QSE Daily Market Commentary and Review

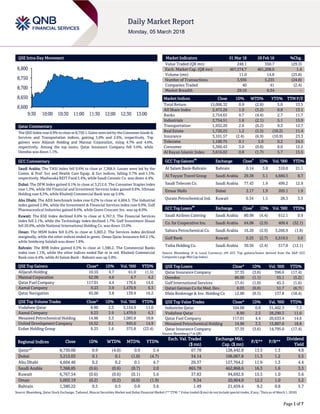

- 1. Page 1 of 7 QSE Intra-Day Movement Qatar Commentary The QSE Index rose 0.9% to close at 8,730.1. Gains were led by the Consumer Goods & Services and Transportation indices, gaining 3.0% and 2.6%, respectively. Top gainers were Alijarah Holding and Mannai Corporation, rising 4.7% and 4.6%, respectively. Among the top losers, Qatar Insurance Company fell 3.6%, while Ooredoo was down 1.1%. GCC Commentary Saudi Arabia: The TASI Index fell 0.6% to close at 7,368.9. Losses were led by the Comm. & Prof. Svc and Health Care Equip. & Svc indices, falling 3.7% and 1.5%, respectively. Musharaka REIT Fund 5.4%, while Saudi Ceramic Co. was down 4.4%. Dubai: The DFM Index gained 0.1% to close at 3,212.0. The Consumer Staples index rose 1.3%, while the Financial and Investment Services index gained 0.6%. Ithmaar Holding rose 6.5%, while Khaleeji Commercial Bank was up 5.6%. Abu Dhabi: The ADX benchmark index rose 0.2% to close at 4,604.5. The Industrial index gained 2.9%, while the Investment & Financial Services index rose 0.9%. Gulf Pharmaceutical Industries gained 8.6%, while Green Crescent Ins. was up 8.0%. Kuwait: The KSE Index declined 0.6% to close at 6,767.5. The Financial Services index fell 2.1%, while the Technology index declined 1.7%. Gulf Investment House fell 20.0%, while National International Holding Co. was down 13.0%. Oman: The MSM Index fell 0.2% to close at 5,003.2. The Services index declined marginally, while the other indices ended in green. Oman Qatar Insurance fell 2.1%, while Sembcorp Salalah was down 1.8%. Bahrain: The BHB Index gained 0.5% to close at 1,380.2. The Commercial Banks index rose 1.1%, while the other indices ended flat or in red. Khaleeji Commercial Bank rose 4.4%, while Al Salam Bank - Bahrain was up 3.8%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Alijarah Holding 10.55 4.7 61.0 (1.5) Mannai Corporation 62.00 4.6 4.7 4.2 Qatar Fuel Company 117.01 4.4 176.6 14.6 Aamal Company 9.23 3.9 1,470.9 6.3 Qatar Navigation 65.00 3.8 139.4 16.2 QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Vodafone Qatar 8.90 2.3 3,154.9 11.0 Aamal Company 9.23 3.9 1,470.9 6.3 Mesaieed Petrochemical Holding 14.96 3.3 1,085.8 18.8 United Development Company 16.52 0.1 845.6 14.9 Ezdan Holding Group 9.25 1.6 575.8 (23.4) Market Indicators 01 Mar 18 28 Feb 18 %Chg. Value Traded (QR mn) 248.1 350.7 (29.3) Exch. Market Cap. (QR mn) 467,574.7 461,208.0 1.4 Volume (mn) 11.0 14.8 (25.8) Number of Transactions 3,936 5,235 (24.8) Companies Traded 40 41 (2.4) Market Breadth 29:10 6:34 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 15,006.32 0.9 (2.8) 5.0 13.5 All Share Index 2,472.26 1.0 (3.2) 0.8 13.1 Banks 2,754.65 0.7 (4.4) 2.7 11.7 Industrials 2,754.51 1.6 (2.1) 5.1 15.9 Transportation 1,932.20 2.6 (0.2) 9.3 12.7 Real Estate 1,720.25 1.2 (5.5) (10.2) 11.4 Insurance 3,101.57 (2.4) (6.9) (10.9) 23.3 Telecoms 1,100.75 0.1 5.0 0.2 24.5 Consumer 5,360.43 3.0 (0.8) 8.0 12.2 Al Rayan Islamic Index 3,616.02 0.8 (1.7) 5.7 15.5 GCC Top Gainers ## Exchange Close # 1D% Vol. ‘000 YTD% Al Salam Bank-Bahrain Bahrain 0.14 3.8 310.0 21.1 Al Tayyar Travel Group Saudi Arabia 29.38 3.1 4,680.3 8.7 Saudi Telecom Co. Saudi Arabia 77.43 1.9 499.2 12.9 Emaar Malls Dubai 2.17 1.9 205.1 1.9 Qurain Petrochemical Ind. Kuwait 0.34 1.5 28.3 3.3 GCC Top Losers ## Exchange Close # 1D% Vol. ‘000 YTD% Saudi Airlines Catering Saudi Arabia 80.98 (4.4) 612.1 0.9 Co. for Cooperative Ins. Saudi Arabia 64.08 (2.9) 409.4 (32.1) Sahara Petrochemical Co. Saudi Arabia 16.20 (2.9) 3,266.9 (1.8) Gulf Bank Kuwait 0.25 (2.7) 5,519.5 5.0 Taiba Holding Co. Saudi Arabia 30.56 (2.4) 317.8 (12.1) Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the S&P GCC Composite Large Mid Cap Index) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Qatar Insurance Company 37.35 (3.6) 396.6 (17.4) Ooredoo 86.00 (1.1) 55.1 (5.2) Gulf International Services 17.41 (1.0) 45.3 (1.6) Qatari German Co for Med. Dev. 6.03 (0.8) 51.7 (6.7) Dlala Brokerage & Inv. Holding Co 12.00 (0.5) 137.8 (18.4) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Industries Qatar 104.08 0.8 31,402.3 7.3 Vodafone Qatar 8.90 2.3 28,290.3 11.0 Qatar Fuel Company 117.01 4.4 20,633.4 14.6 Mesaieed Petrochemical Holding 14.96 3.3 15,887.0 18.8 Qatar Insurance Company 37.35 (3.6) 14,795.0 (17.4) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar*# 8,730.06 0.9 (4.0) 0.9 2.4 67.78 128,442.8 13.5 1.3 4.8 Dubai 3,212.03 0.1 0.1 (1.0) (4.7) 34.14 106,067.8 11.3 1.2 5.5 Abu Dhabi 4,604.46 0.2 0.2 0.1 4.7 20.37 127,764.2 11.6 1.3 4.4 Saudi Arabia 7,368.85 (0.6) (0.6) (0.7) 2.0 865.78 462,868.6 16.3 1.6 3.3 Kuwait 6,767.54 (0.6) (0.6) (0.1) 5.6 37.83 94,692.9 15.5 1.0 5.6 Oman 5,003.19 (0.2) (0.2) (0.0) (1.9) 9.34 20,904.0 12.2 1.0 5.2 Bahrain 1,380.22 0.5 0.5 0.8 3.6 1.49 21,459.4 9.2 0.8 5.7 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Market and Dubai Financial Market (** TTM; * Value traded ($ mn) do not include special trades, if any; # Data as of March 1, 2018) 8,600 8,650 8,700 8,750 8,800 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 7 Qatar Market Commentary The QSE Index rose 0.9% to close at 8,730.1. The Consumer Goods & Services and Transportation indices led the gains. The index rose on the back of buying support from Qatari and GCC shareholders despite selling pressure from non-Qatari shareholders. Alijarah Holding and Mannai Corporation were the top gainers, rising 4.7% and 4.6%, respectively. Among the top losers, Qatar Insurance Company fell 3.6%, while Ooredoo was down 1.1%. Volume of shares traded on Thursday fell by 25.8% to 11.0mn from 14.8mn on Wednesday. However, as compared to the 30-day moving average of 9.4mn, volume for the day was 17.3% higher. Vodafone Qatar and Aamal Company were the most active stocks, contributing 28.7% and 13.4% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Earnings Releases, Global Economic Data and Earnings Calendar Earnings Releases Company Market Currency Revenue (mn) 4Q2017 % Change YoY Operating Profit (mn) 4Q2017 % Change YoY Net Profit (mn) 4Q2017 % Change YoY Middle East Paper Co.* Saudi Arabia SR – – 95.8 182.8% 68.1 -28.2% Saudi Industrial Development Co.* Saudi Arabia SR – – -22.7 N/A -10.2 N/A Arriyadh Development Co. Saudi Arabia SR – – 81.7 73.8% 75.8 101.1% Bawan Co.* Saudi Arabia SR – – 107.3 -33.4% 71.0 -37.9% Sahara Petrochemical Co.* Saudi Arabia SR – – – – 444.5 3.0% Yanbu National Petrochemical Co.* Saudi Arabia SR – – 2,414.1 -0.4% 2,376.4 1.4% Sharjah Cement and Industrial Development Co.* Abu Dhabi AED 650.0 6.1% – – 64.8 1.2% Source: Company data, DFM, ADX, MSM, TASI, BHB. (*Values for FY2017) Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 03/01 US Department of Labor Initial Jobless Claims 24-February 210k 225k 220k 03/01 US Department of Labor Continuing Claims 17-February 1,931k 1,925k 1,874k 03/01 EU Eurostat Unemployment Rate January 8.6% 8.6% 8.6% 03/02 EU Eurostat PPI MoM January 0.4% 0.4% 0.1% 03/02 EU Eurostat PPI YoY January 1.5% 1.6% 2.2% 03/02 Germany German Federal Statistical Office Retail Sales MoM January -0.7% 0.7% -1.1% 03/02 Germany German Federal Statistical Office Retail Sales YoY January 2.3% 3.0% -0.2% 03/02 Germany German Federal Statistical Office Import Price Index MoM January 0.5% 0.4% 0.3% 03/02 Germany German Federal Statistical Office Import Price Index YoY January 0.7% 0.7% 1.1% 03/01 Japan Economic and Social Research Institute Consumer Confidence Index February 44.3 44.8 44.7 03/02 Japan Economic and Social Research Institute Jobless Rate January 2.4% 2.8% 2.7% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Earnings Calendar Tickers Company Name Date of reporting 4Q2017 results No. of days remaining Status ZHCD Zad Holding Company 8-Mar-18 3 Due IGRD Investment Holding Group 12-Mar-18 7 Due Source: QSE Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 47.91% 42.79% 12,715,167.26 Qatari Institutions 27.57% 24.97% 6,459,332.52 Qatari 75.48% 67.76% 19,174,499.78 GCC Individuals 1.15% 0.66% 1,215,342.30 GCC Institutions 3.11% 1.34% 4,389,747.12 GCC 4.26% 2.00% 5,605,089.42 Non-Qatari Individuals 13.08% 13.19% (265,854.17) Non-Qatari Institutions 7.17% 17.05% (24,513,735.03) Non-Qatari 20.25% 30.24% (24,779,589.20)

- 3. Page 3 of 7 News Qatar The Commercial Bank extends talks with Tabarak on United Arab Bank – The Commercial Bank agreed to extend the exclusivity period granted to Abu Dhabi’s Tabarak on potential purchase of its 40% stake in Abu Dhabi listed United Arab Bank to April 2, 2018. (QSE) Ezdan Holding Group accepts the resignation of the group CEO – Ezdan Holding Group’s board of directors accepted the resignation of the group’s CEO, Ali Mohammed Al Obaidli on February 28, 2018. (QSE) Medicare Group to hold its AGM on March 20 – Medicare Group announced that it will convene an Ordinary General Assembly Meeting (AGM) on March 20, 2018. In case of lack of quorum, a second meeting will be held on April 1, 2018. (QSE) Vodafone Qatar to hold its AGM and EGM on March 19 – Vodafone Qatar announced that it will convene an Ordinary General Assembly Meeting (AGM) and Extraordinary General Assembly Meeting (EGM) on March 19, 2018. In case of lack of quorum, second meeting will be held on March 25, 2018. (QSE) QGTS expands joint venture partnership with Maran Ventures – Qatar Gas Transport Company Limited (QGTS) expanded its joint venture partnership with Greek shipping company Maran Ventures to include two additional LNG vessels. Maran Nakilat Co. was first established in 2005 with four jointly-owned LNG vessels, and was further expanded on several occasions. This new agreement increases the number of vessels jointly-owned by QGTS and Maran Gas Maritime from 13 to 15 vessels. QGTS’ CEO, Abdullah Al Sulaiti said, “QGTS is extremely pleased that our strong partnership with Maran Gas continues to flourish since the first agreement signed in 2005. Strategic alliance with renowned partners has been fundamental to our success, and we are always looking for opportunities to grow our international presence. QGTS now has ownership interest in 69 vessels, affirming our global leadership in energy transportation with the world’s largest LNG fleet. The company’s growth is a testament of our robust financial performance and strategic planning, which has allowed us to further increase our fleet size and strengthen our international portfolio. This expansion comes as part of our efforts to maximize returns for our shareholders and support Qatar’s industry leading position as the world’s top LNG exporter.” (Gulf-Times.com) QEWS: Foreign investments key asset for future – Qatar Electricity and Water Company (QEWS) stated it was considering its foreign investments as very important asset for the future, as the foreign investments shall constitute the major portion of the company profits through foreign projects in which the company participates through Nebras Power Company, where in QEWS owns 60% of the shares. QEWS’s 2017 annual report explains that Nebras Power Company’s board of directors had agreed on purchasing the shares of Carthage Powers, Rades, Tunisia for $10mn and it is currently negotiating with the liquidator of BTU about the price and the completion of the purchase process. The aim is to acquire 60% of the Carthage plant with a production capacity of 471MW. The consent of the shareholders has been obtained and TAPCO’s board of directors decided to transfer the ownership of its shares to Nebras Power Company. (Peninsula Qatar) ETFs set gain traction with QSE debut of Doha Bank ‘QETF’ – Exchange traded funds (ETFs) are set to gain traction in Qatar with Doha witnessing the launch of first such instrument ‘QETF’, which is sponsored by Doha Bank. The market is expected to give a rousing welcome to the fund, which comes about six years after the Qatar Financial Market Authority outlined the broad legislative contours. The debut of QETF, which tracks the 20-stock Qatar Index, comes at a time when global fund houses are increasingly showing interests in the country’s capital markets in view of the macroeconomic potential and despite the economic blockade. Doha Bank’s CEO, R Seetharaman had last year said Qatar has the potential for $10bn to $15bn overseas funds inflow since its upgrade into emerging market. The country’s decision to lift the moratorium on North Field as well as faster growth in the non-hydrocarbons sector, especially multi-billion dollar infrastructure development, all augur well for the growth, sources said. (Gulf- Times.com) Qatar’s fiscal deficit expected to narrow on hydrocarbon gains – Qatar’s fiscal deficit is expected to gradually narrow over the coming quarters on substantial gains in hydrocarbon revenues. However, the government will continue to cover its budget shortfalls through debt issuance, but faces little risk of any credit event, given a still-low debt-to-GDP ratio and vast financial buffers, BMI Research stated in a report. “Overall, we forecast the deficit to come in at 3.1% of GDP in 2018 and 2.2% in 2019, from an estimated 5.5% in 2017,” it said, adding this compares favorably to the government’s 2018 budget, which, based on a highly conservative hydrocarbon price assumption of $45 per barrel, envisions a shortfall of about 4%. As the government continues to borrow to cover its deficits, debt is slated to rise from an estimated 55.8% of GDP in 2017 to 57.1% in 2018, peaking at 57.4% in 2019 before slowly reducing. The debt-to-GDP ratio is still small on a global comparison, which, coupled with Qatar’s vast financial buffers, means that Doha is at little risk of experiencing a credit event, BMI Research stated. (Gulf-Times.com) Qatar Stock Exchange’s CEO participates in world exchange congress in Muscat – Qatar Stock Exchange’s CEO, Rashid Bin Ali Al Mansoori participated in the 13th World Exchange Congress, which was held in Muscat, Oman, with the participation of more than 250 experts and decision makers from 60 countries. Al Mansoori participated in a panel discussion entitled ‘New technology, data and analytics services: How are exchanges reinventing themselves for tomorrow?’ and stressed on the importance of new technologies and FinTech as positive enablers for capital markets infrastructure. (QSE) Qatari banks’ private sector credit at QR463.4bn – Qatari banks’ assets increased QR3.1bn to QR1.366tn by the end of January 2018, compared to previous month; and recorded 8.3% growth or QR104.8bn increase on YoY. A reading of the banks’ consolidated balance sheet figures by The Group analysts has noted that the total domestic private sector deposit at local banks was increased by QR2.1bn to QR358.6bn, by the end of

- 4. Page 4 of 7 January. The banks’ total loans and credit facilities to local private sector increased QR1.9bn to QR463.4bn. The credit facilities to the real estate sector stood at QR146.7bn in January, while individual consumer loans amounted to QR123.4bn. The credit facilities to the trade stood at QR67.5bn and services at QR62.6bn. The loans and facilities amounting to QR17.4bn went for the non-banking financial sector. Qatari banks’ witnessed a decrease in government and public sector deposits in January. The deposits from these sectors were decreased by QR18.9bn to QR296.5bn. Government deposits recorded QR82bn, while the deposits of government institutions settled at QR183.8bn. (Peninsula Qatar) Qatari real estate sector steady and consistent despite siege – Field studies conducted by SAK Holding Group’s Market Watch Office have revealed that the country’s real estate sector demonstrated unparalleled steadiness against the unjust siege imposed on against Qatar. The report stated, “Construction works maintained its pace and was not affected by ramifications of the siege despite closure of sea, air, and land ports. It quickly overcame the crisis that threatened the flow of real estate sector imports, including raw materials and other related items. Since the early days of the siege, the construction sector received greater attention from decision makers as part of the procedures, plans, and alternative strategies under taken by the government to avert the crisis.” SAK’s Market Watch Office also applauded concerned authorities in charge of Qatar’s real estate portfolio for their sustained policy in injecting liquidity to finance infrastructure investments. This boosted confidence in the real estate sector, enabling it to maintain its desirability by a large segment of local and foreign investors who are looking for promising investments opportunities, the report continued. This was in parallel to the property market’s traditional position for savers and small investors who see real estate investment as a safe haven protecting their assets and money, which justifies the increase in the percentage of building permits. (Gulf-Times.com) OBG: Qatar’s proposed PPP law aims to incentivize, mobilize private investment – The proposed public-private partnership (PPP) law aims to further incentivize and mobilize private investment in Qatar. The proposed PPP law is currently passing through the final stage of the legislatorial process, with government figures hopeful it will pass into law by early 2018, Oxford Business Group (OBG) stated in its ‘The Report: Qatar 2017’. With Qatar increasingly looking to engage the private sector in undertaking national infrastructure projects, efforts are under way to introduce new legal framework governing public-private partnerships (PPPs) in the country, OBG stated. Despite the absence of a specific legal framework to date, the government has long worked alongside the private sector in various industry projects. The most developed example of this cooperation is in the oil and gas sector, where state-owned Qatar Petroleum (QP) is participating in a number of long-term joint ventures with foreign players, particularly in gas-to- liquids production. QP’s joint ventures include partnerships with Shell and Sasol Chevron, OBG noted. (Gulf-Times.com) Ooredoo targets 5G lead to sustain data edge – Revenue from data and digital services are soon expected to overtake those from voice and SMS, making it imperative to take a lead in 5G services, according to Ooredoo. Ooredoo’s Chairman, Sheikh Abdulla Bin Mohamed Bin Saud Al Thani said, “Years ago, we recognized that data and digital services were the future – we are now reaching the point where these services will surpass the revenue that the group generates from voice and SMS. To sustain this growth, we will continue to build our global network and take a lead in 5G services.” (Gulf-Times.com) Blockade impact on Industries Qatar operations negligible – The illegal economic blockade imposed on Qatar in June 2017 had no major financial and operational impact on Industries Qatar, which was able to exceed its financial performance last year, according to Industries Qatar’s Chairman and Managing Director, Saad Sherida Al Kaabi. Al Kaabi announced the group’s expansion plans as part of its five-year business strategy, as well as the evaluation of Industries Qatar’s capital expenditure (Capex) opportunities. Al Kaabi said, “The blockade and other challenges like low oil prices presented increased opportunities and created renewed optimism for the group’s petrochemical segment. The overall performance of the group was noteworthy despite the challenges exerted by a number of exogenous factors, including the regional geopolitical instability, a general rise in the supply, muted demand in certain end markets, and an increase in the uncontrollable operating costs.” (Gulf-Times.com) GECF sees natural gas demand growing in key global markets – Qatar based Gas Exporting Countries Forum (GECF) sees the demand of natural gas growing in key global markets including some emerging markets, particularly in Asia. The demand growth, according to GECF’s Secretary General, Yury Sentyurin, is supported by the economic, technical and environmental advantages of natural gas. “Environmental policies aimed at restricting pollution and CO2 emissions are important drivers for increasing demand for natural gas, especially in power generation,” Sentyurin said. He said the GECF expects increased demand for natural gas in power generation by more than 100 bcm between 2016 and 2020. This increase is supported by the penetration of natural gas over coal. The GECF also expects that natural gas will benefit from its ability to provide needed flexibility for power systems, particularly with the increasing penetration of intermittent renewables. Additionally, it sees opportunities for natural gas in the transportation sector, specifically in LNG bunkering and for heavy trucks, with the development of many projects to supply LNG as a fuel, particularly in Europe. (Gulf-Times.com) Qatar, France companies to boost ties in key sectors – Medef International, an entity that represents the French private sector, wants to build on the very strong political relationship between France and Qatar and take the business relationship to the next level, considering that the Gulf crisis has opened up opportunities for cooperation in key sectors in Qatar. The new situation experienced by Qatar opens fields of opportunities for Qatari-French cooperation in key sectors such as agribusiness, logistics along with the usual strong sectors of cooperation such as energy, defense infrastructure and transportation, according to Guillaume Pepy, Chairman of the Qatari-French Committee. Pepy, who is also CEO of the French Railway Company, said the French companies are more determined than ever to engage with Qatari counterparts and contribute to the

- 5. Page 5 of 7 economic diversification of the country and the expansion of its local private sector in line with its the Qatar National Vision 2030. (Gulf-Times.com) International US monthly inflation picks up in January; jobless claims at 48- year low – US consumer prices increased in January, with a gauge of underlying inflation posting its largest gain in 12 months, bolstering views that price pressures will accelerate this year. Those expectations were underscored by other data showing the number of Americans filing for unemployment benefits fell last week to a 48-year low as the labor market tightens. Another survey showed prices paid by manufacturers for raw materials hit a more than six-year high in February. The combination of rising inflation and a robust labor market could force the Federal Reserve to raise interest rates a bit more aggressively this year than currently anticipated as it worries about the economy overheating. Federal Reserve has forecasted three rate hikes in 2018. The first rate increase is expected later this month. (Reuters) PMI: Eurozone’s factory boom slowed again in February but stayed strong – Eurozone’s manufacturing boom slowed a little further last month but factories across the bloc still appear to be enjoying their best growth spell in almost two decades. The recovery remains robust and widespread, alongside price pressures at a near seven-year high, will be welcomed by policymakers at the European Central Bank as they move closer to unwinding their ultra-easy monetary policy. IHS Markit’s final manufacturing Purchasing Managers’ Index for the Eurozone fell to 58.6 in February from 59.6, just piping an earlier flash estimate of 58.5 and comfortably above the 50 mark that separates growth from contraction. An index measuring output, which feeds into a composite PMI fell to 59.6 from 61.1, but was also above its flash estimate. (Reuters) Eurozone’s producer price inflation slows YoY in January – Eurozone’s prices at factory gates slowed in January because of a sharp deceleration of energy price growth, data from the European Union’s statistics office Eurostat showed. Eurostat stated industrial producer prices grew 0.4% MoM in January, as expected by economists polled by Reuters, for 1.5% YoY gain, against market expectations of 1.6% increase. The annual rate compares to 2.2% in December and 2.8% in November, as energy prices grew only 0.5% YoY in January, against 2.7% in December and 5.1% in November. Without the volatile energy prices, producer price inflation was 1.9% YoY in January, the same as in December. (Reuters) Eurozone’s unemployment drops to lowest level since December 2008 – Eurozone’s unemployment fell to its lowest level in more than nine years in January thanks to strong economic growth, official estimates showed, although large differences in jobless rates remained among the 19 countries of the single currency bloc. Eurostat stated the unemployment rate in Eurozone was 8.6% in January. Eurostat revised down to 8.6% its data for December from a previously estimated 8.7%. It stated that the January’s reading was the lowest recorded in Eurozone since December 2008. The number of unemployed fell to 14.111mn people in January from 14.121mn a month earlier. In January last year, the unemployment rate stood at 9.6%, meaning 15.540mn people were jobless. The steady drop in unemployment levels in Eurozone coincides with a firm economic recovery which reached last year its fastest pace in a decade. (Reuters) German monthly retail sales unexpectedly drop in January – German monthly retail sales unexpectedly declined in January, data showed, in a sign that private consumption may remain weak in early 2018 after failing to make any contribution to growth in Europe’s biggest economy in the fourth quarter. The volatile indicator, which is often subject to revision, showed retail sales, fell by 0.7% on the month in real terms, according to the Federal Statistics Office. That missed the Reuters consensus forecast for 0.9% rise and came after an upwardly revised drop of 1.1% in December. Private consumption has been a key growth driver in recent years as consumers benefit from rising wages, record-high employment and strong job security but data published last week showed foreign trade propelled Germany’s fourth-quarter expansion of 0.6%. On the year, retail sales increased by 2.3%, missing a Reuters consensus forecast for 3.5% increase. (Reuters) China’s February factory growth picks up to six-month high – Growth in China’s manufacturing sector unexpectedly picked up to a six-month high in February as factories rushed to replenish inventories to meet rising new orders. The findings were largely at odds with a downbeat official factory activity reading, which raised concerns of a sharper-than-expected slowdown in the world’s second biggest economy this year. The Caixin/Markit Manufacturing Purchasing Manager’s Index (PMI) edged up to 51.6 last month, from 51.5 in January, and countering economists’ expectations for a slight dip to 51.3. The 50-mark divides expansion from contraction on a monthly basis. (Reuters) Regional Saudi Arabia expands $10bn loan refinancing to $16bn – Saudi Arabia is expanding the refinancing of a $10bn international loan to raise $16bn due to strong demand, its Debt Management Office (DMO) stated. The DMO said it would introduce an Islamic tranche to the transaction, supporting Saudi Arabia’s goal of becoming the leading centre for Islamic finance, and intended to close the deal by mid-March. A $16bn facility would be one of the largest syndicated loans ever extended in emerging markets, underlining Saudi Arabia’s growing clout as an international debt issuer. The Kingdom raised the original $10bn loan from 14 core banks in 2016, in what was its first jumbo transaction after a slump in international oil prices forced it to begin borrowing to cover a huge state budget deficit. (GulfBase.com) Record slide in Saudi Arabian loans to firms poses risk to recovery – Saudi Arabia’s bank lending to private companies shrank for an eleventh month in January, the longest stretch in at least two decades, underscoring the challenge facing officials trying to boost growth in the Kingdom. Data by the Saudi Arabian Monetary Authority showed total credit issued to private companies fell 1% from a year earlier, compared with a 41% jump in lending to the public sector, the most in 11 months. That’s a problem for authorities looking to bolster non- oil private industries to overhaul an economy long reliant on oil revenue and state spending. (Gulf-Times.com)

- 6. Page 6 of 7 BSFR posts 13.1% YoY rise in net profit to SR423mn in 4Q2017 – Banque Saudi Fransi (BSFR) recorded net profit of SR423mn in 4Q2017, an increase of 13.1% YoY. Total operating income rose 4.3% YoY to SR1,620mn in 4Q2017, primarily due to higher net special commission income which was partially offset by a reduction in fee and commission income, exchange income, trading income, gains on non-trading investments as well as other operating income. Total assets stood at SR192.93bn at the end of December 31, 2017 as compared to SR203.43bn at the end of December 31, 2016. Loans and advances portfolio stood at SR121.94bn (-5.8% YoY), while customer deposit stood at SR150.95bn (-4.7% YoY) at the end of December 31, 2017. EPS came in at SR2.94 in FY2017 as compared to SR2.91 in FY2016. (Tadawul) Jabal Omar Development Co. to close Umm Al Qura merger deal in 2018 – Saudi Arabia’s Jabal Omar Development Co. is expecting to finalize its merger deal with Umm Al Qura Development and Construction in 2018, a senior company executive said. The deal is a key to strengthening Jabal Omar Development’s presence in the real estate market of the Muslim holy city of Makkah beyond its flagship project within walking distance of the Grand Mosque to help tap growth in tourism. (GulfBase.com) UAE, Paraguay to boost trade – UAE’s Minister of Economy, Sultan Bin Saeed Al Mansouri discussed ways to strengthen the economic and trade relations between the UAE and Paraguay and open wider prospects for private sector partnerships between the two sides in fields of mutual interest. Al Mansouri said that Paraguay is a promising economic destination among Latin American countries and has many growth factors, due to its excellent geographical location, natural resources, raw materials and energy, all of which offer excellent opportunities for promising economic and development partnerships between the two countries. (GulfBase.com) UAE insurance firms’ profits hit $381mn in 2017 – The combined annual profit of the insurance companies listed on the UAE’s financial markets for 2017 rose to AED1.4bn from AED900mn in 2016, a report stated. The growth is attributed to hiking premiums resulting from the updated unified insurance policy which went into force effective January 2017, and strengthened the insurance companies’ financial resources. (GulfBase.com) UAE’s gross bank assets reach AED2.7tn – The UAE’s gross bank assets, including bankers’ acceptances, reached AED2.688tn at the end of January, reflecting a 0.3% fall from AED2.695tn at the end of prior-month, figures by the UAE’s central bank showed. Gross credit in the banking system increased by 0.5% for the same period to AED1.588tn from AED1.581tn in December. However, total bank deposits decreased by AED5.2bn. (GulfBase.com) Ethiopia acquires 19% stake in DP World’s port – Ethiopia became a shareholder of the Port of Berbera following the signing of an agreement with DP World and the Somaliland Port Authority in Dubai. DP World will hold a 51% stake in the project, Somaliland 30% and Ethiopia the remaining 19%. The government of Ethiopia will also invest in infrastructure to develop the Berbera Corridor as a trade gateway for the inland country, which is one of the fastest growing countries in the world. (GulfBase.com) Omani banks achieve 6.4% credit growth – Total loans and advances of Omani banks grew by 6.4% to OMR23.55bn in 2017, from OMR22.13bn in the previous year. The average interest rates on the loans grew by 4.4-5% at the end of 2017 compared to 4.8% during the same period in 2016, according to National Centre for Statistics and Information. The statistics pointed out that as of the end of December 2017, the domestic liquidity increased by 4.2% to OMR16.07bn compared to OMR15.42bn at the end of December 2016. (GulfBase.com) Oman to raise OMR150mn in bonds – Oman’s central bank announced issue of government development bonds to the tune of OMR150mn. The issue, which will have a maturity of 10 years, will carry a coupon rate of 6% per annum. The issue will open for subscription between March 7 and 15, while the auction will be held on March 18, 2018. The issue settlement date will be on March 21. Interest on the new bonds will be paid semiannually on September 21 and March 21 until its maturity on March 21, 2028. (GulfBase.com) Bank Muscat mandates banks for Dollar bond – Bank Muscat mandated banks to arrange a five-year, US Dollar-denominated benchmark bond issue, according to a document. Bank ABC, Bank Muscat, Citigroup, Credit Agricole, Emirates NBD Capital, First Abu Dhabi Bank, HSBC and ICBC Standard Bank will act as joint lead managers and bookrunners for the issue, according to the document. Ahead of the issue, the banks will arrange a series of fixed income investor meetings in the Middle East, Asia and Europe. (Reuters)

- 7. Contacts Saugata Sarkar, CFA, CAIA Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa Mohamed Abo Daff QNB Financial Services Co. W.L.L. Senior Research Analyst Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6589 PO Box 24025 mohd.abodaff@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L. (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (Q.P.S.C.). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange. Qatar National Bank (Q.P.S.C.) is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 7 of 7 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg ( # Data as of March 1, 2018) Source: Bloomberg Source: Bloomberg (*$ adjusted returns, # Market closed on March 2, 2018) 60.0 80.0 100.0 120.0 140.0 160.0 Feb-14 Feb-15 Feb-16 Feb-17 Feb-18 QSE Index S&P Pan Arab S&P GCC (0.6%) 0.9% (0.6%) 0.5% (0.2%) 0.2% 0.1% (1.0%) (0.5%) 0.0% 0.5% 1.0% SaudiArabia Qatar# Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,322.75 0.4 (0.5) 1.5 MSCI World Index 2,089.84 (0.0) (2.4) (0.6) Silver/Ounce 16.52 0.3 (0.0) (2.5) DJ Industrial 24,538.06 (0.3) (3.0) (0.7) Crude Oil (Brent)/Barrel (FM Future) 64.37 0.8 (4.4) (3.7) S&P 500 2,691.25 0.5 (2.0) 0.7 Crude Oil (WTI)/Barrel (FM Future) 61.25 0.4 (3.6) 1.4 NASDAQ 100 7,257.87 1.1 (1.1) 5.1 Natural Gas (Henry Hub)/MMBtu 2.70 1.1 4.7 (12.6) STOXX 600 367.04 (1.3) (3.7) (3.4) LPG Propane (Arab Gulf)/Ton 75.13 0.2 (18.6) (23.1) DAX 11,913.71 (1.5) (4.5) (5.5) LPG Butane (Arab Gulf)/Ton 73.75 (1.8) (13.7) (30.2) FTSE 100 7,069.90 (1.2) (3.9) (6.4) Euro 1.23 0.4 0.2 2.6 CAC 40 5,136.58 (1.6) (3.4) (1.0) Yen 105.75 (0.5) (1.1) (6.2) Nikkei 21,181.64 (1.4) (2.4) (0.8) GBP 1.38 0.2 (1.2) 2.1 MSCI EM 1,182.06 (0.9) (2.8) 2.0 CHF 1.07 0.5 (0.1) 3.9 SHANGHAI SE Composite 3,254.53 (0.4) (1.2) 0.9 AUD 0.78 0.1 (1.1) (0.6) HANG SENG 30,583.45 (1.5) (2.3) 2.0 USD Index 89.94 (0.4) 0.1 (2.4) BSE SENSEX# 34,046.94 0.0 (0.8) (2.1) RUB 56.82 (0.0) 0.5 (1.4) Bovespa 85,761.34 0.4 (2.3) 14.0 BRL 0.31 (0.1) (0.4) 1.8 RTS 1,261.63 (1.0) (3.0) 9.3 84.4 84.2 78.3