This document outlines various procedures related to tax assessment in Pakistan. Some key points:

- If a complete tax return is filed, the Commissioner is considered to have made an assessment equal to the amounts in the return. An incomplete return can be followed by a notice from the Commissioner to provide missing information.

- The Commissioner can make a best judgment assessment if a taxpayer fails to file a required return or statement or provide required documents.

- Existing assessments can be amended by the Commissioner within 5 years if new information indicates income was missed or underassessed. Amended assessments must provide notice and an opportunity to appeal.

- The Commissioner can revise orders by other tax officers and the Regional Commissioner can revise exemption or

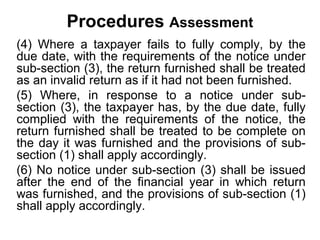

![Procedures Assessment

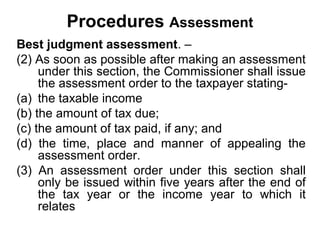

Best judgment assessment. –

(1) Where a person fails to —

(a) furnish a statement as required by a notice under sub-section (5) of

section 115; or

(b) furnish a return as required under section 143 or section 144; or

(c) furnish the statement as required under section 116; or

(d) produce before the Commissioner, or any person employed by a firm

of chartered accountants or a firm of cost and management accountants]

under section 177, accounts, documents and records required to be

maintained under section 174, or any other relevant document or

evidence that may be required by him for the purpose of making

assessment of income and determination of tax due thereon,

the Commissioner may, based on any available information or material

and to the best of his judgment, make an assessment of the taxable

income 5[or income] of the person and the tax due thereon](https://image.slidesharecdn.com/proceduresassesment-131228142201-phpapp01/85/Procedures-assesment-8-320.jpg)

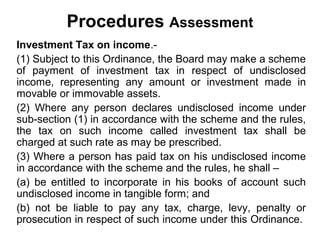

![Procedures Assessment

Amendment of assessments –

(1) Subject to this section, the Commissioner may

amend an assessment order treated as issued

under section 120 or issued under section 121,

[or issued under section 59, 59A, 62, 63 or 65 of

the repealed Ordinance,] by making such

alterations or additions as the Commissioner

considers necessary.

(2) No order under sub-section (1) shall be

amended by the Commissioner after the expiry

of five years from the end of the financial year in

which the Commissioner has issued or treated

to have issued the assessment order to the

taxpayer.]](https://image.slidesharecdn.com/proceduresassesment-131228142201-phpapp01/85/Procedures-assesment-10-320.jpg)

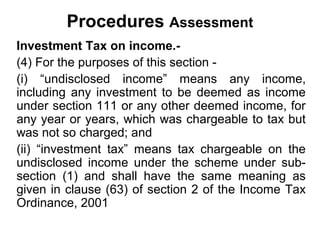

![Procedures Assessment

Amendment of assessments –

(3) Where a taxpayer furnishes a revised return

under sub-section (6) or (6A)] of section 114(a) the Commissioner shall be treated as having

made an amended assessment of the taxable

income and tax payable thereon as set out in

the revised return; and

(b) the taxpayer‘s revised return shall be taken for

all purposes of this Ordinance to be an

amended assessment order issued to the

taxpayer by the Commissioner on the day on

which the revised return was furnished.](https://image.slidesharecdn.com/proceduresassesment-131228142201-phpapp01/85/Procedures-assesment-11-320.jpg)

![Procedures Assessment

Amendment of assessments –

(4) Where an assessment order (hereinafter referred to as

the ―original assessment‖) has been amended under

sub-section (1) (3) or (5A)], the Commissioner may

further amend, as many times as may be necessary, the

original assessment within the later of (a) five years from the end of the financial year in which the

Commissioner has issued or is treated as having issued

the original assessment order to the taxpayer; or

(b) one year 5[from the end of the financial year in which] the

Commissioner has issued or is treated as having issued

the amended assessment order to the taxpayer .](https://image.slidesharecdn.com/proceduresassesment-131228142201-phpapp01/85/Procedures-assesment-12-320.jpg)

![Procedures Assessment

Amendment of assessments –

(6) As soon as possible after making an amended

assessment under 4[sub-section (1), subsection (4) or sub-section (5A)], the

Commissioner shall issue an amended

assessment order to the taxpayer stating –

(a) the amended taxable income of the taxpayer;

(b) the amended amount of tax due;

(c) the amount of tax paid, if any; and

(d) the time, place, and manner of appealing the

amended assessment.](https://image.slidesharecdn.com/proceduresassesment-131228142201-phpapp01/85/Procedures-assesment-14-320.jpg)

![Procedures Assessment

Amendment of assessments –

(7) An amended assessment order shall be treated in all

respects as an assessment order for the purposes of

this Ordinance, other than for the purposes of subsection (1).

(8) For the purposes of this section, ―definite information‖

includes information on sales or purchases of any goods

made by the taxpayer, 1[receipts of the taxpayer from

services rendered or any other receipts that may be

chargeable to tax under this Ordinance,] and on the

acquisition, possession or disposal of any money, asset,

valuable article or investment made or expenditure

incurred by the taxpayer.

(9) No assessment shall be amended, or further amended,

under this section unless the taxpayer has been

provided with an opportunity of being heard.](https://image.slidesharecdn.com/proceduresassesment-131228142201-phpapp01/85/Procedures-assesment-15-320.jpg)

![Procedures Assessment

Revision by the Commissioner.

(1) The Commissioner may , [suo moto,] call for the record of

any proceeding under this Ordinance or under the

repealed Ordinance in which an order has been passed

by any 6[Officer of Inland Inland Revenue] other than the

Commissioner (Appeals).

(2) Subject to sub-section (3), where, after making such

inquiry as is necessary, Commissioner considers that

the order requires revision, the Commissioner may

make such revision to the order as the Commissioner

deems fit.

(3) An order under sub-section (2) shall not be prejudicial to

the person to whom the order relates.](https://image.slidesharecdn.com/proceduresassesment-131228142201-phpapp01/85/Procedures-assesment-16-320.jpg)

![Procedures Assessment

Revision by the Commissioner.

(4) The Commissioner shall not revise any order

under sub-section (2) if—

(a) an appeal against the order lies to the

Commissioner (Appeals) or to the Appellate

Tribunal, the time within which such appeal may

be made has not expired; or

(b) the order is pending in appeal before the

Commissioner (Appeals) or has been made the

subject of an appeal to the Appellate Tribunal.]](https://image.slidesharecdn.com/proceduresassesment-131228142201-phpapp01/85/Procedures-assesment-17-320.jpg)

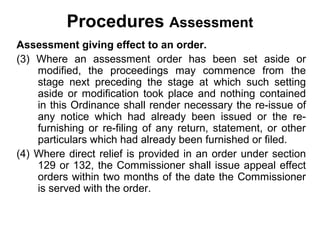

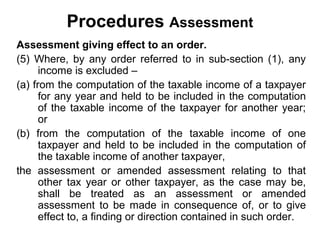

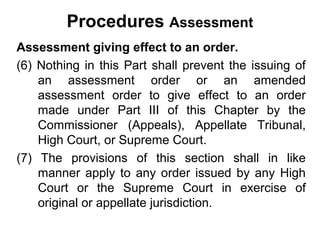

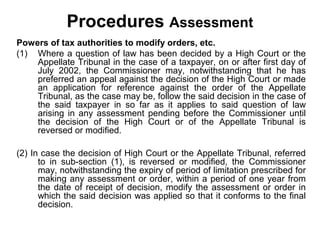

![Procedures Assessment

Assessment giving effect to an order.

(1) Except where sub-section (2) applies, where, in consequence of, or

to give effect to, any finding or direction in any order made under

Part III of this Chapter by the Commissioner (Appeals), Appellate

Tribunal, High Court, or Supreme Court an assessment order or

amended assessment order is to be issued to any person, the

Commissioner shall issue the order within two years from the end of

the financial year in which the order of the Commissioner (Appeals),

Appellate Tribunal, High Court or Supreme Court, as the case may

be, was served on the Commissioner.

(2) Where, by an order made under Part III of this Chapter by the

Appellate Tribunal, High Court, or Supreme Court, an assessment

order is set aside [wholly or partly,] and the Commissioner [or

Commissioner (Appeals), as the case may be,] is directed to [pass]

a new assessment order, the Commissioner [or Commissioner

(Appeals), as the case may be,] shall [pass] the new order within

[one year from the end of the financial year in which] the

Commissioner [or Commissioner (Appeals), as the case may be,] is

served with the order .](https://image.slidesharecdn.com/proceduresassesment-131228142201-phpapp01/85/Procedures-assesment-21-320.jpg)

![Procedures Assessment

Evidence of assessment.

(1) The production of an assessment order or a certified copy of an

assessment order shall be conclusive evidence of the due making of

the assessment and, except in proceedings under Part III of this

Chapter relating to the assessment, that the amount and all particulars

of the assessment are correct.

(2) Any [order] of assessment or other document purporting to be made,

issued, or executed under this Ordinance may not be –

(a) quashed or deemed to be void or voidable for want of form; or

(b) affected by reason of any mistake, defect, or omission therein

if it is, in substance and effect, in conformity with this Ordinance and the

person assessed, or intended to be assessed or affected by the

document, is designated in it according to common understanding.](https://image.slidesharecdn.com/proceduresassesment-131228142201-phpapp01/85/Procedures-assesment-27-320.jpg)