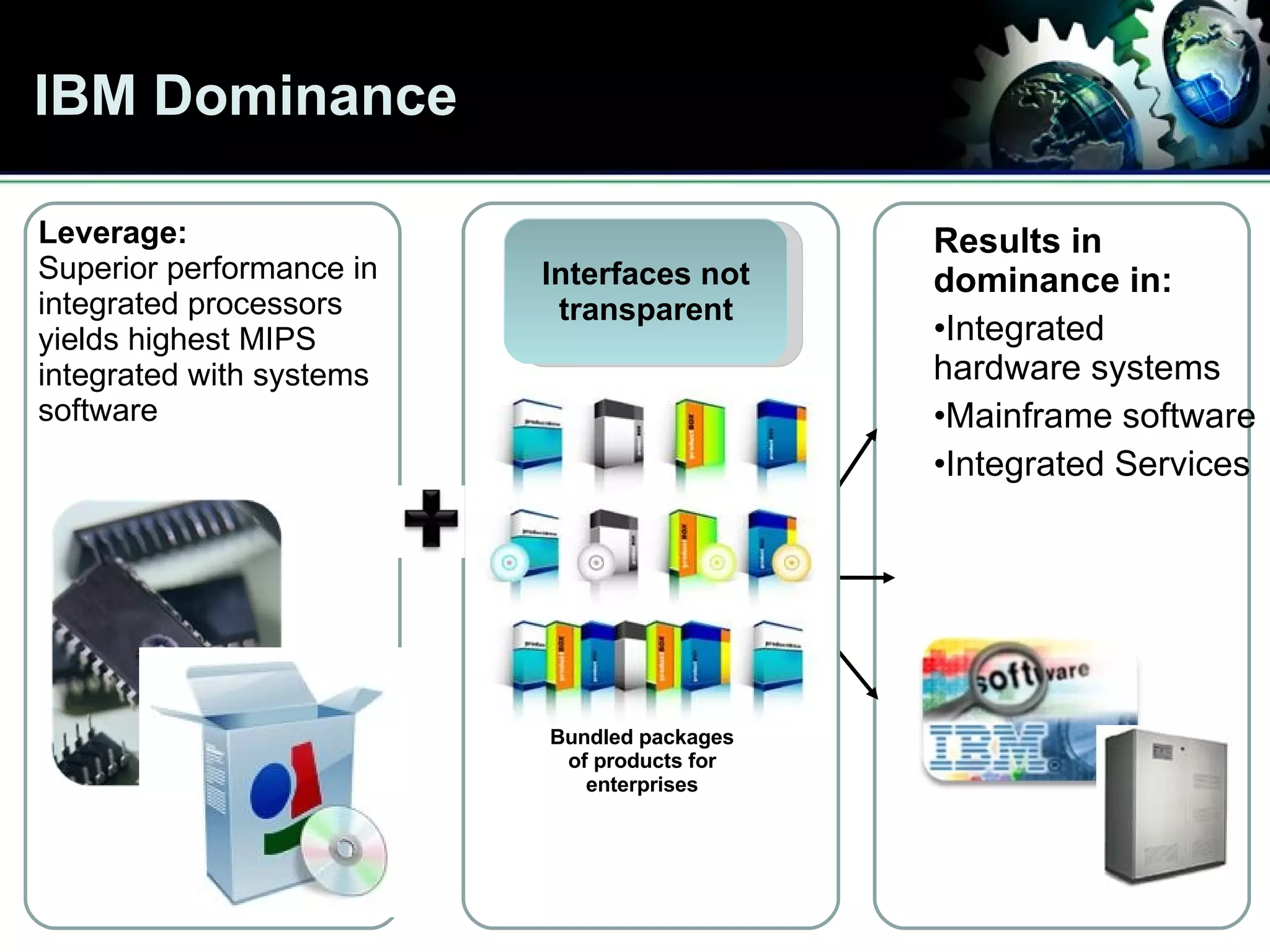

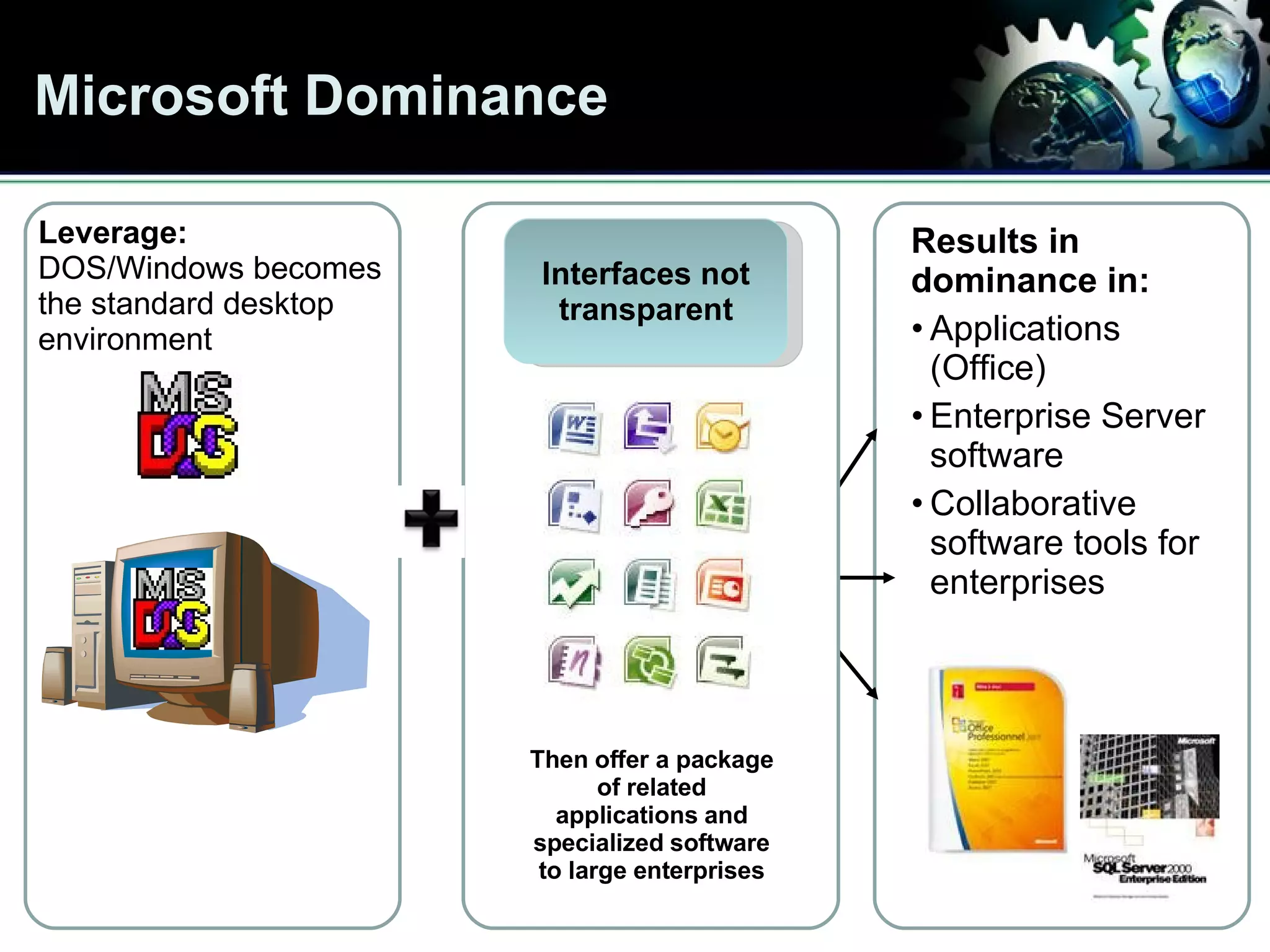

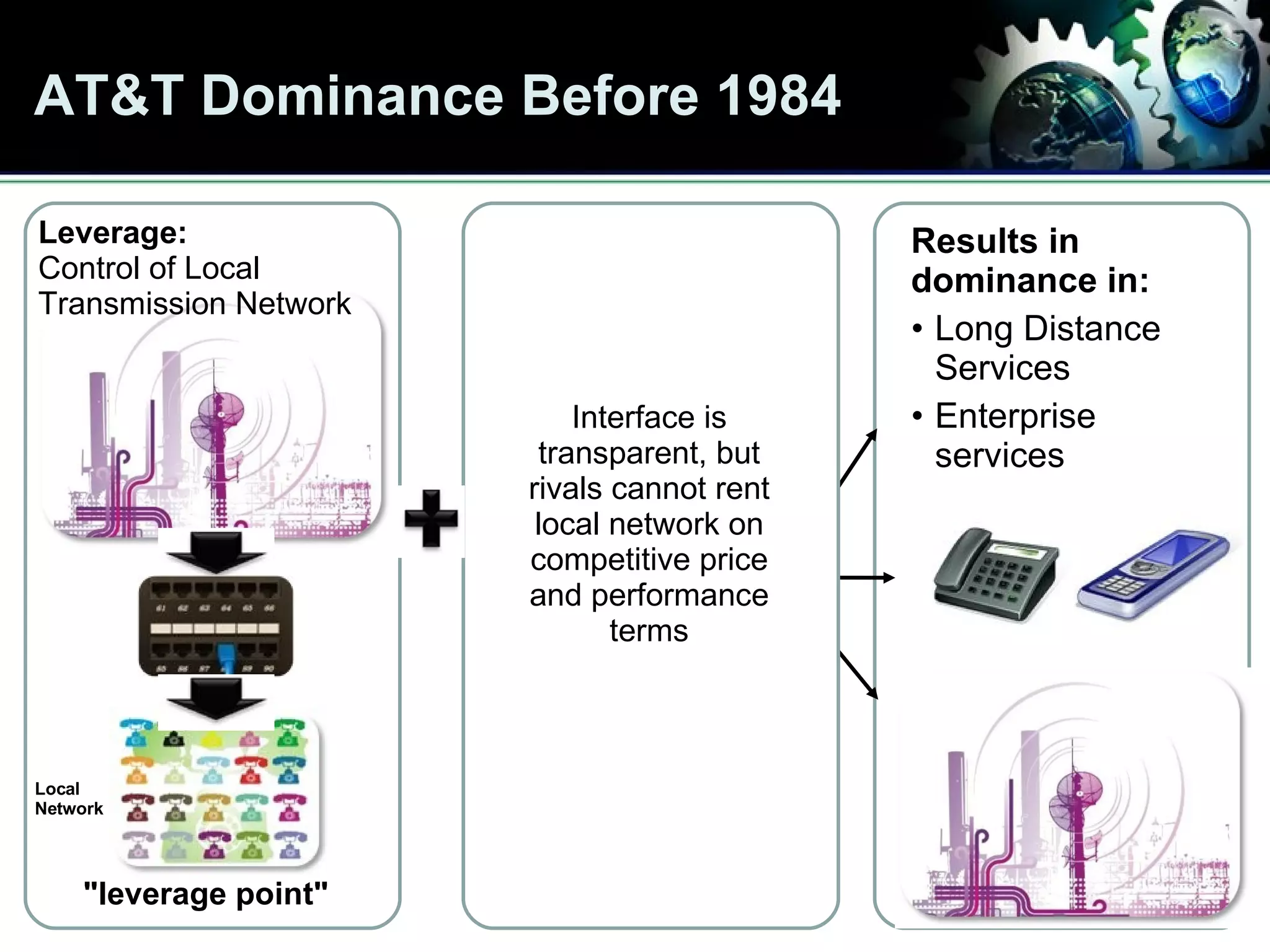

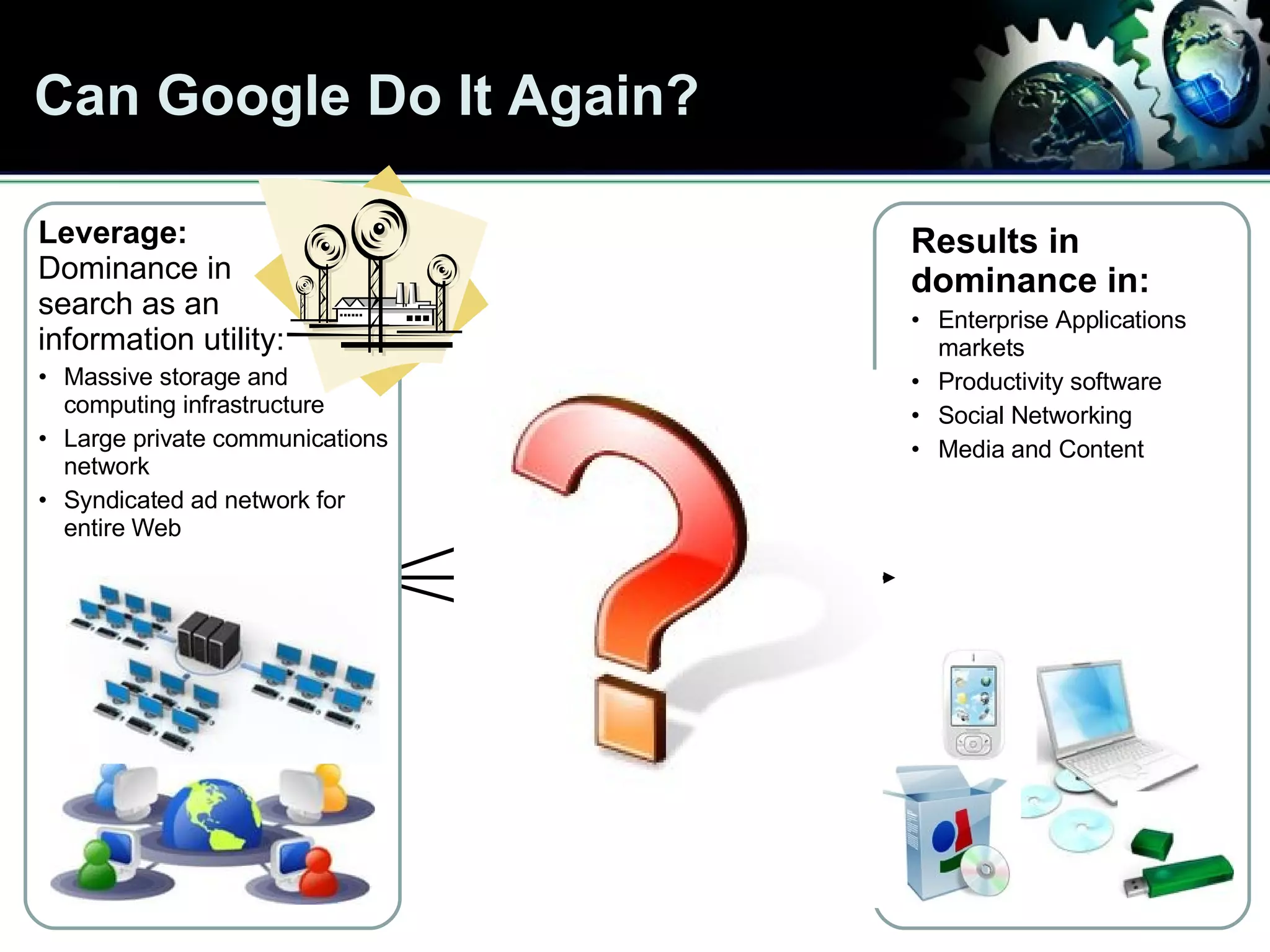

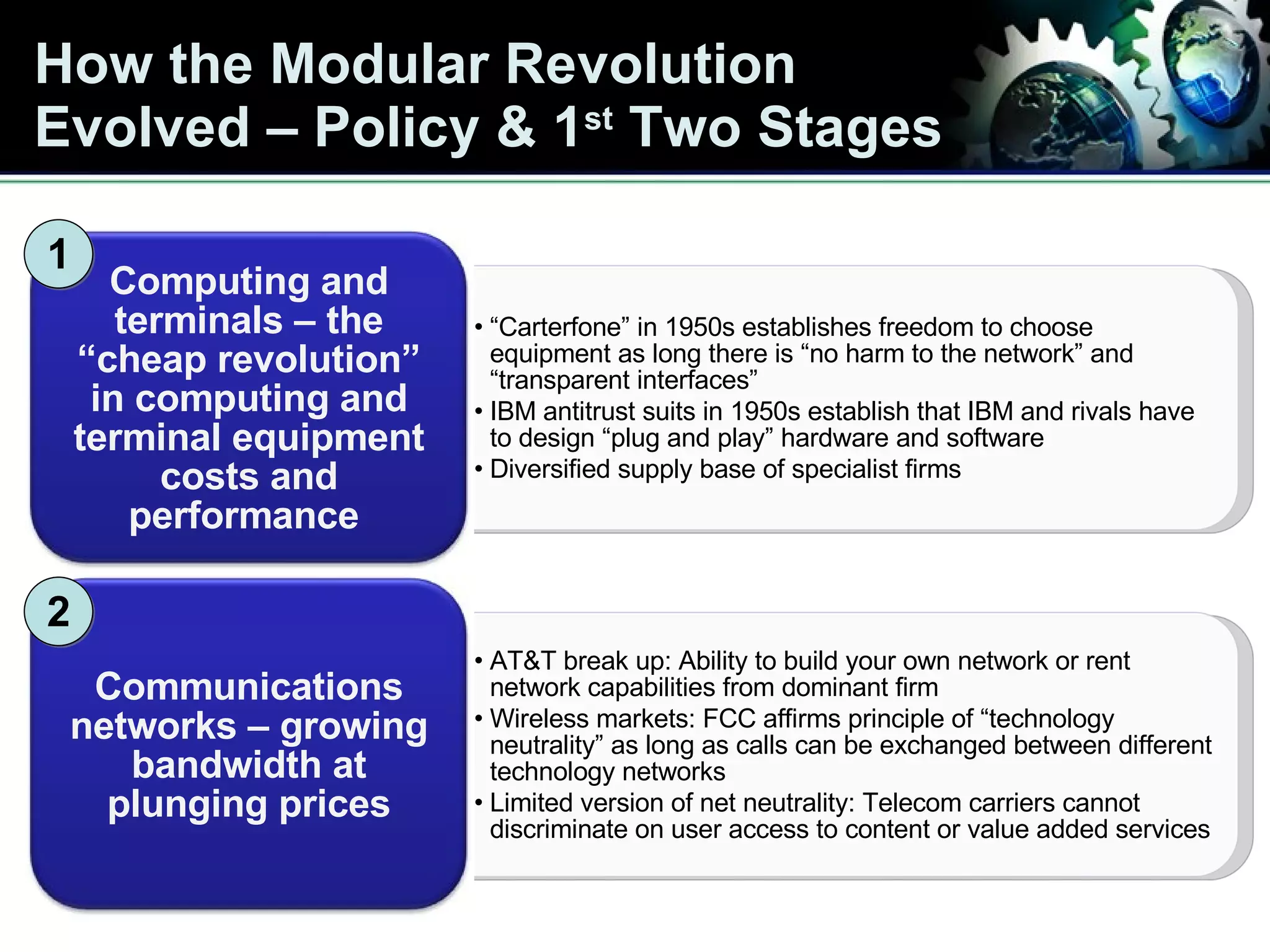

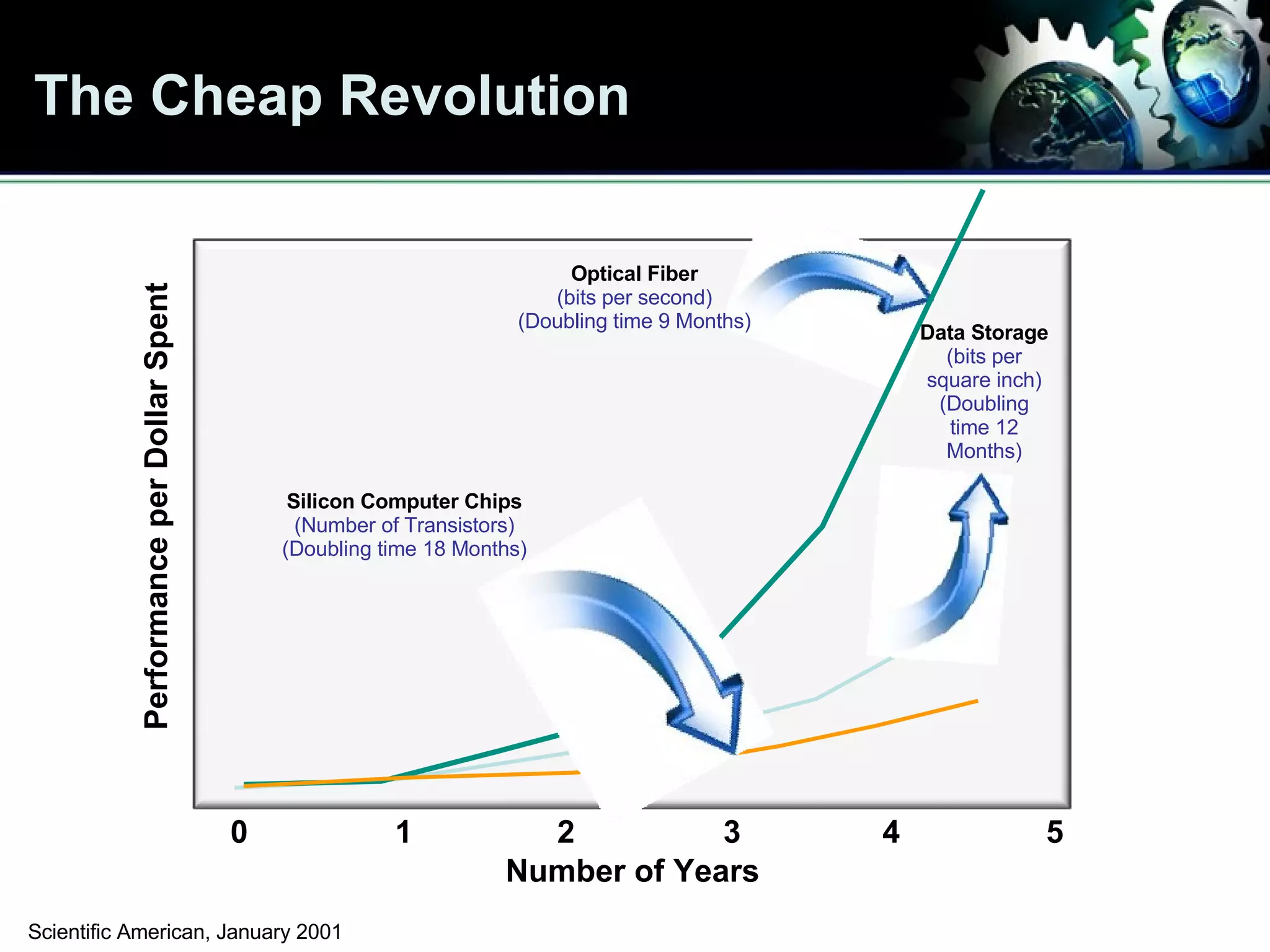

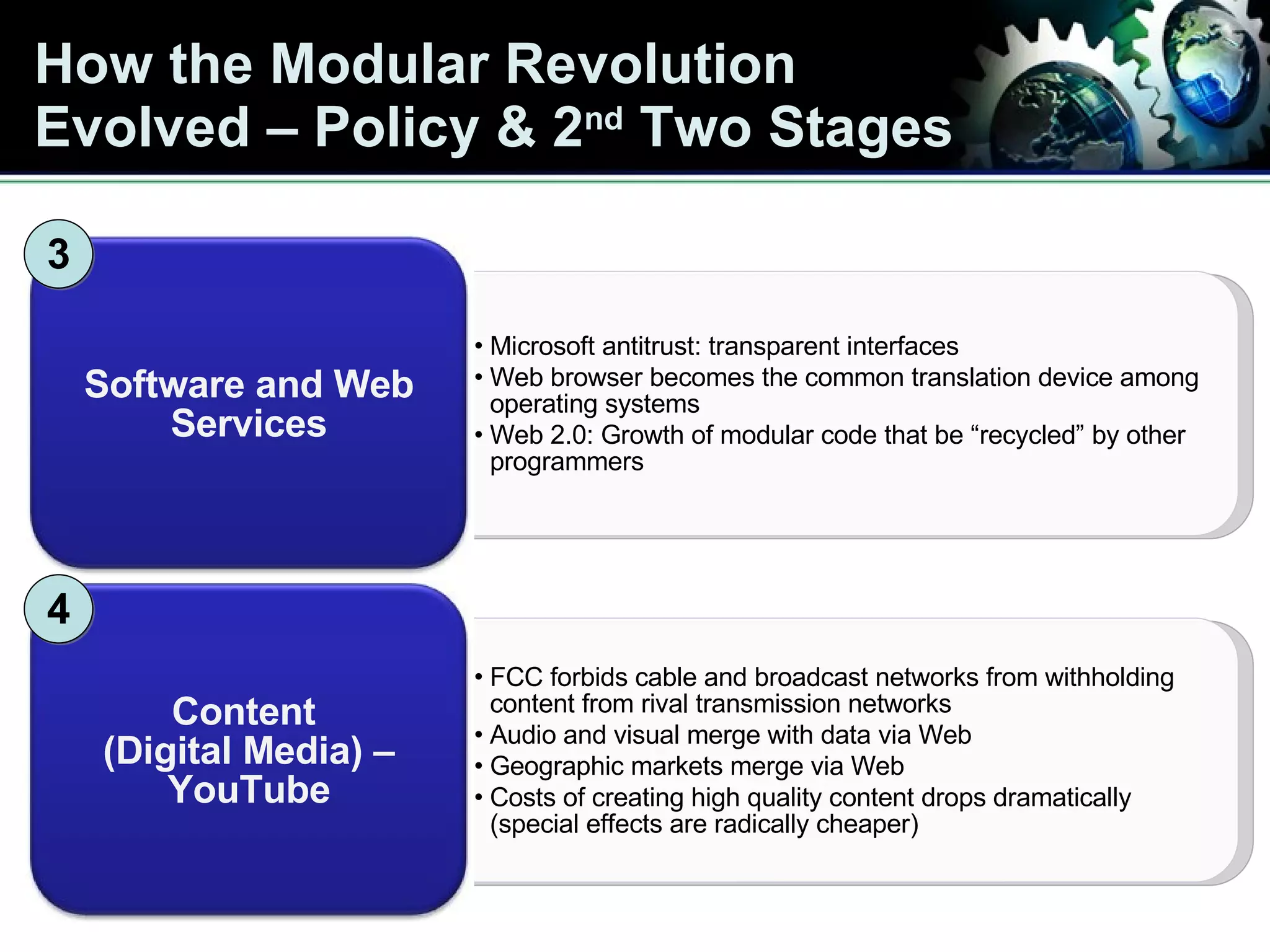

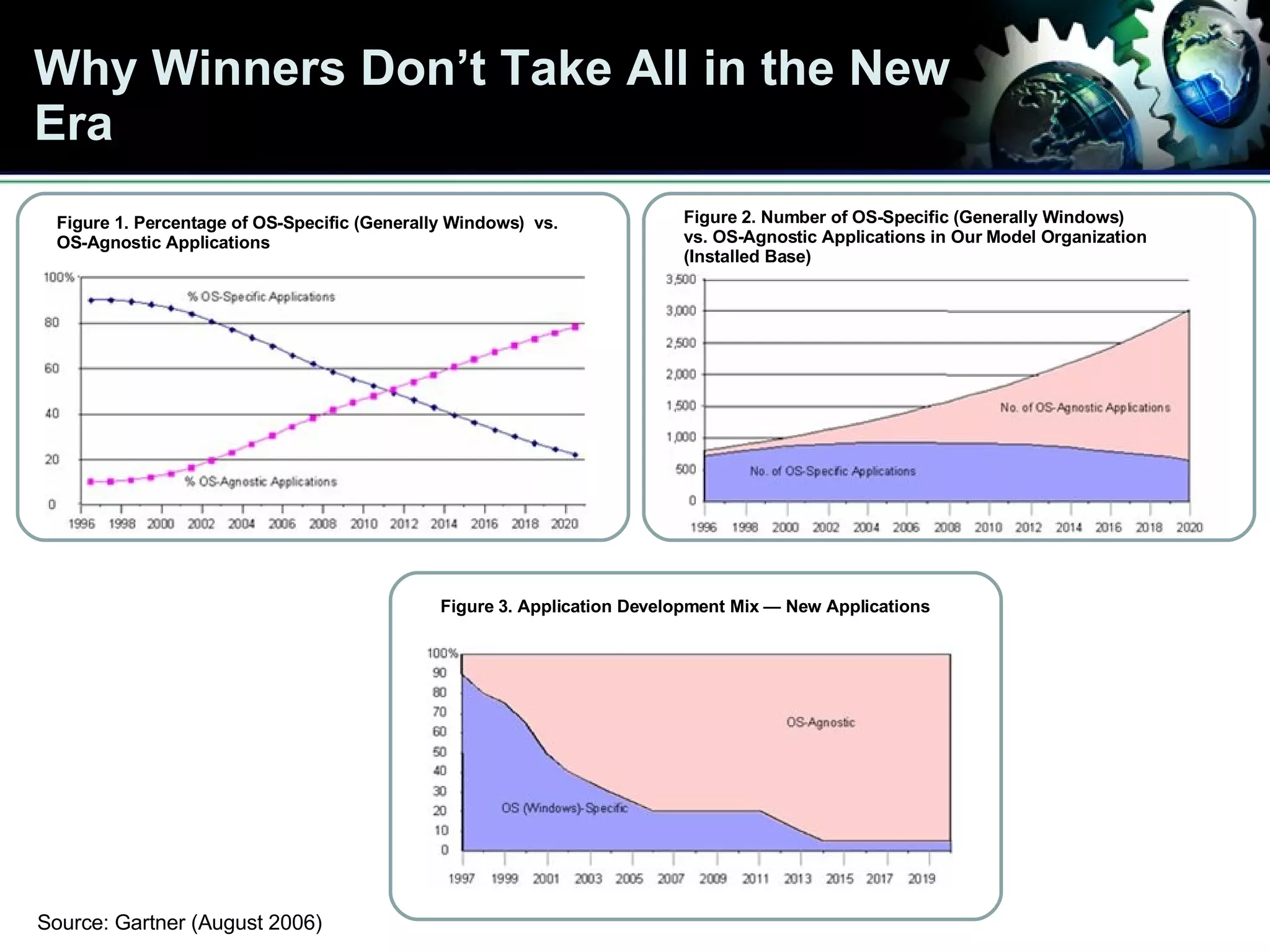

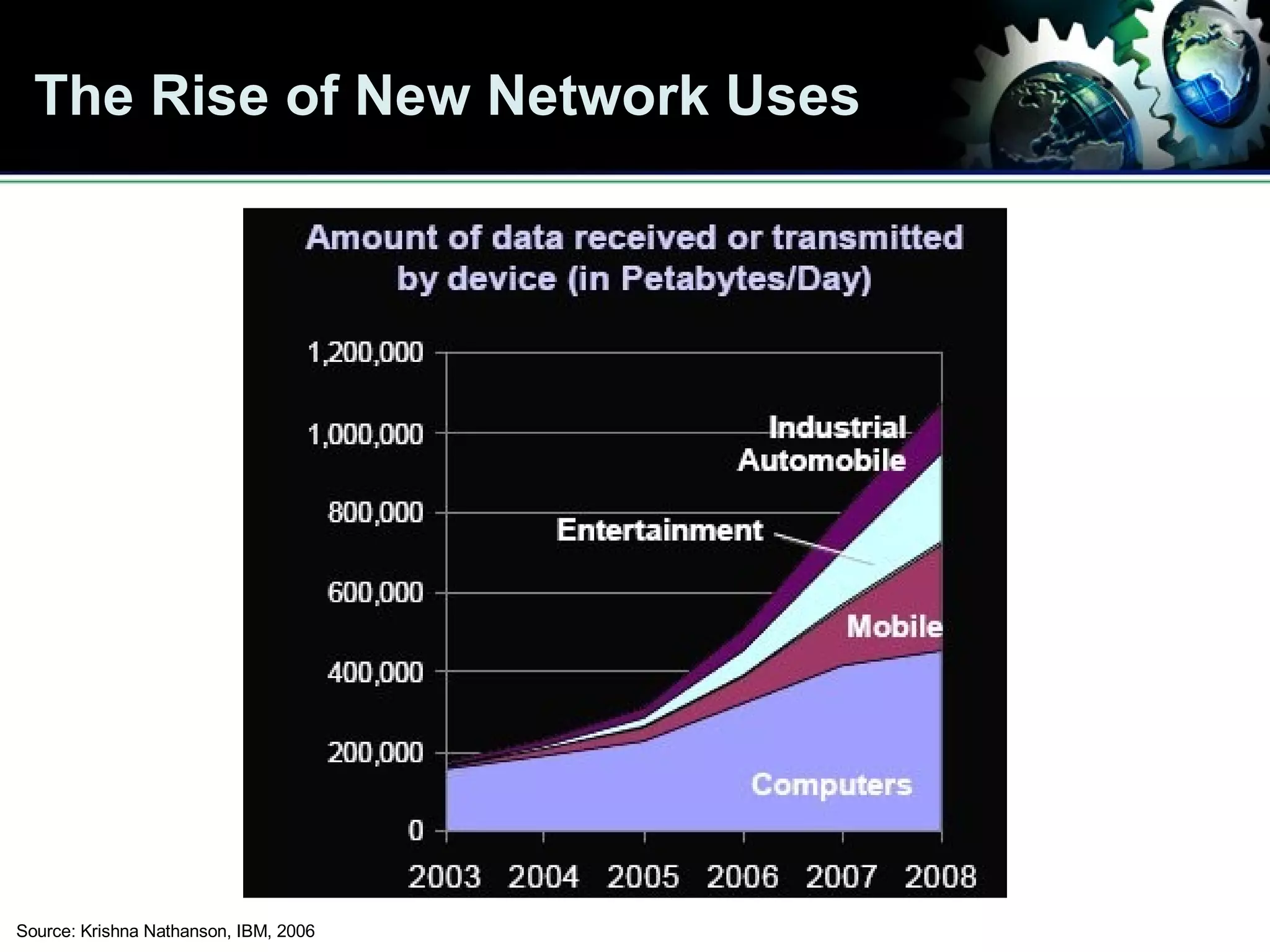

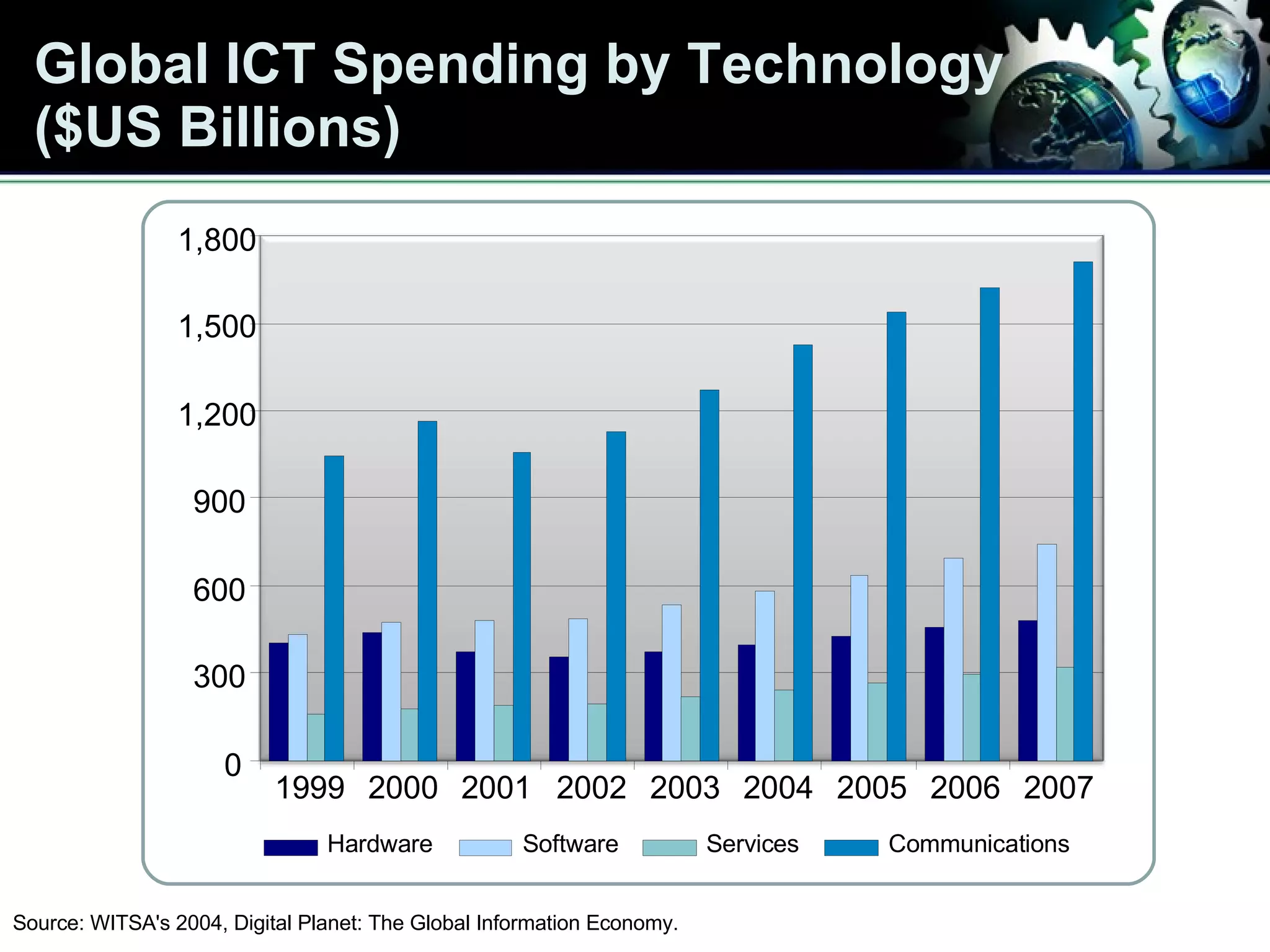

The presentation discusses the merging of information and communication technology (ICT) and how this modular architecture presents new market dynamics and challenges traditional leverage models used by companies like IBM, Microsoft, and AT&T. It emphasizes the importance of smart competition policy to facilitate opportunities arising from modularity, while also noting the challenges faced in developing countries. The document outlines guiding principles and norms for effective global governance and innovation in the ICT sector.