Retail ETF and consumer confidence

•

1 like•259 views

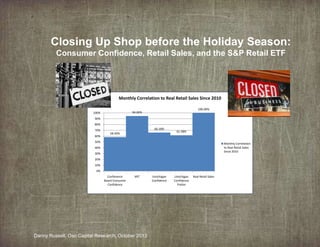

S&P Retail ETF and Real Retail Sales are highly correlated. I expect the S&P Retail ETF (XRT) to hit a cycle low soon and trend upwards into the beginning of the Holiday Season. The XRT should then fall after Black Friday and the budget negotiations start to come to into focus. This presentation lays out the seasonality and cyclicality of Retail Sales, Consumer Confidence and the S&P Retail ETF.

Report

Share

Report

Share

Recommended

Recommended

Matthews Asia I October 2015 | Presentation posted with author permission to the blog post available at http://www.frbsf.org/banking/programs/asia-program/pacific-exchange-blog/after-the-fall-the-path-forward-for-chinas-stock-market-and-economy/After the Fall: The Path Forward for China’s Economy and Stock Market

After the Fall: The Path Forward for China’s Economy and Stock MarketFederal Reserve Bank of San Francisco

Thirty years ago, Japan was growing so quickly that some predicted it would overtake the United States, while China’s economy was small and closed. Much has changed. China has overtaken Japan as the world’s second largest economy, but as China shifts to a “new normal” of lower growth, observers are increasingly concerned that it may no longer serve as the world’s economic engine. Meanwhile, proactive Japanese economic policy has renewed interest in Japan’s prospects. In this presentation delivered at a recent Asia Financial Forum in Seattle, Cindy Li and Sean Creehan explain how China and Japan impact the global economy.

China and Japan: How Asia’s Economic Giants are Shaping the Region’s Outlook

China and Japan: How Asia’s Economic Giants are Shaping the Region’s OutlookFederal Reserve Bank of San Francisco

Mr. Bilguun Ankhbayar, CEO, Mongolian Investment Banking Group LLC05.09.2014, Review and outlook of Mongolian investment environment, Mr. Bilgu...

05.09.2014, Review and outlook of Mongolian investment environment, Mr. Bilgu...The Business Council of Mongolia

More Related Content

What's hot

Matthews Asia I October 2015 | Presentation posted with author permission to the blog post available at http://www.frbsf.org/banking/programs/asia-program/pacific-exchange-blog/after-the-fall-the-path-forward-for-chinas-stock-market-and-economy/After the Fall: The Path Forward for China’s Economy and Stock Market

After the Fall: The Path Forward for China’s Economy and Stock MarketFederal Reserve Bank of San Francisco

Thirty years ago, Japan was growing so quickly that some predicted it would overtake the United States, while China’s economy was small and closed. Much has changed. China has overtaken Japan as the world’s second largest economy, but as China shifts to a “new normal” of lower growth, observers are increasingly concerned that it may no longer serve as the world’s economic engine. Meanwhile, proactive Japanese economic policy has renewed interest in Japan’s prospects. In this presentation delivered at a recent Asia Financial Forum in Seattle, Cindy Li and Sean Creehan explain how China and Japan impact the global economy.

China and Japan: How Asia’s Economic Giants are Shaping the Region’s Outlook

China and Japan: How Asia’s Economic Giants are Shaping the Region’s OutlookFederal Reserve Bank of San Francisco

Mr. Bilguun Ankhbayar, CEO, Mongolian Investment Banking Group LLC05.09.2014, Review and outlook of Mongolian investment environment, Mr. Bilgu...

05.09.2014, Review and outlook of Mongolian investment environment, Mr. Bilgu...The Business Council of Mongolia

What's hot (19)

After the Fall: The Path Forward for China’s Economy and Stock Market

After the Fall: The Path Forward for China’s Economy and Stock Market

Amárach Economic Recovery Index April 2016 Special Edition

Amárach Economic Recovery Index April 2016 Special Edition

China and Japan: How Asia’s Economic Giants are Shaping the Region’s Outlook

China and Japan: How Asia’s Economic Giants are Shaping the Region’s Outlook

CapitalVue - China in Numbers - Macro Update - March 2013

CapitalVue - China in Numbers - Macro Update - March 2013

05.09.2014, Review and outlook of Mongolian investment environment, Mr. Bilgu...

05.09.2014, Review and outlook of Mongolian investment environment, Mr. Bilgu...

Epic research singapore daily i forex report 06 sep 2016

Epic research singapore daily i forex report 06 sep 2016

Daily sgx sinagpore report by epic research singapore 16 th octobar 2014

Daily sgx sinagpore report by epic research singapore 16 th octobar 2014

Viewers also liked

Viewers also liked (6)

Final presentation for module 2 cms distance learning success 20151205

Final presentation for module 2 cms distance learning success 20151205

European Banks: Overflowing the Proverbial Glass with Rum

European Banks: Overflowing the Proverbial Glass with Rum

Similar to Retail ETF and consumer confidence

Hunter Research Foundation's economist Dr Alan Rai presents the latest Hunter Economic Indicators research findings at the Hunter Economic Breakfast, a Hunter Innovation Festival event, in July 2015Is the Hunter's economic storm over?

Is the Hunter's economic storm over?Hunter Research Foundation Centre (HRFC) University of Newcastle

Similar to Retail ETF and consumer confidence (20)

Mercer Capital's Value Focus: Real Estate Industry | Q4 2015 | Segment Focus:...

Mercer Capital's Value Focus: Real Estate Industry | Q4 2015 | Segment Focus:...

Q4 Results Preview: Demand revival of Retail sector yet to pick up

Q4 Results Preview: Demand revival of Retail sector yet to pick up

The World This Week November 7 - November 11 - 2016

The World This Week November 7 - November 11 - 2016

South Walton County and 30A Real Estate Report for May 2015

South Walton County and 30A Real Estate Report for May 2015

Netwealth portfolio construction series - Discover cost effective investment ...

Netwealth portfolio construction series - Discover cost effective investment ...

Recently uploaded

Falcon stands out as a top-tier P2P Invoice Discounting platform in India, bridging esteemed blue-chip companies and eager investors. Our goal is to transform the investment landscape in India by establishing a comprehensive destination for borrowers and investors with diverse profiles and needs, all while minimizing risk. What sets Falcon apart is the elimination of intermediaries such as commercial banks and depository institutions, allowing investors to enjoy higher yields.Unveiling Falcon Invoice Discounting: Leading the Way as India's Premier Bill...

Unveiling Falcon Invoice Discounting: Leading the Way as India's Premier Bill...Falcon Invoice Discounting

Saudi Arabia [ Abortion pills) Jeddah/riaydh/dammam/++918133066128☎️] cytotec tablets uses abortion pills 💊💊 How effective is the abortion pill? 💊💊 +918133066128) "Abortion pills in Jeddah" how to get cytotec tablets in Riyadh " Abortion pills in dammam*💊💊 The abortion pill is very effective. If you’re taking mifepristone and misoprostol, it depends on how far along the pregnancy is, and how many doses of medicine you take:💊💊 +918133066128) how to buy cytotec pills

At 8 weeks pregnant or less, it works about 94-98% of the time. +918133066128[ 💊💊💊 At 8-9 weeks pregnant, it works about 94-96% of the time. +918133066128) At 9-10 weeks pregnant, it works about 91-93% of the time. +918133066128)💊💊 If you take an extra dose of misoprostol, it works about 99% of the time. At 10-11 weeks pregnant, it works about 87% of the time. +918133066128) If you take an extra dose of misoprostol, it works about 98% of the time. In general, taking both mifepristone and+918133066128 misoprostol works a bit better than taking misoprostol only. +918133066128 Taking misoprostol alone works to end the+918133066128 pregnancy about 85-95% of the time — depending on how far along the+918133066128 pregnancy is and how you take the medicine. +918133066128 The abortion pill usually works, but if it doesn’t, you can take more medicine or have an in-clinic abortion. +918133066128 When can I take the abortion pill?+918133066128 In general, you can have a medication abortion up to 77 days (11 weeks)+918133066128 after the first day of your last period. If it’s been 78 days or more since the first day of your last+918133066128 period, you can have an in-clinic abortion to end your pregnancy.+918133066128

Why do people choose the abortion pill? Which kind of abortion you choose all depends on your personal+918133066128 preference and situation. With+918133066128 medication+918133066128 abortion, some people like that you don’t need to have a procedure in a doctor’s office. You can have your medication abortion on your own+918133066128 schedule, at home or in another comfortable place that you choose.+918133066128 You get to decide who you want to be with during your abortion, or you can go it alone. Because+918133066128 medication abortion is similar to a miscarriage, many people feel like it’s more “natural” and less invasive. And some+918133066128 people may not have an in-clinic abortion provider close by, so abortion pills are more available to+918133066128 them. +918133066128 Your doctor, nurse, or health center staff can help you decide which kind of abortion is best for you. +918133066128 More questions from patients: Saudi Arabia+918133066128 CYTOTEC Misoprostol Tablets. Misoprostol is a medication that can prevent stomach ulcers if you also take NSAID medications. It reduces the amount of acid in your stomach, which protects your stomach lining. The brand name of this medication is Cytotec®.+918133066128) Unwanted Kit is a combination of two medicines, ounwanted pregnancy Kit [+918133066128] Abortion Pills IN Dubai UAE Abudhabi![unwanted pregnancy Kit [+918133066128] Abortion Pills IN Dubai UAE Abudhabi](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![unwanted pregnancy Kit [+918133066128] Abortion Pills IN Dubai UAE Abudhabi](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

unwanted pregnancy Kit [+918133066128] Abortion Pills IN Dubai UAE AbudhabiAbortion pills in Kuwait Cytotec pills in Kuwait

Recently uploaded (20)

Falcon's Invoice Discounting: Your Path to Prosperity

Falcon's Invoice Discounting: Your Path to Prosperity

Falcon Invoice Discounting: Tailored Financial Wings

Falcon Invoice Discounting: Tailored Financial Wings

Unveiling Falcon Invoice Discounting: Leading the Way as India's Premier Bill...

Unveiling Falcon Invoice Discounting: Leading the Way as India's Premier Bill...

Falcon Invoice Discounting: Empowering Your Business Growth

Falcon Invoice Discounting: Empowering Your Business Growth

Mifepristone Available in Muscat +918761049707^^ €€ Buy Abortion Pills in Oman

Mifepristone Available in Muscat +918761049707^^ €€ Buy Abortion Pills in Oman

The Abortion pills for sale in Qatar@Doha [+27737758557] []Deira Dubai Kuwait![The Abortion pills for sale in Qatar@Doha [+27737758557] []Deira Dubai Kuwait](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![The Abortion pills for sale in Qatar@Doha [+27737758557] []Deira Dubai Kuwait](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

The Abortion pills for sale in Qatar@Doha [+27737758557] []Deira Dubai Kuwait

Al Mizhar Dubai Escorts +971561403006 Escorts Service In Al Mizhar

Al Mizhar Dubai Escorts +971561403006 Escorts Service In Al Mizhar

Call 7737669865 Vadodara Call Girls Service at your Door Step Available All Time

Call 7737669865 Vadodara Call Girls Service at your Door Step Available All Time

unwanted pregnancy Kit [+918133066128] Abortion Pills IN Dubai UAE Abudhabi![unwanted pregnancy Kit [+918133066128] Abortion Pills IN Dubai UAE Abudhabi](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![unwanted pregnancy Kit [+918133066128] Abortion Pills IN Dubai UAE Abudhabi](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

unwanted pregnancy Kit [+918133066128] Abortion Pills IN Dubai UAE Abudhabi

Falcon Invoice Discounting: Unlock Your Business Potential

Falcon Invoice Discounting: Unlock Your Business Potential

Marel Q1 2024 Investor Presentation from May 8, 2024

Marel Q1 2024 Investor Presentation from May 8, 2024

Lundin Gold - Q1 2024 Conference Call Presentation (Revised)

Lundin Gold - Q1 2024 Conference Call Presentation (Revised)

Over the Top (OTT) Market Size & Growth Outlook 2024-2030

Over the Top (OTT) Market Size & Growth Outlook 2024-2030

SEO Case Study: How I Increased SEO Traffic & Ranking by 50-60% in 6 Months

SEO Case Study: How I Increased SEO Traffic & Ranking by 50-60% in 6 Months

Retail ETF and consumer confidence

- 1. Closing Up Shop before the Holiday Season: Consumer Confidence, Retail Sales, and the S&P Retail ETF Monthly Correlation to Real Retail Sales Since 2010 100.00% 94.66% 100% 90% 80% 70% 60% 66.18% 58.40% 61.58% 50% Monthly Correlation to Real Retail Sales Since 2010 40% 30% 20% 10% 0% Conference Board Consumer Confidence XRT Danny Russell, Oso Capital Research, October 2013 Umichigan Confidence Umichigan Confidence Prelim Real Retail Sales

- 2. Retail Sales leads S&P Retail ETF Upwards Since the start of 2010, S&P Retail ETF (XRT) has followed Real Retail Sales closely The cumulative change in XRT and Real Retail Sales since January 2010 is 128% and 14.2% respectively S&P Retail ETF and Real Retail Sales 140 58 120 56 100 54 80 52 60 Real Retail Sales Index 50 40 20 XRT is levered to Real Retail Sales by an average of 6.27x every month XRT Index 48 0 46 Indexed at 12/31/2009 at 50 S&P Retail ETF and Retail Sales CAGR Since 2010 30.00% 25.00% 24.64% 20.00% 15.00% CAGR 10.00% 3.60% 5.00% 0.00% XRT Source: Federal Reserve, Yahoo Finance Real Retail Sales

- 3. Correlation to Real Retail Sales The correlation between XRT and Real Retail Sales is just under 95% Monthly Correlation to Real Retail Sales Since 2010 This correlation beats the Conference Board’s Consumer Confidence and University of Michigan’s Consumer Confidence 100.00% 94.66% 100% 90% 80% 70% 60% 66.18% 58.40% 61.58% 50% 40% 30% The correlation between Real Retail Sales and Consumer Confidence is relatively high at 70% 20% 10% 0% Conference Board Consumer Confidence XRT Umichigan Umichigan Confidence Prelim Sales Confidence Real Retail Conference Board Consumer Confidence XRT Umichigan Confidence Umichigan Confidence Prelim Real Retail Sales Conference Board Consumer Confidence 100.00% 69.05% 72.76% 73.10% 58.40% XRT 69.05% 100.00% 69.89% 64.04% 94.66% Umichigan Confidence Final 72.76% 69.89% 100.00% 97.19% 66.18% Umichigan Confidence Prelim 73.10% 64.04% 97.19% 100.00% 61.58% Real Retail Sales 58.40% 94.66% 66.18% 61.58% 100.00% Source: Federal Reserve, Yahoo Finance, Conference Board, University of Michigan/Reuters, Monthly Correlation to Real Retail Sales Since 2010

- 4. Consumer Confidence, Retail Sales, & XRT Seasonality 20.00% 15.00% Real Retail Sales bottom during the summer months and peak during the early fall and slide into the end of the year 1-Dec 1-Nov 1-Oct 1-Sep -10.00% 1-Aug -5.00% 1-Jul 2012 1-Jun 0.00% 1-May 2011 1-Apr 5.00% 1-Mar 2010 1-Feb 10.00% 1-Jan The rolling three month change in XRT, Real Retail Sales and the University of Michigan Consumer Confidence all exhibit similar seasonality XRT Rolling 3 MOM Change Seasonality 2013 -15.00% Real Retail Sales Index Rolling 3 MOM Change Seasonality 15.00% 10.00% 2010 1-Dec 1-Nov 1-Oct 1-Sep 1-Aug 1-Jul 1-Jun 1-May -5.00% 1-Apr 2012 1-Mar 0.00% 1-Feb The XRT shows similar seasonality to Real Retail Sales bottoming in the summer only to rise into the early fall and then slide down into the end of the year 2011 1-Jan 5.00% 2013 -10.00% Umichigan Confidence Final 2010 15.00% 10.00% 2010 -10.00% Source: Federal Reserve, Yahoo Finance, Conference Board, University of Michigan/Reuters, 1-Dec 1-Nov 1-Oct 1-Sep 1-Aug 1-Jul 1-Jun 1-May -5.00% 1-Apr 2012 1-Mar 0.00% 1-Feb 2011 1-Jan 5.00% 2013

- 5. Real Retail Sales & XRT Trade I expect the annualized volatility to mean revert just slightly and the XRT to trend up into the Black Friday and then start to fall This will correspond to the Real Retail Sales seasonality The recently passed “kick the can” bill to have a budget in early December of 2013 should act as a tailwind to this trade with the fear happening right along with the seasonality slide after Thanksgiving 80% Historical Volatility of XRT Volatility 70% Historical Volatility 60% 50% Average Vol Adjusted Close 50 Day SMA 90 80 70 60 50 40% 40 30% 20% 30 20 10% 10 0% 0 Source: Google Finance, InvestExcel

- 6. XRT Cycles and Buying Spot Courtesy of Stockcharts, the XRT makes a turn every 30 or so days The most recent turn was August 1 when the XRT retraced -4.95% in 7 trading days This retracement was due partially to the government shutdown and the broader market selloff I would buy the XRT when it makes another cycle low which should happen rather soon and will most likely correspond to the support which is around $81.20 I do not believe the economy is turning around or that consumers will spend a lot during the holidays, this is purely a sentiment play Source:StockCharts