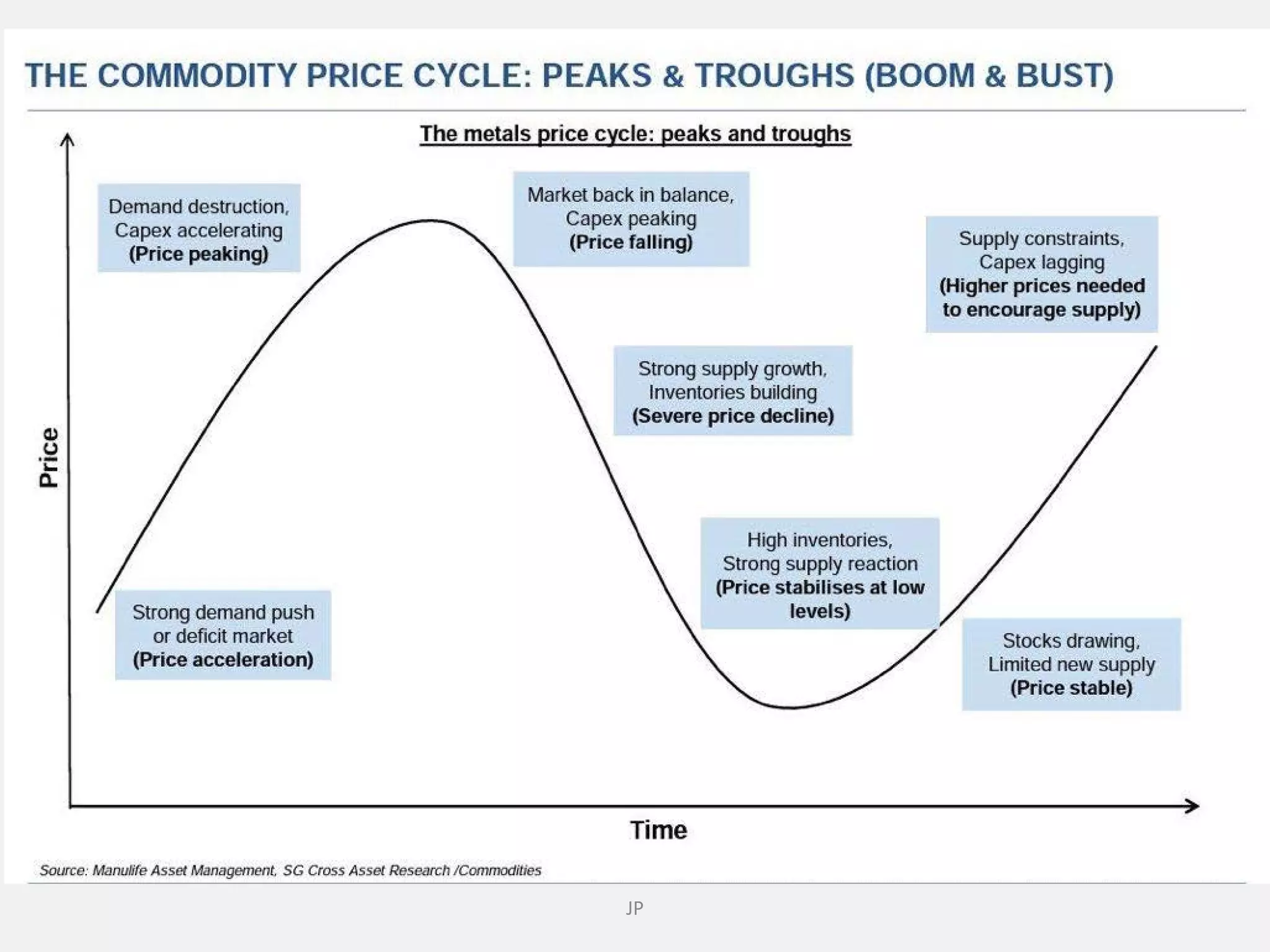

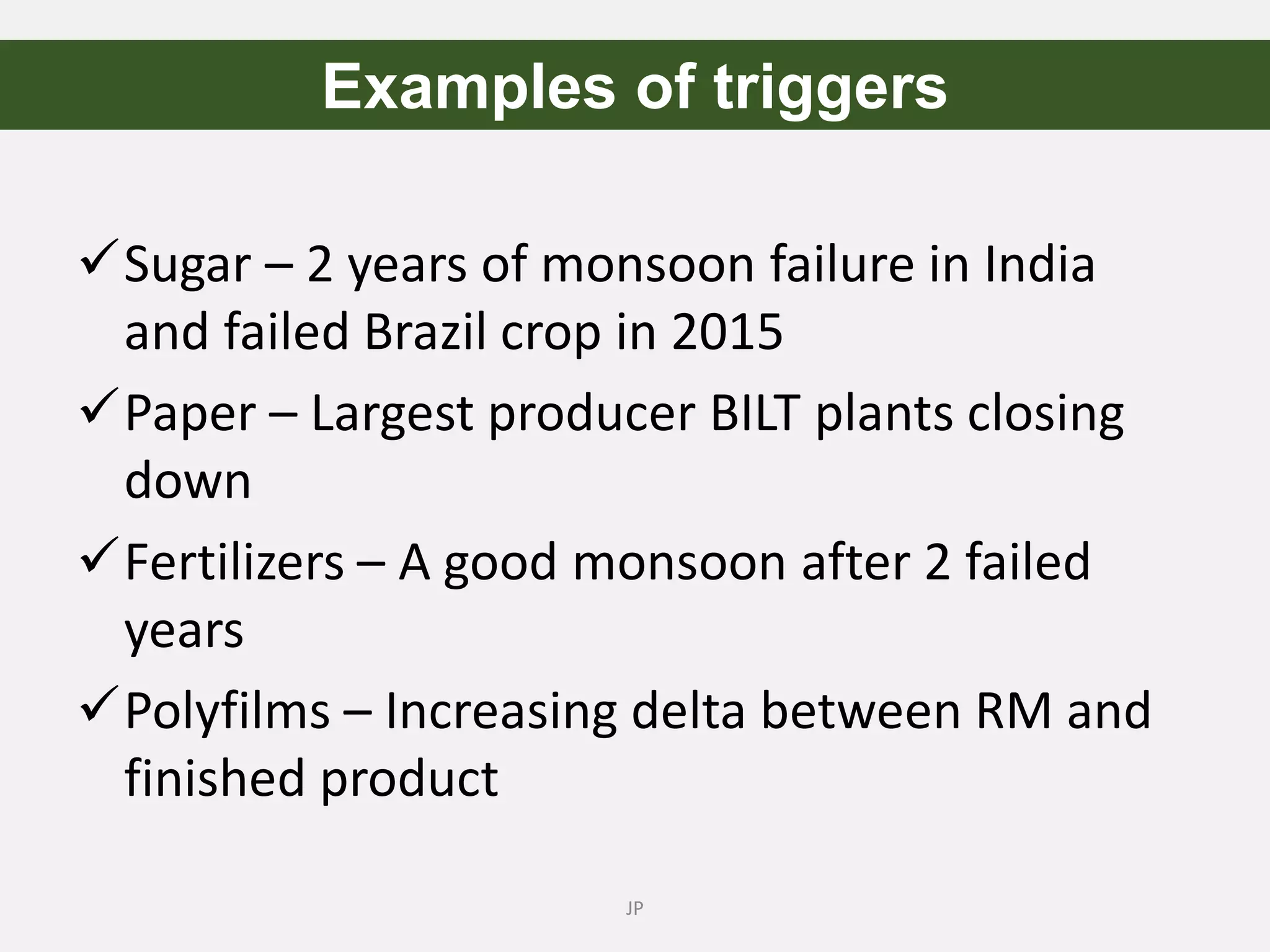

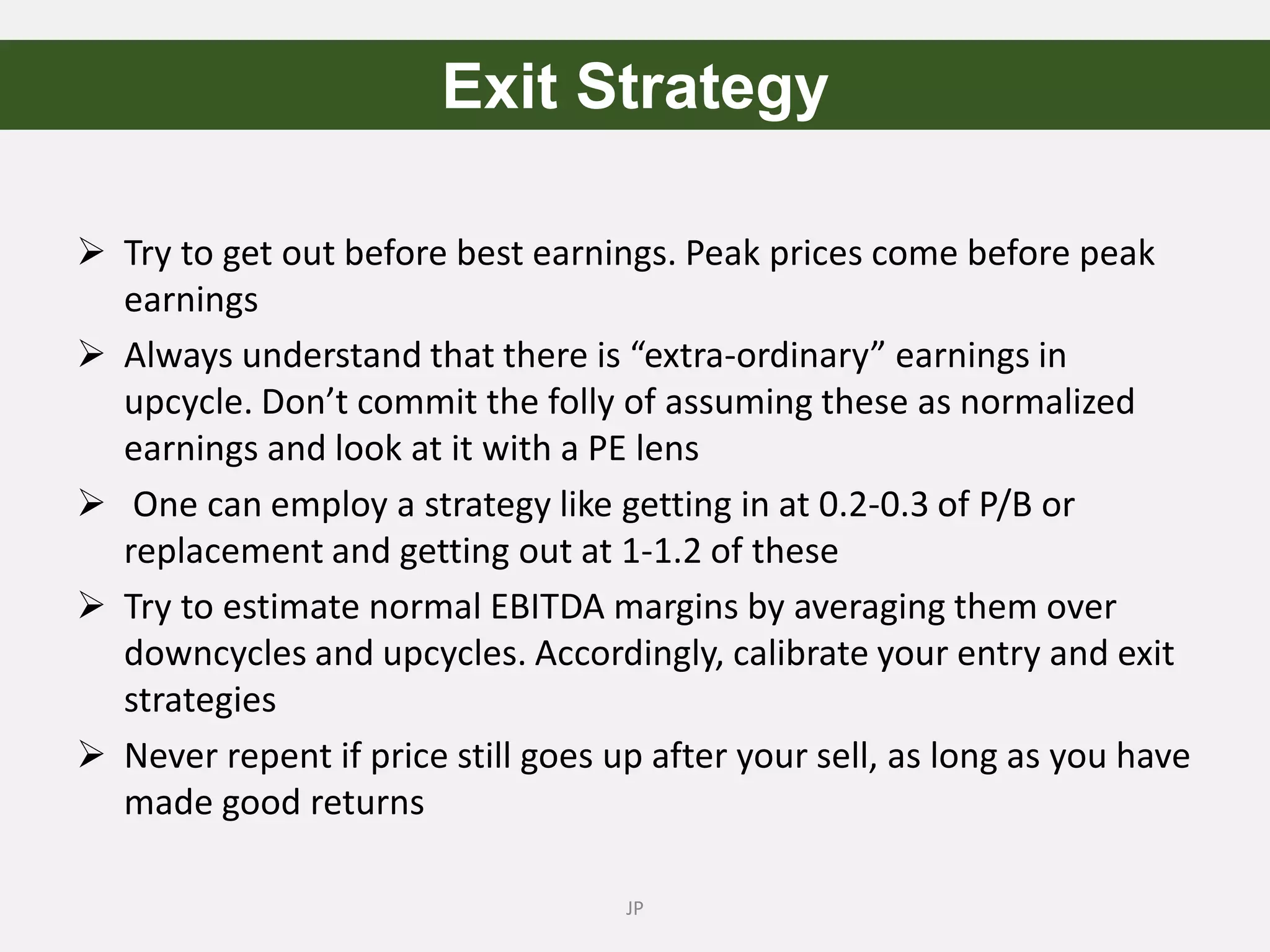

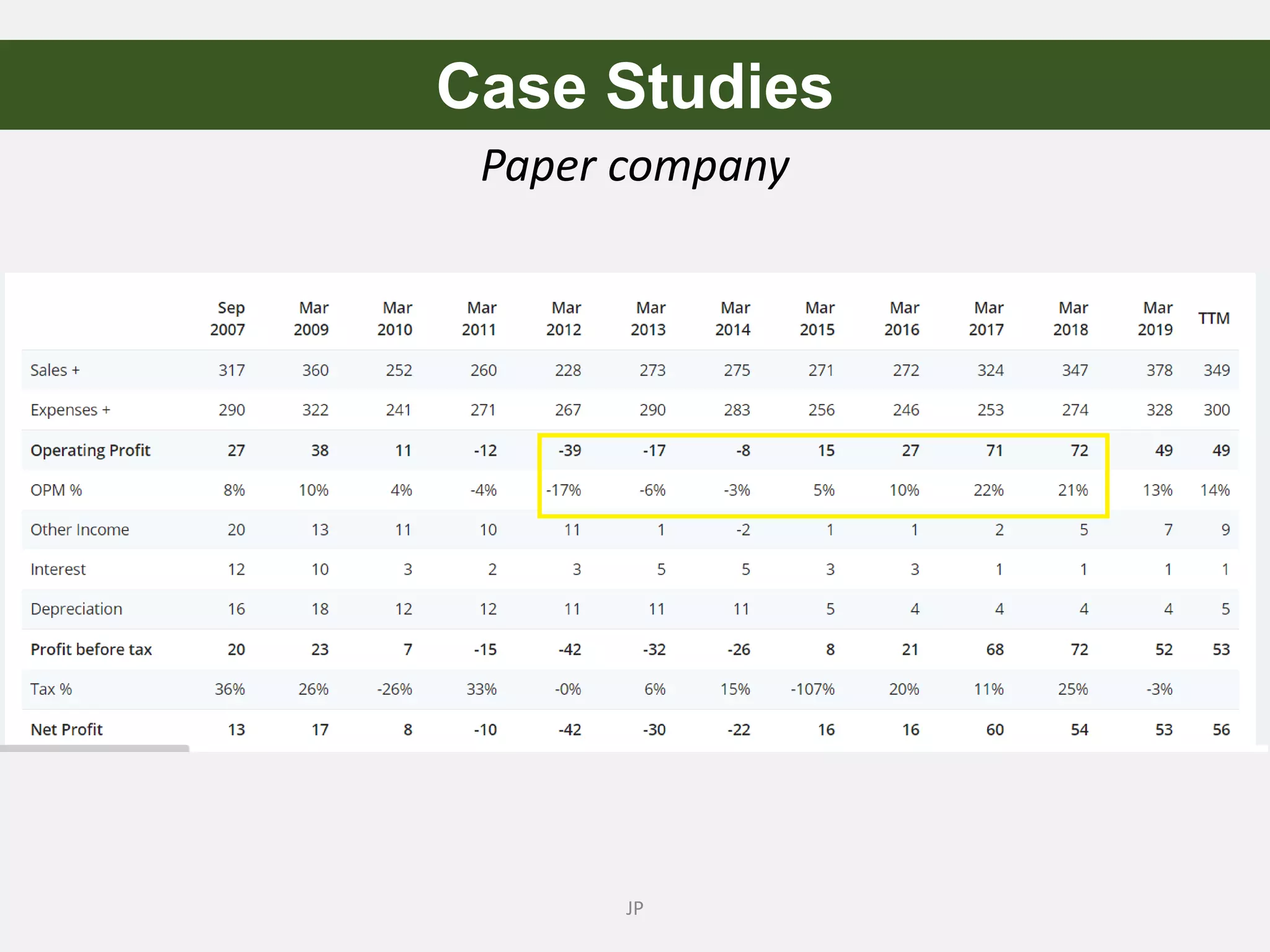

The document outlines Jiten Parmar's insights on navigating investment cycles, emphasizing the importance of understanding cyclicality in markets and sectors. It provides various strategies for identifying investment opportunities, including contrarian approaches and the significance of timing and sector analysis. Additionally, Parmar shares guidelines for an effective investment process, highlighting the need for patience and systematic exit strategies.