FISM2 - 22102021 (2).pdf

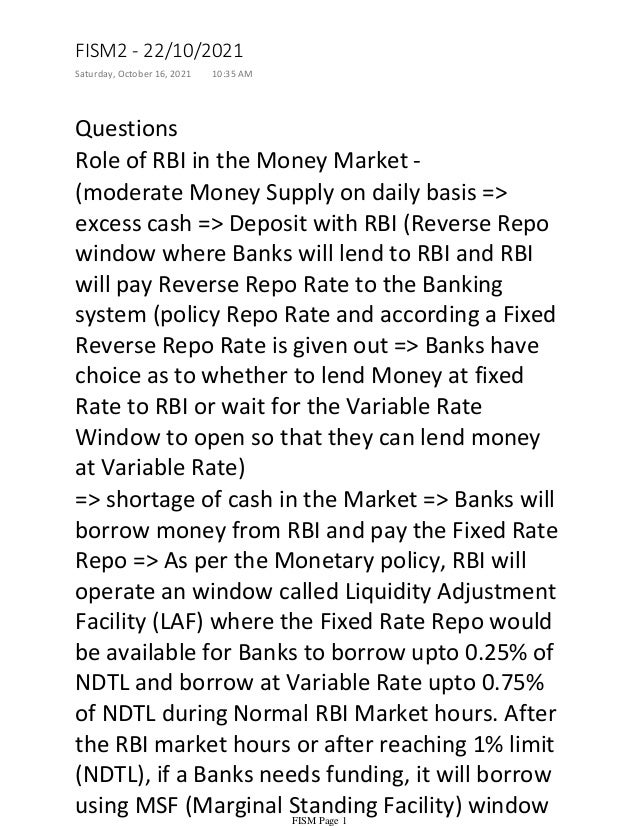

- 1. Questions Role of RBI in the Money Market - (moderate Money Supply on daily basis => excess cash => Deposit with RBI (Reverse Repo window where Banks will lend to RBI and RBI will pay Reverse Repo Rate to the Banking system (policy Repo Rate and according a Fixed Reverse Repo Rate is given out => Banks have choice as to whether to lend Money at fixed Rate to RBI or wait for the Variable Rate Window to open so that they can lend money at Variable Rate) => shortage of cash in the Market => Banks will borrow money from RBI and pay the Fixed Rate Repo => As per the Monetary policy, RBI will operate an window called Liquidity Adjustment Facility (LAF) where the Fixed Rate Repo would be available for Banks to borrow upto 0.25% of NDTL and borrow at Variable Rate upto 0.75% of NDTL during Normal RBI Market hours. After the RBI market hours or after reaching 1% limit (NDTL), if a Banks needs funding, it will borrow using MSF (Marginal Standing Facility) window FISM2 - 22/10/2021 Saturday, October 16, 2021 10:35 AM FISM Page 1

- 2. of RBI. (For example, on 21-Oct-2021, a Bank borrowed 370CR from RBI at MSF Rate which is fixed 25bps above the Policy Repo Rate. Repo Rate is applicable for normal borrowing limits which is within 1% of NDTL within the approved timings of RBI. MSF is a penal Rate which is fixed 25bps above Repo Rate in case a Bank needs funding beyond above parameters. MSF is exact rate of Bank Rate. Using this LAF window, RBI moderates Money Supply => either it lends money or it absorbs liquidity from the Banking system. RBI also opens special window for providing liquidity support to the Banking system where Banks can access the designated pool to on- lend their customers. (Fed Quantitative Easing) 9082323799 / 9820511897 Why a Central Bank operation (Asset Buying when there is a crash in the market) helps? When the Assets are held in the Books of the Banking system, Banks have to necessarily use a concept called "Mark to Market" => they have to value on daily basis and provide for the FISM Page 2

- 3. to value on daily basis and provide for the depreciation in value by eating up their own capital / reserves. Capital is eaten up => Business is linked to RWA (Investments are Assets ) => Less Business a Bank can do when Capital falls. (Infusion of Capital or Recapitalizing the Banks). The provision of providing for losses in the Books is as per the requirement of Basel Regulations. But Central Banks around the World are not categorized as Commercial Banks and hence they are exempt from Basel Regulations. So there will be no valuation debit for the assets (they can hold it in the Book value). The fall stops there as RBI / Central Bank buys the assets as it does not intend to sell (all sellers have been paid out through this target buying thereby reducing the selling pressure => asset price stabilizes). If the market has to fund, this will continue to drop. As a global practice, Central banks participate in the Money Market to moderate the Money / Funds. RBI Repo or LAF: RBI on one side vs Banks 1) FISM Page 3

- 4. RBI Repo or LAF: RBI on one side vs Banks and Primary Dealers (another category of institutions predominantly owned by Banks who have given license to Underwrite the Government Issuances / Borrowings) are on other side (NO other Institutions are allowed here). Call Market (Inter-bank market) is also restricted to Banks and Primary Dealers. 1) Banks and Institutions vs Banks and Institutions: All Institutional entities are allowed to lend or Borrow money from each other. Component 1 (non-instrument based market (Lending & Borrowing based market): (i) Call (1D) / Notice (2-14D)/ Term (15-364D); => Mostly it is used for CRR replenishment by Banks (ii) Repo - Market Repo upto 364 Days => Banks and Institutions Borrow and Lend against Government Securities. (iii) Tri-Party Repo Market (Banks and Institutions vs Banks and Institutions but the process runs through a approved Tri-Party (CCIL). (iv) Corporate Band Repo where the collaterals are Corporate Bonds. a. 2) FISM Page 4

- 5. collaterals are Corporate Bonds. Component 2: Asset based market => (Buying and Selling) => TBs issued by Govt and bought and sold by participants; Certificate of Deposits issued by Banks (upto 1 year)/ FIs (NABARD, EXIM Banks, SIDBI, IFCI) (upto 2 years; Commercial Papers - issued by large corporates having Second Highest Credit Rating for short term papers and minimum Net worth condition. All these papers are issued as Discounted Instruments = They are sold at a Discount to the Face Value using PV = FV (100)/(1+R%*n/365). If we have TB for 45 days outstanding maturity and trading at 4.6%, the price would be =100/(1+4.6%* 45/365)= 99.4631 b. RBI participates only in LAF market to moderate Money supply and not in any other part of Money Market. 3) Monetary Policy interacts with the Money Market: Excess Funds in the system: Banks will be putting their money in RBI (Bankers' Bank) and RBI will pay the Reverse Repo Rate to a. 4) FISM Page 5

- 6. and RBI will pay the Reverse Repo Rate to fund such lending by Banks. In case of Excess funds in the market, Banks have a choice to either lend them to other Banks or to RBI. Hence the Support to the system is the Reverse Repo Rate => "Why should I lend you at lower than RBI Reverse Repo Rate when RBI can pay me Rev Repo if I put my Money there?" (For example 3.35% is the Support Rate for inter-bank market). When There is shortage of funds in the market => Why should I borrow from you at a higher than Repo Rate as RBI will lend me at Repo Rate if I have a problem (till 1% of NDTL). This is a Resistance Rate. You get a band (Interest Rate Corridor) within the which the Market is targeted to work. If people work outside this corridor for a longer period of time, the policy is not in sync with the market requirement and Monetary policy needs relook. FISM Page 6