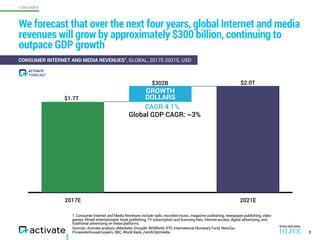

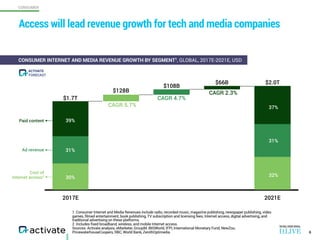

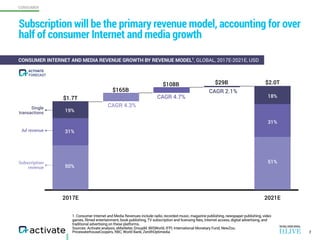

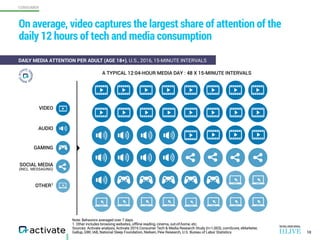

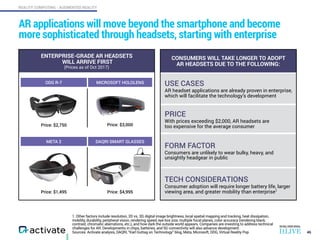

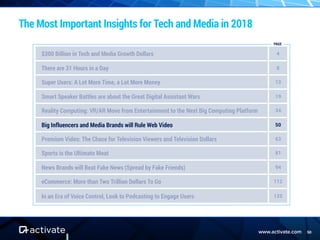

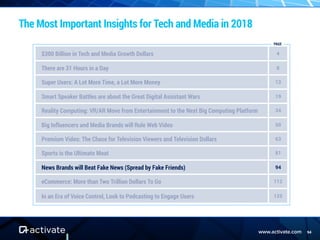

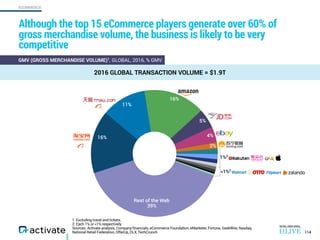

The Activate Tech & Media Outlook 2018 report outlines key insights and trends expected to shape the technology and media landscape, forecasting a $300 billion growth in global internet and media revenues by 2021. Major highlights include the rise of super users, the evolution of smart speakers and AR/VR technologies, and the critical role of video content and influencers in media consumption. The report emphasizes the importance of adapting to changing consumer behaviors and the competitive digital assistant landscape.