Young Workers Network: The Development of the Irish State

•Download as PPT, PDF•

0 likes•399 views

The document discusses the development of the Irish state in relation to housing policy and ownership. It notes that in the 1920s and 1930s, the Irish government aimed to promote home ownership through building grants and rates remissions for owner-occupiers. In the 1950s and 1960s, there was a push for private home ownership as a way to combat communism and social unrest. The 1966 Housing Act allowed many public housing tenants to purchase their homes, resulting in over 200,000 public units being sold into private ownership by the early 1990s. The global financial crisis that began in 2008 saw overbuilding and overborrowing inflate asset values in an unsustainable way according to the CEO of NAMA in 2011.

Report

Share

Report

Share

Recommended

Recommended

More Related Content

What's hot

What's hot (18)

All in it together? Organising musicians in the First World War

All in it together? Organising musicians in the First World War

Conflict and Consensus: The Musicians' Union and industrial relations in the ...

Conflict and Consensus: The Musicians' Union and industrial relations in the ...

Community Rights to Land in Scotland Poster Presentation

Community Rights to Land in Scotland Poster Presentation

Similar to Young Workers Network: The Development of the Irish State

Similar to Young Workers Network: The Development of the Irish State (20)

Wk 5 –The invention of radio and broadcasting in the UK

Wk 5 –The invention of radio and broadcasting in the UK

Irish Labour movement, 1889-1924 - Lecture Seven: Civil War and Retreat.

Irish Labour movement, 1889-1924 - Lecture Seven: Civil War and Retreat.

InfoGraphic Poster Assignment: The Federal Government Deals with the Great De...

InfoGraphic Poster Assignment: The Federal Government Deals with the Great De...

More from Conor McCabe

More from Conor McCabe (20)

Equality, Community and the Problem of Irish Finance: Challenges, Blockages, ...

Equality, Community and the Problem of Irish Finance: Challenges, Blockages, ...

Global Finance & Ireland: A Feminist Economics Perspective

Global Finance & Ireland: A Feminist Economics Perspective

Hope or Austerity? Unite the Union Presentation Mayday 2020

Hope or Austerity? Unite the Union Presentation Mayday 2020

Presentation to Tom Stokes Branch, Unite the Union 12.10.19

Presentation to Tom Stokes Branch, Unite the Union 12.10.19

Lessons from the Financial Crisis - Spare Room, Cork, 29.9.19

Lessons from the Financial Crisis - Spare Room, Cork, 29.9.19

Towards a democratization of money, credit and financial systems

Towards a democratization of money, credit and financial systems

Mary mellor, an eco feminist proposal, nlr 116 117, march june 2019

Mary mellor, an eco feminist proposal, nlr 116 117, march june 2019

Feminist Economics, the Commons, and Irish Activist Strategies

Feminist Economics, the Commons, and Irish Activist Strategies

Recently uploaded

Making communications land - Are they received and understood as intended? we...

Making communications land - Are they received and understood as intended? we...Association for Project Management

TỔNG ÔN TẬP THI VÀO LỚP 10 MÔN TIẾNG ANH NĂM HỌC 2023 - 2024 CÓ ĐÁP ÁN (NGỮ Â...

TỔNG ÔN TẬP THI VÀO LỚP 10 MÔN TIẾNG ANH NĂM HỌC 2023 - 2024 CÓ ĐÁP ÁN (NGỮ Â...Nguyen Thanh Tu Collection

Recently uploaded (20)

Making communications land - Are they received and understood as intended? we...

Making communications land - Are they received and understood as intended? we...

Food safety_Challenges food safety laboratories_.pdf

Food safety_Challenges food safety laboratories_.pdf

Salient Features of India constitution especially power and functions

Salient Features of India constitution especially power and functions

UGC NET Paper 1 Mathematical Reasoning & Aptitude.pdf

UGC NET Paper 1 Mathematical Reasoning & Aptitude.pdf

Unit-V; Pricing (Pharma Marketing Management).pptx

Unit-V; Pricing (Pharma Marketing Management).pptx

ICT Role in 21st Century Education & its Challenges.pptx

ICT Role in 21st Century Education & its Challenges.pptx

TỔNG ÔN TẬP THI VÀO LỚP 10 MÔN TIẾNG ANH NĂM HỌC 2023 - 2024 CÓ ĐÁP ÁN (NGỮ Â...

TỔNG ÔN TẬP THI VÀO LỚP 10 MÔN TIẾNG ANH NĂM HỌC 2023 - 2024 CÓ ĐÁP ÁN (NGỮ Â...

Micro-Scholarship, What it is, How can it help me.pdf

Micro-Scholarship, What it is, How can it help me.pdf

Young Workers Network: The Development of the Irish State

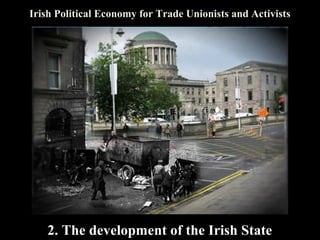

- 1. Irish Political Economy for Trade Unionists and Activists 2. The development of the Irish State

- 19. “We wish to resuscitate the speculative builder..” W.T. Cosgrave, 1925

- 20. “We wish to resuscitate the speculative builder..” W.T. Cosgrave, 1925 Housing Acts, 1924 & 1925 - Building grants for owneroccupiers - Remission on local authority rates

- 22. “I am a firm believer in private ownership, because it makes for better citizens, and there is no greater barrier against communism.” Senator James Tunney, Labour Party, 1952

- 23. “The man of property is ever against revolutionary change. Consequently a factor of the first importance in combating emigration and preventing social unrest, unemployment marches, and so on, is the widest possible diffusion of ownership.” Most Revd Dr. Cornelius Lucey, Bishop of Cork, 1957

- 24. 1966 Housing Act - allowed local authority tenants in urban areas to purchase their homes - by the early 1990s, 220,000 of the 330,000 public housing units in the state had been sold to

- 34. NAMA PROPERTIES = c.16,000

- 35. “The problem here is that, when one looks at the top 190 debtors in the NAMA universe with debts of €62 billion, a relatively small number of people were chasing the same assets and it was like a Ponzi scheme. They overborrowed and were overlent to by banks. There was huge inflation of asset values and this was not sustainable in the context of the economy. There was a disconnect between the economy growing at 8% or 9% per annum and lending by banks growing at 35% or 40% per year. The problem was caused by overpaying for assets.” Brendan McDonagh, Chief Executive, NAMA, in evidence to the Public Accounts Committee, 26 October 2011