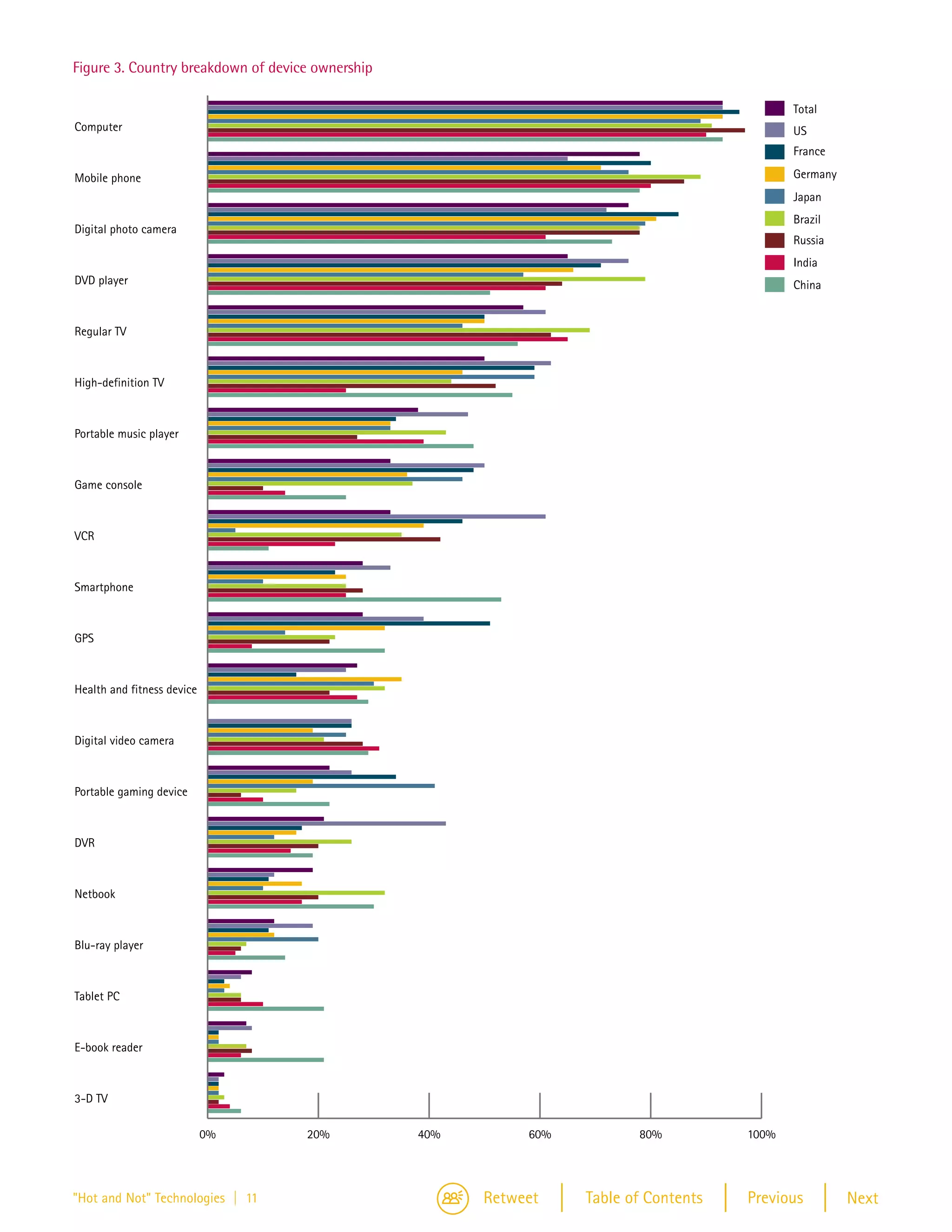

1) Consumer technology is now seen as an integral part of lifestyle, like fashion. However, consumer preferences are shifting rapidly.

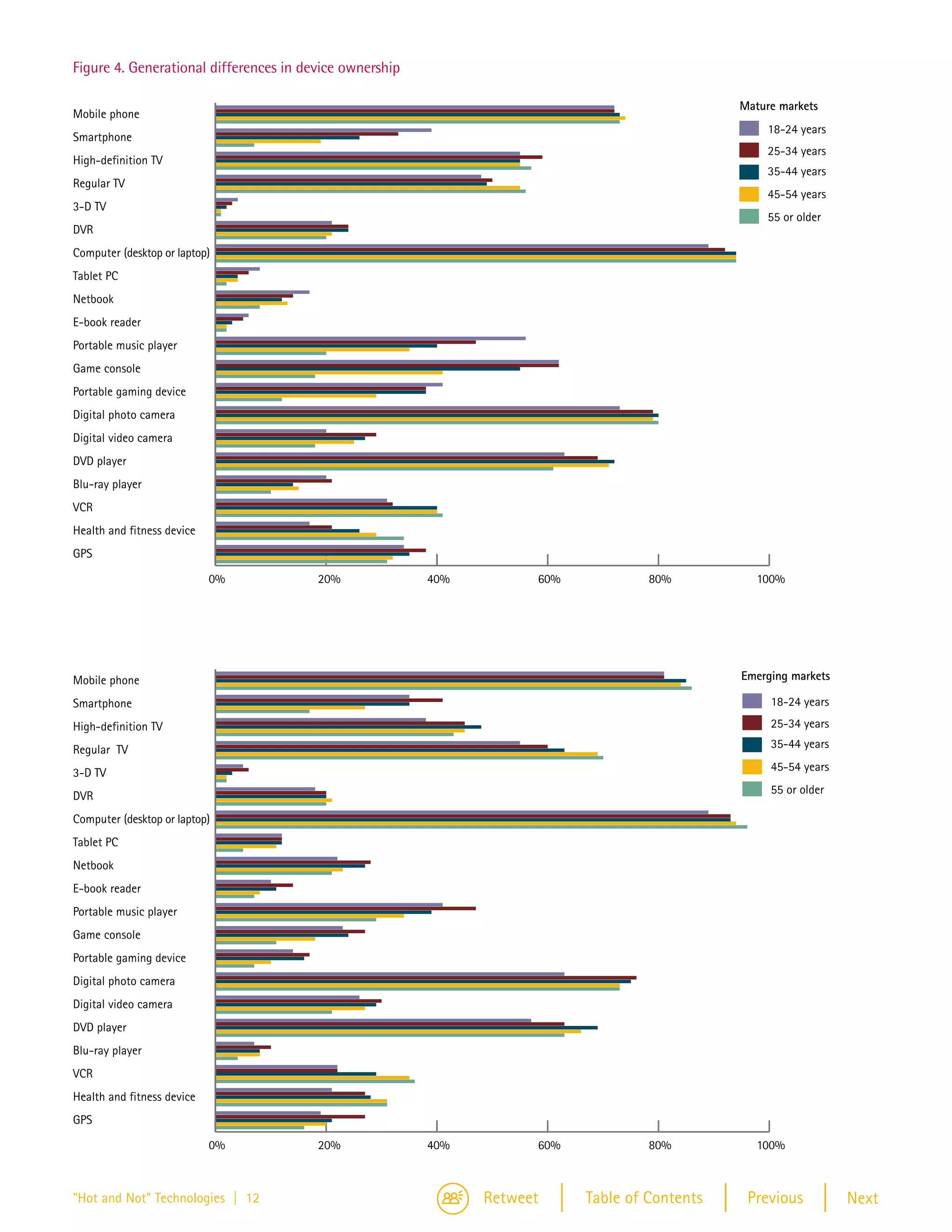

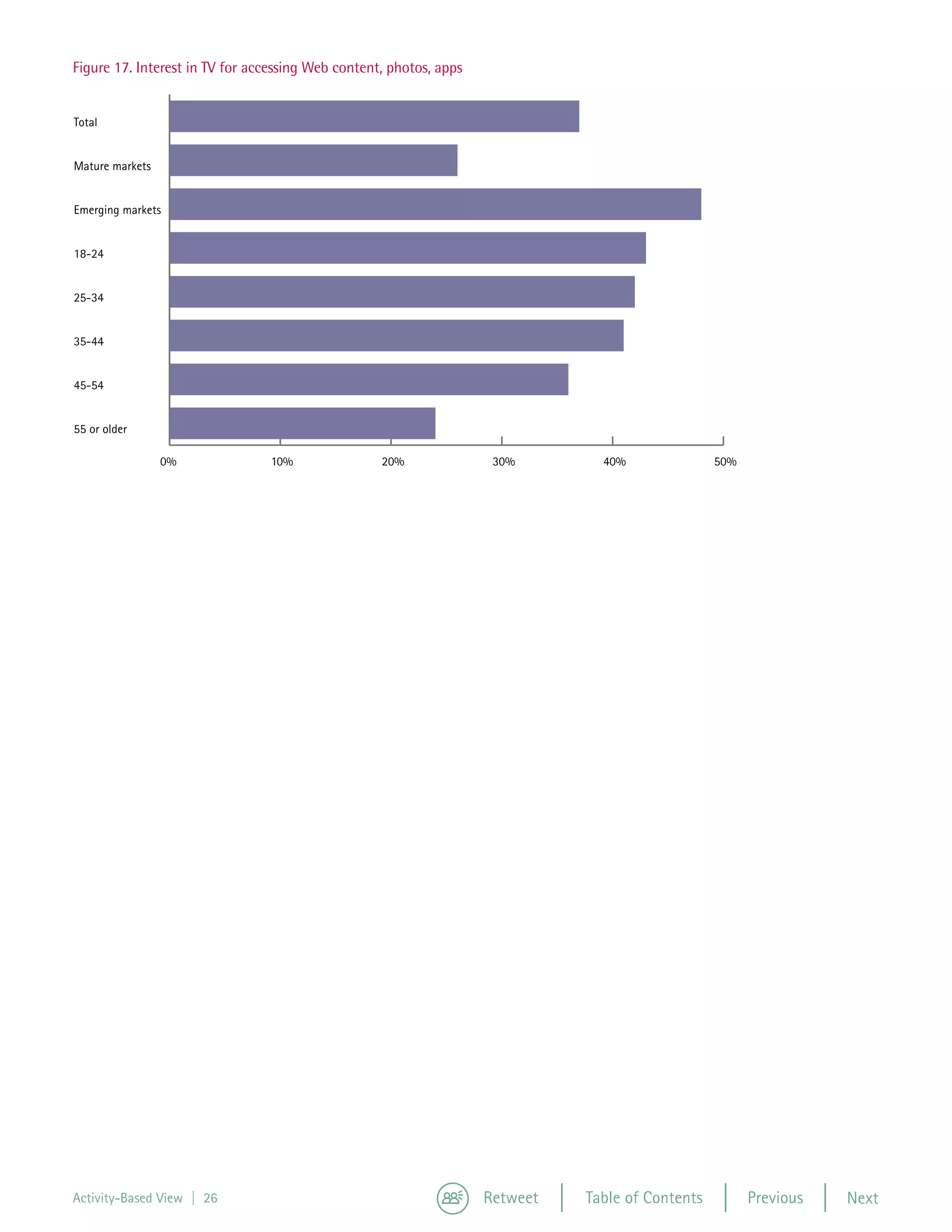

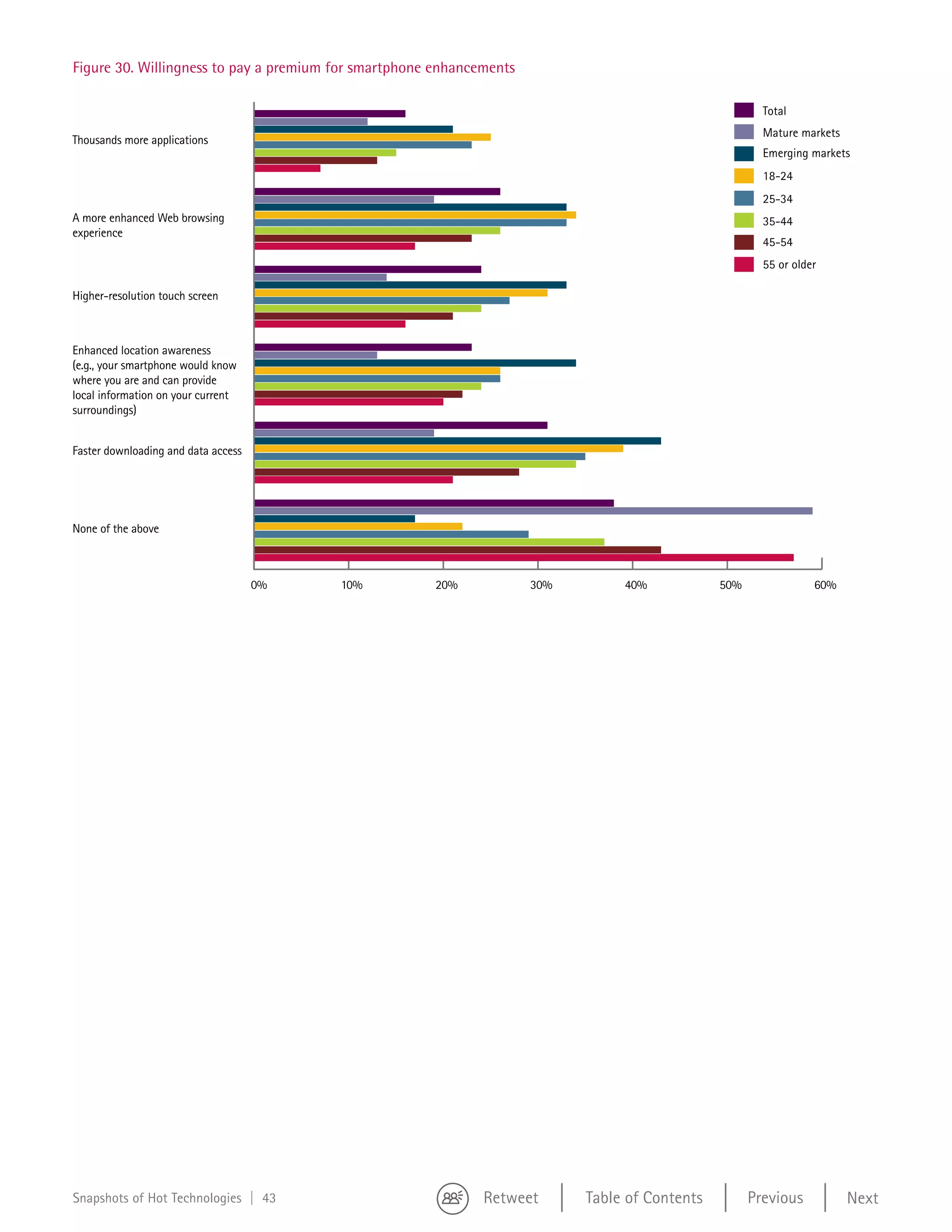

2) Younger consumers, especially in emerging markets, are more interested in new technologies and willing to pay premiums. Mature markets are more price sensitive.

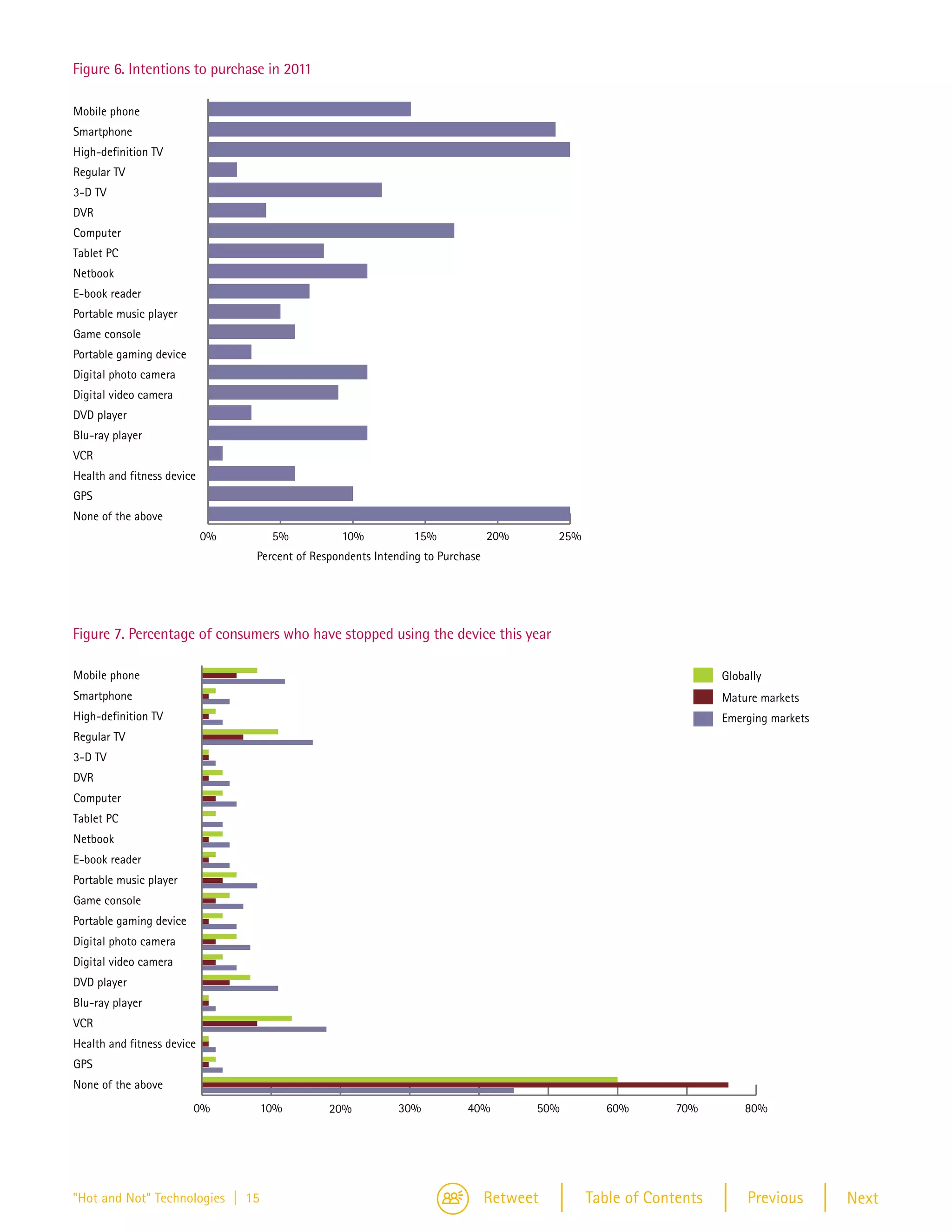

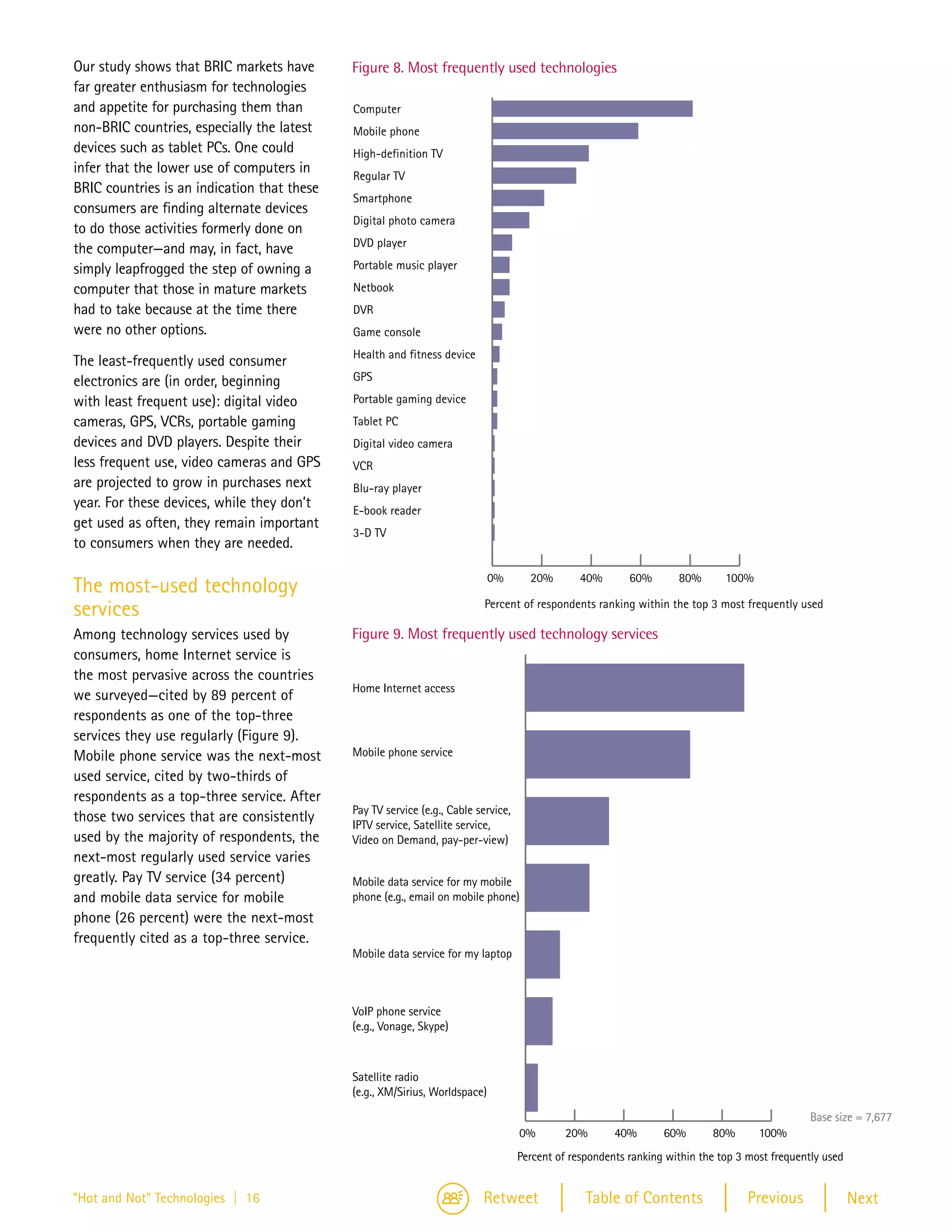

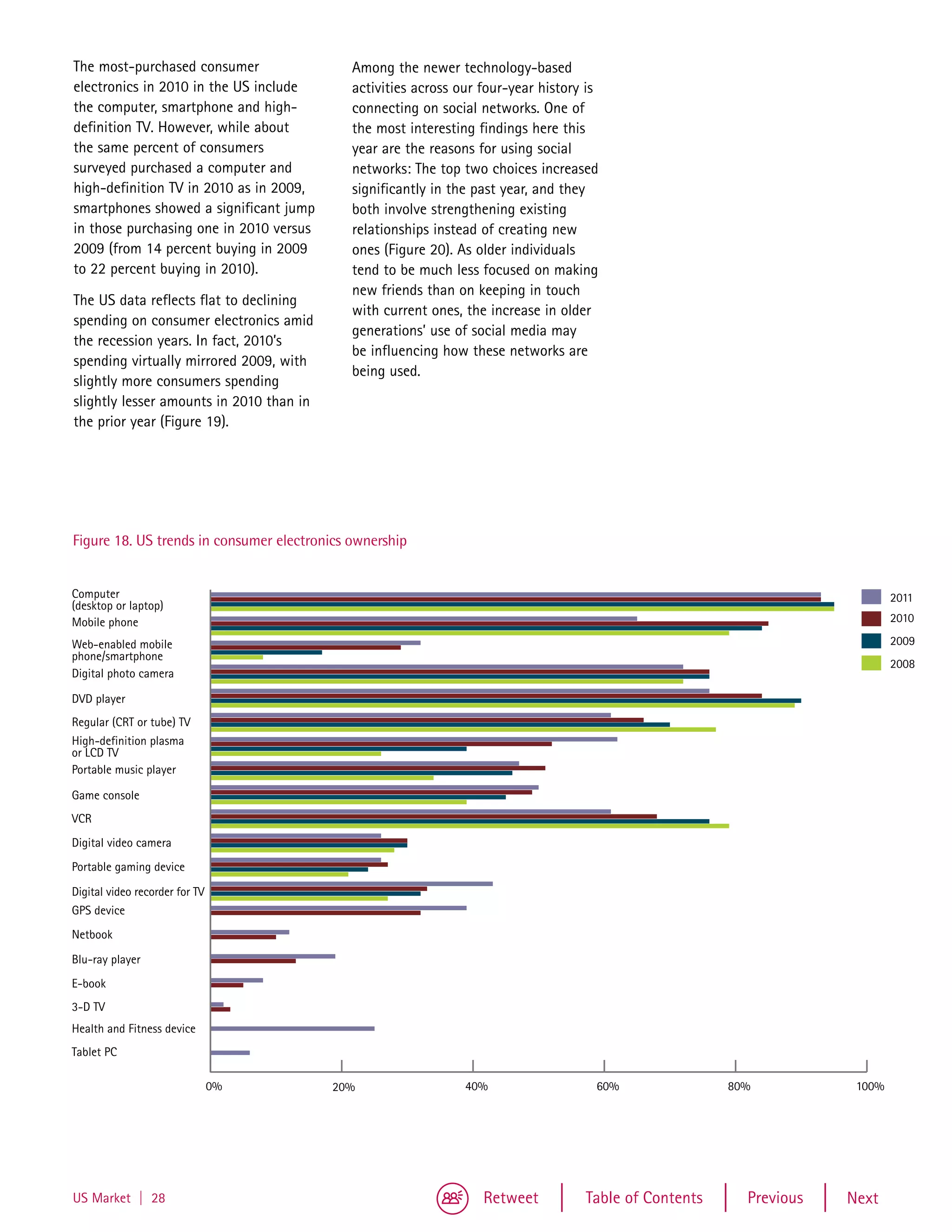

3) A new paradigm is emerging as technologies like smartphones, tablets, and e-readers potentially make older devices like computers obsolete, driven by shifting usage patterns and preferences.