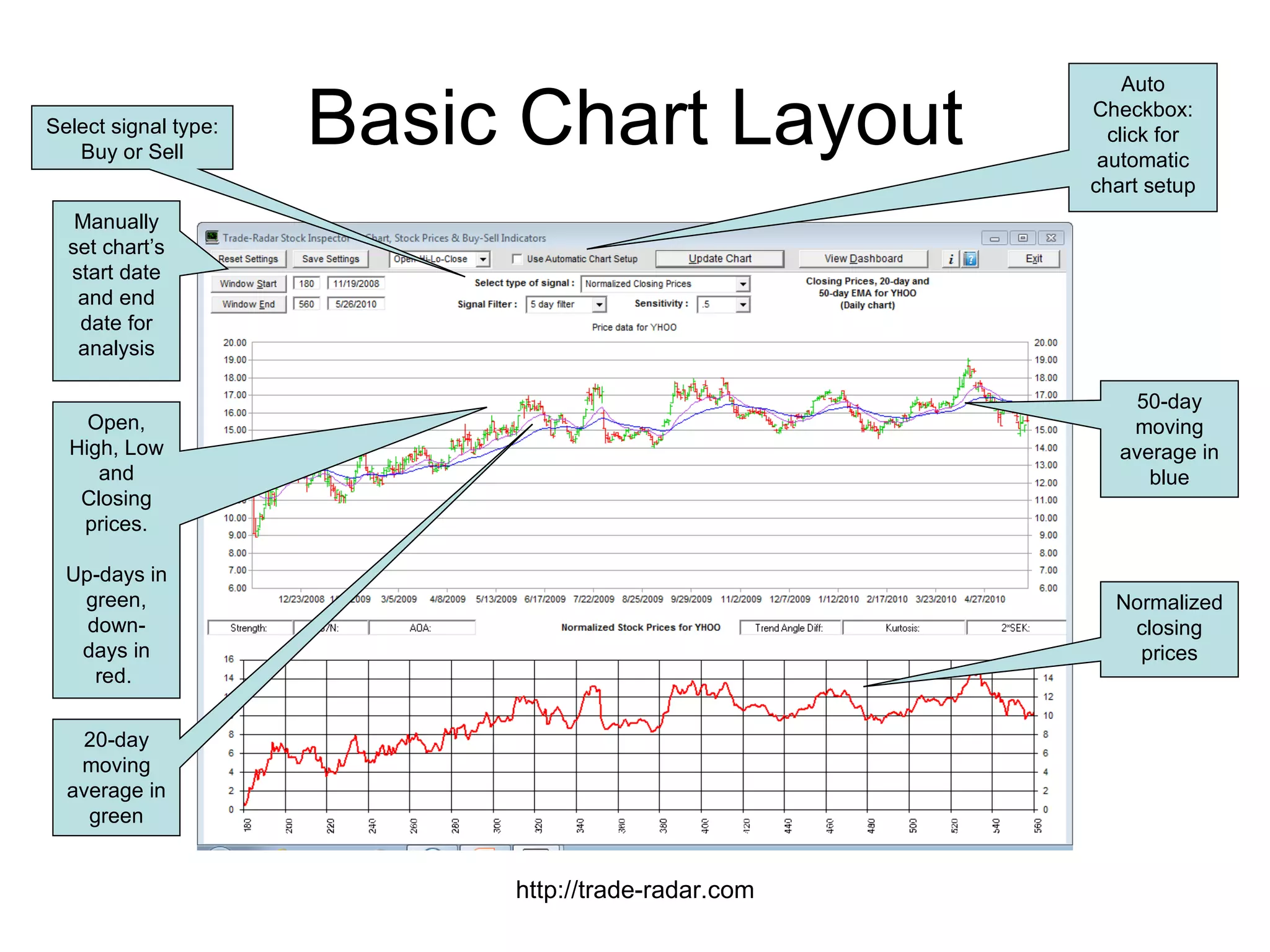

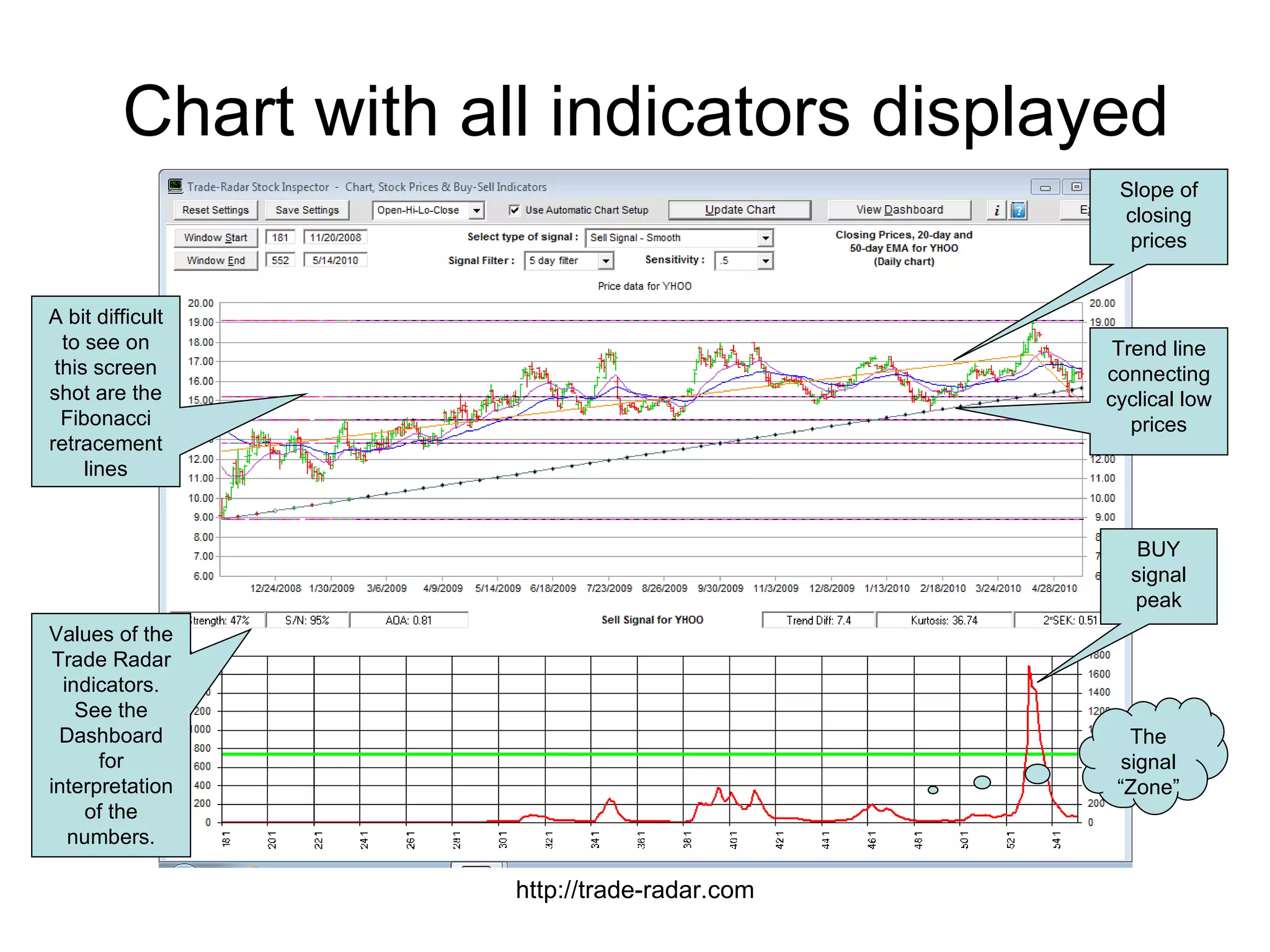

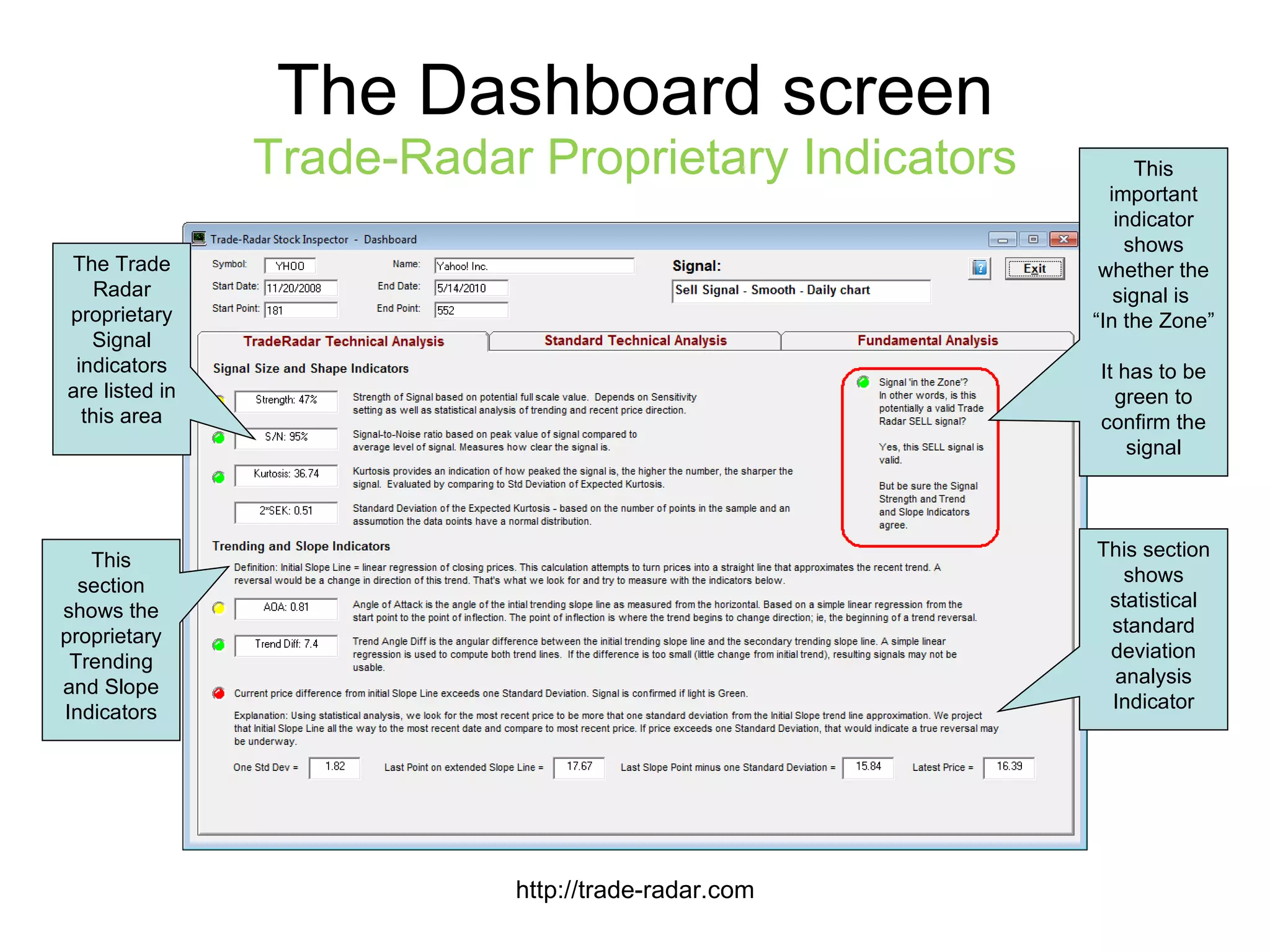

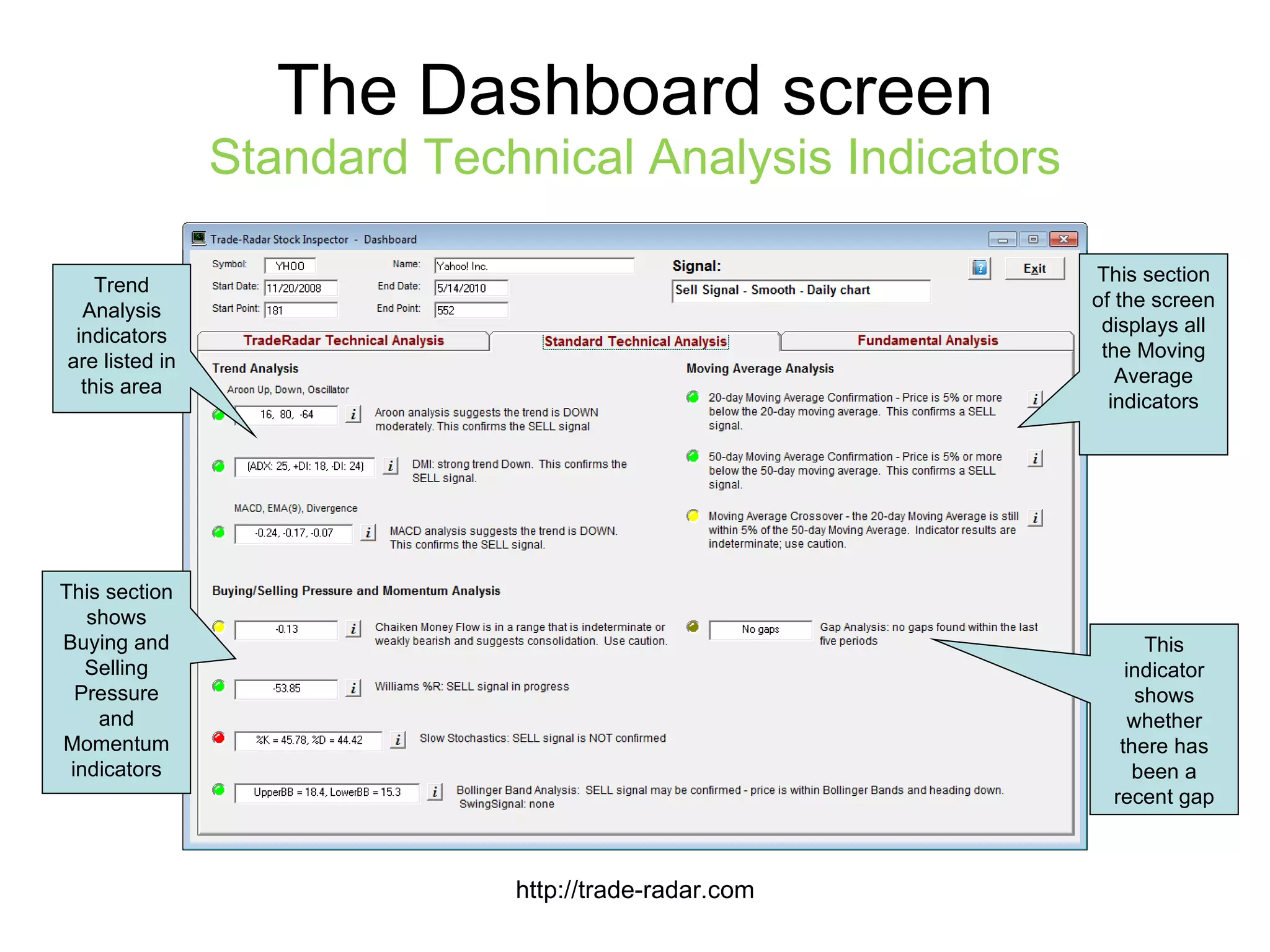

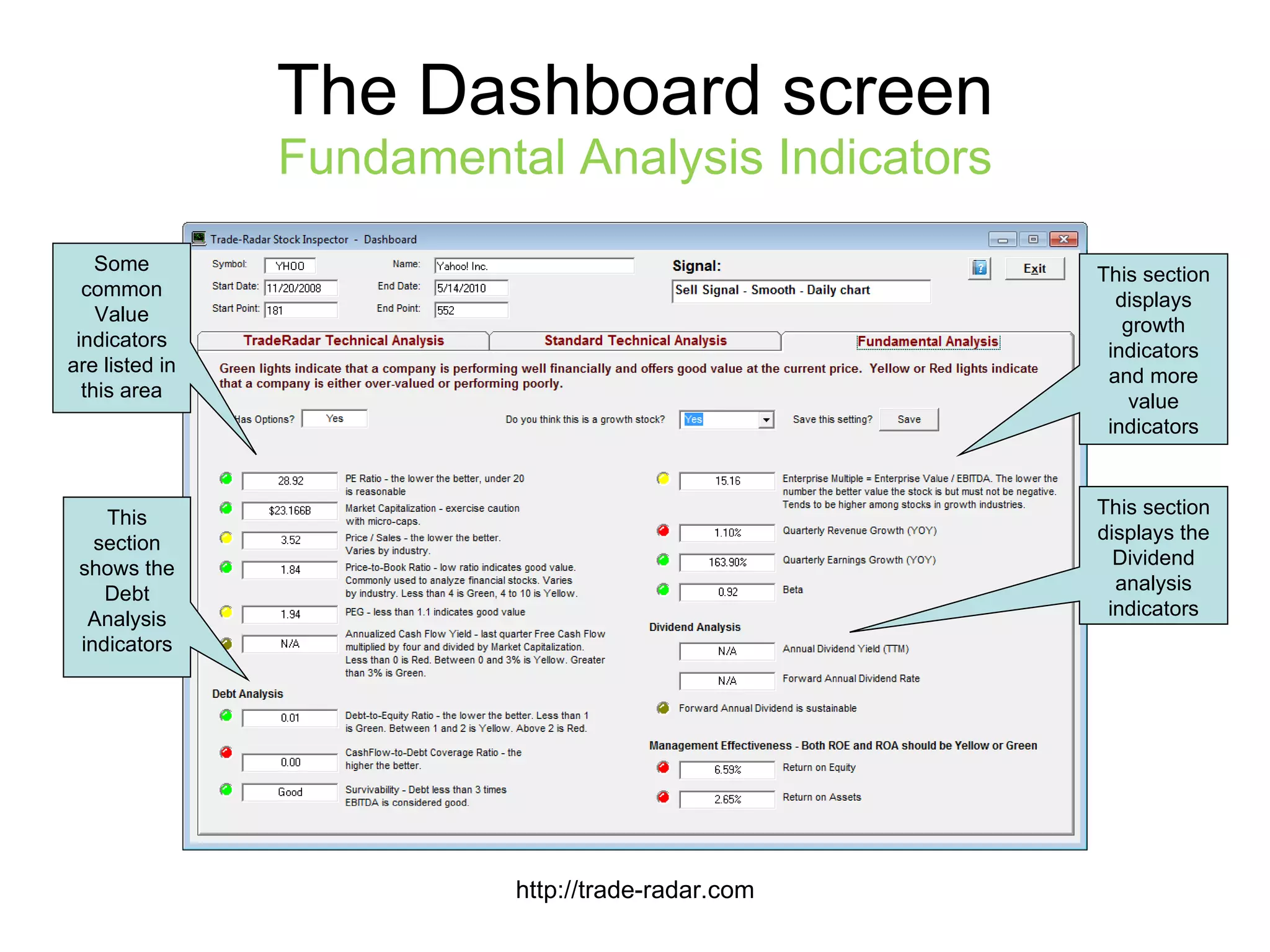

The document describes the Trade Radar stock analysis software. The software analyzes technical and fundamental factors to generate buy and sell signals for stocks and ETFs. It displays these signals on stock charts along with 36 indicators in a dashboard view. The indicators have color-coded signals to help evaluate whether technical and fundamental factors support the displayed buy or sell signal. This allows users to quickly evaluate many factors to determine the validity of a given signal.