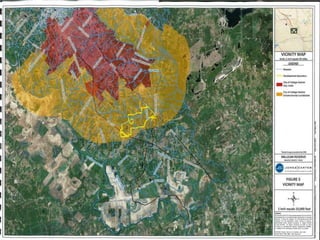

The developer is seeking conditional consent from the city to create up to five municipal utility districts (MUDs) in the city's extraterritorial jurisdiction to develop a 2,354 acre property. The proposed development includes 1,900 single family homes, 258 acres of commercial space, 33 acres of civic/institutional uses, and 1,062 acres of conservation space, with a total projected value of $974 million. City staff and the planning and zoning commission recommend approving the request subject to conditions regarding infrastructure, bonding, development agreements, transparency, and compliance with the comprehensive plan.