PCE Learning Material_1

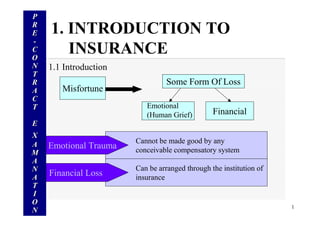

- 1. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN 1. INTRODUCTION TO INSURANCE 1.1 Introduction Misfortune Some Form Of Loss Emotional (Human Grief) Financial Cannot be made good by any conceivable compensatory system Can be arranged through the institution of insurance Emotional Trauma Financial Loss 1 PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN

- 2. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Why Insurance ? 1.2 Importance Of Insurance Shared by Individual Financial Losses Members of a group facing similar risk = Insurance (Loss Sharing Arrangement) PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN 2

- 3. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN The Concept of Insurance Explained 1.3 How Insurance Work Houseowners or term life # 1 #2 #3 . . . # 999 # 1000 Premiums RM200 RM200 RM200 RM200 RM200 Combined Contributions (Premiums) 1000 X RM200 =RM200,000 Claims Expenses & Other Outgoes Profits PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN 3

- 4. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Essential Features Of Insurance 1.4 What Is Insurance * It is an economic institution . * It is based on the principle of mutuality or co-operation. * Its objective is to accumulate funds to pay for claims as a result of the operation of specific risks. * Only certain risks can be insured against, whose occurrence can be confidently estimated with certain degree of accuracy PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN 4

- 5. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN The equitable spread of the financial losses of a few who are insured among the many insured . •Cost Stabilisation – to avoid the necessity of having to freeze capital to provide financial protection against losses. •Stimulates Business Enterprise – risk transfer mechanism for large scale commercial & industrial enterprises * Removes Fear and Worries of losses – to establish confidence * Reduction of Losses * Means of Saving – Endowment Plan –both protection & savings * Sources of Capital For Investment * Provides Employment For Many – employment opportunities 1. Primary Function 2. Secondary Function PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN 1.5 Functions Of Insurance 5

- 6. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN 1.6 Classes Of Insurance Classes Of Insurance Life Insurance General Insurance Risk Covered by General InsuranceRisk Covered by Life Insurance A) Life insurance defined as a contract which pays an agreed sum of money on the happening of a contingency (event),or of a variety of contingencies, dependent on human life . A) Any other form of insurance business other than life insurance business . * Premature death * Income for retirement * Sickness or Disability * Motor Vehicles * Marine and Aviation * Products or goods sold PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN 6

- 7. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN 1.7 Historical Aspect Of Insurance * The earliest beginning of insurance was in the field of Marine Insurance * The insurance industry in Malaysia is patterned according to the British System * Insurance Business in Malaysia is controlled by the Government through the enactment of Insurance Act 1963/1996 PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN 7

- 8. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN 2. Nature Of Risk And Its Management Risk Definition Of RISK * An uncertain loss * The possibility of loss * The exposure to danger * The subject matter of insurance PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN 8

- 9. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Perils And Their Losses 2.1 Concept Of Risk Negligence Illness PERIL Fire Property Profit/Revenue Lives LOSSES Future Earnings Medical Expenses Court Awards Legal Expenses Leads to PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN 9

- 10. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN 3 Measurements of Risk Priori Probability Judgmental ProbabilityEmpirical Probability Determined by the total number of known possible events Example : Dice Determined by the basis of historical data (Law of Large Number) Determined by the judgement of a person predicting the outcome (When there’s a lack of historical data or credible statistics PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN 10

- 11. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN 2.2 Related Concepts 2 Major Types Of Hazards Physical Hazard Moral Hazard Is a physical chance that increases the condition of loss *Poor mechanical condition of a motor car Is a character defect in an individual that increases the chance of loss *Dishonesty, carelessness PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN 11

- 12. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN 2.3 Basic Categories Of Risk Distinguishing Risk From The Following Concepts Loss Is a reduction or disappearance of economic value Peril Is a cause of loss Hazard Is a condition that increase the chance of loss PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN 12

- 13. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN BASIC CATEGORIES OF RISK Fundamental Risks Speculative Risks Pure Risks Particular Risks - It affects the entire economy and a large number of people. Exp :Typhoon, wars, earthquakes -It affects only individuals and not the entire community - Exp :In road accident Loss or - No Loss. Exp :Risk of premature death - Loss or - No Loss or - Gain. Exp :Investment in stock market PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN 13

- 14. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN RISK MANAGEMENT Avoiding Risk Transferring Risk Accepting Risk Controlling Risk -we can avoid risk of financial loss in the stock market – by not investing it at all -Taking steps to prevent or reduces losses eg, banning smoking / installing smoke detectors - accepting or retaining risk. Eg. Assuming all financial responsibility for that risk – insurance - can afford to reduce their standard of living -Transferring risk to another party / shifting. eg. Insurance coverage – be used to cover property damage risk , liability risk and personal risk. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN 14

- 15. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN 3.The Basic Principle Of Insurance And An Introduction To Takaful 3.1 Principles Of Insurance Is the legal right to insure which arise from the legitimate financial interest an insured has in a subject matter of insurance. A) Insurable Interest General Insurance Contracts Insurable interest must exist at the beginning & at the time of loss . Life Insurance Contracts Insurable interest must exist at the beginning only PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN 15

- 16. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN ASSIGNMENT * Transfer of rights and liabilities by one person to another . * Prior written consent from the insurer is needed for an assignment to be valid . * Substitution of the insured by a new insured ,a new contact is created between the insured and the assignee of the original policy . The alteration is termed Novation Exception Of Prior Consent PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Transfer by will or operation of law Life Policies Marine Policies 16

- 17. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN B) The principle Of Utmost Good Faith PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN I .Commercial Contracts (The principle of Utmost Good Faith does not apply) * No need for parties to disclose information not requested . * Make best bargains as long as it does not mislead the other. * The legal principle governing such contracts is caveat emptor (let the buyer be aware) . 17

- 18. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Breach Of Utmost Good Faith PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Non Disclosure Misrepresentation Breach Of Utmost Good Faith Voidable Contract 18

- 19. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN C) Indemnity PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN * The principle of indemnity requires the insurer to restore the insured to the same financial position as he had enjoyed immediately before the loss General Insurance contracts are contracts of indemnity where insurable interest is measurable . Personal Accident Life Insurance contracts are not strictly contracts of indemnity where insurable interest is unlimited . 19

- 20. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN D) Subrogation PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN * An insurer who has indemnified an insured for loss may exercise the insured’s rights to claim from the third party in respect of the loss . * To prevent the insured from getting more than indemnity when he has to or more avenues to recover his loss . * Is considered as corollary of indemnity, a natural consequence of indemnity. Since subrogation arises when indemnity arises, it is not applicable to non-indemnity contract. 20

- 21. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Essentials of Contribution * 2 or more policies of indemnity must be inforced . * The loss involves a common subject matter covered by the policies . * The policies must cover a common peril which give uses to the loss. * The policies must cover a common interest . E) The Principle Of Contribution 21

- 22. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN F) The Principle Of Proximate Cause •Onus of proof of loss rests on the insured – thus when a loss is the result of many causes the proximate cause – that is the dominant or effective cause, it must be identified and attributed as the cause of the loss. * Insured has to prove the loss . * The insurer is not liable for an uninsured or excluded peril - not mentioned in the policy therefore not covered. Also policy contracts which have been expressly excluded from the policy. 22

- 23. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN 3.3 The Formation of Takaful Companies Takaful Companies * Provide insurance based on a system that is in accordance with Islamic religion Law or Syariah Takaful Act 1984 4 Parts Part I:Business Classification Part II:Mode & Conduct Part III: Power Vest In Bank Negara Part IV :Administration and enforcement of matters 2323

- 24. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Syariah Supervisory Council PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN * The function is to advise operations to ensure that it does not involve in any element which is not approved by the Syariah. * Member of council are Muslim jurisprudents . * Decisions of the council must always follow the ruling of Syura or mutual consultation and agreement . 24

- 25. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN 3.4 Principles Of Takaful Operation PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN 1. The Concept Of Takaful A method of joint guarantee among groups to share the burden of unexpected financial losses that may fall upon any of them . 2. The Concept Of Tabaruk “Tabaruk” means to donate. The participants of takaful plan make an aqad (agreement) to deposit as donation a certain proportion of takaful contribution or installment into a risk fund . 3. The Principle of Mudharabah “Mudharabah” (Trustee Profit-Sharing) is defined as a contractual agreement between provider of capital and entrepreneur for the purpose of business venture whereby both parties agree on a profit sharing arrangement. 25

- 26. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN 4.5.1General Insurance Related Institutes PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN * MIB - Motor Insurers’ Bureau Provides compensation to victims of motor accident. * IMB - Insurance Mediation Bureau Provides an alternative procedure to resolve disputes arising from personal insurance policies . * UMP - Unplaced Motor Pool Provides a reasonable cost of insurance coverage to certain classes of vehicles in view of its adverse claim experience. * PIAM - Persatuan Insurans Am Malaysia The membership of PIAM is compulsory for all general insurance in Malaysia. * IBAM - Insurance Brokers’ Association Of Malaysia To protect the interest of insurance brokers. * AMLA - Association Of Malaysian Loss Adjusters An association for loss adjusters approved by the minister . 26

- 27. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN * LIAM - Life Insurance Association Of Malaysia The representative body of life insurance companies. It consists of 18 companies .Responsible for the registration of life insurance agents . * NAMLIFA - National Association Of Malaysia Life Insurance Financial Advisors An association for life insurance agents and tier supervisors . * ASM - The Actuarial Society of Malaysia To promote studies and researches Actuarial subjects and allied aspects of life insurance . * MII - The Malaysian Insurance Institute Conducts courses and examinations in insurance related discipline for those who are in the insurance industry . 4.5.2 Life Insurance Related Organisation 2727

- 28. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN 6.The Insurance Contract PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN 6.1 Law Of Contract * An insurance contract is a legally binding agreement between an insured and an insurer . Essential Legal Requirements Of Insurance Contracts 1. Intention to create legal relationship 2. Offer and acceptance 3. Consent-consensus ad idem 4. Consideration 5. Legal Capacity to contact 6. Legality of the contact 2828

- 29. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN 1. Intention To Create A Legal Relationship PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN * Parties to an agreement intend to be legally bound 2. Offer And Acceptance * The offer and acceptance must be voluntary * Offer :Proposer Accept :Insurer * The insurer may not accept a proposal on its original terms but may offer to provide insurance on different terms Counter Offer . 2929

- 30. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN 3. Consent - Consensus ad idem PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN * Parties to the agreement must agree upon every material term of the agreement totally . * Consensus ad idem, that is of one mind . 4. Consideration Insured (Policyholder) Insurer (Company) Consideration : Premium Consideration : Agreed Sum Insured 3030

- 31. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN 5. Legal Capacity To Contract PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN * Who has legal capacity to enter into a contact ?- Everyone . * Section 41, Insurance Act 1963 (section 153, Insurance Act 1996) minor aged 16 can enter into a legally binding insurance contact . * Section 41, further provides that a minor aged 10 to 16 may enter into insurance contract with written consent of his parents or guardian . 6. Legality Of A Contract * An agreement should be created for a legal purpose . 3131

- 32. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN DEFECTIVE CONTRACTS PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Void Contract Unenforceable ContractsVoidable Contract •Totally invalid - no contract at all * Not enforceable in a court of law which has no consideration. * Remain valid until the aggrieved party exercises the option to treat it void . * An insurance contract is voidable if the insured fails to observe the duty of disclosure during negotiation or breach a warranty .The contract is valid until the insurer exercises the option to treat it void. * It arises out of failure to comply with legal formalities . •Eg. The need for certain contracts to be in writing – fails to comply with the statutory provision Requiring. 3232

- 33. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Insurance Act 1996 Section 151 PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN * The knowledge of an agent who relates to any matter concerning the acceptance of risks by the insurer shall be deemed the knowledge of the insurer. * This section shall not apply - - Agent has been terminated and the insurer has taken all reasonable steps to inform policy owners and the public in general of such cessation . 3333

- 34. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Insurance Act 1996 Section 150 (4) PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Any person who induces or attempts to induce another person to enter into any contract of insurance with an insurer shall be found guilty and liable to Penalty : 1 Million Ringgit Malaysia . 3434

- 35. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN 8. MARKETING & AFTER SALES SERVICES PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN 8.1 Sales Sales Versus Marketing Definition of Marketing :- The management process responsible for identifying, anticipating and satisfying customer requirement profitably . - Sales-oriented products often don’t meet consumer needs - Market-oriented products are developed & marketed with the consumers’ need in mind . 35

- 36. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Functions Of The Marketing Department * Planning & Controlling * Market Identification * Product Development * Pricing * Selection Of Distribution Channel * Promotion 36

- 37. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN The Selling Process * Locating The Prospective Customer * Conducting The Sales Interview * Creating A Sales Presentation * Closing The Sales * Handling Objections 37

- 38. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Selling Techniques Order Processing Missionary SellingCreative Selling Is Useful in situations where customer is able to recognise his need immediately -agent identified a need, draws his attention & make the sale. Is need when customer is unaware of his needs.Agent to help to uncover his needs and recommend policies to meet those needs. Is used where selling is done indirectly by establishing good will between the agent and his Customers, eg thru technical assistance & good after-sales service 38

- 39. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN 8.2 After Sales Services PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Benefits : * The chance of lapse or business flowing elsewhere could be minimised . * The client’s new needs for insurance coverage could be recognised and a sale quickly made, thus enhancing the agent’s business . * The reputation of the insurer as a service-oriented organisation is enhanced 39

- 40. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Premium Notice - A reminder to policyholder to pay premium Policy Register - A legal requirement for insurer to maintain up to date register of all policies issued . Premium Receipt - Insurer issue an official receipt upon receiving the premiums . Grace Period - Due premium shall be paid within a specified period -30 days from the due date . 40

- 41. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Introduction to Medical & Health Insurance OverviewOverview ofof Medical & Health InsuranceHealth Insurance CharacteristicsCharacteristics ofof Medical & Health InsuranceHealth Insurance

- 42. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN 1. INTRODUCTION & CONCEPT OF MEDICAL & HEALTH INSURANCE 1.1 Introduction Adverse changes In health Medical Expenses / Treatment Accident Occurrences Critical Illness Occurrences Medical reimbursable after the effective date of the policy Medical reimbursable after policy inforced more than than 30 days after effective date Accidental Occurring Illness Occurring 42 PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN

- 43. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Why Medical & Health Insurance ? 1.2 Importance Of Medical & Health Insurance Shared by Medical Expenses Pooling of resources from all policy- holders = Health & Medical Insurance (Claims Sharing Arrangement) PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN 43

- 44. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Why NOT Medical & Health Insurance ? PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN 44 Truth of the matter is, people are living longer. However, living longer does not mean living better What if suffering longer period of chronic illness or disability? Who will take care of you while long-term nursing care is needed? Moreover, how about healthcare cost? $$$?

- 45. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN What is Medical & Health Insurance? •Health or Medical Insurance –Sometimes known as “Accident and Health”, “A&H” or “Accident & Sickness” –Designed to ease the financial burden caused by adverse changes in health. –Is a device whereby money is collected from a pool of contributors or policyholders and whenever a valid health insurance claim is made by the policyholders, money is paid out from this pool. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN 45

- 46. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Principles & Practices of Medical & Health Insurance •These apply in the same manner in which they are applicable to non-medical & health insurance: - –Insurable Interest - Offer & acceptance –Utmost Good Faith - Underwriting –Indemnity - Policy processing –Subrogation - Claim administration –Contribution - Reinsurance –Proximate Cause PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN 46

- 47. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Guidelines Applicable to Medical & Health Insurance •Section 12 (2) of the Insurance Act 1996 JPI/GPI 16 issued by BNM on 24 December 1998 – for the conduct & compliance for policy sold in Malaysia. •On 5 May 2003 – JPI 12/2003 ‘Minimum Standard on Product Disclosures & Transparency in the Sales of Medical & Health Insurance Policies was issued. - Checklist indicating confirmation that the intermediary has clearly highlighted aspects of the products to the proposer - The right of the proposer to surrender his policy for cancellation during the ‘cooling off’ period. - The duty of the insurer to highlight certain important features of the products; and - Insurers launching new medical & health insurance policies or making amendments to existing products effective 1 Oct 2003 are required to lodge with BNM an actuarial certificate for such products at least 30 days before offering the product to the public. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN 47

- 48. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Categories of Medical & Health Insurance • Medical & Health insurance policies may be divided into the following 2 categories:- 1) Indemnity polices An indemnity policy places the insured in the same financial position as before the occurrence of the insured risk, subject to maximum limits of the insured amount. An example is hospitalisation & surgical insurance. 2) Benefits policies A benefit policy pays a pre-determined sum of money if an insured event occurs during the policy period. Examples are Hospitalisation cash benefit plans, critical illness insurance & disability income insurance PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN 48

- 49. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Some Features of Medical & Health Insurance • Claim Payment does not terminate coverage. The payment of a claim does not result in the termination of a policy, except in the event of death claim. It provides for the claims up to the stipulated in policy Example; Per disability limit / Overall limit / Lifetime limit. • The Insurance Risk increase with Time as it involves morbidity. Generally, the risks increases with age. (probability of the disability resulting from an accident / illness). Other external factors such as occupation & environment also affecting the risk. • ‘Cashless’ Hospital Admission arrangement – admission to a panel hospital is by the issuance of a letter of guarantee & hospital deposit may be eliminated. Upon discharge from hospital – insured only pays for non-reimbursable charges, others will be taken care by insurer. Usually, it is merely value added services provided by insurers to certain eligible policyholders. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN 49

- 50. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Type of Medical & Health Insurance Medical & HealthMedical & Health Group PoliciesGroup Policies Individual HealthIndividual Health PoliciesPolicies Premium are usually age bandedPremium are usually age banded & increase with age& increase with age Policies issued to groups ofPolicies issued to groups of three or more personsthree or more persons

- 51. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Individual Health Insurance PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN • Provides cover against medical expenses of only one person or family. • May be bought directly from an insurance company, or via an insurance company agent. • The risk potential determines eligibility and cost of the insurance. • Riskier than group insurance 51

- 52. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN 52 Types of Medical and Health Insurance Coverage • Medical Expense Insurance • Hospitalization & Surgical Insurance • Major Medical Expenses Insurance

- 53. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN 53 Medical Expense Insurance • Provides reimbursement of the insured’s eligible medical costs. • Insurers market three basic medical expense policies : 1.Hospital-Surgical policy 2.Major-medical policy 3.Comprehensive medical policy

- 54. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN 54 Hospital & Surgical Insurance • Provides cover against loss from medical expense incurred • 16 specific benefit provisions 1. Hospital Room & Board 2. Intensive Care Unit 3. Hospital Miscellaneous Services 4. Surgeon’s Fees 5. Operating Theatre Fees 6. Anesthetic Fees 7. Ambulance Fees 8. In-hospital Physician’s Visits

- 55. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN 55 Hospital & Surgical Insurance 9. Pre-Hospitalization Specialist Consultation 10. Post- Hospitalization Treatment 11. Pre-Hospitalization Diagnostic Tests 12. Emergency Accident – Outpatient Treatment Some policies may be extended to cover the followings: 13. Daily Cash Allowance at Government Hospitals 14. Out-patient Cancer Treatment 15. Out-patient Kidney Dialysis 16. Organ Transplant 17. Insured Child’s Daily Guardian Allowance

- 56. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN 56 Major Medical Expense Insurance • Design to cover a broad coverage & substantial protection from large unpredictable healthcare expenses with benefits applying to virtually all kinds of health care prescribed by the physician. • It Includes benefits for the same medical expenses that are covered by H&S policies. • Provides coverage for expenses like: - – Receiving out patient treatment – Employing private-duty nurses – Renting or purchasing expensive treatment equipment and medical supplies – Purchasing prescribed medicine • It covers virtually all types of medical expensed whether incurred in or out of a hospital ‘As Charged’ policies in Malaysia. • It includes imposing benefit as Per Disability Limits & Overall Annual Limits

- 57. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN 57 Expense Participation • Is sharing in the cost of medical expenses with the insured. • Enables insurer to keep premium rates to a lower level. • Two common expense participation methods are : – Deductibles Requires the policyholder to pay a pre-agreed amount first before the balance of eligible expenses are reimbursed or paid by the insurer. Fixed amount typically in the range of RM1,000 to RM5,000

- 58. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN 58 Expense Participation (con’t) – Corridor Deductible Is a flat amount which the insured must pay above the amount paid by the hospital-surgical policy before any benefits are payable under the major medical policy. Amount normally between RM 300.00 or RM 500.00 – Coinsurance/ Percentage Participation Under this method, the insured pay a specified percentage of all the eligible medical expenses, in excess of the deductible, which he or she incurs as a result of a sickness or injury. Most of the major medical policy has this kind of arrangement.

- 59. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN 59 Group Medical & Health Insurance The contract - One master policy (single policy) issued for many insured lives. Coverage issued to employer- employee groups as an employee benefits scheme Premium Calculated - Yearly premium with high protection at low cost – less expensive when underwriting a group of people Limited use of evidence of insurability - Simplified Underwriting – as long as they eligible for coverage Group Size - Guideline issued by BNM JPI/GPI 16 – 24/12/1998 -a group policy is one that covers a group of 3 or more lives

- 60. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN 60 Group Medical & Health Insurance The contract – A single policy called a master contract is issued to the group policyholder to cover a group of individuals who have a defined relationship to the policy holder, such as: • Employer-employee • Association/cooperative/union member • Debtor-creditor

- 61. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN 61 Group Medical & Health Insurance Contributory Scheme where the employee pays certain % or all the premiums It requires the participation of at least 75% of the eligible members of the group Non-Contributory Scheme where the employer pays all the premiums It covers all eligible members of the group

- 62. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Medical & Health Insurance Underwriting AntiAnti -- SelectionSelection MedicalMedical FactorsFactors OccupationalOccupational FactorsFactors Final Underwriting ActionFinal Underwriting Action Modified CoverageModified Coverage Renewal UnderwritingRenewal Underwriting

- 63. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Medical & Health Insurance Underwriting What is Underwriting? Defined as a process of assessment & selection of risks determine the premium & term & conditions to be apply” What is the Purpose of Underwriting? - To ensure that sufficient funds are/will be available to pay claims occurrence, insurer has to :- - Guard against anti-selection - Charge a premium that is commensurate with the risk transferred

- 64. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN – Occurs when a high risk applicant submits a proposal for insurance – The actual loss will be greater than the expected loss. – Premium is charged based on expected loss – The amount collected will not be adequate to pay claims if anti-selection exists. Underwriting - What is Anti-Selection?

- 65. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Underwriting - Risk Selection Process Medical Factors - Considerations of both history and current physical conditions for the probability of future problems that causes disability income & result in medical expenses for hospitalization & treatment. Financial Factors - The financial status of the applicant is a prime consideration in underwriting. Disability income coverage will be issued to a specified percentage of the applicant’s earned income. Occupational Factors - Morbidity rates vary considerably according to a person’s occupation. - Class 1 - Least hazardous occupations. Mostly professionals. - Class 2 - Requires more physical activity than Class 1. Examples would be second hand car dealers. - Class 3 - Light manual duties or skilled work is involved like plumbers and mechanics. - Class 4 - Heavy manual duty or near accidental hazards like construction workers and agricultural laborers Age & Sex (gender) - Morbidity rates generally increase with the age (grow older)

- 66. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Sources of Underwriting Information 1. Application form 2. Agent’s statement 3. Medical or paramedical examinations 4. Attending Physician Statements (APS) 5. Hospital medical records

- 67. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Final Underwriting Action Standard Issue: – Decision to approve as applied for – Policy will not contain any special exclusions or reductions in benefits. Declination Of Issue: – Decision to decline Substandard/ Modified Issue: – Modifying in terms of additional riders, premiums or benefits

- 68. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Issuing Modified Coverage Exclusion Endorsements – Riders (Waivers) – The rider excludes a particular disability or medical expense Extra Premiums (premium loadings) – Additional premiums usually ranges from 25 to 100 percent of the standard premium. Change of Benefits (modified benefits) – Modifying the benefits like changing a smaller amount of indemnity or a longer elimination period.

- 69. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Renewal Underwriting Some form of renewal underwriting is necessary for adequate control of the insurer’s claim experience. The degree of renewal underwriting that may take place is limited by the renew ability provision of the policy.

- 70. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Renewal Underwriting Optional Renewable Policies Information that could lead an insurer to take adverse action on an optionally renewable policy comes from many sources, including information developed: – At the time of a claim – During the underwriting of a new application for insurance – During the reinstatement of another policy

- 71. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN The insurer may choose to modify an optionally renewable policy rather than to decline renew ability. The modification may be: – An exclusion endorsement or loading of premium because of a given physical impairment – An increase in the basic premium because of a change to a more hazardous occupation – An increase in elimination periods to avoid small, repetitious claims Renewal Underwriting Optional Renewable Policies

- 72. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Guaranteed Renewable Policies Limited to the rescission of the policy during the contestable period (material misrepresentation during the period) May be subject to premium rate changes if the insurer has had to pay out more in claims that it expected

- 73. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Non Cancelable Policies An insurer does not have the right to increase premium rates for such policies under any circumstances Premium rates are specified and guaranteed in the policy Guaranteed to be renewable until the insured’s age reaches maturity However, insurer may have to take action to discontinue further sale of the product

- 74. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Payment of Premium & Termination of a Policy Modes of Premium Payment – Monthly, quarterly, semi yearly and annually – Premiums paid annually are always lower Billing arrangements Warranty/Grace Period – Allows the insured 31 to 61 days to pay the premium after its due date Policy automatically terminated - on the death of Insured / Person - on Policy Anniversary – insured maximum eligibility age - if total benefits paid out under policy exceed maximum limit specified in benefit schedule

- 75. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Conditionally Renewable A conditionally renewable medical & health insurance policy grants an insurer a limited right to refuse to renew a health policy at the end of a premium payment period. It must be based on one or more specific reasons stated in the policy contact given to the insured

- 76. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN PolicyPolicy DocumentsDocuments PolicyPolicy FormForm ProposalProposal FormForm EndorsementEndorsement RenewalRenewal NoticeNotice Proof of Medical &Proof of Medical & Health InsuranceHealth Insurance Premium PaymentPremium Payment for Tax Relieffor Tax Relief Chapter 4 – Policy Documents

- 77. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Policy Administration Documents used in the conduct of medical & health insurance business :- – The Proposal Form – The Policy Form – Endorsement – Renewal Notice – Proof of medical & health insurance premium payment for tax relief

- 78. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Section 149 of the Insurance Act 1996 provides for the control by and the lodgment of proposal forms, policies and brochures of insurers with Bank Negara Malaysia Section 149 also provides that Bank Negara Malaysia may specify a code of good practice in relation to any description of proposal form, policy or brochure Policy Administration

- 79. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN - A document in the form of questionnaires – Assist the insurer in gathering information required to assess a risk – Enables the insurer to consider application speedily and accurately – Frequently used in relation to simple risks where information can be furnished in a structured format The Usefulness of Proposal Form

- 80. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN The Structure of a Proposal Form Contents of a Proposal Form Disclosure Statement as per Requirements of Insurance Act, 1996 Questions of a General Nature Risk Address Proposer’s Occupation Previous and Present Insurance Specific Questions relating to Health Insurance Declaration Signature

- 81. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN The Policy Form A document drafted by the insurers Not the contract of insurance but represents the written evidence of it Has to be stamped in accordance with the provisions of the Stamp Act – Otherwise it cannot be used as evidence in court Scheduled typed form are frequently used Endorsement – Form part of the policy

- 82. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Renewal Notices The Practice in Relation to Medical & Health Insurance Products – sold on annually renewable basis & thus subject to renewal by the insurers at the end of the policy period. – No legal obligation on the part of the insurer – The insurers to advise the insured that his policy is due to expire on a particular date – The notice incorporates all relevant particulars of the policy – A note advising the insured to disclose any material alterations in the risk since the inception of policy – The usual business practice is to send a Premium Notice Reminder to the policy holder

- 83. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Entitle up to RM 3000 for premiums paid for education or medical insurance – This is over and above the RM 5000 deduction from taxable income already allowed for premiums paid in respect of life insurance policies and contributions to approved retirement schemes. Inland Revenue Board guidelines:- – Health insurance policy coverage should be for a period of 12 months or more – The coverage should be related to the medical treatment or benefit payment for TPD resulting from disease or accident A copy of the health insurance policy must be submitted with the Tax Return Form, to qualify for tax allowance. Documents for Tax Relief for Medical & Health Insurance Premium Payments

- 84. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Claim Procedures Notification of LossNotification of Loss Checking of CoverageChecking of Coverage Investigation of the ClaimInvestigation of the Claim SettlementSettlement of Claimof Claim Repudiation of LiabilityRepudiation of Liability DisputesDisputes Negotiation andNegotiation and CompromiseCompromise VALID NOT VALID

- 85. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Medical & Health Insurance Claims Notification of Loss – The insured must give the insurer written notice of claims for any loss covered – notice have to be given within 30 days after the occurrence.

- 86. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Proof of Loss / Claim The insured is required to furnish written proof of loss, in the case of a claim for disability benefits, within a stipulated timeframe (eg 90 days) after the termination of the period for which the insurer is liable. Affirmative proof like original hospitalization bill and claim form is required for hospital or medical claim

- 87. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Checking Coverage Conditions for a Valid Claim – Is the policy in force? – Has premium been paid? – Is the loss caused by an insured peril? – Is the subject matter affected by the loss the same as that insured under the policy? – Has notice of loss been given without undue delay? Claims Register (Section 47 Insurance Act 1996)

- 88. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Investigation of a Claim The validity of a Claim – Existence of loss – Loss is caused by a peril insured under the policy – Loss does not fall within the scope of an exclusion of the policy – The person making the claim is the rightful claimant

- 89. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Claim Documents General information required in all Claim Forms – Identity of the insured – The insured’s interest in the loss – Circumstances of and extent of loss Medical & Health Insurance Claim Forms - comprises a claimant’s or insured’s statement and an attending physician’s statement. However, the format may be different with each insurer. Settlement of Medical & Health Insurance Claim - having reviewed the considerations applicable - having made the decision to pay the claim - computing the amount payable & issue claim payment

- 90. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Repudiation of Liability by Insurers There was no loss or damage as reported The loss or damage for which a claim has been made was not caused by a peril or was excluded by the policy The policy has been rendered void as a result of a breach in condition (implied or express) or warranty

- 91. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Usually there are two ways in which rejections are normally handled: – By letter to the policyholder from the claims office - By letter from the claim office to the agent, instructing the agent to contact the insured personally and to notify the insured of the rejection and explain the reason. Repudiation of Liability by Insurers

- 92. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Disputes Disputes between claimants and insurers generally may involve one of the two issues: – The question of whether the insurer is liable – The quantum of loss, if the insurer is liable When a dispute arises, it may be resolved through the following channels: – Negotiation and compromise settlement - discussion – Litigation – claimant unhappy – take court action – Arbitration – pertaining to insurance polices - a clause – Mediation – eg Financial Mediation Bureau – a centre to air consumer complaints against all financial institutions regulated by BNM.

- 93. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Negotiation and Compromise Settlement Litigation – Court action between the insured and the insurer Arbitration – An out of court settlement unless it involves a huge claim or an important point of principle – Speedier and less costly than court action Mediation – Set up by the Insurance Mediation Bureau (IMB) – Offers free investigation and mediation services to policyholders in insurance disputes

- 94. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN 16. Life Insurance Preliminaries PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN 16.2 Characteristics Of Life Insurance Products 1. Life Insurance Contracts Are Long-Term Contracts With Usually Level Premium . * The long-term nature of the contract requires the insurer to adopt a cautious view of the many factors which enter into the premium rate calculations. Principal amongst these factors are the following :- - mortality - expenses - rate of investment returns - tax * Legislative requirements in the form of minimum statutory reserves and solvency margins must be maintained . 94

- 95. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN 2. Both Parties Must Observe The Principle Of Uberrima Fides. Utmost good faith has to be observed by both parties, the insured and the insurer. 3. Life Insurance Contracts Are Aleatory Contracts. * One party provides something of value to another party in exchange for a promise that the other party will perform a stated act if a specific, uncertain event occurs . * The claim amount is determined at the very beginning of the contract. 4. Insurable Interest * The purchaser of a life insurance policy must stand to suffer a financial loss on the death of the person on whose life the life insurance policy has been bought . * Insurable interest exist : - Every person is considered to have an unlimited interest in ♠ his or her own life ♠ their spouse’s life - Parent Child (below age of majority) - Creditor Debtor - Employer Employee - Partner Partner (in business) * It needs to exist only at the inception of the insurance . 95

- 96. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN 5. Payment Of A Terminates Life Insurance Contract . PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN In life insurance, with the exception of permanent health insurance policies, the settlement of a claim terminates the contract . 6. The Risk To Be Insured Increases With Time . For life insurance, mortality risk increases with age and hence with the duration of the contract . 7. The Basic Principles Of Insurance As Applied To Life Insurance. * Insurable Interest * Utmost Good Faith * Indemnity * Subrogation * Contribution * Proximate Cause (Discussed in Chapter 3) 96

- 97. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Risk Covered By Life Insurance Policies PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN * Premature Death * Temporary Disability * Permanent Disability * Retirement Benefits * Financial Guarantees 97

- 98. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN 17.1 Introduction 3 Kinds Of Life Insurance Contracts - Ordinary – Term, Whole Life, Endowment and Annuities - Home Service – for lower income class of the population – WL/END Plan / premium payments collected weekly - Group Insurance * Non -Participating Contracts - Mainly for protection purposes / SA is guaranteed * Participating Contracts - Mainly used for protection & saving . The total coverage / benefit is generally made up of a guaranteed benefit, regular bonuses and a final bonus. 17. Life Insurance Products 98

- 99. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Term Insurance / Level Term Insurance PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN •Also known as Temporary life insurance protection for a specific period of time called policy term. Premiums payable are relatively low and it does not provide any surrender value. • Policy benefit is payable only in the event of death or becomes total and permanent disabled of LA within the stipulated terms of the policy and nothing is payable if the LA survives the term. *It also act as an additional protection for financial or mortgage loan, as a means of protecting mortgage obligations. 9999

- 100. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Whole Life Assurance PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN 1. Ordinary Life Policy - Protection provided for the whole duration of Life with the sum assured including any accrued bonuses. - Participating or non - participating . - Provides the cheapest from of permanent protection . - Payment of premiums need to be continued until the death of the life assured. - This policy comes with non-forfeiture provisions for eg. surrender value, automatic premium loan and paid-up value. 2. Limited Payment Whole Life Policy - Sum Assured is payable only upon death or TPD, but premiums are payable for a limited number of years only . - It is eligible for non-forfeiture provisions, eg surrender value & paid up value. 100

- 101. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Endowment Assurance PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Uses of Endowment Assurance: 1. As an incentive to save in a systematic manner.- putting aside a moderate sum each year with a view of having all the accumulation available at the end of a fixed period. 2. As a convenient and easy means of providing for old age.- when policy mature 3. As a means of hedging against the possibility of untimely death- despite premature death of disability of the LA 4. As a means of accumulating a fund for specific purposes.- children educational needs Anticipated Endowment Assurance * Installment cash payments by the insurance to the policyholder payable at regular intervals during the terms of the policy . * An additional benefits that the full sum assured shall be payable in the event of the life assured’s death during the term of the policy. * If the assured survives till the end of the term, he will be paid only the sum assured less the instalment payments 101

- 102. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Types of Annuities PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN * SINGLE LIFE IMMEDIATE ANNUITY - Annuitant pays a lump sum as the purchase price & in return he starts to receives the annuity payments immediately for as long as he lives. * GUARANTEED IMMEDIATE ANNUITY - Annuity will be paid for a fixed number of years, thereafter as long as the annuitant is alive. - If annuitant dies during this period, the annuity payments will continue to be paid until the end of the guaranteed period. * DEFERRED ANNUITY-paid one lump sum at entry - Annuity payment will not start immediately but will commence only on the attainment of specific age or defined period called deferred period. - Annuity payments are made throughout the life of the annuitant of a specified amount until death. * JOINT LIFE ANNUITY – that provides a specified amount of: - Annuities granted on two or more lives. - Annuity payments stop on the first death. 102

- 103. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN * LAST SURVIVOR ANNUITY - It is issued on two or more lives and provides for annuity payments to be made until the date of death of the annuitant. * REVERSIONARY ANNUITY - Annuity commences at the death of the assured person, to be paid throughout the life time of the annuitant (or nominee), eg wife on the death of her husband. * ANNUITY CERTAIN -In return for the payment of a certain sum of money, the annuitant received a yearly, half yearly or quarterly payment for a specific number of years. Types of annuity contracts 103

- 104. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Permanent Health Insurance (PHI) * It provides for an income during periods of sickness or disability on a long term basic . * The income provided is limited to a maximum of 2/3 or 3/4 of the insured’s earnings. * It cannot be cancelled by the insurer because of an adverse claims experience. * It is usually arranged with a “deferred period”. During this period of disability no benefits are payable. (1 month, 6 months or 12 months) Dread Disease Covers A dread disease contract pays out a lump sum on the diagnosis of any of a number of specified diseases. The benefit can take either of these 2 main forms :- - It may provide an acceleration of all or part of any death benefit, or - It may be an additional benefit . PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Investment Linked Policies * Premium divided into the following components . - expenses related - mortality and/or morbidity cost related, - investments related. 104

- 105. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Group Insurance * Insure lives in large groups at low rates of premium and often without medical examination. * It covers all or a certain class or classes of employees of a company. * Group term life insurance is a yearly renewable term insurance. * It may extend to cover employee’s spouse and eligible children. Requirements :- * Minimum number must be 10. - Non -contributory - Contributory Eligibility :- * All full time employees between the ages of 16 and 55 and actively at work on the effective date of the plan are eligible to join . 105

- 106. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Evidence of Insurability :- * If individual amount of insurance is less than the Free Cover Limit, no medical underwriting is necessary . Amount of insurance :- - Fixed amount for all - Classified according to salary or occupation Calculation of premium :- - by age and sex * A master policy is issued to the employer. A certificate of insurance is issued to each employee. * ‘Experience Rating’ is applied for large schemes of 2000 lives or more. Group Insurance 106

- 107. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Disability Benefits Before attainment of age 60, the assured become disabled and unable to engage in any occupation or perform any work for remuneration or profit, the insurer will - waive all future premiums -pay the sum assured together with any bonus attached . Sickness Benefits -Hospitalization Benefits. - Surgical And Nursing Fees Benefits. Supplementary Benefits Accidental Death Benefit *This rider provides for payment of specified sums if the life assured should sustain any body injury due solely and directly caused through external, violent and visible means. * Double Accident Benefit. 107

- 108. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Types Of Family Takaful Business PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Objective : 1) Protection in the form of matual financial assistance to participants against misfortune of their untimely death . 2) An investment to provide for some future financial need if they survive the plan . Supplementary benefits : 1) Permanent Total Disability 2) Personal Accident 3) Hospitalization Benefit 108

- 109. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Types Of Family Takaful Plan 1) Family Takaful Plans with term of a) 10 years b) 15 years c) 20 years d) 25 years e) 30 years f) 35 years 2) Takaful Mortgage Plan 3) Takaful Plans For Education 4) Group Takaful Plan 5) Health And Medical Takaful Plan 109

- 110. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Operation Of Family Takaful Plans PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN • The Participant signs a takaful contract with the takaful company based on the principle of mudharabah . • The Participant decides on the amount for takaful installment which includes the proportion of tabaruk to be paid regularly to the company . • These installments are then credited into a fund known as the ‘Family Takaful Fund’ 110

- 111. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Contribution = PA + PSA = (Saving / investment) + Tabaruk = (Saving / investment) + risk premium PSA = the amount credited into the PSA is made with the intention of tabaruk to be pooled into a risk fund, and company use the fund to make payment of takaful benefits to the heir of any participant who may die before reaching the term of the plan . Participant’s Special Account PA = the main function of the PA is for saving and investments Participant’s Account 111

- 112. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Family Takaful Benefit PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Divided into 3 main portions : Death Benefit Maturity Benefit Surrender Value It shall be paid to participant depending on 3 cases : • Case 1: The participant dies before the term of the takaful plan. Death Benefit Amount of Death benefit defined by plan Accumulated value of the Participant’s PA = + 112

- 113. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN •Case 2 : The participant survives to the end of the term of the takaful plan Maturity Benefit Total Accumulated value of participant’s PA Share of surplus from the risk fund at maturity = + •Case 3 : The participant terminates the contract . Only amounts to the accumulated value of participant’s Personal Account 113

- 114. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN POLICY CONDITIONS PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Contract : An intangible and a legally binding agreement between the concerned parties . 114

- 115. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN (a) Privileges Days Of Grace - Days allowed for the premium payment (30 days) after due date - The coverage under the policy continues during the days of grace Surrender Value -It is attached to a life insurance policy after premiums have been paid for a certain minimum number of years . Home service policy : 6 years or more Ordinary policy : 3 years or more 115

- 116. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Policy Loans Paid-up Policy After premium have been paid for a minimum period, loans are generally up to 85% or 90% of the acquired cash value of a policy . A paid-up policy (also known as free policy) uses the cash value available As a single premium to provide for an insurance on the original terms, but a reduced sum assured . 116

- 117. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Non-Forfeiture Conditions * A valuable privilege to assure who overlooks the payment of the premium or is temporarily unable to meet it . * It only comes into play after the policy has acquired a cash value . Automatic Premium Loan - premium is paid automatically as it falls due . - the automatic premium loan provides for a continuation of the insurance cover. - Insurance protection decreases each time the amount of loan increase . Paid-up Policy - once converted, no further premium are required. - all riders and supplementary benefits are cancelled . - participating policy will crease to participate in future profits . 117

- 118. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Extended Term Assurance - exchange the acquired cash value for a paid-up term insurance for the full sum assured . - the need for insurance protection continues, but financial capacity impaired . 118

- 119. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Reinstatement Condition - enables a person to apply for reinstatement of the contract, notwithstanding that the days of grace and the period of non- forfeiture have both expired . - policies reinstated subject to evidence of health .Company reserves the right to impose its own terms . 119

- 120. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN (b) Restrictive Conditions Suicide Clause If the insured commits suicide within a stated period of time (1 year or 2 years) from the date of inception or reinstatement ,the policy becomes void (may refund all premium paid). Foreign Travel & Residence Most policies do not impose any restriction on travel or foreign residence . 120

- 121. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Occupation And Dangerous Hobbies Additional premiums may be charged for occupational risks. Example : motor racing, policeman etc...... . Incontestability Clause The insurer cannot deny liability on a policy after 2 years of its issue on the grounds of misrepresentation or non- disclosure alone unless he can prove that such misrepresentation ,non-representation or non-disclosure was fraudulently made by the insured. 121

- 122. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN ( c) Conditions Explaining The Contract Admission of Age Documents generally accepted as proof of age : • official certificate of birth . • school leaving certificate . • extract from service record of government ,Semi-Government, Public sector undertakings and reputed Commercial firms . • certified extract from Baptism Register . • Identity Card . • International Passport . • Statutory declaration by the life assured or by an elderly relative where the birth certificate has been lost or destroyed or duplicate copy is not obtainable. 122

- 123. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Misrepresentation of Age -Age understated The amount of money payable would be such sum, as the premium paid would purchase according to the true age . - Age overstated Excess premium paid could be refunded or higher sum be payable. Under Section 15 (C) of the Insurance Act, 1963 - A policy shall not be canceled by reason only of a misstatement of the age of the life assured. 123

- 124. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Assignment of a life policy The legal rights vested under a life insurance policy may be transferred by an assignment . Absolute Assignment -one does not leave any right with the assignor except paying of premiums if he chooses to pay. Conditional Assignment - assignor can revoke all the rights If the assignee dies before the payment becomes due under the policy or if the life assured survives till the maturity date of an endownment policy. Assignment can be carried out by : - writing - an endorsement or a separate deed. - a written notice of the assignment served to the insurer. - registration by the insurer to establish the order of priority in a claim when a policy has multiple assignments. 124

- 125. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Practice Of Life Insurance New Business – Selection Of Lives And Other Issues PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Risk Management The Risk Factor - Mortality • Age • Sex • Occupation • Social Status • Ethnicity • Geographical Location • Marital Status • Personal Habits & Family History • Avocation • Foreign Residence 125

- 126. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Selection Of Lives To Be Insured • The insurer has to select the lives to be insured to avoid anti-selection. This is principally done through the process of underwriting . Financial Underwriting (Seek to discover the presence of moral hazard) The proposal form will be checked for the following :- * the existence of insurable interest. * the earning capacity ,financial standing . * whether the insured maintains multiple insurance policies. * whether the proposer has been turned down by any insurer. Medical Underwriting (seek to assess the extent of physical hazard) * if there is any unusual features in the proposal ,supplementary questions, medical report ,or further medical examination is required. * if proposer is in good health , he would be offered coverage at normal terms. * if proposer is not in good health ,he would be considered as a sub- standard life or as an impaired life. 126

- 127. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN For sub-standard lives :- * Charge extra premium. * Charge a debt or a lien I.e. reduce the amount payable in the event of death . * Offer an alternative contract. • Decline or postpone coverage . Non – Medical Underwriting * The advances in medicine ,together with the rising costs of obtaining medical evidence and the need to process increasing volumes of business quickly, led to the issuance of policies for which medical evidence is not required. * This privilege is usually given only to the permanent forms of insurance such as whole life and endownment insurance, and age related limits on the sum insured when imposed. 127

- 128. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN The Role Of The Agent In The Underwriting Process Of Non-Medical Insurance The insurers rely on the integrity, loyalty and good judgment of their agents to ensure that the proposers for non-medical coverage disclose all material information honestly. “ Cooling Off ” period The insured within 15 days of receipt of the policy can return the policy with a notice in writing objecting to a term or condition of the policy and the insurer then has to refund the premium . Loading Letter A letter indicating the loading is issued to the proposer as a counter-offer if there is an extra loading on the proposal. If the proposer agrees, he will be required to return a copy of the letter of consent to the company . 128

- 129. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Backdating Of Commencement Date It may be backdated to an earlier date, usually up to a maximum of six months. The purpose is to benefit the proposer for paying the premium applicable to a lower age . 129

- 130. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Practice Of Life Insurance - New Business - Premium Rating PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Quantifying The Risk Pooling Of Similar Risk When a large number of similar risks are combined into a group there will be less uncertainty about the amount of loss likely to be incurred within a certain period . Law Of Large Number When a large number of lives are insured, the fluctuation in the rate of death from year to year, under normal circumstances will not be very significant . The Past Forms A Guide To The Future The mortality statistics of insured lives give the results of the experience of the past, and these are used as a guide to chart the mortality trend for the future . 130

- 131. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN 20.2 Costing The Risk For the purpose of premium calculation ,the following factors need to be considered : Mortality Investment Returns Expenses - Initial expenses - Renewal expenses - Termination expenses Tax Other Factors - Financing costs - Reinsurance costs - Bonus loading (participating policies) - Cost for options and guarantees, if any - Cost for maintaining statutory reserves and solvency margins . 131

- 132. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Birthday :21 March 1965 PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Calculation Of Age •Age Last Birthday Calculations : 31March 21, 1996December 31, 1996 29March 21, 1994January 1, 1995 30March 21, 1995May 20,1995 Age Last BirthdayLast Birthday Reference Date (Date of the proposal submitted) 132

- 133. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Birthday :21 March 1965 PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN 32March 21, 1997December 31, 1996 30March 21, 1995January 1, 1995 31March 21, 1996May 20,1995 Age Last BirthdayLast Birthday Reference Date (Date of the proposal submitted) •Age Next Birthday Calculations : 133

- 134. PP RR EE -- CC OO NN TT RR AA CC TT EE XX AA MM AA NN AA TT II OO NN Thank YouThank You && All the BestAll the Best