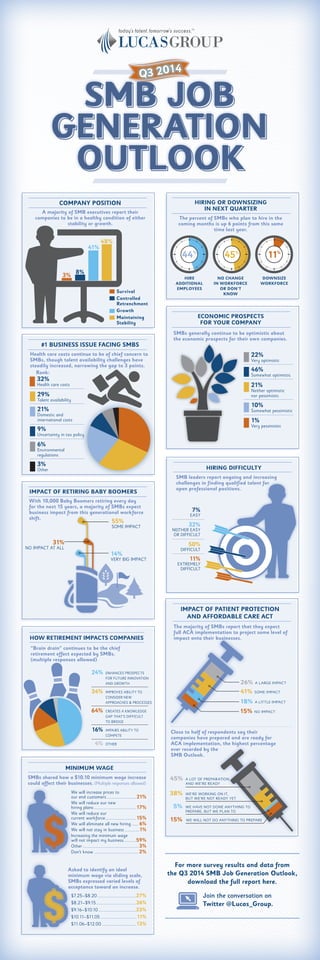

Q3 2014 SMB Job Generation Outlook Infographic

- 1. SMB JOB GENERATION OUTLOOK Q3 2014 HIRING OR DOWNSIZING IN NEXT QUARTER The percent of SMBs who plan to hire in the coming months is up 6 points from this same time last year. ECONOMIC PROSPECTS FOR YOUR COMPANY HIRE ADDITIONAL EMPLOYEES NO CHANGE IN WORKFORCE OR DON’T KNOW DOWNSIZE WORKFORCE COMPANY POSITION A majority of SMB executives report their companies to be in a healthy condition of either stability or growth. 3% 8% 41% 48% Survival Controlled Retrenchment Growth Maintaining Stability #1 BUSINESS ISSUE FACING SMBS Health care costs continue to be of chief concern to SMBs, though talent availability challenges have steadily increased, narrowing the gap to 3 points. Rank: 44% 45% 11% SMBs generally continue to be optimistic about the economic prospects for their own companies. 1% Very pessimistic 10% Somewhat pessimistic 21% Neither optimistic nor pessimistic 46% Somewhat optimistic 22% Very optimistic 9% Uncertainty in tax policy 6% Environmental regulations 29% Talent availability 21% Domestic and international costs 32% Health care costs 3% Other HIRING DIFFICULTY SMB leaders report ongoing and increasing challenges in finding qualified talent for open professional positions. 11% EXTREMELY DIFFICULT 50% DIFFICULT 7% EASY 32% NEITHER EASY OR DIFFICULT IMPACT OF PATIENT PROTECTION AND AFFORDABLE CARE ACT The majority of SMBs report that they expect full ACA implementation to project some level of impact onto their businesses. Close to half of respondents say their companies have prepared and are ready for ACA implementation, the highest percentage ever recorded by the SMB Outlook. 15% NO IMPACT 18% A LITTLE IMPACT 41% SOME IMPACT 26% A LARGE IMPACT 45% A LOT OF PREPARATION, AND WE’RE READY 38% WE’RE WORKING ON IT, BUT WE’RE NOT READY YET 5% WE HAVE NOT DONE ANYTHING TO PREPARE, BUT WE PLAN TO 15% WE WILL NOT DO ANYTHING TO PREPARE MINIMUM WAGE SMBs shared how a $10.10 minimum wage increase could affect their businesses. (Multiple responses allowed) Asked to identify an ideal minimum wage via sliding scale, SMBs expressed varied levels of acceptance toward an increase. We will increase prices to our end customers...........................21% We will reduce our new hiring plans......................................17% We will reduce our current workforce............................15% We will eliminate all new hiring....... 6% We will not stay in business..............1% Increasing the minimum wage will not impact my business............59% Other.................................................. 3% Don’t know........................................ 2% $7.25–$8.20...................................27% $8.21–$9.15....................................26% $9.16–$10.10..................................23% $10.11–$11.05................................ 11% $11.06–$12.00...............................13% IMPACT OF RETIRING BABY BOOMERS With 10,000 Baby Boomers retiring every day for the next 15 years, a majority of SMBs expect business impact from this generational workforce shift. 55% SOME IMPACT 14% VERY BIG IMPACT 31% NO IMPACT AT ALL For more survey results and data from the Q3 2014 SMB Job Generation Outlook, download the full report here. Join the conversation on Twitter @Lucas_Group. HOW RETIREMENT IMPACTS COMPANIES “Brain drain” continues to be the chief retirement effect expected by SMBs. (multiple responses allowed) 24% ENHANCES PROSPECTS FOR FUTURE INNOVATION AND GROWTH 34% IMPROVES ABILITY TO CONSIDER NEW APPROACHES & PROCESSES 64% CREATES A KNOWLEDGE GAP THAT’S DIFFICULT TO BRIDGE 16% IMPAIRS ABILITY TO COMPETE 4% OTHER