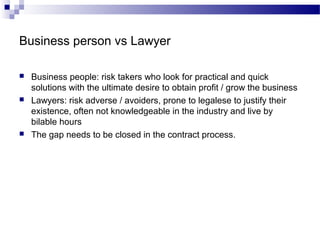

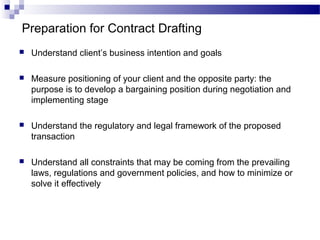

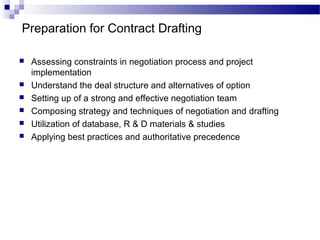

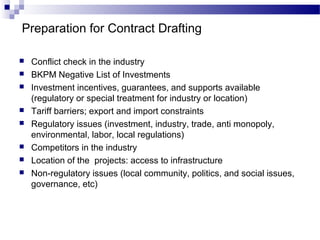

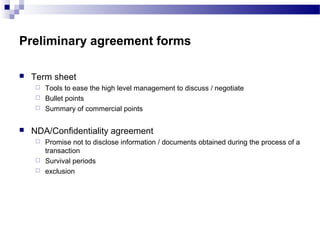

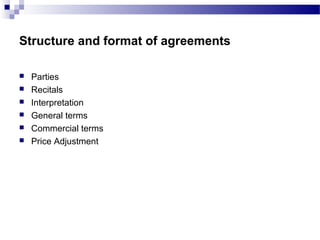

This document serves as an introduction to commercial contract drafting, outlining important principles and practices for both in-house and external counsel. Key topics include the purpose of contracts, the role of legal communication, contract preparation, different contract forms, and common drafting pitfalls. It emphasizes the importance of understanding client goals, legal frameworks, and the dynamics between business professionals and lawyers to create effective agreements.

![General drafting pitfalls

Hasty, Inadequate or Non- Existent Due Diligence

Drafting a clause or section from scratch.

Inconsistently defining terms and phrases.

Leaving out key details

Lack of details in mechanism

Not spending enough time on choice of law, forum, dispute resolution, damages, and

limitation of liabilityeaving out key details

Relying on Word’s Track Changes feature

Running out of time to review

Assuming that outside counsel provided perfect work product.

Not having a system for managing standard forms

Forgetting what version you sent and to whom.

What is the exact amount to be paid? When? How? Conditions of non payment?

Delay..what the cpnsequence?

Shipping / delivery? Demurage, dispatch

Dont understand what we drafted [??]](https://image.slidesharecdn.com/km-introtocontractdrafting-170502044501/85/Introduction-to-Commercial-Contract-Drafting-23-320.jpg)