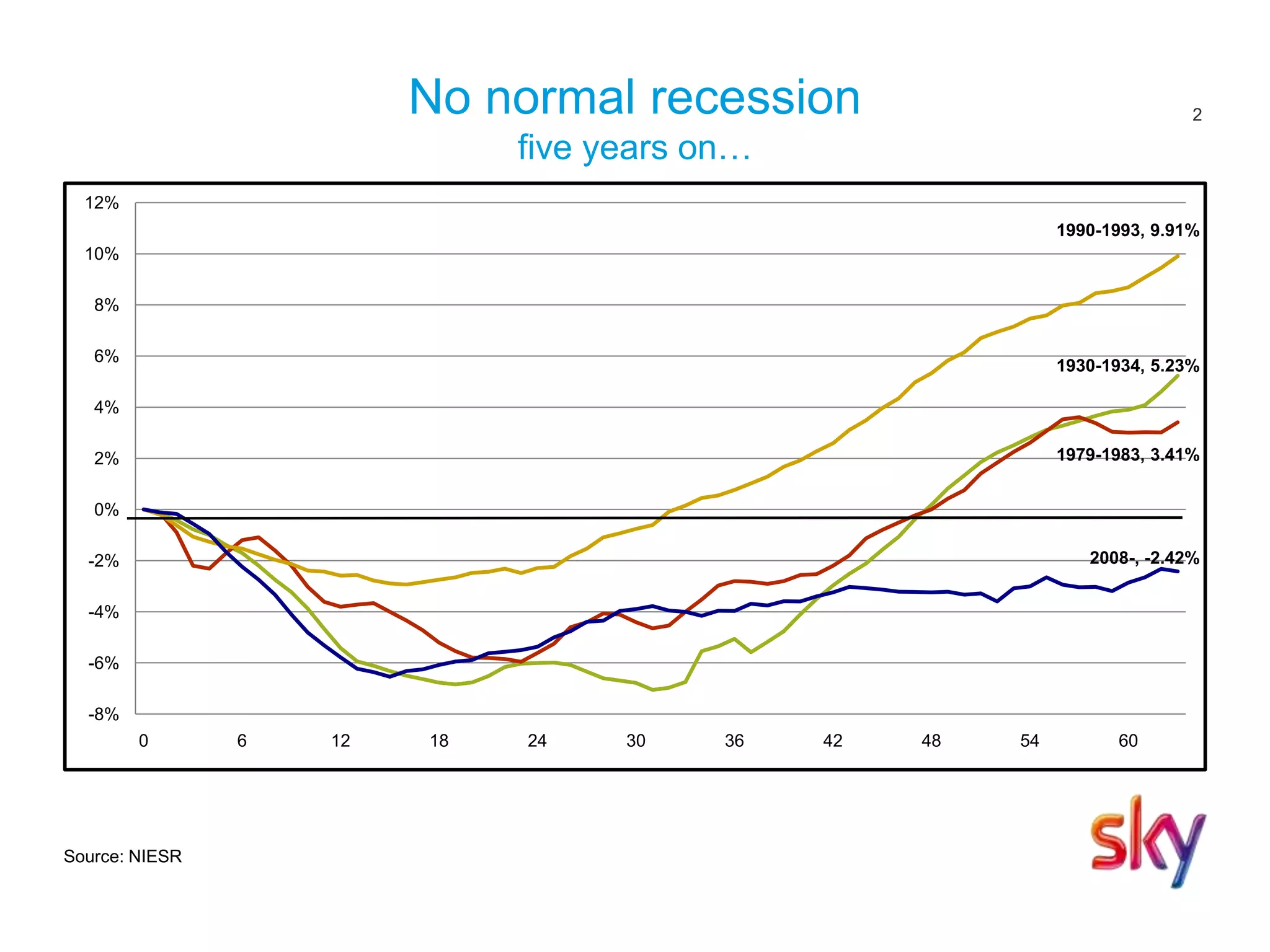

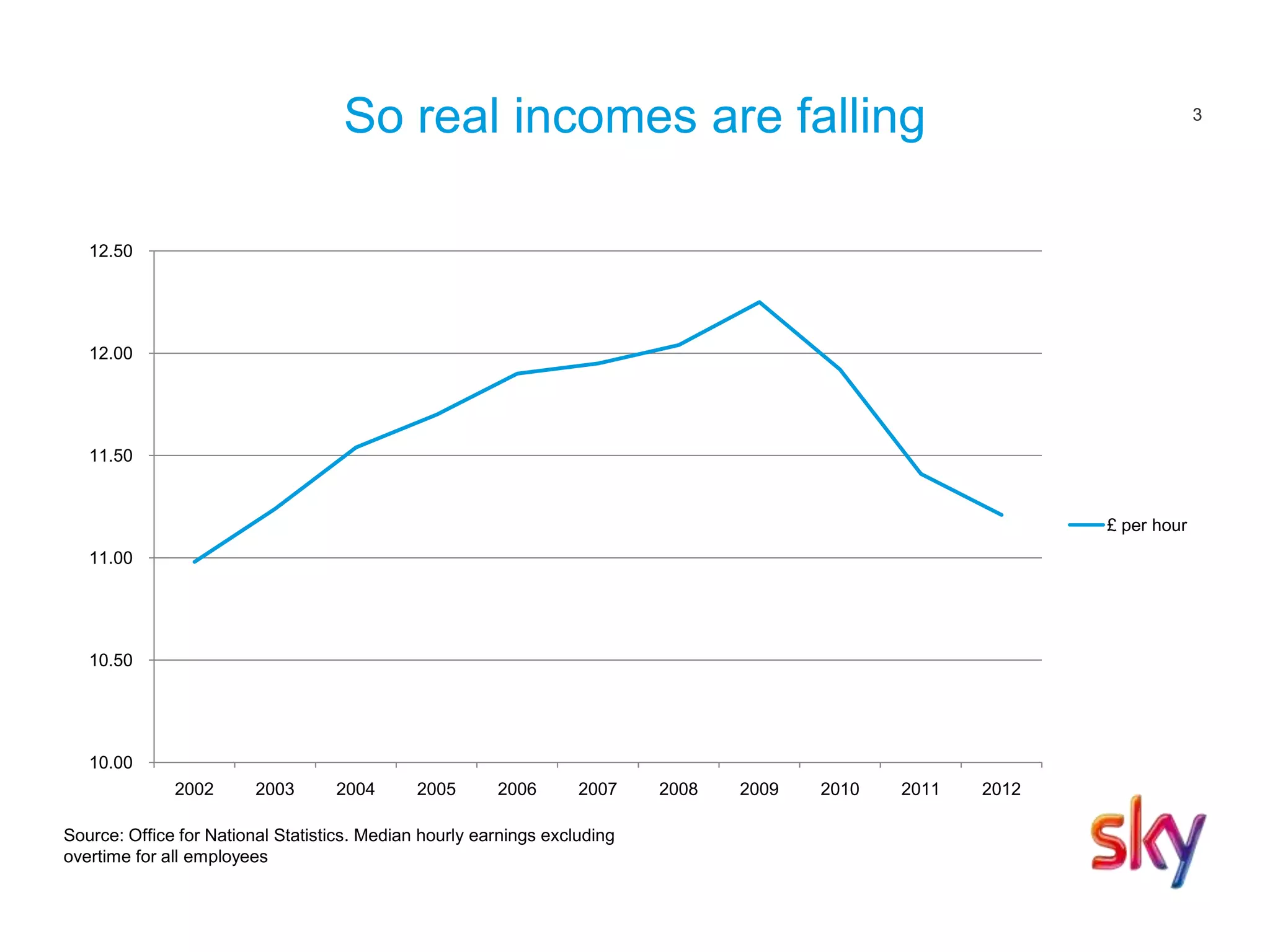

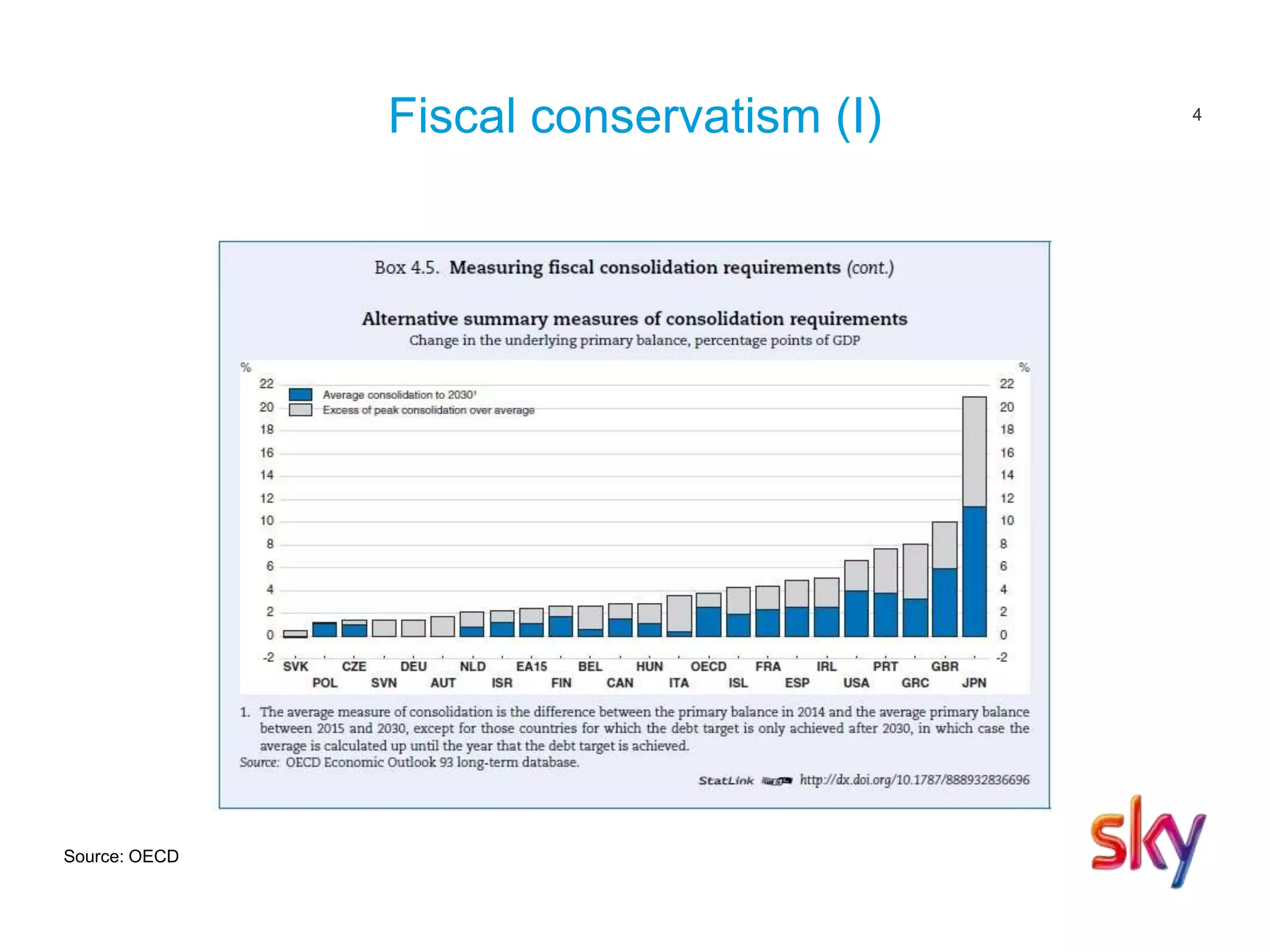

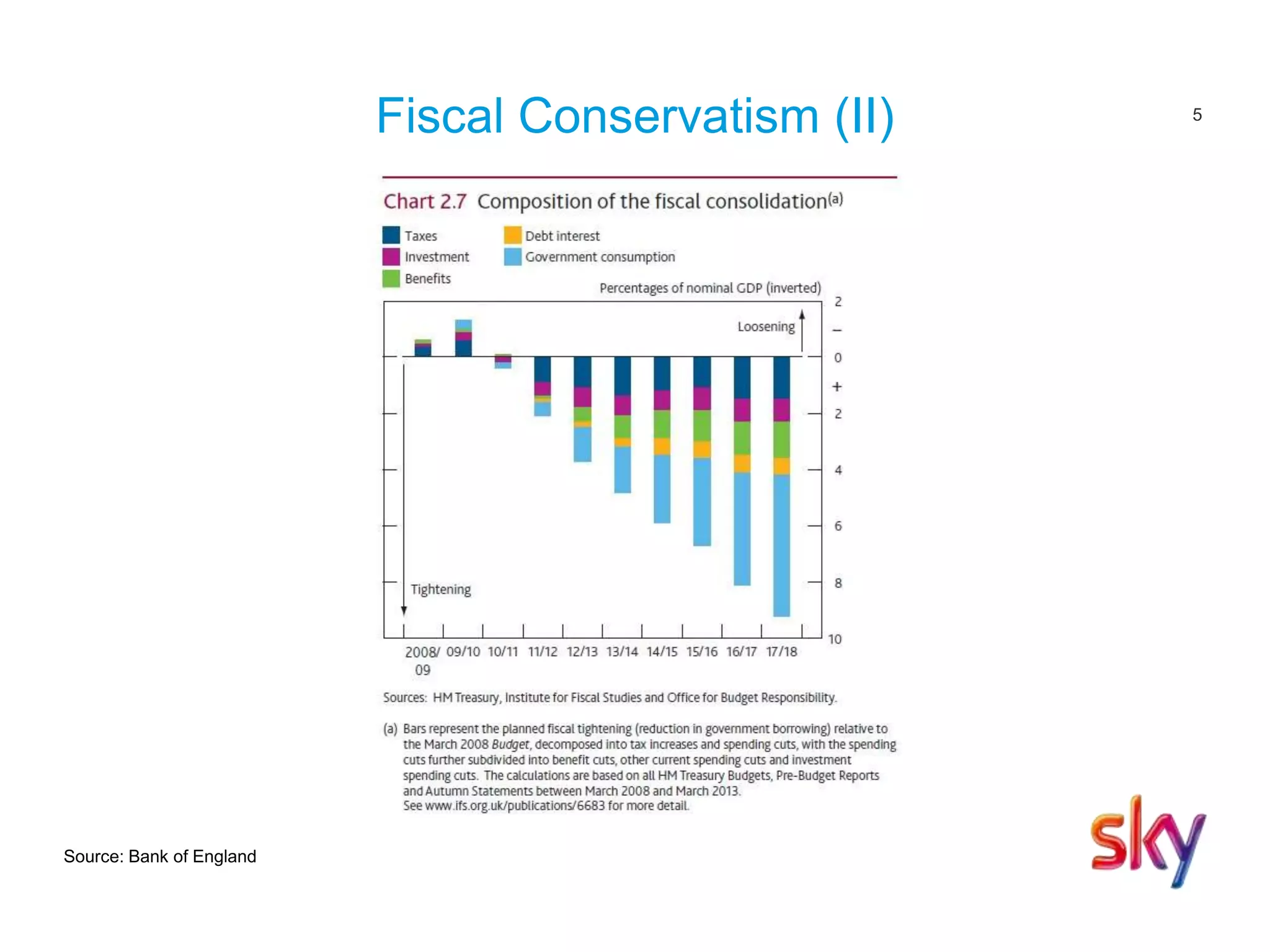

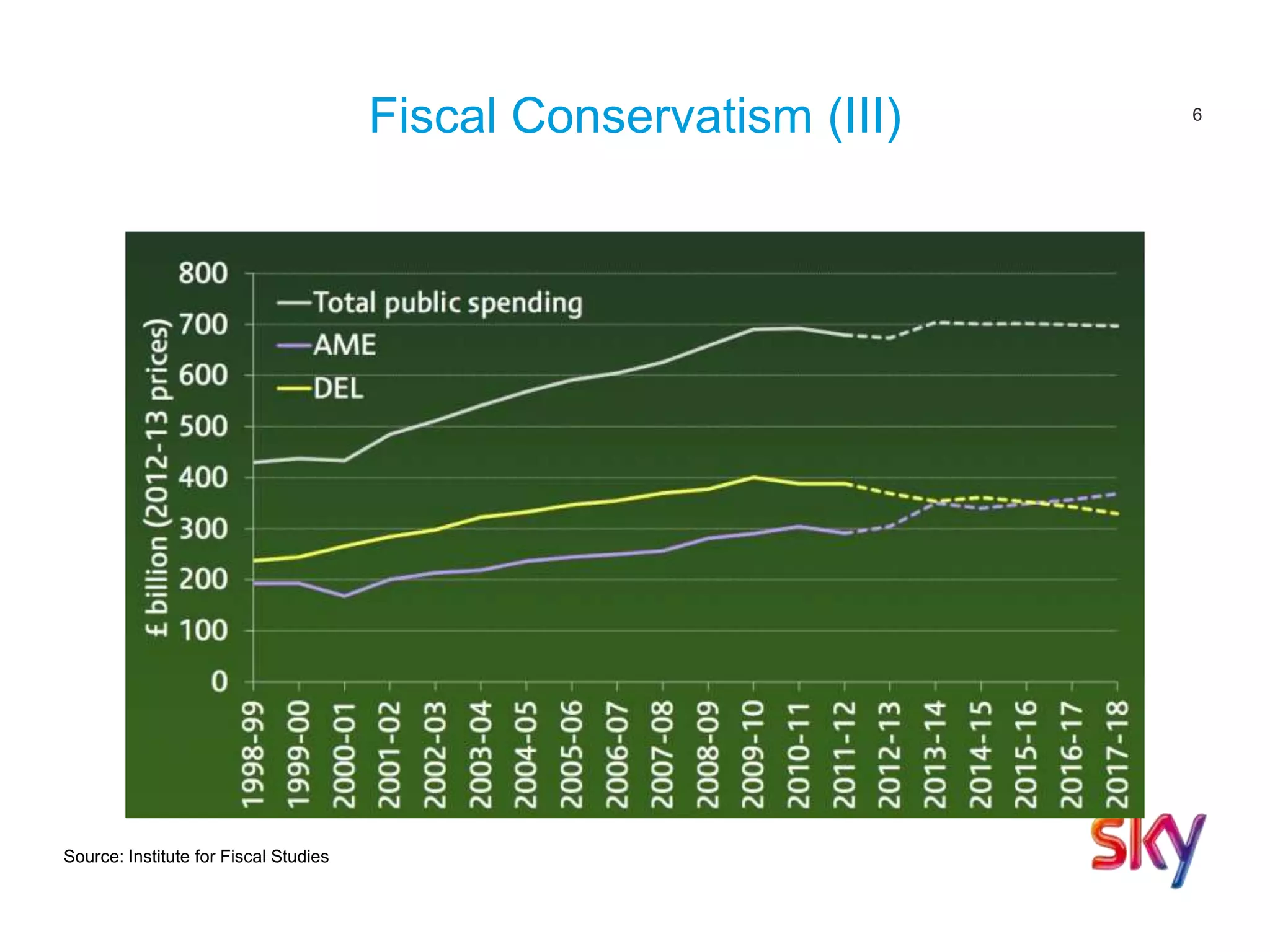

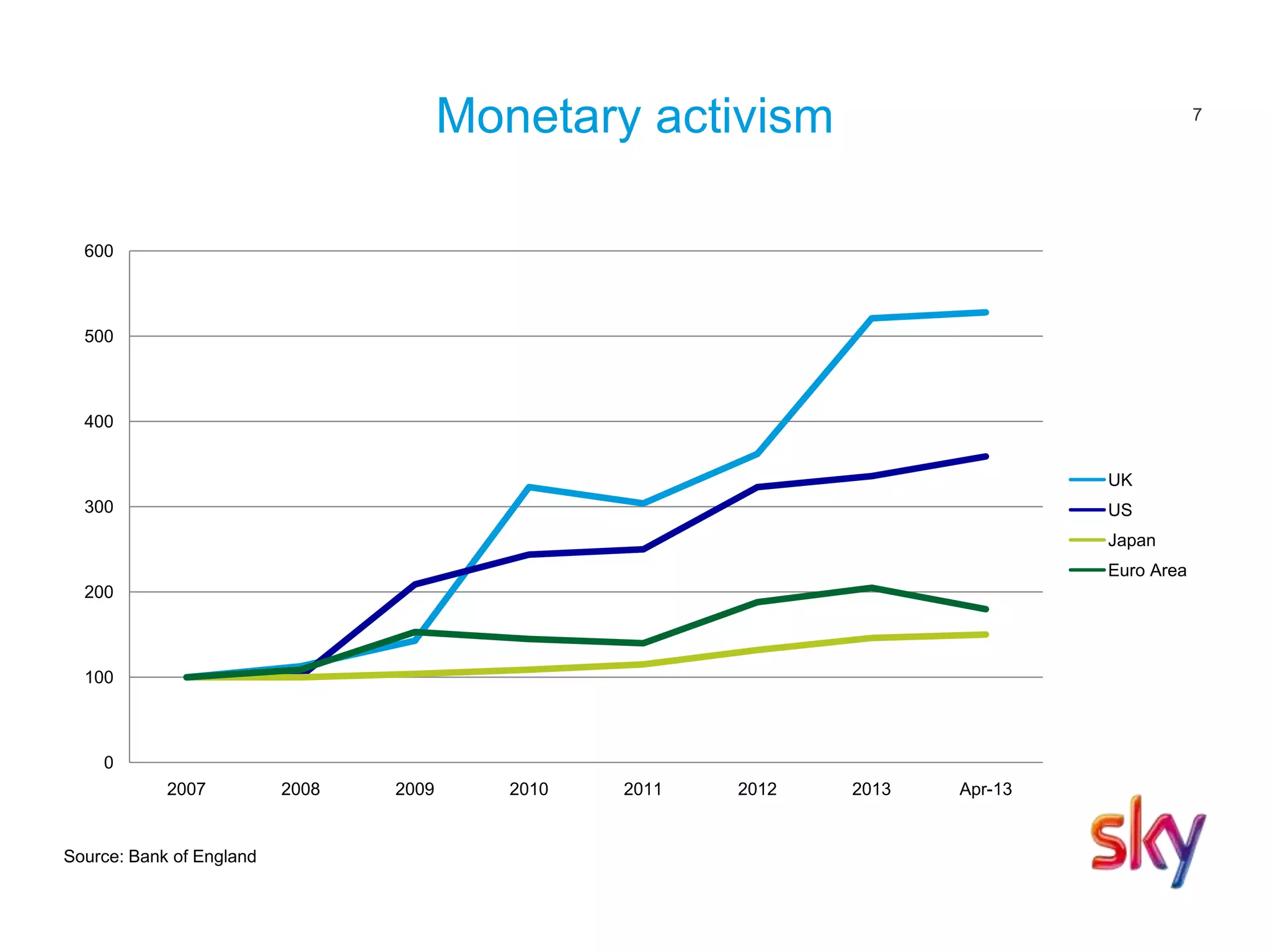

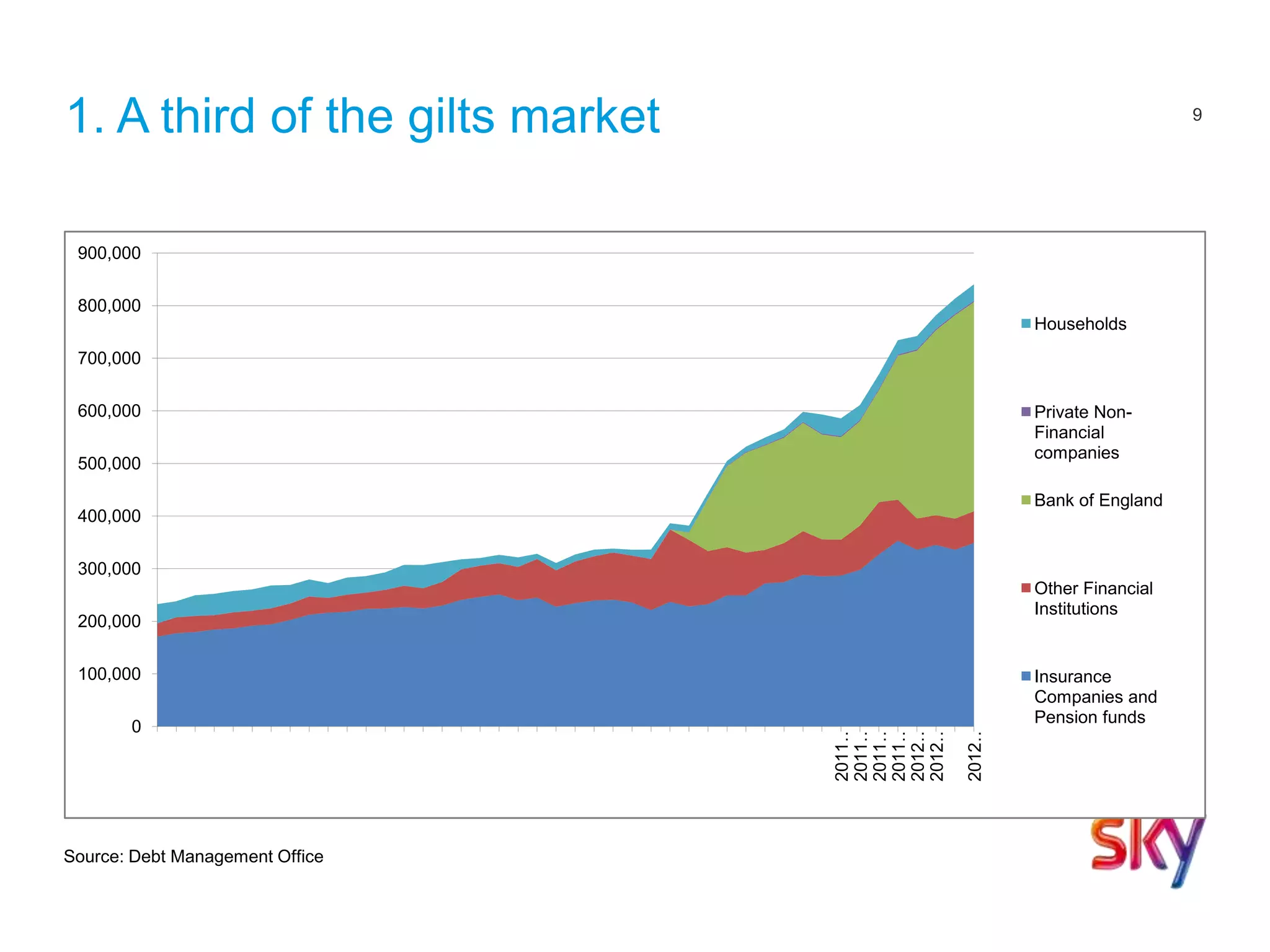

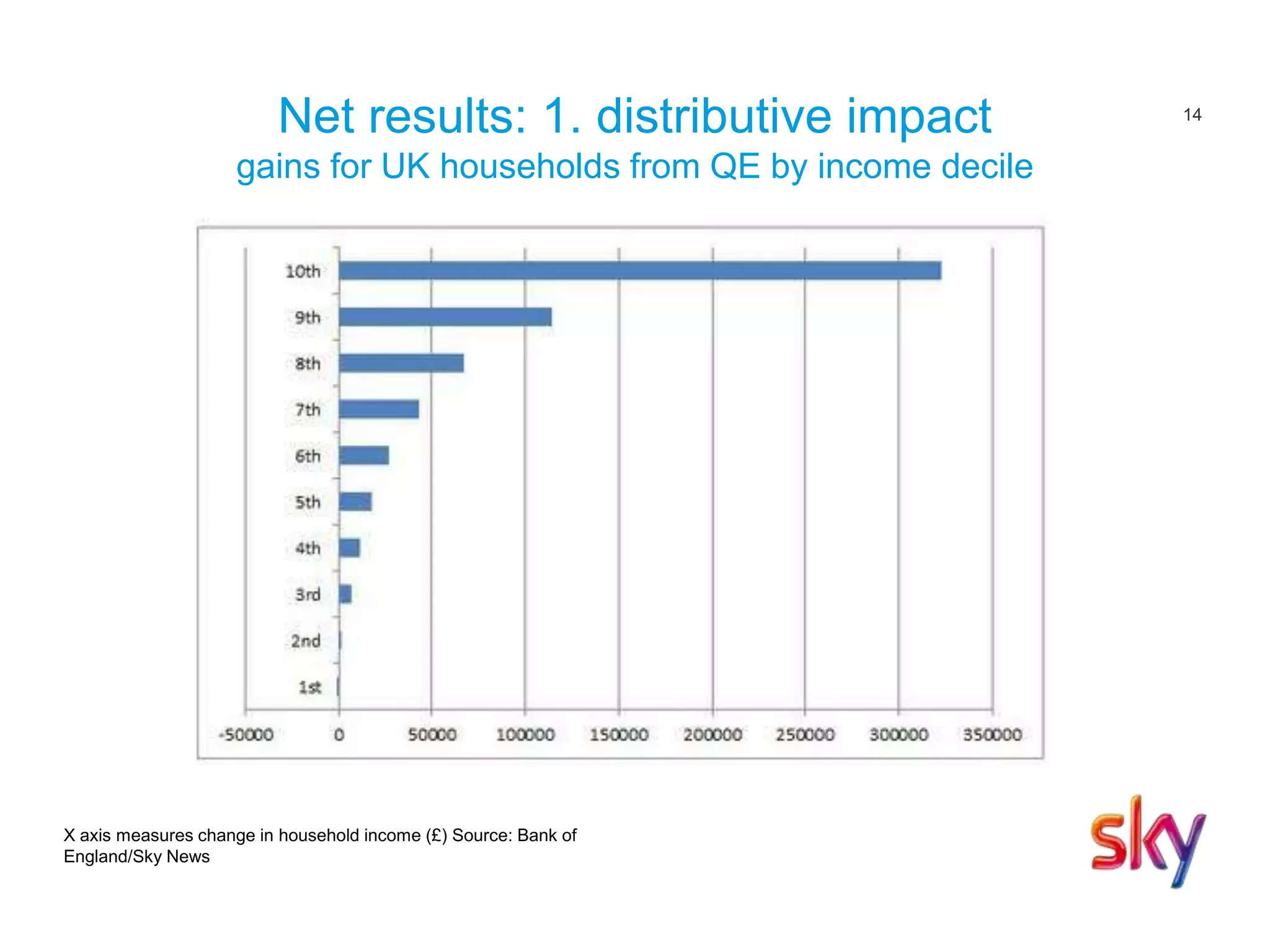

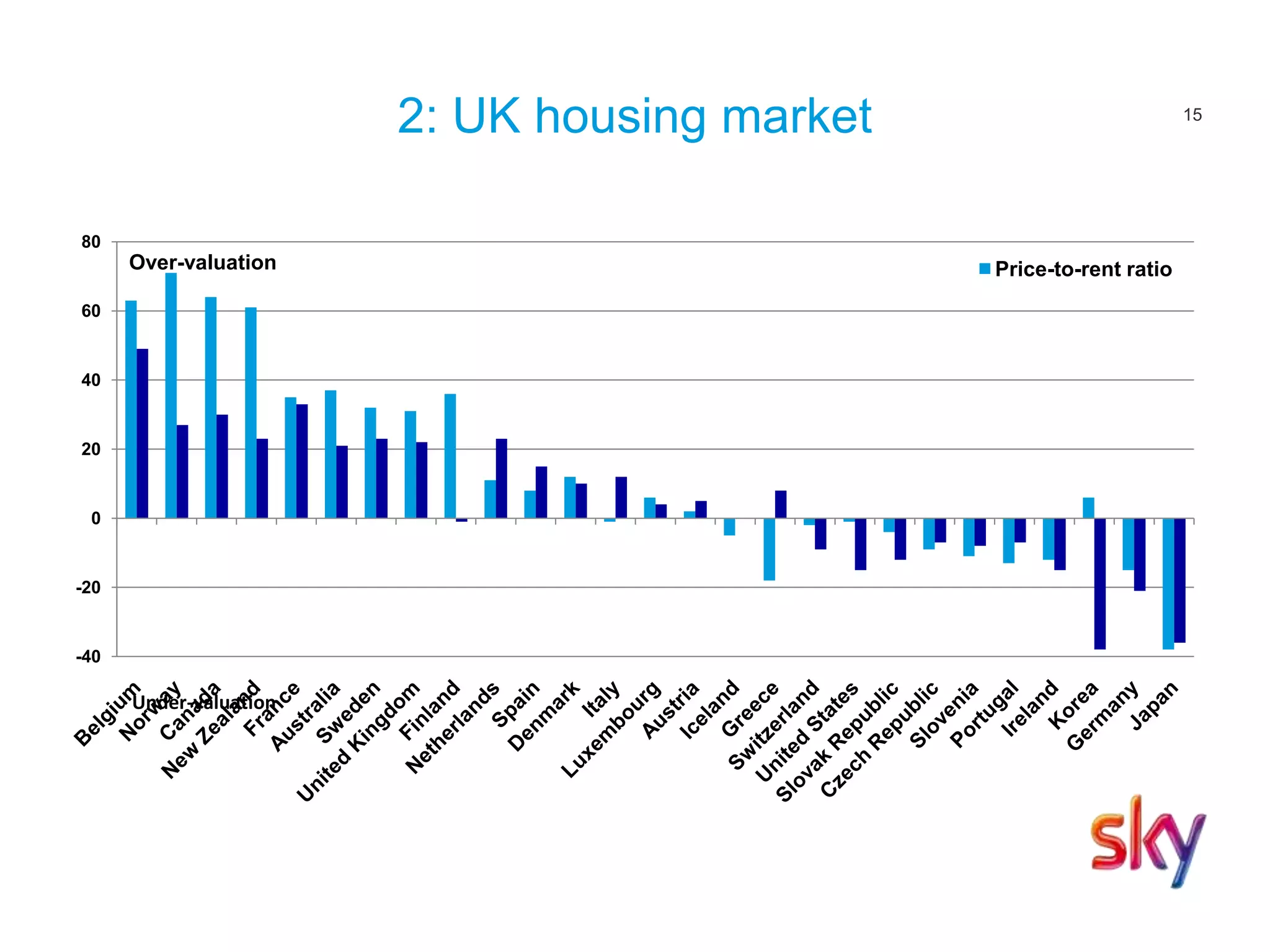

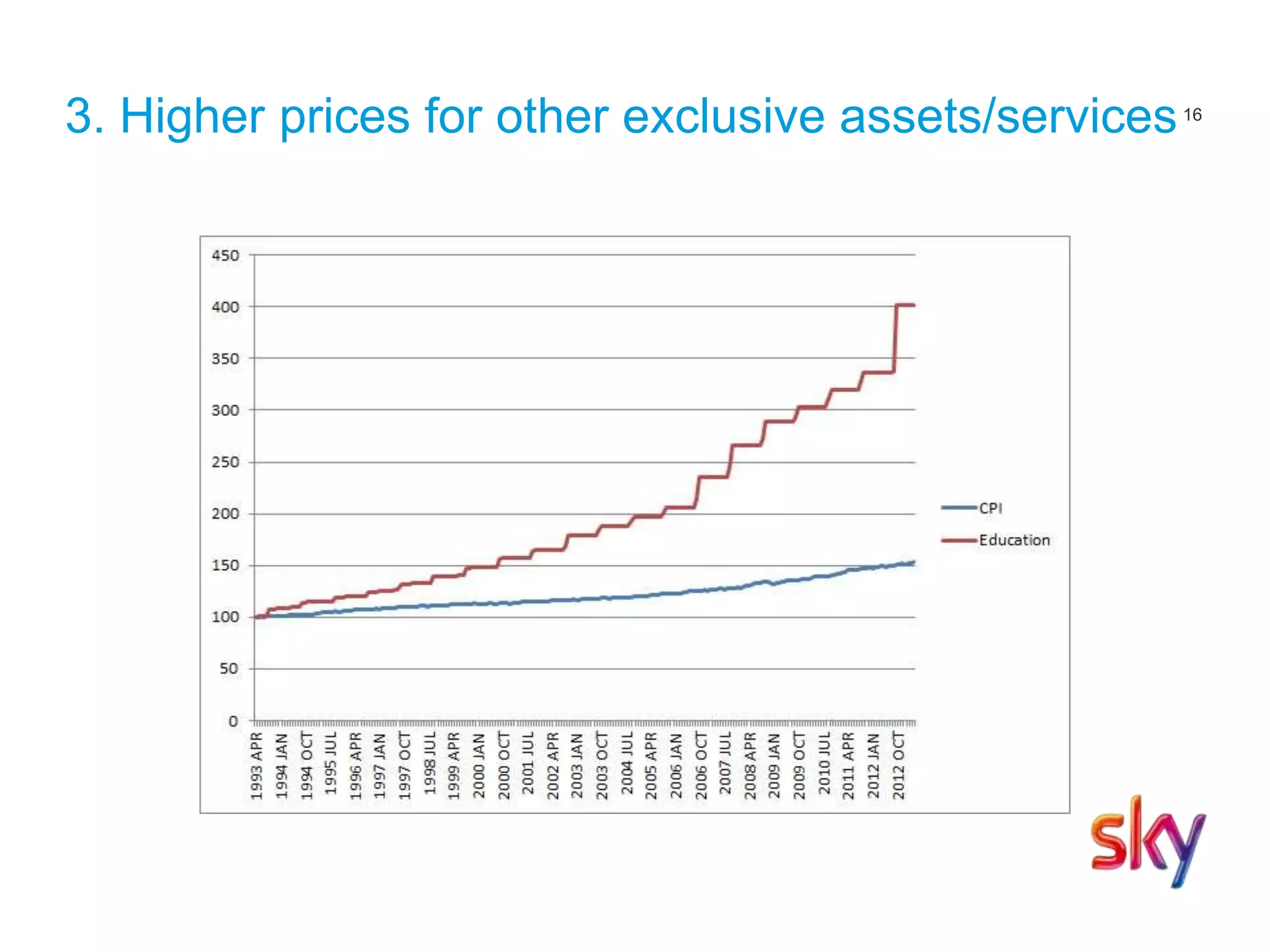

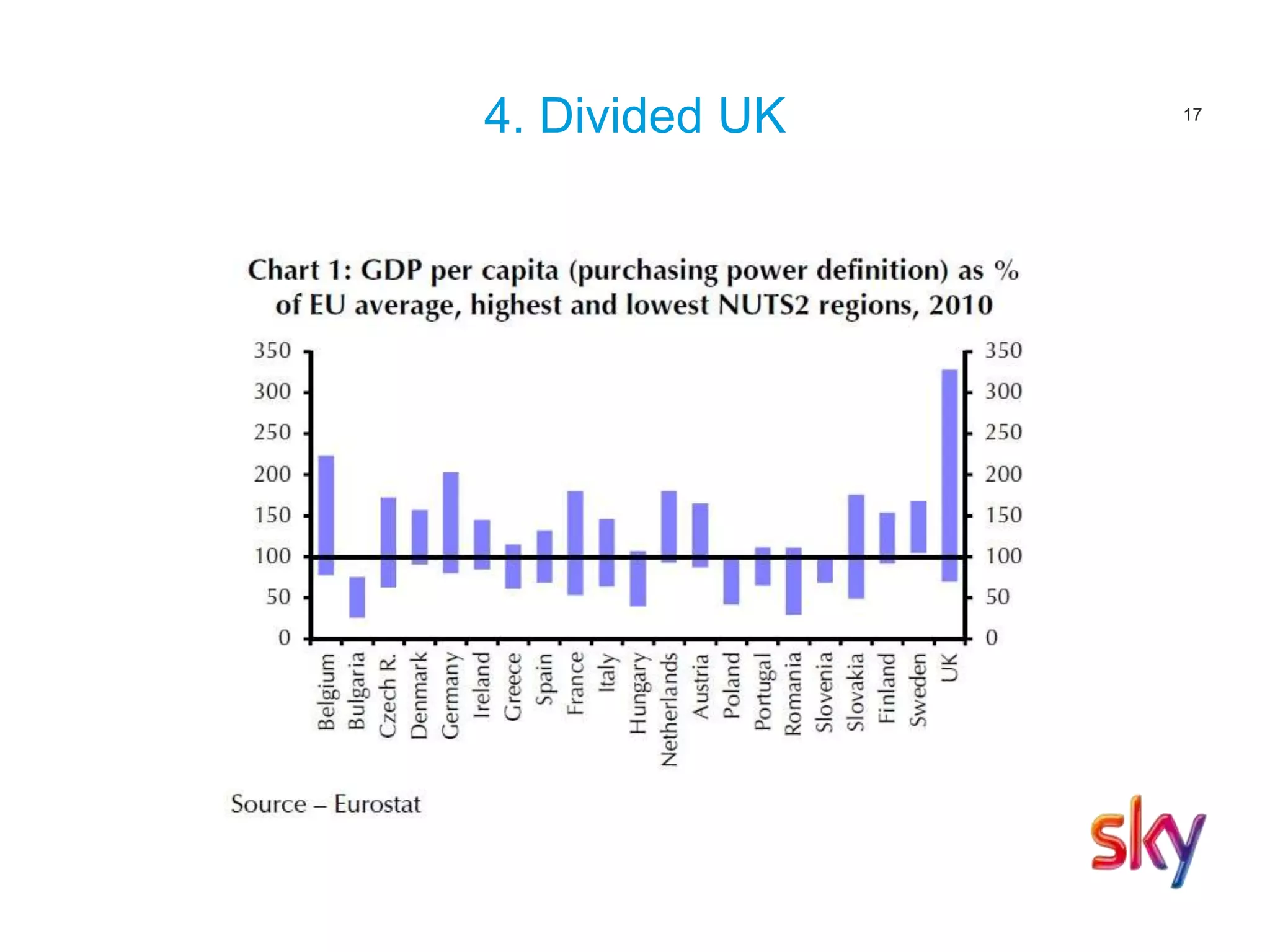

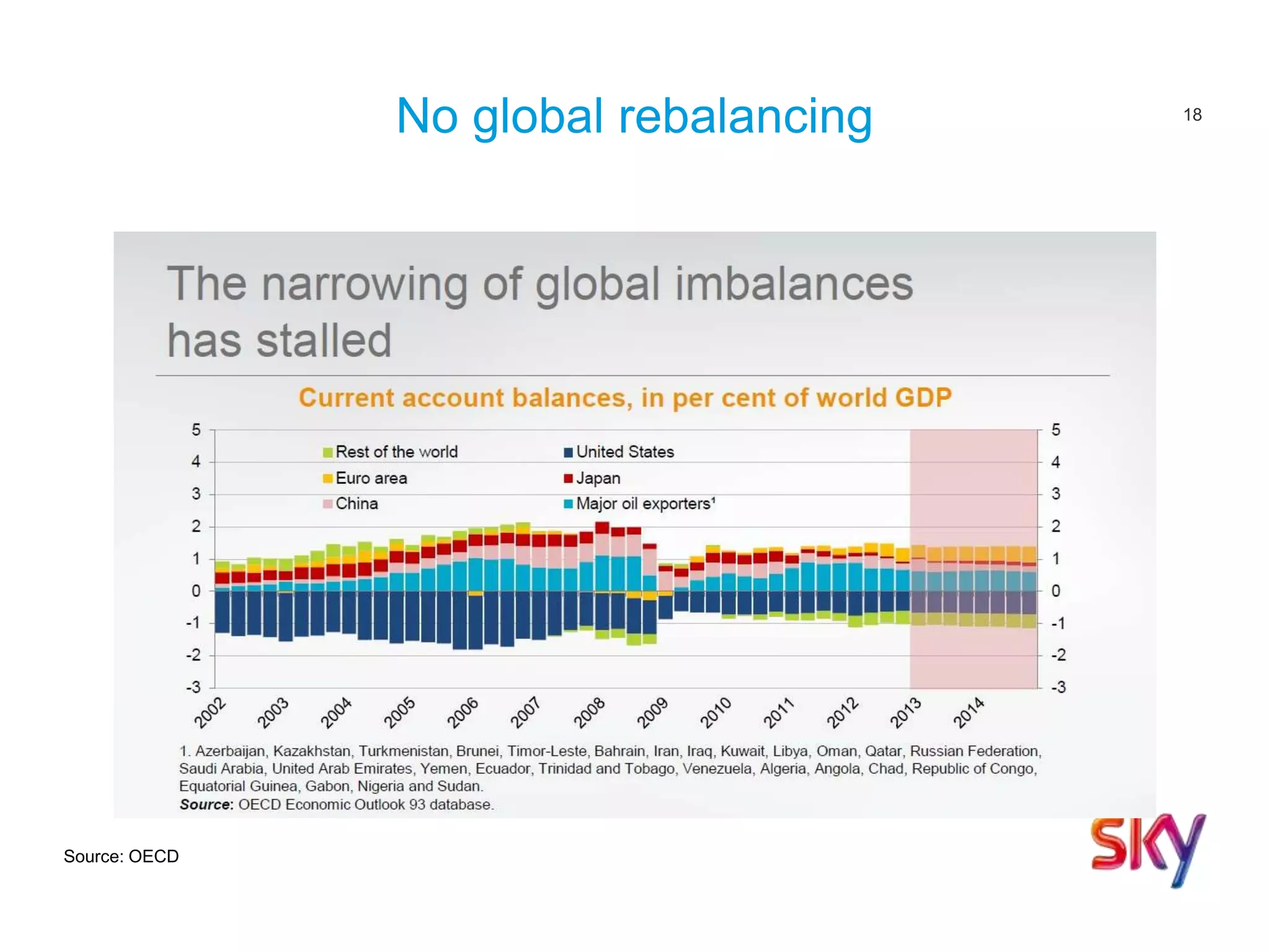

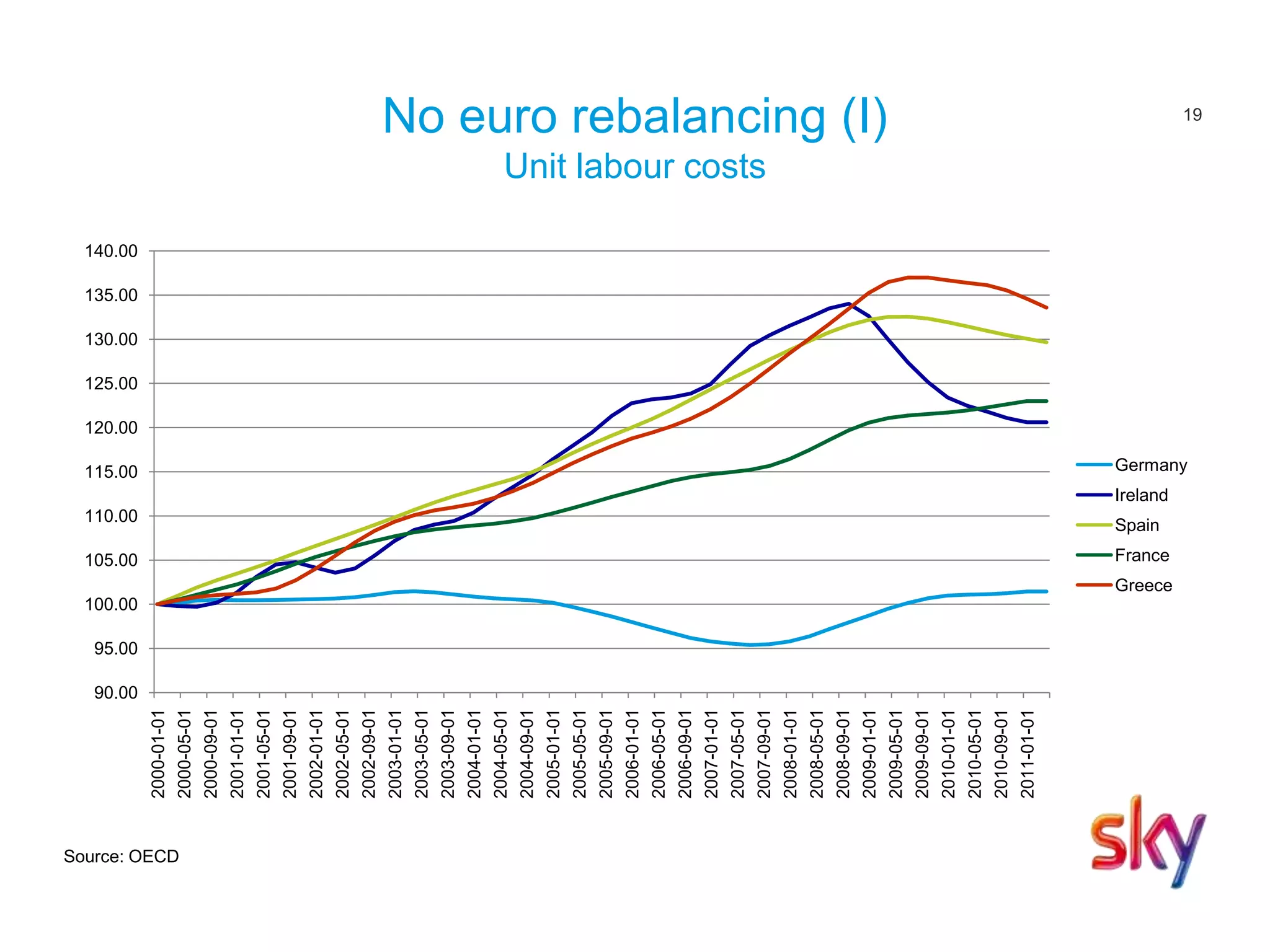

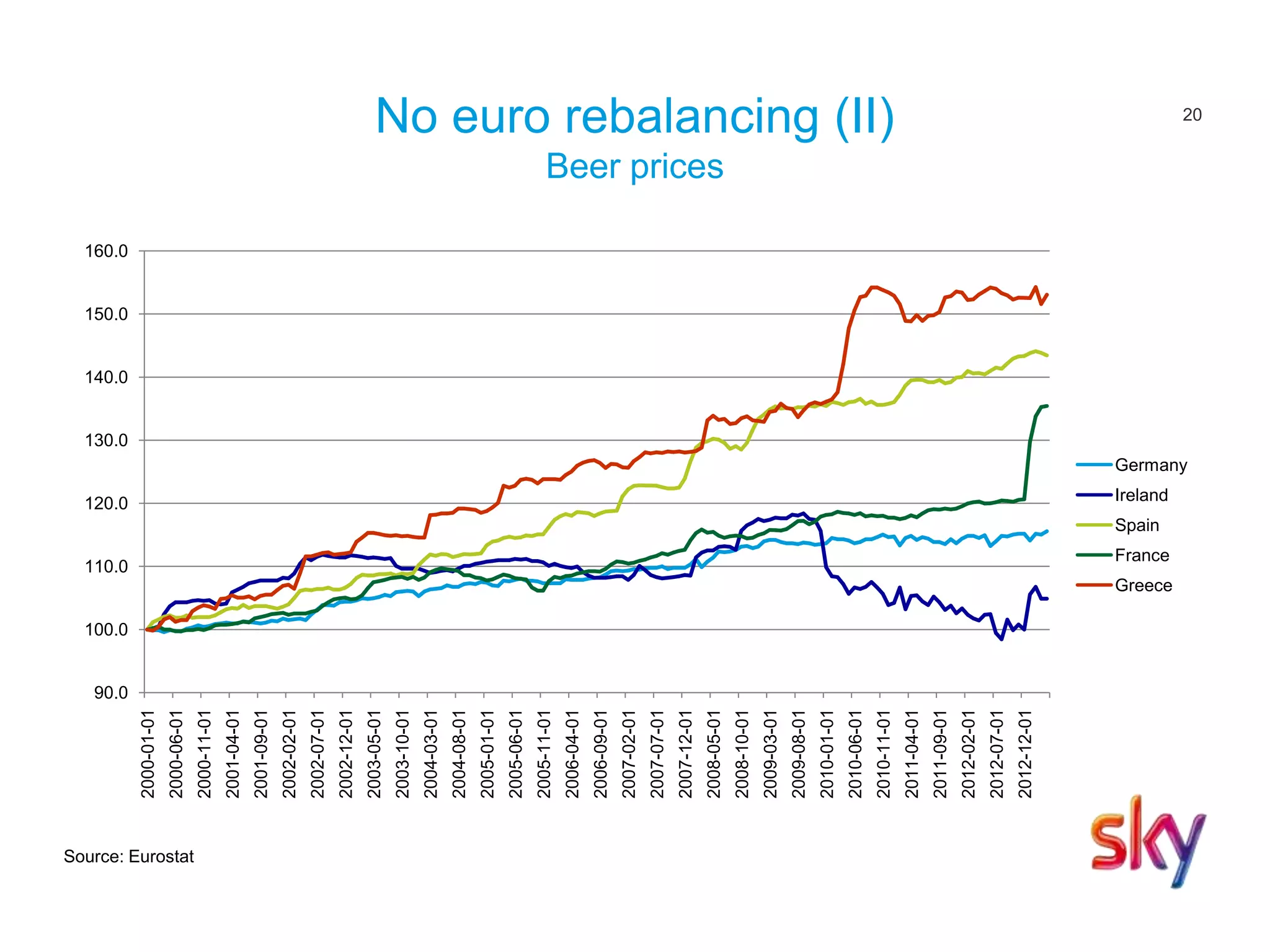

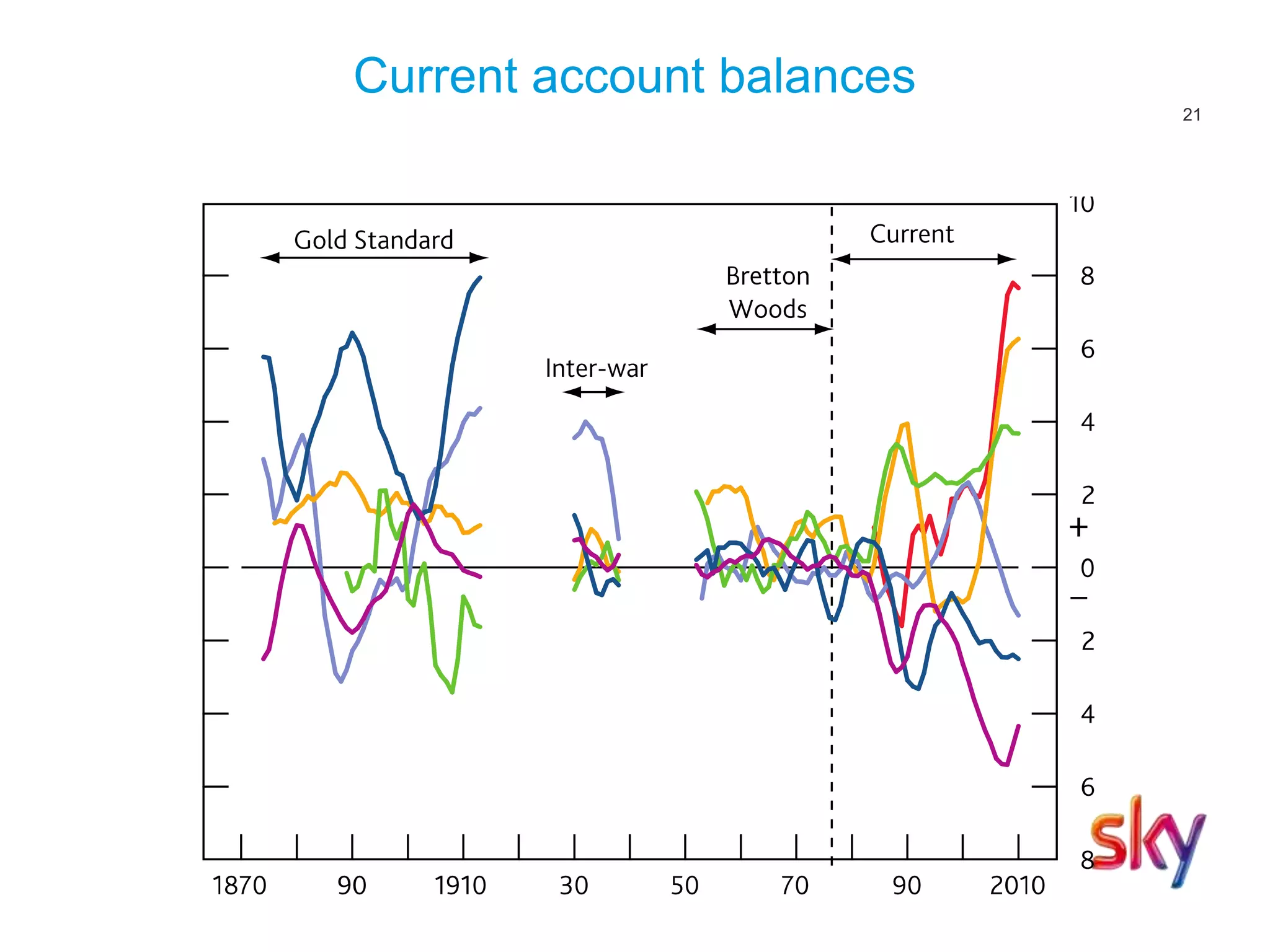

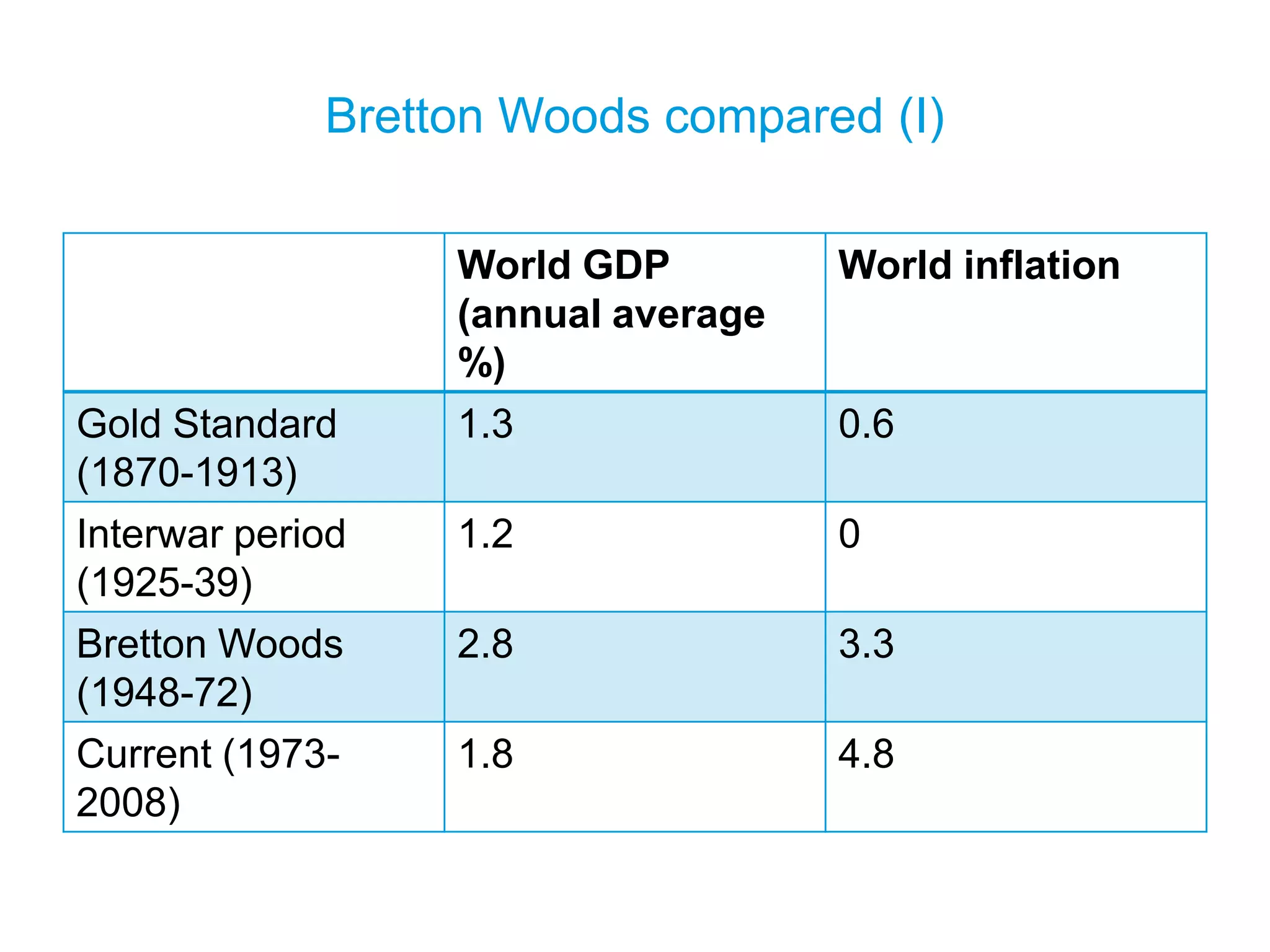

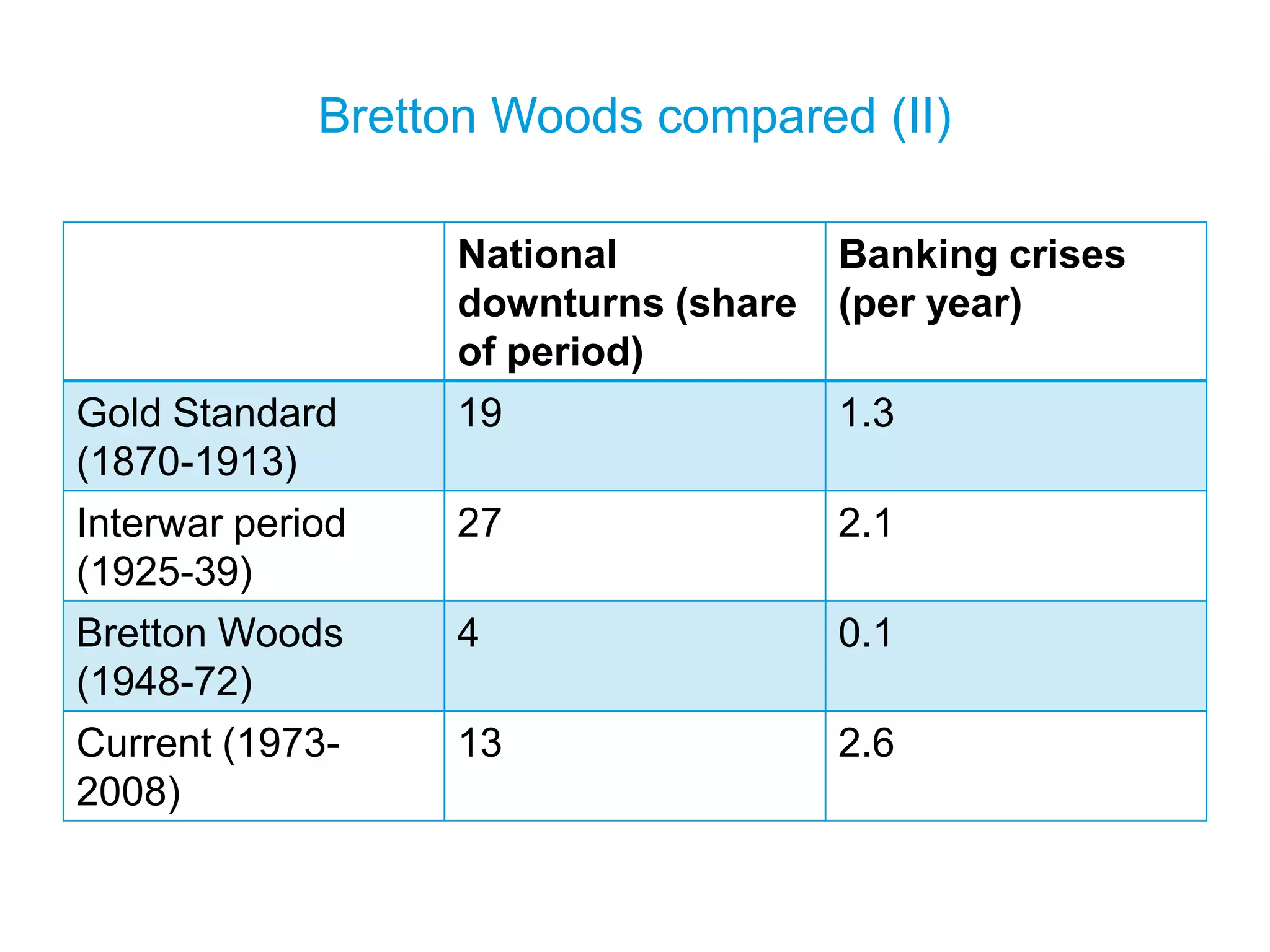

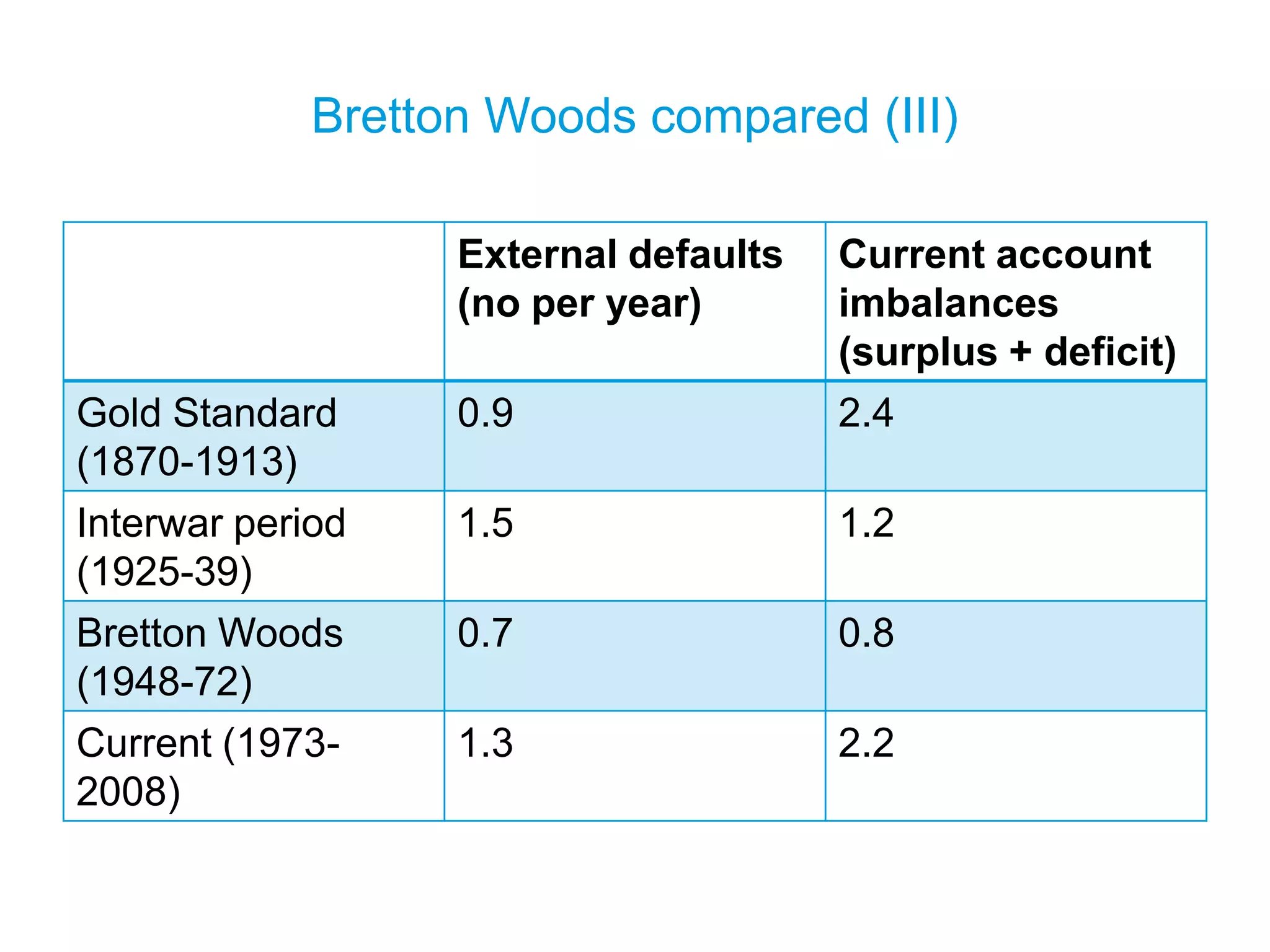

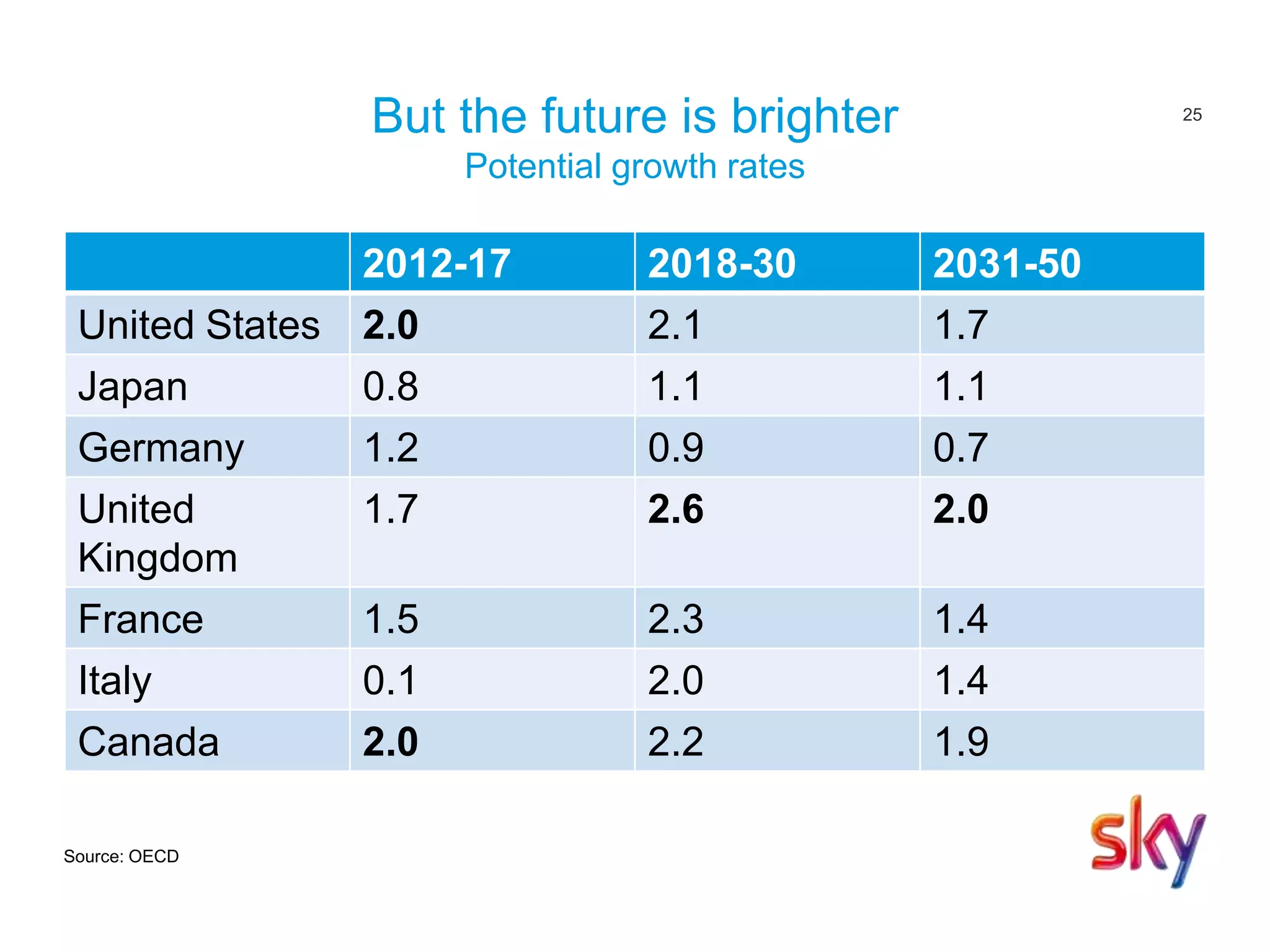

This document summarizes an economics teacher conference that discusses the state of the UK and global economies following the 2008 financial crisis. It notes that the recession in the UK was unusually long compared to previous downturns. It also discusses the effects of fiscal conservatism and monetary activism in the UK, as well as issues like declining real incomes, housing prices, and lack of global trade rebalancing.