EPF Calculation.docx

•Download as DOCX, PDF•

0 likes•2 views

EPF CALCULATION

Report

Share

Report

Share

Recommended

PF and ESI Payment, Due Date, Late Fees & Interests

www.guptaconsultants.com

Contact: 8744079902,9871004014Pf and esi payment due date late fees & interests ppt (g&cc managemen...

Pf and esi payment due date late fees & interests ppt (g&cc managemen...GNCC Managment Services

You may need to spend some time on this analysis since it somewhat complex, however, if you have never analyzed your UC Rate notice it is time well spent! I am hoping you will be able to follow this algorithm using your company’s PA UC Contribution Rate Notice and work your way through the analysis I’ve outlined below to gain a better understanding of what you are paying to the (PA) Commonwealth each year for UC Taxes, and why you are paying the rate assigned.Interpreting your pennsylvania unemployment compensation (uc) contribution ra...

Interpreting your pennsylvania unemployment compensation (uc) contribution ra...James Baker, SPHR Retired, MAS

Recommended

PF and ESI Payment, Due Date, Late Fees & Interests

www.guptaconsultants.com

Contact: 8744079902,9871004014Pf and esi payment due date late fees & interests ppt (g&cc managemen...

Pf and esi payment due date late fees & interests ppt (g&cc managemen...GNCC Managment Services

You may need to spend some time on this analysis since it somewhat complex, however, if you have never analyzed your UC Rate notice it is time well spent! I am hoping you will be able to follow this algorithm using your company’s PA UC Contribution Rate Notice and work your way through the analysis I’ve outlined below to gain a better understanding of what you are paying to the (PA) Commonwealth each year for UC Taxes, and why you are paying the rate assigned.Interpreting your pennsylvania unemployment compensation (uc) contribution ra...

Interpreting your pennsylvania unemployment compensation (uc) contribution ra...James Baker, SPHR Retired, MAS

Pa UC Contribution rates are difficult to understand, but not impossible to interpret. If you have a copy of your notice from 12/31/14 you can input the data into this format and better understand why your rate is set at the level determined by the Commonwealth.Interpreting your Pennsylvania unemployment compensation (UC) contribution ra...

Interpreting your Pennsylvania unemployment compensation (UC) contribution ra...James Baker, SPHR Retired, MAS

More Related Content

Similar to EPF Calculation.docx

Pa UC Contribution rates are difficult to understand, but not impossible to interpret. If you have a copy of your notice from 12/31/14 you can input the data into this format and better understand why your rate is set at the level determined by the Commonwealth.Interpreting your Pennsylvania unemployment compensation (UC) contribution ra...

Interpreting your Pennsylvania unemployment compensation (UC) contribution ra...James Baker, SPHR Retired, MAS

Similar to EPF Calculation.docx (20)

Employee’s provident funds and miscellaneous act,1952 copy

Employee’s provident funds and miscellaneous act,1952 copy

Interpreting your Pennsylvania unemployment compensation (UC) contribution ra...

Interpreting your Pennsylvania unemployment compensation (UC) contribution ra...

A CASE STUDY ON EPF INCENTIVE REFUND SCHEME - CONDUCTED BY NABARUN CHAKRABORT...

A CASE STUDY ON EPF INCENTIVE REFUND SCHEME - CONDUCTED BY NABARUN CHAKRABORT...

THE ESSENTIAL GUIDE TO PAYROLL SERVICE IN BANGALORE.docx

THE ESSENTIAL GUIDE TO PAYROLL SERVICE IN BANGALORE.docx

Pre-tax retirement annuity contributions - the tax benefit that very few bene...

Pre-tax retirement annuity contributions - the tax benefit that very few bene...

Recently uploaded

Understand that with the use of Human Resources Management Software (HRMS) you will receive a secure solution for handling any confidential employee related information and also high level of confidentiality will be maintained. Become familiar with the importance of data security in human resource management while exploring the aspects of HRMS that guarantee data safeguarding. Through the compliance with norms, employee self-service portals, and AI-powered HRMS solutions the future of HR will be through this system. Discuss about the benefits of such a software, in terms of process streamlining, insuring compliance, and creating an environment in which employees can trust and feel comfortable in the organization due to transparent and up-to-date data.Data Security Matters: Ensure Confidentiality with Human Resources Management...

Data Security Matters: Ensure Confidentiality with Human Resources Management...HRMantra Software Pvt. Ltd

Recently uploaded (12)

From Awareness to Action: An HR Guide to Making Accessibility Accessible

From Awareness to Action: An HR Guide to Making Accessibility Accessible

Webinar - How to Implement a Data-Driven Compensation Strategy

Webinar - How to Implement a Data-Driven Compensation Strategy

Databricks Data Analyst Associate Exam Dumps 2024.pdf

Databricks Data Analyst Associate Exam Dumps 2024.pdf

Data Security Matters: Ensure Confidentiality with Human Resources Management...

Data Security Matters: Ensure Confidentiality with Human Resources Management...

6 Common Mistakes to Avoid When Creating a Performance Appraisal Dashboard in...

6 Common Mistakes to Avoid When Creating a Performance Appraisal Dashboard in...

Market Signals – Global Job Market Trends – April 2024 summarized!

Market Signals – Global Job Market Trends – April 2024 summarized!

Recruit Like A Pro: Dives Deep into the world of Data-Driven Recruitment

Recruit Like A Pro: Dives Deep into the world of Data-Driven Recruitment

EPF Calculation.docx

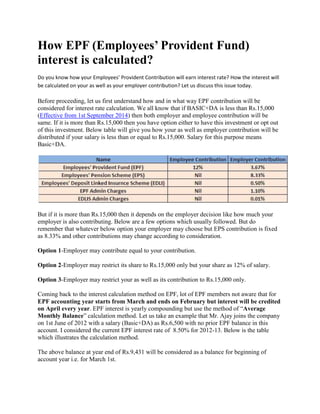

- 1. How EPF (Employees’ Provident Fund) interest is calculated? Do you know how your Employees’ Provident Contribution will earn interest rate? How the interest will be calculated on your as well as your employer contribution? Let us discuss this issue today. Before proceeding, let us first understand how and in what way EPF contribution will be considered for interest rate calculation. We all know that if BASIC+DA is less than Rs.15,000 (Effective from 1st September 2014) then both employer and employee contribution will be same. If it is more than Rs.15,000 then you have option either to have this investment or opt out of this investment. Below table will give you how your as well as employer contribution will be distributed if your salary is less than or equal to Rs.15,000. Salary for this purpose means Basic+DA. But if it is more than Rs.15,000 then it depends on the employer decision like how much your employer is also contributing. Below are a few options which usually followed. But do remember that whatever below option your employer may choose but EPS contribution is fixed as 8.33% and other contributions may change according to consideration. Option 1-Employer may contribute equal to your contribution. Option 2-Employer may restrict its share to Rs.15,000 only but your share as 12% of salary. Option 3-Employer may restrict your as well as its contribution to Rs.15,000 only. Coming back to the interest calculation method on EPF, lot of EPF members not aware that for EPF accounting year starts from March and ends on February but interest will be credited on April every year. EPF interest is yearly compounding but use the method of “Average Monthly Balance” calculation method. Let us take an example that Mr. Ajay joins the company on 1st June of 2012 with a salary (Basic+DA) as Rs.6,500 with no prior EPF balance in this account. I considered the current EPF interest rate of 8.50% for 2012-13. Below is the table which illustrates the calculation method. The above balance at year end of Rs.9,431 will be considered as a balance for beginning of account year i.e. for March 1st.

- 2. A few points to be noted– Contributions will be shown by your employer based on the salary due. For example, September month salary will be payable on October. So the September month contribution will be shown as a contribution against October but not in September. Whether the payment will be in October month or not. Interest will be rounded off to a nearest rupee. In case of death claims, interest should be restricted to the month preceding the month in which death occurred.