rates of tax on the total income The rates of tax for the different classes of assessees are prescribed. For individuals, HUFs etc., there is a slab rate and basic exemption limit. At present, the basic exemption limit is Rs. 2,50,000/- for individuals. This means that no tax is payable by individuals with total income of up to Rs. 2,50,000/-. The tax rates have to be applied on the total income to arrive at the income-tax liability. Step 10 - Rebate under section 87A In order to provide tax relief to the individual tax payers who are in the 10% tax slab i.e. Total Income does not exceed Rs. 5,00,000/-, section 87A provides a rebate from the tax payable by an assessee, being an individual resident in India. The rebate shall be equal to the amount of income-tax payable on the total income for any assessment year or an amount of Rs. 5,000/-whichever is less. Step 11 - Education cess and secondary and higher education cess on income-tax The income-tax, as reduced by the rebate under section 87A, if applicable, is to be further increased by an additional surcharge called education cess@2% and secondary and higher education cuss on income-tax @1% of income-tax. Step 12 - Advance tax and tax deducted at source Although the tax liability of an assesses is determined only at the end of the year, tax is required to be paid in advance in four installments on the basis of estimated income In certain cases, tax is Required to be deducted at source from the income by the payer at the rates prescribed in the Income-tax Act, 1961 or the Annual Finance Act. Its prepared by students so its Contain errors (NOMI BRO) DTL SECTION (2016-2017)

- 21. GUESS SOLVED WITH ORDER WISE INCOME TAX The assessee has to pay the amount of tax payable on or before the due date of filing of the return. Similarly, if any refund is due, assessee will get the same after filing the return of income. Return of Income Return of income is the format in which the assessee furnishes information as to his total income and tax pa ble. The particulars of income earned under different heads, gross total income, deductions from gross total income, total income and ta yabl the assessee are required to be furnished in a return of income. In short, a return of income is the declaration of income by the assessee in the prescribed format. Assessee [Section 2(7)] "Assessee" means a person by whom any tax or any other sum of money is payable under this Act Person [Section 2(31)] The definition of 'assessee' leads us to the definition of 'person' as the former is closely connected with the latter. There are seven categories of assessees each of which constitute a separate unit for income computation. Individual: The term 'individual' means only a natural person, i.e., a human being. It includes both males and females. HUF: Under the Income-tax Act, 1961, a Hindu undivided family (HUF) is treated as a separate entity for the purpose of assessment. "Hindu undivided family" has not been defined under the Income-tax Act. The expression is, however, defined under the Hindu Law as a family, which consists of all males lineally descended from a common ancestor and includes their wives and daughters. Company [Section 2(17)]: Company means: Any Indian company formed or registered under Companies Act, 2013 Anybody corporate incorporated by or under the laws of a country outside India, i.e., any foreign company Firm [Section 2(23)]: The terms 'firm', 'partner' and 'partnership' have the same meanings as assigned to them in the Indian Partnership Act, 1932 Association of Persons (AOP): When persons combine together for promotion of joint enterprise they are assessable as an AOP when they do not in law constitute a partnership. Body of Individuals (BOI): It denotes the status of persons like executors or trustees who merely receive the income jointly and who may be assessable in like manner and to the same extent as the beneficiaries individually. Thus, co-executors or co-trustees are assessable as a BOI as their title and interest are indivisible Local Authority: The term means a municipal committee, district board, body of port commissioners or other authority legally entitled to or entrusted by the Government with the Control or management of a municipal or local fund. Artificial Persons: This category could cover every artificial juridical person not falling under other heads. Assessment year [Section 2(9)] This means a period of 12 months commencing on 1st April every year. The year in which income is earned is the previous year and such income is taxable in the immediately following year which is the assessment year. Income earned in the previous year 2016-17 is taxable in the assessment year 2017-18.Its prepared by students so its Contain errors (NOMI BRO) DTL SECTION (2016-2017)

- 22. GUESS SOLVED WITH ORDER WISE INCOME TAX Its prepared by students so its Contain errors (NOMI BRO) DTL SECTION (2016-2017) Previous year [Section 3] It means the financial year immediately proceeding the assessment year. As mentioned earlier, the income earned during the previous year is taxable in the assessment year. Business or profession newly set up during the financial year or a source of income comes into existence in the said financial year. In such a case, the previous year shall be the period beginning on the date of setting up of the business or profession ending with 31st March of the said financial year. EXCEPTIONAL cases when Previous Year and Assessment Year both are SAME existence of such source and The income of an assessee for a previous year is charged to income-tax in the assessment year following the previous year. For instance, income of previous year 2016-17 is assessed during 2016-17. Therefore, 2018-19 is the assessment year for assessment of income of the previous year 2016-17. However, in a few cases, this rule does not apply and the income is taxed in the previous year in which it is earned. These exceptions have been made to protect the interests of revenue. The exceptions are as follows: Shipping business of non-resident [Section 172]: Where a ship, belonging to or chartered by a non-resident, carries passengers, livestock, mail or goods shipped at a port in India, the ship is allowed to leave the port only when the tax has been paid.

- 23. GUESS SOLVED WITH ORDER WISE INCOME TAX Its prepared by students so its Contain errors (NOMI BRO) DTL SECTION (2016-2017) Persons leaving India [Section 174]: Where it appears to the Assessing Officer that any individual may leave India during the current assessment year and he has no present intention of returning to India, the total income of such indiv ual is chargeable to tax in that same financial year. AOP / BOI / Artificial Juridical Person formed for a particular event or purpose [Section 174A]: If an AOP/BOI etc. is formed or established for a particular event or purpose and the Persons likely to transfer property to avoid tax [Section 175]: During the current assessment year, if it appears t the Assessing Officer that a person is likely to charge, sell, transfer, Dispose of or otherwise part with any of his assets to avoid payment of any liability under this Act, the total income of such person is chargeable to tax in that assessment year. Discontinued business [Section 176]: Where any business or profession is discontinued in any assessment year, the income is charged to tax in that assessment year. Rates of Tax INDIVIDUAL or HUF or AOP/BOI or ARTIFICIAL JURIDICIAL PERSON: Applicable to Resident Individual who is of the age of less than 60 years (0-60) Non-Resident Individual irrespective of its age HUF or AOP/BOI or Artificial Juridical Person whether resident or non-resident

- 24. GUESS SOLVED WITH ORDER WISE INCOME TAX 1.Where the taxable income does not exceed Rs, 400,000 2.Where the taxable income exceeds Rs, 400,000 but does not exceed Rs, 500,000 3.Where the taxable income exceeds Rs, 500,000 but does not exceed Rs, 750,000 4.Where the taxable income exceeds Rs, 750,000 but does not exceed Rs, 1,400,000 5.Where the taxable income exceeds Rs, 1,400,000 but does not exceed Rs, 1,500,000. 6.Where the taxable income exceeds Rs, 1,500,000 but does not exceed Rs, 1,800,000 7.Where the taxable income exceeds Rs, 1,800,000 but does not exceed Rs, 2,500,000 8.Where the taxable income exceeds Rs, 2,500,000 but does not exceed Rs, 3,00,000 0% 2% of the amount exceeding Rs, 400,000 Rs,2,000+5% of the amount exceeding Rs, 500,000 Rs, 14,500+10% of the amount exceeding Rs, 750,000 Rs, 79,500+12.5% of the amount exceeding Rs, 1,400,000 Rs, 92,000+15% of the amount exceeding Rs, 1,500,000 Rs, 137,000+17.5% of the amount exceeding Rs, 1,800,000 Rs, 259,500+20% of the amount exceeding Rs, 2,500,000 9. Where the taxable income exceeds Rs, 3,000,000 but does not exceed Rs, 3,500,000 Rs, 359,500+22.5% of the amount exceeding Rs, 3,000,000 10. Where the taxable income exceeds Rs, 3,500,000 but does not exceed Rs, 4,000,000 Rs, 472,000+25% of the amount exceeding Rs, 3,500,000 11. Where the taxable income exceeds Rs, 4,000,000 but does not exceed Rs, 7,000,000 Rs,597,000+27.5%of the amount exceeding Rs, 4,000,000 12. Where the taxable income exceeds Rs,7,000,000 Rs,1,422,000+30% of the amount exceeding Rs, 7,000,000 Who should complete BIR60? BIR60 is issued to an individual taxpayer for him/her to report his/her salaries, rental income from solely owned properties and profits from sole-proprietorship businesses, and to elect personal assessment. BIR60 should be completed and signed by the individual taxpayer. If the taxpayer is married for all or part of the year and has elected joint assessment / personal assessment or has been nominated by his/her spouse to claim home loan interest deduction, his/her BIR60 should also be signed by his/her spouse. Its prepared by students so its Contain errors (NOMI BRO) DTL SECTION (2016-2017) If you receive BIR60 from us, you must complete and submit it in time even if you do not have any income to report. How to complete BIR60 (1) Guide to Tax Return - Individuals A "Guide to Tax Return - Individuals" explains how to complete the Tax Return-Individuals. Most of your questions will be answered in the Guide. You should read the whole Guide care' completing the Tax Return. Related Tax Rules

- 25. GUESS SOLVED WITH ORDER WISE INCOME TAX If you need further information on related tax rules, e.g. what types of income are taxable, qualifying conditions for claiming deductions or allowances, Its prepared by students so its Contain errors (NOMI BRO) DTL SECTION (2016-2017) (3) Specimen of BIR60 with some key points to note You may download a specimen of the Tax Return - Individuals (BIR60), in either English or Chinese, which contains a quick guidance on how to complete BIR60. Some key points, with ex highlighted for your attention. Alternatively, the specimen is also available through the 24- hour Fax-A-Form Service (2598 6001). Attention Notes on completion of BIR60: Fill in HK identity card number, date of birth and relationship, as appropriate, of your spouse / dependant(s) to update your marital status / support your Claim. Exclude '$', ',' or cents when filling in amounts in boxes provided. Fill in all relevant boxes for reporting full information. (4) Further Information on completion of BIR60 When to file BIR60 (1) Time limit for filing Tax Return - Individuals should be filed: within 1 month from the date of issue of the Tax Return if the taxpayer did not solely own any unincorporated business during the year of assessment; or within 3 months from the date of issue of the Tax Return if the taxpayer solely owned any unincorporated business during the year of assessment; or An automatic extension of 1 month will be given for filing the Tax Return for the year of assessment 2016/17 electronically. Extension of time for filing Block Extension Scheme for taxpayers who have appointed a tax representative :

- 26. GUESS SOLVED WITH ORDER WISE INCOME TAX Under the Block Extension Scheme, an extension of time for submission of Tax Return is granted to those individual taxpayers who have appointed a tax representative. For details about I Extension Scheme, Requests for extension beyond the extended due dates would be granted only in the most exceptional circumstanc s. Applications for further extension should be made in writing on a ca basis. If the reasons or exceptional circumstances are the s me for employees of a particular company, the requests for further extension could be made by way of a list. (b) Individual application for extension of time for submission of Tax Return: If you have great difficulties in submitting the Tax Return within the prescribed time as mentioned above, you may apply for an extension of time to submit the Return in writing. You shot reason why the Tax Return could not be submitted in time. Such application will only be entertained in exceptional circumstances. (3) Request for a duplicate Tax Return 6 Pakistan Corporate - Taxes on corporate income Choose a topic A resident company is taxed on its worldwide income. Non-resident companies operating in Pakistan through a branch are taxed on their Pakistan-source income, attributable to the branch, at rates applicable to a company. The federal corporate tax rates on taxable income are as follows: Company type Tax rate (%) Banking company 35 Public company other than a banking company 31 Any other company 31 Small company (see the Tax credits and incentives section for more information) 25 Its prepared by students so its Contain errors (NOMI BRO) DTL SECTION (2016-2017)

- 27. GUESS SOLVED WITH ORDER WISE INCOME TAX Note that the corporate tax rate for tax year 2018 and onwards is 30% for companies other than banking companies. The term 'public company' implies a company listed on any stock exchange in Pakistan or one in which not l ss tha 50% of the shares are held by the federal government or a public trust. In the case of a Moradabad (see the Income determination section for a definition), income, except relating to trading activities, is exempt from tax, provided that 90% of its profit is distributed to the certificate holders as cash dividends. The final tax regime (FTR) for resident taxpayers, a presumptive tax scheme where taxes are withheld at the source on the sale of goods and execution of contracts or collected at the time of import (for other than industrial raw materials), is considered the final tax liability in respect of income arising from the sale, contract, or import. In the case of exports, tax collected at the time of realization of foreign-exchange proceeds is treated as the final tax for that income. The FTR is also applicable to non-resident taxpayers, at their option. However, it is only applicable in cases of receipts on account of the execution of a contract for construction, assembly, or installation, including a contract for the supply of management activities in relation to such project as well as certain contracts for services and contracts for advertisement services rendered by television satellite channels. Taxation of a permanent establishment (PE) of a non-resident The following principles shall apply in computing taxable income of a PE: It is a distinct and separate entity dealing independently with the non-resident of which it is a PE. In addition to business expenditure, executive and administrative expenditure, whether incurred in Pakistan or elsewhere, will be allowed as deductions. Head office expenditure, including rent, salaries, travelling, and any other expenditure that may be prescribed, shall be allowed as a deduction in proportion to the turnover of the PE in the same proportion as the non-resident's total head office expenditure bears to its worldwide turnover. Royalties, compensation for services (including management services), and interest on loans (except in banking business) payable or receivable to or from a PE's head office shall be considered in computing taxable income of the PE. No deduction will be allowed for any interest paid on loans acquired by a non-resident to finance the operations of a PE (or for the insurance premium in respect of such loans). Minimum tax on turnover Where the tax payable by a company is less than 1% of the turnover, except where the company is in a loss position before charging depreciation and other inadmissible expenses, the company is required to pay a minimum tax equivalent to 0.5% of the turnover. Tax paid in excess of normal tax liability can be carried forward for adjustment against tax liability of a subsequent tax year. However, such tax can only be adjusted against tax liability of the five tax years immediately succeeding the tax year for which the amount was paid. The minimum tax rate for companies providing services is 8% of the turnover, except for certain specified services sectors, which are allowed concessions with conditions. Alternate Corporate Tax (ACT) Under the ACT, the minimum tax liability of a company is the highest of 17% of accounting income or the corporate tax liability determined under the ordinance, including minimum tax on turnover. This concept is applicable for all companies except insurance companies, companies engaged in exploration and production of petroleum, banking companies, and companies enjoying a reduced rate of tax. Exempt income, income taxable under the FTR, gain on disposal of specified listed securities, income entitled to 100% tax credit on account of equity investment, and income of non-profit organizations, trusts, and welfare institutions are not taxable under the ACT. Super tax Its prepared by students so its Contain errors (NOMI BRO) DTL SECTION (2016-2017)