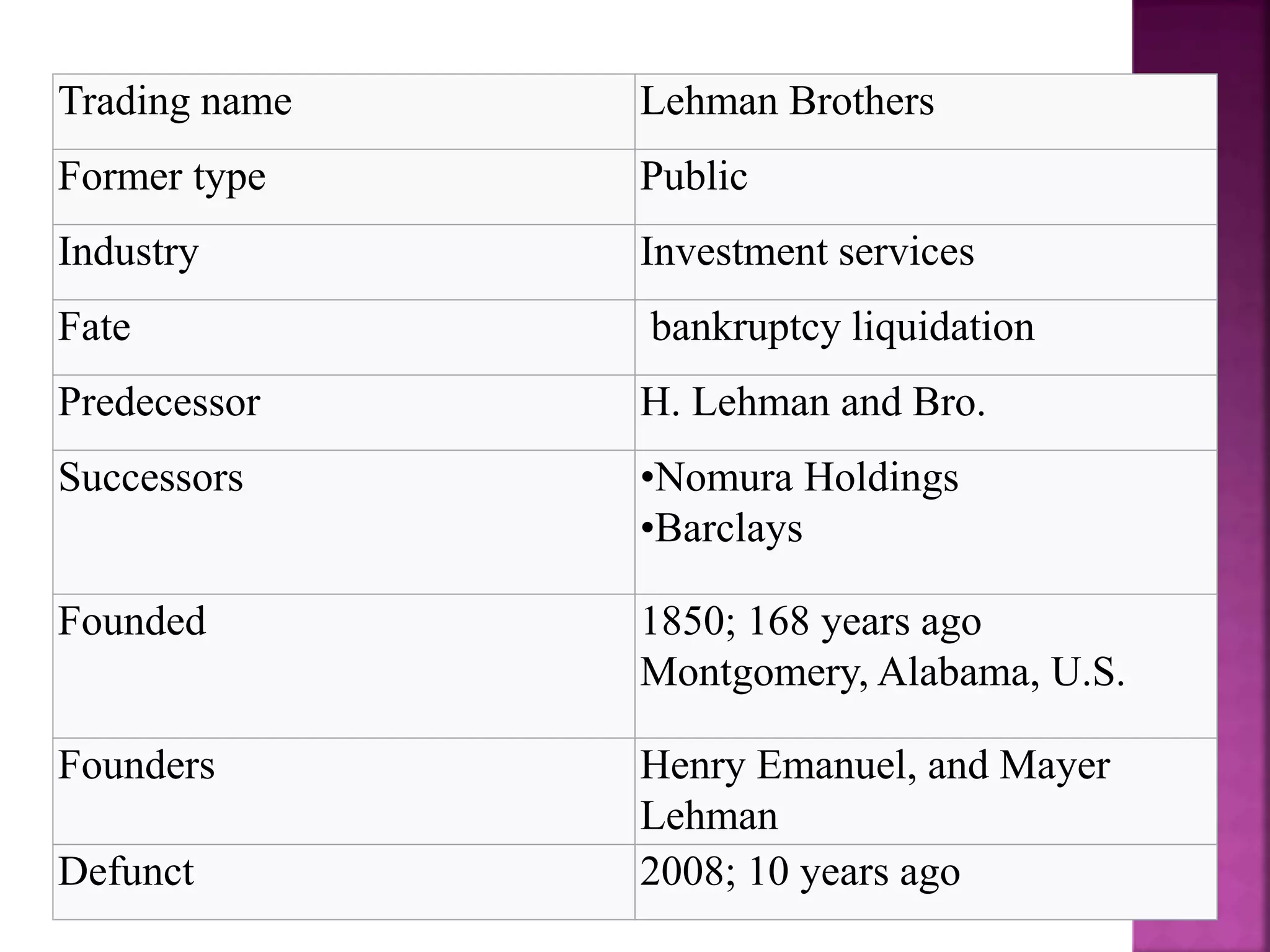

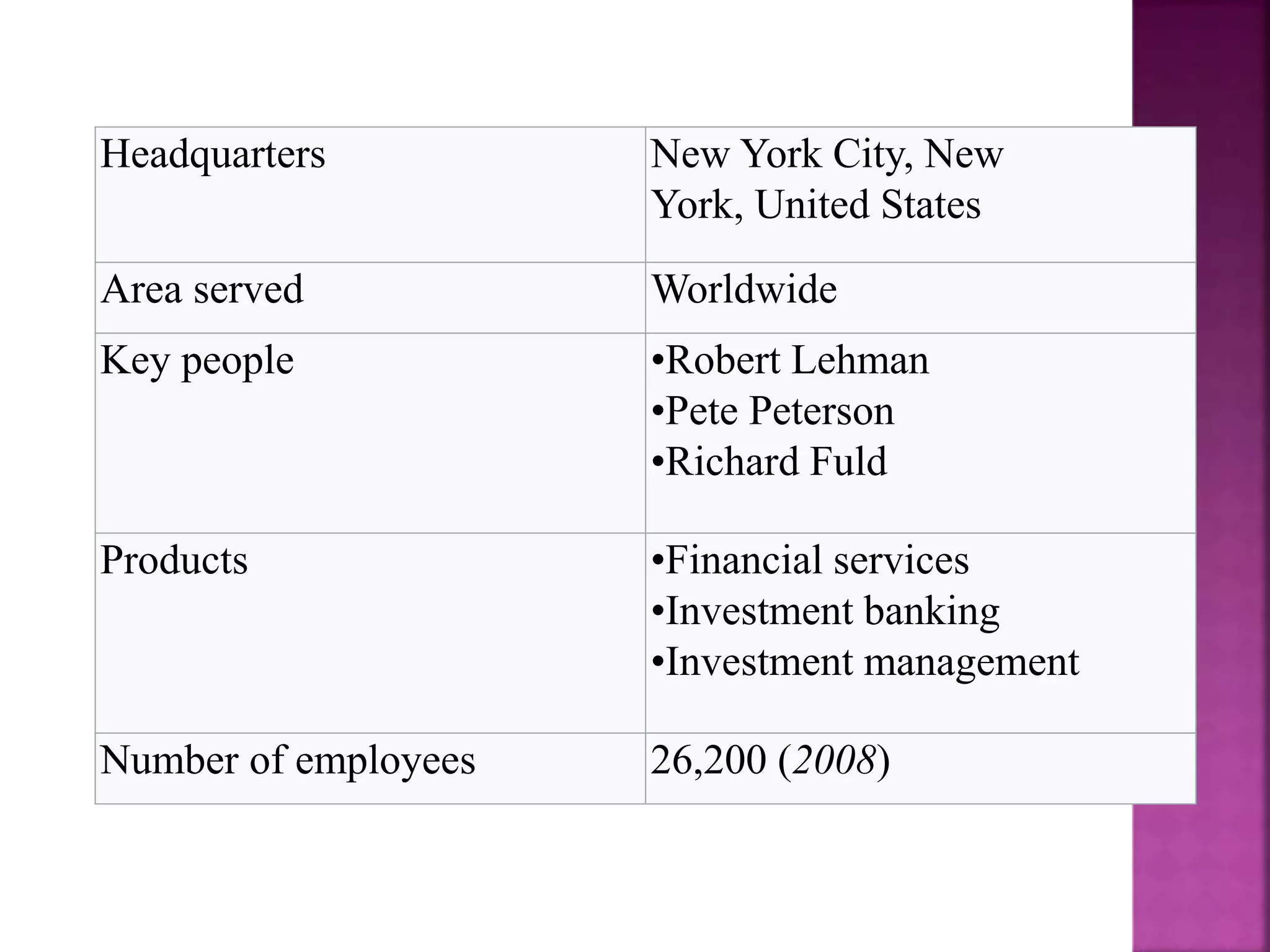

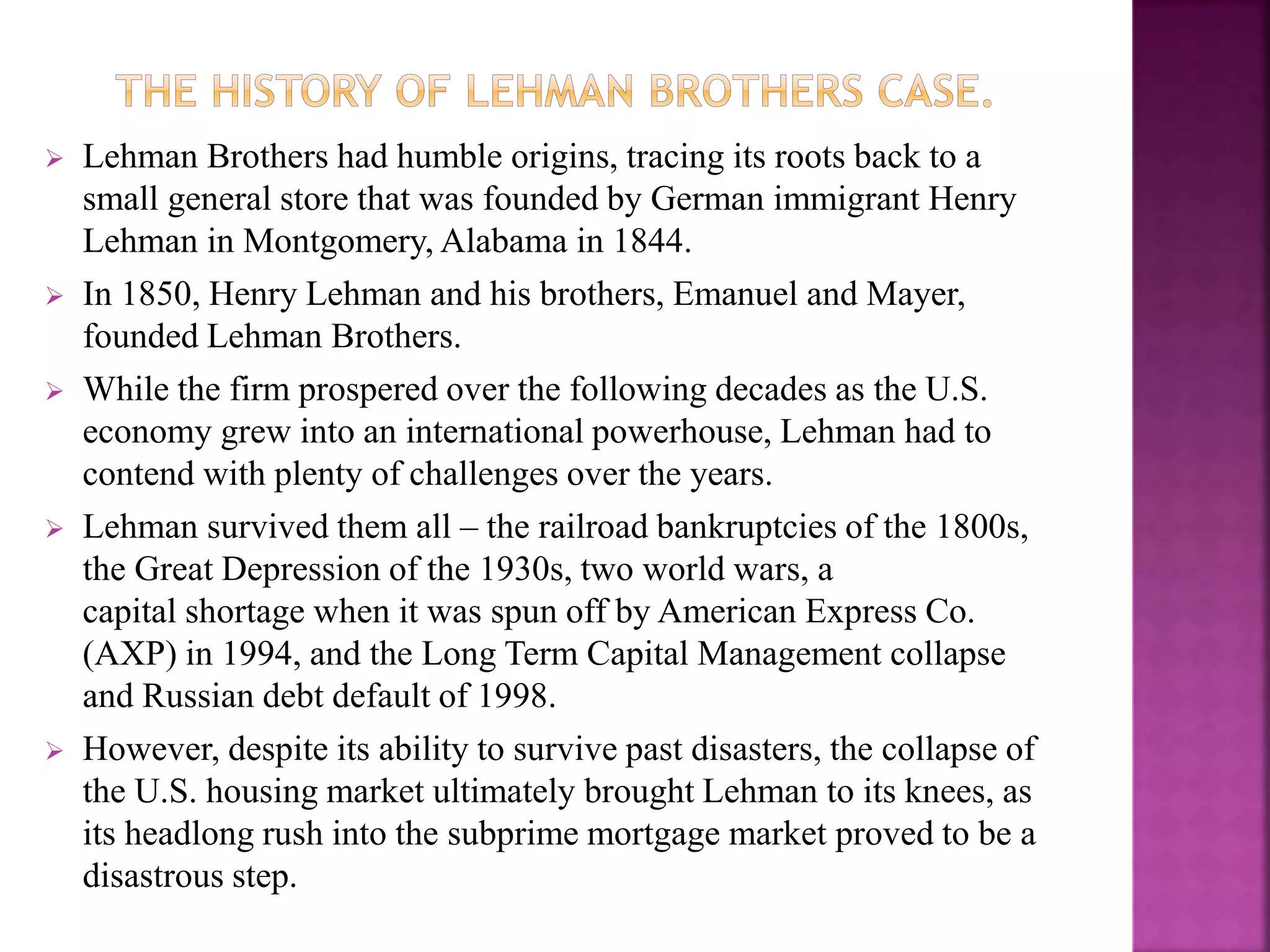

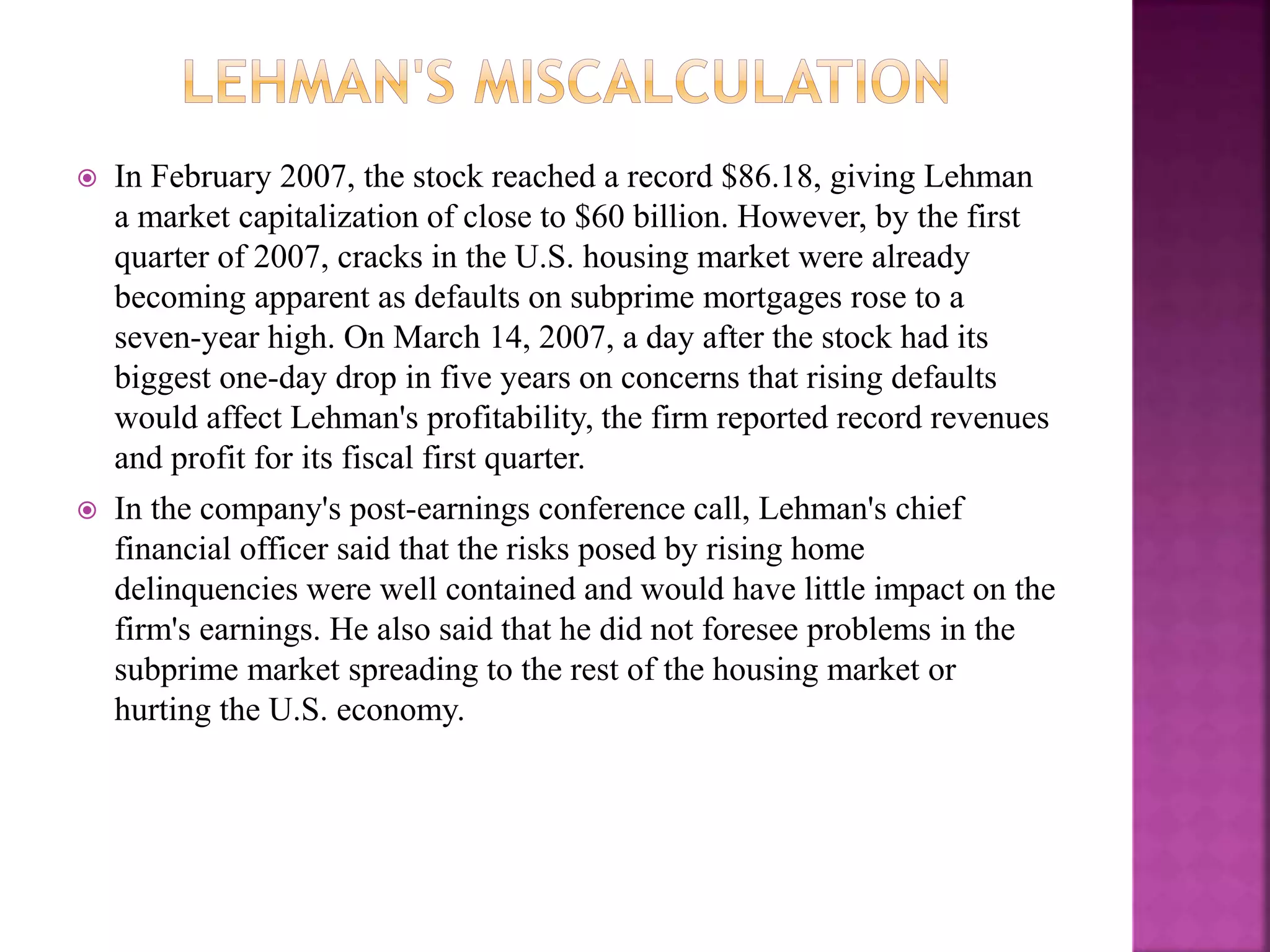

Lehman Brothers was a global investment bank that filed for the largest bankruptcy in US history in September 2008 during the global financial crisis. With over $600 billion in assets and liabilities, Lehman's collapse accelerated the crisis and greatly intensified the crisis. The bankruptcy occurred due to Lehman's excessive risk taking, including accumulating a $85 billion mortgage-backed securities portfolio. The collapse roiled global markets and resulted in over $46 billion of Lehman's market value being wiped out.