SemiWEEK: SPIE Highlights, Coronavirus forecast scenarios; Semi Equip Outlook; Stocks recover some lost ground

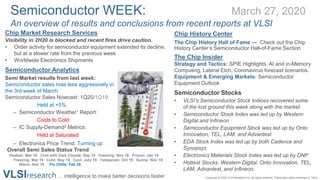

- 1. VLSIresearch … intelligence to make better decisions faster Copyright © 2020 VLSI Research Inc. All rights reserved. Distribution rights contained in T&Cs. Chip Market Research Services Visibility in 2H20 is blocked and recent fires drive caution. • Order activity for semiconductor equipment extended its decline, but at a slower rate from the previous week • Worldwide Electronics Shipments Semiconductor Analytics Semi Market results from last week: Semiconductor sales rose less aggressively in the 3rd week of March. Semiconductor Sales Nowcast: 1Q20/1Q19 Held at +5% – Semiconductor Weather1 Report: Cools to Cold – IC Supply-Demand2 Metrics: Held at Saturated – Electronics Price Trend: Turning up Overall Semi Sales Status Trend: Peaked: Mar 18 Cold with Dark Clouds: Sep 18 Freezing: Nov 18 Frozen: Jan 19 Freezing: Mar 19 Cold: May 19 Cool: July 19 Temperate: Oct 19 Sunny: Nov 19 Warm: Dec 19 Flu Chills: Feb 28 Chip History Center The Chip History Hall of Fame — Check out the Chip History Center’s Semiconductor Hall-of-Fame Section The Chip Insider Strategy and Tactics: SPIE Highlights, AI and in-Memory Computing, Lateral Etch, Coronavirus forecast scenarios. Equipment & Emerging Markets: Semiconductor Equipment Outlook Semiconductor Stocks • VLSI’s Semiconductor Stock Indices recovered some of the lost ground this week along with the market • Semiconductor Stock Index was led up by Western Digital and Infineon • Semiconductor Equipment Stock was led up by Onto Innovation, TEL, LAM, and Advantest • EDA Stock Index was led up by both Cadence and Synopsys • Electronics Materials Stock Index was led up by DNP • Hottest Stocks: Western Digital, Onto Innovation, TEL, LAM, Advantest, and Infineon. Semiconductor WEEK: March 27, 2020 An overview of results and conclusions from recent reports at VLSI

- 2. VLSIresearch … intelligence to make better decisions faster Copyright © 2020 VLSI Research Inc. All rights reserved. Distribution rights contained in T&Cs. The Chip Insider®'s Graphics File March 2020 Visibility in 2H20 is blocked and recent fires drive caution. This issue contains the latest forecast. Call us to access more details • Order activity for semiconductor equipment extended its decline, but at a slower rate from the previous week • Even though the chip making industry has been somewhat insulated from COVID-19 fallout, the overall sentiment is deteriorating in the face of a sharp contraction in economic activity • Second quarter GDP is now expected fall double digits with services and consumer expected to take the biggest hit • The positive is the memories of the Great Recession are still fresh and the central banks and governments around the world are pulling their bazookas to backstop the economy • The data from China is also becoming more positive, so there is light at the end of the tunnel even though timing remains uncertain • The Chip Price Performance Index (CPPI) slipped by another point

- 3. VLSIresearch … intelligence to make better decisions faster Copyright © 2020 VLSI Research Inc. All rights reserved. Distribution rights contained in T&Cs. Mild COVID-19 impact--VLSI Forecast Forecast as of March 2020: 2019 2020 2021 Semi Equipment ($B): 76.6$ 72.8$ 85.2$ Sequential Change -8.3% -5.1% 17.2% Capacity Utilization: 84.6% 82.1% 90.3% ICs ($B): 352.3$ 337.4$ 418.0$ Sequential Change -13.4% -4.2% 23.9% IC Units (BU): 299.4 284.8 342.1 Sequential Change -6.0% -4.9% 20.1% Electronics ($B) : 2,122$ 2,020$ 2,362$ Sequential Change -2.0% -4.8% 16.9% Mild COVID-19, but delayed recovery in 4Q20. Forecast as of March 2020: 2019 2020 2021 Semi Equipment ($B): 76.6$ 61.9$ 85.2$ Sequential Change -8.3% -19.2% 37.7% ICs ($B): 352.3$ 303.4$ 418.0$ Sequential Change -13.4% -13.9% 37.8% IC Units (BU): 299.4 255.1 342.1 Sequential Change -6.0% -14.8% 34.1% Electronics ($B) : 2,122$ 1,885$ 2,362$ Sequential Change -2.0% -11.2% 25.3% Severe COVID-19 impact, recovery 1Q21 Forecast as of March 2020: 2019 2020 2021 Semi Equipment ($B): 76.6$ 58.4$ 85.2$ Sequential Change -8.3% -23.8% 46.1% ICs ($B): 352.3$ 282.7$ 418.0$ Sequential Change -13.4% -19.8% 47.9% IC Units (BU): 299.4 238.3 342.1 Sequential Change -6.0% -20.4% 43.5% Electronics ($B) : 2,122$ 1,741$ 2,362$ Sequential Change -2.0% -18.0% 35.7%

- 4. VLSIresearch … intelligence to make better decisions faster Copyright © 2020 VLSI Research Inc. All rights reserved. Distribution rights contained in T&Cs. The Chip Insider® Graphics Worldwide Electronics Shipments • Electronics sales are being hit hard due to Coronavirus outbreak Worldwide Electronics Shipments: chart gives rolling averages for electronics sales

- 5. VLSIresearch … intelligence to make better decisions faster Copyright © 2020 VLSI Research Inc. All rights reserved. Distribution rights contained in T&Cs. Semiconductor Analytics Last Week in the Semiconductor Market: Overall Semi Sales Status Trend: Peaked: Mar 18 Cold with Dark Clouds: Sep 18 Freezing: Nov 18 Frozen: Jan 19 Freezing: Mar 19 Cold: May 19 Cool: July 19 Temperate: Oct 19 Sunny: Nov 19 Warm: Dec 19 Flu Chills: Feb 28 W/W:Week-over-WeeksequentialgrowthW/Q:Week-over-QuarterW/Y:Week-over-Year 1: Measures Order Activity 2: Measures Pricing Power 5 Thank you for supporting us through this last issue of 2018. Semiconductor Analytics will return January . Semiconductor sales rose less aggressively in the 3rd week of March, as the IC weather cooled to 59˚ F. Strong demand continued to drive electronics pricing up as well due to the Work-from-Home (WfH) economic restructuring. Semiconductor Sales Nowcast: 1Q20/1Q19 Held at +5% Semiconductor Weather1 Report: 59˚ F Cools to Cold IC Supply-Demand2 Metrics: Held at Saturated Electronics Pricing Trend: Turning up Driven by Work-from-Home economic restructuring

- 6. VLSIresearch … intelligence to make better decisions faster Copyright © 2020 VLSI Research Inc. All rights reserved. Distribution rights contained in T&Cs. 2019 Semiconductor Market Drivers 6 Coronavirus has had a deep negative impact on Integrated Circuit sales: • Certainties: – Coronavirus Pandemic – Macroeconomic Slowdown – 5G: Smartphone, Auto, Industrial – Win 7 EoL refresh – 7/10nm and 5/7nm demand ramps – Memory Price Elasticity • Uncertainties: – Ability of Central Banks to prevent economic infection from Coronavirus – 2020 Elections in U.S.

- 7. VLSIresearch … intelligence to make better decisions faster Copyright © 2020 VLSI Research Inc. All rights reserved. Distribution rights contained in T&Cs. The Chip Insider® Strategy & Tactics Strategy and Tactics: SPIE Highlights, AI and in-Memory Computing, Lateral Etch, Coronavirus forecast scenarios. Summaries: SPIE 2020 Highlights: This year’s conference would have had an eerie feeling even if fears of the Coronavirus had not made it so, because after a decades-long task as monumental as the seven-wonders of the world … EUV is done. If the plenary session quietly communicated that EUV is done, a large part of the rest of the conference was about the many things that need to be done to optimize EUV. Evangelos Eleftheriou’s Plenary made an undeniable case for why in- Memory Computing (iMC) is inexorably linked to the advancement of AI. He’s out of IBM Zürich, where they really know the topic. He addressed the elephant in the room that many in the AI intelligentsia don’t want the world to know: That making these leaps to larger NNs has come at the cost of an unsustainable rise to compute-power. Evangelos showed how with iMC, using Phase-Change Memory as an analog storage cell, one can make a spiking neural network that can do matrix-vector multiplication without moving data. IBM has made the chip and they were able to do 8-bit precision multiply operations with an efficiency of ~6fJ! In-memory computing solves the power problem, making it possible to bring AI to the edge like the CPU brought the computer to your desktop, lap, and then in your hand. This will be a huge market driver. The only question is … what to call it? Is it an iMP or in-Memory Processor? Applied Materials’ Lateral Etch: It’s rare to see a truly new revolutionary technology at a conference. SPIE had two. The second I saw was lateral etch in a presentation given by Regina Freed and quaintly titled “Materials engineering solutions to extend DRAM scaling.” What blew me away most was Applied’s development of what they’re calling “precision lateral etch.” Applied has been able to open up vias, thereby reducing EPE induced yield loss while lowering cost compared to a conventional multi-patterned cut mask approach, and carving out a larger via. Importantly it points to a new trend in strategic marketing. We show you why. Important ChipChirps™ Coronavirus Semiconductor Sales Watch and Equipment Market Impact “Intelligence is quickness in seeing things as they are” — George Santayana Contact us to get the full report and more

- 8. VLSIresearch … intelligence to make better decisions faster Copyright © 2020 VLSI Research Inc. All rights reserved. Distribution rights contained in T&Cs. The Chip Insider® Equipment & Emerging Markets Semiconductor Equipment Outlook • Semi Manufacturing in the wake of Coronavirus • Forecast Scenarios • Changes since last forecast • Semi Equipment Trends • Long-term trend is not impacted • VLSI’s view WildPhotons: Fear knocked at the door…

- 9. VLSIresearch … intelligence to make better decisions faster Copyright © 2020 VLSI Research Inc. All rights reserved. Distribution rights contained in T&Cs. Semi Manufacturing in Wake of Coronavirus • WGDP is collapsing from Coronavirus related shutdowns – Demand is dropping as populations get stay- in-place or quarantine orders throughout the world – 2Q GDP growth projections in U.S. vary wildly from -10% to -25% • One thing is clear: consumer and industrial demand is dropping dramatically short-term • We expect Electronics and Semiconductor demand dropping in the wake of WGDP collapse • However, this forecast is based on the following key assumptions: – 1.3B smartphones will be shipped, of which 7% to 15% will be 5G phones and will require 7nm and 5nm capacity – 250M PCs will be shipped – Datacenter and AI will require additional 7nm and 5nm manufacturing capacity • Hyperscale capex at least 2019 level – Consumer, Automotive, and Industrial segments will be hit in this crisis

- 10. VLSIresearch … intelligence to make better decisions faster Copyright © 2020 VLSI Research Inc. All rights reserved. Distribution rights contained in T&Cs. VLSI’s View • Key long-term drivers and trends are not changing: – Electronics sales running over $2T – ICs running at $330B – Equipment sales over $70B • New applications drive more complex processes, which drive equipment demand • Equipment sales are reliant on healthy semiconductor sales, units, and transition to new technologies • We have not yet seen substantial reduction in Semiconductor Equipment sales due to Coronavirus – The key industry drivers are still intact: • 5G Phones and Infrastructure • Datacenter • PC upgrade cycle • AI development • But, we expect activity to decline as economic activity collapses from local population movement restrictions – Segments likely to be affected most: • Automotive • Industrial • Consumer – 2Q20 is likely to be substantial down quarter • Recovery is still uncertain but VLSI is presenting three different scenarios and how they impact 2020

- 11. VLSIresearch … intelligence to make better decisions faster Copyright © 2020 VLSI Research Inc. All rights reserved. Distribution rights contained in T&Cs. semiStockWEEK: VLSI's Semiconductor Stock Indices recovered some of the lost ground this week along with the market. Semiconductors +13%, Equipment +21%, EDA +13%, Electronic Materials +14%.

- 12. VLSIresearch … intelligence to make better decisions faster Copyright © 2020 VLSI Research Inc. All rights reserved. Distribution rights contained in T&Cs. Semiconductor Stocks: Weekly Growth and Forward P/E Ratios by Company VLSI’s Semiconductor Stock Index was led up 12.6% by Western Digital and Infineon. IDM +18.7% Foundry & OSAT +3.1% Fabless & Fablite +14.0% AMD AMD Analog Devices ADI AmkorAMKR ASE ASX Broadcom AVGO IBM IBM Infineon IFNNY.PK Intel INTC JCET600584.SS Kingpak Technology6238.TWO Micron Technology MU On Semiconductor ON Panasonic PC MagnaChip Semiconductor MX Maxim MXIM MaxLinear MXL MediaTek 2454.TW NVIDIA NVDA Qualcomm QCOM Samsung Electronics 005930.KS Silicon Laboratories SLAB Skyworks SWKS SMIC SMI STMicroelectronics STM Texas Instruments TXN TSMC TSM UMC UMC Western Digital WDC Xilinx XLNX Weekly Gains 3/27/2020 Semiconductor Stocks Price Change Forward P/E Semiconductor Stocks Price Change Forward P/E IDM Fab-lite to Fabless Intel 14.3% 11 AMD 17.6% 29 Micron 20.4% 9 Analog Devices 4.2% 16 ON Semiconductor 19.1% 7 Broadcom 20.0% 10 Samsung Electronics 6.4% – IBM 13.0% 8 SK hynix 11.4% Infineon 26.0% 13 STMicroelectronics 22.9% 12 MagnaChip Semiconductor 19.2% 11 Western Digital 36.1% 6 Maxim 7.8% 19 Foundry & OSAT MaxLinear 13.4% 11 Amkor 11.2% 7 MediaTek 13.0% – ASE 5.5% 13 NVIDIA 22.8% 28 JCET -11.7% 66 Panasonic 15.3% 10 Kingpak Technology 14.0% – Qualcomm 9.3% 11 SMIC -0.2% 1214 Silicon Laboratories 15.7% 22 TSMC 5.3% 15 Skyworks 18.2% 12 UMC -2.7% 13 Texas Instruments 3.0% 18 Xilinx 4.7% 23

- 13. VLSIresearch … intelligence to make better decisions faster Copyright © 2020 VLSI Research Inc. All rights reserved. Distribution rights contained in T&Cs. Chip Equipment & Related Stocks: Weekly Growth and Forward P/E Ratios by Company VLSI’s Semiconductor Equipment Stock Index was led up 20.6% by Onto Innovation, Tokyo Electron, Lam Research, and Advantest. WFE +22.0% Test +24.4% Assembly +12.7% Applied Materials AMAT Advantest ATEYY ASM International ASMI ASM Lithography ASML ASM Pacific 0522.HK BE Semiconductor BESIY.PK FormFactor FORM KLA KLAC Kulicke & Soffa KLIC Lam Research LRCX Onto Innovation ONTO Nikon 7731 Teradyne TER Tokyo Electron Limited 8035 Veeco VECO Weekly Gains 0 3/27/2020 Equipment Stocks Price Change Forward P/E Equipment Stocks Price Change Forward P/E Wafer Process: Test: Applied Materials 18.6% 10 Advantest 28.3% – ASM International 16.5% 15 Teradyne 23.8% 15 ASML 16.9% 23 FormFactor 21.2% 17 KLA 24.8% 13 Lam Research 28.4% 12 Assembly: Onto Innovation 33.3% – BESI 22.2% – Nikon 12.2% – Kulicke & Soffa 11.5% 10 TEL 29.3% – ASM Pacific Technology 4.3% Veeco Instruments 18.1% 9

- 14. VLSIresearch … intelligence to make better decisions faster Copyright © 2020 VLSI Research Inc. All rights reserved. Distribution rights contained in T&Cs. Electronic Materials Stocks: Weekly Growth and Forward P/E Ratios by Company VLSI’s EDA Stock Index was led up 13.1% by both Cadence and Synopsys. VLSI’s Electronics Materials Stock Index was led up 14.4% by DNP. BASF BASFY Cabot Microelectronics CCMP Cadence CNDS DNP 7912 DuPont DD JSR 4185 Shin-Etsu 4063 SOITEC SOI.PA Synopsys SNPS Tokyo Ohka 4186 Weekly Gains 3/27/2020 EDA & Electronic Materials Stocks Price Change Forward P/E EDA & Electronic Materials Stocks Price Change Forward P/E EDA DNP 24.9% – Cadence 13.1% 23 DuPont 7.4% 4 Synopsys 13.1% 21 JSR 18.3% – Electronic Materials Shin-Etsu 19.6% – BASF 7.3% 2 SOITEC 5.1% – Cabot Microelectronics 20.2% 14 Tokyo Ohka 12.6% –

- 15. VLSIresearch … intelligence to make better decisions faster Copyright © 2020 VLSI Research Inc. All rights reserved. Distribution rights contained in T&Cs. Semi Stocks Equipment Stocks Materials Stocks EDA Stocks Semi Stocks Equipment Stocks Materials Stocks EDA Stocks 23-Aug-19 78.6 74.7 85.7 95.4 -1.3% -0.8% 0.8% 0.6% 19 6.6% -35 -9.5% 16.1% 87.9 -1.4% 30-Aug-19 81.2 75.8 87.7 99.0 3.2% 1.5% 2.4% 3.8% 45 7.3% -9 -6.6% 13.9% 90.3 2.8% 06-Sep-19 84.7 79.3 91.2 101.4 4.3% 4.6% 4.0% 2.5% 53 10.2% -1 -2.8% 13.0% 91.9 1.8% 13-Sep-19 87.6 83.4 95.8 94.3 3.5% 5.2% 5.0% -7.0% 45 17.1% -8 -7.5% 24.6% 92.8 1.0% 20-Sep-19 85.4 84.5 94.5 95.0 -2.6% 1.3% -1.3% 0.8% 19 5.7% -35 -8.3% 14.0% 92.3 -0.5% 27-Sep-19 83.6 83.6 93.8 94.7 -2.1% -1.1% -0.7% -0.4% 16 3.7% -37 -12.1% 15.8% 91.4 -1.0% 04-Oct-19 84.6 84.4 93.1 96.0 1.1% 1.1% -0.8% 1.4% 34 10.1% -20 -3.5% 13.6% 91.1 -0.3% 11-Oct-19 86.0 86.4 95.0 96.0 1.7% 2.3% 2.0% 0.0% 35 9.0% -15 -4.4% 13.4% 91.7 0.6% 18-Oct-19 86.2 86.7 97.5 94.5 0.2% 0.3% 2.7% -1.5% 28 11.2% -23 -6.0% 17.2% 92.2 0.5% 25-Oct-19 88.2 92.4 100.0 94.9 2.4% 6.6% 2.5% 0.4% 46 15.6% -7 -16.3% 31.9% 93.3 1.2% 01-Nov-19 90.3 92.6 101.2 94.8 2.4% 0.2% 1.3% -0.1% 36 9.9% -15 -12.1% 22.0% 94.7 1.5% 08-Nov-19 91.7 94.9 103.2 96.1 1.5% 2.5% 1.9% 1.3% 37 12.5% -14 -4.2% 16.7% 95.5 0.9% 15-Nov-19 92.0 97.0 101.5 97.6 0.4% 2.1% -1.6% 1.6% 31 10.8% -20 -5.0% 15.8% 96.3 0.9% 22-Nov-19 90.0 92.0 98.7 95.9 -2.2% -5.1% -2.8% -1.8% 7 5.7% -44 -17.7% 23.4% 96.0 -0.3% 29-Nov-19 90.9 93.7 96.7 100.1 1.0% 1.8% -2.0% 4.4% 37 5.0% -14 -15.0% 20.0% 96.9 1.0% 06-Dec-19 92.6 94.7 95.5 95.5 1.8% 1.1% -1.2% -4.6% 33 8.2% -19 -4.8% 13.0% 97.1 0.2% 13-Dec-19 96.7 98.0 100.0 96.9 4.5% 3.5% 4.7% 1.5% 48 10.7% -3 -1.4% 12.1% 97.8 0.7% 20-Dec-19 99.2 99.9 100.1 99.6 2.6% 1.9% 0.1% 2.7% 39 12.5% -13 -8.4% 20.9% 99.4 1.7% 27-Dec-19 100.0 100.0 100.0 100.0 0.8% 0.1% -0.1% 0.4% 29 5.9% -23 2.7% 8.6% 100.0 0.6% 03-Jan-20 100.3 100.2 98.9 100.5 0.3% 0.2% -1.1% 0.5% 23 9.5% -24 -3.4% 12.9% 99.8 -0.2% 10-Jan-20 101.5 100.9 99.2 104.7 1.2% 0.7% 0.2% 4.2% 32 7.2% -22 -4.8% 12.0% 100.8 0.9% 17-Jan-20 104.7 104.8 101.0 106.4 3.2% 3.9% 1.8% 1.7% 45 19.1% -10 -3.8% 22.9% 102.8 2.0% 24-Jan-20 106.1 105.1 100.5 107.8 1.3% 0.3% -0.5% 1.3% 29 14.9% -25 -10.8% 25.7% 101.7 -1.0% 31-Jan-20 98.4 98.4 96.0 103.8 -7.3% -6.3% -4.5% -3.8% 3 2.2% -51 -17.7% 19.9% 99.5 -2.1% 07-Feb-20 102.5 101.3 100.4 107.2 4.2% 2.9% 4.6% 3.3% 45 21.4% -10 -11.7% 33.1% 102.7 3.2% 14-Feb-20 106.5 106.6 101.0 114.2 3.9% 5.3% 0.6% 6.5% 47 27.5% -8 -10.0% 37.5% 104.3 1.6% 21-Feb-20 103.7 99.3 98.1 106.4 -2.6% -6.9% -2.8% -6.9% 6 4.5% -49 -17.1% 21.6% 103.0 -1.3% 28-Feb-20 93.1 90.4 85.5 96.2 -10.2% -8.9% -12.9% -9.5% 0 -0.8% -55 -21.3% 20.5% 91.2 -11.5% 06-Mar-20 91.8 91.0 84.8 95.1 -1.5% 0.6% -0.7% -1.2% 18 7.9% -35 -11.0% 18.9% 91.7 0.6% 13-Mar-20 81.1 78.3 71.0 90.7 -11.6% -13.9% -16.3% -4.6% 0 -2.1% -55 -26.6% 24.5% 83.7 -8.8% 20-Mar-20 69.6 65.2 67.0 78.4 -14.2% -16.7% -5.7% -13.6% 3 15.3% -52 -28.9% 44.2% 71.1 -15.0% 27-Mar-20 78.3 78.7 76.6 88.7 12.6% 20.6% 14.4% 13.1% 52 36.1% -3 -11.7% 47.8% 78.4 10.3% S&P500 Growth VLSI’s Indices of Chip Industry Stocks Weekly Growth The Prior Week's Close S&P500 MaxGrowth Companies Up Companies Down Rangeof Growth MinGrowth