Malaysia Public Funding Challenges

•Download as PPT, PDF•

0 likes•590 views

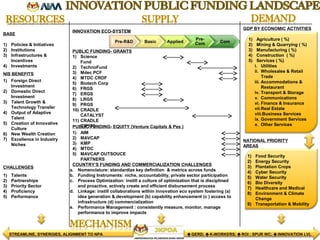

This document discusses Malaysia's innovation ecosystem, including public funding sources and challenges. It outlines key pillars to strengthen the ecosystem such as policies, institutions, infrastructure, investments, talents, and partnerships. National priority areas are listed like food security, energy security, and healthcare. Public funding sources are identified including various science and technology funds. Challenges around commercialization are highlighted involving foreign/domestic investment, talent growth, output, culture, and wealth creation. Benefits of a national innovation system are noted. The document advocates streamlining efforts, creating synergies, and aligning initiatives to national priority areas.

Report

Share

Report

Share

Recommended

Innovative Multi Sector, Multi-stakeholder Partnerships for Scalability and S...

Innovative Multi Sector, Multi-stakeholder Partnerships for Scalability and S...Commonwealth Telecommunications Organisation

H.E. Mr Gita Wirjawan's Keynote Address in the 6th Asia Think Tank Summit

H.E. Mr Gita Wirjawan's Keynote Address in the 6th Asia Think Tank SummitEconomic Research Institute for ASEAN and East Asia

More Related Content

Similar to Malaysia Public Funding Challenges

Innovative Multi Sector, Multi-stakeholder Partnerships for Scalability and S...

Innovative Multi Sector, Multi-stakeholder Partnerships for Scalability and S...Commonwealth Telecommunications Organisation

H.E. Mr Gita Wirjawan's Keynote Address in the 6th Asia Think Tank Summit

H.E. Mr Gita Wirjawan's Keynote Address in the 6th Asia Think Tank SummitEconomic Research Institute for ASEAN and East Asia

Similar to Malaysia Public Funding Challenges (20)

28.05.2012, Mid-term development priority, Dr. Khashchuluun Ch.

28.05.2012, Mid-term development priority, Dr. Khashchuluun Ch.

Information and Communication Technology in dissemination of Agricultural Tec...

Information and Communication Technology in dissemination of Agricultural Tec...

"The Asian Opportunity: New Profitable Markets for Ireland’s Most Important I...

"The Asian Opportunity: New Profitable Markets for Ireland’s Most Important I...

An International Perspective of the Future of Food Business

An International Perspective of the Future of Food Business

Inria | White paper Agriculture and Digital Technology (January 2022)

Inria | White paper Agriculture and Digital Technology (January 2022)

Innovative Multi Sector, Multi-stakeholder Partnerships for Scalability and S...

Innovative Multi Sector, Multi-stakeholder Partnerships for Scalability and S...

Africa RISING Phase 2 umbrella proposal: what is new?

Africa RISING Phase 2 umbrella proposal: what is new?

H.E. Mr Gita Wirjawan's Keynote Address in the 6th Asia Think Tank Summit

H.E. Mr Gita Wirjawan's Keynote Address in the 6th Asia Think Tank Summit

Recently uploaded

(INDIRA) Call Girl Mumbai Call Now 8250077686 Mumbai Escorts 24x7

(INDIRA) Call Girl Mumbai Call Now 8250077686 Mumbai Escorts 24x7Call Girls in Nagpur High Profile Call Girls

From Luxury Escort Service Kamathipura : 9352852248 Make on-demand Arrangemen...

From Luxury Escort Service Kamathipura : 9352852248 Make on-demand Arrangemen...From Luxury Escort : 9352852248 Make on-demand Arrangements Near yOU

Top Rated Pune Call Girls Viman Nagar ⟟ 6297143586 ⟟ Call Me For Genuine Sex...

Top Rated Pune Call Girls Viman Nagar ⟟ 6297143586 ⟟ Call Me For Genuine Sex...Call Girls in Nagpur High Profile

Top Rated Pune Call Girls Pashan ⟟ 6297143586 ⟟ Call Me For Genuine Sex Serv...

Top Rated Pune Call Girls Pashan ⟟ 6297143586 ⟟ Call Me For Genuine Sex Serv...Call Girls in Nagpur High Profile

VIP Independent Call Girls in Mira Bhayandar 🌹 9920725232 ( Call Me ) Mumbai ...

VIP Independent Call Girls in Mira Bhayandar 🌹 9920725232 ( Call Me ) Mumbai ...dipikadinghjn ( Why You Choose Us? ) Escorts

VIP Call Girl in Mira Road 💧 9920725232 ( Call Me ) Get A New Crush Everyday ...

VIP Call Girl in Mira Road 💧 9920725232 ( Call Me ) Get A New Crush Everyday ...dipikadinghjn ( Why You Choose Us? ) Escorts

VIP Independent Call Girls in Andheri 🌹 9920725232 ( Call Me ) Mumbai Escorts...

VIP Independent Call Girls in Andheri 🌹 9920725232 ( Call Me ) Mumbai Escorts...dipikadinghjn ( Why You Choose Us? ) Escorts

( Jasmin ) Top VIP Escorts Service Dindigul 💧 7737669865 💧 by Dindigul Call G...

( Jasmin ) Top VIP Escorts Service Dindigul 💧 7737669865 💧 by Dindigul Call G...dipikadinghjn ( Why You Choose Us? ) Escorts

VIP Call Girl Service Andheri West ⚡ 9920725232 What It Takes To Be The Best ...

VIP Call Girl Service Andheri West ⚡ 9920725232 What It Takes To Be The Best ...dipikadinghjn ( Why You Choose Us? ) Escorts

Recently uploaded (20)

Call Girls Koregaon Park Call Me 7737669865 Budget Friendly No Advance Booking

Call Girls Koregaon Park Call Me 7737669865 Budget Friendly No Advance Booking

Solution Manual for Principles of Corporate Finance 14th Edition by Richard B...

Solution Manual for Principles of Corporate Finance 14th Edition by Richard B...

(INDIRA) Call Girl Mumbai Call Now 8250077686 Mumbai Escorts 24x7

(INDIRA) Call Girl Mumbai Call Now 8250077686 Mumbai Escorts 24x7

Mira Road Awesome 100% Independent Call Girls NUmber-9833754194-Dahisar Inter...

Mira Road Awesome 100% Independent Call Girls NUmber-9833754194-Dahisar Inter...

From Luxury Escort Service Kamathipura : 9352852248 Make on-demand Arrangemen...

From Luxury Escort Service Kamathipura : 9352852248 Make on-demand Arrangemen...

Top Rated Pune Call Girls Viman Nagar ⟟ 6297143586 ⟟ Call Me For Genuine Sex...

Top Rated Pune Call Girls Viman Nagar ⟟ 6297143586 ⟟ Call Me For Genuine Sex...

Top Rated Pune Call Girls Pashan ⟟ 6297143586 ⟟ Call Me For Genuine Sex Serv...

Top Rated Pune Call Girls Pashan ⟟ 6297143586 ⟟ Call Me For Genuine Sex Serv...

VIP Independent Call Girls in Mira Bhayandar 🌹 9920725232 ( Call Me ) Mumbai ...

VIP Independent Call Girls in Mira Bhayandar 🌹 9920725232 ( Call Me ) Mumbai ...

TEST BANK For Corporate Finance, 13th Edition By Stephen Ross, Randolph Weste...

TEST BANK For Corporate Finance, 13th Edition By Stephen Ross, Randolph Weste...

WhatsApp 📞 Call : 9892124323 ✅Call Girls In Chembur ( Mumbai ) secure service

WhatsApp 📞 Call : 9892124323 ✅Call Girls In Chembur ( Mumbai ) secure service

Call Girls Banaswadi Just Call 👗 7737669865 👗 Top Class Call Girl Service Ban...

Call Girls Banaswadi Just Call 👗 7737669865 👗 Top Class Call Girl Service Ban...

VIP Call Girl in Mira Road 💧 9920725232 ( Call Me ) Get A New Crush Everyday ...

VIP Call Girl in Mira Road 💧 9920725232 ( Call Me ) Get A New Crush Everyday ...

Call Girls in New Friends Colony Delhi 💯 Call Us 🔝9205541914 🔝( Delhi) Escort...

Call Girls in New Friends Colony Delhi 💯 Call Us 🔝9205541914 🔝( Delhi) Escort...

VIP Independent Call Girls in Andheri 🌹 9920725232 ( Call Me ) Mumbai Escorts...

VIP Independent Call Girls in Andheri 🌹 9920725232 ( Call Me ) Mumbai Escorts...

( Jasmin ) Top VIP Escorts Service Dindigul 💧 7737669865 💧 by Dindigul Call G...

( Jasmin ) Top VIP Escorts Service Dindigul 💧 7737669865 💧 by Dindigul Call G...

VIP Call Girl Service Andheri West ⚡ 9920725232 What It Takes To Be The Best ...

VIP Call Girl Service Andheri West ⚡ 9920725232 What It Takes To Be The Best ...

Kharghar Blowjob Housewife Call Girls NUmber-9833754194-CBD Belapur Internati...

Kharghar Blowjob Housewife Call Girls NUmber-9833754194-CBD Belapur Internati...

Malaysia Public Funding Challenges

- 1. INNOVATION ECO-SYSTEM PUBLIC FUNDING- GRANTS GDP BY ECONOMIC ACTIVITIES BASE CHALLENGES 1) Policies & Initiatives 2) Institutions 3) Infrastructures & Incentives 4) Investments 1) Talents 2) Partnerships 3) Priority Sector 4) Proficiency 5) Performance 1) Agriculture ( %) 2) Mining & Quarrying ( %) 3) Manufacturing ( %) 4) Construction ( %) 5) Services ( %) i. Utilities ii. Wholesales & Retail Trade iii. Accommodations & Restaurant iv. Transport & Storage v. Communications vi. Finance & Insurance vii.Real Estate viii.Business Services ix. Government Services x. Other Services NATIONAL PRIORITY AREAS 1) Food Security 2) Energy Security 3) Plantation Crops 4) Cyber Security 5) Water Security 6) Bio Diversity 7) Healthcare and Medical 8) Environment & Climate Change 9) Transportation & Mobility 1) Science Fund 2) TechnoFund 3) Mdec PCF 4) MTDC CRDF 5) Biotech Corp 6) FRGS 7) ERGS 8) LRGS 9) PRGS 10) CRADLE CATALYST 11) CRADLE CIP500 COUNTRY’S FUNDING AND COMMERCIALIZATION CHALLENGES 1) Foreign Direct Investment 2) Domestic Direct Investment 3) Talent Growth & Technology Transfer 4) Output of Adaptive Talent 5) Creation of Innovative Culture 6) New Wealth Creation 7) Excellence in Industry Niches a. Nomenclature: standardize key definition & metrics across funds b. Funding Instruments: niche, accountability, private sector participation c. Process Optimization: instill a culture of optimization that is disciplined and proactive, actively create and efficient disbursement process d. Linkage: instill collaborations within innovation eco system fostering (a) idea generation & development (b) capability enhancement (c ) access to infrastructure (d) commercialization e. Performance Management : consistently measure, monitor, manage performance to improve impacts NIS BENEFITS PUBLIC FUNDING- EQUITY (Venture Capitals & Pes ) 1) AIM 2) MAVCAP 3) KMP 4) MTDC 5) MAVCAP OUTSOUCE PARTNERS GERD; K-WORKERS; ROI ; SPUR WC; INNOVATION LVLSTREAMLINE, SYNERGIES, ALIGNMENT TO NPA