Report

Share

Download to read offline

Recommended

Recommended

More Related Content

What's hot

What's hot (20)

Similar to FISM4 - 24102021.pdf

Similar to FISM4 - 24102021.pdf (20)

1.The concept of present value relates to the idea that a)Th.pdf

1.The concept of present value relates to the idea that a)Th.pdf

SEBI streamlines the process of Buy-back of securities.pdf

SEBI streamlines the process of Buy-back of securities.pdf

HW 5.docxAssignment 5 – Currency riskYou may do this assig.docx

HW 5.docxAssignment 5 – Currency riskYou may do this assig.docx

HDFC sec note mf category analysis - arbitrage funds - june 2015

HDFC sec note mf category analysis - arbitrage funds - june 2015

Recently uploaded

Recently uploaded (20)

ASSESSING HRM EFFECTIVENESS AND PERFORMANCE ENHANCEMENT MEASURES IN THE BANKI...

ASSESSING HRM EFFECTIVENESS AND PERFORMANCE ENHANCEMENT MEASURES IN THE BANKI...

How can I withdraw my pi coins to real money in India.

How can I withdraw my pi coins to real money in India.

Satoshi DEX Leverages Layer 2 To Transform DeFi Ecosystem.pdf

Satoshi DEX Leverages Layer 2 To Transform DeFi Ecosystem.pdf

Maximize Your Business Potential with Falcon Invoice Discounting

Maximize Your Business Potential with Falcon Invoice Discounting

Managing personal finances wisely for financial stability and

Managing personal finances wisely for financial stability and

Retail sector trends for 2024 | European Business Review

Retail sector trends for 2024 | European Business Review

FISM4 - 24102021.pdf

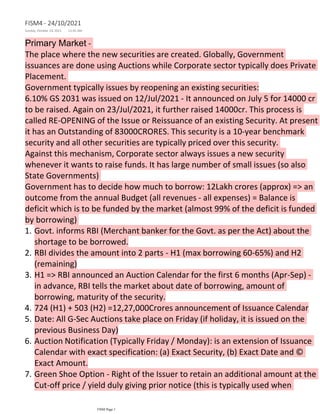

- 1. Primary Market - The place where the new securities are created. Globally, Government issuances are done using Auctions while Corporate sector typically does Private Placement. Government typically issues by reopening an existing securities: 6.10% GS 2031 was issued on 12/Jul/2021 - It announced on July 5 for 14000 cr to be raised. Again on 23/Jul/2021, it further raised 14000cr. This process is called RE-OPENING of the Issue or Reissuance of an existing Security. At present it has an Outstanding of 83000CRORES. This security is a 10-year benchmark security and all other securities are typically priced over this security. Against this mechanism, Corporate sector always issues a new security whenever it wants to raise funds. It has large number of small issues (so also State Governments) Government has to decide how much to borrow: 12Lakh crores (approx) => an outcome from the annual Budget (all revenues - all expenses) = Balance is deficit which is to be funded by the market (almost 99% of the deficit is funded by borrowing) Govt. informs RBI (Merchant banker for the Govt. as per the Act) about the shortage to be borrowed. 1. RBI divides the amount into 2 parts - H1 (max borrowing 60-65%) and H2 (remaining) 2. H1 => RBI announced an Auction Calendar for the first 6 months (Apr-Sep) - in advance, RBI tells the market about date of borrowing, amount of borrowing, maturity of the security. 3. 724 (H1) + 503 (H2) =12,27,000Crores announcement of Issuance Calendar 4. Date: All G-Sec Auctions take place on Friday (if holiday, it is issued on the previous Business Day) 5. Auction Notification (Typically Friday / Monday): is an extension of Issuance Calendar with exact specification: (a) Exact Security, (b) Exact Date and © Exact Amount. 6. Green Shoe Option - Right of the Issuer to retain an additional amount at the Cut-off price / yield duly giving prior notice (this is typically used when market has high demand and excess liquidity) 7. FISM4 - 24/10/2021 Sunday, October 24, 2021 11:45 AM FISM Page 1

- 2. market has high demand and excess liquidity) Uniform price method for 4.26% GS 2023, 5.63% GS 2026, 6.67% GS 2035 (in this method, all will pay the Cut-off price irrespective of their Quote) and multiple price method for 6.67% GS 2050 (each one will pay the price it quotes) GOI 6.10% GS 2031 => 14000CR (Notice) a. It will be using Price Based Auction b. The security is already in existence and its coupon is already known and hence, we can sell/buy it by quoting the price c. A New Security would require the Yield / Coupon to be explored and hence it will go for Yield based Auction (On Date of issue Yield = Coupon) SBI 1500CR 98.15 i. PNB 3500CR 98.22 ii. Citi 1500CR 98.18 iii. HDFC 2500CR 98.19 iv. STANC 4500CR 98.22 v. CANBANK 2500CR 98.22 vi. BOB 9000 98.26 Uniform Method (Cut-off 98.22) BOB 9000 a) 5000 CR to be allocated to 3 on the basis of their application b) = 4500+3500+2500 = 10500 c) PNB = (3500/10500)*5000 = 1666.6667 d) STANC = (4500/10500)*5000 = 2142.8571 e) CANBANK = (2500/10500)*5000 = 1190.4762 These 3 Banks will get Partial allocation and will pay the same Price 98.22 (BOB gained even though it wanted to pay higher) i) f) 1) Multiple Price BOB will pay 98.26 as it Bid for that price a) Other 3 banks will get the same security at lower price (Winner's curse) b) 2) Green Shoe Option for additional 2000CRores may be used as there is higher demand for the security 3) vii. d. 8. Competitive Bidding - You have to Quote both Price and Quantity (all institutional buyers are to go through this route) 9. FISM Page 2

- 3. institutional buyers are to go through this route) Non-competitive bids (retail => 5% of the Issue is reserved) => it has to only quote the Amount / Quantity and it would be allocated at Cut-Off. 10. As per Auction Rules, each Primary Dealer would compulsorily underwrite at least 50% (all combined) of the issue amount notified => 21 PDs => each one will underwrite (Minimum Underwriting Commitment is 2.5% of the issues size) and Primary Dealers do not get any Underwriting Fees for the MUC. If they propose to Underwrite Additional amount beyond this Minimum, they would be eligible to get Underwriting Fees. 11. Underwriting of the Additional Competitive Underwriting (ACU) - Fees will be decided by the Auction system where on the Day of the Auction, all Primary Dealers will submit their ACU bids to RBI for the issuance (9 to 9.30AM) and RBI will announces the successful Underwriters and the cut-off fees. 12. When Issued Market 13. Yield Based and Price Based 14. Repurchase Eligibility 15. Issuance Needs and Issuance Policy Auctions including When Issued Market Rollovers FISM Page 3