The document discusses revisions made to Form 3CD in India. Key points include:

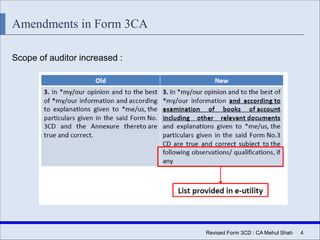

- Amendments were made to Forms 3CA and 3CB related to the scope of auditors and providing space for observations.

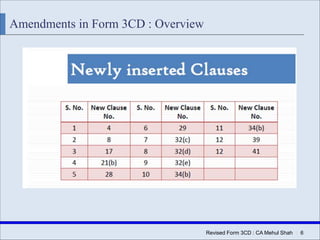

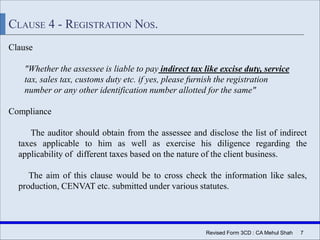

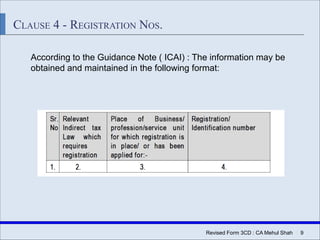

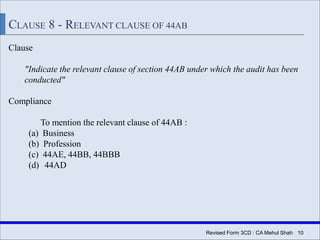

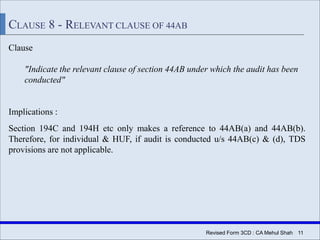

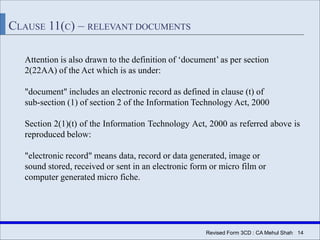

- New clauses were inserted into Form 3CD including requiring registration numbers for indirect taxes, the relevant clause of section 44AB for the audit, address details for books of accounts, and details of immovable property transfers.

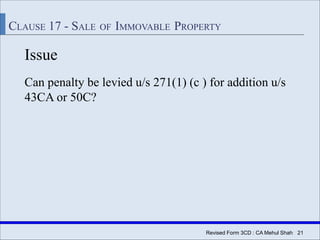

- Specific details must be provided for deductions claimed, employee contributions, inadmissible expenses, and payments to non-residents without TDS.

- The auditor must assess the admissibility of deductions and contributions according to the Income Tax Act and provide section-

![Revised Form 3CD : CA Mehul Shah| 20

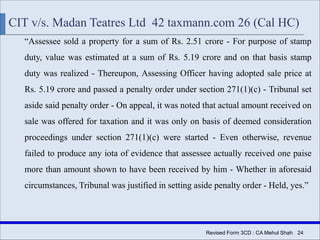

DCIT vs Tejinder Singh [ 32 CCH 58 (Kolkata Tribunal) ]

“monies received by the assessee being clearly in the nature of receipts for the

transfer of tenancy rights, section 50C of the act could not be invoked ”.](https://image.slidesharecdn.com/3cdpresentation-150801201253-lva1-app6891/85/Revised-Form-3CD-presentation-20-320.jpg)

![Revised Form 3CD : CA Mehul Shah| 22

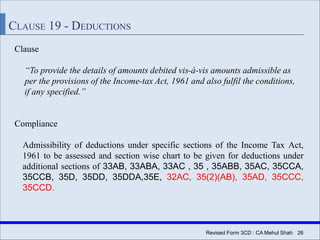

Renu Hingorani vs ACIT [ ITA No. 2210/Mum/2010 ]

“Merely because the assessee agreed for addition on the basis of valuation made by

the Stamp Valuation Authority would not be a conclusive proof that the sale

consideration as per this agreement was incorrect and wrong. Accordingly the

addition because of the deeming provisions does not ipso facto attract the penalty u/s

271(1)(c ). Hence in view of the decision of the Hon’ble Supreme Court in the case

of CIT V/s Reliance Petroproducts Pvt.Ltd (supra), the penalty levied u/s 271(1)( c )

is not sustainable. The same is deleted. “](https://image.slidesharecdn.com/3cdpresentation-150801201253-lva1-app6891/85/Revised-Form-3CD-presentation-22-320.jpg)

![Revised Form 3CD : CA Mehul Shah| 23

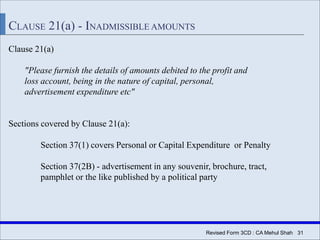

Sukhabhai P. Ahir (HUF) vs ITO [ITA No. 2454/Ahd/2009]

“ It is pertinent to note that in the quantum proceedings, there is no finding that the

assessee has received anything more than the consideration mentioned in the sale

deed. The addition was made by invoking the provisions contained in section 50C of

the I.T.Act, 1961. In the case of Shri Haresh P. Shah (supra), relied on by the ld.

Counsel of the assessee, on identical fact, the penalty of Rs.33,082/- was levied

under section 271(1)(c) of the I.T. Act and the same was cancelled by the ITAT,

‘SMC’ Bench, Ahmedabad vide order dated 08.07.2010 (supra) and hence in the

present case also the penalty is deleted “](https://image.slidesharecdn.com/3cdpresentation-150801201253-lva1-app6891/85/Revised-Form-3CD-presentation-23-320.jpg)

![Revised Form 3CD : CA Mehul Shah| 30

CLAUSE 20(b) – Employees’ Contribution

Any delayed deposit of employees’ contribution is deemed as income under

section 2(24)(x). The reporting has to be done under this clause irrespective of

the time of deposit. If the same has been deducted and deposited before the

due date of filing of return under section 139(1), then it is worthwhile to note

that the same may not be added to the income of the assessee as per following

judgements :

1) CIT vs AIMIL Ltd. [2010] 321 ITR 508 (Del)

2) CIT vs Kichha Sugar 356 ITR 351 (Utt)

However, a converse view has been taken in the case of CIT vs Gujarat

State Road Transport Corporation [2014] (41 Taxmann.com 100) by

Gujarat High Court.](https://image.slidesharecdn.com/3cdpresentation-150801201253-lva1-app6891/85/Revised-Form-3CD-presentation-30-320.jpg)

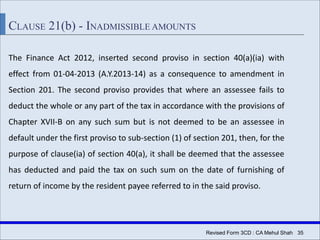

![Revised Form 3CD : CA Mehul Shah| 32

CLAUSE 21(a) - INADMISSIBLE AMOUNTS

Where the penalty or fine is in the nature of penalty or fine only, the

entire amount thereof will have to be stated.

“In case of Malwa Vanaspati & Chemical Co. vs CIT [ 1997] 225 ITR 383

(SC), it was held that where the assessee is required to pay an amount

comprising both the elements of compensation and penalty, the amount shall

be bifercated and the compensation is allowable as business expenditure , and

penalty shall be disallowed”](https://image.slidesharecdn.com/3cdpresentation-150801201253-lva1-app6891/85/Revised-Form-3CD-presentation-32-320.jpg)

![IT : When it was not established that there was failure on part of assessee to

disclose truly and correctly all material facts, assessment could not be reopened

after expiry of four years to disallow interest on ground that no interest was

offered on loan advanced and to disallow rent on ground that TDS was not

deducted thereon.

CIT vs Ankit Maheshwari [2014] 48 taxmann.com 147 (Gujarat)](https://image.slidesharecdn.com/3cdpresentation-150801201253-lva1-app6891/85/Revised-Form-3CD-presentation-58-320.jpg)