Accounting For Management Unit 2

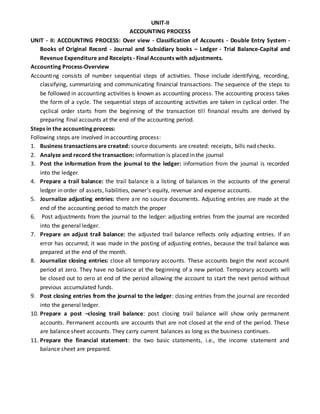

- 1. UNIT-II ACCOUNTING PROCESS UNIT - II: ACCOUNTING PROCESS: Over view - Classification of Accounts - Double Entry System - Books of Original Record - Journal and Subsidiary books – Ledger - Trial Balance-Capital and Revenue Expenditure and Receipts - Final Accounts with adjustments. Accounting Process-Overview Accounting consists of number sequential steps of activities. Those include identifying, recording, classifying, summarizing and communicating financial transactions. The sequence of the steps to be followed in accounting activities is known as accounting process. The accounting process takes the form of a cycle. The sequential steps of accounting activities are taken in cyclical order. The cyclical order starts from the beginning of the transaction till financial results are derived by preparing final accounts at the end of the accounting period. Steps in the accounting process: Following steps are involved in accounting process: 1. Business transactions are created: source documents are created: receipts, bills nad checks. 2. Analyze and record the transaction: information is placed in the journal 3. Post the information from the journal to the ledger: information from the journal is recorded into the ledger. 4. Prepare a trail balance: the trail balance is a listing of balances in the accounts of the general ledger in order of assets, liabilities, owner’s equity, revenue and expense accounts. 5. Journalize adjusting entries: there are no source documents. Adjusting entries are made at the end of the accounting period to match the proper 6. Post adjustments from the journal to the ledger: adjusting entries from the journal are recorded into the general ledger. 7. Prepare an adjust trail balance: the adjusted trail balance reflects only adjusting entries. If an error has occurred, it was made in the posting of adjusting entries, because the trail balance was prepared at the end of the month. 8. Journalize closing entries: close all temporary accounts. These accounts begin the next account period at zero. They have no balance at the beginning of a new period. Temporary accounts will be closed out to zero at end of the period allowing the account to start the next period without previous accumulated funds. 9. Post closing entries from the journal to the ledger: closing entries from the journal are recorded into the general ledger. 10. Prepare a post –closing trail balance: post closing trail balance will show only permanent accounts. Permanent accounts are accounts that are not closed at the end of the period. These are balance sheet accounts. They carry current balances as long as the business continues. 11. Prepare the financial statement: the two basic statements, i.e., the income statement and balance sheet are prepared.

- 2. Types of Accounts (or) Classification of Accounts An accountant records a transaction in his book of accounts; first he must understand which transaction should be debited and which should be credited. To perform such accounting transactions, a clear idea of types of accounts and classification of accounts is very important. Classification of Accounts Following are the types and classification of accounts 1. Personal accounts 2. Real Accounts 3. Nominal Accounts Personal Accounts Those accounts which are related to individuals, persons and firms are called personal accounts. Personal accounts can be further divided in to: 1. Natural Person’s Personal Accounts 2. Artificial Persons Accounts 3. Representative Personal Accounts 1. Natural Person’s Personal Accounts These accounts are related to human beings, physically we can touch them. They can sell or buy product and we can we can also do the same in response. Such accounts are necessary to track to those amounts which are payable or receivable. For Example: Baltiwala Accounts, Eraj Enterprises Accounts 2. Artificial Persons Accounts These are not living or human beings but have a separate entity as per the law. Such business can be operated by Board of Governors, Head of Departments, and Principles etc. For Example: Standard Chartered Bank, Club or Society Accounts 3. Representative Personal Accounts When an account represents certain person(s) is called representative personal accounts. These are

- 3. i. Outstanding Expense Account Such accounts are created when we are bound to pay expense because we have got some services from other individuals and firms. In the balance sheet the amount will be appeared on the liability side. These accounts are also known as liability accounts. For Example: Outstanding courier charges, salaries, communication charges. ii. Advance Expense Accounts In this case expenses are paid in advance but in reward we have not yet get the services. Here we will create an advance payment account in the name of those persons to whom advances are paid. For Example: Advance Mobile Charges, Advance Salary etc. iii. Outstanding Income Account In simple words the amount which is receivable and the services are already provided. For Example. Eraj Enterprises provided his services to Singer Group, but Eraj Enterprises have not yet received in income against services provided. EE will open outstanding income account in the name of Singer Group, which will show accounts receivable from Singer Group. iv. Advance income Account. Here earnings are received before the services are provided to the party. For Example: A lawyer received his fee in advance but he has not presented in the court for hearing. Real Accounts Real accounts represent the assets both tangible and intangible. For Example: Bonds purchased property and building, cash in hand etc. Nominal Accounts These accounts have no existence in real life but just a name in the books of account. These are also called proprietary because they are related to business proprietor. For Example: Salary Accounts, Discount Accounts, Rent Accounts etc. Debit and Credit (or) Golden rules of Accounting: 1. Personal Account: Debit the Receiver

- 4. Credit the Giver 2. Real Account: Debit what comes in Credit What Goes out 3. Nominal Account: Debit all Expenses and losses Credit all incomes and Gains Systems of Accounting They are two systems in accounting. They are; a) Single Entry System b) Double Entry System A) Single Entry System; Meaning of Single Entry System: Under this system, a Cash Book is prepared which shows the receipts and payments of cash transactions and no other ledger is maintained except a rough book for recording transactions relating to personal accounts. It is actually called ‘Pure Single Entry’. Under this method, real accounts and nominal accounts are not recognized. In short, these transactions are only recorded in Cash Book without, however, applying the principles of double entry. That is why it is said: The system which does not totally follow the principles of Double Entry System is called Single Entry System’. For recording transactions relating to personal accounts, however, double entry system is followed, say, when cash is received from a customer—it is recorded in Cash Book first and, thereafter, in the personal account of the customer concerned, i.e., recorded in two places—like double entry basis.

- 5. Again, no entry is recorded in the books of accounts for any internal transactions, like depreciation on assets. Therefore, it may be said that Single Entry System is nothing but an admixture of Single Entry, Double Entry, and no entry. According to R. N. Carter, Single Entry cannot be termed as a system, as it is not based on any scientific system like Double Entry System. For this purpose, Single Entry is nowadays known as Preparation of accounts from incomplete records. Practically, this system is followed by those firms whose transactions are limited and, at the same time, who maintain only the essential records. There is no hard and fast rule for maintaining records under this system, i.e., it depends on the circumstances and the necessity of the firm. Salient Features of Single Entry System: The salient features of Single Entry System are: i) This system is followed by a sole proprietorship firm or a partnership firm. The companies cannot follow this system. (ii) Under this system, only one Cash Book is maintained which mixes up both the private and business transactions. (iii) Usually personal accounts are recorded only, i.e., Real and Nominal accounts are ignored. (iv) Lack of uniformity is noticed if accounts are kept under Single Entry basis. (v) Profit or loss, under this system, can be ascertained but not the financial position as a whole. (vi) Arithmetical accuracy of the account is not possible since Trial Balance cannot be prepared. (vii) Practically, this system is the admixture of Single Entry, Double Entry and no entry. Advantages of Single Entry System: (i) Since this system is very simple, anyone can maintain it without any adequate knowledge of accounting. (ii) Limited accounts are to be opened under this system since the transactions relating to personal accounts are recognized only and not the Real and Nominal accounts. (iii) Since the number of books is limited, expenses related to the keeping of records are also very nominal. (iv) In the case of accounting for an event, i.e., household, social and festival etc., it is very helpful. Disadvantages of Single Entry System: (i) Arithmetical accuracy of the books of account is not possible since the Trial Balance cannot be prepared under this system. (ii) It is also not possible to ascertain the correct amount of profit or loss of the firm—i.e., results from operation—since the nominal accounts are missing under this system.

- 6. (iii) Similarly, Balance Sheet cannot be prepared since the real accounts are not recognized. Therefore, the real financial position cannot be known at the end of the accounting period. (iv) As arithmetical accuracy is not possible, possibility of committing fraud or manipulation is greater in comparison with Double Entry System. (v) Any statistical information relating to the business or the comparison between the two firms or the interim accounts etc.—which help the management to take decision or to formulate policy in future—is not possible under this system. (vi) Outsiders (e.g., Income-tax authorities, Bank etc.) do not rely on this system. B) Double Entry System According to this system, every transaction has two-fold aspect i.e., one party receiving benefit and another party giving the benefit. When we receive something we give something else in return. For example, when we purchased goods for cash, we receive goods and give cash in return. When we sell goods on credit, goods are given and the customer becomes debtor. This method of writing every transaction in two accounts is known as Double Entry System. Every transaction is divided into two aspects, debit and credit. One account is to be debit and another is to be credited for every transaction in order to have a complete record of the same. Every transaction has to be recorded in two different accounts in opposite sides for an equal value. Both the accounts cannot be debited or credited. The basis principle double entry system of book keeping is that for every debit there is a corresponding credit of equal value. Advantages of Double Entry System: Based on scientific accounting information If we study the history of accounting, we find many clues which tell us that double entry system is fully based on scientific accounting equation. This equation shows two side one is asset and other is liabilities. If we compare both sides, it will be always equal. It means assets=liabilities. So, if we pass the any entry on the basis of double entry system, we are apply this formula. We have to pass the entry in such a way so that i) Scientific system: This system is the only scientific system of recording business transactions in a set of accounting records. It helps to attain the objectives of accounting. ii) Complete record of transactions: This system maintains a complete record of all business transactions. iii) A check on the accuracy of accounts: By use of this system the accuracy of accounting book can be established through the device called a Trail balance. iv) Ascertainment of profit or loss: The profit earned or loss suffered during a period can be ascertained together with details by the preparation of Profit and Loss Account. v) Knowledge of the financial position of the business: The financial position of the firm can be ascertained at the end of each period, through the preparation of balance sheet. vi) Full details for purposes of control: This system permits accounts to be prepared or kept in as much detail as necessary and, therefore, affords significant information for purposes of control etc.

- 7. vii) Comparative study is possible: Results of one year may be compared with those of the precious year and reasons for the change may be ascertained. viii) Helps management in decision making: The management may be also to obtain good information for its work, especially for making decisions. ix) No scope for fraud: The firm is saved from frauds and misappropriations since full information about all assets and liabilities will be available. Difference between Double Entry System and Single Entry System: The following are the points of difference between single entry system and double entry system: Double Entry System Single Entry System 1. Both the aspects of a transaction are recorded in it. So complete analysis of a transaction is possible. 1. For some transactions both the aspects are recorded, while for some other transactions only one aspect is considered. Again, some transactions are not recorded at all. Thus, complete analysis of a transaction is not always possible. 2. All the difference classes of accounts - assts a/c, liability a/c, capital a/c, expense a/c and revenue a/c - are maintained. 2. Only cash accounts and personal accounts are maintained. 3. It is possible to verify the arithmetical accuracy of books through trial balance. 3. As under this system both the aspects of all transactions are not recorded, it is not possible to prepare trial balance and thereby verify arithmetical accuracy of books of account. 4. In this system profit and loss account can be prepared and the result of the business can be determined thereby 4. Under this system no account is maintained in respect of income or expenditure. So it is not possible to prepare profit and loss account. However, profit and loss is determined through a statement by comparing closing capital with the opening capital, but is is not so reliable. 5. The financial position of the business can be compared through balance sheet. 5. No account is maintained in respect of assets and liabilities. So, balance sheet cannot be prepared. However, a statement of affairs is prepared on the lines of balance sheet. But it is not regarded as a reliable document, since the values of assets and liabilities are not obtained from the regular books of accounts.

- 8. 6. All the necessary information is available from this systemat any time. 6. As no detailed record is maintained in respect of all transactions full information is not available from the books of account. 7. It is easier to detect mistakes and deflections under this system. 7. Mistakes and deflections cannot be detected easily under this system. 8. This systemis based on scientific method 8. It does not follow any scientific rules. 9. Accounting is complex and costly under this system 9. Accounting is less complex and less costly under this system. 10. This system requires men with special knowledge. 10. Men with common knowledge will do in this case. 11. In the first stage each transaction is recorded in a book named "journal" and therefore it is posted in another book named "ledger" in the second stage. 11. There is no rule here as such. 12. Since accounting under this system requires a large number of employees, it may not be possible to maintain secrecy. 12. Here secrecy can be maintained, since only a few persons are sufficient for performing accounting job. Books of Original Record Accounting books and records include records of assets and liabilities, monitory transactions, ledgers, journal, any supporting documents such as checks and invoices. The various books of account can be conveniently classified into journals. Journal: Journal means a day book or daily record. It is the book where in all the transactions are first recorded in chronological order. It is a book of prime, original or first entry, as all business transactions are first recorded in the journal. From journal the posting are made in the ledger. Journal is only subsidiary book i.e., a book which is sub-ordinate to the ledger. Which is principal book of accounts? the journal analysis the various transactions into their debits and credits so that they could be easily posted to the ledger accounts. In other words journal is helpful in the preparation of accounts in the ledger. The process of recording transactions in journal is termed as ‘journalizing’. The journal is rules as follows: JOURNAL Date Particulars L.F Debit (Rs) Credit(Rs)

- 9. Year month day Name of A/c(to be debited) To name of A/c (to be credited) 1. Date: the date on which the transaction took place in entered in this column. The year is written on the top, and then the date column is divided in two parts, the first is divided into two parts, the first part is used for writing the month and second part is used for writing the date. 2. Particulars: in the first line the name of the account to be debited is written. The word’Dr’ (Debit) is written at the end of the first line. The second line some space is left and the word ‘To’ is written before the name of the account to be credited is written. A brief explanation, usually beginning with the word. Being Or For is written called ‘narration’. The ‘narration explains the reason for debiting and crediting the particular accounts and helps one to understand the nature and purpose of the Journal entry at a future date. To separate one entry from another, a line does not extend to other columns. 3. L.F: The L.F stands for “Ledger Folio” in this column the page numbers on which the various appear in the ledger are entered. 4. Debit Amount: in this column the amount to be debited against the debit account is written. 5. Credit Amount: in this column the amount to be debited against the debit account is written. Advantages of Journal 1. It provides date wise record for all business transactions. 2. It provides an explanation of the transactions. 3. It shows all the necessary information regarding a transaction. 4. It helps to locate and prevent errors. Subsidiary Books: Subsidiary Books are those books of original entry in which transactions of similar nature are recorded at one place and in chronological order. In a big concern, recording of all transactions in one Journal and posting them into various ledger accounts will be very difficult and involve a lot of clerical work. This is avoided by sub-dividing the journal into various subsidiary journals or books. The subdivisions of journal into various subsidiary journals for recording transactions of similar nature are called as ‘Subsidiary Books.’ Types of subsidiary Books: 1. Cash Book 2. Purchase Book 3. Sales Book 4. Purchase Return Book 5. Sales Return Book

- 10. 6. Bills Receivable Book 7. Bills Payable Book 8. Journal Proper 1. Cash Book: transactions held in cash or by cheque are recorded in this book. There are two sides in a cash book. In the left hand side all cash receipts are recorded and in the right hand side all cash payments are recorded. Cash book is of five types: a) Single column cash book: only receipt of cash book and payment of cash are recorded. b) Double column cash book: Receipt of cash, receipt of cash discount, payment of cash and discount allowed are recorded. c) Triple column cash book: along with the transactions which are recorded in double column cash book, cheque received and cheque paid are recorded. d) Bank cash book: receipt of cheque, payment of cheque, cash discount allowed and cash discount received are recorded. e) Pretty cash book: Only small payments of cash are recorded by the petty cashier. Advantages of cash book: 1. Daily cash receipts and cash payments are easily ascertained. 2. Cash in hand at any time can easily be ascertained through Cash Book balance. 3. Any mistake in the book can be easily detected at the time of verification of cash. 4. Any defalcation of money can be detected while verifying cash. 5. Since cash is verified daily, Cash Book is always kept up-to-date. 2. Purchase Book: all credit purchase of goods are written in this book. Cash purchse of goods and credit purchase of assets are not recorded in this book. Other names of purchase book are purchase day book, purchase journal, bought journal, inward invoice book etc. 3. Sales Book: all sales of goods are written in this book. Cash sale of goods and credit sale of assets are not recorded in this book. Other names of sales book are sales day book, sales journal, sold book, outward invoice book etc. 4. Purchase Return Book: it may be necessary to return some goods that the firm has bought on credit for a variety of reasons. All returns of such goods are recorded primarily in return outward Book. This book is also known as Purchase Return Book. 5. Sales Return Book: goods may be return by customers for a variety of reasons. All goods return from customers are recorded in sales return book. This book is also known as Return Inward Book. 6. Bills Receivable Book: when credit sale of goods are made the purchaser gives his guarantee to make payment in future in the form of bill. When the seller receives such bill, it is bills receivables for him as he will receive payment in future against such bill. In case a business house receives a number of bills, a bill receivable book is maintained to record all such bills. 7. Bills Payable Book: when credit purchases are made by a firm it gives a guarantee to the seller to make payment in future in the form of a bill. The bill is said to be Bills Payable for the firms as he will pay for the bill in future. A bill payable book is opened to record all such bills.

- 11. 8. Journal proper: it is a subsidiary book maintained to record the transactions which cannot be recorded in other special subsidiary books. Usually the transactions of infrequent character are recorded in the journal proper. The entries like adjustment entries, opening entries, closing entries, transfer entries, purchase and sale of assets on credit, interest on capital, interest of drawings etc. are recorded in journal proper. Ledger The book in which accounts are maintained is called ledger. Generally, one account is opened on each page of this book, but if transactions relating to a particular account are numerous, it may extend to more than one page. All transactions relating to that account are recorded chronologically. From journal each transaction is posted to at least two concerned accounts - debit side of one account and credit side of another account. Remember that, if there are two accounts involved in a journal entry, it will be posted to two accounts in the ledger and if the journal entry consists of three accounts (compound entry) it will be posted to three different accounts in the ledger. The process of transferring information from journal to ledger accounts is known as posting. The goal of all transactions is ledger. Ledger is known as the destination of entries in journal but it must be remembered that transactions cannot be recorded directly in the ledger - they must be routed through journal. This concept is illustrated below: Transaction ↓ Journal ↓ Ledger So, the books in which all the transactions of a business concern are finally recorded in the concerned accounts in a summarized form is called ledger. Characteristics of Ledger Account: The ledger has the following main characteristics: 1. It has two identical sides - left hand side (debit side) and right hand side (credit side). 2. Debit aspect of all the transactions are recorded on the debit side and credit aspects of all the transactions are recorded on credit side according to date. 3. The difference of the totals of the two sides represents balance. The excess of debit side over credit side indicates debit balance, while excess of credit side over debit side indicates the credit balance. If the two sides are equal, there will be no balance.

- 12. 4. Generally the balance is drawn at the year end and recorded on the lesser side to make the two sides equal. This balance is known as closing balance. 5. The closing balance of the current year becomes the opening balance of the next year. Forms of Ledger Account o understand clearly as to how to write the accounts in ledger, the standard form of an account is given below with two separate transactions: Date Particulars J.F Amount Date Particulars J.F Amount It appears that each account in the ledger has two similar sides - left hand side is called debit side (briefly Dr.) and right hand side (briefly Cr.) side. Now a day these two words are not used, because it is obvious that the left hand side is debit side and right hand side is credit side. Posting Procedure: Transferring information i.e. entries from journal to ledger accounts is called posting. The procedure of posting from journal to ledger is as follows: 1. Locate the ledger account from the first debit in the journal entry. 2. Record the date in the date column on the debit side of the account. The date is the date of transaction rather than the date of the posting. 3. Record the name of the opposite account (account credited in entry) in the particular (also know as reference column, description column etc) column. 4. Record the page number of the journal in the journal reference (J.R) column from where the entry is being posted. 5. Record the amount of the debit in the "amount column" 6. Locate the ledger account for the first credit in the journal and follow the same procedure. Advantages of Ledger Transactions relating to a particular person, item or heading of expenditure or income are grouped in the concerned account at one place. When each account is periodically balanced it reflects the net position of that account. Ledger is the stepping stone for preparing Trial Balance – which tests the arithmetical accuracy of the accounting books. Since the entries recorded in the journal are referenced into ledger the possibility of errors of defalcations are reduced to the minimum. Ledger is the destination of all entries made in journal or sub-journals. Ledger is the “store-house” of all information which subsequently is used for preparing final accounts and financial statements.

- 13. Trail Balance: Meaning: trail balance is a statement, prepared with the debit and credit balances of ledger accounts to test the arithmetical accuracy of the books. Asset and expenses accounts appear on the debit side of the trail balance whereas liabilities, capital and income accounts appear on the credit side. If all accounting entries are recorded correctly and all the ledger balance are accuracy extracted, the total of all debit balances appearing in the trail balance must equal to the sum of all credit balances. Features of trail balance: The features of trail balance are as follows: 1. It is only a statement. It is not an account. It is simply a list of balances of all accounts. 2. Trail balance can be prepared anytime during the accounting period. 3. It is prepared to check the arithmetical accuracy of posting of entries from journal to ledger, in other words it is an instrument for carrying out the job of checking and testing. 4. It is not a part of the double entry system book keeping bit only for checking the accuracy of posting. However it does not reveal all errors. 5. Tallying of trail balance is not a conclusive profit of accuracy of accounts. Objectives of Trail balance: The preparation of trial balance has the following objectives: 1. Trail balance enables one to establish whether the posting and other accounting processes have been carried out without committing arithmetical errors. 2. Financial statements are normally prepared on the basic of agreed trial balance; otherwise the work may be cumbersome. Preparation of financial statements therefore is the second objective. 3. The trial balance serves as a summary of what is contained in the ledger; the ledger may have to be seen only when details are required in respect of an account. The form of the trail balance is simple and as shown below: Trial Balance as at----------------------------- SNO. Particulars L.F Dr. Amount (Total or Balance) RS Cr. Amount (Total or Balance) RS Some important points to be noted are as follows: 1. A Trial balance is prepared as on a particular date which should be mentioned at the top. 2. In the second column the name of the account is written. 3. In the fourth column the total of the debit side of the account concerned or the debit balance, if any is entered. 4. In the next column, the total of the credit side or the credit balance is written. 5. The two columns are totaled at the end.

- 14. Specimen of trial balance 1 Capital Credit Loan 2 Opening stock Debit Asset 3 Purchases Debit Expense 4 Sales Credit Gain 5 Returns inwards Debit Loss 6 Returns outwards Credit Gain 7 Wages Debit Expense 8 Freight Debit Expense 9 Transportexpenses Debit Expense 10 Royalities onproduction Debit Expense 11 Gas, fuel Debit Expense 12 Discountreceived Credit Revenue 13 Discountallowed Debit Loss 14 Bas debts Debit Loss 15 Dab debts reserve Credit Gain 16 Commission received Credit Revenue 17 Repairs Debit Expense 18 Rent Debit Expense 19 Salaries Debit Expense 20 Loan Taken Credit Loan 21 Interest received Credit Revenue 22 Interest paid Debit Expense 23 Insurance Debit Expense 24 Carriageoutwards Debit Expense 25 Advertisements Debit Expense 26 Petty expenses Debit Expense 27 Trade expenses Debit Expense 28 Petty receipts Credit Revenue 29 Income tax Debit Drawings 30 Office expenses Debit Expense 31 Customs duty Debit Expense 32 Sales tax Debit Expense 33 Provision for discount ondebtors Credit Liability 34 Provision for discount oncreditors Debit Asset 35 Debtors Debit Asset 36 Creditors Credit Liability 37 Goodwill Debit Asset 38 Plant, machinery Debit Asset 39 Land, buildings Debit Asset 40 Furniture, fittings Debit Asset

- 15. 41 Investments Debit Asset 42 Cash in hand Debit Asset 43 Cash at bank Debit Asset 44 Reservefund Credit Liability 45 Loan advances Debit Asset 46 Horse, carts Debit Asset 47 Excise duty Debit Expense 48 Generalreserve Credit Liability 49 Provision for depreciation Credit Liability 50 Bills receivable Debit Asset 51 Bills payable Credit Liability 52 Depreciation Debit Loss 53 Bank overdraft Credit Liability 54 Outstanding salaries Credit Liability 55 Prepaidinsurance Debit Asset 56 Bad debt reserve Credit Revenue 57 Patents & Trademarks Debit Asset 58 Motor vehicle Debit Asset 59 Outstanding rent Credit Revenue Limitations of Trial balance: One should note that the agreement of trial balance is not a conclusive proof of accuracy. In spite of the agreement of the trial balance some errors may remains .these may be of the following types: 1. Transaction has not been entered at all in the journal. 2. Wrong amount has been written has been written in the both column of the journal 3. A Wrong amount has been mentioned in the journal 4. An entry has not at all been posted in the ledger. 5. Entry is posted twice in the ledger. Methods for preparation of Trial balance The different methods of preparation of Trial balance are: 1. Total Method 2. Balance Method 3. Total and Balance Method 1. Total Method: Under this method, every ledger account is totaled and that total amount is transferred to trial balance. In this method, trial balance can be prepared as soon as ledger account is totaled. Time taken to balance the ledger accounts is saved under this method as balance can be found out in the trial balance itself. The difference of totals of each ledger account is the balance of that particular account. This method is not commonly used as it cannot help in the preparation of the financial statements.

- 16. 2. Balance method: under this method, every ledger account is balanced and those balances only are carrying forward to the trail balance. This method is used commonly by the accountants and helps in the preparation of the balances of the ledger accounts. 3. Total and Balance Method: under this method, the above two methods are combined. Under this method statement of the trail balance contain seven columns instead of two columns. Rules of Preparing the Trail Balance While preparing the trail balance from the given list of ledger balances, following rules should Be taken into care: a) The balances of all (i) assets accounts (ii) expenses accounts (iii) losses (iv) drawings (v) cash and bank balances are placed in the debit column of the trail balance. b) The balances of all (i) liabilities accounts (ii) income accounts (iii) profits (iv) capital are placed in the credit column of the trail balance. Error in Trail Balance: The mistakes and omissions made unknowingly while recording transactions are termed as accounting errors. In case the debit and credit columns of trail balance do not agree, it is presumed that some error might have crept in. but if both these columns match, it is presumed that the books of accounts are properly maintained. However, tallying of trail balance does not mean that no mistake has been made in the books of accounts. In trail balance, there are few errors which can be disclosed and some of the error cannot be disclosed. Both types of errors are as follows: Types of errors Errors which are Disclosed by a Trail Balance: Errors which are not Disclosed by a Trail Balance: Wrong Posting Errors of Omission Omission of Posting Errors Of commission Errors in Casting or Totaling Errors of Principle Errors in Balancing Errors of Wrong Posting Double Posting Compensating Errors Incomplete Double Entry Balance Carried Forward Wrongly Variation in Amount Wrong Total in Trail Balance REVENUE AND CAPITAL EXPENDITURE AND RECEIPTS Final Accounts are prepared at the end of the year to find out results of the business during the year in terms of profit or loss and financial position of the business at the yearend in terms of Assets and Liabilities.

- 17. To find out the Profit and loss Trading and P&L A/c is prepared where as to find out Assets and Liabilities the Balance Sheet is prepared. In preparing the final accounts the accounting principles of showing all the Revenue Expenditure and receipts in the Trading and P&L A/c where as the Capital Expenditure and receipts in the Balance Sheet is followed. Before preparation of the Final Accounts it is necessary to know something about Revenue and Capital Expenditure and Receipts. Revenue Expenditure: Any amount spent in earning revenues/profits is called revenue Expenditure and includes the expenses like salaries, rent, wages, repairs, maintenance, stores, Insurance, taxes ,printing and stationery, depreciation and materials etc., All the items of Revenue expenditure are to be debited to Trading and P&L A/c. Capital Expenditure: Any amount spent in increasing the earning capacity of a business is called as Capital Expenditure and includes expenses like Purchase, Installation and improvement of fixed assets and repayment of loans. All the items of Capital Expenditure are to be shown as an asset or to be deducted from the liability in the Balance Sheet. Revenue Receipts: Any amount received in the normal course of business is called as Revenue Receipts and includes sale of goods, interest, discount, commission, rent received. All the items of Revenue Receipts are to be credited to Trading and P&L A/c. Capital Receipts: Any amount received as investment by the owners, raised by the way of loans and sale proceeds of fixed assets is called Capital Receipts. All the items of Capital Receipts are to be shown as a liability or to be deducted from the assets in the Balance Sheet. Deferred Revenue Expenditure: Any amount of Revenue Expenditure nature spent in huge sum and its benefits will be spread over more than one year is called as Deferred Revenue Expenditure and includes the expenses like Preliminary expenses , discount on issue of shares and debentures, heavy advertisement and shifting of business premises etc.,

- 18. All the items of deferred revenue expenditure are to be shown as an asset in the Balance sheet where as part of such expenditure (to the extent of benefit received during the current year) should be debited to Profit and Loss A/c. Final Accounts: Any business is started with an objective of earning profits. As such the business concerns are interested to know: 1. Results of the business i.e., profits earned or loss incurred during the year will be calculated by preparing Trading and Profit and Loss account which is also known as Income Statement. 2. Financial position of the business i.e., Assets and Liabilities at the yearend will be calculated by preparing Balance Sheet. The above two are called as Financial Statements since they show the financial results and financial position of the business. They are also called as Final Accounts as they are prepared at the end of the accounting cycle i.e., transaction, journal/subsidiary books, ledger, trail balance and final accounts. Importance: 1. Reveals financial results of the business i.e., Profit or loss. 2. Reveals financial position of the business i.e., Assets and Liabilities. 3. Liquidity and solvency of the business can be understood. 4. Helps in taxation calculation. Limitations: 1. Profit or loss true picture cannot be calculated. 2. Assets and Liabilities values are not accurate. 3. Window dressing is possible in preparing Final Accounts. 4. Personal opinions of accountants/owners will influence final accounts to some extent. Definition and Explanation: Trading Account The account which is prepared to determine the gross profit or gross loss of a business concern is called trading account. It should be noted that the result of the business determined through trading account is not true result. The true result is the net profit or the net loss which is determined through profit and loss account. The trading accounting has the following features: 1. It is the first stage of final accounts of a trading concern. 2. It is prepared on the last day of an accounting period. 3. Only direct revenue and direct expenses are considered in it. 4. Direct expenses are recorded on its debit side and direct revenue on its credit side. 5. All items of direct expenses and direct revenue concerning current year are taken into account but no item relating to past or next year is considered in it. 6. If its credit side exceeds it represents gross profit and if debit side exceeds it shows gross loss.

- 19. Purpose of Preparing Trading Account: The profit or loss determined by a trading account is the gross result of the business but not the net result. If so, then a question arises - what is the use of preparing a trading account? This account is necessary because of the following advantages. 1. Gross profit of a business is very important data, since all business expenses are met out of it. So the amount of gross profit should be adequate to meet the indirect expenses of a business concern. 2. The amount of net sales can be determined through this account. Gross sales can be ascertained from sales account in the ledger, but net sales cannot be so obtained. The true sales of a business is net sales - not gross sales. Net sales are determined by deducting sales returns from gross sales in trading account. 3. The success or failure of a business can be ascertained by comparing net sales of the current year with that of the last year. It should be noted that an increase in the amount of net sales of the current year over the last year may not be regarded as a sign of success, since sales may increase because of rise in price level. 4. Percentage of gross profit on net sales (gross profit ratio) can be easily determined from trading account. This percentage is very important yardstick for measuring the success or failure of a business. Compared to last year, if the rate increases, it indicates success; on the other hand if the rate decreases, it is an indication of failure. 5. Percentage of different items of buying expenses (direct expenses) on gross profit can be easily determined and by comparing the percentage of the current year with that of the previous year the variations can be ascertained. An analysis of variances will disclose their cause which will help in controlling the amount of expenses. 6. Inventory or stock turnover ratio can be determined from trading account. The success or failure of a business can be measured by this rate. Higher rate indicates a favorable sign i.e. goods are sold soon after their purchase. On the other hand, low rate signifies deterioration, i.e. goods are sold long after their purchase. Method of Preparation of Trading Account: Trial balance is a list of all ledger accounts balances, so all the necessary information for preparation of a trading account is available from the trial balance. As gross profit or gross loss of a particular period is determined through trading account. So its heading will be as follows: XYZ co. Trading Account for the year ended 31.12.2005 (if accounting period ends on 31.12.2005) From the trial balance, the balance of opening stock account, purchases account, returns inwards account and of all direct expenses are transferred on the debit side of the trading account, and the balance of the sales account, returns outwards account, and closing stock account are transferred on the credit side of the trading account. If the credit side of the trading account exceeds the debit side, the result is "gross profit", and if debit side exceeds the credit side, the result is "gross loss". The format of a trading account is shown below: Proforma for Trading A/c

- 20. TradingAccount of _________________ forthe yearending________________ Dr. Cr. Definition and Explanation: The profit & loss (P&L) statement is one of the three primary financial statements used to assess a company’s performance and financial position (the two others being the balance sheet and the cash flow statement). The profit & loss statement summarizes the revenues and expenses generated by the company over the entire reporting period. The profit & loss statement is also known as the income statement, statement of earnings, statement of operations, or statement of income. The basic equation on which a profit & loss statement is based is Revenues – Expenses = Profit. Purpose: All companies need to generate revenue to stay in business. Revenues are used to pay expenses, interest payments on debt, and taxes owed to the government. After the costs of doing business are paid, the amount left over is called net income. Net income is theoretically available to shareholders, though instead of paying out dividends, the firm’s management often chooses to retain earnings for future investment in the business. Proforma for Profit and Loss A/c ProfitandLoss Accountof _____________ for the yearending________________ Particulars Amount Particulars Amount To OpeningStock To Purchases XXX Less: Returns XX Purchase Expenses: To Carriage Inwards To Freight,Cartage To CustomsDuty To ClearingCharges To Octroi Direct Expenses: To Wages To ManufacturingExpenses To Coal,water,gas, fuel ,power,heating, lighting To Factory rent,rate& taxes To Work’s ManagerSalary To Factory Supervision To Consumablesstores To Gross ProfitC/d (Transferredto P & L A/c) XX XX XX XX XX XX XX XX XX XX XX XX XX XX XX By Sales XXX Less: SalesReturns XX By ClosingStock By Gross Loss C/d (Transferredto P & L A/c) XX XX XX XX XX

- 21. Dr. Cr Note: 1) All the itemsof Revenue Expenditureare tobe debitedtoTradingand ProfitandLoss A/c 2) All the items of RevenueReceiptsare tobe creditedto Trading andProfitand LossA/c Balance Sheet: Definition: A Balance Sheet is a statement of the financial position of a firm at a given date. The given date is the date at which the final accounts are prepared. Transactions are first recorded m journal. Entries in the journal are posted to ledgers. Ledger accounts are balanced and the balances are recorded in a Trial Balance Trial Balance consists of all Accounts-Personal, Real and Nominal. From the Trial Balance, nominal accounts are transferred to Trading or Profit and Loss Account and the remaining balances are taken to Balance Sheet. To Gross Loss B/d Office & Administrative expenses: To Salaries To Rent,rates,taxes& Insurance To Printing& Stationary To Postage & Telegram& Telephone To Legal charges To General Expenses To Auditfee To Trade Expenses Selling& DistributionExpenses: To Carriage Outwards/onsales To advertising To Traveler’s Salaries,expenses&Commission To Bad Debts To Bank Charges To cost of samples Depreciation& Maintenance To Depreciation To Repairs& Maintenance Financial Expenses To DiscountAllowed To InterestonLoans Abnormal Expenses To Loss due to Fire Accident To Loss on Sale of assets To NetProfitC/d (Transferredto Capital A/c) XX XX XX XX XX XX XX XX XX XX XX XX XX XX XX XX XX XX XX XX XX By Gross ProfitB/d By Discountreceived By Interestreceived By Commissionreceived By Rentreceived By interestondrawings By Profitonsale of assets By ApprenticeshipPremium By Otherreceipts(if any) By NetLoss (TransferredtoCapital A/c) XX XX XX XX XX XX XX XX XX XX XXX XXX

- 22. However, Balance Sheet is a summary of whole of the accounting record. This is because the nominal accounts are transferred to Revenue Accounts, and Revenue account is closed by shifting the balance to the Balance Sheet. Balance Sheet is also known as a statement of Assets and Liabilities. Balance Sheet is the last and the most important link in the chain of Final Accounts and Statements. It describes the financial position of a business in a systematic standard form. It is a mirror of a business. When the assets exceed the liabilities, one can conclude that the business is sound and solvent. The function of the Balance Sheet is to show the true picture of the business on a particular date. Form of Balance Sheet: It has two sides’ left hand side (liabilities) and right hand side (assets). It is not an account. It is a statement. ‘To’ and ‘By’ should not be used in the Balance Sheet. The left hand side contains the credit balances of all personal accounts while right hand side contains debit balances of real and personal accounts. The two sides of the Balance Sheet must always agree. Functions of a Balance Sheet: 1. A Balance Sheet exhibits the true financial position of a firm at a particular date. 2. Financial position can be ascertained clearly with the help of Balance Sheet. 3. It provides valuable information to the management for taking better decision through ratio analysis. 4. Balance Sheet helps in knowing past and present position of an enterprise. It may be called the horoscope of the concern. 5. It is a mirror of a business. Limitations of Balance Sheet: 1. It is prepared on a historical cost basis. Changes in prices are not considered. 2. Window-dressing may be done in Balance Sheet. 3. Historical Cost of Balance Sheet does not convey fruitful information. 4. Different assets are valued according to different rules. 5. It cannot reflect the ability or skill of staff. 6. It is measured in terms of money or money’s worth. That is, only those assets are recorded in it This can be expressed in money. 7. in inflationary trend, if the readers are not expert may mislead. 8. Balance Sheet has some fictitious assets, which have no market value. Such items are unnecessarily inflate the total value of assets. The format of the balance sheet is not mandated by accounting standards, but rather by customary usage. The two most common formats are the vertical balance sheet (where all line items are presented down the left side of the page) and the horizontal balance sheet (where asset line items are listed down the first column and liabilities and equity line items are listed in a later column). The vertical format is easier to use when information is being presented for multiple periods. The line items to be included in the balance sheet are up to the issuing entity, though common practice typically includes some or all of the following items:

- 23. Current Assets: Cash and cash equivalents Trade and other receivables Investments Inventories Assets held for sale Non-Current Assets: Property, plant, and equipment Intangible assets Goodwill Current Liabilities: Trade and other payables Accrued expenses Current tax liabilities Current portion of loans payable Other financial liabilities Liabilities held for sale Non-Current Liabilities: Loans payable Deferred tax liabilities Other non-current liabilities Equity: Capital stock Additional paid-in capital Retained earnings Within the balance sheet, the following should be classified as current assets: Cash. This includes all liquid, short-term investments that are easily convertible into cash. Do not include in current assets cash that is restricted, or to be used to pay down a long-term liability. Marketable securities. This includes all securities that are held for trading. Accounts receivable. This includes all trade receivables, as well as all other types of receivables that should be collected within one year. Prepaid expenses. This includes any prepayment that is expected to be used within one year. Inventory. This includes all raw materials, work in process, and finished goods items, less an obsolescence reserve. In general, any asset is classified as a current asset when there is a reasonable expectation that the asset will be consumed within the next year, or within the operating cycle of the business. All other assets are to be classified as non-current. Within the balance sheet, the following should be classified as current liabilities: Payables. This is all trade payables related to the purchase of goods or services from suppliers. Accrued expenses. This is expenses incurred by the business, for which no supplier invoice has yet been received. Short-term debt. This is loans for which payment is due within the next year. Unearned revenue. This is advance payments from customers that have not yet been earned by the company.

- 24. In general, a liability is classified as current when there is a reasonable expectation that the liability will come due within the next year, or within the operating cycle of the business. All other liabilities are to be classified as non-current. Proforma of Balance Sheet Balance Sheet of __________________ as on _______________ Note: 1) All the itemsof Capital Receipts are to be shownas a Liabilitiessideof Balance Sheet. 2) All the itemsof Capital Expendituresare tobe shownas Assetsside of Balance Sheet. Adjustmentsin Final Accounts: S.No. Adjustments TRADING& ProfitandLoss A/c Balance Sheet 1. ClosingStock In TradingA/c By ClosingStock AssetSide ( Show as an Asset) Liabilities Amount Assets Amount Capital: Capital Add:NetProfit Or LessNetLoss Less:Drawings Add:InterestonCapital Less: Intereston Drawings Long Term Liabilities: Mortgage Loan Bank Loan Loan From FamilyMembers Current Liabilities: Bank Overdraft SundryCreditors BillsPayable Out StandingExpenses Income ReceivedinAdvance XX XX ----- XX XX ----- XX XX ---- XX XX XX XX XX XX XX XX XX XX XX FixedAssets: A) TangibleAssets: Plantand Machinery Furniture andFixtures Land and Buildings Motor Vehicles Toolsand Equipments Lease HoldPremises B) IntangibleAssets: Trade Marks CopyRights Patents GoodWill Long Term Investments: BankFixed Deposits Financial Institutions Current Assets: Cash inHand Cash at Bank BillsReceivable SundryDebtors ClosingStock PrepaidExpenses Out StandingIncomes Shortterm investments XX XX XX XX XX XX XX XX XX XX XX XX XX XX XX XX XX XX XX XX XX XX XX

- 25. Note : If ClosingStockisgivenonly inTrial Balance,ShownasAssetsSide inBalance Sheet 2. Out StandingExpenses In TradingA/c or P & L A/c Addto ConcernedExpenses LiabilitiesSide( Showasa Liability) Note : If OutstandingExpensesgivenonly inTrial Balance,ShownasLiabilitiesSideinBalance Sheet 3. Pre paidExpenses In TradingA/c or P & L A/c Lessfrom ConcernedExpenses Assets Side ( Show as an Asset) Note : If PrepaidExpensesgivenonly inTrial Balance,ShownasAssetsSide inBalance Sheet 4. AccruedIncomesor Income Receivables In P & L A/c Addto ConcernedIncomes AssetsSide ( Show as an Asset) Note : If Accrued IncomesorIncome Receivables givenonly inTrial Balance,ShownasAssets Side in Balance Sheet 5. IncomesReceivedinAdvance In P & L A/c Lessfrom ConcernedIncomes LiabilitiesSide( Showasa Liability) Note : If IncomesReceivedinAdvance givenonly inTrial Balance,ShownasLiabilitiesSide inBalance Sheet 6. GoodsWithdrawnfor Private Use In TradingA/c Lessfrom Purchases LiabilitiesSide LessFrom Capital Note : If Goods WithdrawnforPrivate Use givenonly inTrial Balance,deductfromCapital inBalance Sheet 7. Intereston Capital In P & L A/c To Intereston Capital LiabilitiesSide Addto Capital Note : If Intereston Capital givenonly inTrial Balance,ShownasTo InterestonCapital in P & L A/c 8. InterestonDrawings In P & L A/c By Intereston Drawings LiabilitiesSide LessFrom Capital Note : If Intereston Drawings givenonly inTrial Balance,ShownasBy InterestonDrawingsin P & L A/c 9. Depreciation In P & L A/c To Depreciation AssetsSide LessFrom ConcernedAsset Note : If Depreciationgivenonly in Trial Balance,ShownasTo Depreciation in P& L A/c 10. Bad Debts In P & L A/c To Bad debts AssetsSide LessFrom SundryDebtors Note : If Bad Debtsgivenonly inTrial Balance,ShownasTo Bad Debts in P & L A/c 11. Provisionfor Badand Doubtful Debts In P & L A/c To Provisionfor Bad andDoubtful Debts AssetsSide LessFrom SundryDebtors Note : If Provisionfor Bad and Doubtful Debts(old)givenonly inTrial Balance,ShownasLessfromBad Debts (Provisionfor Badand Doubtful Debts (old) in P& L A/c 12. Provisionfor DiscountonSundry Debtors In P & L A/c To Provisionfor Discounton SundryDebtors AssetsSide LessFrom SundryDebtors 13. Provisionfor DiscountonSundry Creditors In P & L A/c By Provisionfor Discounton Sundrycreditors LiabilitiesSide LessFrom SundryCreditors