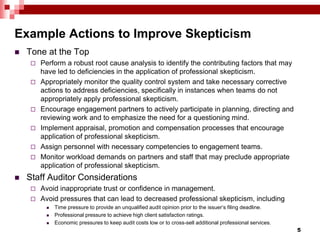

The document discusses the importance of professional skepticism in auditing, detailing its essential role under PCAOB standards, particularly in areas involving significant management judgments and fraud risks. It highlights inspection observations regarding insufficient skepticism practices among auditors, such as reliance on management expertise and inadequate verification of audit evidence. Recommendations for improving professional skepticism include enhancing oversight, promoting a questioning mindset, and addressing pressures that may hinder auditors' skepticism.