SemiWEEK: Coronavirus Watch. 450mm: Why it failed. Has Moore’s Law slowed?; 2019 Top Semi Equipment Suppliers; Stocks plummet

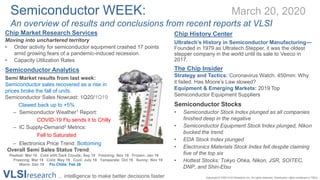

- 1. VLSIresearch … intelligence to make better decisions faster Copyright © 2020 VLSI Research Inc. All rights reserved. Distribution rights contained in T&Cs. Chip Market Research Services Moving into unchartered territory • Order activity for semiconductor equipment crashed 17 points amid growing fears of a pandemic-induced recession. • Capacity Utilization Rates Semiconductor Analytics Semi Market results from last week: Semiconductor sales recovered as a rise in prices broke the fall of units. Semiconductor Sales Nowcast: 1Q20/1Q19 Clawed back up to +5% – Semiconductor Weather1 Report: COVID-19 Flu sends it to Chilly – IC Supply-Demand2 Metrics: Fell to Saturated – Electronics Price Trend: Bottoming Overall Semi Sales Status Trend: Peaked: Mar 18 Cold with Dark Clouds: Sep 18 Freezing: Nov 18 Frozen: Jan 19 Freezing: Mar 19 Cold: May 19 Cool: July 19 Temperate: Oct 19 Sunny: Nov 19 Warm: Dec 19 Flu Chills: Feb 28 Chip History Center Ultratech’s History in Semiconductor Manufacturing— Founded in 1979 as Ultratech Stepper, it was the oldest stepper company in the world until its sale to Veeco in 2017. The Chip Insider Strategy and Tactics: Coronavirus Watch. 450mm: Why it failed. Has Moore’s Law slowed? Equipment & Emerging Markets: 2019 Top Semiconductor Equipment Suppliers Semiconductor Stocks • Semiconductor Stock Index plunged as all companies finished deep in the negative • Semiconductor Equipment Stock Index plunged, Nikon bucked the trend • EDA Stock Index plunged • Electronics Materials Stock Index fell despite claiming five of the top six • Hottest Stocks: Tokyo Ohka, Nikon, JSR, SOITEC, DNP, and Shin-Etsu Semiconductor WEEK: March 20, 2020 An overview of results and conclusions from recent reports at VLSI

- 2. VLSIresearch … intelligence to make better decisions faster Copyright © 2020 VLSI Research Inc. All rights reserved. Distribution rights contained in T&Cs. The Chip Insider®'s Graphics File March 2020 Moving into unchartered territory This issue contains the latest forecast. Call us to access more details • Order activity for semiconductor equipment crashed 17 points amid growing fears of a pandemic-induced recession. • The world economy is likely in a recession due to the accelerating shutdown of economic activity. • We have cut the forecasts across the board in March to reflect the significant disruption caused by the coronavirus pandemic in Electronics, ICs, and Equipment. Our current projection expects a big hit to the industry in 1H20 followed by a rapid recovery in the second half. If the recovery is delayed, the declines in Electronics, ICs, and Equipment will be far greater—see the next page for more details on the forecast scenarios. • The Chip Price Performance Index (CPPI) slid 1 point. • Falling end-demand will halt the IC recovery and keep the IC market in the red in the near term.

- 3. VLSIresearch … intelligence to make better decisions faster Copyright © 2020 VLSI Research Inc. All rights reserved. Distribution rights contained in T&Cs. Mild COVID-19 impact--VLSI Forecast Forecast as of March 2020: 2019 2020 2021 Semi Equipment ($B): 76.6$ 72.8$ 85.2$ Sequential Change -8.3% -5.1% 17.2% Capacity Utilization: 84.6% 82.1% 90.3% ICs ($B): 352.3$ 337.4$ 418.0$ Sequential Change -13.4% -4.2% 23.9% IC Units (BU): 299.4 284.8 342.1 Sequential Change -6.0% -4.9% 20.1% Electronics ($B) : 2,122$ 2,020$ 2,362$ Sequential Change -2.0% -4.8% 16.9% Mild COVID-19, but delayed recovery in 4Q20. Forecast as of March 2020: 2019 2020 2021 Semi Equipment ($B): 76.6$ 61.9$ 85.2$ Sequential Change -8.3% -19.2% 37.7% ICs ($B): 352.3$ 303.4$ 418.0$ Sequential Change -13.4% -13.9% 37.8% IC Units (BU): 299.4 255.1 342.1 Sequential Change -6.0% -14.8% 34.1% Electronics ($B) : 2,122$ 1,885$ 2,362$ Sequential Change -2.0% -11.2% 25.3% Severe COVID-19 impact, recovery 1Q21 Forecast as of March 2020: 2019 2020 2021 Semi Equipment ($B): 76.6$ 58.4$ 85.2$ Sequential Change -8.3% -23.8% 46.1% ICs ($B): 352.3$ 282.7$ 418.0$ Sequential Change -13.4% -19.8% 47.9% IC Units (BU): 299.4 238.3 342.1 Sequential Change -6.0% -20.4% 43.5% Electronics ($B) : 2,122$ 1,741$ 2,362$ Sequential Change -2.0% -18.0% 35.7%

- 4. VLSIresearch … intelligence to make better decisions faster Copyright © 2020 VLSI Research Inc. All rights reserved. Distribution rights contained in T&Cs. The Chip Insider® Graphics Capacity Utilization Rates: • Utilization rates remain low due to overcapacity Capacity Utilization Rates: chart gives rolling averages for semiconductor wafer fab, test, and assembly

- 5. VLSIresearch … intelligence to make better decisions faster Copyright © 2020 VLSI Research Inc. All rights reserved. Distribution rights contained in T&Cs. Semiconductor Analytics Last Week in the Semiconductor Market: Overall Semi Sales Status Trend: Peaked: Mar 18 Cold with Dark Clouds: Sep 18 Freezing: Nov 18 Frozen: Jan 19 Freezing: Mar 19 Cold: May 19 Cool: July 19 Temperate: Oct 19 Sunny: Nov 19 Warm: Dec 19 Flu Chills: Feb 28 W/W:Week-over-WeeksequentialgrowthW/Q:Week-over-QuarterW/Y:Week-over-Year 1: Measures Order Activity 2: Measures Pricing Power 5 Thank you for supporting us through this last issue of 2018. Semiconductor Analytics will return January . Semiconductor sales recovered as a rise in prices broke the fall of units. Semiconductor Supply- Demand fell to Saturated last week as defensive buying from the Coronavirus paused. Memory hoarding from Korea COVID-19 fears ended. Semiconductor Sales Nowcast: 1Q20/1Q19 Clawed back up to +5% Semiconductor Weather1 Report: 63˚ F COVID-19 Flu sends it to Chilly IC Supply-Demand2 Metrics: Fell to Saturated Electronics Pricing Trend: Bottoming Notebooks and CE turned up, Smartphones down

- 6. VLSIresearch … intelligence to make better decisions faster Copyright © 2020 VLSI Research Inc. All rights reserved. Distribution rights contained in T&Cs. 2019 Semiconductor Market Drivers 6 Coronavirus has had a deep negative impact on Integrated Circuit sales: • Certainties: – Coronavirus Pandemic – Macroeconomic Slowdown – 5G: Smartphone, Auto, Industrial – Win 7 EoL refresh – 7/10nm and 5/7nm demand ramps – Memory Price Elasticity • Uncertainties: – Ability of Central Banks to prevent economic infection from Coronavirus – 2020 Elections in U.S.

- 7. VLSIresearch … intelligence to make better decisions faster Copyright © 2020 VLSI Research Inc. All rights reserved. Distribution rights contained in T&Cs. The Chip Insider® Strategy & Tactics Strategy and Tactics: Coronavirus Watch. 450mm: Why it failed. Has Moore’s Law slowed? Summaries: Coronavirus Semiconductor Watch: Coronavirus Semiconductor Market Watch: Last week’s IC Sales were up over its 5-year TMA in week+4 of the Coronavirus pandemic. Hoarding drove prices up enough to offset the drop in units and hold up revenues. VLSI did update its semiconductor value-stack forecast recently to account for the likely impact of the Coronavirus based on previous forecasts. The biggest outlook change was in the first quarter of 2020, where semiconductor shipments were cut by 1.0B units and sales by $2B due to the Coronavirus … The Coronavirus is now expected to cost Electronics shipments $26.4B in in the first quarter of 2020... 450mm: Why it failed… There are a lot of reasons one can point to for the semiconductor industry’s failure to bring 450mm silicon wafers to fruition. One is that a consensus of its urgency never emerged among the foundries and IDMs. Another was the thinly veiled opposition from the semiconductor equipment and materials industry. The same could also be said for the lack of consensus of wafer fab owners, as they all knew the history of first-to-a-new-wafer-size. But in the end it was the economics of Moore’s Law … So, has Moore’s Law slowed? The answer is it depends on exactly what you think Moore’s Law is. It means many things to many people, but to everyone it means some form of innovation. As the chart shows, what’s amazing about the industry-wide growth in areal density is the semiconductor industry is still above the trendline after 55-years! We’ve done an amazing job of delaying forever, as Gordon Moore told us to do: “No physical quantity can continue to change exponentially forever… Your job is delaying forever.” What’s Happening and What’s the Meaning: Nikon reorganizes its corporate structure. Intel’s Supplier Quality Awards announced. Lam Research formally launched its Sense.i™ etch platform and its dry resist process. KLA announced the Archer™ 750 overlay metrology system and the SpectraShape™ 11k optical CD metrology system. GLOBALFOUNDRIES announced its eMRAM had entered production of its 22FDX platform. Comments, Questions & Answers: Why is Intel lagging TSMC and Samsung on moving EUV to production, when they’ve been the one to push the hardest. What’s changed? Dan, Regarding your Coronavirus reports of wild IC price fluctuations, it’s my understanding that most of time lower prices come from an oversupply (supply/demand curve) but is that not the case now? Contact us to get the full report and more

- 8. VLSIresearch … intelligence to make better decisions faster Copyright © 2020 VLSI Research Inc. All rights reserved. Distribution rights contained in T&Cs. The Chip Insider® Equipment & Emerging Markets 2019 Top Semiconductor Equipment Suppliers • Key business drivers in 2019 • Leading semiconductor equipment suppliers • Challenging year • 2019 Winners and notes • WildPhotons: Even the friendliest competitor…

- 9. VLSIresearch … intelligence to make better decisions faster Copyright © 2020 VLSI Research Inc. All rights reserved. Distribution rights contained in T&Cs. Key Business Drivers in 2018 • Logic/foundry saved the year for semiconductor equipment suppliers – Strong capacity and technology investments, increasing CAPEX – Continued 10nm, 7nm, and 5nm investments • Substantial investments in EUV – 5G, AI, Datacenter, and Automotive continued to be key drivers • Memory bubble burst in late 2018 and continued through 2019 – Memory prices collapsed and withdrew available cashflow for equipment spending – Second half of 2019 started to show some signs of the recovery • Strategic investment in 5G and Datacenter as well as 7 & 5nm in logic and foundries helped rapid 2H recovery – Positive surprise for all players led to forecast revisions • Equipment service and support held pretty well due to installed base 9

- 10. VLSIresearch … intelligence to make better decisions faster Copyright © 2020 VLSI Research Inc. All rights reserved. Distribution rights contained in T&Cs. 2019 Top Equipment Suppliers Challenging year resulted in only a 4% decline for top companies 10

- 11. VLSIresearch … intelligence to make better decisions faster Copyright © 2020 VLSI Research Inc. All rights reserved. Distribution rights contained in T&Cs. 2019 Winners and Notes • The year was won by ALD, Process Control, EUV, and SOC Test: – Nikon doubled sales with 112% growth – ASM International led ALD pack by growing 27% – KLA grew 10% – ASML reached flat year, while their EUV sales grew 29% – Teradyne grew 4% – Advantest declined 4%, while SOC test grew 23% • Regional basis Europe based companies gained small growth for the year: – EU: +2% – U.S.: -5% – JA: -5% – CH: -24% • Overall 2019 was mixed based on quarterly and segment results – WFE experienced substantial recovery in 2H19 from Logic and Foundry customers – Memory reached a bottom and showed some improvement – Test was driven by high design and engineering activity in 5G and datacenter – Assembly struggled to find growth in 2019 • Substantial over capacity in multiple application slowed demand • Weak memory demand also contributed to the decline • The preliminary segment results show substantial differences 11

- 12. VLSIresearch … intelligence to make better decisions faster Copyright © 2020 VLSI Research Inc. All rights reserved. Distribution rights contained in T&Cs. semiStockWEEK: VLSI's Semiconductor Stock Indices plummeted with the market again as fears surrounding COVID-19 intensified even more. Semiconductors -14%, Equipment -17%, EDA -14%, Electronic Materials -6%.

- 13. VLSIresearch … intelligence to make better decisions faster Copyright © 2020 VLSI Research Inc. All rights reserved. Distribution rights contained in T&Cs. Semiconductor Stocks: Weekly Growth and Forward P/E Ratios by Company VLSI’s Semiconductor Stock Index plunged 14.2% as all companies finished the week deep in the negative. IDM -17.7% Foundry & OSAT -11.8% Fabless & Fablite -13.6% AMD AMD Analog Devices ADI AmkorAMKR ASE ASX Broadcom AVGO IBM IBM Infineon IFNNY.PK Intel INTC JCET600584.SS Kingpak Technology6238.TWO Micron Technology MU On Semiconductor ON Panasonic PC MagnaChip Semiconductor MX Maxim MXIM MaxLinear MXL MediaTek 2454.TW NVIDIA NVDA Qualcomm QCOM Samsung Electronics 005930.KS Silicon Laboratories SLAB Skyworks SWKS SMIC SMI STMicroelectronics STM Texas Instruments TXN TSMC TSM UMC UMC Western Digital WDC Xilinx XLNX Weekly Gains 3/20/2020 Semiconductor Stocks Price Change Forward P/E Semiconductor Stocks Price Change Forward P/E IDM Fab-lite to Fabless Intel -15.8% 9 AMD -9.8% 25 Micron -16.0% 7 Analog Devices -14.7% 15 ON Semiconductor -25.3% 6 Broadcom -17.9% 8 Samsung Electronics -9.1% – IBM -11.6% 7 SK hynix -9.3% Infineon -28.9% 10 STMicroelectronics -22.8% 9 MagnaChip Semiconductor -7.5% 9 Western Digital -25.8% 4 Maxim -9.1% 17 Foundry & OSAT MaxLinear -21.5% 10 Amkor -13.4% 6 MediaTek -11.7% – ASE -17.2% 8 NVIDIA -14.6% 22 JCET -5.5% 75 Panasonic -10.6% 9 Kingpak Technology -16.4% – Qualcomm -19.7% 10 SMIC -10.3% 1216 Silicon Laboratories -15.3% 19 TSMC -14.8% 13 Skyworks -11.2% 10 UMC -5.1% 8 Texas Instruments -8.0% 17 Xilinx -6.1% 22

- 14. VLSIresearch … intelligence to make better decisions faster Copyright © 2020 VLSI Research Inc. All rights reserved. Distribution rights contained in T&Cs. Chip Equipment & Related Stocks: Weekly Growth and Forward P/E Ratios by Company VLSI’s Semiconductor Equipment Stock Index plunged 16.7%, Nikon bucked the trend, jumping 7%. WFE -17.2% Test -16.8% Assembly -15% Applied Materials AMAT Advantest ATEYY ASM International ASMI ASM Lithography ASML ASM Pacific 0522.HK BE Semiconductor BESIY.PK FormFactor FORM KLA KLAC Kulicke & Soffa KLIC Lam Research LRCX Onto Innovation ONTO Nikon 7731 Teradyne TER Tokyo Electron Limited 8035 Veeco VECO Weekly Gains 0 3/20/2020 Equipment Stocks Price Change Forward P/E Equipment Stocks Price Change Forward P/E Wafer Process: Test: Applied Materials -25.3% 8 Advantest -15.0% – ASM International -11.4% 13 Teradyne -18.8% 12 ASML -15.9% 19 FormFactor -16.7% 13 KLA -21.6% 10 Lam Research -28.2% 9 Assembly: Onto Innovation -23.4% – BESI -14.2% – Nikon 7.1% – Kulicke & Soffa -18.3% 9 TEL -12.4% – ASM Pacific Technology -12.6% Veeco Instruments -23.3% 7

- 15. VLSIresearch … intelligence to make better decisions faster Copyright © 2020 VLSI Research Inc. All rights reserved. Distribution rights contained in T&Cs. Electronic Materials Stocks: Weekly Growth and Forward P/E Ratios by Company VLSI’s EDA Stock Index plunged 13.6% VLSI’s Electronics Materials Stock Index fell 5.7% despite claiming five of the six top performers. BASF BASFY Cabot Microelectronics CCMP Cadence CNDS DNP 7912 DuPont DD JSR 4185 Shin-Etsu 4063 SOITEC SOI.PA Synopsys SNPS Tokyo Ohka 4186 Weekly Gains 3/20/2020 EDA & Electronic Materials Stocks Price Change Forward P/E EDA & Electronic Materials Stocks Price Change Forward P/E EDA DNP -3.5% – Cadence -11.8% 21 DuPont -15.1% 4 Synopsys -15.3% 18 JSR 3.5% – Electronic Materials Shin-Etsu -4.1% – BASF -14.0% 2 SOITEC -1.0% – Cabot Microelectronics -26.4% 11 Tokyo Ohka 15.3% –

- 16. VLSIresearch … intelligence to make better decisions faster Copyright © 2020 VLSI Research Inc. All rights reserved. Distribution rights contained in T&Cs. Semi Stocks Equipment Stocks Materials Stocks EDA Stocks Semi Stocks Equipment Stocks Materials Stocks EDA Stocks 16-Aug-19 79.7 75.2 85.0 94.9 0.1% 0.5% -1.2% -1.4% 25 8.7% -28 -8.8% 17.5% 89.2 -1.0% 23-Aug-19 78.6 74.7 85.7 95.4 -1.3% -0.8% 0.8% 0.6% 19 6.6% -35 -9.5% 16.1% 87.9 -1.4% 30-Aug-19 81.2 75.8 87.7 99.0 3.2% 1.5% 2.4% 3.8% 45 7.3% -9 -6.6% 13.9% 90.3 2.8% 06-Sep-19 84.7 79.3 91.2 101.4 4.3% 4.6% 4.0% 2.5% 53 10.2% -1 -2.8% 13.0% 91.9 1.8% 13-Sep-19 87.6 83.4 95.8 94.3 3.5% 5.2% 5.0% -7.0% 45 17.1% -8 -7.5% 24.6% 92.8 1.0% 20-Sep-19 85.4 84.5 94.5 95.0 -2.6% 1.3% -1.3% 0.8% 19 5.7% -35 -8.3% 14.0% 92.3 -0.5% 27-Sep-19 83.6 83.6 93.8 94.7 -2.1% -1.1% -0.7% -0.4% 16 3.7% -37 -12.1% 15.8% 91.4 -1.0% 04-Oct-19 84.6 84.4 93.1 96.0 1.1% 1.1% -0.8% 1.4% 34 10.1% -20 -3.5% 13.6% 91.1 -0.3% 11-Oct-19 86.0 86.4 95.0 96.0 1.7% 2.3% 2.0% 0.0% 35 9.0% -15 -4.4% 13.4% 91.7 0.6% 18-Oct-19 86.2 86.7 97.5 94.5 0.2% 0.3% 2.7% -1.5% 28 11.2% -23 -6.0% 17.2% 92.2 0.5% 25-Oct-19 88.2 92.4 100.0 94.9 2.4% 6.6% 2.5% 0.4% 46 15.6% -7 -16.3% 31.9% 93.3 1.2% 01-Nov-19 90.3 92.6 101.2 94.8 2.4% 0.2% 1.3% -0.1% 36 9.9% -15 -12.1% 22.0% 94.7 1.5% 08-Nov-19 91.7 94.9 103.2 96.1 1.5% 2.5% 1.9% 1.3% 37 12.5% -14 -4.2% 16.7% 95.5 0.9% 15-Nov-19 92.0 97.0 101.5 97.6 0.4% 2.1% -1.6% 1.6% 31 10.8% -20 -5.0% 15.8% 96.3 0.9% 22-Nov-19 90.0 92.0 98.7 95.9 -2.2% -5.1% -2.8% -1.8% 7 5.7% -44 -17.7% 23.4% 96.0 -0.3% 29-Nov-19 90.9 93.7 96.7 100.1 1.0% 1.8% -2.0% 4.4% 37 5.0% -14 -15.0% 20.0% 96.9 1.0% 06-Dec-19 92.6 94.7 95.5 95.5 1.8% 1.1% -1.2% -4.6% 33 8.2% -19 -4.8% 13.0% 97.1 0.2% 13-Dec-19 96.7 98.0 100.0 96.9 4.5% 3.5% 4.7% 1.5% 48 10.7% -3 -1.4% 12.1% 97.8 0.7% 20-Dec-19 99.2 99.9 100.1 99.6 2.6% 1.9% 0.1% 2.7% 39 12.5% -13 -8.4% 20.9% 99.4 1.7% 27-Dec-19 100.0 100.0 100.0 100.0 0.8% 0.1% -0.1% 0.4% 29 5.9% -23 2.7% 8.6% 100.0 0.6% 03-Jan-20 100.3 100.2 98.9 100.5 0.3% 0.2% -1.1% 0.5% 23 9.5% -24 -3.4% 12.9% 99.8 -0.2% 10-Jan-20 101.5 100.9 99.2 104.7 1.2% 0.7% 0.2% 4.2% 32 7.2% -22 -4.8% 12.0% 100.8 0.9% 17-Jan-20 104.7 104.8 101.0 106.4 3.2% 3.9% 1.8% 1.7% 45 19.1% -10 -3.8% 22.9% 102.8 2.0% 24-Jan-20 106.1 105.1 100.5 107.8 1.3% 0.3% -0.5% 1.3% 29 14.9% -25 -10.8% 25.7% 101.7 -1.0% 31-Jan-20 98.4 98.4 96.0 103.8 -7.3% -6.3% -4.5% -3.8% 3 2.2% -51 -17.7% 19.9% 99.5 -2.1% 07-Feb-20 102.5 101.3 100.4 107.2 4.2% 2.9% 4.6% 3.3% 45 21.4% -10 -11.7% 33.1% 102.7 3.2% 14-Feb-20 106.5 106.6 101.0 114.2 3.9% 5.3% 0.6% 6.5% 47 27.5% -8 -10.0% 37.5% 104.3 1.6% 21-Feb-20 103.7 99.3 98.1 106.4 -2.6% -6.9% -2.8% -6.9% 6 4.5% -49 -17.1% 21.6% 103.0 -1.3% 28-Feb-20 93.1 90.4 85.5 96.2 -10.2% -8.9% -12.9% -9.5% 0 -0.8% -55 -21.3% 20.5% 91.2 -11.5% 06-Mar-20 91.8 91.0 84.8 95.1 -1.5% 0.6% -0.7% -1.2% 18 7.9% -35 -11.0% 18.9% 91.7 0.6% 13-Mar-20 81.1 78.3 71.0 90.7 -11.6% -13.9% -16.3% -4.6% 0 -2.1% -55 -26.6% 24.5% 83.7 -8.8% 20-Mar-20 69.6 65.2 67.0 78.4 -14.2% -16.7% -5.7% -13.6% 3 15.3% -52 -28.9% 44.2% 71.1 -15.0% The Prior Week's Close S&P500 MaxGrowth Companies Up Companies Down Rangeof Growth MinGrowth S&P500 Growth VLSI’s Indices of Chip Industry Stocks Weekly Growth