Case private equity

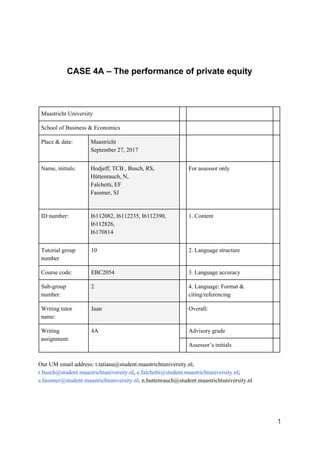

- 1. CASE 4A – The performance of private equity Maastricht University School of Business & Economics Place & date: Maastricht September 27, 2017 Name, initials: Hodjeff, TCB , Busch, RS, Hüttenrauch, N, Falchetti, EF Fassmer, SJ For assessor only ID number: I6112082, I6112235, I6112390, I6112826, I6170814 1. Content Tutorial group number 10 2. Language structure Course code: EBC2054 3. Language accuracy Sub-group number: 2 4. Language: Format & citing/referencing Writing tutor name: Juan Overall: Writing assignment: 4A Advisory grade Assessor’s initials Our UM email address: t.tatiana@student.maastrichtuniversity.nl, r.busch@student.maastrichtuniversity.nl, e.falchetti@student.maastrichtuniversity.nl; s.fassmer@student.maastrichtuniversity.nl, n.huttenrauch@student.maastrichtuniversity.nl 1

- 2. Table of Contents Introduction:................................................................................................................................ 3 Summary statistics:..................................................................................................................... 4 Diversification potential:............................................................................................................. 4 Performance over time:............................................................................................................... 5 Performance on a risk-adjusted basis:......................................................................................... 5 Future Potential........................................................................................................................... 6 Conclusion:................................................................................................................................. 6 2

- 3. 00 Introduction Private equity is a separate investment class from the listed equity. High minimum investment requirements are hurdle rate for many investors. Typically high net worth investors and pension fund are the major contributors towards private equity fund. Similar to mutual funds, a private equity fund is a pooled investment vehicle to make investments in the best interests of the investors. The investment scope is however much longer compared to mutual funds, generally from ten to twelve years. Since private equity fund are not registered with the SEC and are therefore not subject to public disclosure requirements. The returns of private equity firms substantially differ from other investment classes. In the early years the cash flows are shaped by negative outflows and incoming flows in the later years, this is why the returns follow a J-curve shape. Investors normally do not know upfront in which firm the money will be investment. Pension funds as well as high net worth investors use private equity fund to improve their portfolio diversification. Nonetheless is the performance of these fund highly correlated to the abilities of the general fund manager. The crucial intention of this essay is, to asses the overall profitability of private equity funds and whether it is worth considering this asset class. First, the overall differences and performance between listed and private equity will be examined. After that the focus will shift to the second key aspect, whether further diversification can be achieved. Thirdly the time-periods will be analyzed to see whether the performance of both assets change over time. The fourth part of the paper will investigate, if private equity outperforms the listed equity on a risk-adjusted basis. Lastly the future of private equity will be highlighted. 01 Summary statistics This section of the paper will outline the summary statistics of the US Private Equity Fund and market index. The sample data provides quarterly returns for these asset classes from 1986 to 2012. For analysis purposes the quarterly returns were annualized. First by looking at the annual mean of the two return series (table 1 in the appendix), it can be said that private equity has a higher annual mean return (8.21) than listed equity (6.89). Hence it can be expected that the volatility of private equity should be proportionally higher compared to the market. The actual findings however shows that the annualized volatility of the market is higher. The standard deviation of the market index is 17,45, which is 79% higher; the private 3

- 4. equity index only shows an annual volatility is 9,75. This results in the conclusion that private equity has an improved risk-return performance. This can also be seen by looking at the maximas and minimas, the market index shows more extreme values compared to the private equity index. The maximum return for listed equity is 20,64% whereas private equity has a lower maximum return of 16,49%. Nonetheless, the most negative return of listed equity is higher (-24,32) than for listed equity (-15, 35). The minimum and maximum returns fit therefore to the corresponding volatilities. Furthermore the sharpe ratio is the next variable that will be outlined and defines the risk-adjusted return over time. In order to calculate the sharpe ratio a constant risk free rate of 3% is assumed. Private equity has a sharpe ratio of 0,84, which shows that the average annualized return in redundant of the risk free rate 0,84 per unit of volatility. Hence the excess return is 84% higher per unit of risk. The market index shows also a positive sharpe ratio 0,39 which is significantly lower. However, both investments shows excess returns per unit of volatility compared to risk free investments. The maximum drawdown also reflect that general pattern, that private equity outperforms the market index. The maximum drawdown of private equity is 36,52%, whereas the maximum drop for the listed equity is 50,24%. The market index reflect therefore compared to private equity a more extreme volatility. Concluding it can be said, that just by comparing the summary statistics, private equity appears to be the dominating asset class, it clearly shows a better risk-return performance. 02 Diversification potential Diversification plays an important role for investors who decide to allocate their fund in private equity. Considering that private equity is not directly driven by the efficient market hypothesis and the listed equity market, the most crucial impact on returns are the overall macroeconomic developments. The diversification is however marked by the long time horizon and therefore is not suitable for short term diversification during high volatility markets. Uncertain cash flows also play an important role, since after legally binding to the private equity fund, the promised investment has to be paid in after the demand. Hence it can be the case that several month can pass before the money is demand, the contributions needs therefore be hold in the form of cash or highly liquid assets,. This can affect the diversification in a negative way and can suppress returns. 4

- 5. The correlation matrix (Appendix X) shows that the overall correlation between private and listed equity is neither weak nor strong. The private equity correlates with the listed equity with a magnitude of 0,70. It is important to remark that the correlation is highly driven by the macroeconomic factors, when the overall market development is extreme then the two equities tend to move together. This is illustrated by looking at the financial crises of 2001 and 2008. During the dotcom bubble burst, the correlation between listed and private equity increased to 0,80. Whereas this correlation is even higher during the sub-prime mortgage crises, there the correlation peaked at 0,95 (see Appendix XX). Significant macroeconomic developments affect the listed but also private equity. On the other hand is the effect of market developments low during less volatile markets. Summarized can be said, that private equity does increase diversification, but has significant disadvantages regarding the uncertain cash flows and the long time horizon. Times that are characterized by non extreme market developments result in an improvement of diversification. Extreme macroeconomic developments affect the listed as well as the private equity equally. During those periods is the marginal improvement of diversification relatively low. 03 Long-term performance evaluation In order to examine the performance over time of both listed and private equity, we computed graph 1 (see appendix) with the average returns for the period of 1986-2012. In general, we can observe that private equity reports significant lower fluctuations in returns than listed equity. This confirms our claim that private equity is less volatile compared to listed equity for the whole period. The period from 1997 to 2008 is characterized by significant macroeconomic events such as the dot-com bubble and the financial crisis. Prior to the burst of the dot-com bubble, the private equity index had higher returns than the market. Later, during the period between the two crises, the private equity fund almost consistently outperformed the market. Again, during the financial crisis, we can observe a decrease in returns for both private and listed equity. Both listed and private equity have been affected by the crises, but listed equity suffered more than private equity. Overall, this analysis shows that private equity provides investors with attractive diversification opportunities as well as options for market outperformance. 5

- 6. 04 Outperformance of Private Equity The intention of this paper is to analyse whether private equity outperforms listed equity on a risk-adjusted basis. In order to answer that statement a multi-factor regression model will be used. That regression model follows the Fama & French approach by considering the following three predictors: market, small minus big and high minus low indexes. The Fama & French model describes the reality better than the capital asset pricing model (Fama & French, 2012). The multi-factor model is used to assess the exposure of non-listed equity. Private equity is highly dominated by venture capital funds and leveraged buyouts, these are comparable to listed equity investments. Venture capital investment can be compared to small firms with a growth potential and a low book to market value. Buyout can be compared to growth stocks that are big companies with a high book to market value and have a low growth perspective (Joost Driessen, 2007). Hence the Fama & French model should be highly applicable to predict the returns of private equity. The regression output (see Appendix Table 4) shows that the ANOVA test is highly significant at a 1% confidence level. The adjusted r-square shows that 49,07% of the dependent variable variation can be explained by this model. Considering that the data consists of real life data from different asset classes over time is the resulting adjusted r-square moderately high. About half of the dependent variable variation can be explained. The important parts of the regression are the predictors with their coefficients and the intersect. The regression model results in a positive intersect, an alpha, with a annualized magnitude of 5,80%. This shows that the return of the private equity consistently outperforms listed equity. This result is also statistically significant and the null hypothesis can be rejected at a 1% confidence level. The market coefficient has the highest correlation (0,38) of all three predictors and is the only significant coefficient at a one percent significance level. The high minus low strategy is significantly important only at a 5% confidence level. The correlation with the private equity index is however non existing. The small minus big strategy of the Fama & French three factor model does also not show any significant correlation, since the p-value is insignificant. Summarized can be said, the Fama & French three-factor model does not perfectly exhibit the returns of private equity. The three betas of the predictors do not have a strong correlation towards the returns of private equity, the only beta that shows some significant correlation is 6

- 7. the market index. Nonetheless can be said that private equity outperform listed equity on a risk-adjusted basis. 05 Our view on the future potential of private equity funds Investment in private equity experienced a severe growth, especially investments in venture capital and buyouts. Since 1992, the investment class’ assets have increased from 30 billion dollars to 4.3 trillion. Moreover, in 2017 Forbes stated that an unprecedented number of investors are in the process of increasing their allocation to private equity. Private equity provides a higher return-risk ratio and allows for diversification in an investment portfolio. Nevertheless, much concern still exists around the transparency of private equity. Increased transparency will be required in the future. Also, there is a growing threat of increased competition from corporates. Corporates are often competing against PE funds in the acquisition of target assets. Due to this high competition, PE funds are finding it harder to find good deals, and returns will suffer. This is why private equity funds will have to adapt to the new environment. Overall, based on our analysis, we claim that the future potential of private equity is positive. 06 Conclusion This paper has investigated the performance of private equity compared to listed equity. The summary statistics revealed that on average private equity outperforms listed equity on a risk-adjusted basis. The overall development of private equity is more stable and less volatile than listed equity. The regression analysis also supported that with statistically significant results, the alpha (intersect) revealed to be positive and significant. This shows that private equity consistently outperforms the listed equity. Diversification can also be achieved by holding positions in private equity. There are however some drawbacks considering the uncertain cash flows and the illiquid position. The diversification effect also changes during volatile and stable times. During stable times is the diversification effect significant, during stress periods, that are defined by macroeconomic factors, is the diversification effect low. Overall can be said that the performance of private equity on the basis of risk-adjusted returns is good. Private equity shows a consistent outperformance of listed equity. 7

- 8. Reference List Bodie Z., A. Kane and A. Marcus, Essentials of Investments, 9 5 edition, 2013 (BKM) Forbes (2017). Ten predictions for private equity in 2017. Retrieved from: https://www.forbes.com/sites/antoinedrean/2017/01/25/ten-predictions-for-private-equity-in-2017/#32 3cbf617db9 Forbes (2016). Private equity is set to grow much bigger. Retrieved from: https://www.forbes.com/sites/antoinedrean/2016/11/08/private-equity-is-set-to-grow-much-bigger/#57 6e2ec275f5 Private Equity Education Series, UBS Alternative Investments, Parts 1-4, 2011 Sciencedirect (1998) Size, value, and momentum in international stock returns. Retrieved from: http://www.sciencedirect.com/science/article/pii/S0304405X12000931 ECB Europe (2007) Estimating the performance of risk exposure of private equity funds: a new methodology. Retrieved from: http://www.ecb.europa.eu/events/pdf/conferences/ecbcfs_conf9/PE_estimation_DLP.pdf 8

- 9. Appendix Table 1: summary statistics Private equity Listed equity Annual mean 8.21 6.89 Annual standard deviation 9.75 17.45 Sharpe ratio 0.84 0.39 Maximum 16.49 20.64 minimum -15.35 -24.32 Max drawdown 36.52 50.24 Table 2: correlation analysis Private equity Market SMB HML Private equity 1 Market 0.6963 1 SMB 0.3076 0.4585 1 HML -0.2161 -0.1076 0.0566 1 Table 3: correlation analysis during crisis 1999-2003 2006-2009 Listed equity Listed equity Private equity 0.803 0.952 9

- 10. Table 4: regression statistics Graph 1: yearly returns of private & listed equity 10

- 11. Graph 2: Portfolio Developments 11