The document provides an overview of the electronics sector in India with the following key points:

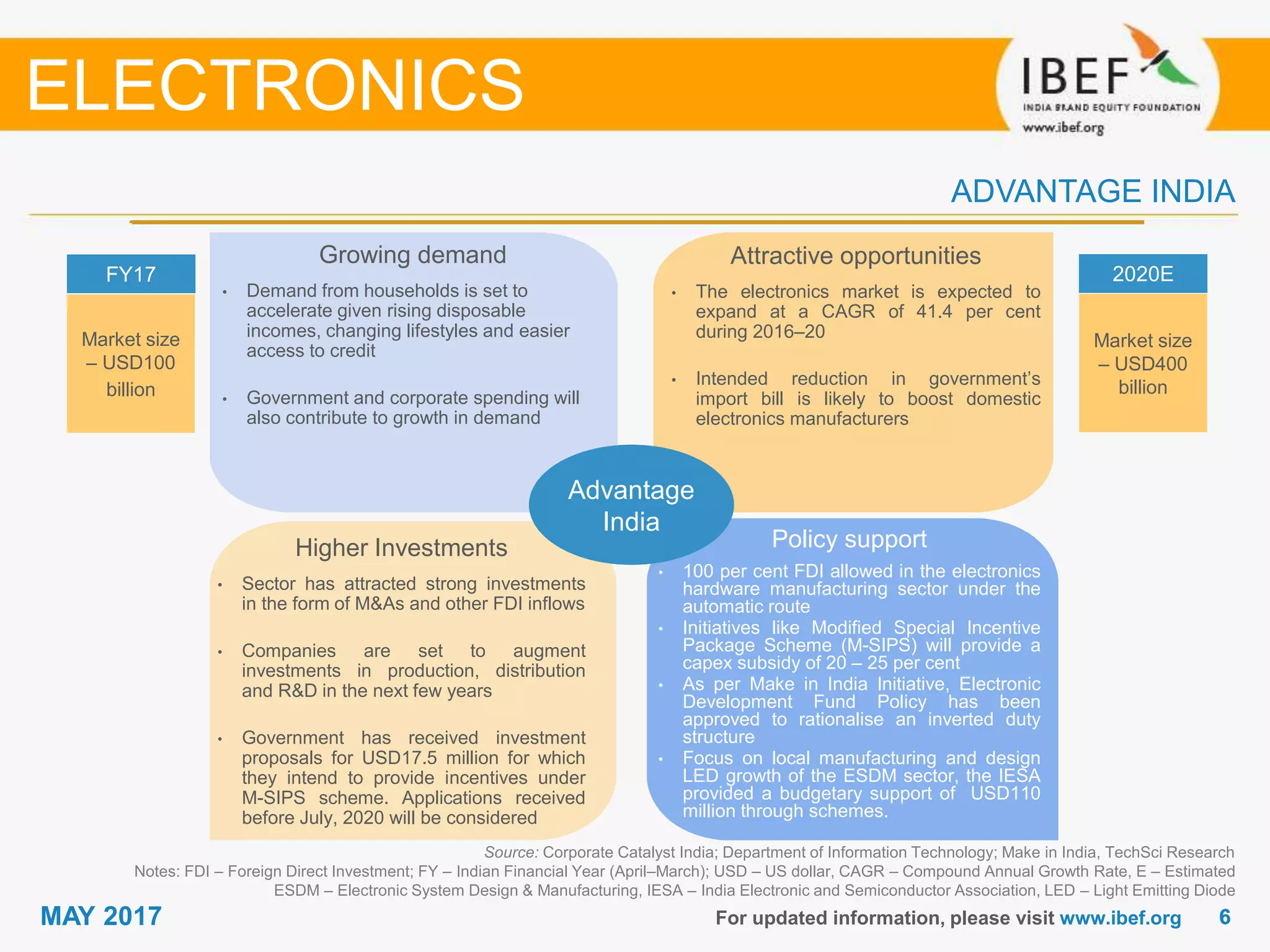

- The electronics market in India is expected to increase from USD 100 billion in 2016 to USD 400 billion in 2020, growing at a CAGR of 41.4%.

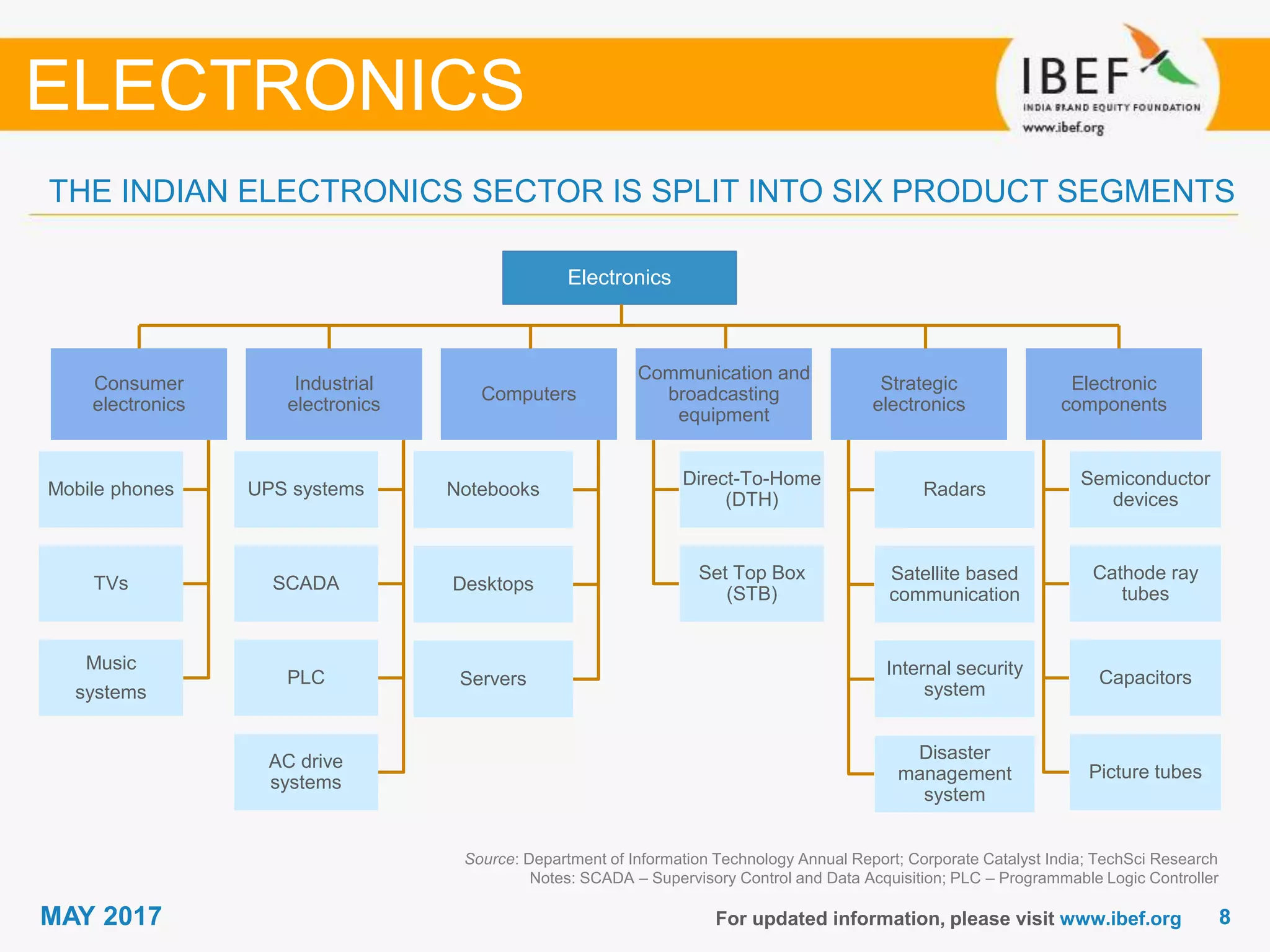

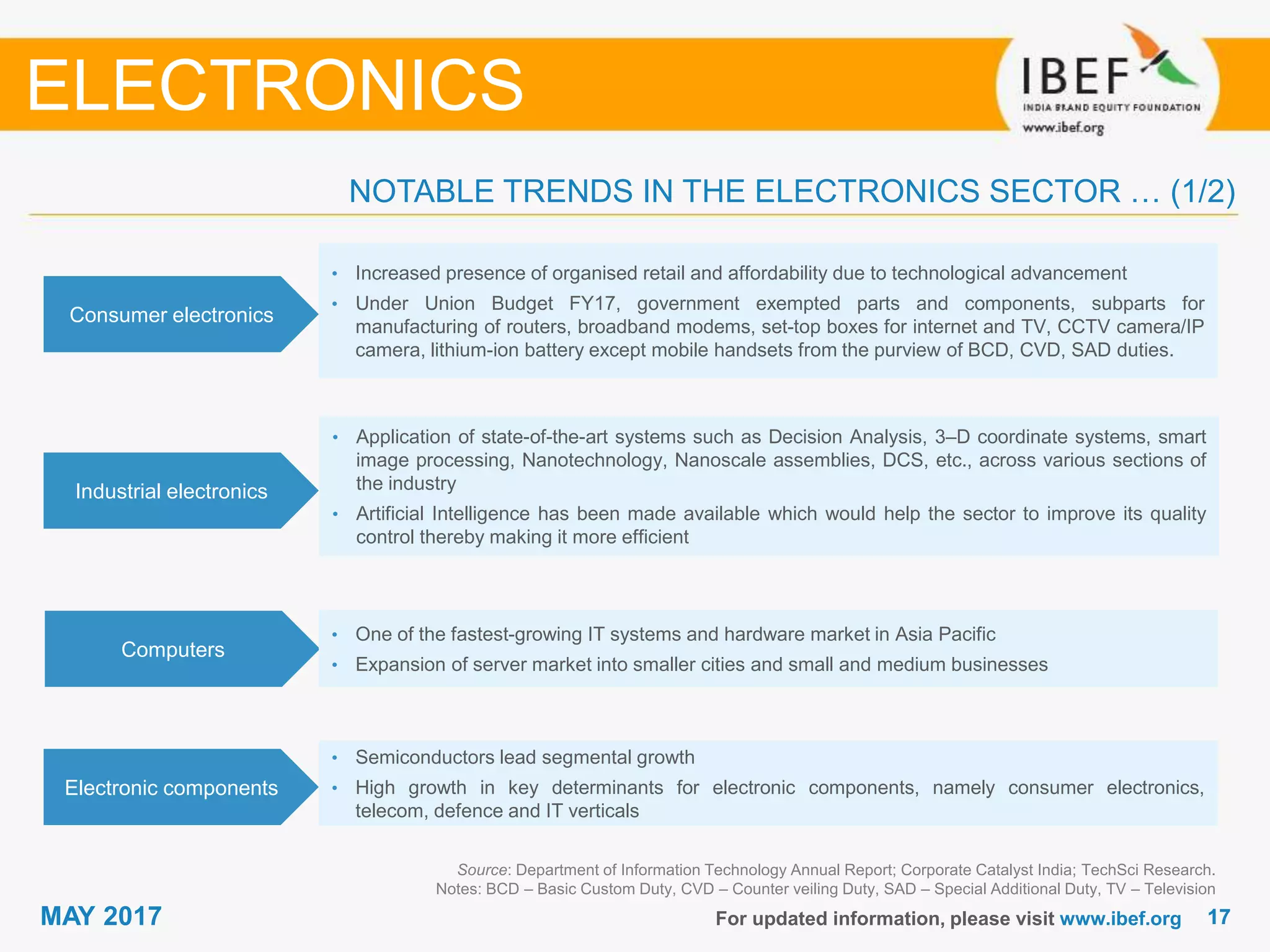

- Major segments of the electronics market include consumer electronics, industrial electronics, computers, communication equipment, strategic electronics, and electronic components.

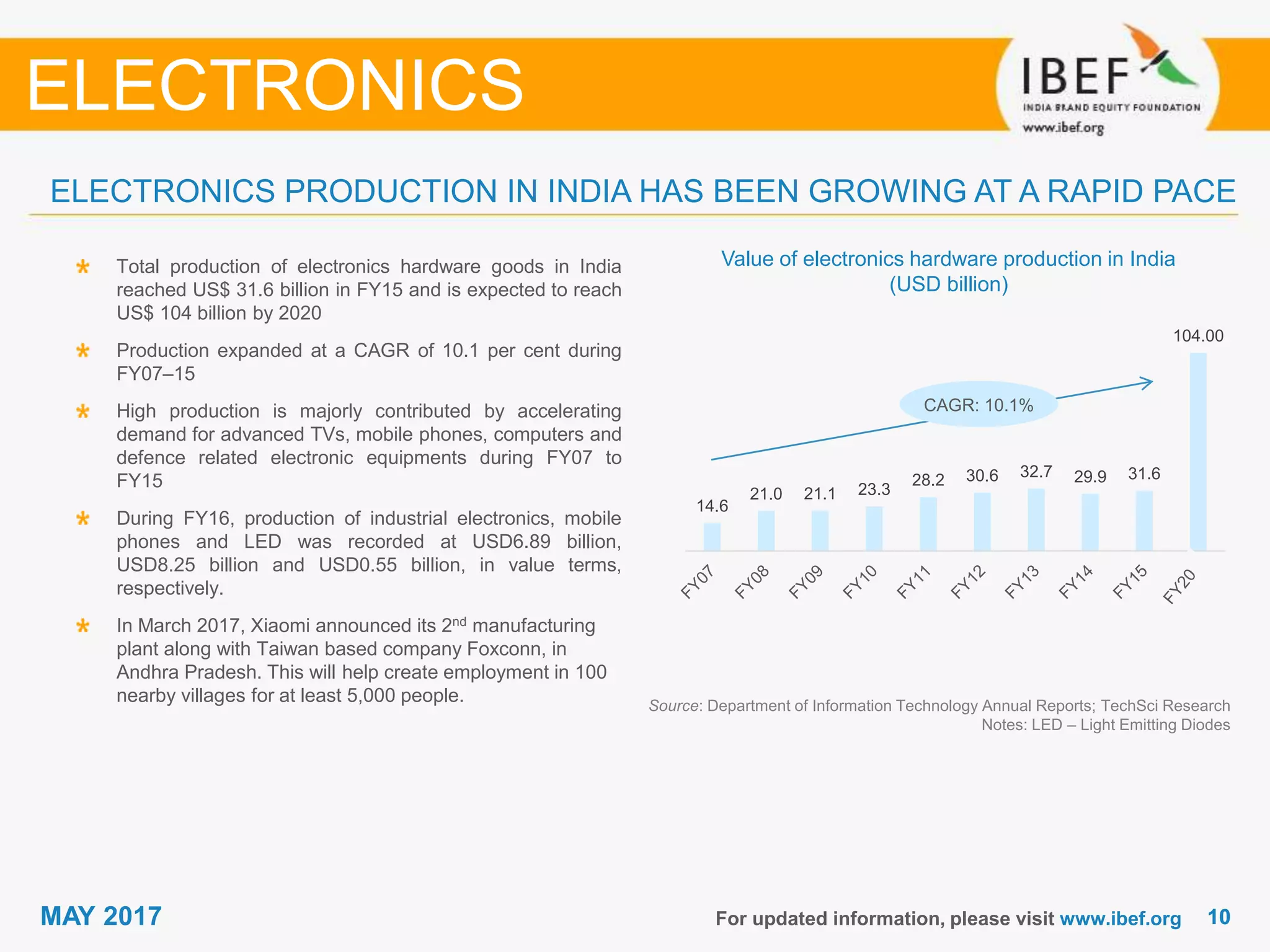

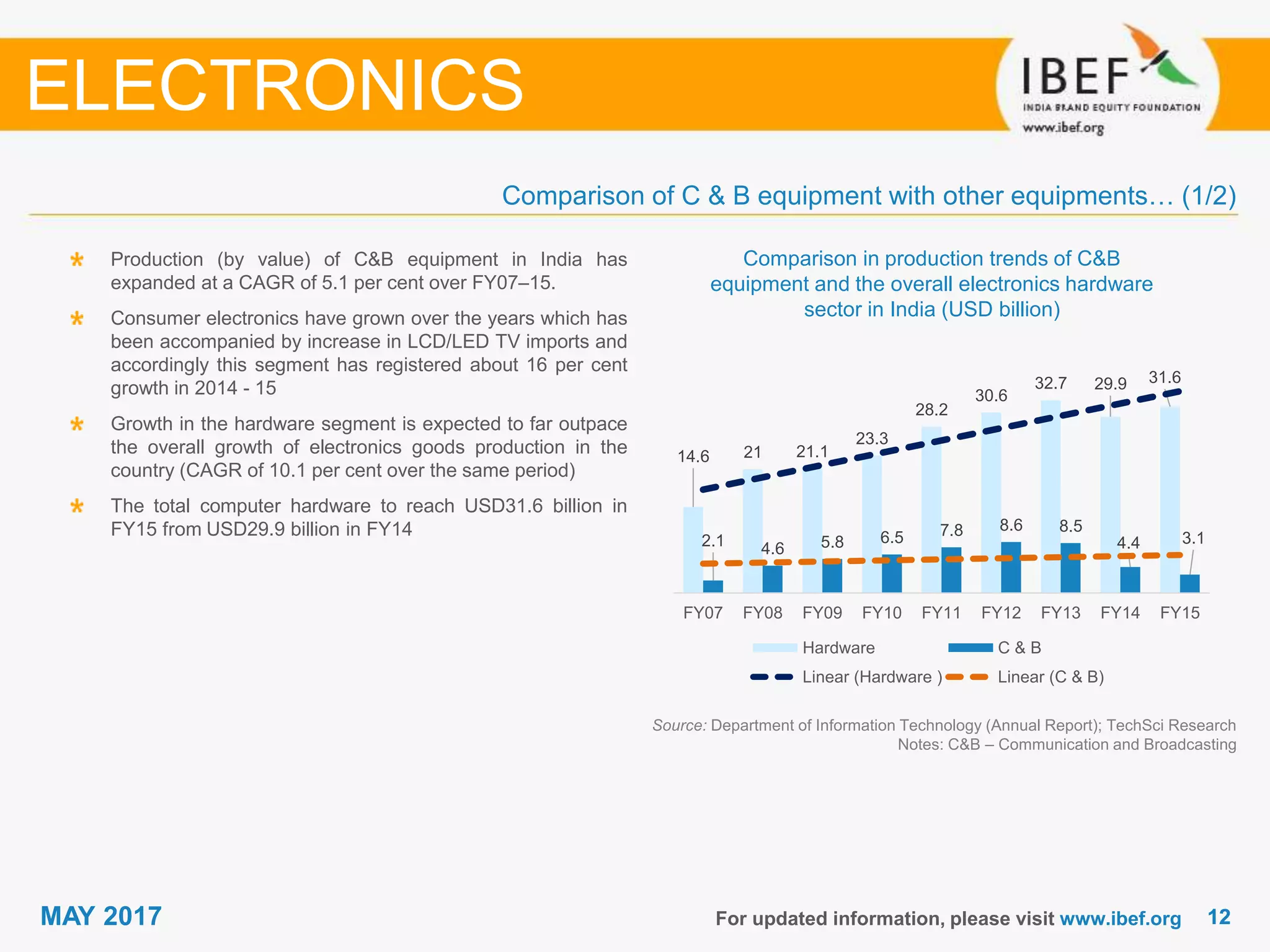

- Production of electronics hardware in India reached USD 31.6 billion in FY2015 and is estimated to reach USD 104 billion by 2020, growing at a CAGR of 10.1%.

- Consumer electronics account for the largest share (29.7%) of total electronics production in India.