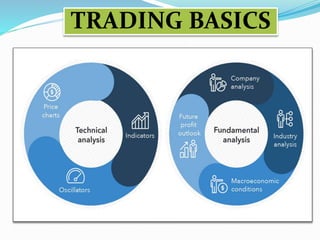

The document discusses the basics of trading stocks. It defines what a stock is and how owning stocks can generate earnings through trading, investing, bonus shares, and dividends. It then outlines different trading styles like position trading, swing trading, day trading, and scalping based on the time period and trading activity. The document also discusses technical analysis using indicators like moving averages, Bollinger bands, and relative strength index to identify trends and momentum. Fundamental analysis is also covered, which involves quantitatively and qualitatively analyzing companies and industries to estimate a stock's intrinsic value using ratios and financial metrics. Contact details are provided at the end for assistance.