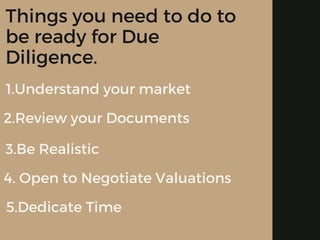

This document provides guidance on preparing for and undergoing a startup's due diligence process when seeking investment. It defines due diligence as an audit of a company to discover liabilities or deficiencies before a business transaction like an investment. Due diligence allows investors to systematically analyze and vet startups to mitigate risks and uncertainties. The document outlines steps founders should take to be ready, such as understanding their market and reviewing documents. It emphasizes the importance of preparation, organization, follow up and persistence throughout the process.