AUDITOR'S REPORT AND TYPES OF OPINIONS

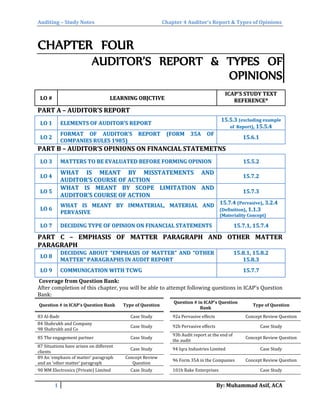

- 1. Auditing – Study Notes Chapter 4 Auditor’s Report & Types of Opinions CHAPTER FOUR AUDITOR’S REPORT & TYPES OF OPINIONS LLOO ## LLEEAARRNNIINNGG OOBBJJCCTTIIVVEE IICCAAPP''SS SSTTUUDDYY TTEEXXTT RREEFFEERREENNCCEE** PPAARRTT AA –– AAUUDDIITTOORR’’SS RREEPPOORRTT LLOO 11 EELLEEMMEENNTTSS OOFF AAUUDDIITTOORR’’SS RREEPPOORRTT 1155..55..33 ((eexxcclluuddiinngg eexxaammppllee ooff RReeppoorrtt)),, 1155..55..44 LLOO 22 FFOORRMMAATT OOFF AAUUDDIITTOORR’’SS RREEPPOORRTT ((FFOORRMM 3355AA OOFF CCOOMMPPAANNIIEESS RRUULLEESS 11998855)) 1155..66..11 PPAARRTT BB –– AAUUDDIITTOORR’’SS OOPPIINNIIOONNSS OONN FFIINNAANNCCIIAALL SSTTAATTEEMMEETTNNSS LLOO 33 MMAATTTTEERRSS TTOO BBEE EEVVAALLUUAATTEEDD BBEEFFOORREE FFOORRMMIINNGG OOPPIINNIIOONN 1155..55..22 LLOO 44 WWHHAATT IISS MMEEAANNTT BBYY MMIISSSSTTAATTEEMMEENNTTSS AANNDD AAUUDDIITTOORR’’SS CCOOUURRSSEE OOFF AACCTTIIOONN 1155..77..22 LLOO 55 WWHHAATT IISS MMEEAANNTT BBYY SSCCOOPPEE LLIIMMIITTAATTIIOONN AANNDD AAUUDDIITTOORR’’SS CCOOUURRSSEE OOFF AACCTTIIOONN 1155..77..33 LLOO 66 WWHHAATT IISS MMEEAANNTT BBYY IIMMMMAATTEERRIIAALL,, MMAATTEERRIIAALL AANNDD PPEERRVVAASSIIVVEE 1155..77..44 ((PPeerrvvaassiivvee)),, 33..22..44 ((DDeeffiinniittiioonn)),, 11..11..33 ((MMaatteerriiaalliittyy CCoonncceepptt)) LLOO 77 DDEECCIIDDIINNGG TTYYPPEE OOFF OOPPIINNIIOONN OONN FFIINNAANNCCIIAALL SSTTAATTEEMMEENNTTSS 1155..77..11,, 1155..77..44 PPAARRTT CC –– EEMMPPHHAASSIISS OOFF MMAATTTTEERR PPAARRAAGGRRAAPPHH AANNDD OOTTHHEERR MMAATTTTEERR PPAARRAAGGRRAAPPHH LLOO 88 DDEECCIIDDIINNGG AABBOOUUTT ““EEMMPPHHAASSIISS OOFF MMAATTTTEERR”” AANNDD ““OOTTHHEERR MMAATTTTEERR”” PPAARRAAGGRRAAPPHHSS IINN AAUUDDIITT RREEPPOORRTT 1155..88..11,, 1155..88..22 1155..88..33 LLOO 99 CCOOMMMMUUNNIICCAATTIIOONN WWIITTHH TTCCWWGG 1155..77..77 Coverage from Question Bank: After completion of this chapter, you will be able to attempt following questions in ICAP’s Question Bank: Question # in ICAP’s Question Bank Type of Question Question # in ICAP’s Question Bank Type of Question 83 Al-Badr Case Study 92a Pervasive effects Concept Review Question 84 Shahrukh and Company 98 Shahrukh and Co Case Study 92b Pervasive effects Case Study 85 The engagement partner Case Study 93b Audit report at the end of the audit Concept Review Question 87 Situations have arisen on different clients Case Study 94 Iqra Industries Limited Case Study 89 An ‘emphasis of matter’ paragraph and an ‘other matter’ paragraph Concept Review Question 96 Form 35A in the Companies Concept Review Question 90 MM Electronics (Private) Limited Case Study 101b Rake Enterprises Case Study 1 By: Muhammad Asif, ACA

- 2. Auditing – Study Notes Chapter 4 Auditor’s Report & Types of Opinions PART A – AUDITOR’S REPORT LLOO 11:: EELLEEMMEENNTTSS OOFF AAUUDDIITTOORR’’SS RREEPPOORRTT:: Auditor’s Report is always in written form with following elements/contents: Elements of an Unmodified Auditor’s Report: Sr. # Content Brief Explanation 1. Title Auditor’s report shall have a title clearly indicating that it is “auditor’s report”. Title is necessary to differentiate auditor’s report from other type of reports included in annual report. 2. Addressee Addressee is the stakeholder to whom report is issued. Report may be addressed to any appropriate addressee according to circumstances e.g. “Members”, or “Board of Directors”. 3. Introductory Paragraph This paragraph states: That an audit has been conducted. Title of each statement making complete set of financial statements. Entity whose financial statements have been audited. Date or Period covered by each statement. 4. Management’s Responsibility Paragraph This paragraph describes responsibilities of management: for preparation of financial statements in accordance with AFRF. for such internal control which management and TCWG determine necessary for preparation of financial statements. 5. Auditor’s Responsibility Paragraph This paragraph describes: auditor’s responsibility to express an opinion on financial statements based on audit. brief description of audit. that his audit provides a reasonable basis for his opinion 6. Auditor’s Opinion Paragraph In this paragraph, auditor states whether: financial statements have been prepared, in all material respects, in accordance with AFRF (if compliance framework is used), or financial statements give a true and fair view in accordance with AFRF (if fair presentation framework is used). 7. Other Reporting Responsibilities (if any) If auditor is required by local laws and regulations to report on matters other than financial statements, such matter shall also be covered in a separate section in audit report. 8. Signature This section contains signature of auditor: if auditor is a sole-proprietor, he shall sign in his personal name. if auditor is a partnership firm, any partner will sign in the name of audit firm. However, name of engagement partner shall also be mentioned in this case. 9. Date The date of audit report should not be earlier than the date on which auditor obtains sufficient appropriate evidence on which his report is based (including evidence that financial statement have been prepared and approved by management/TCWG). Date also indicates that auditor has considered the effect of events and transactions upto that date. 10. Address This is the name of city where auditor practices. 2 By: Muhammad Asif, ACA

- 3. Auditing – Study Notes Chapter 4 Auditor’s Report & Types of Opinions If local laws/regulations require different format/wording of auditor’s report, auditor shall refer to ISAs only when, at minimum, all of above elements are included in auditor’s report. Additional Elements of a Modified Auditor’s Report: A modified report includes any of following: “Modified Opinion” (alongwith “Basis for Modified Opinion” Paragraph), or “Emphasis of Matter” Paragraph, or “Other Matter” Paragraph. CONCEPT REVIEW QUESTION List down the basic elements of an audit report. (05 marks) (CA Inter -Autumn 2004) ISA 700 Forming an Opinion and Reporting on Financial Statements provides guidance on the form and content of the auditor’s report and should contain a number of elements. Required: Describe FIVE elements of an unmodified auditor’s report. (05 marks) (ACCA F8 – December 2011) The International Auditing Standards (ISAs) prescribe a format for the auditor.s report and also provide guidance regarding its preparation and contents thereof. In the light of these guidelines you are required to briefly discuss the requirements in respect of the following: – Auditor’s signature (02 marks) – Date of report (03 marks) – Auditor’s address (01 mark) (ICMAP - 2015 March ) Who can sign the audit report under section 257(1) of the Companies Ordinance, 1984? (02 marks) (ICMAP - 2013 September ) LLOO 22:: FFOORRMMAATT OOFF UUNNMMOODDIIFFIIEEDD AAUUDDIITTOORR’’SS RREEPPOORRTT ((FFOORRMM 3355AA OOFF CCOOMMPPAANNIIEESS RRUULLEESS 11998855)):: Auditor’s Report to the Members We have audited the annexed balance sheet of Star Chemicals Limited (the Company) as at June 30, 2015 and the related profit and loss account, cash flow statement and statement of changes in equity together with the notes forming part thereof, for the year then ended and we state that we have obtained all the information and explanations which, to the best of our knowledge and belief, were necessary for the purposes of our audit. It is the responsibility of the company’s management to establish and maintain a system of internal control, and prepare and present the above said statements in conformity with the approved accounting standards and the requirements of the Companies Ordinance, 1984. Our responsibility is to express an opinion on these statements based on our audit. We conducted our audit in accordance with the auditing standards as applicable in Pakistan. These standards require that we plan and perform the audit to obtain reasonable assurance about whether the above said statements are free of any material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the above said 3 By: Muhammad Asif, ACA

- 4. Auditing – Study Notes Chapter 4 Auditor’s Report & Types of Opinions statements. An audit also includes assessing the accounting policies and significant estimates made by management, as well as, evaluating the overall presentation of the above said statements. We believe that our audit provides a reasonable basis for our opinion and, after due verification, we report that: (a) in our opinion, proper books of accounts have been kept by the company as required by the Companies Ordinance, 1984; (b) in our opinion: (i) the balance sheet and profit and loss account together with the notes thereon have been drawn up in conformity with the Companies Ordinance, 1984, and are in agreement with the books of accounts and are further in accordance with accounting policies consistently applied, except for the changes as stated in note # xxx with which we concur; (ii) the expenditure incurred during the year was for the purpose of the company’s business; and (iii) the business conducted, investments made and the expenditure incurred during the year were in accordance with the objects of the company; (c) in our opinion and to the best of our information and according to the explanations given to us, the balance sheet, profit and loss account, cash flow statement and statement of changes in equity together with the notes forming part thereof conform with approved accounting standards as applicable in Pakistan, and, give the information required by the Companies Ordinance, 1984, in the manner so required and respectively give a true and fair view of the state of the company’s affairs as at June 30, 2015 and of the profit (or loss), its cash flows and changes in equity for the year then ended; and (d) in our opinion, Zakat deductible at source under the Zakat and Ushr Ordinance, 1980 (XVIII of 1980), was deducted by the company and deposited in the Central Zakat Fund established under section 7 of that Ordinance(N–1). ABC & Co. August 13, 2015 Lahore Engagement partner: XYZ N – 1: Where no Zakat is deductible, substitute “in our opinion, no Zakat was deductible at source under the Zakat and Ushr Ordinance, 1980”. CONCEPT REVIEW QUESTION Under the Companies Ordinance 1984, while reporting on the financial statements the auditor has to express an opinion whether the financial statements give a true and fair view in all material respect. Briefly state the matters other than the above, on which the auditor is required to express his opinion as per the requirements of Section 255 of the Companies Ordinance, 1984. (08 marks) Study Tips You are advised to learn this report by heart. Or atleast, learn how the key words/phrases (in bold) are presented. In exam, you may be required to identify errors in a given report either omitting or wrongly including these words/phrases. 4 By: Muhammad Asif, ACA

- 5. Auditing – Study Notes Chapter 4 Auditor’s Report & Types of Opinions (CA Inter, Autumn 2007) Briefly describe the responsibilities of the management and the auditors as described in the audit report of a company given in Form 35A prescribed under the Companies Ordinance, 1984. (07 marks) (CA Inter -Spring 2007) PART B – AUDITOR’S OPINIONS ON FINANCIAL STATEMETNS LLOO 33:: MMAATTTTEERRSS TTOO BBEE EEVVAALLUUAATTEEDD BBEEFFOORREE EEXXPPRREESSSSIINNGG OOPPIINNIIOONN:: Before forming an opinion, auditor shall conclude: 1) Whether there is a misstatement or scope limitation. 2) Whether effect of misstatements or scope limitation is immaterial, material or pervasive. Auditor shall also evaluate following (before forming an opinion on financial statements): Whether financial statements present true and fair view (if fair presentation framework is used). Whether financial statements provide adequate disclosures. Whether accounting estimates are reasonable. Whether accounting policies are selected, applied and disclosed in accordance with AFRF. Whether accounting policies are consistently applied. Whether AFRF is adequately described. Auditor’s responsibilities if accounting policy is changed during the year: Auditor shall: a) mention the exception to consistent application of accounting policies in his report. b) refer to the note in financial statements where full disclosure is available. c) also state in his report whether he concurs with the change or not. CONCEPT REVIEW QUESTION What steps should auditors take before forming an opinion on the financial statements of a company. (08 marks) (CA Inter, Spring 1995) What is the responsibility of the external auditor regarding assessment and disclosure of a change in accounting policy made by his client. (05 marks) (CA Final, Summer 2003) LLOO 44:: WWHHAATT IISS MMEEAANNTT BBYY MMIISSSSTTAATTEEMMEENNTTSS AANNDD AAUUDDIITTOORR’’SS CCOOUURRSSEE OOFF AACCTTIIOONN IIFF HHEE IIDDEENNTTIIFFIIEESS AA MMIISSSSTTAATTEEMMEENNTT DDUURRIINNGG AAUUDDIITT:: Definition and Examples of Misstatements: Misstatement: Misstatement means difference between: amount, classification, presentation and disclosure reported in financial statements, and amount, classification, presentation and disclosure required to be reported in 5 By: Muhammad Asif, ACA

- 6. Auditing – Study Notes Chapter 4 Auditor’s Report & Types of Opinions accordance with AFRF. A misstatement in financial statements may arise in relation to following: (a) The appropriateness of the selected accounting policies: The selected accounting policies are not consistent with the AFRF. Financial statements do not represent underlying transactions and events in ‘true and fair’ manner. (b) The application of the selected accounting policies: Selected accounting policies are not applied consistently (e.g. between prior period or to similar items) and auditor does not concur with change. Selected accounting policies are not applied correctly (e.g. errors in application of accounting policies) (c) The appropriateness or adequacy of disclosures in the financial statements: Financial statements do not provide all disclosures required by AFRF. Disclosures in financial statements are not in accordance with AFRF. Financial statements do not provide the disclosures necessary to achieve fair presentation Auditor’s course of action/responsibilities if there is a misstatement: 1. Auditor accumulates all misstatements identified during the audit, whether material or immaterial. 2. In the light of identified misstatements, auditor considers their impact on audit strategy and audit plan (i.e. risk and audit procedures may be revised). 3. All misstatements should be communicated to management on timely basis and auditor should request to correct misstatements in financial statements. 4. If some of the misstatements are not corrected, auditor shall inquire management reasons for not correcting. 5. For uncorrected misstatements, auditor considers their materiality: a. If misstatement are immaterial (individually as well as in aggregate), auditor shall obtain written representation from management that uncorrected misstatements are immaterial. b. If misstatements are material or pervasive, auditor: shall communicate them to TCWG alongwith their effect on auditor’s opinion, and shall express qualified opinion (if effect is material) or adverse opinion (if effect is pervasive). Study Tips 1. Disclosure of misstatement in financial statements is not a substitute for correct accounting treatment. 2. There will be no misstatement in financial statements if management corrects it before the date of auditor’s report. Study Tips A misstatement can also be identified after end of the audit (i.e. after auditor’s report). Appropriate course of action in this case will be discussed in a later chapter.6 By: Muhammad Asif, ACA

- 7. Auditing – Study Notes Chapter 4 Auditor’s Report & Types of Opinions CONCEPT REVIEW QUESTION Your firm is concluding its audit of the financial statements of Turtle Ltd (Turtle) for the year ended 31 March 2015. The audit work has identified a number of misstatements, which are individually immaterial, in transactions and account balances recorded in the statement of profit or loss and statement of financial position. State the actions your firm should take in relation to the misstatements before reaching its audit opinion on the financial statements of Turtle. (03 marks) (ICAEW - 2015 September) LLOO 55:: WWHHAATT IISS MMEEAANNTT BBYY SSCCOOPPEE LLIIMMIITTAATTIIOONN AANNDD AAUUDDIITTOORR’’SS CCOOUURRSSEE OOFF AACCTTIIOONN IIFF HHEE FFAACCEESS AA SSCCOOPPEE LLIIMMIITTAATTIIOONN DDUURRIINNGG AAUUDDIITT:: Definition and Examples of Scope Limitation: Scope Limitation: Scope Limitation arises when auditor is unable to obtain sufficient appropriate audit evidence on which to base his opinion. A scope limitation on audit may arise in relation to following: (a) Circumstances beyond the control of entity: Accounting records of entity have been destroyed (e.g. by fire, computer virus or other natural disaster). Accounting records of entity have been seized by govt. authorities. (b) Circumstances relating to the timing or nature of auditor’s work: The timing of the auditor’s appointment is such that the auditor is unable to observe the counting of the physical inventories. Entity is required to use “equity method” of accounting for an associated entity, but auditor is unable to obtain evidence about financial information of associated entity. Substantive procedures alone do not provide sufficient evidence and entity’s internal controls are also weak. (c) Limitations imposed by management/entity: Management prevents the auditor from observing the counting of the physical inventory. Management prevents the auditor from requesting external confirmation of specific account balances. Management does not provide written representations to auditor. Auditor’s course of action/responsibilities if there is a scope limitation: If auditor is unable to perform a required procedure, Study Tip There will be no scope limitation if auditor is able to obtain evidence from alternative audit procedures in above cases. 7 By: Muhammad Asif, ACA

- 8. Auditing – Study Notes Chapter 4 Auditor’s Report & Types of Opinions Auditor shall discuss the matter with management and TCWG and shall try to obtain evidence by performing alternative audit procedures. If auditor is unable to obtain evidence from alternative procedures too, this will be a scope limitation. If scope limitation is material, auditor shall express Qualified Opinion. If scope limitation is pervasive, auditor shall withdraw from engagement if possible and practicable. If withdrawal is not possible and practicable, auditor shall express Disclaimer of opinion. If scope limitation is imposed by management, auditor shall also consider integrity of management (in addition to effect on report). If management lacks integrity: Auditor shall reassess reliability of representations by management. Risk of fraud will be increased. Auditor shall also consider withdrawal from engagement (as precondition for audit is not present). CONCEPT REVIEW QUESTION Discuss different types of limitations of scope that may result in a modified opinion giving suitable examples of each (You are not required to draft opinion). (05 marks) (CA Inter, Spring 2002) List down the situations that may result in limitation on scope of auditor’s work. (04 marks) (CA Inter -Autumn 2005) In peculiar circumstances the client restricts the auditors from performing certain audit procedures. Discuss how the auditor should deal with such restrictions if the same are imposed: (i) at the time of appointment (ii) during the audit. (08 marks) (CA Inter -Autumn 2007) LLOO 66:: WWHHAATT IISS MMEEAANNTT BBYY IIMMMMAATTEERRIIAALL,, MMAATTEERRIIAALL AANNDD PPEERRVVAASSIIVVEE:: Immaterial: An item which is not material, is called immaterial. Material: Misstatements, including omissions, are considered material if they, individually or in aggregate, could reasonably be expected to influence the economic decisions of users taken on the basis of the financial statements. Materiality depends on size as well as nature of misstatement. Pervasive: Pervasive effects on the financial statements are those that, in the auditor’s Study Tips A scope limitation can also be faced before acceptance of audit. Appropriate course of action in this case will be discussed in a later chapter. 8 By: Muhammad Asif, ACA

- 9. Auditing – Study Notes Chapter 4 Auditor’s Report & Types of Opinions judgments: i. Are not confined to specific accounts/elements of the financial statements; ii. If so confined, represent substantial proportion of the financial statements; or iii. In relation to disclosures, are fundamental to users’ understanding of the financial statements. CONCEPT REVIEW QUESTIONS What are the factors which make an item material? (04 marks) (CA Final, Summer 1997) Briefly explain the term ‘pervasive effects on the financial statements’. (04 marks) (CA Inter, Spring 2011) LLOO 77:: DDEECCIIDDIINNGG TTYYPPEE OOFF OOPPIINNIIOONN OONN FFIINNAANNCCIIAALL SSTTAATTEEMMEENNTTSS:: Which opinion to express in what Circumstances: There are four types of audit opinions, expressed by an auditor. Immaterial effect Material effect Pervasive effect Misstatement Unmodified Opinion Qualified Opinion Adverse Opinion Scope Limitation Disclaimer of Opinion* When to express Unmodified Opinion: Auditor shall express unmodified opinion when auditor has obtained sufficient appropriate audit evidence and concludes that financial statements are free from material misstatements. This opinion is expressed as “the financial statements give a true and fair view… in accordance with AFRF”. When to express Adverse Opinion: Auditor shall express adverse opinion when auditor has obtained sufficient appropriate evidence and concludes that there are misstatements in financial statements whose effect is pervasive. This opinion is expressed as “the financial statements do not give a true and fair view….. in accordance with AFRF”. When to express Disclaimer of Opinion: Auditor shall express disclaimer of opinion when: 1. auditor is unable to obtain sufficient appropriate evidence on which to base the opinion and concludes that possible effect of undetected misstatements in financial statements is pervasive, or 2. there are multiple uncertainties and auditor concludes that it is not possible to form an opinion due to these uncertainties. This opinion is expressed as “we do not express an opinion on the financial statements”. When to express Qualified Opinion: Auditor shall express qualified opinion when: 9 By: Muhammad Asif, ACA

- 10. Auditing – Study Notes Chapter 4 Auditor’s Report & Types of Opinions 1. auditor has obtained sufficient appropriate evidence and concludes that there are misstatements in financial statements whose effect is material (but not pervasive), or 2. auditor is unable to obtain sufficient appropriate evidence on which to base the opinion and concludes that possible effect of undetected misstatements in financial statements is material (but not pervasive). This opinion is expressed as “except for …….., the financial statements give a true and fair view… in accordance with AFRF”. CONCEPT REVIEW QUESTION Explain and distinguish between the following three types of modified audit opinions: (i) qualified opinion; (ii) adverse opinion; and (iii) disclaimer of opinion. (06 marks) (ICAEW – June 2011) Describe the situations in which an auditor issues a qualified audit opinion. (07 marks) (CA Inter -Spring 2009) (i) Explain the circumstances when a modification to the auditor's opinion is required. (02 marks) (ii) Describe the circumstances when an auditor will form a qualified opinion, an adverse opinion and a disclaimer of opinion. (05 marks) (ICMAP - 2016 February) Study Tips 1. Qualified Opinion, Adverse Opinion and Disclaimer of Opinion are collectively called “Modified Opinions”. 2. Whenever a Qualified/Adverse/Disclaimer of opinion is expressed, an additional paragraph (called basis for Qualified/Adverse/Disclaimer of opinion) is also included in audit report to explain nature of misstatement or scope limitation. 10 By: Muhammad Asif, ACA

- 11. Auditing – Study Notes Chapter 4 Auditor’s Report & Types of Opinions PART C – EMPHASIS OF MATTER AND OTHER MATTER PARAGRAPHS LLOO 88:: DDEECCIIDDIINNGG AABBOOUUTT ““EEMMPPHHAASSIISS OOFF MMAATTTTEERR”” AANNDD ““OOTTHHEERR MMAATTTTEERR”” PPAARRAAGGRRAAPPHHSS IINN AAUUDDIITT RREEPPOORRTT:: Emphasis of Matter Paragraph Other Matter Paragraph When to add paragraph in auditor’s report (Definition) Emphasis of Matter Paragraph is included if auditor considers it necessary to draw users’ attention to a matter which is disclosed in financial statement that is fundamental to users’ understanding of the financial statements, provided matter is not materially misstated in financial statements. Other Matter Paragraph is included if auditor considers it necessary to communicate a matter which is not required to be disclosed in financial statements but is relevant to users’ understanding of the audit, auditor’s report or auditor’s responsibilities, provided communication is not prohibited by law. Examples of Situations/ Circumstance a. If there is an exceptional litigation or regulatory action pending against company. b. If there are events and conditions causing doubt on going concern assumption. c. When a major catastrophe significantly affects entity’s financial statements. d. Early application of a new accounting standard that has a pervasive effect. a. When financial statements of prior period were not audited or were audited by another auditor. b. When auditor reports on more than one sets of financial statements for same entity and for same period (but with different frameworks). c. When auditor restricts distribution of auditor’s report. d. When “Other Information” is materially inconsistent with audited Financial Statements. Requirements for Presentation in Auditor’s Report Use the heading “Emphasis of Matter”. Show immediately after opinion paragraph. State briefly the matter being emphasized. State the reference of notes to accounts where full disclosure is available. State that auditor’s opinion is not qualified in respect of this matter. Use the heading “Other Matter”. Place immediately after Opinion Paragraph and Emphasis of Matter Paragraph (if any). Example of Draft “We draw your attention to Note X to the financial statements which describe the uncertainty related to the outcome of the lawsuit filed against the company by XYZ Company. Our opinion is not qualified in respect of this matter.” “The financial statements of ABC Company for the year ended December 31, 20X0 were audited by another auditor who expressed an unmodified opinion on those statements on March 31, 20X1.” Exam Tip 1. Emphasis of Matter paragraph is not a substitute of “Modified Opinion”, or “Disclosure required in financial statements”. 2. Auditor should avoid excessive use and excessive elaboration of Emphasis of Matter paragraph. 11 By: Muhammad Asif, ACA

- 12. Auditing – Study Notes Chapter 4 Auditor’s Report & Types of Opinions CONCEPT REVIEW QUESTION (i) Define an ‘Emphasis of Matter paragraph’ and explain, providing examples, the use of such a paragraph; (06 marks) (ii) Define an ‘Other Matter paragraph’ and explain, providing examples, the use of such a paragraph. (04 marks) Note: You are not required to produce draft paragraphs. (ACCA P7 – June 2010) Identify the situations in which an auditor may modify his report without affecting his opinion. Also explain how such a modification should be presented in the audit report. (07 marks) (CA Inter - Spring 2010) Specify the requirements of International Standards on Auditing while including an emphasis of matter paragraph in the auditor’s report. (04 marks) (ICMAP - 2013 September ) LLOO 99:: CCOOMMMMUUNNIICCAATTIIOONN WWIITTHH TTCCWWGG:: If the auditor expects to modify his report by including “Modified Opinion” or “Emphasis of Matter” or an “Other Matter” paragraph in his report, the auditor shall communicate with those charged with governance the circumstances that led to modification and the proposed wording of modification. This communication: 1. Enables auditor to communicate the intended modification and its reasons to TCWG on timely basis and also enables to obtain their concurrence. 2. Gives TCWG an opportunity to provide further information and explanation regarding the matter causing modification. 12 By: Muhammad Asif, ACA

- 13. Auditing – Case Studies Chapter 4 Auditor’s Report & Types of Opinions CHAPTER FOUR (CASE STUDIES) AUDITOR’S REPORT & TYPES OF OPINIONS AAPPPPEENNDDIIXX 11:: CCAASSEE SSTTUUDDYY RREELLAATTIINNGG TTOO IIDDEENNTTIIFFYYIINNGG EERRRROORRSS IINN AAUUDDIITTOORR’’SS RREEPPOORRTT:: Structure of the Case: An audit report with numerous errors will be given in question; and you will be required to identify errors from given auditor’s report. Suggested Approach to Solve: 1. Learn the key terms used in the audit report; also learn requirements regarding modification in opinion, emphasis of matter paragraph and other matter paragraph. 2. Use element-wise format to comment on report. 3. If something is omitted, state the words/phrase/name of para which is omitted. 4. If something is wrong, write error alongwith explanation (i.e. correct treatment). 5. DO NOT redraft report; otherwise you will get zero marks. If there is modified opinion in the report: 1. Evaluate whether the matter requires qualified opinion or adverse opinion or disclaimer of opinion. 2. Basis for modified opinion paragraph and modified opinion paragraph should be separate. 3. Management’s point of view is not given in Basis for Modified Opinion Paragraph. In the absence of information, assume that Auditor’s Report is to be drafted/corrected in accordance with “Form 35A of Companies Rules 1985”. Model Case Study From Examination Questions: Case Study 1: Al-Badr & Company, Chartered Accountants, have conducted the statutory audit of the financial statements of Al-Qasim Limited, a listed company, for the year ended June 30, 2010 under the requirements of the Companies Ordinance, 1984. The job in charge has drafted the following audit report: Auditors’ Report to the Directors We have audited the annexed balance sheet of Al-Qasim Limited as at June 30, 2010 and the related profit and loss account and statement of changes in equity together with the notes forming part thereof, for the year then ended and we state that we have obtained all the information and explanations which, to the best of our knowledge and belief, were necessary for the purposes of our audit. We conducted our audit in accordance with the auditing standards. These standards require that we plan and perform the audit to obtain reasonable assurance about whether the above said statements are free of any material misstatement. An audit includes examining evidence supporting the amounts and disclosures in the above said statements. An audit also includes assessing the accounting policies and all estimates made by management, as well as, evaluating the overall presentation of the above said statements. We believe that our audit provides a reasonable basis for our opinion and, after due verification, we report that: 1 By Muhammad Asif, ACA

- 14. Auditing – Case Studies Chapter 4 Auditor’s Report & Types of Opinions (a) in our opinion: (i) the balance sheet and profit and loss account together with the notes thereon have been drawn up in conformity with the Companies Ordinance, 1984, and are in agreement with the books of account and further in agreement with accounting policies consistently applied; (ii) the expenditure incurred during the year was for the purpose of the company’s business; and (iii) the business conducted, investments made and the expenditure incurred during the year were in accordance with the objects of the company; (b) in our opinion and to the best of our information and according to the explanations given to us, the balance sheet, profit and loss account and statement of changes in equity together with the notes forming part thereof conform with International Financial Reporting Standards, and give the information required by the Companies Ordinance, 1984, in the manner so required and respectively give a true and fair view of the state of the company’s affairs as at June 30, 2010 and of the profit and changes in equity for the year then ended; and (c) in our opinion, no zakat was deductible at source under the Zakat and Ushr Ordinance, 1980 (XVIII of 1980). Al-Badr & Company Chartered Accountants Karachi Dated: September xx, 2010 Required: Identify and explain (where necessary) the errors in the above audit report. (Note: You are not required to redraft the report.) (12 marks) (CA Inter, Autumn 2010) Solution: Element Error/Omission Addressee Word “Directors” should be replaced by word “Members”. Introductory Paragraph “Cash flow statement” is omitted from complete set of financial statements. Management’s Responsibility Paragraph This paragraph is omitted from report. Auditor’s Responsibility Paragraph Sentence “Our responsibility is to express an opinion on these statements based on our audit” is omitted. Words “as applicable in Pakistan” are omitted after the words “We conducted our audit in accordance with the auditing standards”. Phrase “on a test basis” is omitted from description of audit. Words “all estimates” should be replaced by words “significant estimates”. Opinion Paragraph Sentence “in our opinion, proper books of accounts have been kept by the company as required by the Companies Ordinance, 1984;”, is omitted. “cash flow statement” is omitted from complete set of financial statements. Words “conform with International Financial Reporting Standards” should be replaced by words “conform with approved accounting standards as applicable in Pakistan”. True and fair view of “cash flows” is omitted Date “xx” should be replaced by a real date of the month of September. Name Name of engagement partner is omitted. 2 By Muhammad Asif, ACA

- 15. Auditing – Case Studies Chapter 4 Auditor’s Report & Types of Opinions AAPPPPEENNDDIIXX 22:: CCAASSEE SSTTUUDDYY RREELLAATTIINNGG TTOO IIDDEENNTTIIFFYYIINNGG IIMMPPAACCTT OONN AAUUDDIITTOORR’’SS OOPPIINNIIOONN//RREEPPOORRTT:: Structure of the Case: You will be given many short situations, and requirement will be to explain implication of each situation on auditor’s opinion/report (even if all situations relate to same client). Suggested Approach to Solve: Step # 1: Explain whether the given situation is a Misstatement or Scope Limitation, or matter affecting Additional Opinions, or matter affecting Emphasis of Matter/Other Matter Paragraph. Any wrong argument by management in the question is to be criticized and corrected. (A list of frequently examined questions is given in Appendix – 3 alongwith explanation). Step # 2: (only in case of misstatement or scope limitation) State whether effect of misstatement/scope limitation is Immaterial, Material or Pervasive. Two situations are possible in exam in this regard: It will be mentioned in question (i.e. either question states effect is material/pervasive, or profit is given from which materiality can be calculated suing Rule of Thumb i.e Materiality = 5% of Profit) If it is not mentioned in question, cover Both situations. (words “significant” or “major” in question indicate to cover both situations). Step # 3: State effect on opinion/report in 3 stages: a) State type of opinion on financial statements. If opinion is modified, also include “Basis for Qualified/Adverse/Disclaimer of Opinion paragraph” in report. b) If any of 5 additional opinions (e.g. change in accounting policy, proper books of accounts, deduction and deposit of Zakat.) is to be modified, state this. c) If the situation requires inclusion of emphasis of matter paragraph (e.g. there is material uncertainty) or other matter paragraph (e.g. prior year financial statements audited by another auditor), mention this stating the information to be included in the paragraph. If it is an open-end question (i.e. question without specific requirement), you can discuss all possibilities however impact on report to be discussed only for that possibility which modifies auditor’s report (e.g. when financial statements are not amended). Suggested Marking Scheme for a 5-marks’ Case on Reporting 1 – 2 marks for explanation of case. 1 mark for calculation of materiality (if relevant). 1 mark for stating opinion on financial statements. 1 marks for mentioning basis for modified opinion paragraph. 1 mark for stating impact on additional opinion or EOM/OM (if relevant). 3 By Muhammad Asif, ACA

- 16. Auditing – Case Studies Chapter 4 Auditor’s Report & Types of Opinions Model Case Study From Examination Questions: CASE STUDY ON DECIDING TYPE OF OPINION– FIRST EXAMPLE Case Study 1: Identify with justification how the following items would effect the auditors opinion (a) The auditors have not been able to physically verify the inventory and have to rely on management representation letter. The inventory constitutes a material portion of the current assets of the company. (b) The company has determined the useful life of vehicles to be 10 years over which they are depreciated. The auditors believe that this useful life is not justified. (c) 3% of the total purchases are authorized by the purchase officer rather than the purchase manager. (d) The company has labour problems. It has lost a major franchise and government has passed legislation against its main product. (e) The Company is not complying with the provisions of IAS-2 Inventories for valuation of inventory. The company has misclassified capital expenditure on account of machinery as revenue expenditure. The company has not disclosed one of its long term loans in the financial statements. (10 marks) (PIPFA, Winter 2008) Solution: (a) This is a scope limitation if auditor is unable to obtain evidence from alternative procedures too. Management representation is not a sufficient appropriate audit evidence. Auditor shall express Qualified Opinion on financial statements (as effect is material). Auditor shall also include Basis for Qualified Opinion paragraph immediately before opinion paragraph in his report to describe nature of scope limitation. (b) This is a misstatement in financial statements as estimate is not reasonable. Auditor shall express qualified opinion on financial statements (if effect is material) or adverse opinion (if effect is pervasive). Auditor shall also include Basis for Qualified/Adverse Opinion paragraph immediately before opinion paragraph in his report to describe nature of misstatement. (c) This is a weakness in internal control of company which does not affect audit report as no opinion is required regarding operating effectiveness of internal controls. Auditor shall express unmodified opinion on financial statements. (d) These are multiple uncertainties which create doubt on entity’s ability to continue as going concern (not misstatements if these uncertainties are adequately disclosed in financial statements). As there are multiple significant uncertainties, auditor shall express disclaimer of opinion instead of Emphasis of Matter Paragraph. Auditor shall also include Basis for Disclaimer of Opinion paragraph immediately before opinion paragraph in his report to describe nature of multiple significant uncertainties. (e) These are misstatement in financial statements as company is not complying with various requirements of IFRS. Effect is pervasive as it is not confined to single element of financial statements. Auditor shall express adverse opinion on financial statements. Auditor shall also include Basis for Adverse Opinion paragraph immediately before opinion paragraph in his report to describe nature of misstatements. 4 By Muhammad Asif, ACA

- 17. Auditing – Case Studies Chapter 4 Auditor’s Report & Types of Opinions CASE STUDY ON DECIDING TYPE OF OPINION– SECOND EXAMPLE Case Study 2: The following situations have arisen on different clients being audited by your firm. The year-end in each instance is 31 December 2013. (i) During the year Iron Limited has changed its policy for valuation of intangible assets from Cost Model to Revaluation Model. (03 marks) (ii) Due to fire in the record room of Titanium Limited, all the records and backup related to the fixed assets, trade debtors and stocks were destroyed and you are unable to perform audit procedures for verification of the balances. (03 marks) (iii) During the planning stage of Coal Limited it was noted that the system of internal controls of the company is weak. This aspect was taken into consideration in determining the nature, timing and extent of the audit procedures. (02 marks) (iv) One of the plants of Uranium Limited was destroyed subsequent to year-end. Appropriate disclosure thereof has been made in the financial statements. (02 marks) Required: Discuss the impact of each of the above matters on the audit report. (CA Inter, Spring 2014) Solution: (i) This is a change in accounting policy which does not affect auditor’s opinion. However, auditor shall: a) Mention the exception to consistent application of accounting policies in his report. b) Refer to the note in financial statements where full disclosure is available. c) State in his report whether he concurs with the change or not. (ii) 1. This is a scope limitation. 2. Effect is pervasive as it is not confined to single element of financial statements. 3. Auditor shall express Disclaimer of opinion on financial statements. 4. Auditor shall also include a basis for disclaimer of opinion paragraph immediately before opinion paragraph to explain nature of scope limitation. 5. Auditor shall also modify his opinion, as required by Form 35A, by stating that “proper books of accounts have not been kept in respect of this matter”. (iii) This is a weakness in internal control of company which does not affect audit report as no opinion is required regarding operating effectiveness of internal controls. Auditor shall express unmodified opinion on financial statements. (iv) 1. As per IAS – 10, if major fixed assets have been destroyed/impaired because of events after the year, it is a non-adjusting event requiring disclosure in financial statements. As adequate disclosure has been given, this is not a misstatement in financial statements. 2. Auditor shall express unmodified opinion on financial statements. 3. As matter is fundamental for users’ understanding of financial statements, auditor shall draw users’ attention to this matter by including Emphasis of Matter Paragraph in his report (immediately after opinion paragraph) which shall: o State brief description of the matter. o Refer to the note in financial statements where full disclosure is available. o State that auditor’s opinion is not modified in respect of this matter. 5 By Muhammad Asif, ACA

- 18. Auditing – Case Studies Chapter 4 Auditor’s Report & Types of Opinions Examiners’ Comments: (i) Very few candidates identified the need to mention the exception to the consistent application of accounting policies and whether or not the auditor concurred to the exception. Instead, they stated that an emphasis of matter paragraph would be required. Some candidates wrote about the accounting treatment of intangible assets under the Cost and Revaluation model which was not required. (ii) Most candidates correctly mentioned that a disclaimer of opinion would be required under the circumstances; however, many among them could not identify that the auditor would also be required to report that proper books of accounts as required by the Companies Ordinance, 1984 have not been maintained. (iii) Most of the candidates did not appreciate the fact that weaknesses in controls are not reported in the audit report. Most of them advised some sort of modification. (iv) About half the candidates correctly identified the need of an emphasis of matter paragraph which should give reference to the note in the financial statements where the matter was disclosed. The others had little idea and resorted to guesswork which mostly resulted in irrelevant answers. Some candidates went into details regarding the going concern assumption. Such a discussion was not required. CASE STUDY ON DECIDING TYPE OF OPINION– THIRD EXAMPLE Case Study 3: Described below are situations which have arisen in four audits. The year end in each case is 31 March 2002. Mercury Ltd On 21 March 2002, the Inland Revenue commenced a major enquiry into all aspects of the tax affairs of the company. Until the enquiry is completed, it is not possible to estimate, with any reasonable degree of certainty, any ultimate liability which may fall upon the company. Consequently, no liability in respect of this matter has been included in the financial statements. The directors have included a note to the accounts explaining the situation. Pluto Ltd Included in the balance sheet at 31 March 2002 are fixed assets at cost of £2.5 million which have been constructed by the company during the year. The costs include own labour capitalised of £180,000. The labour costs are based on the directors’ estimates of time spent by employees on the construction work, which are unsupported by time records. There are no satisfactory audit procedures to confirm that labour costs have been appropriately capitalised. The pre-tax profit of Pluto Ltd for the year ended 31 March 2002 is £650,000. Jupiter Ltd On 16 May 2002 a liquidator was appointed at Saturn Ltd, a major customer of Jupiter Ltd. The balance due from Saturn Ltd on 31 March 2002 was £242,000. In addition, work in progress included £520,000, the cost of customised work relating to Saturn Ltd. The directors refuse to make a provision for the debt on the grounds that the liquidator was appointed after the balance sheet date. They also refuse to make any provision in respect of the work in progress because they are planning to convert it to finished goods at an estimated cost of completion of £260,000 as another customer has agreed to buy it for £700,000. Final audit materiality has been set at £250,000 for Jupiter Ltd for the year ended 31 March 2002. Requirement In respect of each of the situations outlined above, reach a conclusion on whether or not you would qualify your audit report. Give reasons for your conclusion and describe the effect on your audit report. (12 marks) (ICAEW – June 2002) 6 By Muhammad Asif, ACA

- 19. Auditing – Case Studies Chapter 4 Auditor’s Report & Types of Opinions Solution: Mercury Ltd: As per IAS – 37, if a regulatory action is pending against company at year end, and amount of obligation is uncertain, it should be disclosed as contingency. If disclosure in financial statements is adequate, there is no misstatement. Auditor shall express unmodified opinion on financial statements. However, auditor shall include Emphasis of Matter Paragraph in his report (immediately after opinion paragraph) which shall: o State this matter which is fundamental for users’ understanding of financial statements. o Refer to the note in financial statements where full disclosure is available. o State that auditor’s opinion is not modified in respect of this matter. If disclosure in financial statements is not adequate, there is misstatement. Auditor shall express qualified opinion on financial statements (if effect is material) or adverse opinion (if effect is pervasive). Auditor shall also include Basis for Qualified/Adverse Opinion paragraph immediately before opinion paragraph in his report to describe nature of misstatement. Pluto Ltd: This is a scope limitation on audit. Effect is material as amount of scope limitation 180,000 is greater than materiality level determined using rule of thumb 32,500 (650,000 * 5%). Auditor shall express Qualified Opinion on financial statements. Auditor shall also include a "Basis for Qualified Opinion Paragraph" (immediately before opinion paragraph) to describe the nature of scope limitation. Auditor shall also qualify his opinion, as required by Form 35A, by stating that proper books of accounts have not been kept in respect of this matter. Jupiter Ltd: As per IAS – 10, subsequent bankruptcy of debtor and reduction of NRV below cost after the year-end are adjusting events. If provision is not recorded for unrecoverable debt, or write-down of inventory below cost is not recorded, these will be misstatements in financial statements. Amount of misstatement of debtor 242,000 is less than materiality level 250,000, therefore it is individually immaterial. Amount of misstatement of inventory 80,000 (Cost 520,000 – NRV 440,000 i.e. 700,000 – 260,000) is less than materiality level 250,000, therefore it is also individually immaterial. However, when aggregated, these amounts become material (322,000 = 242,000 + 80,000). Auditor shall express Qualified Opinion on financial statements. Auditor shall also include Basis for Qualified Opinion paragraph immediately before opinion paragraph in his report to describe nature of misstatements. Examiners’ Comments: Weaker candidates were unable to distinguish between the two grounds for qualification ie disagreement and limitation in scope. The most common omission was the failure to appreciate that, in the case of Pluto Ltd, there would be a requirement to consider whether proper accounting records had been maintained. The most common misunderstanding was that, in the case of Jupiter Ltd, although the amount owed by the customer in liquidator ship and the amount needed to reduce stock to its NRV were individually immaterial when aggregated they were material. 7 By Muhammad Asif, ACA

- 20. Auditing – Case Studies Chapter 4 Auditor’s Report & Types of Opinions AAPPPPEENNDDIIXX 33:: EEXXPPLLAANNAATTIIOONN OOFF FFRREEQQUUEENNTTLLYY AASSKKEEDD CCAASSEESS:: Category 1 There is misstatement in financial statements. Inventory becomes physically damage or technically obsolete: IAS – 2 requires that inventories are measured at lower of cost and net realizable value. Appropriate depreciation or impairment loss on fixed assets is not recorded: IAS – 16 requires that depreciation should be recorded on fixed assets when they are available for use. Selective revaluation of fixed assets: IAS – 16 requires policy of revaluation to be applied to entire class of non-current assets. If revaluation exercise cannot be completed before auditor’s report, revaluations recorded so far should be reversed and should be stated at cost. Research Cost is recognized as Intangible Asset: IAS – 38 requires to capitalize development cost only if strict criteria is met. Related party transactions are not disclosed in financial statements: IAS – 24 requires management to disclose adequately related party relationships and transactions in financial statements. Litigations/Regulatory Action started before year end: IAS – 37 states that if a litigation or regulatory action/investigation is pending against company at year-end, and: outflow of resources is probable, a provision should be recorded, or outflow of resources is possible, disclose it as a contingency, or outflow of resources is uncertain or amount cannot be measured reliably, disclose it as a contingency. However, auditor shall also include Emphasis of Matter Paragraph, if litigation or regulatory action is material. An Uncertainty casting doubt on going concern (whether created before or after year end): As per IAS – 1, if there is an uncertainty which cast significant doubt on entity’s ability to continue as a going concern (e.g. cash flow difficulties, major product failure, loss of major franchise/license/customer/supplier), it should be disclosed in the financial statements. Auditor shall also include Emphasis of Matter Paragraph if there is a material uncertainty. However, if there are multiple uncertainties, auditor shall express disclaimer of opinion. Category 2 There are Subsequent events requiring adjustment. Bankruptcy of debtor after year end: As per IAS – 10, subsequent bankruptcy of debtor after the year-end is an adjusting event. Provision should be recorded for unrecoverable debt. 8 By Muhammad Asif, ACA

- 21. Auditing – Case Studies Chapter 4 Auditor’s Report & Types of Opinions Notes: If some customized inventory is held on behalf of bankrupt customer, it will also be written- down to NRV. Similarly, if some specialized equipment is held on behalf of bankrupt customer, impairment loss will also be recorded on such equipment. Sale of inventory below cost after year end: As per IAS – 10, sale of inventory below cost after the year-end is an adjusting event. Inventory should be written down to NRV. Decision of Litigations after year-end: As per IAS – 10, settlement of a court case after the year-end is an adjusting event. Category 3 There are Subsequent events requiring disclosure. Major fixed assets have been destroyed/impaired (e.g. due to fire, natural disaster): As per IAS – 10, if major fixed assets have been destroyed/impaired because of events after the year, it is a non-adjusting event requiring disclosure in financial statements. However, auditor shall also include Emphasis of Matter Paragraph. Litigations/regulatory action started after year end: If a litigation is initiated against company after the year (because of events after the year), IAS – 10 states that it is a non-adjusting event and requires to disclose it in financial statements. However, auditor shall also include Emphasis of Matter Paragraph, if there is material litigation or regulatory action. Restructuring (due to closure of factory and redundancies): IAS – 10 states that a restructuring announced after year end is a non-adjusting event requiring disclosure in financial statements. However, auditor shall also include Emphasis of Matter Paragraph. Bank Guarantee issued: If significant guarantee has been issued after the year, IAS – 10 states that it is a non-adjusting event requiring disclosure in financial statements. Exam Tip If disclosure is given in financial statements, check whether to discuss if disclosure is adequate/ appropriate. Exam Tip Provision for Restructuring is recorded only when entity has announced the plan or has started to implement it. A mere board decision is not sufficient to record a provision or disclosure. 9 By Muhammad Asif, ACA

- 22. Auditing – Case Studies Chapter 4 Auditor’s Report & Types of Opinions Category 4 There is scope limitation on audit. If auditor is unable to physically verify the inventory: This will be a scope limitation if auditor is unable to obtain evidence from alternative procedures too. If books of accounts are destroyed by fire (or evidence supporting expenses/assets is not available): This is a scope limitation if auditor is unable to obtain evidence from alternative procedures too. Auditor shall also modify his opinion, as required by Form 35A, by stating that proper books of accounts have not been kept in respect of this matter. If management does not provide written representation required by auditor. If management does not provide written representation, it will be scope limitation on audit. Auditor shall also qualify his opinion, as required by Form 35A, by stating that he has not obtained all the information and explanation which were necessary for the purpose of audit. Category 5 There is a matter affecting additional opinions required by Law Change in Accounting Policy: If an accounting policy is changed, auditor shall: a) Mention the exception to consistent application of accounting policies in his report. b) Refer to the note in financial statements where full disclosure is available. c) State in his report whether he concurs with the change or not. Examples of changes in Accounting Policy Valuation method of PPE changed from Cost to Revaluation Model (or vice-versa) Valuation method Intangible Assets changed from Cost to Revaluation Model (or vice-versa) Valuation of Inventory changed from FIFO to Average Cost (or vice-versa) Valuation of Investments changed from fair value to cost (or vice-versa). (remember change in depreciation method is a change in estimate, not a change in policy) Expenditure incurred during the year was not for the purpose of the company’s business Auditor shall state in his report that expenditure was not for the purpose of the company’s business. Exam Tips 1. If fire burns accounting records, it may cause scope limitation and modification regarding proper books of accounts. However, if fire burns assets, it may cause emphasis of matter paragraph. 2. If there is scope limitation, check whether to discuss if evidence can be obtained from alternative procedures. 10 By Muhammad Asif, ACA

- 23. Auditing – Case Studies Chapter 4 Auditor’s Report & Types of Opinions Investments/Expenditures were not in accordance with the objects of the company. Auditor shall state in his report that investment/expenditure was not in accordance with the objects of the company. Zakat deductible was not deducted or not deposited by the company. Auditor shall also state in his report that Zakat deductible at source has not been deducted by company, or has not been deposited by the company in central zakat fund. Category 6 Matters requiring “Other Matter Paragraph” When financial statements of prior period were audited by another auditor. Auditor shall add “Other Matter Paragraph” in the audit report, immediately after the opinion paragraph and Emphasis of Matter Paragraph (if any), in which auditor shall state: 1. That financial statements of company for last year were audited by another auditor 2. Type of opinion expressed by predecessor auditor. (If opinion of predecessor auditor is modified, auditor should also explain reason for modification in this paragraph) 3. Date when opinion was expressed by predecessor auditor. If other information (e.g. Directors’ Report, or Supplementary information) is materially inconsistent with financial statements: Auditor shall: Discuss the matter with management to determine whether the audited financial statements or the other information needs to be corrected. If financial statements need correction, and management refuses to correct financial statements, auditor shall modify his opinion. If other information needs correction, and management refuses to correct financial statements, there is no ground for qualification of opinion on financial statements. However, auditor should: o communicate the matter to TCWG, and o include Other Matter Paragraph in audit report describing material inconsistency or withhold report or withdraw from engagement. Category 7 Matters NOT affecting audit report. Following matters do not affect audit report in any manner: Weakness in Internal Control. Immaterial misstatements or scope limitations. Change in accounting estimates (unless change is unreasonable). Use of internal auditor Use of expert (unless work of expert requires modification in report) Use of component auditor (unless work of component auditor requires modification in report) 11 By Muhammad Asif, ACA