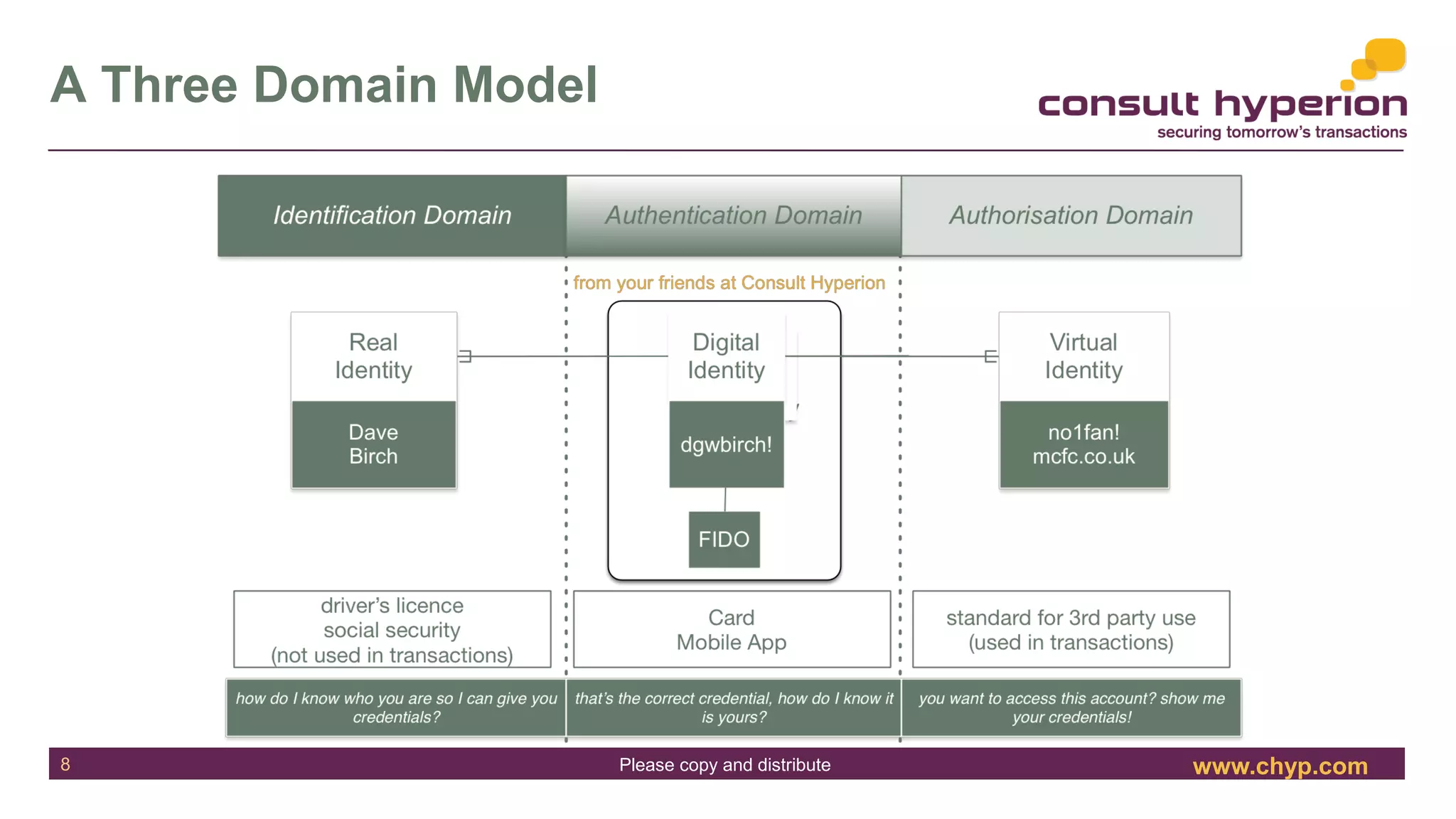

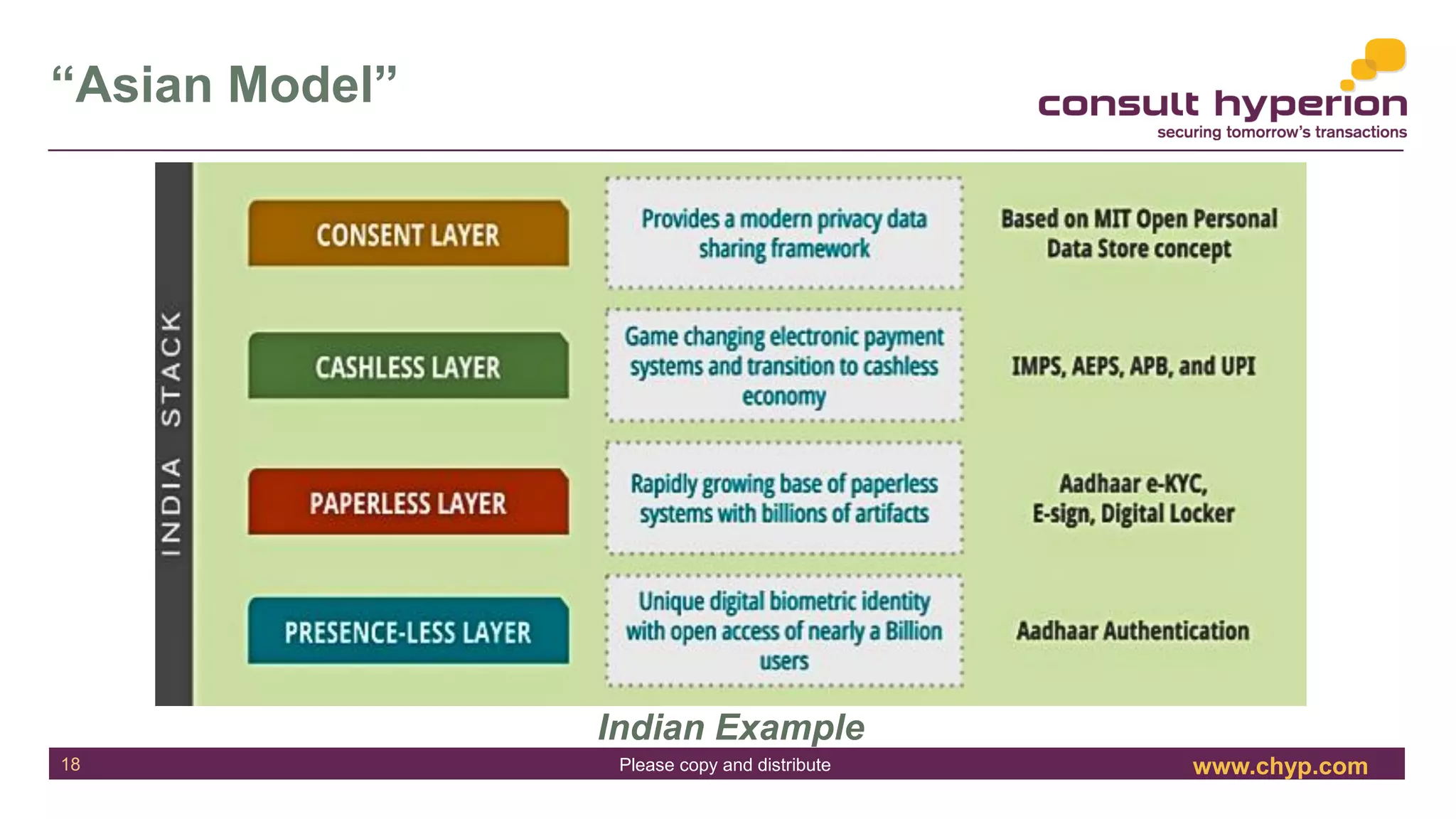

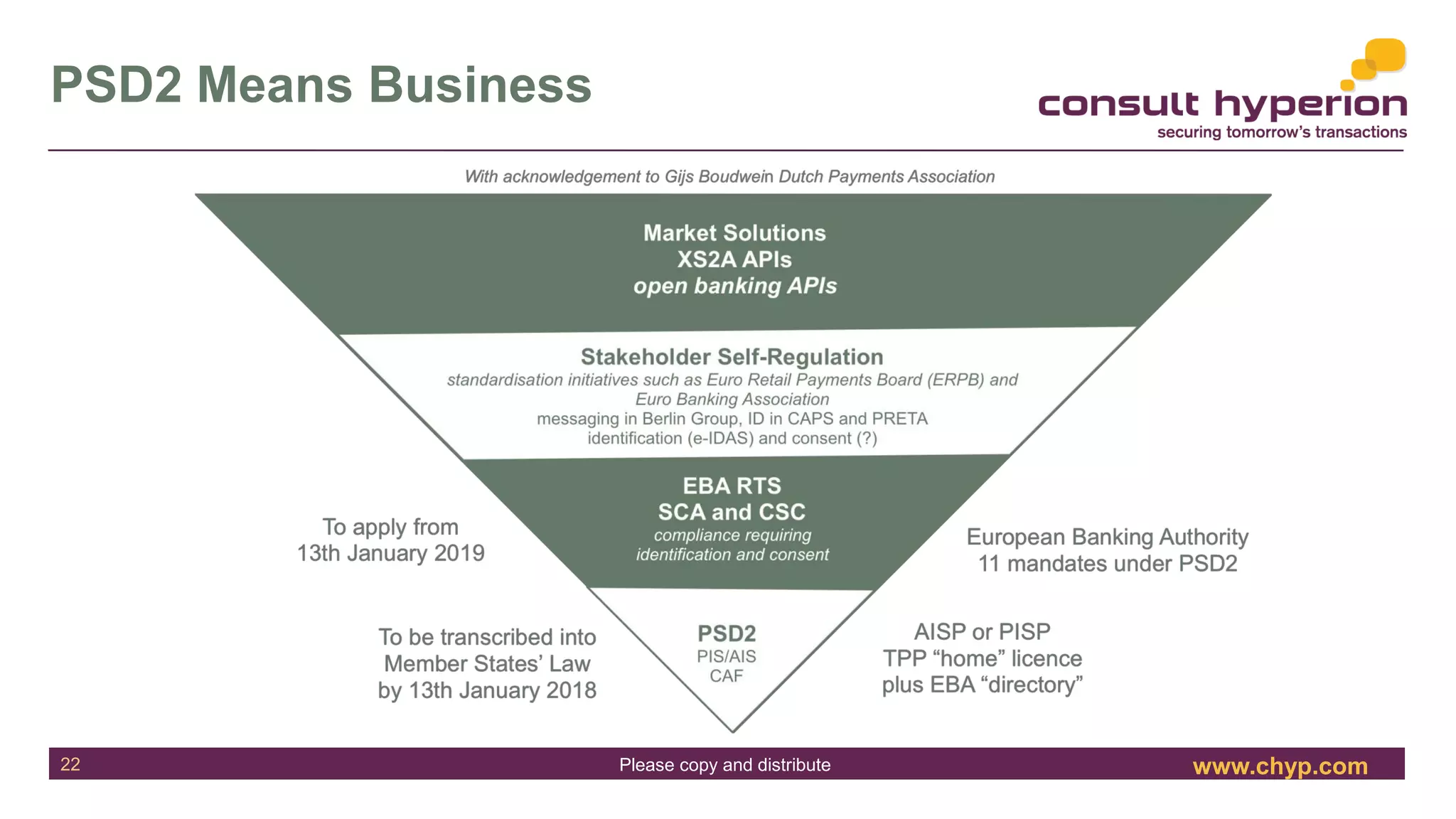

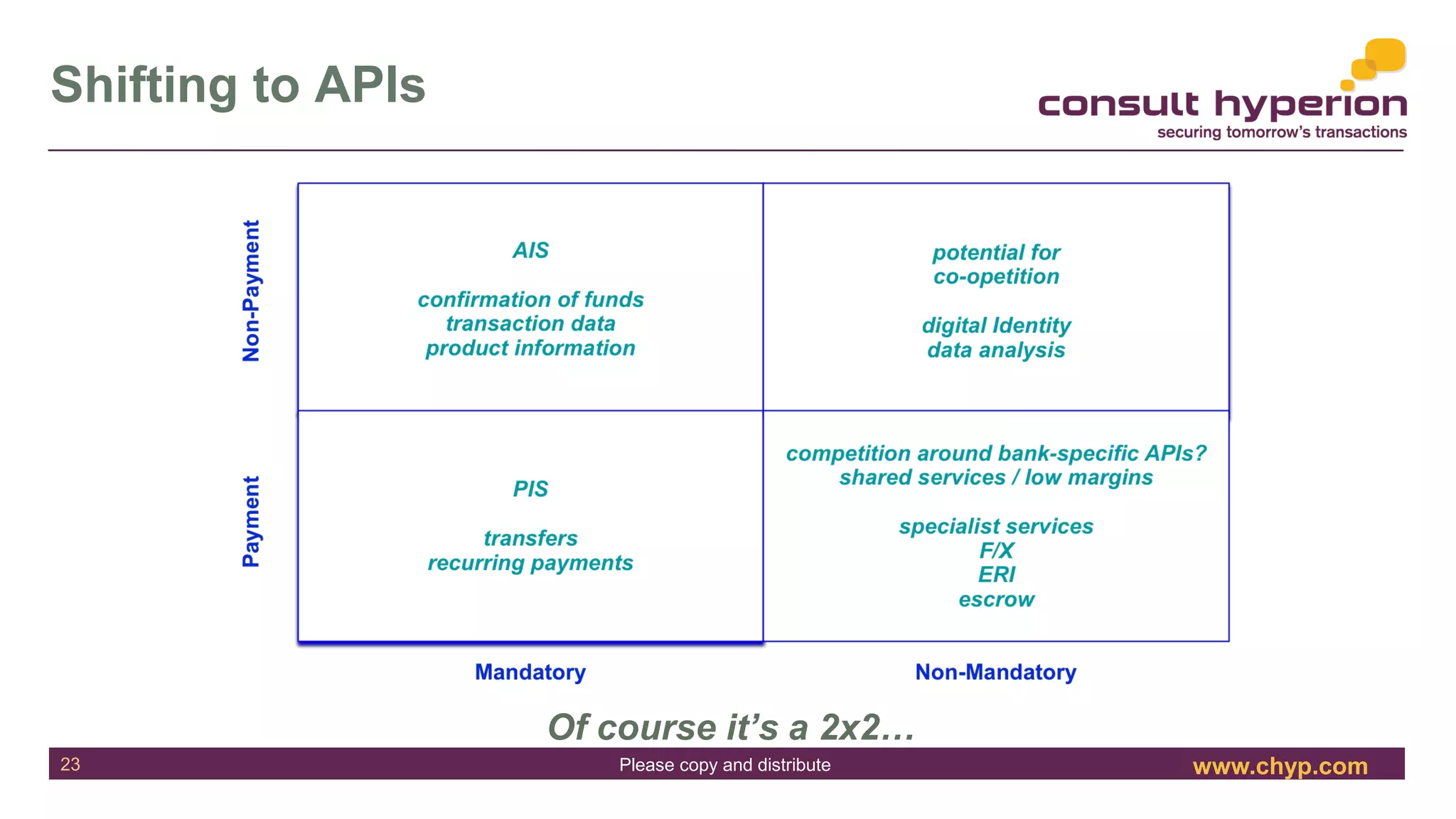

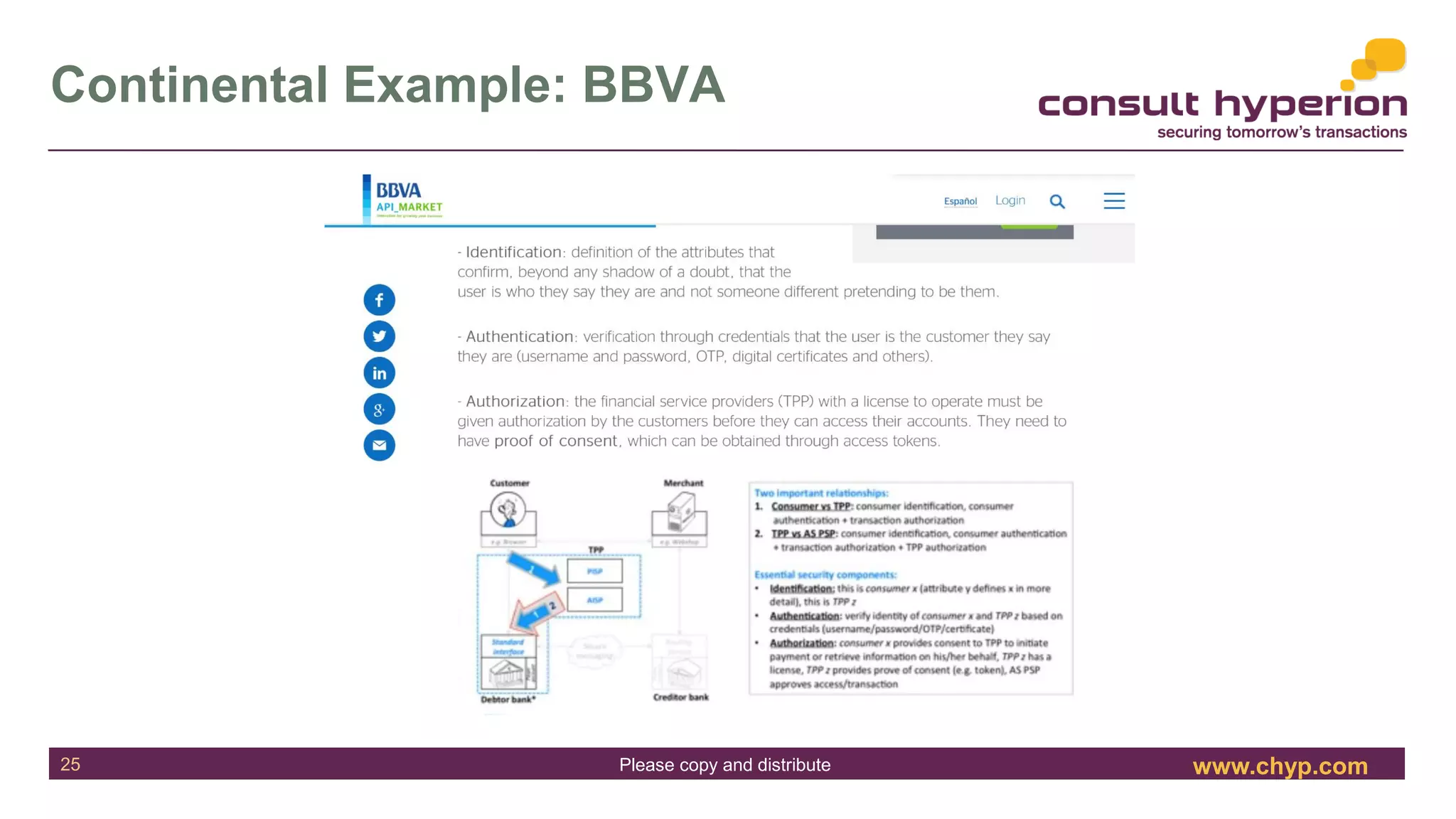

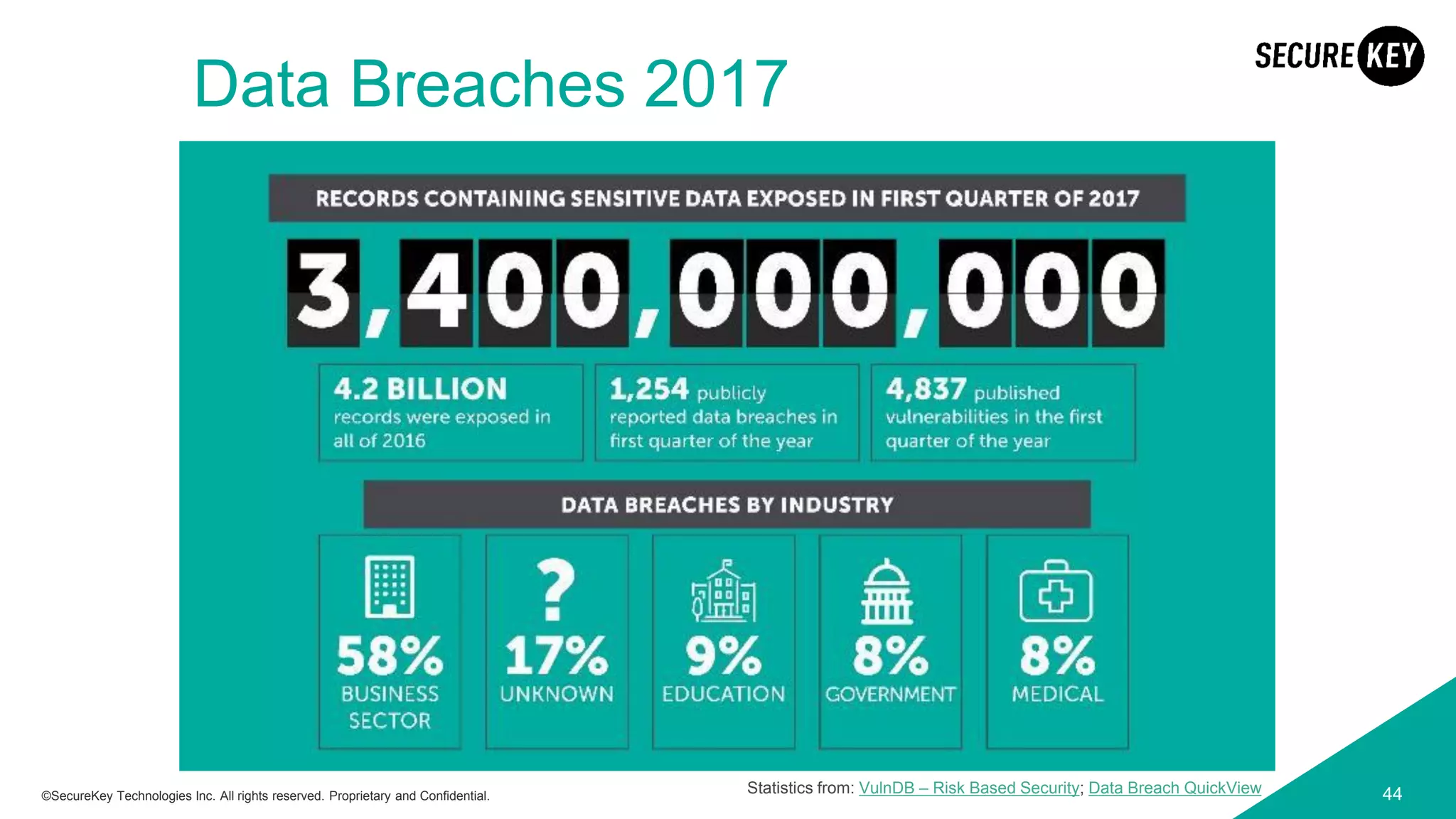

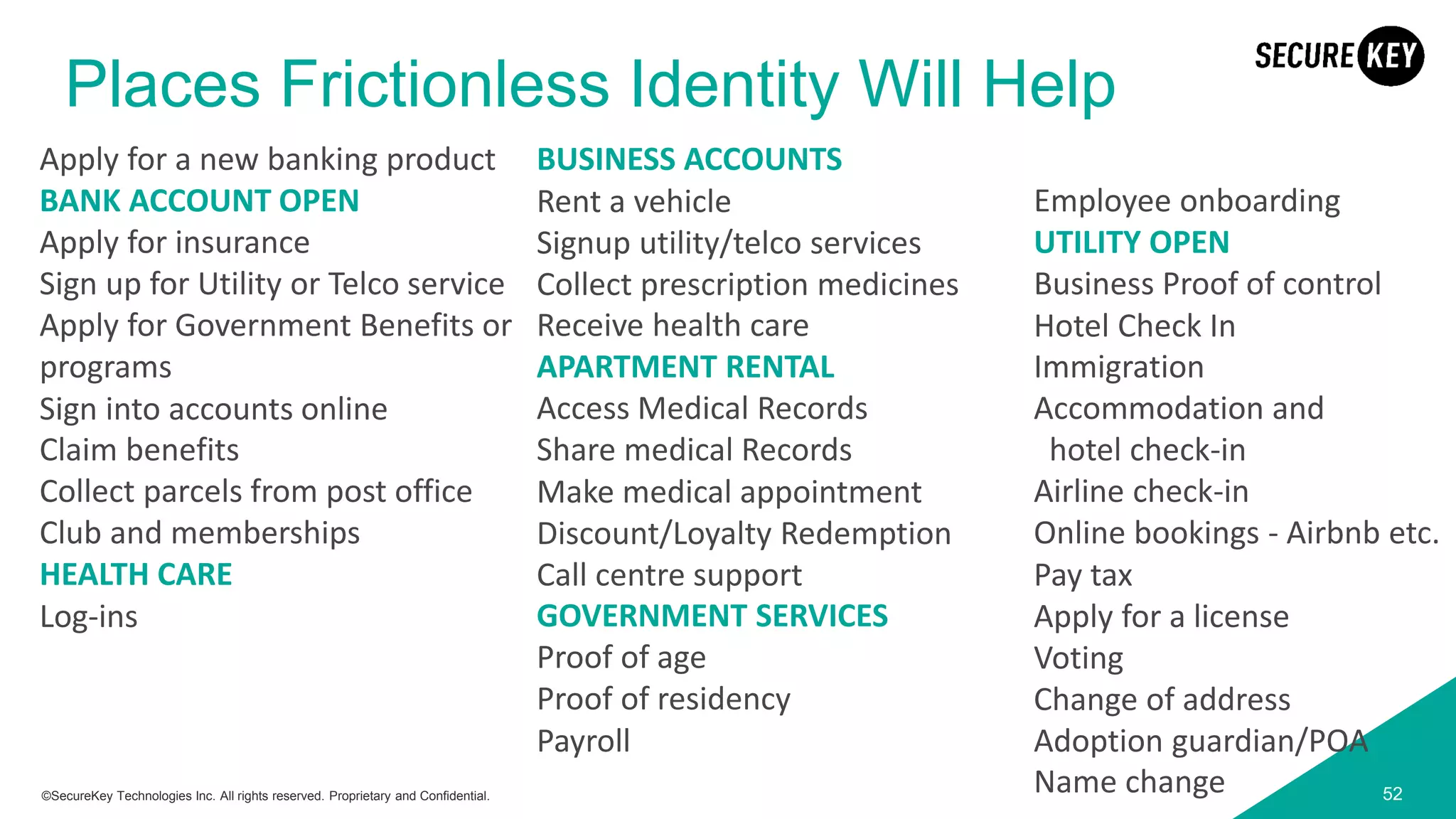

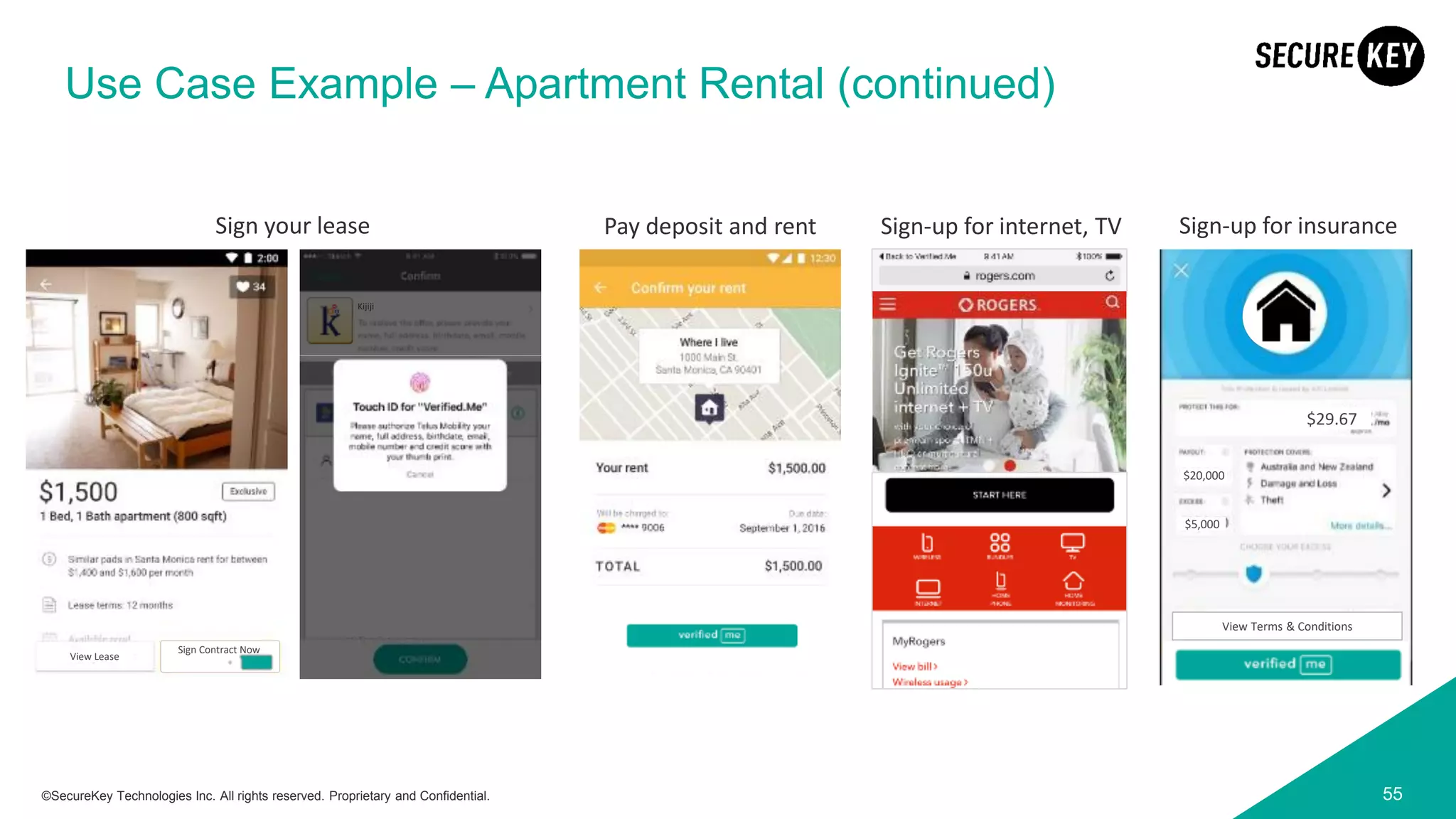

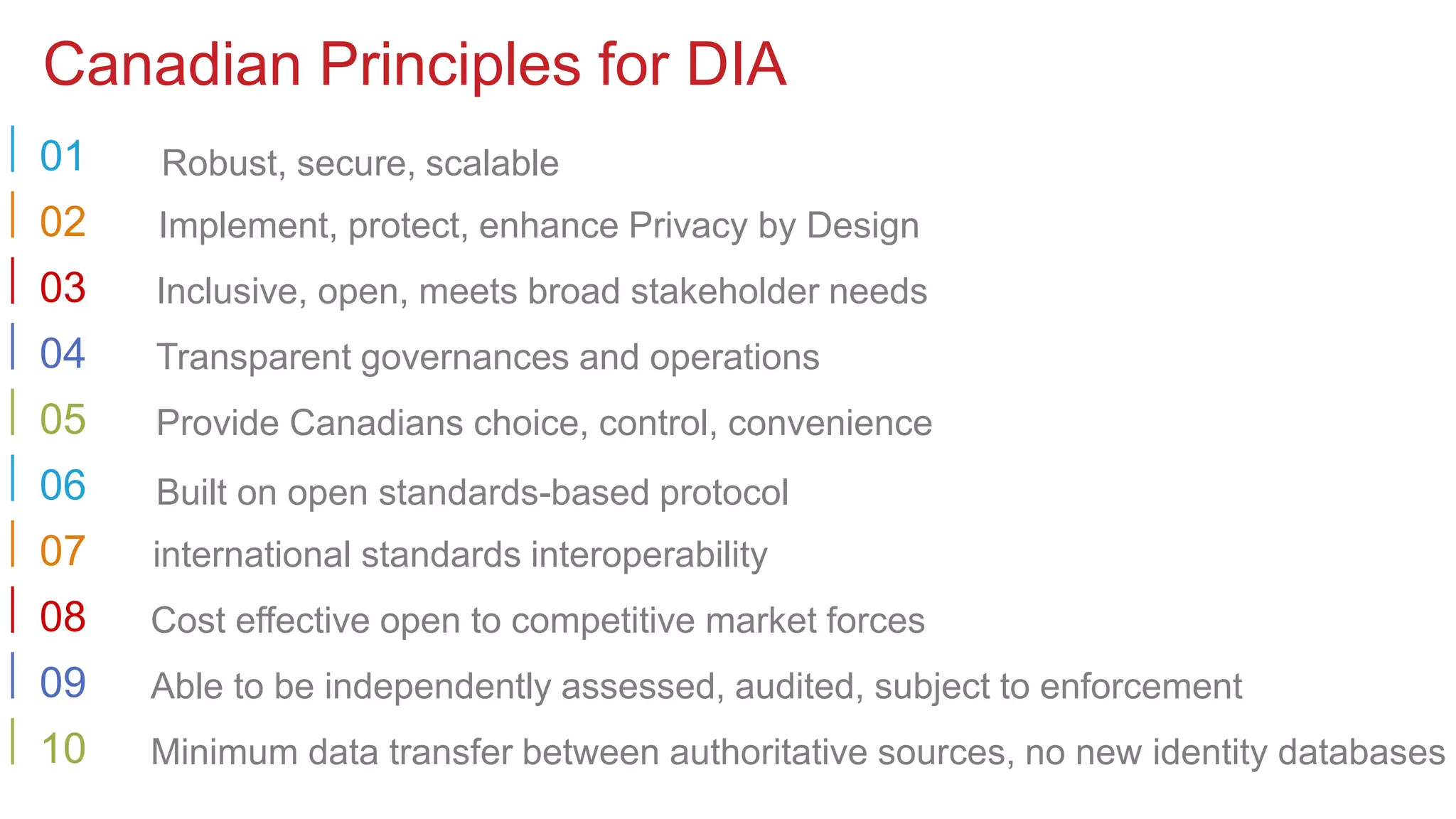

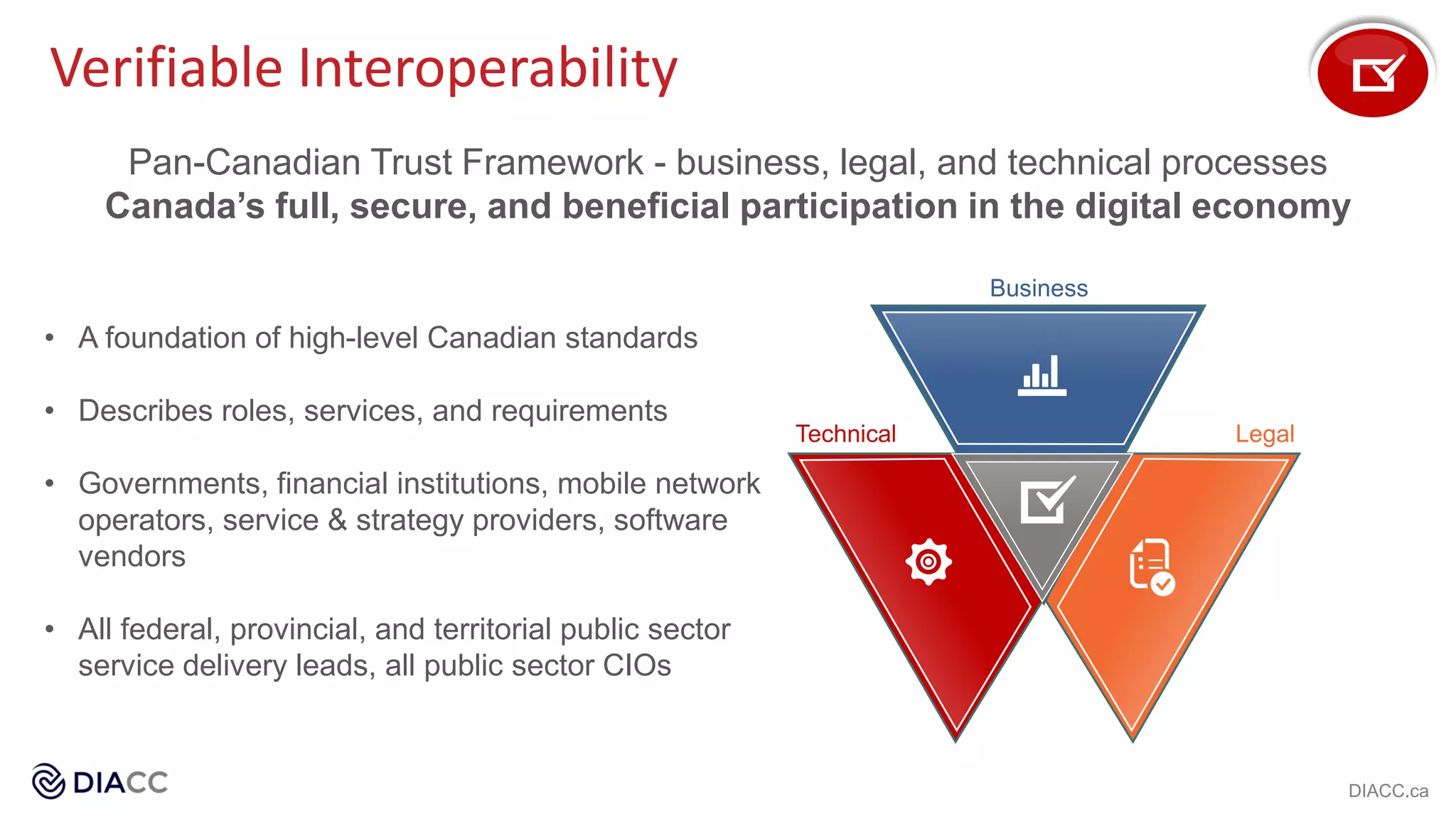

The document discusses the importance of digital identity strategies for banks, emphasizing the need for secure and efficient systems amid evolving regulations and consumer expectations. It outlines various identity models and approaches and highlights the challenges faced by banks, such as increasing competition and the need for open ecosystems. Additionally, it presents potential solutions, including a Canadian digital identification framework aimed at enhancing consumer privacy and innovation in the digital economy.