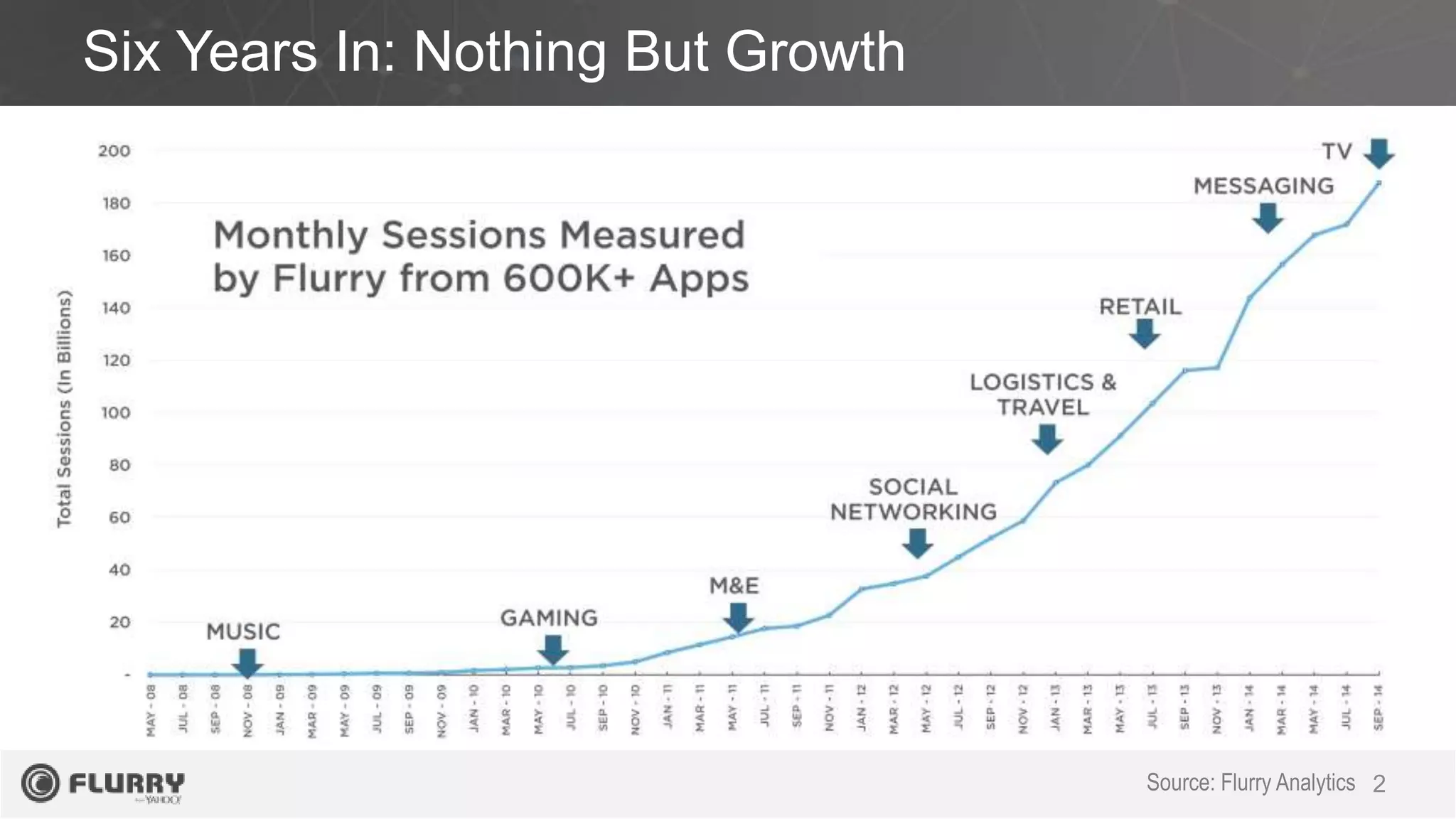

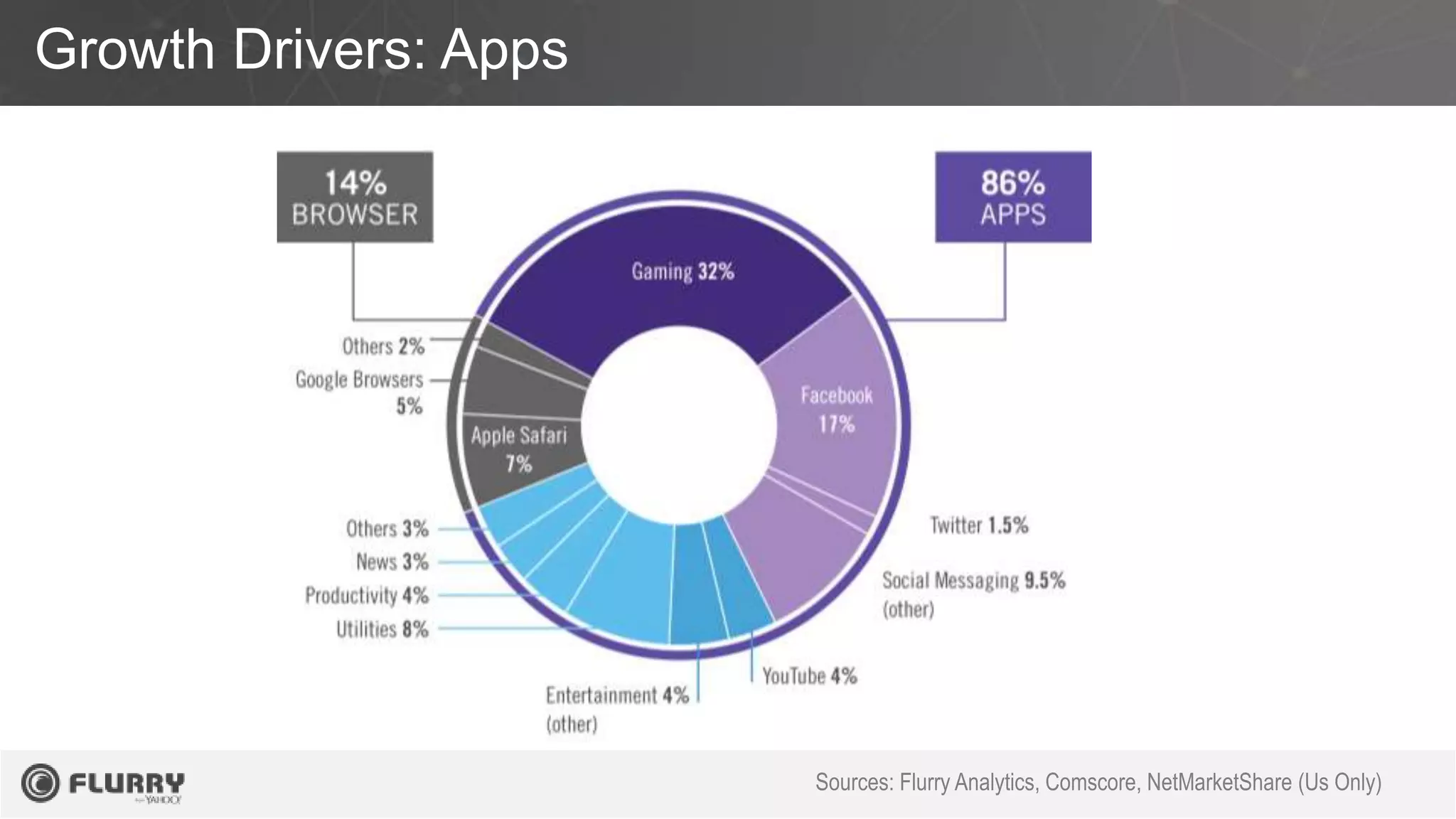

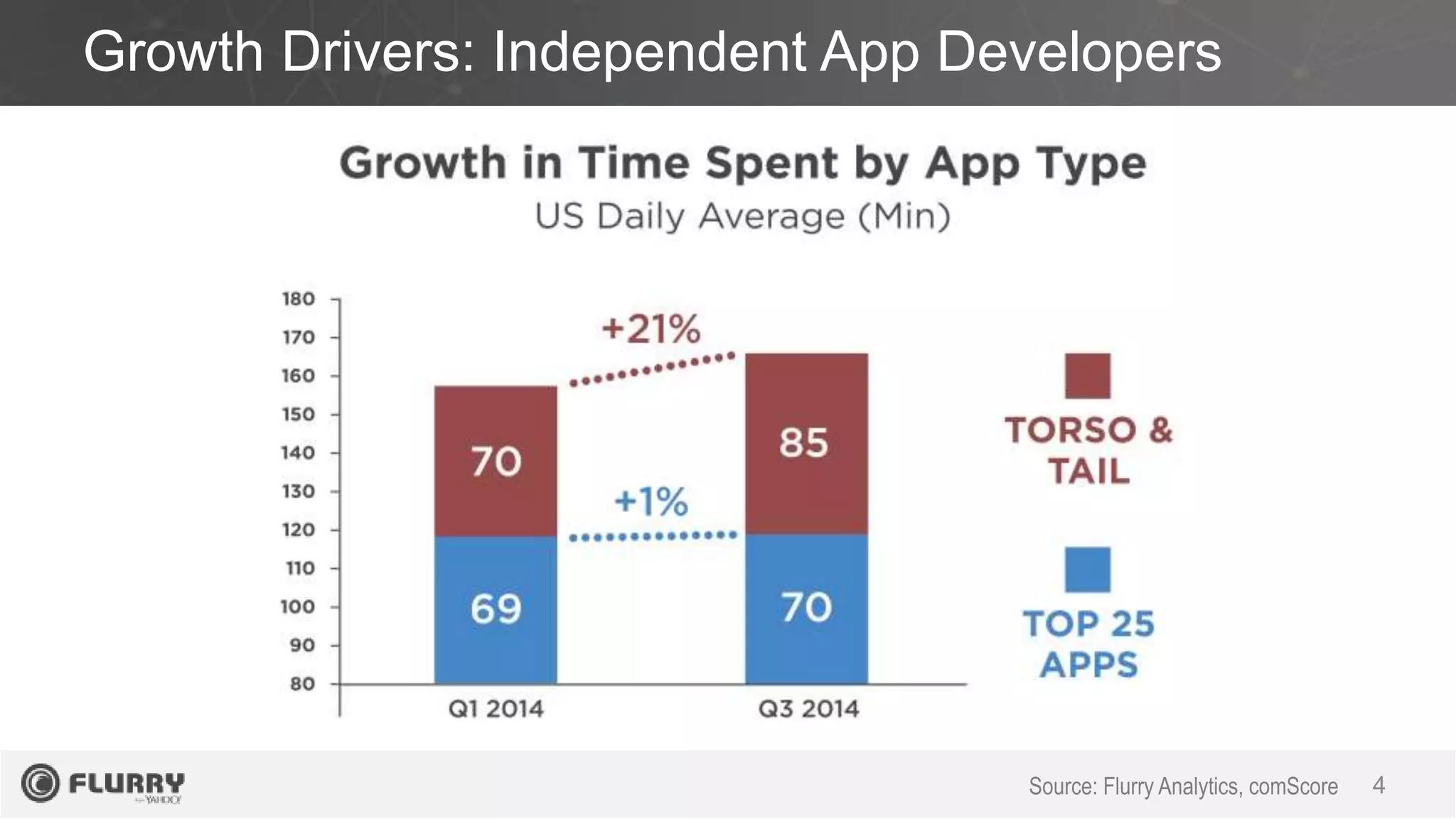

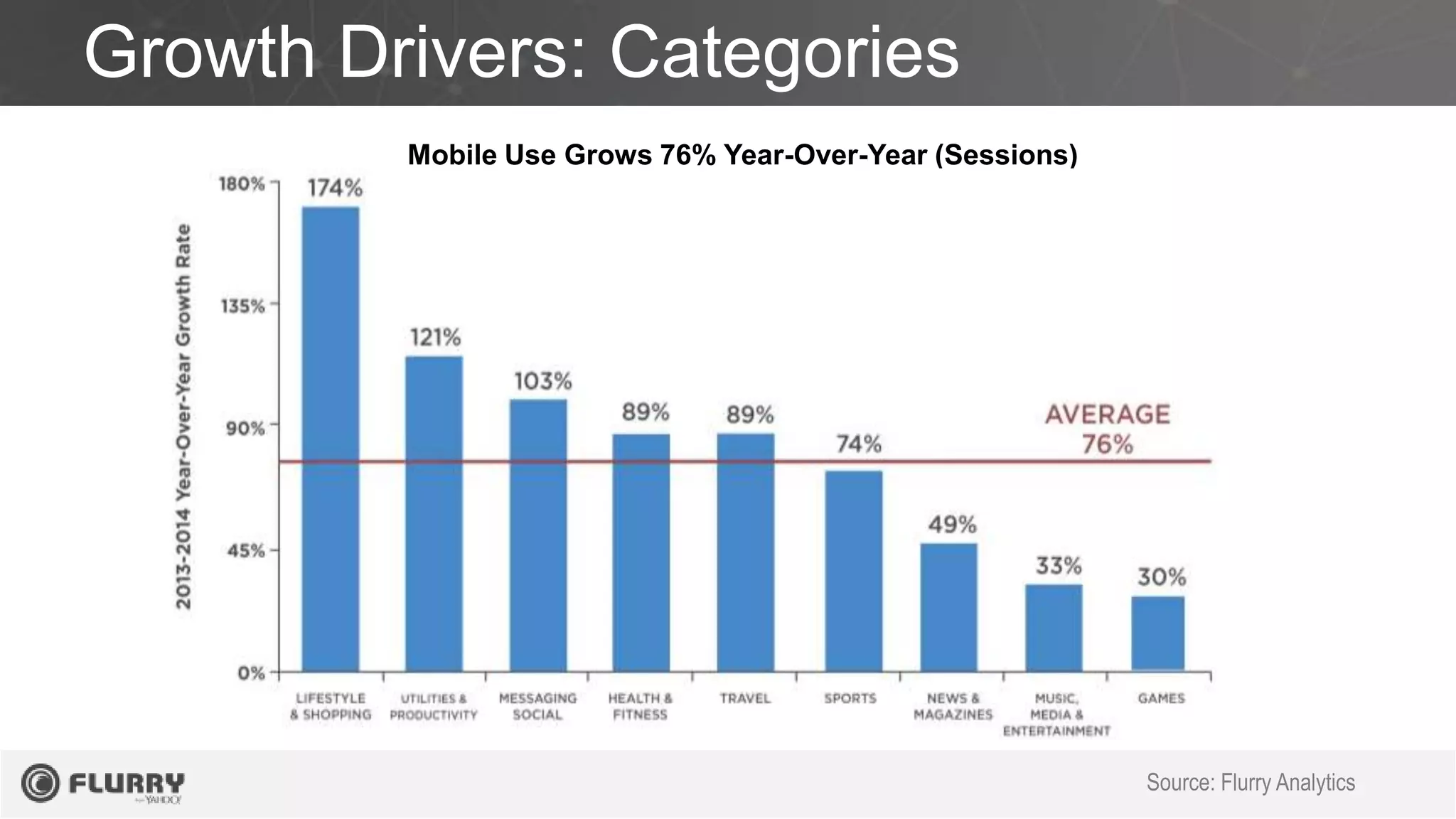

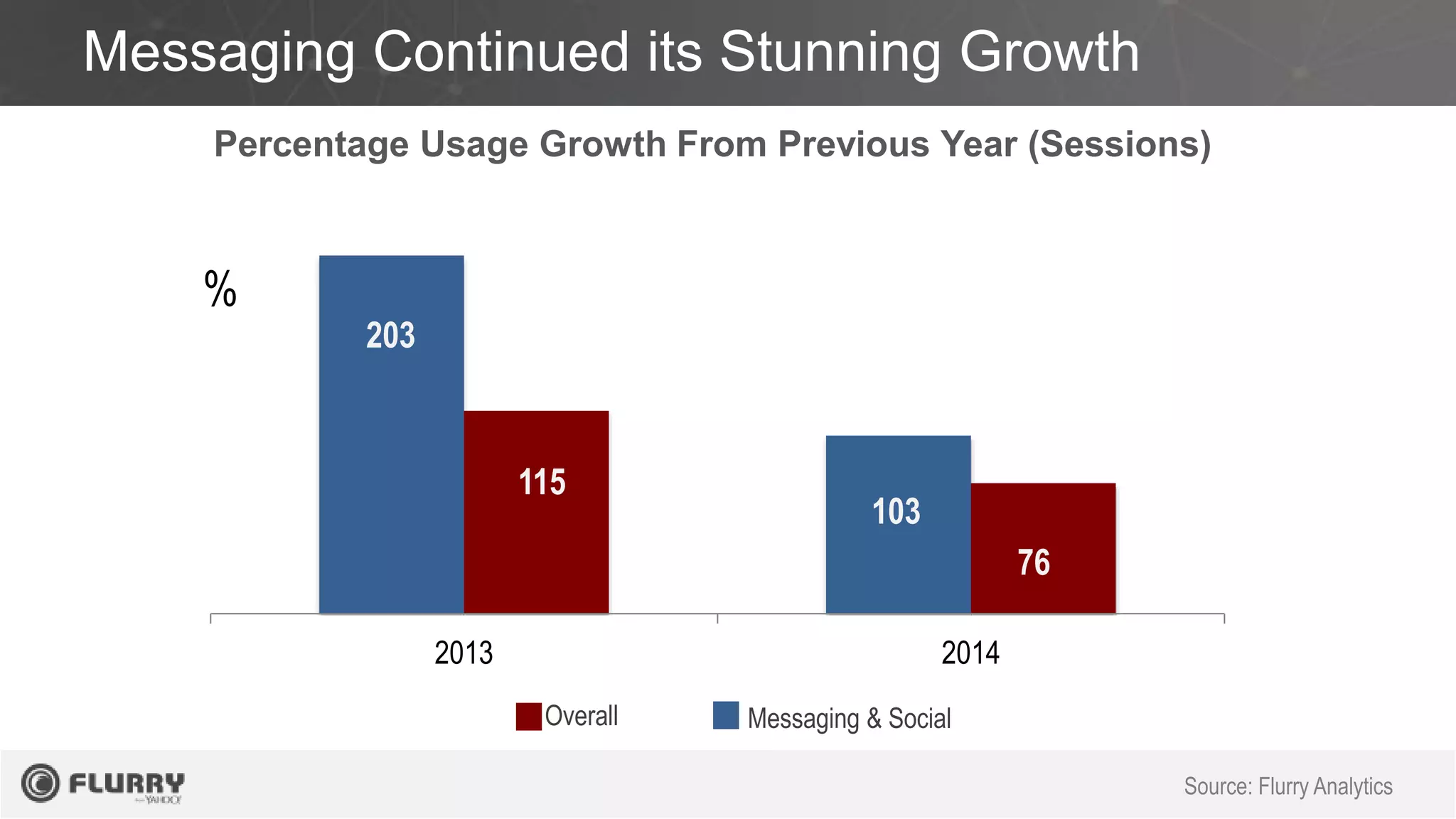

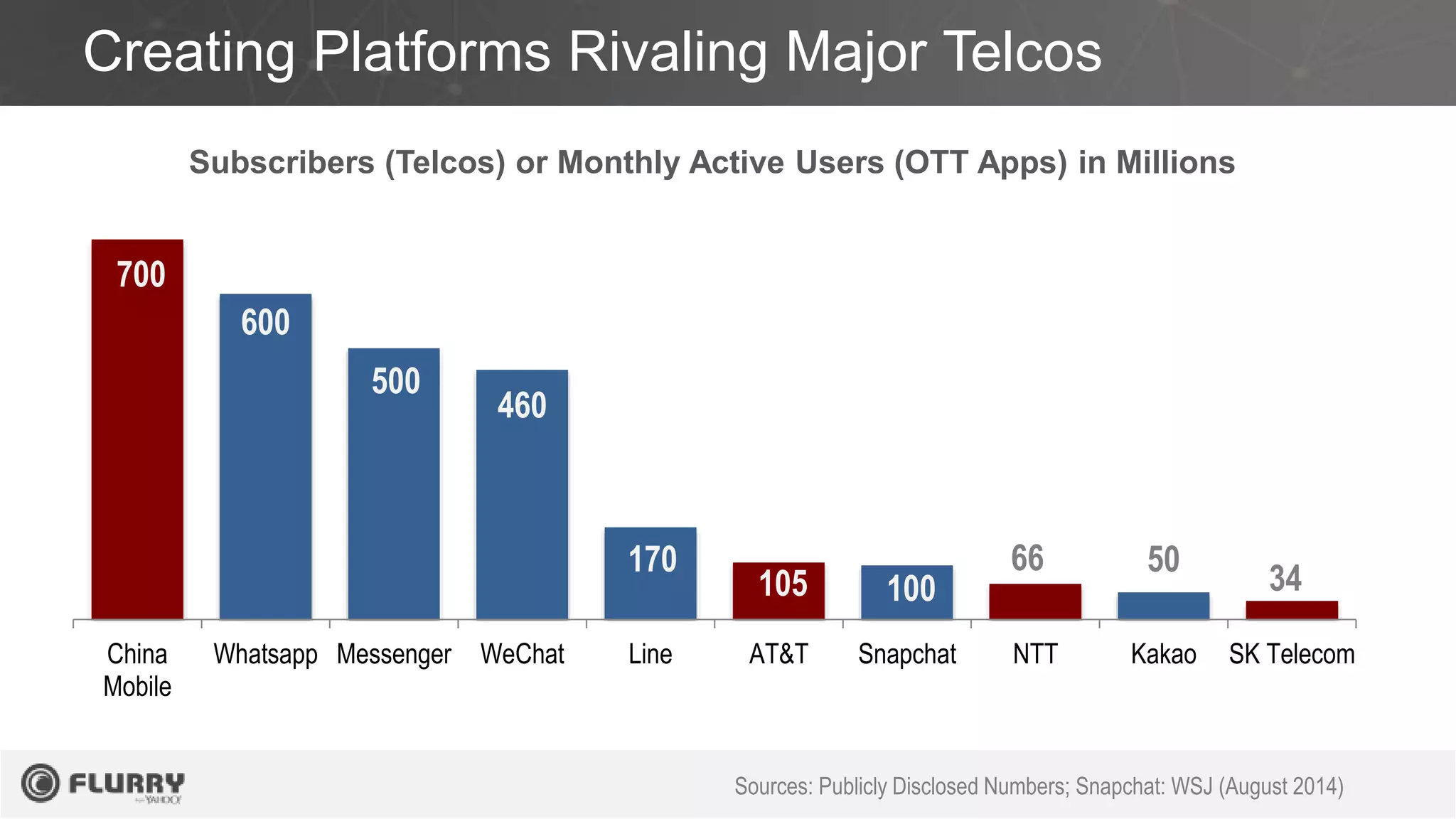

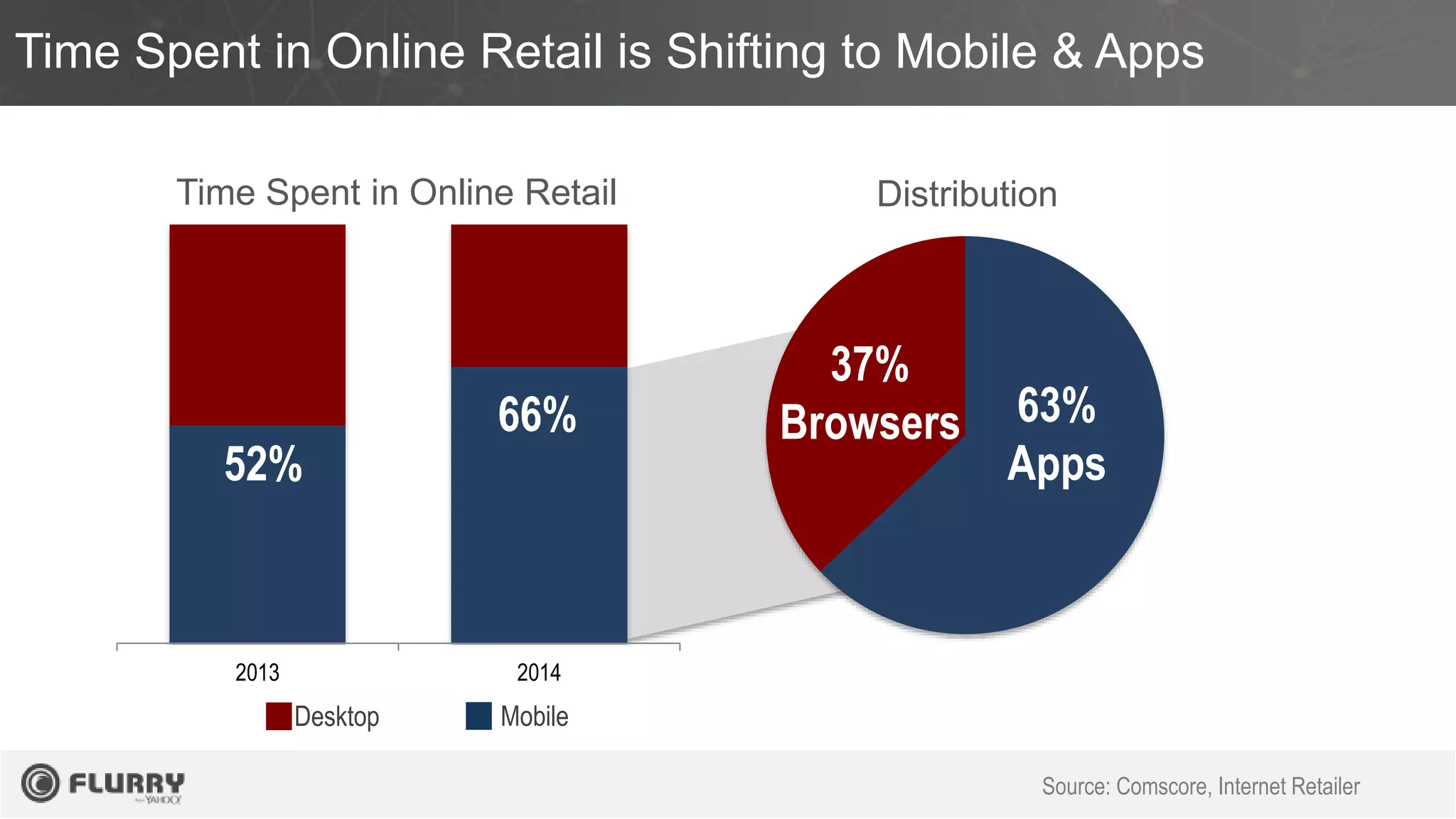

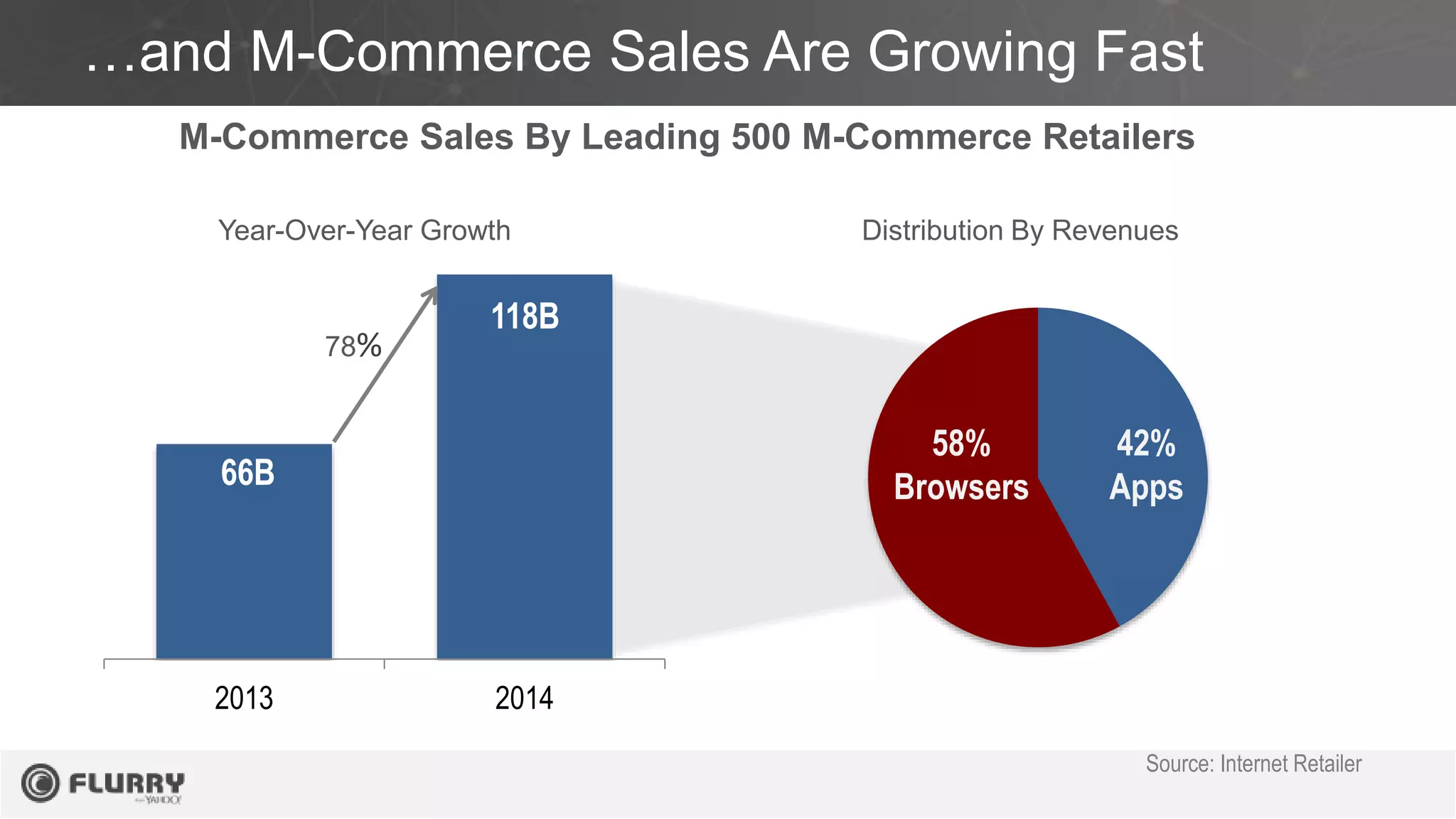

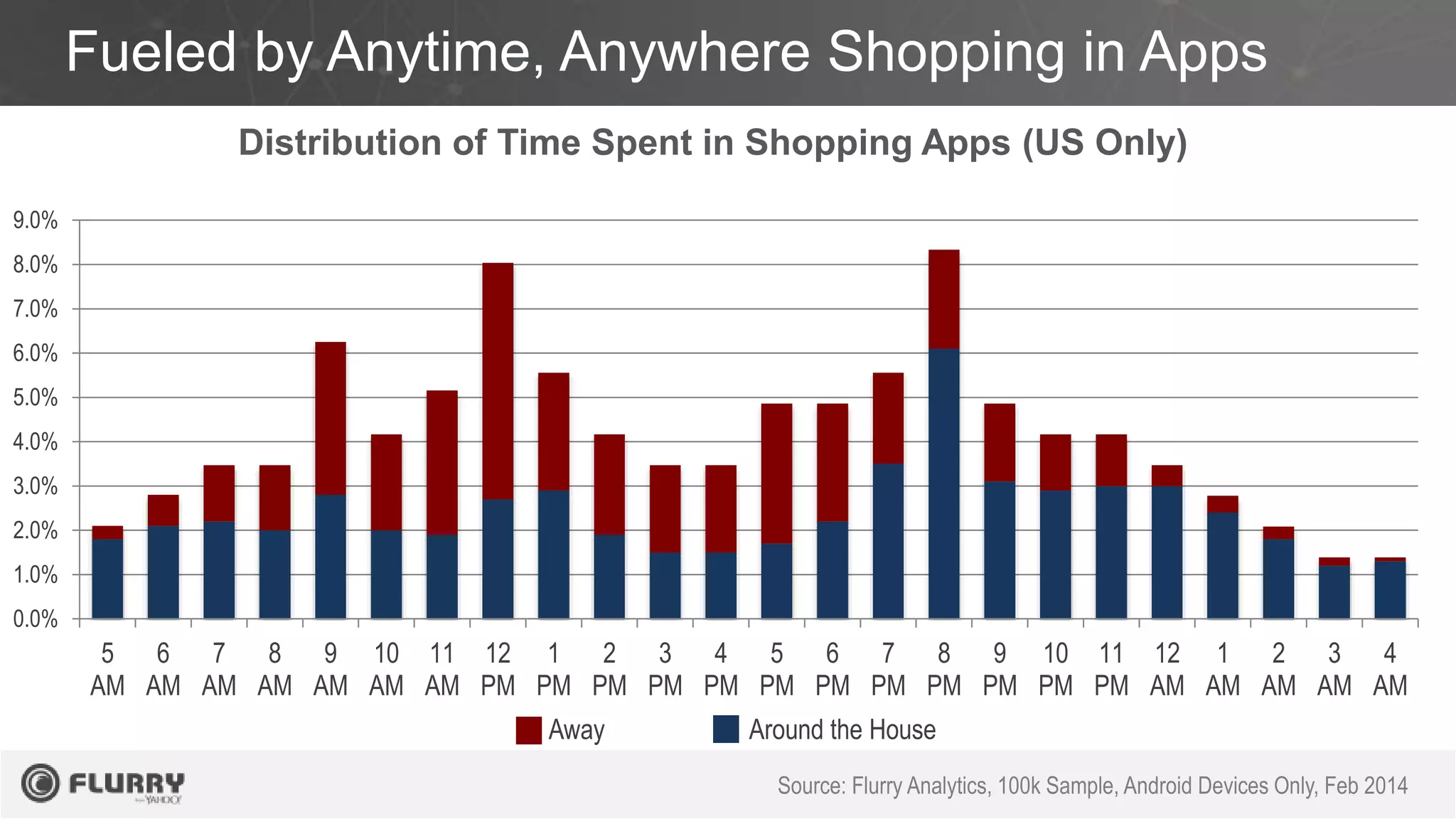

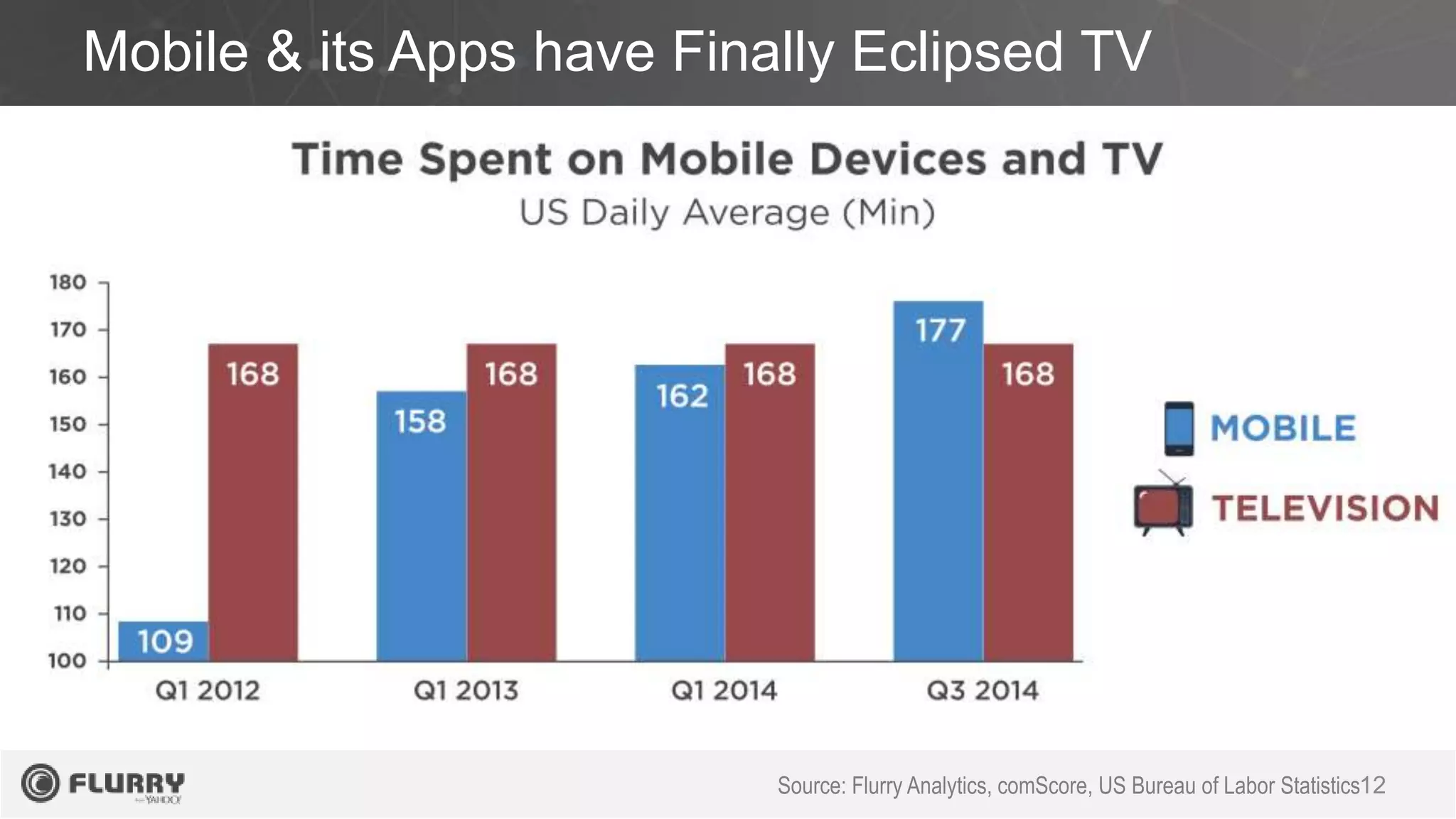

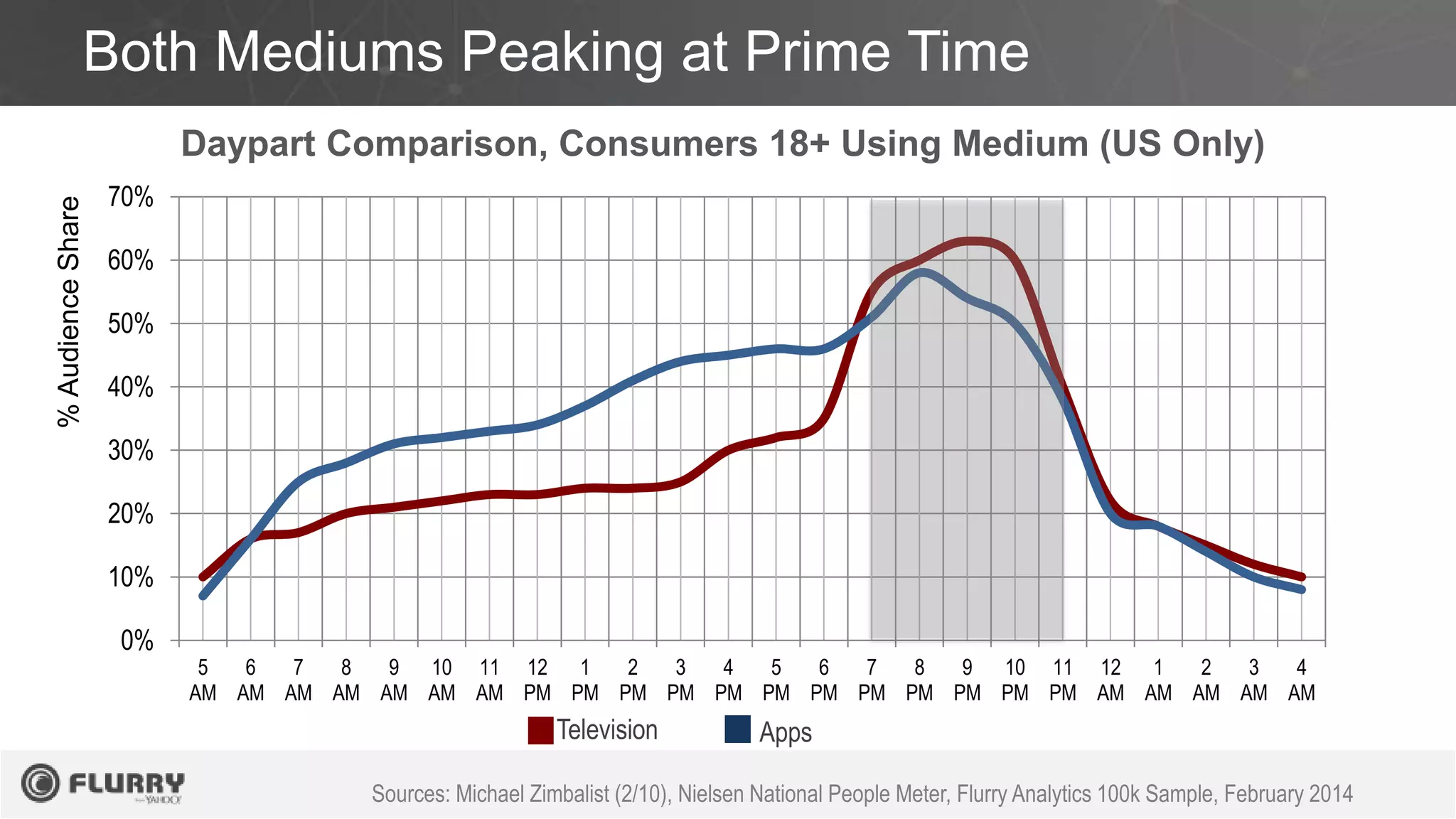

The document discusses the growth of mobile applications and their impact on various sectors from 2013 to 2014, highlighting a 76% year-over-year increase in mobile usage. Notably, messaging apps are emerging as significant competitors to traditional telecommunications. The rise in m-commerce sales indicates a shift towards mobile platforms for shopping and retail activities.