Cannacord Genuity analyst report

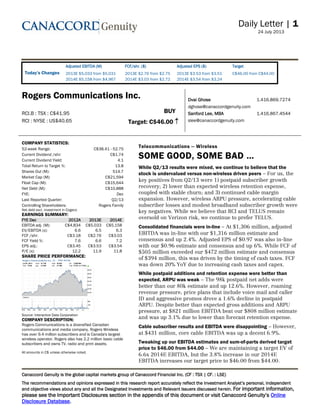

- 1. Daily Letter | 1 24 July 2013______ Canaccord Genuity is the global capital markets group of Canaccord Financial Inc. (CF : TSX | CF. : LSE) The recommendations and opinions expressed in this research report and objective views about any and all the Designated Investments and Relevant Issuers discussed herein. For important information, Online Disclosure Database. Changes Adjusted EBITDA (M) FCF/shr. ($) Adjusted EPS ($) Target 2013E $5,033 from $5,031 2014E $5,158 from $4,967 2013E $2.76 from $2.75 2014E $3.03 from $2.72 2013E $3.53 from $3.51 2014E $3.54 from $3.24 C$46.00 from C$44.00 Rogers Communications Inc. Dvai Ghose 1.416.869.7274 dghose@canaccordgenuity.com Sanford Lee, MBA 1.416.867.4544 slee@canaccordgenuity.com RCI.B : TSX : C$41.95 RCI : NYSE : US$40.65 BUY Target: C$46.00 COMPANY STATISTICS: 52-week Range: C$38.41 - 52.75 Current Dividend /shr: C$1.74 Current Dividend Yield: 4.1 Total Return to Target %: 13.8 Shares Out (M): 514.7 Market Cap (M): C$21,594 Float Cap (M): C$15,644 Net Debt (M): C$10,888 FYE: Dec Last Reported Quarter: Q2/13 Controlling Shareholders: Rogers Family Net debt excl. investment in Cogeco EARNINGS SUMMARY: FYE Dec 2012A 2013E 2014E EBITDA adj. (M): C$4,834 C$5,033 C$5,158 EV/EBITDA (x): 6.6 6.5 6.3 FCF /shr: C$3.18 C$2.76 C$3.03 FCF Yield %: 7.6 6.6 7.2 EPS adj.: C$3.45 C$3.53 C$3.54 P/E (x): 12.2 11.9 11.8 SHARE PRICE PERFORMANCE: Source: Interactive Data Corporation COMPANY DESCRIPTION: Rogers Communications is a diversified Canadian communications and media company. Rogers Wireless has over 9.4 million subscribers and is Canada's largest wireless operator. Rogers also has 2.2 million basic cable subscribers and owns TV, radio and print assets. All amounts in C$ unless otherwise noted. Telecommunications -- Wireless SOME GOOD, SOME BAD While Q2/13 results were mixed, we continue to believe that the stock is undervalued versus non-wireless driven peers For us, the key positives from Q2/13 were 1) postpaid subscriber growth recovery;; 2) lower than expected wireless retention expense, coupled with stable churn;; and 3) continued cable margin expansion. However, wireless ARPU pressure, accelerating cable subscriber losses and modest broadband subscriber growth were key negatives. While we believe that RCI and TELUS remain oversold on Verizon risk, we continue to prefer TELUS. Consolidated financials were in-line At $1,306 million, adjusted EBITDA was in-line with our $1,316 million estimate and consensus and up 2.4%. Adjusted EPS of $0.97 was also in-line with our $0.96 estimate and consensus and up 6%. While FCF of $505 million exceeded our $472 million estimate and consensus of $394 million, this was driven by the timing of cash taxes. FCF was down 20% YoY due to increasing cash taxes and capex. While postpaid additions and retention expense were better than expected, ARPU was weak The 98k postpaid net adds were better than our 80k estimate and up 12.6%. However, roaming revenue pressure, price plans that include voice mail and caller ID and aggressive promos drove a 1.6% decline in postpaid ARPU. Despite better than expected gross additions and ARPU pressure, at $821 million EBITDA beat our $808 million estimate and was up 3.1% due to lower than forecast retention expense. Cable subscriber results and EBITDA were disappointing However, at $431 million, core cable EBITDA was up a decent 6.9%. Tweaking up our EBITDA estimates and sum-of-parts derived target price to $46.00 from $44.00 We are maintaining a target EV of 6.6x 2014E EBITDA, but the 3.8% increase in our 2014E EBITDA increases our target price to $46.00 from $44.00.

- 2. Daily Letter | 2 24 July 2013 SOME GOOD, SOME BAD, SOME VALUE INVESTMENT SUMMARY KEY POSITIVES These include 1) much stronger than expected postpaid gross and net subscriber additions;; 2) a sequential decline in wireless churn, despite a significant sequential decline in retention expense;; and 3) strong cable Internet ARPU and revenue growth. For the first time in many quarters, Rogers Wireless may have accounted for nearly one-third of national incumbent postpaid net additions in Q2/13 While BCE and TELUS have yet to report Q2/13 results (they report on August 8), given that 1) Rogers Wireless reported 98,000 postpaid net additions (which was well above our 80,000 estimate and consensus of 76,100 and up 12.6% YoY;; and 2) we expect 100,000 postpaid net additions each for Bell Mobility and TELUS Mobility, Rogers Wireless could have accounted for 33% of national incumbent postpaid net additions in the quarter. This would mark a significant improvement from prior quarters as shown in Figure 1. Figure 1: Market share of national incumbent postpaid net additions 10% 15% 20% 25% 30% 35% 40% 45% 50% Q1/11 Q2/11 Q3/11 Q4/11 Q1/12 Q2/12 Q3/12 Q4/12 Q1/13 Q2/13E Postpaidnetadditionshare(%) Rogers Wireless TELUS Mobility Bell Mobility Source: Company reports, Canaccord Genuity forecasts Wireless subscriber retention expense and device subsidies fell sharply on a sequential basis and despite this, churn also declined sequentially Despite 1) stronger than expected gross postpaid subscriber loading (374,000 versus our 365,000 estimate and up 6.9% YoY);; and 2) an unexpected 1.6% decline in Q2/13 postpaid ARPU, at 49.2%, wireless service margin easily exceeded our 47.3% estimate and was up

- 3. Daily Letter | 3 24 July 2013 98 bps YoY. Consequently, while wireless network revenue was lower than forecast, at $821 million, wireless adjusted EBITDA beat our $808 million estimate and was up 3.1%. This is because at $208 million or 12% of network revenue, retention expense was significantly below our $222 million or 13% of network revenue forecast and it was down 15.8% on a sequential basis (although it was up 4.0% YoY). Despite the significant sequential decline in retention expense, postpaid churn declined slightly to 1.17% in Q2/13 from 1.22% in Q1/13 and was below our 1.20% estimate, although it was up slightly from 1.15% in Q2/12. While cable broadband subscriber growth was disappointing in Q2/13 after a strong Q1/13, ARPU and revenue exceeded expectations again with 17% revenue growth On the negative side, Rogers only added 6,000 net broadband customers on an organic basis in Q2/13, well below our 16,000 estimate, consensus of 14,700, the 9,000 in Q2/12 and the impressive 26,000 in Q1/13 (although Q2 is seasonally weaker due to university student deactivations). However, at an estimated $50.09, Internet ARPU was above our $49.17 estimate and up 11.0% YoY driven by increased bandwidth usage and price increases. Consequently, at $287 million, broadband revenue exceeded our $283 million estimate and was up an impressive 17.1% YoY. Given the very high margins associated with broadband, this is very encouraging and clearly helped generate the 173 bps YoY increase in core cable EBITDA margin. In addition, despite the fact that cable broadband only generated $287 million of revenue in Q2/13 versus $458 million for cable TV, now generates a higher gross profit than TV, reflecting high broadband and low TV margins. As a result of strong broadband subscriber growth, Rogers Cable is also generating peer group leading EBITDA growth Last reported EBITDA and broadband growth for the four publicly listed Canadian cablecos is shown in Figure 2. We wonder if especially given its deep discount to Shaw as shown in Figure 3. Figure 2: Last reported YoY broadband subscriber and cable EBITDA growth 0% 1% 2% 3% 4% 5% 6% 7% Rogers Cable Shaw Cable Videotron Cogeco Cable (Can.) YoYgrowth(%) Cable EBITDA Broadband subscribers Source: Company reports

- 4. Daily Letter | 4 24 July 2013 KEY NEGATIVES We also saw some key negatives in the Q2/13 release These include 1) the unexpected 1.6% YoY decline in postpaid ARPU;; 2) the organic loss of 35,000 net basic cable subscribers, which was much worse than our 24,200 net loss forecast and consensus;; and 3) weak Media margins. Q2/13 postpaid ARPU was down an unexpected 1.6% due to roaming, promotions and inclusion of features like voice mail and caller ID in core rate plans Management attributed the 1.6% decline in postpaid ARPU to 1) lost roaming revenue, which declined by over $20 million on a sequential basis due to reprice (we also assume lost share to Bell and TELUS);; 2) rate plans that were introduced at the beginning of this year that include voice mail and caller ID without offsetting price increases;; and 3) aggressive promotions in H1/13, which seem to have helped generate strong subscriber loading, but also put pressure on ARPU. On the negative side, the impact of roaming reprice could go on for some time, especially as Rogers was the monopolist on international roaming outside the U.S., until Bell and TELUS launched HSPA at the end of 2009. The impact of lost calling feature revenue could also impact ARPU for some time. However, we see some offsets On the positive side 1) roaming reprice could be offset by greater usage over time;; 2) we hope that Rogers management decides not to pursue aggressive pricing promotions in H2/13 and onwards, as this does not help cure its real issue, which is churn;; and 3) new price plans that were unveiled by Rogers this week will increase wireless prices by approximately $5-10 per month beginning on August 9. Consequently, while we expect postpaid ARPU to decline again in Q3/13, we believe that the decline could be less than the 1.6% decline we saw in Q2/13. We expect it to be down 1.3% in Q3/13, 1.1% in Q4/13 and 1.0% in 2014 due to the offsetting factors outlined above. We also now conclude that even if Verizon enters Canadian wireless, it is unlikely to have any real impact until 2015. Reduced roaming rates may make Canada less enticing for Verizon, especially as it may have a technology compatibility issue between the U.S. and Canada for some time While reprice of roaming is clearly negative for Rogers, it may also make Ca time could be U.S. roaming, because of its extensive wireless networks in the U.S. In contrast, Canadian carriers have to pay U.S. carriers when their customers roam south of the border. However, reduced roaming rates in Canada could make this advantage less enticing for Verizon. In addition, we find it ironic that if Verizon acquires WIND and Mobilicity and their HSPA networks, it will not be able to initially offer its Canadian customers roaming on Verizon networks in the U.S. because they are a CDMA carrier in the U.S. Consequently, it may have to pay competitors like AT&T Wireless when its acquired Canadian customers roam to the U.S. for some time. On the flip-side, its U.S. subscribers may have to continue to some time, making the overall cross border roaming advantage for Verizon less enticing than it may seem, at least until it has deployed LTE across Canada and the U.S., introduced voice over LTE (VoLTE) and upgraded its subscribers in the U.S. and Canada to LTE-based devices. The decline in basic cable subscribers was a little shocking On an annualized basis, the loss of 35,000 basic cable subscribers equates to 6.4% of Rogers Cable base at the end of Q2/13, including subscribers acquired through Mountain

- 5. Daily Letter | 5 24 July 2013 Cablevision. It is also the worst net cable subscriber loss ever reported by a Canadian cableco. In our view, this wing IPTV footprint in Rogers territory, which we now believe overlaps as much as 65% of But again we see some offsets While cable TV still accounted for 52.6 core cable revenue (cable TV, Internet and Phone) in Q2/13 and cable TV revenue broadband base was up 4.5%, its cable Internet revenue was up 17.1% and Internet now accounts for more gross profit than cable, even though cable TV revenue in the quarter was 60% higher than Internet revenue, due to much higher Internet margins. Weak Media margins were in part due to the end of the NHL lock-out, which meant that Sportsnet showed an unusual amount of games in Q2/13 This in turn put unusual pressure on programming expense. The weak Media margin was also due to increasing Blue Jays salaries. While we are not fans of media convergence and see the Blue Jays lack of success on the field this season as remarkable given their payroll, the 13.6% EBITDA margin in Q2/13 could be unusually low. Figure 3: Relative valuation of North American telcos and cablecos Source: Company reports, Thomson Reuters, IBES consensus estimates, Canaccord Genuity forecasts Share Price Market Dividend ($) Cap. TEV Yield Company 7/24/13 ($ mm) ($ mm) 2012 2013E 2014E 2012 2013E 2014E (%) 2012 2013E 2014E 2012 2013E 2014E Canadian telco (in C$) Rogers Communications2 $41.95 21,594 32,485 6.6x 6.5x 6.3x 12.2x 11.9x 11.8x 4.1% 7.6% 6.6% 7.2% 54.8% 63.1% 57.5% BCE3,4 (consolidated) $42.59 33,046 56,106 6.9x 6.8x 6.6x 14.4x 14.0x 12.9x 5.5% 6.9% 7.3% 7.9% 79.5% 74.9% 68.8% Telus4 $31.02 20,287 26,882 6.9x 6.4x 6.2x 16.6x 14.1x 13.0x 4.4% 7.0% 6.8% 7.5% 63.1% 64.6% 58.8% MTS5 $34.50 2,321 3,099 7.5x 7.3x 7.2x 15.7x 20.0x 17.3x 4.9% 5.1% 4.1% 7.9% 96.3% 119.4% 62.5% Bell Aliant Inc.4 $27.89 6,392 9,888 7.6x 7.6x 7.5x 16.6x 16.5x 15.7x 6.8% 8.6% 8.4% 7.8% 79.1% 81.1% 87.4% Canadian telco average 7.1x 6.9x 6.7x 15.1x 15.3x 14.1x 5.1% 7.0% 6.6% 7.7% 74.5% 80.6% 67.0% U.S. telco (in US$) AT&T $35.40 188,859 259,819 6.3x 6.4x 6.2x 15.3x 14.6x 13.3x 5.1% 9.5% 7.9% 7.9% 53.7% 64.4% 64.1% Verizon (proportionate) $50.38 144,188 187,169 7.7x 7.0x 6.6x 21.8x 17.7x 15.5x 4.1% 4.2% 7.4% 9.2% 98.4% 55.2% 44.4% T-Mobile US $24.21 17,426 32,205 5.0x 5.7x 5.5x n/a n/a n/a n/a 5.5% neg 7.8% n/a n/a n/a U.S. telco average 6.3x 6.4x 6.1x 18.6x 16.2x 14.4x 4.6% 6.4% 7.6% 8.3% 76.0% 59.8% 54.3% Canadian cable (in C$) Shaw Communications6 $26.04 11,726 16,548 7.9x 7.5x 7.2x 16.1x 15.6x 15.3x 3.9% 4.2% 4.3% 3.7% 93.3% 91.7% 107.3% Cogeco Cable7 $50.45 2,464 5,413 5.8x 6.4x 6.1x 14.4x 11.2x 10.0x 2.1% 2.7% 5.9% 9.1% 76.3% 34.7% 22.6% Quebecor Inc. (pro forma prop.) $48.30 3,010 6,910 6.6x 6.4x 6.1x 15.6x 14.5x 11.9x 0.4% 6.1% 7.5% 7.9% 6.8% 5.6% 5.2% Canadian cable average 6.8x 6.8x 6.5x 15.4x 13.7x 12.4x 2.1% 4.3% 5.9% 6.9% 58.8% 44.0% 45.0% U.S. cable (in US$) Cablevision $18.70 4,995 13,187 6.6x 8.2x 7.5x n/a n/a n/a 3.2% 3.8% 3.5% 7.1% 84.8% 92.0% 45.5% Comcast $44.96 118,398 162,259 8.1x 7.7x 7.3x 23.3x 18.6x 16.2x 1.7% 6.5% 6.6% 7.5% 26.7% 26.3% 23.3% Time Warner Cable $117.29 34,343 57,900 7.4x 7.3x 7.0x 20.4x 18.2x 15.3x 2.2% 7.4% 7.0% 7.1% 30.2% 31.5% 31.3% U.S. cable average 7.4x 7.7x 7.3x 21.8x 18.4x 15.7x 2.4% 5.9% 5.7% 7.2% 47.2% 50.0% 33.3% 1 Includes pension expense, but excludes restructuring charges 2 TEV based on current net debt excluding the market value of investments in Cogeco 3 Pro forma Astral EV and EV/EBITDA multiples 4 FCF estimates exclude special pension fund contributions, non-recurring cash tax savings, and non-recurring deferral account payments 5 Pro forma EV/EBITDA multiples including the sale of Allstream, use of proceeds and including capitalized equipment subsidies in EBITDA 6 Pro forma EV and EV/EBITDA multiples including asset swaps with Corus and the sale of Mountain Cablevision 7 Pro forma 2013E and 2014E EV/EBITDA including the acquisitions of Atlantic Broadband and Peer 1 TEV/EBITDA (x)1 Payout Ratio (%) Pre-dividend FCF P/E (x)1 FCF Yield (%) Pre-dividend

- 6. Daily Letter | 6 24 July 2013 CONCLUSIONS We conclude that 1) Rogers Wireless remains the weakest of the three national incumbents;; 2) it could be the most susceptible to Verizon risk;; and 3) declining ARPU is a real concern. However, the acceleration in postpaid net additions, stable wireless churn and more modest retention expense in the quarter were positives. While the loss of basic cable subscribers and the slowdown in broadband subscriber growth in Q2/13 are also concerns, strong Internet ARPU and revenue growth and industry leading cable EBITDA growth do not seem to be current stock price. , and we prefer TELUS on fundamentals and valuation, we prefer RCI over BCE, Shaw, MTS and Bell Aliant This is due to fundamentals and its discount valuation. As shown in Figure 3, RCI shares are trading at an EV of 6.3x our upwardly revised 2014E EBITDA versus 6.6x for BCE, 7.2x for Shaw and MTS (including wireless equipment subsidies) and 7.5x for Bell Aliant. We are tweaking up our wireless and cable margin assumptions and this increases our target 2014E EBITDA by 4% and our price target to $46.00 from $44.00 Our new target price equates to an EV of 6.6x our new 2014E EBITDA minus our 2014E year-end net debt after subtracting the current market value of Cogeco Cable and Cogeco Inc. It also equates to a yield of 6.6% on our upwardly revised 2014E FCF per share of $3.03. As our new target price implies a 13.8% potential rate of return from current levels (including the current 4.1% dividend yield), we are maintaining a BUY rating on RCI shares. Q2/13 RESULTS SUMMARY RCI reported consolidated Q2/13 financials that were largely in-line with expectations At $3,212 million, consolidated revenue was in-line with our $3,233 million forecast and consensus of $3,208 million. It was up 3.4% on a reported basis and 2.6% on an organic basis, excluding acquisitions. Adjusted EBITDA of $1,306 million was slightly below our $1,316 million estimate and consensus of $1,315 million and up a reported 2.4%. At $0.97 adjusted EPS was in-line with our $0.96 estimate and consensus of $0.97 and up from $0.92 in Q2/12. Due to lower than expected cash taxes, FCF of $505 million was above our $472 million estimate and consensus of $394 million, but down 20.2% YoY, as cash taxes were up sharply and capex increased by 14.6%. At $525 million, consolidated capex was above our $471 million estimate, but below consensus of $552 million. Postpaid wireless subscriber growth was encouraging, but ARPU was disappointing Rogers Wireless added 98,000 net postpaid subscribers in the quarter. This was above our 80,000 estimate and consensus of 76,100 and up from 87,000 in Q2/12. At 1.17%, postpaid churn was slightly below our 1.20% estimate, but up slightly from 1.15% in Q2/12. However, at $67.36, postpaid ARPU was well below our $69.14 estimate and consensus of $69.05 and down an unexpected 1.6%. This was attributed to the reprice of roaming revenue, promotions, and the inclusion of features like voice mail and caller ID in core rate plans that were introduced at the beginning of this year. Blended ARPU of $59.30 was below our $60.76 estimate and consensus of $60.46 and up a modest 0.3% driven by changing mix in favour of postpaid, as the company lost 56,000 net prepaid subscribers, as expected. Given the lower than forecast ARPU, at $1,670 million, network revenue was below our $1,709 million estimate and consensus of $1,702

- 7. Daily Letter | 7 24 July 2013 million and only up a modest 1.1%. However, adjusted wireless EBITDA of $821 million was above our $808 million estimate and consensus of $814 million and up 3.1%. This was because at $208 million, or 12% of network revenue, retention expense was below our $222 million or 13% of network revenue estimate. Cable subscriber results were generally worse than expected Excluding Mountain Cablevison, which was acquired on May 1, Rogers Cable lost a record 35,000 net basic cable subscribers, the worst ever reported by a Canadian cableco. This was much worse than our 24,200 net loss estimate, which was in-line with consensus. The basic cable subscriber base was down 4.5% YoY on an organic basis. The 6,000 broadband net additions were also worse than our 16,000 estimate and consensus of 14,700, but the broadband base was still up 4.5% YoY. On the positive side, the 17,000 organic telephony net additions beat our 7,200 estimate and consensus of 7,600 and the base was up 4.4% on an organic basis. Rogers lost 12,000 organic net primary service units (PSUs) in Q2/13, worse than our 1,000 loss estimate and consensus loss of 2,100. We define PSUs as the aggregate of basic cable, Internet and cable telephony subscribers. Cable financials were also below our estimates At $870 million, core cable revenue was below our $885 million estimate, but up 3.2% on a reported basis and 1.9% on an organic basis. Adjusted EBITDA of $431 million was also below our $445 million forecast, but in-line with consensus, and up 6.9%. RBS revenue of $90 million was below our $98 million estimate and flat YoY on a reported basis and down 8.9% on an organic basis, as it continues to exit low margin segments. RBS EBITDA of $25 million was in-line and up 13.6%, in part due to the acquisition of BLACKIRON Data on April 17. Media margins were weak While revenue of $470 million was above our $456 million estimate and up 6.8% YoY, in part due to the acquisition of The Score on April 30, EBITDA of $64 million was below our $70 million estimate and consensus of $67 million and down 19.0%. Excluding The Score, revenue was up 5.2%.

- 8. Daily Letter | 8 24 July 2013 Figure 4: Rogers Communications Inc. CanGen % change % change (In $ mm except per share and subscriber data) Q2/13 Q2/13E Q2/12 YoY Q1/13 QoQ Postpaid subscribers 7,976,000 7,958,000 7,708,000 3.5% 7,878,000 1.2% Prepaid subscribers 1,442,000 1,443,000 1,643,000 -12.2% 1,498,000 -3.7% Total wireless subscribers 9,418,000 9,401,000 9,351,000 0.7% 9,376,000 0.4% Postpaid net additions 98,000 80,000 87,000 12.6% 32,000 206.3% Prepaid net additions (56,000) (55,000) (46,000) 21.7% (93,000) -39.8% Total wireless net additions 42,000 25,000 41,000 2.4% (61,000) NA Postpaid ARPU ($) $67.36 $69.14 $68.46 -1.6% $68.56 -1.8% Prepaid ARPU ($) $15.79 $15.59 $15.91 -0.8% $14.63 7.9% Blended ARPU ($) $59.30 $60.76 $59.10 0.3% $59.68 -0.6% Voice ARPU ($) $32.17 $33.05 $35.90 -10.4% $32.66 -1.5% Data ARPU ($) $27.13 $27.71 $23.20 16.9% $27.02 0.4% Data as % of blended ARPU (%) 45.8% 45.6% 39.3% 16.5% 45.3% 1.1% Postpaid churn (%) 1.17% 1.20% 1.15% 1.7% 1.22% -4.1% Prepaid churn (%) 4.13% 4.50% 4.04% 2.2% 4.48% -7.8% Estimated blended churn (%) 1.63% 1.72% 1.67% -2.0% 1.76% -7.0% Basic cable subscribers 2,194,000 2,205,800 2,255,000 -4.5% 2,189,000 -1.6% Organic basic cable net additions (35,000) (24,200) (21,000) 66.7% (25,000) 40.0% Cable modem subscribers 1,930,000 1,940,000 1,815,000 4.5% 1,890,000 0.3% Organic cable modem net additions 6,000 16,000 9,000 -33.3% 26,000 -76.9% Cable telephony subscribers 1,145,000 1,136,200 1,061,000 4.4% 1,091,000 1.6% Organic cable telephony net additions 17,000 7,200 8,000 112.5% 17,000 0.0% Cable PSUs 5,269,000 5,282,000 5,131,000 0.5% 5,170,000 -0.2% Organic cable PSU net additions (12,000) (1,000) (4,000) 200.0% 18,000 NA Revenue Wireless network revenue 1,670 1,709 1,652 1.1% 1,683 -0.8% Wireless equipment revenue 143 118 113 26.5% 77 85.7% Total wireless revenue 1,813 1,827 1,765 2.7% 1,760 3.0% Core cable 870 885 843 3.2% 861 1.0% RBS 90 98 90 0.0% 93 -3.2% Total cable 960 983 933 2.9% 954 0.6% Media 470 456 440 6.8% 341 37.8% Corporate & eliminations (31) (34) (32) -3.1% (28) 10.7% Total revenue 3,212 3,233 3,106 3.4% 3,027 6.1% IBES consensus revenue 3,208 3.3% 6.0% Adjusted EBITDA Wireless 821 808 796 3.1% 765 7.3% Core cable 431 445 403 6.9% 429 0.5% RBS 25 24 22 13.6% 23 8.7% Total cable 456 469 425 7.3% 452 0.9% Media 64 70 79 -19.0% (7) NA Corporate & eliminations (35) (31) (24) 45.8% (31) 12.9% Total adjusted EBITDA 1,306 1,316 1,276 2.4% 1,179 10.8% IBES consensus EBITDA 1,315 3.1% 11.5% Adjusted basic EPS ($) $0.97 $0.96 $0.92 5.9% $0.80 20.7% IBES consensus EPS ($) $0.97 6.0% 20.8% Consolidated capex 525 471 458 14.6% 464 13.1% IBES consensus capex 552 20.5% 18.9% Free cash flow analysis Adjusted EBITDA 1,306 1,316 1,276 2.4% 1,179 10.8% Capex (525) (471) (458) 14.6% (464) 13.1% Interest on long term debt, net of capitalization (179) (180) (162) 10.5% (172) 4.1% Cash taxes (97) (194) (23) 321.7% (115) -15.7% Free cash flow 505 472 633 -20.2% 428 18.0% Free cash flow per share ($) $0.98 $0.92 $1.21 -19.1% $0.83 18.0% IBES consensus FCF 394 -37.7% -7.9% Source: Company reports, IBES consensus estimates, Canaccord Genuity forecasts

- 9. Daily Letter | 9 24 July 2013 CHANGES TO ESTIMATES Increasing our 2013 cable EBITDA estimate There were no changes to 2013 guidance from RCI. While we have increased our basic cable subscriber net loss assumption for 2013, this has been offset by an increase in our broadband ARPU estimates. Given the high margins associated with broadband revenue, this in turn increases in our 2013 core cable EBITDA estimate to $1,731 million or YoY reported growth of 7.8% from $1,715 million or 6.8% growth. Raising our 2014 cable and wireless EBITDA estimates As we may have - through to cable EBITDA, we have also increased our core cable EBITDA estimates from 2014 onward. In addition, while we have reduced our ARPU estimates for Rogers Wireless, we have also increased our postpaid subscriber forecasts and reduced our churn and retention expense estimates. These changes resulted in a 4% increase in our 2014E wireless EBITDA, as shown in Figure 5.

- 10. Daily Letter | 10 24 July 2013 Figure 5: Chan Rogers Communications Inc. % change % change (In $ mm except per share data) 2012 New Old YoY (New) New Old YoY (New) Revenue Core cable 3,358 3,483 3,530 3.7% 3,575 3,583 2.6% RBS 351 369 392 5.1% 393 416 6.4% Total Cable 3,709 3,852 3,922 3.9% 3,967 4,000 3.0% Wireless network revenue 6,719 6,864 6,945 2.2% 6,982 6,989 1.7% Wireless equipment revenue 561 590 565 5.2% 602 570 2.0% Total wireless revenue 7,280 7,454 7,510 2.4% 7,584 7,559 1.7% Media 1,620 1,693 1,676 4.5% 1,735 1,718 2.5% Corporate and eliminations (123) (127) (127) 3.3% (135) (135) 6.7% Consolidated revenue 12,486 12,871 12,981 3.1% 13,151 13,141 2.2% Adjusted EBITDA1 Core cable 1,605 1,731 1,715 7.8% 1,791 1,720 3.5% RBS 89 104 102 16.8% 112 116 7.4% Total Cable 1,694 1,835 1,817 8.3% 1,902 1,836 3.7% Wireless 3,063 3,165 3,168 3.3% 3,207 3,076 1.3% Media 190 171 177 -10.3% 173 180 1.8% Corporate and eliminations (113) (137) (130) 21.2% (125) (125) -8.8% Total consolidated EBITDA 4,834 5,033 5,031 4.1% 5,158 4,967 2.5% Adjusted EPS ($) $3.45 $3.53 $3.51 2.4% $3.54 $3.24 0.4% Consolidated capex Cable excl. RBS 832 880 839 5.8% 815 817 -7.4% RBS 61 79 63 29.5% 84 82 6.1% Total Cable 893 959 902 7.4% 899 899 -6.3% Wireless 1,123 1,125 1,162 0.2% 1,145 1,149 1.8% Media & other 126 152 149 20.6% 150 150 -1.3% Total capex 2,142 2,236 2,213 4.4% 2,194 2,198 -1.9% Free cash flow Adjusted EBITDA 4,834 5,033 5,031 4.1% 5,158 4,967 2.5% Interest on long term debt, net of capitalization (663) (713) (708) 7.5% (720) (711) 1.0% Capex (2,142) (2,236) (2,213) 4.4% (2,194) (2,198) -1.9% Cash taxes (380) (664) (692) 74.8% (685) (659) 3.1% Free cash flow 1,649 1,420 1,419 -13.9% 1,559 1,399 9.8% Free cash flow per share ($) $3.18 $2.76 $2.75 -13.2% $3.03 $2.72 9.8% Wireless Postpaid subscribers 7,846,000 8,131,000 8,026,000 3.6% 8,356,000 8,176,000 2.8% Postpaid subscriber net additions 268,000 285,000 180,000 6.3% 225,000 150,000 -21.1% Prepaid subscribers 1,591,000 1,382,000 1,391,000 -13.1% 1,182,000 1,231,000 -14.5% Prepaid subscriber net additions (170,000) (209,000) (200,000) 22.9% (200,000) (160,000) -4.3% Total wireless subscribers 9,437,000 9,513,000 9,417,000 0.8% 9,538,000 9,407,000 0.3% Total wireless subscriber net additions 98,000 76,000 (20,000) NA 25,000 (10,000) -67.1% Blended ARPU ($) $59.79 $60.60 $61.58 1.4% $61.09 $61.88 0.8% Voice ARPU ($) $35.57 $32.41 $32.95 -8.9% $29.51 $30.96 -9.0% Data ARPU ($) $24.22 $28.19 $28.63 16.4% $31.58 $30.92 12.0% Blended churn (%) 1.77% 1.72% 1.74% -2.9% 1.65% 1.67% -3.7% Cable Basic cable subscribers 2,214,000 2,128,000 2,152,800 -5.7% 2,021,600 2,045,160 -5.0% Organic basic cable net additions (83,000) (126,000) (102,200) 51.8% (106,400) (107,640) -15.6% Internet subscribers 1,864,000 1,968,500 1,982,000 3.8% 2,028,500 2,052,000 3.0% Organic Internet net additions 73,000 70,500 84,000 -3.4% 60,000 70,000 -14.9% Cable telephony subscribers 1,074,000 1,159,000 1,147,000 4.5% 1,189,000 1,157,000 2.6% Organic cable telephony net additions 23,000 48,000 35,000 108.7% 30,000 10,000 -37.5% Cable PSUs 5,152,000 5,255,500 5,281,800 -0.1% 5,239,100 5,254,160 -0.3% Organic PSU net additions 13,000 (7,500) 16,800 NA (16,400) (27,640) 118.7% CanGen 2013E CanGen 2014E Source: Company reports, Canaccord Genuity forecasts

- 11. Daily Letter | 11 24 July 2013 TARGET PRICE CALCULATION Increasing our target price to $46.00 per share from $44.00 Given the increases to our cable and wireless financial forecasts, we have increased our target enterprise value for Rogers Wireless to $20.3 billion or 6.3x our new 2014E EBITDA from $20.1 billion or 6.5x our previous 2014E EBITDA. We have also increased our target enterprise value for Rogers Cable (ex-RBS) to $11.2 billion or 6.2x our new 2014E EBITDA from $10.0 billion or 5.8x our previous 2014E EBITDA. These changes increase our consolidated target enterprise value to $35.0 billion or 6.6x our new 2014E consolidated EBITDA from $33.8 billion or 6.6x our previous 2014E EBITDA. This also increases our target equity value to $23.7 billion or $46.00 per share from $22.5 billion or $44.00 per share. Figure 6: -of-the-parts valuation for Rogers Communications Inc. (In $ mm except where indicated) Valuation Asset methodology Value Rogers Wireless DCF - equates to 6.3x 2014E EBITDA 20,313 Rogers Cable excluding RBS DCF - equates to 6.2x 2014E EBITDA 11,185 Rogers Business Solutions DCF - equates to 6.2x 2014E EBITDA 693 Rogers Media DCF - equates to 6.8x 2014E EBITDA 1,176 Cogeco Inc. market value 283 Cogeco Cable Inc. market value 539 Other investments (incl. MLSE) at market value or book value if private 860 Target enterprise value 35,049 Net debt (including convertible debentures and fair value of derivatives) estimated at end of 2014E (11,395) Net asset value 23,654 Shares o/s (mm) ending 2013E 515 Target price ($) $45.94 Source: Company reports, Canaccord Genuity forecasts INVESTMENT RISKS Rogers Wireless has enjoyed amongst the highest wireless ARPU, margins and FCF yields in the developed world. This may not be sustainable. Rogers Cable has enjoyed a benign competitive environment, especially in downtown cores where satellite TV competition is limited. However, Bell's IPTV launch could drive greater-than-forecast pressure on Rogers Cable's subscriber base and cash flow. Balance sheet risk - We have assumed that management will continue to take a conservative approach by increasing the dividend modestly and pursuing share buybacks. However, the company could pursue dilutive M&A transactions instead. In addition, the market may have underestimated the cash flow impact from the transition to a full cash tax environment from 2012.

- 12. Daily Letter | 12 24 July 2013 APPENDIX: IMPORTANT DISCLOSURES Analyst Certification: Each authoring analyst of Canaccord Genuity whose name appears on the front page of this research hereby certifies that (i) the recommendations and opinions expressed in this research accurately reflect the authoring relevant issuers discusse recommendations or views expressed by the authoring analyst in the research. Site Visit: An analyst has not visited Rogers Communications Inc.'s material operations. Price Chart:* Distribution of Ratings: Global Stock Ratings (as of 28 June 2013) Coverage Universe IB Clients Rating # % % Buy 568 59.1% 36.6% Speculative Buy 58 6.0% 60.3% Hold 288 30.0% 11.1% Sell 47 4.9% 6.4% 964* 100.0% *Total includes stocks that are Under Review Canaccord Genuity Ratings System: BUY: The stock is expected to generate risk-adjusted returns of over 10% during the next 12 months. HOLD: The stock is expected to generate risk-adjusted returns of 0-10% during the next 12 months. SELL: The stock is expected to generate negative risk-adjusted returns during the next 12 months. NOT RATED: Canaccord Genuity does not provide research coverage of the relevant issuer. - designated investment or the relevant issuer. Risk Qualifier: SPECULATIVE: Stocks bear significantly higher risk that typically cannot be valued by normal fundamental criteria. Investments in the stock may result in material loss.

- 13. Daily Letter | 13 24 July 2013 Canaccord Genuity Research Disclosures as of 24 July 2013 Company Disclosure Rogers Communications Inc. 7 1 The relevant issuer currently is, or in the past 12 months was, a client of Canaccord Genuity or its affiliated companies. During this period, Canaccord Genuity or its affiliated companies provided the following services to the relevant issuer: A. investment banking services. B. non-investment banking securities-related services. C. non-securities related services. 2 In the past 12 months, Canaccord Genuity or its affiliated companies have received compensation for Corporate Finance/Investment Banking services from the relevant issuer. 3 In the past 12 months, Canaccord Genuity or any of its affiliated companies have been lead manager, co-lead manager or co-manager of a public offering of securities of the relevant issuer or any publicly disclosed offer of securities of the relevant issuer or in any related derivatives. 4 Canaccord Genuity acts as corporate broker for the relevant issuer and/or Canaccord Genuity or any of its affiliated companies may have an agreement with the relevant issuer relating to the provision of Corporate Finance/Investment Banking services. 5 Canaccord Genuity or one or more of its affiliated companies is a market maker or liquidity provider in the securities of the relevant issuer or in any related derivatives. 6 In the past 12 months, Canaccord Genuity, its partners, affiliated companies, officers or directors, or any authoring analyst involved in the preparation of this research has provided services to the relevant issuer for remuneration, other than normal course investment advisory or trade execution services. 7 Canaccord Genuity or one or more of its affiliated companies intend to seek or expect to receive compensation for Corporate Finance/Investment Banking services from the relevant issuer in the next six months. 8 the preparation of this research, has a long position in the shares or derivatives, or has any other financial interest in the relevant issuer, the value of which increases as the value of the underlying equity increases. 9 the preparation of this research, has a short position in the shares or derivatives, or has any other financial interest in the relevant issuer, the value of which increases as the value of the underlying equity decreases. 10 Those persons identified as the author(s) of this research, or any individual involved in the preparation of this research, have purchased/received shares in the relevant issuer prior to a public offering of those shares, and 11 A partner, director, officer, employee or agent of Canaccord Genuity or its affiliated companies, or a member of his/her household, is an officer, or director, or serves as an advisor or board member of the relevant issuer ed above. 12 As of the month end immediately preceding the date of publication of this research, or the prior month end if publication is within 10 days following a month end, Canaccord Genuity or its affiliated companies, in the aggregate, beneficially owned 1% or more of any class of the total issued share capital or other common equity securities of the relevant issuer or held any other financial interests in the relevant issuer which are significant in relation to the research (as disclosed above). 13 As of the month end immediately preceding the date of publication of this research, or the prior month end if publication is within 10 days following a month end, the relevant issuer owned 1% or more of any class of the total issued share capital in Canaccord Genuity or any of its affiliated companies. 14 Other specific disclosures as described above. Inc., including Canaccord Genuity Inc., Canaccord Genuity Limited, Canaccord Genuity Corp., and Canaccord Genuity (Australia) Limited, an affiliated company that is 50%-owned by Canaccord Financial Inc. The authoring analysts who are responsible for the preparation of this research are employed by Canaccord Genuity Corp. a Canadian broker-dealer with principal offices located in Vancouver, Calgary, Toronto, Montreal, or Canaccord Genuity Inc., a US broker-dealer with principal offices located in New York, Boston, San Francisco and Houston, or Canaccord Genuity Limited., a UK broker-dealer with principal offices located in London (UK) and Dublin (Ireland), or Canaccord Genuity (Australia) Limited, an Australian broker-dealer with principal offices located in Sydney and Melbourne. In the event that this is compendium research (covering six or more relevant issuers), Canaccord Genuity and its affiliated companies may choose to provide by reference specific disclosures of the subject companies or its policies and procedures regarding the dissemination of research. To access this material or for more

- 14. Daily Letter | 14 24 July 2013 information, please refer to http://disclosures.canaccordgenuity.com/EN/Pages/default.aspx or send a request to Canaccord Genuity Corp. Research, Attn: Disclosures, P.O. Box 10337 Pacific Centre, 2200-609 Granville Street, Vancouver, BC, Canada V7Y 1H2 or disclosures@canaccordgenuity.com. The authoring analysts who are responsible for the preparation of this research have received (or will receive) compensation based upon (among other factors) the Corporate Finance/Investment Banking revenues and general profits of Canaccord Genuity. However, such authoring analysts have not received, and will not receive, compensation that is directly based upon or linked to one or more specific Corporate Finance/Investment Banking activities, or to recommendations contained in the research. Canaccord Genuity and its affiliated companies may have a Corporate Finance/Investment Banking or other relationship with the issuer that is the subject of this research and may trade in any of the designated investments mentioned herein either for their own account or the accounts of their customers, in good faith or in the normal course of market making. Accordingly, Canaccord Genuity or their affiliated companies, principals or employees (other than the authoring analyst(s) who prepared this research) may at any time have a long or short position in any such designated investments, related designated investments or in options, futures or other derivative instruments based thereon. Some regulators require that a firm must establish, implement and make available a policy for managing conflicts of interest arising as a result of publication or distribution of research. This research has been nformation barriers or firewalls have been used where appropriate. The information contained in this research has been compiled by Canaccord Genuity from sources believed to be reliable, but (with the exception of the information about Canaccord Genuity) no representation or warranty, express or implied, is made by Canaccord Genuity, its affiliated companies or any other person as to its fairness, accuracy, completeness or correctness. Canaccord Genuity has not independently verified the facts, assumptions, and estimates contained herein. All estimates, opinions and other information contained change without notice and are provided in good faith but without legal responsibility or liability. and other professionals may provide oral or written market commentary or trading strategies to our clients and our proprietary trading desk that reflect opinions that are principal trading desk, and investing businesses may make investment decisions that are inconsistent with the recommendations or views expressed in this research. This research is provided for information purposes only and does not constitute an offer or solicitation to buy or sell any designated investments discussed herein in any jurisdiction where such offer or solicitation would be prohibited. As a result, the designated investments discussed in this research may not be eligible for sale in some jurisdictions. This research is not, and under no circumstances should be construed as, a solicitation to act as a securities broker or dealer in any jurisdiction by any person or company that is not legally permitted to carry on the business of a securities broker or dealer in that jurisdiction. This material is prepared for general circulation to clients and does not have regard to the investment objectives, financial situation or particular needs of any particular person. Investors should obtain advice based on their own individual circumstances before making an investment decision. To the fullest extent permitted by law, none of Canaccord Genuity, its affiliated companies or any other person accepts any liability whatsoever for any direct or consequential loss arising from or relating to any use of the information contained in this research. For Canadian Residents: This research has been approved by Canaccord Genuity Corp., which accepts sole responsibility for this research and its dissemination in Canada. Canadian clients wishing to effect transactions in any designated investment discussed should do so through a qualified salesperson of Canaccord Genuity Corp. in their particular province or territory. For United States Residents: Canaccord Genuity Inc., a US registered broker-dealer, accepts responsibility for this research and its dissemination in the United States. This research is intended for distribution in the United States only to certain US institutional investors. US clients wishing to effect transactions in any designated investment discussed should do so through a qualified salesperson of Canaccord Genuity Inc. Analyst(s) preparing this report that are not employed by Canaccord Genuity Inc. are resident outside the United States and are not associated persons or employees of any US regulated broker-dealer. Such analyst(s) may not be subject to Rule 2711 restrictions on communications with a subject company, public appearances and trading securities held by a research analyst account. For United Kingdom and European Residents: This research is distributed in the United Kingdom and elsewhere Europe, as third party research by Canaccord Genuity Limited, which is authorized and regulated by the Financial Conduct Authority. This research is for distribution only to persons who are Eligible Counterparties or Professional Clients only and is exempt from the general restrictions in section 21 of the Financial Services and Markets Act 2000 on the communication of invitations or inducements to engage in investment activity on the grounds that it is being distributed in the United Kingdom only to persons of a kind described in Article 19(5) (Investment Professionals) and 49(2) (High Net Worth companies, unincorporated associations etc) of the Financial

- 15. Daily Letter | 15 24 July 2013 Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended). It is not intended to be distributed or passed on, directly or indirectly, to any other class of persons. This material is not for distribution in the United Kingdom or elsewhere in Europe to retail clients, as defined under the rules of the Financial Conduct Authority. For Jersey, Guernsey and Isle of Man Residents: This research is sent to you by Canaccord Genuity Wealth (International) Limited (CGWI) for information purposes and is not to be construed as a solicitation or an offer to purchase or sell investments or related financial instruments. This research has been produced by an affiliate of CGWI for circulation to its institutional clients and also CGWI. Its contents have been approved by CGWI and we are providing it to you on the basis that we believe it to be of interest to you. This statement should be read in conjunction with your client agreement, CGWI's current terms of business and the other disclosures and disclaimers contained within this research. If you are in any doubt, you should consult your financial adviser. CGWI is licensed and regulated by the Guernsey Financial Services Commission, the Jersey Financial Services Commission and the Isle of Man Financial Supervision Commission. CGWI is registered in Guernsey and is a wholly owned subsidiary of Canaccord Financial Inc. For Australian Residents: This research is distributed in Australia by Canaccord Genuity (Australia) Limited ABN 19 075 071 466 holder of AFS Licence No 234666. To the extent that this research contains any advice, this is limited to general advice only. Recipients should take into account their own personal circumstances before making an investment decision. Clients wishing to effect any transactions in any financial products discussed in the research should do so through a qualified representative of Canaccord Genuity (Australia) Limited. Canaccord Genuity Wealth Management is a division of Canaccord Genuity (Australia) Limited. Additional information is available on request. Copyright © Canaccord Genuity Corp. 2013. Member IIROC/Canadian Investor Protection Fund Copyright © Canaccord Genuity Limited 2013. Member LSE, authorized and regulated by the Financial Conduct Authority. Copyright © Canaccord Genuity Inc. 2013. Member FINRA/SIPC Copyright © Canaccord Genuity (Australia) Limited 2013. Authorized and regulated by ASIC. All rights reserved. All material presented in this document, unless specifically indicated otherwise, is under copyright to Canaccord Genuity Corp., Canaccord Genuity Limited, Canaccord Genuity Inc. or Canaccord Financial Inc. None of the material, nor its content, nor any copy of it, may be altered in any way, or transmitted to or distributed to any other party, without the prior express written permission of the entities listed above.