More Related Content

Similar to SBAC Top Sheet (20)

SBAC Top Sheet

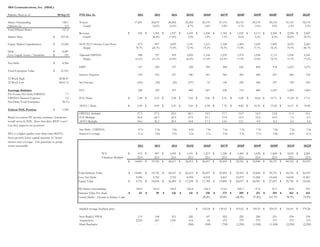

- 1. SBA Communications, Inc. (SBAC)

Balance Sheet as of 30-Sep-15 FYE Dec 31, 2012 2013 2014 2015E 2016P 2017P 2018P 2019P 2020P 2021P 2022P

Shares Outstanding 126.1 Towers 17,491 20,079 24,292 25,424 26,133 27,133 28,133 29,133 30,133 31,133 32,133

Options (a) 0.9 Growth 14.8% 21.0% 4.7% 2.8% 3.8% 3.7% 3.6% 3.4% 3.3% 3.2%

Total Diluted Shares 127.0

Revenue 954$ 1,305$ 1,527$ 1,635$ 1,658$ 1,782$ 1,935$ 2,113$ 2,309$ 2,558$ 2,827$

Market Price 107.00$ Growth 36.8% 17.0% 7.0% 1.4% 7.5% 8.6% 9.2% 9.2% 10.8% 10.5%

Equity Market Capitalization 13,585$ NOI (TCF+Service Cash Flow) 675 897 1,099 1,191 1,213 1,328 1,469 1,629 1,805 2,035 2,281

Margin 70.7% 68.7% 71.9% 72.9% 73.2% 74.5% 75.9% 77.1% 78.2% 79.5% 80.7%

Debt 8,487$

Less: Liquid Assets / Securities 121$ Adjusted EBITDA 588 797 999 1,092 1,126 1,239 1,379 1,538 1,711 1,938 2,181

Margin 61.6% 61.1% 65.4% 66.8% 67.9% 69.5% 71.3% 72.8% 74.1% 75.7% 77.2%

Net Debt 8,366$

EBIT 147 230 337 328 394 508 646 804 978 1,219 1,475

Total Enterprise Value 21,951$

Interest Expense 278 312 337 340 361 369 390 420 451 490 532

52 Week High $128.47

52 Week Low $101.12 Net Income (181) (56) (24) (197) 33 140 256 384 527 728 943

Leverage Statistics FCF 228 329 473 490 607 638 753 880 1,019 1,204 1,403

Pro Forma Net Debt/EBITDA 7.7

EBITDA/Interest Expense 3.2 FCF/Share 1.88$ 2.53$ 3.58$ 3.83$ 5.06$ 5.51$ 6.88$ 8.64$ 10.71$ 13.58$ 17.11$

Net Debt/Total Enterprise 38.1%

AFFO / Share 3.09$ 4.09$ 5.21$ 5.69$ 6.20$ 7.32$ 8.82$ 10.76$ 13.02$ 16.11$ 19.89$

Federal NOL Position 1,300$

EBITDA Multiple 37.3 27.5 22.0 20.1 19.5 17.7 15.9 14.3 12.8 11.3 10.1

Based on current PT income estimates, burndown FCF Multiple 56.8 42.3 29.9 27.9 21.1 19.4 15.5 12.4 10.0 7.9 6.3

would occur in 2020. Does that drive REIT conv? AFFO Multiple 34.6 26.2 20.5 18.8 17.3 14.6 12.1 9.9 8.2 6.6 5.4

Can they improve tax position?

Net Debt / EBITDA 8.7x 7.2x 7.8x 8.2x 7.9x 7.6x 7.5x 7.3x 7.4x 7.2x 7.0x

SBA is a higher quality asset than other REITS, Interest Coverage 2.1x 2.6x 3.0x 3.2x 3.1x 3.4x 3.5x 3.7x 3.8x 4.0x 4.1x

faster growth, lower capital intensity w/ better

interest rate coverage. 2-4x premium vs group

seems reasonable 2012 2013 2014 2015E 2016P 2017P 2018P 2019P 2020P 2021P 2022P

TCF 675$ 897$ 1,099$ 1,191$ 1,213$ 1,328$ 1,469$ 1,629$ 1,805$ 2,035$ 2,281$

Valuation Multiple 22.0 22.0 22.0 22.0 22.0 22.0 22.0 22.0 22.0 22.0 22.0

14,841$ 19,726$ 24,167$ 26,212$ 26,697$ 29,205$ 32,310$ 35,848$ 39,721$ 44,765$ 50,193$

Total Intrinsic Value 14,841$ 19,726$ 24,167$ 26,212$ 26,697$ 29,205$ 32,310$ 35,848$ 39,721$ 44,765$ 50,193$

Less: Net Debt 5,090 5,702 7,763 8,954 8,915 9,401 10,273 11,268 12,624 14,045 15,267

Equity Value 9,751$ 14,024$ 16,404$ 17,258$ 17,782$ 19,804$ 22,037$ 24,581$ 27,097$ 30,720$ 34,926$

FD Shares Outstanding 149.0 141.0 130.4 122.4 118.3 113.0 105.3 97.8 91.9 84.8 78.9

Intrinsic Value Per share 65$ 99$ 126$ 141$ 150$ 175$ 209$ 251$ 295$ 362$ 443$

Current Market - Discount to Intrinsic Value 28.8% 39.0% 48.9% 57.4% 63.7% 70.5% 75.8%

Implied average buyback price 124.54$ 139.63$ 163.62$ 199.55$ 254.53$ 316.01$ 379.28$

New Build CAPEX 113 168 211 226 147 222 225 228 231 234 236

Acquisitions 2,259 687 1,591 614 68 375 375 375 375 375 375

Share Buybacks - - - (900) (500) (750) (1,250) (1,500) (1,500) (2,250) (2,250)