FISM1-16102021 (1).pdf

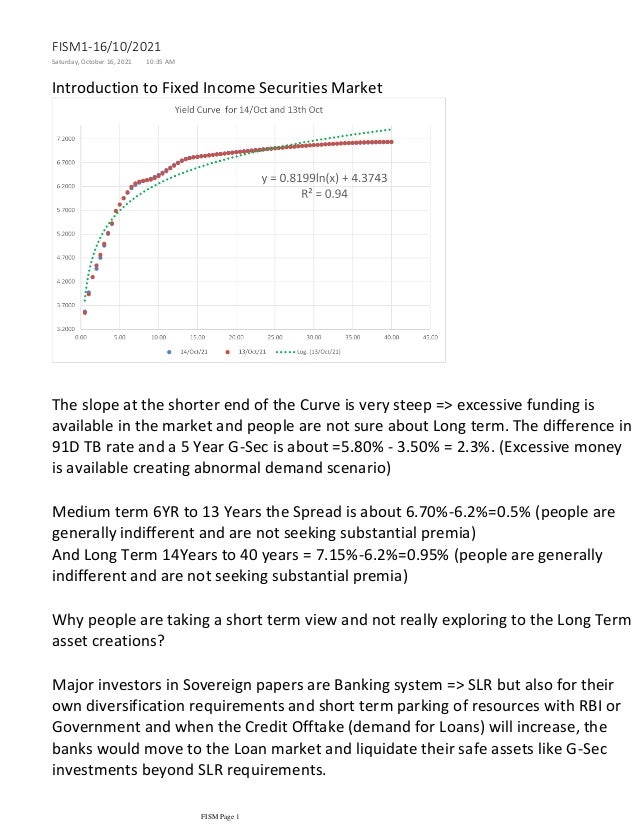

- 1. Introduction to Fixed Income Securities Market The slope at the shorter end of the Curve is very steep => excessive funding is available in the market and people are not sure about Long term. The difference in 91D TB rate and a 5 Year G-Sec is about =5.80% - 3.50% = 2.3%. (Excessive money is available creating abnormal demand scenario) Medium term 6YR to 13 Years the Spread is about 6.70%-6.2%=0.5% (people are generally indifferent and are not seeking substantial premia) And Long Term 14Years to 40 years = 7.15%-6.2%=0.95% (people are generally indifferent and are not seeking substantial premia) Why people are taking a short term view and not really exploring to the Long Term asset creations? Major investors in Sovereign papers are Banking system => SLR but also for their own diversification requirements and short term parking of resources with RBI or Government and when the Credit Offtake (demand for Loans) will increase, the banks would move to the Loan market and liquidate their safe assets like G-Sec investments beyond SLR requirements. FISM1-16/10/2021 Saturday, October 16, 2021 10:35 AM FISM Page 1

- 2. What are the sources? Foreign Exchange market??? RBI Net Buying is about 26000USD Million = 26000000000*73.45=1.91E12 = 1.91E12/10000000=191000CR = RBI must have paid about 200000CR for its Buying of USD. RBI has to sterilize this flow of excess funds to the system otherwise excess funds will further reduce interest rate and destabilize the market with the creation of bubbles in the financial system (the lendi9ng entities are likely to take excessive risk in creating assets when excess funds are not sterilized and demand for loans do not rise for structural reasons). Flow of this money gets into the Money Market. It is the short term market where RBI / central Banks around the world play an important role in directing the economic activity using Monetary policy. RBI / Central banks must work for creating of Effective Demand / Aggregate Demand for goods and Services at appropriate price to kick start the economy. RBI moderates the Money Supply or the availability of funding at appropriate rates i9n the financial system for the economic activity to prosper. RBI in the Money Market either absorbs excess liquidity from the market or it pumps / injects liquidity into the system if the market is under squeeze (shortage). Accepts funds from the banking system => Reverse Repo Giving funds to the Banking system => Repo Hence, RBI Monetary policy revolves around the Repo Rate => The rate at which RBI will supply or absorb funds. Money Market is a short term Market. There are 2 parts of this Market. (a) RBI is on one side and Banks and Primary Dealers are on the other side (extremely captive market). (b) Only Institutions like Banks, Insurance Companies, Primary Dealers, Mutual Funds, etc. are dealing with each other and here no RBI role in direct form. RBI only deals with banks and primary Dealers. However, at the time of need, RBI creates special window to fund the stressed entities (economy is at stake (NBFC crisis or Mutual Funds crisis for investment in Realty sector) but that funding is only done through the banks (Banks will accept the risk on lending to these entities but RBI will only take exposure against the Banks through special FISM Page 2

- 3. these entities but RBI will only take exposure against the Banks through special Lending which will be outside the calculations for a Bank - for example, a Bank is allowed to access 1% of its NDTL from RBI window for its own operations, but when RBI announces a special scheme, this will be outside the scope of the 1% explained above). RBI market is about -7.5lakh net Injection (RBI has taken money from the banking system as banks cannot manage the excess liquidity available with them). Hence, RBI is in a way giving some kind of subsidy by taking this money as the "Banker of the Last Resort". Otherwise, Banking system possible would be stressed as they would run negative spread on deposits. Again, the second part of the market has about 4.50lakh crores. Total excess liquidity in short term is 12Lakh Crores. FISM Page 3