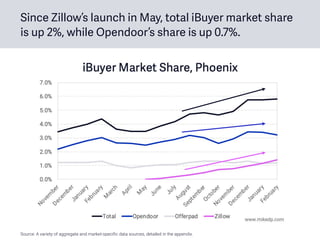

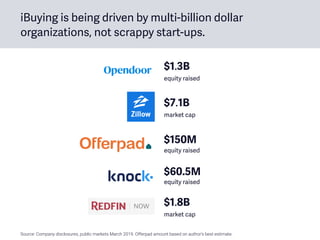

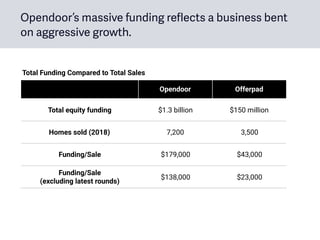

The 2019 iBuyer Report discusses the transformative impact of instant buyers (ibuyers) on the real estate industry, led by companies like Opendoor. With significant investment and market presence, ibuyers accounted for 0.2% of national transactions in 2018, while in Phoenix, this share reached nearly 6%. The report outlines the financial dynamics, customer propositions, and competitive landscape of the ibuying sector, emphasizing the importance of scale for profitability.