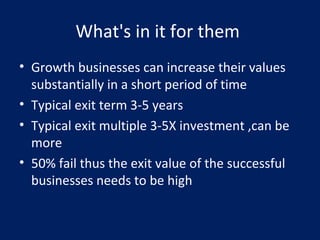

Business angels are high net worth individuals who invest in private equity, acknowledging the high risk but also high reward potential. They typically aim to have a portfolio of 10 small-to-medium enterprises (SMEs), expecting 4 to fail, 4 to maintain their value, and 2 to grow exponentially. Successful exits within 3-5 years allowing for 3-5 times return on investment are motivating. Angels invest for growth, using their experience and networks to add value beyond just capital. They seek strong management teams and business plans with realistic projections of doubling their investment. Tax reliefs make angel investing an attractive asset class.