Reliance On Others - BUSINESS

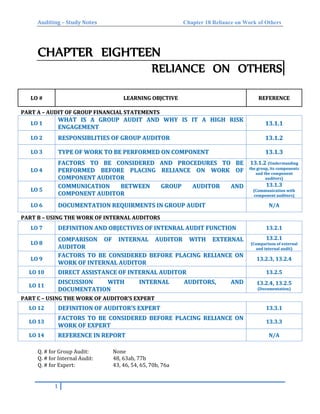

- 1. Auditing – Study Notes Chapter 18 Reliance on Work of Others CHAPTER EIGHTEEN RELIANCE ON OTHERS LLOO ## LLEEAARRNNIINNGG OOBBJJCCTTIIVVEE RREEFFEERREENNCCEE PPAARRTT AA –– AAUUDDIITT OOFF GGRROOUUPP FFIINNAANNCCIIAALL SSTTAATTEEMMEENNTTSS LLOO 11 WWHHAATT IISS AA GGRROOUUPP AAUUDDIITT AANNDD WWHHYY IISS IITT AA HHIIGGHH RRIISSKK EENNGGAAGGEEMMEENNTT 1133..11..11 LLOO 22 RREESSPPOONNSSIIBBLLIITTIIEESS OOFF GGRROOUUPP AAUUDDIITTOORR 1133..11..22 LLOO 33 TTYYPPEE OOFF WWOORRKK TTOO BBEE PPEERRFFOORRMMEEDD OONN CCOOMMPPOONNEENNTT 1133..11..33 LLOO 44 FFAACCTTOORRSS TTOO BBEE CCOONNSSIIDDEERREEDD AANNDD PPRROOCCEEDDUURREESS TTOO BBEE PPEERRFFOORRMMEEDD BBEEFFOORREE PPLLAACCIINNGG RREELLIIAANNCCEE OONN WWOORRKK OOFF CCOOMMPPOONNEENNTT AAUUDDIITTOORR 1133..11..22 ((UUnnddeerrssttaannddiinngg tthhee ggrroouupp,, iittss ccoommppoonneennttss aanndd tthhee ccoommppoonneenntt aauuddiittoorrss)) LLOO 55 CCOOMMMMUUNNIICCAATTIIOONN BBEETTWWEEEENN GGRROOUUPP AAUUDDIITTOORR AANNDD CCOOMMPPOONNEENNTT AAUUDDIITTOORR 1133..11..33 ((CCoommmmuunniiccaattiioonn wwiitthh ccoommppoonneenntt aauuddiittoorrss)) LLOO 66 DDOOCCUUMMEENNTTAATTIIOONN RREEQQUUIIRRMMEENNTTSS IINN GGRROOUUPP AAUUDDIITT NN//AA PPAARRTT BB –– UUSSIINNGG TTHHEE WWOORRKK OOFF IINNTTEERRNNAALL AAUUDDIITTOORRSS LLOO 77 DDEEFFIINNIITTIIOONN AANNDD OOBBJJEECCTTIIVVEESS OOFF IINNTTEENNRRAALL AAUUDDIITT FFUUNNCCTTIIOONN 1133..22..11 LLOO 88 CCOOMMPPAARRIISSOONN OOFF IINNTTEERRNNAALL AAUUDDIITTOORR WWIITTHH EEXXTTEERRNNAALL AAUUDDIITTOORR 1133..22..11 ((CCoommppaarriissoonn ooff eexxtteerrnnaall aanndd iinntteerrnnaall aauuddiitt)) LLOO 99 FFAACCTTOORRSS TTOO BBEE CCOONNSSIIDDEERREEDD BBEEFFOORREE PPLLAACCIINNGG RREELLIIAANNCCEE OONN WWOORRKK OOFF IINNTTEERRNNAALL AAUUDDIITTOORR 1133..22..33,, 1133..22..44 LLOO 1100 DDIIRREECCTT AASSSSIISSTTAANNCCEE OOFF IINNTTEERRNNAALL AAUUDDIITTOORR 1133..22..55 LLOO 1111 DDIISSCCUUSSSSIIOONN WWIITTHH IINNTTEERRNNAALL AAUUDDIITTOORRSS,, AANNDD DDOOCCUUMMEENNTTAATTIIOONN 1133..22..44,, 1133..22..55 ((DDooccuummeennttaattiioonn)) PPAARRTT CC –– UUSSIINNGG TTHHEE WWOORRKK OOFF AAUUDDIITTOORR’’SS EEXXPPEERRTT LLOO 1122 DDEEFFIINNIITTIIOONN OOFF AAUUDDIITTOORR’’SS EEXXPPEERRTT 1133..33..11 LLOO 1133 FFAACCTTOORRSS TTOO BBEE CCOONNSSIIDDEERREEDD BBEEFFOORREE PPLLAACCIINNGG RREELLIIAANNCCEE OONN WWOORRKK OOFF EEXXPPEERRTT 1133..33..33 LLOO 1144 RREEFFEERREENNCCEE IINN RREEPPOORRTT NN//AA Q. # for Group Audit: None Q. # for Internal Audit: 48, 63ab, 77b Q. # for Expert: 43, 46, 54, 65, 70b, 76a 1

- 2. Auditing – Study Notes Chapter 18 Reliance on Work of Others PART A – AUDIT OF GROUP FINANCIAL STATEMENTS LLOO 11:: WWHHAATT IISS AA GGRROOUUPP AAUUDDIITT AANNDD WWHHYY IISS IITT AA HHIIGGHH RRIISSKK EENNGGAAGGEEMMEENNTT:: Definitions: Group: A group is an audit client which has more than one components. Component: A component is an entity or business activity, for which financial information is prepared, that should be included in the group financial statements (e.g. subsidiaries, branches). Features/Problems of a Group Audit: A group audit is considered a high risk audit client because of following problems: It includes complex consolidation process and adjustments (e.g. inter-company transactions). Some of the components may have different currencies, different accounting year-end and even different financial reporting frameworks. Some of the components may be audited by another firms of chartered accountants. CONCEPT REVIEW QUESTION Explain the main features of a group audit which differentiate it from an audit of individual separate financial statements. (04 marks) (ICMA Pakistan – August 2014) LLOO 22:: RREESSPPOONNSSIIBBLLIITTIIEESS OOFF GGRROOUUPP AAUUDDIITTOORR:: It is responsibility of group auditor to: Accept a group audit engagement only if it can obtain sufficient appropriate evidence on all components. Obtain understanding of group, its components and consolidation process. Develop audit strategy for group (i.e. to assess risk of material misstatement, to determine materiality levels, to determine type of work to be performed on components). Obtain sufficient appropriate audit evidence (by himself or through component auditor). Issue audit report on group financial statements which is appropriate in the circumstances. As a result, auditor shall not refer to the work of component auditor in auditor’s report unless it is required by Law or Regulation. If such reference is required by law or regulation, the auditor’s report shall indicate that the reference does not diminish the group auditor’s responsibility for the group audit opinion. Consolidated financial statements are called “Group financial statements”. Auditor of group financial statements is called “Group auditor”. Subsidiary of an audit client is called “Component”. Auditor of a subsidiary (if different from group auditor) is called “Component auditor”. 2

- 3. Auditing – Study Notes Chapter 18 Reliance on Work of Others LLOO 33:: TTYYPPEE OOFF WWOORRKK TTOO BBEE PPEERRFFOORRMMEEDD OONN CCOOMMPPOONNEENNTT:: What is a significant component: Significant Component is a component identified by the group engagement team, that is: 1. of individual financial significance to the group (e.g. a component whose revenue exceeds 15% of group’s revenue) or 2. likely to include significant risk of material misstatement in the group financial statements due to its specific nature or circumstances (e.g. a component engaged in foreign exchange trading). Type of work to be performed on components: Type of component Work to be performed Significant (on financial basis) Audit of financial information of component using component materiality. Significant (on risk basis) An audit of the financial information of the component using component materiality. An audit of one or more account balances, classes of transactions or disclosures. Specified procedures. Non-significant Analytical procedures at group level. If sufficient appropriate evidence cannot be obtained from analytical procedures, group auditor shall select components that are not significant and shall perform one or more of followings: An audit of the financial information of the component using component materiality. An audit of one or more account balances, classes of transactions or disclosures. A review of the financial information of the component using component materiality. Specified procedures. This selection of components will change every year. LLOO 44:: FFAACCTTOORRSS TTOO BBEE CCOONNSSIIDDEERREEDD AANNDD PPRROOCCEEDDUURREESS TTOO BBEE PPEERRFFOORRMMEEDD BBEEFFOORREE PPLLAACCIINNGG RREELLIIAANNCCEE OONN WWOORRKK OOFF CCOOMMPPOONNEENNTT AAUUDDIITTOORR:: Factors to be considered: If the group engagement team plans to request a component auditor to perform work on the financial information of a component, the group engagement team shall obtain an understanding of component auditor in respect of following: 1. The component auditor’s professional competence. 2. Whether the component auditor understands and will comply with the ethical requirements that are relevant to the group audit and, in particular, is independent. 3. Whether the group engagement team will be able to be involved in the work of the component auditor to the extent necessary to obtain sufficient appropriate audit evidence 4. Whether the component auditor operates in a regulatory environment that actively oversees auditors. 3

- 4. Auditing – Study Notes Chapter 18 Reliance on Work of Others Procedures to be performed to obtain understanding: Sources of information to obtain understanding, in the first year, include: 1. Visit the component auditor to discuss the matters regarding competence, ethics of component auditor, and involvement of group auditor in work. 2. Requesting component auditor to confirm these matters in writing. 3. Request the component auditor to complete questionnaires about these matters. 4. Evaluate results of quality control reviews of component auditor if group auditor and component auditor both operate under common monitoring policies and procedures. 5. Discuss component auditor with third parties having previous interaction with him. 6. Obtain confirmation from professional bodies to which component auditor belongs. Sources of information to obtain understanding, in subsequent years, include: 1. Understanding may be based on the group engagement team’s previous experience with the component auditor 2. Group engagement team may request the component auditor to confirm any changes in matters regarding competence, ethics of component auditor, and involvement of group auditor in work. CONCEPT REVIEW QUESTION When a group engagement team plans to request a component auditor to perform work on the financial information of a component, the team is required to obtain an understanding of the component auditor. State the matters to be considered by the group engagement team when obtaining an understanding of a component auditor. (03 marks) (ICAEW – 2010 June) You are a manager in Dando & Co, a firm of Chartered Certified Accountants responsible for the audit of the Adams Group. An overseas subsidiary, Lynott Co, is audited by a local firm, Clapton & Co. Explain the matters to be considered, and the procedures to be performed, in respect of planning to use the work of Clapton & Co. (08 marks) (ICAEW – 2014 June) Pak Tools Limited has a subsidiary in Dubai whose operation is significant to the company. You, as principle auditor, are responsible to express an opinion on the company’s consolidated financial statements. The subsidiary was previously being audited by a local firm. However, the auditors were changed last year, and the current year’s audit has been performed by a firm, which has been affiliated with your firm for a long time. Required: What difference do you expect in your audit procedures while using the work of other auditors in view of the above change? (04 marks) (CA Inter -Spring 2006) What type of involvement is necessary in the work of component auditor Group engagement team shall be involved in component’s risk assessment to identify significant risk. This involvement shall include, at minimum, following: o Discussing those business activities of component which are significant to the group. o Discussing susceptibility of component to misstatement due to fraud or error. o Reviewing component auditor’s documentation of identified significant risks for group financial statements. 4

- 5. Auditing – Study Notes Chapter 18 Reliance on Work of Others LLOO 55:: CCOOMMMMUUNNIICCAATTIIOONN BBEETTWWEEEENN GGRROOUUPP AAUUDDIITTOORR AANNDD CCOOMMPPOONNEENNTT AAUUDDIITTOORR:: Communication/Instructions from Group engagement team to component auditor: The group engagement team shall timely communicate its requirements to the component auditor e.g. The work to be performed by the component auditor, and use to be made of that work. A request that component auditor will cooperate with the group engagement team. The ethical requirements that are relevant to the group audit, specially independence requirements. Component materiality levels (i.e. overall materiality, performance materiality, threshold for clearly trivial misstatements) Identified significant risks of the group financial statements that are relevant to the work of the component auditor. A list of related parties prepared by group management Reporting deadlines which component auditor is required to comply. Communication from component auditor to Group engagement team: The group engagement team shall request the component auditor to communicate matters relevant to the group engagement team’s conclusion with regard to the group audit e.g. Whether the component auditor has complied with ethical requirements that are relevant to the group audit, including independence and professional competence; Whether the component auditor has complied with the group engagement team’s requirements Non-compliance with laws or regulations if it may result in material misstatement of group financial statements. A list of uncorrected misstatements of the financial information of the component; Any fraud or suspected fraud involving management, employees or others if fraud may result in material misstatement. Description of any identified significant deficiencies in internal control at the component level; The component auditor’s overall findings, conclusions or opinion. Evaluation of the work of component auditor: The group engagement team shall evaluate the component auditor’s communication. If the group engagement team concludes that the work of the component auditor is insufficient, the group engagement team shall determine: what additional procedures are to be performed, and whether they are to be performed by the component auditor or by the group engagement team. CONCEPT REVIEW QUESTION You are the audit manager of a listed company having seven subsidiaries. Three of them are audited by other audit firms. Required: State the key matters / instructions which you would communicate to the component auditors. (08 marks) (CA Final - Winter 2015) Gunderson LLP has been the external auditor of Blu Botanicals Ltd (Blu) for a number of years. During the year, Eva plc (Eva) acquired 100% of the share capital of Blu. The Eva group financial statements are audited by Nigel LLP, a UK-based firm of external auditors. Blu is material to the group financial statements of Eva. 5

- 6. Auditing – Study Notes Chapter 18 Reliance on Work of Others Requirements In respect of the external audit of Blu, list the requirements that Nigel LLP should communicate to Gunderson LLP and the matters on which the Gunderson LLP audit team should report to Nigel LLP. (07 marks) (ICAEW – 2013 March) amended LLOO 66:: DDOOCCUUMMEENNTTAATTIIOONN RREEQQUUIIRRMMEENNTTSS IINN GGRROOUUPP AAUUDDIITT:: The group engagement team shall include in the audit documentation the following matters: 1. An analysis of components, indicating those that are significant, and the type of work performed on the financial information of the components. 2. The nature, timing and extent of the group engagement team’s involvement in the work performed by the component auditors on significant components including, where applicable, the group engagement team’s review of relevant parts of the component auditors’ audit documentation and conclusions thereon. 3. Written communications between the group engagement team and the component auditors about the group engagement team’s requirements. CONCEPT REVIEW QUESTION Pak Tools Limited has a subsidiary in Dubai whose operation is significant to the company. You, as principle auditor, are responsible to express an opinion on the company’s consolidated financial statements. The subsidiary was previously being audited by a local firm. However, the auditors were changed last year, and the current year’s audit has been performed by a firm, which has been affiliated with your firm for a long time. Required: What basic information would you document in the working papers? (04 marks) (CA Inter -Spring 2006) PART B – USING WORK OF INTERNAL AUDITOR LLOO 77:: DDEEFFIINNIITTIIOONN AANNDD OOBBJJEECCTTIIVVEESS OOFF IINNTTEENNRRAALL AAUUDDIITT FFUUNNCCTTIIOONN:: Definition: Internal Audit Function is a function of entity that performs activities to evaluate and improve entity’s Governance, Risk Management and Internal Control. Internal audit is not required by law, therefore it is conducted by an entity only it its benefits are greater than its cost. Internal audit may be conducted by entity’s own employees or by outsourced to external firms. Functions/Activities/Benefits of Internal Audit Department: Following are objectives/scope/activities/benefits of internal audit function: Governance Activities: The internal audit function may assess the governance process to ensure entity is complying best practices in corporate governance. Internal audit function may also assess effectiveness of communication among those charged with governance, external and internal auditors, and management. 6

- 7. Auditing – Study Notes Chapter 18 Reliance on Work of Others Activities Relating to Risk Management: The internal audit function may assist the entity by identifying and evaluating significant exposures to risk and contributing to the improvement of risk management. The internal audit function may perform procedures to assist the entity in the detection of fraud. Activities Relating to Internal Control: Evaluation of internal control: The internal audit function may be assigned specific responsibility for reviewing controls, evaluating their operation and recommending improvements. For this purpose, internal audit function may perform tests of controls. Examination of financial and operating information: For this purpose, internal audit function may perform tests of details. Review of operating activities: The internal audit function may be assigned to review the economy, efficiency and effectiveness of operating activities, including non-financial activities of an entity. (this is also called Operational Audit, or Value for Money Audit or 3E’s Audit) Review of compliance with laws and regulations. Disadvantages of Internal Audit Department: Disadvantages of internal audit department include: Internal auditors are not as independent of entity as external auditors. Higher cost is involved in establishing internal audit department. There may be lack of qualification and experience in internal audit department. CONCEPT REVIEW QUESTION Define the ‘three Es’ of a value for money audit. (03 marks) F8 (ACCA - June 2014) Describe additional functions, other than fraud investigations, the directors of Bush-Baby Hotels Co could ask the internal audit department to undertake. (05 marks) F8 (ACCA - June 2013) Examples of work of the internal audit function that can be used by the external auditor: Testing of the operating effectiveness of controls; Substantive procedures involving limited judgment; Observations of inventory counts; Tracing transactions through the information system relevant to financial reporting; Testing of compliance with regulatory requirements; Audits or reviews of the financial information of subsidiaries that are not significant components to the group. 7

- 8. Auditing – Study Notes Chapter 18 Reliance on Work of Others LLOO 88:: CCOOMMPPAARRIISSOONN OOFF IINNTTEERRNNAALL AAUUDDIITTOORR WWIITTHH EEXXTTEERRNNAALL AAUUDDIITTOORR:: Internal Auditor External Auditor Relationship/Independence Employee of entity Independent of entity Appointment By BOD/Audit Committee By Shareholders Qualification Determined by BOD/Audit Committee Determined by Law Scope / Objectives / Activities Objective is to evaluate and improve entity’s Governance, Risk Management and Internal Control. Objective is to express an opinion on financial statements and on additional matters required by law. Scope/Objectives/ Activities determined by BOD/Audit Committee Determined by Laws and Regulations Reporting Reports To BOD/Audit Committee and his reports are restricted to them. Reports to Members and his report is publically available. Format of Report Any (depending on circumstances) Determined by Law CONCEPT REVIEW QUESTION Differentiate between external and internal auditors with respect to objectives, scope of work and reporting responsibilities. (06 marks) (ICMAP - 2014 February) LLOO 99:: FFAACCTTOORRSS TTOO BBEE CCOONNSSIIDDEERREEDD BBEEFFOORREE PPLLAACCIINNGG RREELLIIAANNCCEE OONN WWOORRKK OOFF IINNTTEERRNNAALL AAUUDDIITTOORR:: Evaluating the Internal Audit Function: Evaluation Factors to consider while evaluating Competence Level of education, professional qualification and experience. whether there are established practices for training of internal auditors Specific knowledge and skills relating to entity’s financial statements. Whether internal audit function is adequately resourced. Objectivity To ensure objectivity of internal audit function, auditor considers its organizational status, scope and objective, and nature of responsibilities i.e. Employment decisions like hiring, firing or promotion of internal audit functions should be made by TCWG, and not by management. Internal auditors should be reportable to TCWG and not to management. Scope of work of internal auditor should be decided by audit committee; and not by management. Internal audit function should be free from conflicting responsibilities. They should not perform any managerial work. Internal auditors should be rotated periodically to avoid familiarity threat e.g. after every 3 to 5 years. Systematic and Disciplined Approach Whether internal auditors apply a systematic and disciplined approach i.e. work is properly planned, performed, documented and reviewed. Quality of internal auditor’s working papers. Consistency of Conclusions with work performed. Quality Control Program for internal auditor. 8

- 9. Auditing – Study Notes Chapter 18 Reliance on Work of Others Evaluating the adequacy of work of Internal Audit Function: Before using specific work of internal auditor, auditor shall determine adequacy of work by evaluating whether: The work of the function has been properly planned, performed, reviewed and documented. Sufficient appropriate evidence has been obtained to draw reasonable conclusions, and Conclusions reached are appropriate in the circumstances and reports prepared are consistent with results of the work performed. Depending on risk assessment, judgments involved, and evaluation of internal audit function; auditor’s procedures (in addition to Reperformance) may include inquiry of internal auditors, observation of procedures of internal auditors, inspection of working papers of internal auditors. If work is not adequate for auditor’s purposes: If auditor determines that the work of internal auditor is not adequate for auditor’s purposes, auditor may: − Perform additional audit procedures appropriate to the circumstances, or − Agree with internal auditor on further work to be performed by internal auditor (i.e. Direct Assistance). CONCEPT REVIEW QUESTION Briefly explain how an external auditor would evaluate the adequacy of the work performed by the internal audit function. (04 marks) (CA Inter - Spring 2016) Identify the factors that are considered in determining the independence of internal auditors. (02 marks) (CA Inter - Autumn 2015) Suppose you have been working as a Manager of external audit team of M/s. Frame Limited. The company has internal audit department lead by a certified internal auditor. What factors would enable you to place reliance on the work done by the internal audit department? (10 marks) (ICMAP - 2013 February) LLOO 1100:: DDIIRREECCTT AASSSSIISSTTAANNCCEE OOFF IINNTTEERRNNAALL AAUUDDIITTOORR:: Direct Assistance: Direct assistance is the use of internal auditors to perform audit procedures under the direction, supervision and review of the external auditor. Determining Whether Internal Auditors Can Be Used to Provide Direct Assistance: The external auditor shall not use an internal auditor to provide direct assistance if: (a) Law or regulations prohibit external auditor from obtaining direct assistance from internal auditors., or (b) There are significant threats to the objectivity of the internal auditor; or (c) The internal auditor lacks sufficient competence to perform the proposed work. Determining the Nature and Extent of Work that Can Be Assigned to Internal Auditors: The external auditor shall not use internal auditors to provide direct assistance to perform procedures that: involve making significant judgements in the audit; relate to higher assessed risks of material misstatement; relate to work with which the internal auditors have been involved and which has already been, or will be, reported to TCWG by the internal audit function; or 9

- 10. Auditing – Study Notes Chapter 18 Reliance on Work of Others relate to decisions the external auditor makes regarding the internal audit function and the use of its work or direct assistance. Using Internal Auditors to Provide Direct Assistance: Prior to using internal auditors to provide direct assistance, the external auditor shall: Obtain written agreement from an authorized representative of the entity that the internal auditors will be allowed to follow the external auditor’s instructions, and that the entity will not intervene in the work the internal auditor performs for the external auditor; and Obtain written agreement from the internal auditors that they will keep confidential specific matters as instructed by the external auditor and inform the external auditor of any threat to their objectivity. LLOO 1111:: DDIISSCCUUSSSSIIOONN WWIITTHH IINNTTEERRNNAALL AAUUDDIITTOORRSS,, AANNDD DDOOCCUUMMEENNTTAATTIIOONN:: Discussion and Coordination with the Internal Audit Function: If the external auditor plans to use the work of the internal audit function, it will be useful to discuss and coordinate following matters with internal auditor in advance: the timing of such work the nature of the work performed the extent of audit coverage materiality and performance materiality methods of item selection and sample sizes documentation of work performed review and reporting procedures. Documentation: If the external auditor uses the work of the internal audit function, the external auditor shall include in the audit documentation: (a) The evaluation of competence, objectivity and systematic and disciplined approach of internal audit function. (b) The nature and extent of the work used and the basis for that decision; and (c) The audit procedures performed by the external auditor to evaluate the adequacy of the work used. If the external auditor uses internal auditors to provide direct assistance on the audit, the external auditor shall include in the audit documentation: (a) The evaluation of competence, and objectivity of internal audit function. (b) The written agreements obtained from an authorized representative of the entity and the internal auditors (c) The working papers prepared by the internal auditors who provided direct assistance on the audit engagement (d) Who reviewed the work performed and the date and extent of that review. 10

- 11. Auditing – Study Notes Chapter 18 Reliance on Work of Others PART C – USING WORK OF EXPERT LLOO 1122:: DDEEFFIINNIITTIIOONN OOFF AAUUDDIITTOORR’’SS EEXXPPEERRTT:: Definition: An individual or organization possessing expertise in a field (other than accounting or auditing), whose work in that field is used by the auditor to assist the auditor in obtaining sufficient appropriate audit evidence. CONCEPT REVIEW QUESTION Define the term ”Auditor’s Expert”. (02 marks) (ICMAP - 2013 September) As the manger on the audit of Masoom Limited you want the management to appoint experts to assist you on certain matters. Explain the circumstances where auditor may use the work of an expert and the auditor’s responsibilities in this regard. (07 marks) (CA Inter, Spring 2008) LLOO 1133:: FFAACCTTOORRSS TTOO BBEE CCOONNSSIIDDEERREEDD BBEEFFOORREE PPLLAACCIINNGG RREELLIIAANNCCEE OONN WWOORRKK OOFF EEXXPPEERRTT:: If auditor uses work of an expert, it is auditor’s responsibility to: Evaluate Competence, Capabilities and Objectivity of the Auditor’s Expert Obtaining an Understanding of the Field of Expertise Agreement with Auditor’s Expert Evaluate the Adequacy of the Auditor’s Expert’s Work Evaluating the Expert: The auditor shall evaluate whether the auditor’s expert has the necessary competence, capabilities and objectivity. Competence, capability and objectivity of an expert may be assessed in following ways: Personal experience of previous work with expert. Discussion with expert. Discussion with other professionals who have worked with expert. Books or papers published by expert. Knowledge of expert’s qualification, membership of professional bodies or other external recognition, license to practice. Examples of areas where work of expert can be used by the external auditor: Expert may be required by auditor when financial statements involve: Estimation of life and valuation of fixed assets. Valuation of specialized inventory. Analysis of complex or unusual tax compliance issues IT Expertise Legal Opinions 11

- 12. Auditing – Study Notes Chapter 18 Reliance on Work of Others Obtaining an Understanding of the Field of Expertise: The auditor shall obtain a sufficient understanding of the field of expertise of the auditor’s expert to enable the auditor to: (a) Determine the nature, scope and objectives of expert’s work for the audit purposes; and (b) Evaluate the adequacy of expert’s work. Agreement between Auditor and his Expert: The auditor shall agree, in writing when appropriate, on the following matters with the auditor’s expert: (a) The nature, scope and objectives of that expert’s work; (b) The respective roles and responsibilities of the auditor and that expert; (c) The nature, timing and extent of communication between the auditor and that expert, including the form of any report to be provided by that expert; and (d) The need for the auditor’s expert to observe confidentiality requirements. Evaluating the adequacy of work of Expert: Before using specific work of expert, auditor shall determine adequacy of work by evaluating: 1. Relevance, completeness, and accuracy of significant source data (if expert’s work involves use of significant source data) 2. Relevance and reasonableness of significant assumptions and methods (if expert’s work involves use of significant assumptions and methods) 3. Reasonableness of expert’s findings and conclusions 4. Consistency of these conclusions with other audit evidence If work is not adequate for auditor’s purposes: If auditor determines that the work of expert is not adequate for auditor’s purposes, auditor shall: − Agree with expert on further work to be performed by expert. − Perform additional audit procedures appropriate to the circumstances − Consider the necessity to engage another expert. CONCEPT REVIEW QUESTION Mineral Limited (ML) has incorporated a liability for gratuity payable to its employees on the basis of actuarial valuation carried out by Professionals Limited (PL). As the audit partner of ML you are not satisfied with the valuation report prepared by PL, and have decided to appoint Experts Limited (EL) to carry out the valuation exercise again. Required: (a) State the matters that you would consider regarding: (i) The competence, capabilities and objectivity of EL. (03 marks) (ii) Evaluation of the adequacy of EL’s work. (03 marks) (b) Briefly discuss the course of action in case you are not satisfied with the work performed by EL. (03 marks) (CA Inter - Spring 2015) List four key terms of engagement which should be agreed with the expert. (02 marks) (CA Inter - Spring 2016) LLOO 1144:: RREEFFEERREENNCCEE IINN RREEPPOORRTT:: Auditor shall not refer to the work of expert in auditor’s report unless it is required by Law or Regulation. If such reference is required by law or regulation, the auditor’s report shall indicate that the reference does not diminish the group auditor’s responsibility for audit opinion. CONCEPT REVIEW QUESTION Under what circumstances would an auditor refer to the result of the work of an expert in the audit report? (04 marks) (CA Inter, Spring 2004) 12