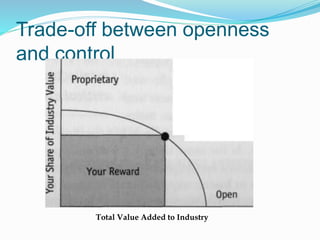

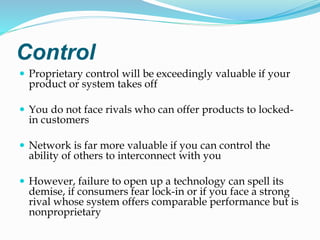

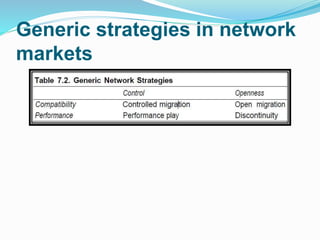

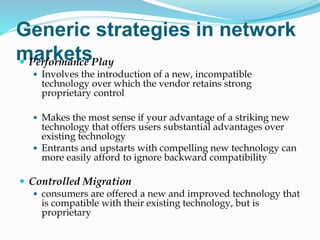

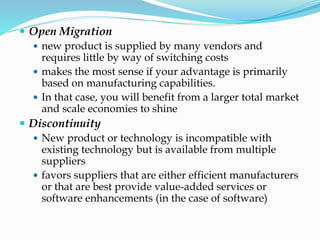

The document discusses how positive feedback effects can drive markets towards a single dominant technology or firm. It explains that in network markets, the value of a technology increases as more users adopt it. This can lead to tipping, where a small initial advantage accumulates into dominance. Firms must consider strategies around compatibility versus performance and openness versus control to leverage these network effects in their favor. The key tradeoffs are around ease of adoption versus technological leadership and industry cooperation versus proprietary control.