Red Company Chapter 4 - Profitability, Efficiency and Leverage Ratios

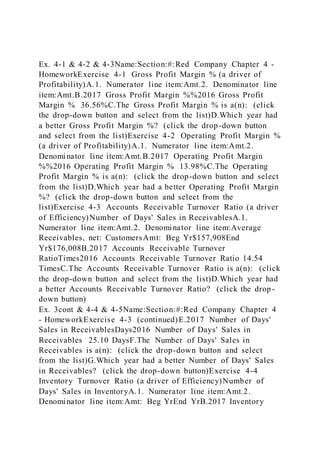

- 1. Ex. 4-1 & 4-2 & 4-3Name:Section:#:Red Company Chapter 4 - HomeworkExercise 4-1 Gross Profit Margin % (a driver of Profitability)A.1. Numerator line item:Amt.2. Denominator line item:Amt.B.2017 Gross Profit Margin %%2016 Gross Profit Margin % 36.56%C.The Gross Profit Margin % is a(n): (click the drop-down button and select from the list)D.Which year had a better Gross Profit Margin %? (click the drop-down button and select from the list)Exercise 4-2 Operating Profit Margin % (a driver of Profitability)A.1. Numerator line item:Amt.2. Denominator line item:Amt.B.2017 Operating Profit Margin %%2016 Operating Profit Margin % 13.98%C.The Operating Profit Margin % is a(n): (click the drop-down button and select from the list)D.Which year had a better Operating Profit Margin %? (click the drop-down button and select from the list)Exercise 4-3 Accounts Receivable Turnover Ratio (a driver of Efficiency)Number of Days' Sales in ReceivablesA.1. Numerator line item:Amt.2. Denominator line item:Average Receivables, net: CustomersAmt: Beg Yr$157,908End Yr$176,008B.2017 Accounts Receivable Turnover RatioTimes2016 Accounts Receivable Turnover Ratio 14.54 TimesC.The Accounts Receivable Turnover Ratio is a(n): (click the drop-down button and select from the list)D.Which year had a better Accounts Receivable Turnover Ratio? (click the drop- down button) Ex. 3cont & 4-4 & 4-5Name:Section:#:Red Company Chapter 4 - HomeworkExercise 4-3 (continued)E.2017 Number of Days' Sales in ReceivablesDays2016 Number of Days' Sales in Receivables 25.10 DaysF.The Number of Days' Sales in Receivables is a(n): (click the drop-down button and select from the list)G.Which year had a better Number of Days' Sales in Receivables? (click the drop-down button)Exercise 4-4 Inventory Turnover Ratio (a driver of Efficiency)Number of Days' Sales in InventoryA.1. Numerator line item:Amt.2. Denominator line item:Amt: Beg YrEnd YrB.2017 Inventory

- 2. Turnover RatioTimes2016 Inventory Turnover Ratio 4.73 TimesC.The Inventory Turnover Ratio is a(n): (click the drop- down button and select from the list)D.Which year had a better Inventory Turnover Ratio? (click the drop-down button)E.2017 Number of Days' Sales in InventoryDays2016 Number of Days' Sales in Inventory 77.17 DaysF.The Number of Days' Sales in Inventory is a(n): (click the drop-down button and select from the list)G.Which year had a better Number of Days' Sales in Inventory? (click the drop-down button)Exercise 4-5 Accounts Payable Turnover RatioNumber of Days' Purchases in Accounts PayableA.1. Numerator line item:Amt.2. Denominator line item:Amt: Beg YrEnd YrB.2017 Accounts Payable Turnover RatioTimes2016 Accounts Payable Turnover Ratio 9.29 Times Ex. 5cont & 4-6Name:Section:#:Red Company Chapter 4 - HomeworkExercise 4-5 (continued)C.The Accounts Payable Turnover Ratio is a(n): (click the drop-down button and select from the list)D.Which year had a better Accounts Payable Turnover Ratio? (click the drop-down button)E.2017 Number of Days' Purchases in Accounts PayableDays2016 Number of Days' Purchases in Accounts Payable 39.29 DaysF.The Number of Days' Sales Purchases in Accounts Payable is a(n): (click the drop-down button)G.Which year had a better Number of Days' Purchases in Accounts Payable? (click the drop-down button)Exercise 4-6 Cash-to-Cash CycleA.Cash-to-Cash Days for 2017 and 20162017 Days2016 DayslessNet Number of Days Cash is Invested in InventoryplusCash-to-Cash DaysB.Discussion of Toro's Cash-to-Cash Days for 2017 compared to 2016 Ex. 4-7 & 4-8Name:Section:#:Red Company Chapter 4 - HomeworkExercise 4-7 Fixed Asset Turnover Ratio (a driver of Efficiency)A.1. Numerator line item:Amt.2. Denominator line item:Amt: Beg YrEnd YrB.2017 Fixed Asset Turnover RatioTimes2016 Fixed Asset Turnover Ratio 10.70 TimesC.The Fixed Asset Turnover Ratio is a(n): (click the drop-down button and select from the list)D.Which year had a better Fixed

- 3. Asset Turnover Ratio? (click the drop-down button and select from the list)Exercise 4-8 Debt% (an indicator of Leverage at year-end)A.1. Schedule to calculate the numerator, Total Liabilities for 2017:Total Current LiabilitiesLong-term debt, less current portionDeferred revenueDeferred income taxesOther long-term liabilitiesTotal Liabilities2. Denominator line item:Amt.B.2017 Debt %%2016 Debt % 60.27%C.The Debt % is a(n): (click the drop-down button and select from the list)D.Which year had more financial leverage? (click the drop- down button and select from the list) Ex. 4-9 & 4-10Name:Section:#:Red Company Chapter 4 - HomeworkExercise 4-9 Debt-to-Equity Ratio (an indicator of Leverage at year-end)A.1. Numerator line item:Total Liabilities answer to Exercise 4-8 A.1Amt.2. Denominator line item:Amt.B.2017 Debt-to-Equity RatioTimes2016 Debt-to- Equity Ratio 1.52 TimesC.The Debt-to-Equity Ratio is a(n): (click the drop-down button and select from the list)D.Which year had more financial leverage? (click the drop-down button and select from the list)Exercise 4-10 Times Interest Earned Ratio (an indicator of interest coverage)A.1. Schedule to calculate the numerator, Earnings before Interest and Taxes for 2017:Net EarningsplusplusEarnings before Interest and Taxes2. Denominator line item:Amt.B.2017 Times Interest Earned RatioTimes2016 Times Interest Earned Ratio 18.09 TimesC.The Times Interest Earned Ratio is a(n): (click the drop-down button and select from the list)D.Which year had a better Times Interest Earned Ratio? (click the drop-down button and select from the list) Lists/ up-arrow indicator2016/ down-arrow indicator2017/ / up-down arrow indicator RED COMPANY 35 Chapter 4

- 4. Drilling Down Into the DuPont Analysis Profitability – Efficiency – Leverage To begin this chapter, open the Red Company model 1-Red Company 15e if it is not already open on your computer. .7-DPont. tab In the last chapter, you learned how the Return on Equity % is driven by: -to-Equity Ratio Leverage In this chapter, you will “drill down” into each of these three elements of Return on Equity %. You will be adding thirteen new tools to your financial statement analysis tool-kit. These new tools will enable you to analyze: Profitability, Efficiency, and Leverage. I T A B I L I T Y I N D I C A T O R S Profitability is the ability of a company to have some number of cents left over from each $1 of Net Sales after covering all expenses. As you can see on the .7- DPont. tab, Net Profit Margin % measures Profitability and is the first ratio in the DuPont Analysis. Below you will add two

- 5. additional Profitability ratios to your tool-kit. These two new ratios will measure Profitability at two different points above Net Income on the Income Statement. Thus these two new ratios will provide additional insight into what is driving the Net Profit Margin %, which is measuring Profitability at the Net Income level on the Income Statement. -Prof. tab Gross Profit Margin % The Gross Profit Margin % measures how many cents of each $1 of Net Sales are left after deducting Cost of Goods Sold. RC’s Gross Profit Margin % of 43.00% indicates that there are 43.00 cents of each $1 of Net Sales left after deducting 57.00 cents for Cost of Goods Sold. You have previously seen this 43.00%. -IS tab The 43.00% is the Gross Profit percent in the % of Net Sales column. 36 RED COMPANY Chapter 4 – Profitability – Efficiency – Leverage Look at RC’s Income Statement and observe that the 43.00 cents of Gross Profit must cover:

- 6. hopefully still have a few cents left over for Net Income. -Prof. tab -arrow after Gross Profit Margin %—indicating that a higher value is always better. A higher value would indicate that fewer pennies are being consumed by Cost of Goods Sold and that Gross Profit is increased. The Gross Profit Margin % is an important Profitability measure for merchandising and manufacturing companies. For merchandisers and manufacturers, the Gross Profit Margin % measures the combined effectiveness of: In summary, Gross Profit Margin % shows how many cents of each $1 of Net Sales is left after deducting Cost of Goods Sold. Operating Profit Margin %

- 7. The Operating Profit Margin % measures how many cents of each $1 of Net Sales are left after deducting operating expenses from Gross Profit. RC’s Operating Profit Margin % of 12.33% indicates that there are 12.33 cents of each $1 of Net Sales left after deducting operating expenses from the 43.00 cents of Gross Profit. You have previously seen this 12.33%. Annual Report Project Companies Look at the Gross Profit Margin % for the ARP companies. _____________________________ rgin%? _____________________________ not apply? _____________________________ companies? _____________________________________________________ ________________ As you can see from the ARP companies, the Gross Profit Margin % will vary significantly depending on the company’s industry.

- 8. Chapter 4 – Profitability – Efficiency – Leverage RED COMPANY 37 -IS tab The 12.33% is the Operating Income percent in the % of Net Sales column. Observe that on RC’s Income Statement there are two operating expense line items, Selling & General Expenses and Depreciation Expense. The number of operating expense line items, and the titles of those operating expense line items, will vary by the type of company and by how much detail the company chooses to show on its Income Statement. The Operating Profit Margin % measures how many cents per $1 of Net Sales is generated from operating the business. This is a measure of operating profitability. Notice on the Income Statement that the 12.33% is before deducting Interest Expense and before deducting Provision for Income Taxes. Interest Expense is the result of how management chooses to finance (debt vs. equity) not operate the company. Provision for Income Taxes (an expense) is the result of tax rates (government policy) and Pre-Tax Income. Thus you can see that the Operating Profit Margin %, which is a measurement before interest and taxes, is a good indicator of how profitably management is able to operate the business. -Prof. tab

- 9. -arrow after Operating Profit Margin %— indicating that a higher value is always better. A higher value would indicate a more profitable operation of the business. In summary, Operating Profit Margin % measures the operating profitability of a company. Net Profit Margin % The Net Profit Margin % ratio shown on the .8-Prof. tab is a repeat of the Net Profit Margin % ratio shown at the top of the .7-DPont. tab. For a discussion of Net Profit Margin %, see Pg 26. The Net Profit Margin % is repeated on the .8-Prof. tab so that you can see all three Profitability ratios together on one tab. Let’s make a change to the Red Company model and see how the change impacts the three Profitability ratios. Annual Report Project Companies Look at the Operating Profit Margin % for the ARP companies. _____________________________ _____________________________

- 10. As you can see from the ARP companies, the Operating Profit Margin % will vary a lot from company to company and industry to industry. 38 RED COMPANY Chapter 4 – Profitability – Efficiency – Leverage -IS tab -Prof. tab All three of the Profitability ratios increased as a result of decreasing the number of cents Cost of Goods Sold consumes of each $1 of Net Sales: 45.00%. This is exactly the change that would be expected when Cost of Goods Sold is decreased from 57.00% to 55.00%. Cost of Goods Sold is now consuming 2.00 fewer cents of each $1 of Net Sales; thus there are 2.00 more cents of Gross Profit available from each $1 of Net Sales. 14.33%. This shows that the additional 2.00 cents of Gross Profit made it to the Operating Income level on the Income Statement.

- 11. This is an increase, but the increase is less than the 2.00 percentage points increase in the Gross Profit Margin % and the Operating Profit Margin %. Let’s take a look at the Income Statement to see why the Net Profit Margin % increased less than the other two Profitability ratios. -IS tab By looking at the Income Statement, you can see a 2.00 percentage point increase in Gross Profit, Operating Income, and Pre-Tax Income. You can also see that Net Income as a % of Net Sales (Net Profit Margin %) increased from 7.71% to 9.07%, an increase of only 1.36 percentage points. Provision for Income Taxes (an expense) is the reason that all of the 2.00 additional cents did not make it down to Net Income. Currently Red Company’s Effective Income Tax Rate is 32%. This means that when Pre-Tax Income increases by 2.00 cents, the Provision for Income Taxes increases by .64 cents (2.00 cents x 32%). As a result of the .64 cents increase in taxes, only 1.36 cents (2.00 – .64) make it down to Net Income. As you have seen, a decrease in the Cost of Goods Sold Percent has a very favorable impact on all three of the Profitability ratios. One or more of the following favorable management actions can cause a decrease in Cost of Goods Sold as a percent of Net Sales and an increase in profitability:

- 12. to increase prices. Let’s examine the impact an increase in sales would have on the three Profitability ratios. -IS tab ey -Prof. tab Two of the three Profitability ratios increased as a result of increasing Net Sales by $400,000. Chapter 4 – Profitability – Efficiency – Leverage RED COMPANY 39 because the Cost of Goods Sold Percent stayed at 57%. The total Gross Profit dollars (the numerator) did increase, but that increase was in the same proportion as the increase in Net Sales dollars (the denominator); thus there was no change in the Gross Profit Margin %.

- 13. 14.60%, an increase of 2.27 percentage points. This increase in the Operating Profit Margin % is the result of Operating Income dollars (the numerator) increasing faster than Net Sales dollars (the denominator). Let’s take a look at the Income Statement to see the details of why the Operating Profit Margin % increased. -IS tab On the Income Statement, observe that Operating Income in the % of Net Sales column is 14.60% and that it was 12.33% before the $400,000 increase in Net Sales. Also observe that Gross Profit in the % of Net Sales column is 43.00% both before and after the sales increase. If the Gross Profit Margin % stayed the same and the Operating Profit Margin % increased, it must mean that operating expenses decreased as a percent of Net Sales. That is exactly what happened. Selling & General Expenses decreased from 27.22% down to 25.50% of Net Sales. Depreciation Expense decreased from 3.45% down to 2.90% of Net Sales. As a result of these two operating expenses decreasing as a percent of Net Sales, the Operating Profit Margin % increased by 2.27 percentage points. -Prof. tab This increase of 1.65 percentage points is .62 percentage points smaller than the

- 14. increase in the Operating Profit Margin %. The two non-operating expenses on RC’s Income Statement are what caused this .62 percentage points smaller increase. Interest Expense, a non-operating item, decreased by .16 percentage points; this helped the Net Profit Margin %. Provision for Income Taxes, the other non-operating item, increased by .78 percentage points; this hurt the Net Profit Margin %. Note: The discussion in this box is not necessary for your understanding of the Gross Profit Margin %. This discussion is based on managerial accounting concepts – but there is certainly an interplay between Financial Statement Analysis and managerial accounting. Cost of Goods Sold is programmed in the Red Company model to be a totally variable cost. This means that Cost of Goods Sold will change by the same proportion as the change in Net Sales (and assumes that the change in Net Sales resulted from a change in the number of units sold and not a change in selling price). For a merchandising company, Cost of Goods Sold is normally a totally variable cost. For a manufacturing company, Cost of Goods Sold is normally a mixture of variable costs and fixed costs. Thus for most manufacturing companies, the Gross Profit Margin % would be expected to increase as a result of an increase in Net Sales. Note: The discussion in this box is not necessary for your understanding of the Operating Profit

- 15. Margin %. Like the discussion in the box above, this discussion is based on managerial accounting concepts. Selling & General Expenses (S&G Expenses) are programmed in the Red Company model as a mixture of fixed costs and variable costs. Saying the same thing in a different way— some of the S&G Expenses stay the same when sales increase (a fixed cost) and some of the S&G Expenses increase proportionally with the increase in sales (a variable cost). This results in the total S&G Expenses increasing at a lower rate than the increase in Net Sales. Depreciation Expense is programmed in the Red Company model as a fixed cost. Depreciation does not change with a change in sales. Depreciation Expense only changes when new Equipment is purchased. 40 RED COMPANY Chapter 4 – Profitability – Efficiency – Leverage In summary, the three Profitability ratios provide insight into how much of each $1 of Net Sales makes it from the Net Sales (top) line of the Income Statement to the Net Income (bottom) line on the Income Statement. -DPont. tab

- 16. Efficiency, as used in DuPont Analysis, is the measurement of how effective a company is at utilizing its assets to generate sales. As you can see on the .7- DPont. tab, the Total Assets Turnover Ratio is the second ratio in the DuPont Analysis and is the ratio that measures Efficiency. The Total Assets Turnover Ratio shows how many dollars of Net Sales are generated from each $1 of Total Assets. By looking at the Total Assets Turnover Ratio, you can see that the denominator of the ratio is Average Total Assets. To better understand what is driving this ratio, it would be helpful to develop some tools that measure the Efficiency of each of the major categories of assets that make up Total Assets. Most companies have three major asset categories: Next you will be introduced to a new set of financial statement analysis tools that will measure how efficiently these asset categories are being managed. -Eff. tab Annual Report Project Companies For the ARP companies, observe the Profitability pattern that is

- 17. shown by their: Gross Profit Margin %, Operating Profit Margin %, and Net Profit Margin %. also have the highest Operating Profit Margin % and Net Profit Margin %? ____ Yes ____ No (enter an X in one box) ame industry have similar Gross Profit Margin %’s? ____ Yes ____ No (enter an X in one box) also have the lowest Net Profit Margin %? ____ Yes ____ No (enter an X in one box) Read the box titled Discussion of Profitability. As you can see from the ARP companies, Profitability will vary a lot from company to company and industry to industry. Chapter 4 – Profitability – Efficiency – Leverage RED COMPANY 41 Accounts Receivable Turnover Ratio – Number of Days’ Sales in Receivables

- 18. To help you understand these two Efficiency Indicators for Accounts Receivable, let’s assume that a hypothetical company named Goofy Pattern Company (GPC) has the following sales and cash collection pattern. GPC sells $100 of product each day, and all of those sales are on credit. The following day GPC collects all $100 of the previous day’s credit sales—and then GPC makes another $100 of sales on credit. This sales and cash collection pattern continues for all 365 days of the year. This pattern will result in the following: times each year. le will be $100. The $100 Accounts Receivable balance is from that 1 day’s sales (the current day’s sales). 365 days in a year). The Accounts Receivable Turnover Ratio measures how many times per year a company collects its average Accounts Receivable balance. Based on the above facts, you can easily see that GPC collects its Accounts Receivable balance 365 times per year; thus the value of GPC’s Accounts Receivable Turnover Ratio should be 365 times. Number of Days’ Sales in Receivables measures how many days’ sales are in a company’s average Accounts Receivable balance. Based on the above facts, you can easily see that GPC has 1 day of sales in its Accounts Receivable balance; thus the

- 19. value of GPC’s Number of Days’ Sales in Receivables should be 1 day. Using the calculation formula shown on the .9-Eff. tab and the data for GPC, we can verify our observation that GPC’s Accounts Receivable Turnover Ratio is 365 times. Net Sales $36,500 = 365.00 Times Average Accounts Receivable, net ($100 + $100) / 2 (A/R bal. beg. of yr + A/R bal. end of yr) / 2 Using the calculation formula shown on the .9-Eff. tab and GPC’s Accounts Receivable Turnover Ratio value, we can verify our observation that GPC’s Number of Days’ Sales in Receivables is 1 day. 365 Days in a Year 365 = 1.00 Day Accounts Receivable Turnover Ratio 365.00 While no company would have the sales and cash collection pattern of GPC, hopefully the use of this hypothetical company has given you an intuitive feel for what is being measured by the Accounts Receivable Turnover Ratio and Number of Days’ Sales in Receivables. 42 RED COMPANY Chapter 4 – Profitability – Efficiency – Leverage

- 20. Look at the .9-Eff. tab and observe RC’s values for these two Accounts Receivable Efficiency Indicators. RC’s values are fairly typical for a company that makes most of its sales to customers on credit1. RC’s Accounts Receivable Turnover Ratio of 8.69 indicates that RC collects its average Accounts Receivable balance 8.69 times per year. Using RC’s Accounts Receivable Turnover Ratio value of 8.69, we can calculate that RC’s Number of Days’ Sales in Receivables is 42.00 days. Saying that RC’s Accounts Receivable Turnover Ratio is 8.69 times and that RC’s Number of Days’ Sales in Receivables is 42.00 days is saying the same thing, just in a different way. RC’s Number of Days’ Sales in Receivables value of 42.00 days indicates that when RC makes a sale to a customer on credit, 42.00 days later that customer pays the cash to RC for the credit sale. Note that the 42.00 days is an average and will vary from customer to customer. A company’s Number of Days’ Sales in Receivables will vary depending on many factors, some of those factors are: company operates.

- 21. Accounts Receivable collection efforts of the company. -arrow after Accounts Receivable Turnover Ratio—indicating that a higher value -arrow after Number of Days’ Sales in Receivables— indicating that a lower value is always better. These two arrows are indicating the same thing, collecting Accounts Receivable more often (higher turnover); and thus collecting from customers in a shorter period of time (lower days), results in a lower average Accounts Receivable balance. A lower average Accounts Receivable balance means that we are getting our cash quicker, and getting cash quicker is always a good thing. While the discussion above about the Accounts Receivable up and down arrows is normally true, it is important to keep in mind that credit terms granted to customers and collection efforts on past- due Accounts Receivable are always a balancing act between two competing factors: payment is expected and/or giving credit to customers with only the absolute best credit rating), customers will be dissatisfied and the company will miss out on sales. If collection efforts are too aggressive, customers will be alienated and could be lost forever. is expected and/or granting credit to customers with questionable credit ratings), the

- 22. investment in Accounts Receivable will be excessive and bad debt expense will be large. 1 Selling to customers on credit does not mean that the customer used a credit card for the transaction. Selling on credit means a company has extended certain credit terms to its customers allowing the customers to pay for the sale after a certain amount of ti me. Chapter 4 – Profitability – Efficiency – Leverage RED COMPANY 43 The following are calculation notes related to the Accounts Receivable Efficiency Indicators: 2021: Dec 31, 2020 Dec 31, 2021 Average Accounts ( Accounts Receivable, net + Accounts Receivable, net ) / 2 = Receivable, net for 2021 ( $246,000 + $237,288 ) / 2 = $241,644 Note: The Accounts Receivable amounts come from RC’s Balance Sheets 2-BS tab. The two Accounts Receivable amounts used for the calculation are the amounts at the beginning of 2021 and at the end of 2021. The Dec 31, 2020 amount is 2020’s ending Accounts Receivable amount and is also 2021’s beginning Accounts Receivable

- 23. amount. Average Accounts Receivable, net was rounded to a whole number—that is, to 0 decimal places. All averages in this book and in the Red Company software will always be rounded to a whole number. See the appendix on Pg 86 for rounding examples and directions. Accounts Receivable Turnover Ratio would be Net Credit Sales. In their published financial statements, companies do not split sales into cash sales and credit sales; thus the Net Sales amount shown on a company’s Income Statement will be used for the numerator in the Accounts Receivable Turnover Ratio. Days’ Sales in Receivables. This alternative calculation method will result in the same value (sometimes there might be a slight difference due to rounding) as the method shown on the .9-Eff. tab . This alternative calculation method does not require that you first calculate the Accounts Receivable Turnover Ratio. Average Accounts Receivable, net ($246,000 + $237,288) / 2 = $241,644 = 42.00 Days Average Daily Net Sales $2,100,000 / 365 days = $5,753

- 24. In summary, the Accounts Receivable Turnover Ratio and the Number of Days’ Sales in Receivables provide insight into how efficiently a company is managing the Accounts Receivable asset. Annual Report Project Companies Look at the Accounts Receivable Turnover Ratio and the Number of Days’ Sales in Receivables for the ARP companies. times per year (has the highest Accounts Receivable Turnover Ratio)? _____________________________ Receivables (excluding any company with zero Accounts Receivable)? _____________________________ As you can see from the ARP companies, these indicators will vary a lot from company to company and industry to industry. 44 RED COMPANY Chapter 4 – Profitability – Efficiency – Leverage Inventory Turnover Ratio – Number of Days’ Sales in Inventory

- 25. -Eff. tab Look at the .9-Eff. tab and observe how the Inventory Turnover Ratio is calculated. The Inventory Turnover Ratio measures how many times per year a company sells its average Inventory balance. To make this ratio easier to think about, assume that a hypothetical company has only one item in inventory. If the company’s Inventory Turnover Ratio is 4.00 times, that would mean that 4 times per year the company would: and Look at the .9-Eff. tab and observe how the Number of Days’ Sales in Inventory is calculated. Number of Days’ Sales in Inventory measures the number of days between when an inventory item is purchased from a vendor or produced internally and when that item is sold to a customer. Saying the same thing in a different way, Number of Days’ Sales in Inventory measures how long a company could make sales out of its current inventory before the inventory balance would be down to zero. RC’s Inventory Turnover Ratio of 3.84 indicates that for the average item in inventory, RC purchases or produces the item and then sells the item to a

- 26. customer 3.84 times per year. Using RC’s Inventory Turnover Ratio value of 3.84, we can calculate that RC’s Number of Days’ Sales in Inventory is 95.05 days. Saying that RC’s Inventory Turnover Ratio is 3.84 and that RC’s Number of Days’ Sales in Inventory is 95.05 is saying the same thing, just in a different way. A company’s Inventory Turnover Ratio and Number of Days’ Sales in Inventory will be impacted by many factors. Some of these factors are: predict that demand. duced, if the company is a manufacturer. systems. -arrow after Inventory Turnover Ratio— indicating that a higher value is better. -arrow after Number of Days’ Sales in Inventory—indicating that a lower value is better. These two arrows are indicating the same thing, holding inventory for a shorter period of time before selling the inventory to a customer, results in a lower average Inventory balance. A lower Inventory balance means that less cash is invested in inventory, and that is a good thing.

- 27. While the discussion above about the Inventory up and down arrows is normally true, it is important to keep in mind that the amount of inventory a company keeps on-hand is always a balancing act between two competing factors: -hand, customer service goes down as shipments are missed or delayed due to an out-of-stock condition. This will result in missed sales and customer dissatisfaction. -hand, financial performance goes down as a result of the excess investment in inventory. Also, as the amount of inventory on-hand increases, the possibility of obsolete inventory increases. Chapter 4 – Profitability – Efficiency – Leverage RED COMPANY 45 The following are calculation notes related to the Inventory Efficiency Indicators: Dec 31, 2020 Dec 31, 2021 ( Inventory + Inventory ) / 2 = Average Inventory for 2021 ( $280,000 + $343,096 ) / 2 = $311,548 Note: The Inventory amounts come from RC’s Balance Sheets

- 28. 2-BS tab. The two Inventory amounts used for the calculation are the amounts at the beginning of 2021 and at the end of 2021. The Dec 31, 2020 amount is 2020’s ending Inventory amount and is also 2021’s beginning Inventory amount. Average Inventory was rounded to a whole number. ive calculation method for Number of Days’ Sales in Inventory. This alternative calculation method will result in the same value (sometimes there might be a slight difference due to rounding) as the method shown on the .9-Eff. tab. This alternative calculation method does not require that you first calculate the Inventory Turnover Ratio. Average Inventory ($280,000 + $343,096) / 2 = $311,548 = 95.01 Days Average Daily Cost of Goods Sold $1,197,000 / 365 days = $3,279 In summary, the Inventory Turnover Ratio and the Number of Days’ Sales in Inventory provide insight into how efficiently a company is managing the Inventory asset. -Eff. tab Annual Report Project Companies

- 29. Look at the Inventory Turnover Ratio and the Number of Days’ Sales in Inventory for the ARP companies. -over its Inventory the most times per year (has the highest Inventory Turnover Ratio)? _____________________________ les in Inventory? _____________________________ company? _____________________________ As you can see from the ARP companies, these indicators will vary a lot from company to company and industry to industry. Observe that a service company does not have inventory and thus the Inventory Efficiency Indicators do not apply. 46 RED COMPANY Chapter 4 – Profitability – Efficiency – Leverage Accounts Payable Turnover Ratio – Number of Days’ Purchases in Accounts Payable At the start of this section on Efficiency Indicators, there was a listing of the three major categories

- 30. of assets that most businesses have: Accounts Receivable, Inventory, and Fixed Assets. The two Accounts Payable indicators that will be presented next are not directly related to measuring the efficient management of these three categories of assets. The reasons for including the Accounts Payable indicators as part of this Efficiency Indicators section are: efficient management of Accounts Payable can delay when the payment of cash is made for the purchase of inventory. Delaying the payment of Accounts Payable reduces the time cash is tied up in the Inventory asset. ts Payable is needed for the Cash-to-Cash Cycle indicator, which will be introduced later. Look at the .9-Eff. tab and observe how the Accounts Payable Turnover Ratio is calculated. The Accounts Payable Turnover Ratio measures how many times per year a company pays its average Accounts Payable balance. Look at the .9-Eff. tab and observe how the Number of Days’ Purchases in Accounts Payable is calculated. The Number of Days’ Purchases in Accounts Payable measures how many days of inventory purchases are in a company’s average Accounts Payable balance. RC’s Accounts Payable Turnover Ratio of 7.60 indicates that RC pays its average Accounts Payable balance 7.60 times per year. Using RC’s Accounts Payable Turnover Ratio value of 7.60,

- 31. we can calculate that RC’s Number of Days’ Purchases in Accounts Payable is 48.03 days. This indicates that after making a purchase from a vendor, RC waits an average of 48.03 days before making a cash payment to the vendor. Saying that RC’s Accounts Payable Turnover Ratio is 7.60 and that RC’s Number of Days’ Purchases in Accounts Payable is 48.03 days is saying the same thing, just in a different way. -arrow after the Accounts Payable Turnover Ratio—indicating that a lower value is always b -arrow after Number of Days’ Purchases in Accounts Payable—indicating that a higher value is always better. These two arrows are indicating the same thing, paying Accounts Payable less often; thus waiting more days before paying vendors, results in a higher average Accounts Payable balance. A higher Accounts Payable balance means that we are keeping our cash longer, and that is always a good thing. Think of Accounts Payable as an interest free loan from our vendors. While the discussion above about the Accounts Payable up and down arrows is normally true, it is important to keep in mind that holding on to our cash as long as possible and good vendor relations are always a balancing act between two competing factors: payments to vendors are delayed for too many days, the company’s relationships with its vendors can be damaged. The vendors can place the company on payment-in- advance or cash-on-delivery (COD) terms. Vendors that feel

- 32. they have been treated badly by delayed payments, will not work with the company to meet special rush order requirements. does not get the benefit of higher Accounts Payable balances, which are interest free loans from the vendors. Chapter 4 – Profitability – Efficiency – Leverage RED COMPANY 47 The following are calculation notes related to the Accounts Payable indicators: Dec 31, 2020 Dec 31, 2021 ( Accounts Payable + Accounts Payable ) / 2 = Average Accounts Payable for 2021 ( $140,000 + $174,827 ) / 2 = $157,414 Note: The Accounts Payable amounts come from RC’s Balance Sheets 2-BS tab. The two Accounts Payable amounts used for the calculation are the amounts at the beginning of 2021 and at the end of 2021. The Dec 31, 2020 amount is 2020’s ending Accounts Payable amount and is also 2021’s beginning Accounts Payable amount.

- 33. Average Accounts Payable was rounded to a whole number. Days’ Purchases in Accounts Payable. This alternative calculation method will result in the same value (sometimes there might be a slight difference due to rounding) as the method shown on the .9-Eff. tab. This alternative calculation method does not require that you first calculate the Accounts Payable Turnover Ratio. Average Accounts Payable ($140,000 + $174,827) / 2 = $157,414 = 48.01 Days Average Daily Cost of Goods Sold $1,197,000 / 365 days = $3,279 In summary, the Accounts Payable Turnover Ratio and the Number of Days’ Purchases in Accounts Payable provide insight into how long a company waits before paying its vendors for purchases made on credit. -Eff. tab Annual Report Project Companies Look at the Accounts Payable Turnover Ratio and the Number of Days’ Purchases in Accounts Payable for the ARP companies.

- 34. ge Accounts Payable balance the least times per year (has the lowest Accounts Payable Turnover Ratio)? ____________________________ in A/P? _____________________________ As you can see from the ARP companies, these indicators will vary a lot from company to company and industry to industry. 48 RED COMPANY Chapter 4 – Profitability – Efficiency – Leverage Cash-to-Cash Cycle To better understand the Cash-to-Cash Cycle indicator, let’s follow the flow of cash through a company’s operating cycle. This discussion assumes that the company is a merchandising company. The following are the steps in the operating cycle: 1. The company orders and receives inventory. At this point the company does not pay out any cash because normally the inventory vendor grants the company credit terms. Let’s say the vendor expects payment in 48 days. 2. Cash is paid out to the vendor 48 days after the purchase of

- 35. the inventory. 3. The inventory sits on the company’s shelf for some period of time—let’s say the inventory sits on the shelf for 95 days. While the company has had the inventory for 95 days, it did not have any cash invested in the inventory for the first 48 of those 95 days, because of the 48 day delay in paying cash to the vendor. Thus while the company has had the inventory on its shelf for 95 days, it only has its cash invested in the inventory for 47 days (95 total days minus 48 days before paying the vendor). 4. After 95 days the inventory is sold to a customer. At this point the company does not receive in any cash, because the company grants credit terms to its customer. Let’s say the company expects its customer to pay 42 days after the sale. 5. Cash is received in from the customer 42 days after the sale; thus completing the operating cycle. The Cash-to-Cash Cycle indicator combines the Number of Days’ indicators for Inventory, Accounts Payable, and Accounts Receivable to quantify the number of days in the operating cycle between when cash is paid out and when cash is received in. As you can see on the .9-Eff. tab: RC’s Inventory sits on the shelf for 95.05 days – RC takes 48.03 days to pay its vendors – the 95.05 days reduced by the 48.03 days results in the 47.02 days RC has its cash invested before selling the Inventory – after selling the Inventory it takes RC 42.00 days to collect cash from the customer –

- 36. the net result is 89.02 days between when RC pays cash out and when RC receives cash in. By looking at the Cash-to-Cash Cycle indicator, you can see what can be done to reduce the time between when cash is paid out and when cash is received in: shelf before being sold to a customer. You can increase the number of days between when inventory is purchased from a vendor and when cash is paid out to the vendor. inventory is sold to a customer and when cash is collected from that customer. -arrow after Cash-to-Cash Cycle—indicating that a lower value is always better. A lower value means that we are receiving our cash back-in faster, and that is always a good thing. If RC’s management was to make some positive operational changes in the areas of: Inventory management, Accounts Payable policies, and Accounts Receivable policies and collection efforts, then what would be the impact on RC’s: Cash balance, Turnover Ratios, Number of Days’ indicators, and Cash-to-Cash Cycle indicator? Chapter 4 – Profitability – Efficiency – Leverage RED

- 37. COMPANY 49 First, let’s see what the effects would be of reducing by 10 the number of days Inventory sits on the shelf before it is sold to a customer. This reduction of 10 days is the result of RC making positive changes to its Inventory management system. -BS tab Observe the following positive changes that result from holding Inventory for 10 fewer days: —a decrease of $65,589. —an increase of $65,589. -Eff. tab 4.29 times—th -arrow after this ratio’s name indicates that an increase is good. 95.05 days to 85.08 days—the -arrow after this item’s name indicates that a decrease is good. -to-Cash Days decreased from 89.02 to 79.05 days— -arrow after

- 38. this indicator’s name shows that a decrease is good. Next let’s see what the effects would be of increasing by 7 the number of days taken to pay Accounts Payable. This increase in the number of days taken before paying cash to vendors is the result of RC negotiating longer (better) credit terms with its vendors. -BS tab Observe the following positive changes that result from increasing by 7 days the time taken to pay Accounts Payable: —an increase of $45,913. —an increase of $45,913. The combined increase in Cash from the Inventory and Accounts Payable changes is $111,502 ($149,783 to $261,285). Observe the red message indicating that Cash is greater than $250,000. After a few more changes, RC will do something with this excess cash. Note: Given that you entered 85 into the Number of Days’ Sales in Inventory input variable, you would have expected Number of Days’ Sales in Inventory on the 9-Eff tab to be 85.00 rather than 85.08. This slight .08 difference is caused by rounding the Inventory Turnover Ratio to 2 decimal places and then using this rounded value to calculate

- 39. the Number of Days’ Sales in Inventory. When you are doing your homework and your Annual Report Project, always follow the rounding rules given in the appendix on Pg 86 and you will always be correct. 50 RED COMPANY Chapter 4 – Profitability – Efficiency – Leverage -Eff. tab times to 6.64 times—the -arrow after this ratio’s name indicates that a decrease is good. f Days’ Purchases in Accounts Payable increased from 48.03 days to 54.97 days— -arrow after this item’s name indicates that an increase is good. -to-Cash Days decreased by about 7 more days—the -arrow after this indicator’s name shows that a decrease is a good thing. The combined decrease in the Cash-to-Cash Days from the Inventory and Accounts Payable changes is about 17 days. Next let’s see what the effects would be of decreasing by 6 the number of days it takes to collect Accounts Receivable. The decrease in the number of days to collect cash from customers is the result of RC changing its credit terms granted to customers and

- 40. an increased emphasis on collecting past-due accounts. -BS tab Observe the following positive changes that result from decreasing by 6 days the time taken to collect Accounts Receivable: — a decrease of $69,041. from $261,285 to $330,326—an increase of $69,041. The combined increase in Cash from the Inventory, Accounts Payable, and Accounts Receivable changes is $180,543 ($149,783 to $330,326). -Eff. tab ed from 8.69 times to 10.14 times— -arrow after this ratio’s name indicates that an increase is good. decreased from 42.00 days to 36.00 days— -arrow after this item’s name indicates that a decrease is good. -to-Cash Days decreased by 6 more days—the -arrow after this indicator’s name shows that a decrease is a good thing. By comparing the gray box

- 41. values to the current values for the Cash-to-Cash Cycle indicator, you can see what caused Cash-to-Cash Days to decrease by about 23 days. As a result of the significant decrease in its Cash-to-Cash Days, RC now has excess cash. RC now needs to do something with that excess cash to get a positive impact on the Total Assets Turnover Ratio in the DuPont Analysis. -BS tab –115,000 in New Borrowing (Pay Off) on Jan. 1 (Be sure to enter this amount as a negative number.) key Chapter 4 – Profitability – Efficiency – Leverage RED COMPANY 51 RC has now used the excess cash to reduce the Note Payable Long-Term balance from $300,000 to $185,000, and to buy back 2,400 shares of its outstanding Common Stock. -DPont. tab Observe that the Total Assets Turnover Ratio in the DuPont Analysis has increased from 1.82 to -arrow after this ratio’s name this is a good change. Also observe that the positive change in this ratio has resulted from the decrease in the denominator,

- 42. Average Total Assets. There has not been any increase in the numerator, Net Sales. And finally, look at the Return on Equity % and observe the significant change from 27.34% up to 31.29%. This positive change is the result of RC more efficiently managing its assets. -Eff. tab Next you will learn one last Efficiency Indicator. This indicator will be for assets that are not part of a company’s Cash-to-Cash cycle, but these assets are normally a significant component of Total Assets. Fixed Asset Turnover Ratio The Fixed Asset Turnover Ratio is discussed separately from the other Efficiency Indicators because Fixed Assets are not part of a company’s Cash-to-Cash cycle. A company does not purchase Fixed Assets (property, plant, and equipment) with the intent of selling them to customers. A company purchases Fixed Assets to use in the production and sale of products. Thus the logical efficiency measurement for Fixed Assets is how many dollars of Net Sales is the company producing with each $1 invested in Fixed Assets—that is exactly what is measured by the Fixed Asset Turnover Ratio. As shown by the Fixed Asset Turnover Ratio, RC is currently generating $4.50 of Net Sales from

- 43. each $1 of Average Net F -arrow after this ratio’s name indicates that the more dollars of sales that can be produced from each $1 of Fixed Assets the better. Annual Report Project Companies Look at the Cash-to-Cash Cycle indicator for the ARP companies. when cash is paid out and when cash is received in (has the lowest Cash-to-Cash Days)? ____________________________ when cash is paid out and when cash is received in (has the highest Cash-to-Cash Days)? _____________________________ As you can see from the ARP companies, Cash-to-Cash Days will vary a lot from company to company and industry to industry. 52 RED COMPANY Chapter 4 – Profitability – Efficiency – Leverage The following are calculation notes related to the Fixed Asset Turnover Ratio:

- 44. Dec 31, 2020 Dec 31, 2021 ( Net Prop., Plant, & Equip. + Net Prop., Plant, & Equip. ) / 2 = Average Net Fixed Assets for 2021 ( $440,000 + $492,500 ) / 2 = $466,250 Note: The Net Prop., Plant, & Equip. amounts come from RC’s Balance Sheets 2-BS tab. The two Net Prop., Plant, & Equip. amounts used for the calculation are the amounts at the beginning of 2021 and at the end of 2021. The Dec 31, 2020 amount is 2020’s ending Net Prop., Plant, & Equip. amount, and is also 2021’s beginning Net Prop., Plant, & Equip. amount. Average Net Fixed Assets was rounded to a whole number. for Fixed Assets. The most often used titles are Net Property, plant, and equipment and Property, plant, and equipment, net. iation is shown on the Balance Sheet, the amounts used in the Average Net Fixed Assets calculation are the amounts for Property, Plant, and Equipment after deducting Accumulated Depreciation. Look at RC’s Balance Sheets for examples of this. Let’s see the impact on this ratio if RC is able to increase Net Sales without having to purchase any additional Property, Plant, and Equipment.

- 45. -IS tab -Eff. tab The Fixed Asset Turnover Ratio increased significantly as a result of the numerator, Net Sales, increasing and the denominator, Average Net Fixed Assets, not changing. This concludes this section on Efficiency Indicators. In this section, you added eight additional tools to your financial statement analysis tool-kit. Annual Report Project Companies Look at the Fixed Asset Turnover Ratio for the ARP companies. ____________________________ set Turnover Ratio? _____________________________ For the ARP companies, review all of their Efficiency Indicators and then read the box titled Discussion of Efficiency Indicators. As you can see from the ARP companies, the Efficiency Indicators will vary a lot from company to company and industry to industry.

- 46. Chapter 4 – Profitability – Efficiency – Leverage RED COMPANY 53 -DPont. tab Leverage, as used in the DuPont Analysis, is the measurement of how the stockholders’ investment is leveraged up to obtain the assets used in the business. As can see on the .7-DPont. tab, the Assets-to-Equity Ratio is the third ratio in the DuPont Analysis and is the ratio that measures Leverage. The Assets-to-Equity Ratio measures how many dollars of assets a company has for each $1 of stockholders’ (owners’) investment. As discussed in Chapter 3, leverage is also referred to as financial leverage; thus the terms Leverage and financial leverage will be used interchangeably in this section. Before leaving the .7-DPont. tab, observe the following about the Assets-to-Equity Ratio: measures average Leverage for the year being analyzed. Saying the same thing in a different way, the numerator is Average Total Assets and the denominator is Average Total Stockholders’ Equity. The two additional Leverage ratios that you will learn in this section will not measure the

- 47. average Leverage for the year, but rather will measure the company’s Leverage at the end of the year. -DPont. tab, RC’s Assets-to- Equity Ratio has a value of 1.95 to 1. This indicates that on average, for the year 2021, RC has $1.95 of assets for each $1 of stockholders’ investment. The additional $.95 of assets is the result of RC borrowing from creditors. Saying the same thing in a different way, on average for the year 2021, for each $1 of stockholders’ investment RC has borrowed $.95 from creditors. This shows that RC has a little less debt than equity. -Lev. tab On the .10-Lev. tab, you see two additional Leverage Indicators, the Debt % and the Debt-to- Equity Ratio. Like the Assets-to-Equity Ratio, these two new indicators are also measuring Leverage. The new indicators are just measuring Leverage in different ways. The reason you are being introduced to these two new indicators is because the three Leverage Indicators: -to-Equity Ratio Debt-to-Equity Ratio are often used interchangeably in the financial press when discussing a company’s leverage.

- 48. Debt % The Debt % shows the percent of each $1 of Total Assets that is financed with debt. RC’s Debt % shows that 47.42 cents of each $1 of Total Assets is financed with debt. If 47.42 cents of each $1 of Total Assets is financed with debt, then 52.58 cents of each $1 of Total Assets must be financed with equity. 54 RED COMPANY Chapter 4 – Profitability – Efficiency – Leverage The Debt % is measuring the amount of financial leverage a company has at the end of the accounting year. RC’s Debt % shown on the .10-Lev. tab is for 2021; thus the Total Liabilities amount of $579,827 and the Total Assets amount of $1,222,667 are the December 31, 2021 amounts from RC’s 2021 Balance Sheet. -BS tab Observe where the dollar amount for Total Liabilities and the dollar amount for Total Assets come from on RC’s December 31, 2021 Balance Sheet. Also note that the Debt % value of 47.42% is also shown in the % of Total column for Total Liabilities. -Lev. tab Like the DuPont Analysis Leverage indicator, Assets-to-Equity -down-

- 49. arrows after its name—indicating that the desirable value depends on various factors. For a discussion of the factors that determine the desirable value of a Leverage indicator see Pg 23. Debt-to-Equity Ratio The Debt-to-Equity Ratio shows the amount of Total Liabilities (debt) for each $1 of Total Stockholders’ Equity (equity). RC’s Debt-to-Equity Ratio of .90 to 1 shows that RC has $.90 of debt for each $1.00 of equity. The Debt-to-Equity Ratio is measuring the amount of financial leverage a company has at the end of the accounting year. RC’s Debt-to-Equity Ratio shown on the .10-Lev. tab is for 2021; thus the Total Liabilities amount of $579,827 and the Total Stockholders’ Equity amount of $642,840 are the December 31, 2021 amounts from RC’s 2021 Balance Sheet. -BS tab Observe where the dollar amount for Total Liabilities and the dollar amount for Total Stockholders’ Equity come from on RC’s December 31, 2021 Balance Sheet. -Lev. tab Like the two other Leverage indicators, Assets-to-Equity Ratio and Debt %, the Debt-to-Equity -down-arrows after its name—indicating that the desirable value depends on various factors. Observe that the Debt % and the Debt-to-Equity Ratio are each

- 50. indicating the same thing—just in a different way: of debt and 52.58 cents of equity for each $1 of assets—a little less debt than equity. -to-Equity Ratio of .90 shows that RC has $.90 of debt for each $1.00 of equity— a little less debt than equity. Chapter 4 – Profitability – Efficiency – Leverage RED COMPANY 55 Let’s significantly increase RC’s financial leverage and see if the Debt % and the Debt-to-Equity Ratio indicate the same change in financial leverage. -BS tab f) on Jan. 1 key As a result of the above changes, Notes Payable Long-Term has increased from $300,000 to $550,000—increased debt. Treasury Stock has gone from $0 to ($250,000)—decreased equity. -Lev. tab

- 51. Observe that the Debt % and the Debt-to-Equity Ratio still provide a consistent message: debt and 31.46 cents of equity for each $1 of assets—a lot more debt than equity. -to-Equity Ratio of 2.18 shows that RC has $2.18 of debt for each $1.00 of equity—a lot more debt than equity. In summary, the three Leverage indicators: -to-Equity Ratio -to-Equity Ratio are all measuring the same thing, Leverage. Annual Report Project Companies Look at the Debt % and the Debt-to-Equity Ratio for the ARP companies. financial leverage (the highest Debt %)? ____________________________ ich company has the lowest financial leverage (the lowest Debt % and the lowest Debt-to-Equity Ratio)? ____________________________

- 52. to assets than the creditors? ____ Yes ____ No (enter an X in one box) Read the discussion about these two Leverage indicators in the box titled Discussion of Financial Leverage and Interest Coverage. As you can see from the ARP companies, the blending of debt and equity varies a lot from company to company and industry to industry. 56 RED COMPANY Chapter 4 – Profitability – Efficiency – Leverage -Lev. tab The Times Interest Earned Ratio is included on the .10-Lev. tab with the Debt % and the Debt-to- Equity Ratio because the debt that creates financial leverage also creates the requirement for a company to pay interest on that debt. The Times Interest Earned Ratio measures a company’s ability to pay the interest on its debt. This ratio is currently showing that RC has available $12.33 of earnings before interest and taxes for each $1 of interest it must pay to creditors. At this level of

- 53. coverage, the creditors can feel quite certain there will be adequate earnings to cover their interest. The amounts needed to calculate this ratio are shown on the Income Statement. -IS tab The numerator of the Times Interest Earned Ratio is earnings before interest expense and before income tax expense. It is calculated as follows: Net Income .......................................... $161,840 plus Interest Expense ......................... 21,000 plus Provision for Income Taxes ......... 76,160 Earnings before interest and taxes ... $259,000 Income taxes are paid on income after interest has been deducted; therefore the earnings available to pay interest are before income taxes. Saying the same thing in a different way, creditors get their interest before the government gets its income taxes. Given the structure of RC’s Income Statement, earnings before interest and taxes is the same as Operating Income. This will not always be true, but in RC’s case it is. Let us see what the Income Statement and the Times Interest Earned Ratio would look like if RC had just enough earnings before interest and taxes to cover interest expense.

- 54. At this greatly reduced level of sales and increased cost of goods sold percent, RC has just enough earnings before interest and taxes to cover interest expense. Notice that Pre-Tax Income, Provision for Income Taxes, and Net Income are all now zero. -Lev. tab Observe that the Times Interest Earned Ratio is now equal to 1.00. RC now has available just $1 of earnings before interest and taxes for each $1 of interest expense. Before you made the changes to Net Sales and the Cost of Goods Sold Percent, the Times Interest Earned Ratio had a value over 12. With a value that high, the creditor’s interest payments had a good margin of safety. The fact that RC still has adequate earnings to cover interest expense, after Net Sales decreased by over $850,000 (a decrease of over 40%) and after the Cost of Goods Sold Percent increased from 57 to 60, shows how large that margin of safety was. Chapter 4 – Profitability – Efficiency – Leverage RED COMPANY 57 -arrow after this ratios name—indicating that a higher value is always better. A higher value indicates a greater ability to pay interest out of current earnings.

- 55. In summary, the Times Interest Earned Ratio provides information about a company’s ability to pay the interest on its debt. Creditors look to this ratio as one indication of the safety of their future interest payments. Annual Report Project Companies Look at the Times Interest Earned Ratios for the ARP companies. Ratio? ____________________________ lowest Times Interest Earned Ratio? ____________________________ Read the discussion about this ratio in the box titled Discussion of Financial Leverage and Interest Coverage. As you can see from the ARP companies, interest coverage varies a lot from company to company and industry to industry. 58 RED COMPANY Chapter 4 – Profitability – Efficiency – Leverage Chapter 4 Homework

- 56. In these exercises, you will be calculating financial statement analysis indicators that provide additional insight into what drives The Toro Company’s DuPont ratios. Specifically you will be drilling down into Toro’s: Profitability, Efficiency, and Leverage. Use the form in the Excel file Red Company Chapter 4 Homework Form to record your answers. For information and examples on how to round your answers, see the appendix on Pg 86 in the file 6 – Annual Report Project and Rounding Rules.pdf. For these exercises, you will be using the financial statements of The Toro Company. Use Toro's financial statements that you printed when you worked the Chapter 2 Homework. For an introduction to Toro's financial statements, see Pg 18 in the file 2 – Vertical and Horizontal Analysis.pdf. Exercise 4-1 Gross Profit Margin % (a driver of Profitability) A. When calculating the 2017 Gross Profit Margin %, which financial statement line items are used for the: 1. Numerator? – The line item name on Toro’s financial statement and the $ amount. 2. Denominator? – The line item name on Toro’s financial statement and the $ amount. B. Calculate Toro’s Gross Profit Margin % for 2017. Round your percent answer to 2 decimal places.

- 57. C. The Gross Profit Margin % is a(n): - - - down-arrow indicator D. On the Answer Sheet under your answer for item B. is Toro’s 2016 Gross Profit Margin %. Which year, 2017 or 2016, had a better Gross Profit Margin %? Exercise 4-2 Operating Profit Margin % (a driver of Profitability) A. When calculating the 2017 Operating Profit Margin %, which financial statement line items are used for the: 1. Numerator? – The line item name on Toro’s financial statement and the $ amount. 2. Denominator? – The line item name on Toro’s financial statement and the $ amount. B. Calculate Toro’s Operating Profit Margin % for 2017. Round your percent answer to 2 decimal places. C. The Operating Profit Margin % is a(n): - - - down-arrow indicator D. On the Answer Sheet under your answer for item B. is Toro’s 2016 Operating Profit Margin %. Which year, 2017 or 2016, had a better Operating Profit Margin %?

- 58. Chapter 4 – Profitability – Efficiency – Leverage RED COMPANY 59 Exercise 4-3 Accounts Receivable Turnover Ratio (a driver of Efficiency) Number of Days’ Sales in Receivables A. When calculating the 2017 Accounts Receivable Turnover Ratio, which financial statement line items are used for the: 1. Numerator? – The line item name on Toro’s financial statement and the $ amount. 2. Denominator? – (Note that the answers for this item are on the Answer Sheet. Just the Receivables, net: Customers amount should be used for the denominator.) B. Calculate Toro’s Accounts Receivable Turnover Ratio for 2017. Round Average Accounts Receivable to a whole number. Round your final answer to 2 decimal places. C. The Accounts Receivable Turnover Ratio is a(n): - - - down-arrow indicator D. On the Answer Sheet under your answer for item B. is Toro’s 2016 Accounts Receivable Turnover Ratio. Which year, 2017 or 2016, had a better Accounts Receivable Turnover Ratio? E. Calculate Toro’s Number of Days’ Sales in Receivables for 2017. Utilize the Turnover Ratio

- 59. calculated in B. above. Round your final answer to 2 decimal places. F. Number of Days’ Sales in Receivables is a(n): - - - down-arrow indicator G. On the Answer Sheet under your answer for item E. is Toro’s 2016 Number of Days’ Sales in Receivables. Which year, 2017 or 2016, had a better Number of Days’ Sales in Receivables? Exercise 4-4 Inventory Turnover Ratio (a driver of Efficiency) Number of Days’ Sales in Inventory A. When calculating the 2017 Inventory Turnover Ratio, which financial statement line items are used for the: 1. Numerator? – The line item name on Toro’s financial statement and the $ amount. 2. Denominator? – The line item name on Toro’s financial statement and the $ amounts. B. Calculate Toro’s Inventory Turnover Ratio for 2017. Round Average Inventory to a whole number. Round your final answer to 2 decimal places. C. The Inventory Turnover Ratio is a(n): - -arrow indicator - down-arrow indicator D. On the Answer Sheet under your answer for item B. is Toro’s 2016 Inventory Turnover

- 60. Ratio. Which year, 2017 or 2016, had a better Inventory Turnover Ratio? E. Calculate Toro’s Number of Days’ Sales in Inventory for 2017. Utilize the Turnover Ratio calculated in B. above. Round your final answer to 2 decimal places. F. Number of Days’ Sales in Inventory is a(n): - - - down-arrow indicator G. On the Answer Sheet under your answer for item E. is Toro’s 2016 Number of Days’ Sales in Inventory. Which year, 2017 or 2016, had a better Number of Days’ Sales in Inventory? 60 RED COMPANY Chapter 4 – Profitability – Efficiency – Leverage Exercise 4-5 Accounts Payable Turnover Ratio Number of Days’ Purchases in Accounts Payable A. When calculating the 2017 Accounts Payable Turnover Ratio, which financial statement line items are used for the: 1. Numerator? – The line item name on Toro’s financial statement and the $ amount. 2. Denominator? – The line item name on Toro’s financial statement and the $ amounts. B. Calculate Toro’s Accounts Payable Turnover Ratio for 2017.

- 61. Round Average Accounts Payable to a whole number. Round your final answer to 2 decimal places. C. The Accounts Payable Turnover Ratio is a(n): - - - down-arrow indicator D. On the Answer Sheet under your answer for item B. is Toro’s 2016 Accounts Payable Turnover Ratio. Which year, 2017 or 2016, had a better Accounts Payable Turnover Ratio? E. Calculate Toro’s Number of Days’ Purchases in Accounts Payable for 2017. Utilize the Turnover Ratio calculated in B. above. Round your final answer to 2 decimal places. F. Number of Days’ Purchases in Accounts Payable is a(n): - - - down-arrow indicator G. On the Answer Sheet under your answer for item E. is Toro’s 2016 Number of Days’ Purchases in Accounts Payable. Which year, 2017 or 2016, had a better Number of Days’ Purchases in Accounts Payable? Exercise 4-6 Cash-to-Cash Cycle A. On the Answer Sheet complete Toro’s Cash-to-Cash Cycle table for 2017 and 2016. B. Utilizing your answer for item A., discuss Toro’s Cash-to- Cash Days for 2017 compared to 2016.

- 62. Exercise 4-7 Fixed Asset Turnover Ratio (a driver of Efficiency) A. When calculating the 2017 Fixed Asset Turnover Ratio, which financial statement line items are used for the: 1. Numerator? – The line item name on Toro’s financial statement and the $ amount. 2. Denominator? – The line item name on Toro’s financial statement and the $ amounts. B. Calculate Toro’s Fixed Asset Turnover Ratio for 2017. Round Average Fixed Assets to a whole number. Round your final answer to 2 decimal places. C. The Fixed Asset Turnover Ratio is a(n): - - - down-arrow indicator D. On the Answer Sheet under your answer for item B. is Toro’s 2016 Fixed Asset Turnover Ratio. Which year, 2017 or 2016, had a better Fixed Asset Turnover Ratio? Chapter 4 – Profitability – Efficiency – Leverage RED COMPANY 61 Exercise 4-8 Debt % (an indicator of Leverage at year-end) A. When calculating the 2017 Debt %, which financial statement line items are used for the:

- 63. 1. Numerator? – (Note that the answer to this item is a schedule on which you will calculate the numerator, Total Liabilities for 2017. Toro does not show a line item on their Balance Sheet for Total Liabilities.) 2. Denominator? – The line item name on Toro’s financial statement and the $ amount. B. Calculate Toro’s Debt % for 2017. Round your final answer to 2 decimal places. C. The Debt % is a(n): - wn- - down-arrow indicator D. On the Answer Sheet under your answer for item B. is Toro’s 2016 Debt %. Based on the Debt % which year, 2017 or 2016, had more financial leverage at the end of the year? Exercise 4-9 Debt-to-Equity Ratio (an indicator of Leverage at year-end) A. When calculating the 2017 Debt-to-Equity Ratio, which financial statement line items are used for the: 1. Numerator? – See the answer to Exercise 4-8 item A.1. 2. Denominator? – The line item name on Toro’s financial statement and the $ amount. B. Calculate Toro’s Debt-to-Equity Ratio for 2017. Round your final answer to 2 decimal

- 64. places. C. The Debt-to-Equity Ratio is a(n): - - - down-arrow indicator D. On the Answer Sheet under your answer for item B. is Toro’s 2016 Debt-to-Equity Ratio. Based on the Debt-to-Equity Ratio which year, 2017 or 2016, had more financial leverage at the end of the year? Exercise 4-10 Times Interest Earned Ratio (an indicator of interest coverage) A. When calculating the 2017 Times Interest Earned Ratio, which financial statement line items are used for the: 1. Numerator? – (Note that the answer to this item is a schedule on which you will calculate the numerator, Earnings before Interest and Taxes for 2017.) 2. Denominator? – The line item name on Toro’s financial statement and the $ amount. B. Calculate Toro’s Times Interest Earned Ratio for 2017. Round your final answer to 2 decimal places. C. The Times Interest Earned Ratio is a(n): - - - down-arrow indicator D. On the Answer Sheet under your answer for item B. is Toro’s

- 65. 2016 Times Interest Earned Ratio. Which year, 2017 or 2016, had a better Times Interest Earned Ratio? 62 RED COMPANY Chapter 4 – Profitability – Efficiency – Leverage This page intentionally left blank. Textfield-0: Textfield-1: Textfield-2: Textfield-3: Textfield-4: Textfield-5: Operating Profit Margin and Net Profit Margin: Yes: Textfield-6: Yes-0: Profit Margin: Yes-1: highest Accounts Receivable Turnover Ratio: company with zero Accounts Receivable: Inventory Turnover Ratio: Textfield-8: Textfield-9: has the lowest Accounts Payable Turnover Ratio: Textfield-10: Textfield-11: Textfield-12: Textfield-13: Textfield-14: Debt-0: DebttoEquity Ratio-0: creditors: Yes-2: Textfield-16: Textfield- 17: Chapter 3 Financial Statement Analysis Tools Timothy R. Mayes, Financial Analysis with Microsoft Excel, 9th Edition. © 2021 Cengage. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. Analysis Tools Covered in this Chapter In this chapter will see: How to calculate many financial ratios How to use financial ratios to make predictions about potential bankruptcy How to calculate the economic profit (as opposed to net income)

- 66. that a firm earned in a period Timothy R. Mayes, Financial Analysis with Microsoft Excel, 9th Edition. © 2021 Cengage. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. Financial Ratios Financial ratios are simply comparisons of two financial statement items These comparisons help us to draw conclusions about the financial health of the firm that aren’t immediately obvious by looking at the raw values (e.g., net income may be positive, but what matters is how large it is relative to sales, assets, or equity) We will calculate five categories of ratios: Liquidity ratios Efficiency ratios Leverage ratios Coverage ratios Profitability ratios Timothy R. Mayes, Financial Analysis with Microsoft Excel, 9th Edition. © 2021 Cengage. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. Liquidity Ratios Liquidity ratios describe the ability of a firm to meets its short- term obligations by comparing current assets to current liabilities Current assets will be converted to cash which will then be used to retire current liabilities For both ratios, higher values are indicative of a higher

- 67. probability of being able to pay off short-term debts Timothy R. Mayes, Financial Analysis with Microsoft Excel, 9th Edition. © 2021 Cengage. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. Efficiency Ratios Efficiency ratios, also called asset management ratios, provide information about how well the company is using its assets to generate sales Timothy R. Mayes, Financial Analysis with Microsoft Excel, 9th Edition. © 2021 Cengage. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. Leverage Ratios (1 of 2) Leverage ratios describe the degree to which the firm uses debt in its capital structure Timothy R. Mayes, Financial Analysis with Microsoft Excel, 9th Edition. © 2021 Cengage. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

- 68. Leverage Ratios (2 of 2) Generally, lower leverage ratios are preferred though a reasonable amount of debt is usually considered to be a good thing Timothy R. Mayes, Financial Analysis with Microsoft Excel, 9th Edition. © 2021 Cengage. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. Coverage Ratios Coverage ratios describe the quantity of funds available to “cover” certain expenses, particularly interest expense (though this is not the only one) We generally prefer higher coverage ratios as that indicates a level of debt that is easy for the firm to service Timothy R. Mayes, Financial Analysis with Microsoft Excel, 9th Edition. © 2021 Cengage. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. Profitability Ratios (1 of 2) Profitability ratios measure how profitable a firm is relative to sales, total assets, or equity Timothy R. Mayes, Financial Analysis with Microsoft Excel, 9th Edition. © 2021 Cengage. All Rights Reserved. May not be

- 69. scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. Profitability Ratios (2 of 2) Without exception, higher profitability ratios are preferred over lower ones Timothy R. Mayes, Financial Analysis with Microsoft Excel, 9th Edition. © 2021 Cengage. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. 10 E P I’s Financial Ratios The image to the right shows the calculations of all financial ratios that we discussed These values were calculated using the financial statements given in Chapter 2 Timothy R. Mayes, Financial Analysis with Microsoft Excel, 9th Edition. © 2021 Cengage. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. DuPont Analysis DuPont analysis refers to a method of decomposing the return on equity into its components to better understand the R O E and why it may have changed (or why it is different than that of some other firm) There are two versions of DuPont analysis:

- 70. Timothy R. Mayes, Financial Analysis with Microsoft Excel, 9th Edition. © 2021 Cengage. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. Using Financial Ratios Financial ratios can be analyzed in three ways: Trend Analysis Comparing to Industry Averages Compared to Company Goals and Debt Covenants Additionally, ratios can be used in valuation analysis and for financial distress prediction Timothy R. Mayes, Financial Analysis with Microsoft Excel, 9th Edition. © 2021 Cengage. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. Financial Distress Prediction (Z-Scores) In 19 68, Edward Altman first used discriminant analysis to classify firms into one of three categories: bankruptcy predicted, possible bankruptcy, and no financial distress Today, this model would be considered to be a “machine learning” model alongside other classification methods (e.g., k- means or support vector machines) We covered two Z-Score models: The Original Z-Score Model The Z-Score Model for Private Firms Timothy R. Mayes, Financial Analysis with Microsoft Excel, 9th Edition. © 2021 Cengage. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. The Original Z-Score Model The original Z-Score model was for publicly traded firms:

- 71. Z = 1.2X1 + 1.4X2 + 3.3X3 + 0.6X4 + X5 where Timothy R. Mayes, Financial Analysis with Microsoft Excel, 9th Edition. © 2021 Cengage. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. Z-Score Model for Private Firms Altman also estimated a model for privately held firms to allow for the fact that you cannot calculate the market value of equity for a private firm This model is very similar, but the coefficients changed (note that X4 has been redefined): Z = 0.717X1 + 0.847X2 + 3.107X3 + 0.420X4 + 0.998X5 where Timothy R. Mayes, Financial Analysis with Microsoft Excel, 9th Edition. © 2021 Cengage. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. Economic Profit Measures of Performance Economic profit is the profit earned in excess of the firm’s costs, including its implicit opportunity costs (primarily its cost of equity, which is ignored by accounting profit) Definition of Economic Profit: Note that economic profit is often referred to as Economic Value Added (E V A), which is a trademark of Stern Stewart and Company

- 72. Timothy R. Mayes, Financial Analysis with Microsoft Excel, 9th Edition. © 2021 Cengage. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. Red Company HomeworkEnter your answers below - numbers only with20172016EX2-1% of net sales% of net sales1Cost of Sales63.20%63.40%2Gross profit36.70%36.50%3selling, general, and admin expense22.50%22.50%4operating earnings14.17%13.97%5net earnings10.60%9.65%B. Discuss which line item (Cost of sales or selling, general and administrative expense) helped to increase the operating earnings and net earnings as a % of Net Sales from 2016 to 2017This helped operating earnings and net earnings as a percent of sales go up from 2016 to 2017, because the cost of sales was a little less in 2017. This helped.20172016EX 2-2% of net sales% of net sales1Total receivables, net12.25%11.79%2Inventories, net22%22.17%3Accounts payable14.17%13.61%4Retained earnings7.50%7.88%5Total stockholders' equity41.31%39.72%B.Did liabilities or equity finance more of Toro's Total assets in 2017?liabilities20172016EX-2-3% of net sales% of net sales1Net sales4.72%0.05%2Cost of sales4.21%2.40%3Gross profit5.28%4.69%4selling, general, and admin expense4.72%0.62%5net earnings18.89%14.58%B.Coment on the percent change in gross profit from 2016 to 2017 compared to the percent change in net sales from 2016 to 2017It is the percentage change in net sales from 2016 to 2017. Even though net sales have gone up a lot from last year compared to gross profit.20172016EX2-4% of net sales% of net sales1Total receivables, net$19,80812.13%2Inventories, net$21,9587.15%3Accounts payable$37,08421.23%4Retained Earnings$54,28511.30%B.Comment on the percent change in inventory from 2016 to 2017 compared to the percent change in cost of sales from 2016 to 2017When you compare the

- 73. percentage changes in inventory from 2016 to 2017 to the percentage changes in cost of sales from 2016 to 2017, you see that inventory changed more than cost of sales changed. Internet ExerciseBig RockCandy Mountain Mining Co.Income StatementFor the Year Ended Dec. 31,202020202019Sales412,500398,600Cost of Goods Sold318,786315,300Gross Profit93,71483,300=B5-B6Selling and G&A Expenses26,25024,550Other Expenses1,2101,245Depreciation Expense29,80029,652EBIT36,45427,853=B7- SUM(B8:B10)Interest Expense8,5828,457Earnings Before Taxes27,87219,396=B11- B12Taxes6,9684,849=B13*B18Netlncome20,90414,547=B13- B14Notes:Tax Rate0.250.25Shares52,10052,100EPS$0.40$0.40Big Rock Candy Mountain Mining Co.Balance SheetAs of Dec. 31,2020Assets20202019Cash16,43511,596Accounts Receivable45,89647,404Marketable Securities3,656619Inventory52,39754,599Total Current Assets118,384114,218=SUM(B5:B8)Gross Fixed Assets436,573397,023Accumulated Depreciation87,45057,650Net Plant & Equipment349,123339,373=B10-B11Total Assets467,507453,591=B9+B12Liabilities and Owner's EquityAccounts Payable37,75236,819Accured Expenses3,1833,085Total Current Liabilities40,93539,904=SUM(B15:B16)Long-term Debt170,562178,581Total Liabilities211,497218,485=B17+B18Common Stock58,66458,664Additional Paid-In- Capital136,807136,807Retained Earnings60,53939,635Total Shareholder's Equity256,010235,106=SUM(B20:B22)Total Liabilities and Owner's Equity467,507453,591=B19+B23Big Rock Candy Mountain Mining Co.Common Size Income StatementFor the years 2019 and 2020Income StatementCommon Size Income

- 74. Statement2020201920202019Sales412,500.00398,600.00100.00 %100.00%Cost of Goods318,786.00315,300.0077.28%79.10%Gross Profit93,714.0083,300.0022.72%20.90%Depreciation29,800.002 9,652.007.22%7.44%Selling & Admin. Expense26,250.0024,550.006.36%6.16%Other Operating Expense ___1,210.001,245.000.29%0.31%Net Operating Income36,454.0027,853.008.84%6.99%Interest Expense8,582.008,457.002.08%2.12%Earnings Before Taxes27,872.0019,396.006.76%4.87%Taxes6,968.004,849.001.6 9%1.22%Net Income20,904.0014,547.005.07%3.65%New Smyrna Surf ShopStatement of Cash FlowsFor the Year 2020Cash Flows from OperationsNet Income120.540.00Depreciation Expense7,148Change in Accounts Receivable(11,248)Change in Inventories(8,276)Change in Accounts Payable1,589Total Cash Flows from Operations109,753.00Cash Flows from InvestingChange in fixed assets(41,704)Total Cash Flows from InvestingS (41,704)Cash Flows from FinancingChange in Notes Payable(3,025)Change in Long-Term Debt755Change in Common Stock-Change in Paid-In Capital-Cash Dividends(60,000)Total Cash Flows from Financing(62,270.00)Net Change in Cash Balance5,779.00Check answer against Balance SheetBeginning Cash From Balance Sheet15,187Ending Cash From Balance Sheet20,966Net Change in Cash Balance5,779.00