More Related Content

Similar to Plug valuation

Similar to Plug valuation (20)

Plug valuation

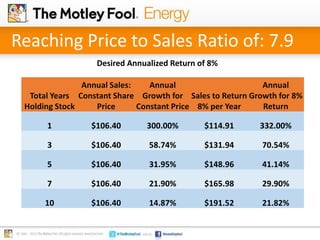

- 1. Reaching Price to Sales Ratio of: 7.9

Desired Annualized Return of 8%

Total Years

Holding Stock

Annual Sales:

Constant Share

Price

Annual

Growth for

Constant Price

Sales to Return

8% per Year

Annual

Growth for 8%

Return

1 $106.40 300.00% $114.91 332.00%

3 $106.40 58.74% $131.94 70.54%

5 $106.40 31.95% $148.96 41.14%

7 $106.40 21.90% $165.98 29.90%

10 $106.40 14.87% $191.52 21.82%

- 2. Reaching Price to Sales Ratio of: 7.9

Desired Annualized Return of 10%

Total Years

Holding Stock

Annual Sales:

Constant Share

Price

Annual

Growth for

Constant Price

Sales to Return

10% per Year

Annual

Growth for

10% Return

1 $106.40 300.00% $117.04 340.00%

3 $106.40 58.74% $138.32 73.25%

5 $106.40 31.95% $159.60 43.10%

7 $106.40 21.90% $180.88 31.50%

10 $106.40 14.87% $212.80 23.11%

- 3. Reaching Price to Sales Ratio of: 7.9

Desired Annualized Return of 12%

Total Years

Holding Stock

Annual Sales:

Constant Share

Price

Annual

Growth for

Constant Price

Sales to Return

12% per Year

Annual

Growth for

12% Return

1 $106.40 300.00% $119.17 348.00%

3 $106.40 58.74% $144.70 75.87%

5 $106.40 31.95% $170.24 44.96%

7 $106.40 21.90% $195.78 33.00%

10 $106.40 14.87% $234.08 24.29%

- 4. Reaching Price to Sales Ratio of: 7.9

Desired Annualized Return of 15%

Total Years

Holding Stock

Annual Sales:

Constant Share

Price

Annual

Growth for

Constant Price

Sales to Return

15% per Year

Annual

Growth for

15% Return

1 $106.40 300.00% $122.36 360.00%

3 $106.40 58.74% $154.28 79.67%

5 $106.40 31.95% $186.20 47.58%

7 $106.40 21.90% $218.12 35.07%

10 $106.40 14.87% $266.00 25.89%

- 5. Reaching Price to Sales Ratio of: 4.7

Desired Annualized Return of 8%

Total Years

Holding Stock

Annual Sales:

Constant Share

Price

Annual

Growth to

Break Even

Sales to Return

15% per Year

Annual

Growth for

15% Return

1 $106.40 300.00% $122.36 360.00%

3 $106.40 58.74% $154.28 79.67%

5 $106.40 31.95% $186.20 47.58%

7 $106.40 21.90% $218.12 35.07%

10 $106.40 14.87% $266.00 25.89%

Total Years

Holding Stock

Annual Sales:

Constant Share

Price

Annual

Growth for

Constant Price

Sales to Return

8% per Year

Annual

Growth for

8% Return

1 $ 177.33 566.67% $ 191.52 620.00%

3 $ 177.33 88.21% $ 219.89 102.20%

5 $ 177.33 46.14% $ 248.27 56.32%

7 $ 177.33 31.13% $ 276.64 39.73%

10 $ 177.33 20.89% $ 319.20 28.21%

- 6. Reaching Price to Sales Ratio of: 4.7

Desired Annualized Return of 10%

Total Years

Holding Stock

Annual Sales:

Constant Share

Price

Annual

Growth to

Break Even

Sales to Return

15% per Year

Annual

Growth for

15% Return

1 $106.40 300.00% $122.36 360.00%

3 $106.40 58.74% $154.28 79.67%

5 $106.40 31.95% $186.20 47.58%

7 $106.40 21.90% $218.12 35.07%

10 $106.40 14.87% $266.00 25.89%

Total Years

Holding Stock

Annual Sales:

Constant Share

Price

Annual

Growth for

Constant Price

Sales to Return

10% per Year

Annual

Growth for

10% Return

1 $ 177.33 566.67% $ 195.07 633.33%

3 $ 177.33 88.21% $ 230.53 105.41%

5 $ 177.33 46.14% $ 266.00 58.49%

7 $ 177.33 31.13% $ 301.47 41.46%

10 $ 177.33 20.89% $ 354.67 29.57%

- 7. Reaching Price to Sales Ratio of: 4.7

Desired Annualized Return of 12%

Total Years

Holding Stock

Annual Sales:

Constant Share

Price

Annual

Growth to

Break Even

Sales to Return

15% per Year

Annual

Growth for

15% Return

1 $106.40 300.00% $122.36 360.00%

3 $106.40 58.74% $154.28 79.67%

5 $106.40 31.95% $186.20 47.58%

7 $106.40 21.90% $218.12 35.07%

10 $106.40 14.87% $266.00 25.89%

Total Years

Holding Stock

Annual Sales:

Constant Share

Price

Annual

Growth for

Constant Price

Sales to Return

12% per Year

Annual

Growth for

12% Return

1 $177.33 566.67% $198.61 646.67%

3 $177.33 88.21% $241.17 108.52%

5 $177.33 46.14% $283.73 60.55%

7 $177.33 31.13% $326.29 43.06%

10 $177.33 20.89% $390.13 30.81%

- 8. Reaching Price to Sales Ratio of: 4.7

Desired Annualized Return of 15%

Total Years

Holding Stock

Annual Sales:

Constant Share

Price

Annual

Growth to

Break Even

Sales to Return

15% per Year

Annual

Growth for

15% Return

1 $106.40 300.00% $122.36 360.00%

3 $106.40 58.74% $154.28 79.67%

5 $106.40 31.95% $186.20 47.58%

7 $106.40 21.90% $218.12 35.07%

10 $106.40 14.87% $266.00 25.89%

Total Years

Holding Stock

Annual Sales:

Constant Share

Price

Annual

Growth for

Constant Price

Sales to Return

15% per Year

Annual

Growth for

15% Return

1 $177.33 566.67% $203.93 666.67%

3 $177.33 88.21% $257.13 113.02%

5 $177.33 46.14% $310.33 63.45%

7 $177.33 31.13% $363.53 45.29%

10 $177.33 20.89% $443.33 32.49%

- 9. Reaching Price to Sales Ratio of: 1.7 (S&P Avg.)

Desired Annualized Return of 8%

Total Years

Holding Stock

Annual Sales:

Constant Share

Price

Annual

Growth to

Break Even

Sales to Return

15% per Year

Annual

Growth for

15% Return

1 $106.40 300.00% $122.36 360.00%

3 $106.40 58.74% $154.28 79.67%

5 $106.40 31.95% $186.20 47.58%

7 $106.40 21.90% $218.12 35.07%

10 $106.40 14.87% $266.00 25.89%

Total Years

Holding Stock

Annual Sales:

Constant Share

Price

Annual

Growth for

Constant Price

Sales to Return

8% per Year

Annual

Growth for

8% Return

1 $458.83 1624.94% $495.54 1762.93%

3 $458.83 158.38% $568.95 177.59%

5 $458.83 76.75% $642.37 89.05%

7 $458.83 50.20% $715.78 60.06%

10 $458.83 32.95% $825.90 41.00%

- 10. Reaching Price to Sales Ratio of: 1.7 (S&P Avg.)

Desired Annualized Return of 10%

Total Years

Holding Stock

Annual Sales:

Constant Share

Price

Annual

Growth to

Break Even

Sales to Return

15% per Year

Annual

Growth for

15% Return

1 $106.40 300.00% $122.36 360.00%

3 $106.40 58.74% $154.28 79.67%

5 $106.40 31.95% $186.20 47.58%

7 $106.40 21.90% $218.12 35.07%

10 $106.40 14.87% $266.00 25.89%

Total Years

Holding Stock

Annual Sales:

Constant Share

Price

Annual

Growth for

Constant Price

Sales to Return

10% per Year

Annual

Growth for

10% Return

1 $458.83 1624.94% $504.72 1797.43%

3 $458.83 158.38% $596.48 181.99%

5 $458.83 76.75% $688.25 91.68%

7 $458.83 50.20% $780.02 62.03%

10 $458.83 32.95% $917.67 42.49%

- 11. Desired Annualized Return of 12%

Total Years

Holding Stock

Annual Sales:

Constant Share

Price

Annual

Growth to

Break Even

Sales to Return

15% per Year

Annual

Growth for

15% Return

1 $106.40 300.00% $122.36 360.00%

3 $106.40 58.74% $154.28 79.67%

5 $106.40 31.95% $186.20 47.58%

7 $106.40 21.90% $218.12 35.07%

10 $106.40 14.87% $266.00 25.89%

Total Years

Holding Stock

Annual Sales:

Constant Share

Price

Annual

Growth for

Constant Price

Sales to Return

12% per Year

Annual

Growth for

12% Return

1 $458.83 1624.94% $513.89 1831.93%

3 $458.83 158.38% $624.01 186.27%

5 $458.83 76.75% $734.13 94.17%

7 $458.83 50.20% $844.25 63.88%

10 $458.83 32.95% $1,009.43 43.85%

Reaching Price to Sales Ratio of: 1.7 (S&P Avg.)

- 12. Desired Annualized Return of 15%

Total Years

Holding Stock

Annual Sales:

Constant Share

Price

Annual

Growth to

Break Even

Sales to Return

15% per Year

Annual

Growth for

15% Return

1 $106.40 300.00% $122.36 360.00%

3 $106.40 58.74% $154.28 79.67%

5 $106.40 31.95% $186.20 47.58%

7 $106.40 21.90% $218.12 35.07%

10 $106.40 14.87% $266.00 25.89%

Total Years

Holding Stock

Annual Sales:

Constant Share

Price

Annual

Growth for

Constant Price

Sales to Return

15% per Year

Annual

Growth for

15% Return

1 $458.83 1624.94% $527.66 1883.68%

3 $458.83 158.38% $665.31 192.45%

5 $458.83 76.75% $802.96 97.68%

7 $458.83 50.20% $940.61 66.42%

10 $458.83 32.95% $1,147.08 45.70%

Reaching Price to Sales Ratio of: 1.7 (S&P Avg.)