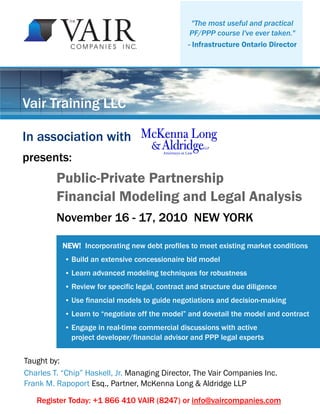

Public-Private Partnership Modeling and Legal Analysis - New York

- 1. "The most useful and practical PF/PPP course I've ever taken." - Infrastructure Ontario Director Vair Training LLC NEW! Incorporating new debt profiles to meet existing market conditions ● Build an extensive concessionaire bid model ● Learn advanced modeling techniques for robustness ● Review for specific legal, contract and structure due diligence ● Use financial models to guide negotiations and decision-making ● Learn to “negotiate off the model” and dovetail the model and contract ● Engage in real-time commercial discussions with active project developer/financial advisor and PPP legal experts Taught by: Charles T. “Chip” Haskell, Jr. Managing Director, The Vair Companies Inc. Frank M. Rapoport Esq., Partner, McKenna Long & Aldridge LLP Public-Private Partnership Financial Modeling and Legal Analysis In association with presents: Register Today: +1 866 410 VAIR (8247) or info@vaircompanies.com November 16 - 17, 2010 NEW YORK

- 2. Vair Training: NEW YORK PPP Financial Modeling and Legal Analysis COURSE OBJECTIVES NEW! Analyzing and modeling project documents including RFP, Project Agreements, Guaranteed Price Contracts, Lenders' Direct Agreements, Value-for-Money Reports, etc. People do not sign models - They sign the contracts that those models represent. Public-Private Partnership Financial Modeling and Legal Analysis is a Vair Training Master Class and focuses uniquely on international PPP projects and their related modeling issues. After reviewing some basic elements that separate PPP from traditional infrastructure and project financing, the participants are given a full suite of project documents and macroeconomic information that are indicative to infrastructure projects. This is followed by a step-by-step procedure of building a complex model for a concessionaire bid. This phase of the course demonstrates how to dovetail contracts and shows that nothing in PPP is mutually exclusive. Once completed, the delegates review the model from a due-diligence analysis, usually taken from a government, lender or third-party equity perspective. The final phase of this module uses sophisticated model techniques to help the practitioner “price the deal” and “negotiate off the financial model”. Special consideration is given to more advanced PPP issues like liquidated-damages analysis, drop-down and direct agreements, and appropriate security packages. The course’s overriding theme is to use the model as a highly-developed financial analysis tool that reviews the appropriate risk-versus-reward profiles of project finance. This is an advanced course and is geared to the intermediate-to-advanced delegate. COURSE OUTLINE Part 1 - Project Finance for PPP Part 13 - Financing Part 2 - The Role of the Model and Common Rules Part 14 - The Income Statement Part 3 - The Risk Matrix Part 15 - The Balance Sheet Part 4 - Introduction of a Project for Modeling Part 16 - The Statement of Cash Flows Part 5 - Legal Due Diligence, Documentation, Permitting Part 17 - Equity Returns & Structuring Part 18 - Loan Values Part 6 - The Assumption Page Part 19 - “Pricing the Deal” and Analysis Part 7 - Revenue: Availability vs. Service & Unitary Payment Part 20 - Documenting Changes to the model Part 8 - Operations Part 21 - Analysis of Liquidated Damages (“LD”), Part 9 - Construction Asset Renewal & Lifecycle Reserves Part 10 - Insurance Part 22 - Monte Carlo Simulation Part 11 - Taxes Part 12 - Depreciation For a detailed course syllabus, click here ● ABN AMRO ● BNP Paribas ● Citi ● Carillion ● Eskom ● Export Development Canada ● General Electric ● Infrastructure Ontario ● Macquarie ● NordLB ● Ontario Teachers' Pension Plan ● PPP Canada ● Pemex ● Royal Bank of Canada ● Royal Bank of Scotland ● Santander ● Shell Gas & Power ● Societe Generale ● US Export-Import Bank ● WestLB ● World Bank/IFC PREVIOUS PARTICIPANTS INCLUDE DELEGATES OF:

- 3. ABOUT THE INSTRUCTORS Charles T. Haskell, Jr. Charles T. “Chip” Haskell, Jr. is a Managing Director with The Vair Companies and author of Advanced Modelling for Project Finance for Negotiations and Analysis. He has taught financial modeling to delegates from hundreds of organizations worldwide. Before founding The Vair Companies, Chip was a Director with Mirant, based in Amsterdam. Prior to joining Mirant, Chip was a Manager with Wärtsilä Development and Finance. Chip has a BA in Economics and French from Hanover College, an MA in French from Middlebury College and a Masters in International Finance and Accounting from Thunderbird School of Global Management. Frank M. Rapoport Frank M. Rapoport is a senior partner and Chair of the Global Infrastructure and Public-Private Partnerships practice at McKenna Long & Aldridge LLP. Frank is widely regarded for his ability to strategize and implement profitable business initiatives for clients in the transportation, real estate development, construction, design and engineering, defense and aerospace, security, life sciences, healthcare, information technology, and government services industries. He recently led a real estate developer from project inception to achieve a $2B inventory in the military housing privatization initiative. His team at McKenna Long & Aldridge includes specialists in U.S. and international government contracting, government affairs at all levels, and seasoned business and economic advisors with years of transportation, infrastructure and privatization experiences, both domestic and internationally. Frank routinely counsels companies on bid protests, debarment and suspension, defective pricing, procurement fraud and voluntary disclosure, change order claims, differing site condition claims, government-caused delay claims, convenience and default termination claims, breach of contract claims, subcontractor claims, business and minority issues, joint venturing, privatization, and marketing to the federal, state, and local government. Vair Training: NEW YORK PPP Financial Modeling and Legal Analysis

- 4. About The Vair Companies Inc. The Vair Companies offers financial advisory, training and seminar services to organizations and individuals working in the international infrastructure and project development industry. We are active advisors to sponsors, lenders, participants and governments in the infrastructure sector, having advised on the closing of over USD 3 billion in assets globally. During training, we use the same real-world methods and industry techniques we employ on behalf of our advisory clients. Our courses are taught by active financial advisors and project developers who impart the same techniques used to drive real projects, valuations and deals. Vair is not a PowerPoint-based training firm. Instead, we apply a “hands-on”, “learn-by-doing” approach to our teaching. For more information, visit www.vaircompanies.com About McKenna Long & Aldridge LLP McKenna Long & Aldridge LLP is an international law firm with 475 attorneys and public policy advisors. The firm provides business solutions in the areas of environmental regulation, international law, public policy and regulatory affairs, corporate law, government contracts, intellectual property and technology, complex litigation, real estate, energy and finance. To learn more about the firm, its professionals and services, log on to www.mckennalong.com Vair Training: NEW YORK PPP Financial Modeling and Legal Analysis

- 5. Vair Training: NEW YORK Registration Form Fax completed registration form to +1 678 802 3222 or register online at www.vaircompanies.com For more information, please call +1 866 410 VAIR (8247) or email info@vaircompanies.com Registration Form Prefix: First Name: Last Name: Title: Department: Company/Organization: Street Address: Mailing Address: City: State/Prov.: ZIP/Postal: Country: Email: Phone: Fax: How did you hear about us?: Please register the following number of delegates for: PPP Financial Modeling & Legal Analysis Nov. 16-17, 2010 New York ____ delegate(s) at US$3,900/ea Early-Bird Special: 10% discount for registrations and payments received by Sept. 20, 2010 Group Rates: 20% discount for the third and subsequent delegates from the same organization Student Rates: 50% off standard rates (additional Early-Bird Special and Group Rates do not apply) Choose one form of payment: Check: Invoice me (applicable discounts will be applied) Credit Card: Charge my card US$___________ (applicable discounts will be applied) Visa Mastercard Diners Club Card Holder Name: ___________________________ Credit Card #: ___________________________ Expiration Date: ___________________________ Signature: ______________________________ Registration Information: Fee: Registration fees include morning coffee/tea, networking lunches and afternoon refreshments. Delegate lodging not included. Billing and Confirmation: Invoices and/or Payment Confirmations are forwarded within three (3) business days of receipt of registrations. Venue: Vair Training courses are held at world-class international venues. Locations, times and meeting places are confirmed two (2) weeks prior to course commencement. Materials: Course materials are provided electronically on Day 1 of on-site registration. Delegates are required to bring a laptop computer equipped with Microsoft Excel software. Hours: Courses run 9:00 AM–5:00 PM daily Cancellation Policy: All cancellations must be received in writing. A full refund less a 15% administrative fee will be given for cancellations up to 21 days before the event start-date. Cancellations received less than 21 days before the event will not be eligible for a refund. A comparable future course may be attended in lieu of a refund depending upon availability and location. Delegate replacements are also welcome. Schedule Changes: Vair Training may find it necessary to reschedule or cancel sessions and will give registrants appropriate advance notice of such changes. On such occasions, full refunds will be given. Vair Training will not be responsible for penalties incurred as a result of discounted airfare purchases. For more information regarding Vair Training administrative policies, please contact our offices at +1 770 853 0362.