Market Data, November 2012

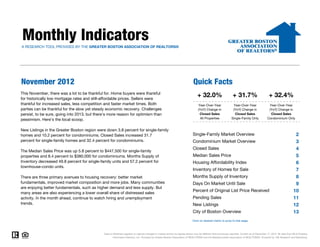

- 1. Monthly Indicators A RESEARCH TOOL PROVIDED BY THE GREATER BOSTON ASSOCIATION OF REALTORS® November 2012 Quick Facts This November, there was a lot to be thankful for. Home buyers were thankful for historically low mortgage rates and still-affordable prices. Sellers were + 32.0% + 31.7% + 32.4% thankful for increased sales, less competition and faster market times. Both Year-Over-Year Year-Over-Year Year-Over-Year parties can be thankful for the slow yet steady economic recovery. Challenges (YoY) Change in (YoY) Change in (YoY) Change in persist, to be sure, going into 2013, but there's more reason for optimism than Closed Sales Closed Sales Closed Sales pessimism. Here's the local scoop. All Properties Single-Family Only Condominium Only New Listings in the Greater Boston region were down 3.8 percent for single-family homes and 10.2 percent for condominiums. Closed Sales increased 31.7 Single-Family Market Overview 2 percent for single-family homes and 32.4 percent for condominiums. Condominium Market Overview 3 Closed Sales 4 The Median Sales Price was up 5.8 percent to $447,500 for single-family properties and 8.4 percent to $380,000 for condominiums. Months Supply of Median Sales Price 5 Inventory decreased 49.8 percent for single-family units and 57.2 percent for Housing Affordability Index 6 townhouse-condo units. Inventory of Homes for Sale 7 There are three primary avenues to housing recovery: better market Months Supply of Inventory 8 fundamentals, improved market composition and more jobs. Many communities Days On Market Until Sale 9 are enjoying better fundamentals, such as higher demand and less supply. But many areas are also experiencing a lower overall share of distressed sales Percent of Original List Price Received 10 activity. In the month ahead, continue to watch hiring and unemployment Pending Sales 11 trends. New Listings 12 City of Boston Overview 13 Click on desired metric to jump to that page. Data is refreshed regularly to capture changes in market activity so figures shown may be different than previously reported. Current as of December 17, 2012. All data from MLS Property Information Network, Inc. Provided by Greater Boston Association of REALTORS® and the Massachusetts Association of REALTORS®. Powered by 10K Research and Marketing.

- 2. Single-Family Market Overview Key market metrics for the current month and year-to-date figures for Single-Family Homes Only. Key Metrics Historical Sparklines Nov-2011 Nov-2012 +/– YTD 2011 YTD 2012 +/– Closed Sales 690 909 + 31.7% 8,324 10,043 + 20.7% 11-2009 11-2010 11-2011 11-2012 Median Sales Price $423,000 $447,500 + 5.8% $451,500 $456,500 + 1.1% 11-2009 11-2010 11-2011 11-2012 Housing Affordability Index 108 112 + 3.7% 102 110 + 7.8% 11-2009 11-2010 11-2011 11-2012 Inventory of Homes for Sale 4,601 3,042 - 33.9% -- -- -- 11-2009 11 2009 11-2010 11 2010 11-2011 11 2011 11-2012 11 2012 Months Supply of Inventory 6.7 3.3 - 49.8% -- -- -- 11-2009 11-2010 11-2011 11-2012 Days on Market Until Sale 110 90 - 18.0% 104 98 - 5.3% 11-2009 11-2010 11-2011 11-2012 Percent of Original 92.4% 94.6% + 2.4% 93.2% 94.4% + 1.3% List Price Received 11-2009 11-2010 11-2011 11-2012 Pending Sales 684 811 + 18.6% 8,612 10,500 + 21.9% 11-2009 11-2010 11-2011 11-2012 New Listings 682 656 - 3.8% 14,927 14,558 - 2.5% 11-2009 11-2010 11-2011 11-2012 All data from MLS Property Information Network, Inc. Provided by the Greater Boston Association of REALTORS® and the Massachusetts Association of REALTORS®. Powered by 10K Research and Marketing. | Click for Cover Page | 2

- 3. Condominium Market Overview Key market metrics for the current month and year-to-date figures for Condominium Properties Only. Key Metrics Historical Sparklines Nov-2011 Nov-2012 +/– YTD 2011 YTD 2012 +/– Closed Sales 562 744 + 32.4% 7,296 8,901 + 22.0% 11-2009 11-2010 11-2011 11-2012 Median Sales Price $350,500 $380,000 + 8.4% $360,000 $378,500 + 5.1% 11-2009 11-2010 11-2011 11-2012 Housing Affordability Index 128 129 + 1.4% 125 130 + 4.1% 11-2009 11-2010 11-2011 11-2012 Inventory of Homes for Sale 3,594 2,037 - 43.3% -- -- -- 11-2009 11 2009 11-2010 11 2010 11-2011 11 2011 11-2012 11 2012 Months Supply of Inventory 6.4 2.7 - 57.2% -- -- -- 11-2009 11-2010 11-2011 11-2012 Days on Market Until Sale 109 74 - 32.4% 104 87 - 16.7% 11-2009 11-2010 11-2011 11-2012 Percent of Original 93.8% 96.2% + 2.6% 94.0% 95.8% + 1.8% List Price Received 11-2009 11-2010 11-2011 11-2012 Pending Sales 564 666 + 18.1% 7,500 9,371 + 24.9% 11-2009 11-2010 11-2011 11-2012 New Listings 628 564 - 10.2% 13,260 12,194 - 8.0% 11-2009 11-2010 11-2011 11-2012 All data from MLS Property Information Network, Inc. Provided by the Greater Boston Association of REALTORS® and the Massachusetts Association of REALTORS®. Powered by 10K Research and Marketing. | Click for Cover Page | 3

- 4. Closed Sales A count of the actual sales that have closed in a given month. November Year to Date Single-Family YoY Change Condominium YoY Change Dec-2011 745 + 1.2% 645 - 1.5% 909 Jan-2012 526 + 12.6% 413 + 2.7% 10,043 Feb-2012 474 + 33.5% 385 + 12.2% 744 8,901 690 8,413 8,324 Mar-2012 657 + 16.5% 608 + 10.9% 634 7,651 Apr-2012 752 + 12.1% 759 + 19.7% 7,296 562 506 May-2012 1,017 + 20.4% 1,013 + 32.1% Jun-2012 1,529 + 21.4% 1,270 + 20.2% Jul-2012 1,293 + 25.4% 1,040 + 21.6% Aug-2012 1,316 + 26.7% 1,204 + 24.5% Sep-2012 772 - 1.5% 754 + 16.4% Oct-2012 798 + 28.9% 711 + 38.6% 2010 2011 2012 2010 2011 2012 2010 2011 2012 2010 2011 2012 Nov-2012 909 + 31.7% 744 + 32.4% +8.8% +31.7% +11.1% +32.4% -1.1% +20.7% -4.6% +22.0% Total 10,788 + 19.1% 9,546 + 20.1% Single-Family Condominium Single-Family Condominium Historical Closed Sales Activity Single-Family Condominium 1,800 1,600 1,400 1,200 1,000 800 600 400 200 Jan-2003 Jan-2004 Jan-2005 Jan-2006 Jan-2007 Jan-2008 Jan-2009 Jan-2010 Jan-2011 Jan-2012 All data from MLS Property Information Network, Inc. Provided by the Greater Boston Association of REALTORS® and the Massachusetts Association of REALTORS®. Powered by 10K Research and Marketing. | Click for Cover Page | 4

- 5. Median Sales Price Median price point for all closed sales, not accounting for seller concessions, in a given month. November Year to Date Single-Family YoY Change Condominium YoY Change Dec-2011 $440,000 + 1.1% $344,500 - 3.0% $443,500 $447,500 $450,000 $451,500 $456,500 Jan-2012 $405,000 - 9.0% $349,950 - 1.7% $423,000 Feb-2012 $391,875 + 3.4% $371,000 + 6.6% $378,200 $380,000 $378,500 $350,500 $349,000 $360,000 Mar-2012 $411,000 - 1.3% $340,000 + 4.8% Apr-2012 $414,850 - 3.3% $370,750 + 5.0% May-2012 $465,000 + 1.3% $381,000 + 4.4% Jun-2012 $500,000 - 0.2% $400,000 + 6.7% Jul-2012 $510,000 + 2.2% $387,000 + 6.3% Aug-2012 $489,450 - 1.9% $380,000 + 3.5% Sep-2012 $430,000 - 4.3% $375,000 + 2.0% Oct-2012 $429,000 + 10.0% $365,500 + 4.7% 2010 2011 2012 2010 2011 2012 2010 2011 2012 2010 2011 2012 Nov-2012 $447,500 + 5.8% $380,000 + 8.4% -4.6% +5.8% -7.3% +8.4% +0.3% +1.1% +3.2% +5.1% Median $455,000 + 1.1% $375,000 + 4.2% Single-Family Condominium Single-Family Condominium Historical Median Sales Price Single-Family Condominium $550,000 $500,000 $450,000 $400,000 $350,000 $300,000 $250,000 Jan-2003 Jan-2004 Jan-2005 Jan-2006 Jan-2007 Jan-2008 Jan-2009 Jan-2010 Jan-2011 Jan-2012 All data from MLS Property Information Network, Inc. Provided by the Greater Boston Association of REALTORS® and the Massachusetts Association of REALTORS®. Powered by 10K Research and Marketing. | Click for Cover Page | 5

- 6. Housing Affordability Index This index measures housing affordability for the region. An index of 120 means the median household income was 120% of what is necessary to qualify for the median-priced home under prevailing interest rates. A higher number means greater affordability. November Year to Date Single-Family YoY Change Condominium YoY Change 128 129 130 Dec-2011 104 + 5.9% 130 + 9.9% 121 125 112 113 Jan-2012 113 + 17.4% 129 + 9.3% 108 110 102 Feb-2012 119 + 7.9% 125 + 4.9% 98 97 Mar-2012 114 + 11.5% 135 + 5.6% Apr-2012 112 + 13.1% 124 + 4.8% May-2012 102 + 7.2% 122 + 4.2% Jun-2012 97 + 8.5% 118 + 1.9% Jul-2012 96 + 7.9% 124 + 3.9% Aug-2012 100 + 11.0% 127 + 5.5% Sep-2012 116 + 15.2% 131 + 8.5% Oct-2012 115 - 0.4% 133 + 4.2% 2010 2011 2012 2010 2011 2012 2010 2011 2012 2010 2011 2012 Nov-2012 112 + 3.7% 129 + 1.4% +10.0% +3.7% +12.8% +1.4% +5.3% +7.8% +3.0% +4.1% Average 108 +9.1% 127 +5.3% Single-Family Condominium Single-Family Condominium Historical Housing Affordability Index Single-Family Condominium 140 130 120 110 100 90 80 70 60 Jan-2004 Jan-2005 Jan-2006 Jan-2007 Jan-2008 Jan-2009 Jan-2010 Jan-2011 Jan-2012 All data from MLS Property Information Network, Inc. Provided by the Greater Boston Association of REALTORS® and the Massachusetts Association of REALTORS®. Powered by 10K Research and Marketing. | Click for Cover Page | 6

- 7. Inventory of Homes for Sale The number of properties available for sale in active status at the end of a given month. November Single-Family YoY Change Condominium YoY Change Dec-2011 3,657 - 2.8% 2,814 - 20.6% 4,760 4,601 4,543 Jan-2012 3,693 - 2.7% 2,973 - 19.2% Feb-2012 4,082 + 6.4% 3,262 - 16.7% 3,594 Mar-2012 4,701 + 1.6% 3,690 - 21.3% 3,042 Apr-2012 5,043 - 5.2% 3,843 - 25.9% May-2012 5,144 - 10.2% 3,652 - 30.1% Jun-2012 4,814 - 15.9% 3,359 - 34.1% 2,037 Jul-2012 4,366 - 22.0% 3,076 - 34.8% Aug-2012 3,974 - 26.0% 2,651 - 37.1% Sep-2012 4,155 - 26.3% 2,755 - 36.3% Oct-2012 3,784 - 30.2% 2,490 - 39.2% 2010 2011 2012 2010 2011 2012 Nov-2012 3,042 - 33.9% 2,037 - 43.3% -3.3% -33.9% -20.9% -43.3% Average 4,205 - 15.1% 3,050 - 30.0% Single-Family Condominium Historical Inventory of Homes for Sale Single-Family Condominium 9,000 8,000 7,000 6,000 5,000 4,000 3,000 2,000 Jan-2003 Jan-2004 Jan-2005 Jan-2006 Jan-2007 Jan-2008 Jan-2009 Jan-2010 Jan-2011 Jan-2012 All data from MLS Property Information Network, Inc. Provided by the Greater Boston Association of REALTORS® and the Massachusetts Association of REALTORS®. Powered by 10K Research and Marketing. | Click for Cover Page | 7

- 8. Months Supply of Inventory The inventory of homes for sale at the end of a given month, divided by the average monthly pending sales from the last 12 months. November Single-Family YoY Change Condominium YoY Change 9.0 Dec-2011 4.9 - 4.0% 4.4 - 19.4% Jan-2012 7.0 - 13.6% 7.2 - 21.4% 7.5 Feb-2012 8.6 - 20.3% 8.5 - 25.8% 6.7 6.4 Mar-2012 7.2 - 12.7% 6.1 - 29.1% Apr-2012 6.7 - 15.4% 5.1 - 38.1% May-2012 5.1 - 25.4% 3.6 - 47.1% Jun-2012 3.1 - 30.8% 2.6 - 45.2% 3.3 Jul-2012 3.4 - 37.8% 3.0 - 46.4% 2.7 Aug-2012 3.0 - 41.6% 2.2 - 49.5% Sep-2012 5.4 - 25.2% 3.7 - 45.3% Oct-2012 4.7 - 45.8% 3.5 - 56.1% 2010 2011 2012 2010 2011 2012 Nov-2012 3.3 - 49.8% 2.7 - 57.2% -11.2% -49.8% -28.8% -57.2% Average 5.2 - 22.3% 4.3 - 35.0% Single-Family Condominium Historical Months Supply of Inventory Single-Family Condominium 14 12 10 8 6 4 2 Jan-2004 Jan-2005 Jan-2006 Jan-2007 Jan-2008 Jan-2009 Jan-2010 Jan-2011 Jan-2012 All data from MLS Property Information Network, Inc. Provided by the Greater Boston Association of REALTORS® and the Massachusetts Association of REALTORS®. Powered by 10K Research and Marketing. | Click for Cover Page | 8

- 9. Days on Market Until Sale Average number of days between when a property is listed and when an offer is accepted in a given month. November Year to Date Single-Family YoY Change Condominium YoY Change Dec-2011 112 - 0.3% 120 + 11.8% 110 109 Jan-2012 130 + 15.0% 124 - 5.1% 105 104 104 102 102 98 Feb-2012 134 + 2.9% 123 - 9.8% 94 90 87 Mar-2012 131 - 3.1% 118 - 4.2% 74 Apr-2012 120 - 1.4% 98 - 16.9% May-2012 96 - 6.4% 86 - 12.0% Jun-2012 90 - 0.1% 75 - 19.5% Jul-2012 81 - 4.5% 71 - 20.7% Aug-2012 88 - 5.4% 76 - 18.3% Sep-2012 89 - 12.2% 85 - 18.0% Oct-2012 91 - 16.4% 83 - 12.3% 2010 2011 2012 2010 2011 2012 2010 2011 2012 2010 2011 2012 Nov-2012 90 - 18.0% 74 - 32.4% +4.1% -18.0% +7.7% -32.4% +10.6% -5.3% +2.5% -16.7% Total 99 - 5.0% 82 - 13.3% Single-Family Condominium Single-Family Condominium Historical Days on Market Until Sale Single-Family Condominium 160 140 120 100 80 60 40 Jan-2003 Jan-2004 Jan-2005 Jan-2006 Jan-2007 Jan-2008 Jan-2009 Jan-2010 Jan-2011 Jan-2012 All data from MLS Property Information Network, Inc. Provided by the Greater Boston Association of REALTORS® and the Massachusetts Association of REALTORS®. Powered by 10K Research and Marketing. | Click for Cover Page | 9

- 10. Percent of Original List Price Received Percentage found when dividing a property’s sales price by its original list price, then taking the average for all properties sold in a given month, not accounting for seller concessions. November Year to Date Single-Family YoY Change Condominium YoY Change Dec-2011 92.1% + 1.0% 93.0% + 0.1% Jan-2012 90.5% - 0.4% 92.8% + 0.5% 94.0% 93.8% 96.2% 94.5% 94.0% 95.8% Feb-2012 91.2% + 0.3% 93.4% + 1.5% 92.7% 92.4% 94.6% 93.8% 93.2% 94.4% Mar-2012 93.0% + 0.8% 94.0% + 0.9% Apr-2012 93.5% + 0.9% 95.7% + 2.0% May-2012 95.4% + 1.2% 96.1% + 1.0% Jun-2012 95.3% + 0.8% 96.3% + 1.7% Jul-2012 95.7% + 1.5% 96.6% + 1.7% Aug-2012 94.8% + 1.5% 96.2% + 2.2% Sep-2012 94.5% + 1.5% 96.4% + 2.4% Oct-2012 94.3% + 2.8% 95.9% + 2.4% 2010 2011 2012 2010 2011 2012 2010 2011 2012 2010 2011 2012 Nov-2012 94.6% + 2.4% 96.2% + 2.6% -0.3% +2.4% -0.2% +2.6% -0.7% +1.3% -0.5% +1.8% Average 94.2% + 1.3% 95.6% + 1.7% Single-Family Condominium Single-Family Condominium Historical Percent of Original List Price Received Single-Family Condominium 99% 98% 97% 96% 95% 94% 93% 92% 91% 90% 89% Jan-2003 Jan-2004 Jan-2005 Jan-2006 Jan-2007 Jan-2008 Jan-2009 Jan-2010 Jan-2011 Jan-2012 All data from MLS Property Information Network, Inc. Provided by the Greater Boston Association of REALTORS® and the Massachusetts Association of REALTORS®. Powered by 10K Research and Marketing. | Click for Cover Page | 10

- 11. Pending Sales A count of the properties in UAG status between the first and last day in a given month, regardless of current status (based on Off Market Date). November Year to Date Single-Family YoY Change Condominium YoY Change Dec-2011 570 + 5.2% 471 + 6.6% 811 10,500 Jan-2012 545 + 26.5% 484 + 18.6% 9,371 Feb-2012 652 + 23.3% 636 + 24.2% 684 666 8,591 8,612 Mar-2012 994 + 24.6% 1,013 + 32.4% 586 576 564 7,759 7,500 Apr-2012 1,154 + 21.9% 1,049 + 24.3% May-2012 1,338 + 23.0% 1,269 + 28.7% Jun-2012 1,272 + 13.7% 1,047 + 19.5% Jul-2012 1,057 + 26.6% 838 + 9.7% Aug-2012 913 + 18.1% 825 + 23.1% Sep-2012 859 + 29.4% 720 + 39.0% Oct-2012 905 + 21.6% 824 + 39.0% 2010 2011 2012 2010 2011 2012 2010 2011 2012 2010 2011 2012 Nov-2012 811 + 18.6% 666 + 18.1% +16.7% +18.6% -2.1% +18.1% +0.2% +21.9% -3.3% +24.9% Total 11,070 + 20.9% 9,842 + 23.9% Single-Family Condominium Single-Family Condominium Historical Pending Sales Activity Single-Family Condominium 1,400 1,200 1,000 800 600 400 200 Jan-2003 Jan-2004 Jan-2005 Jan-2006 Jan-2007 Jan-2008 Jan-2009 Jan-2010 Jan-2011 Jan-2012 All data from MLS Property Information Network, Inc. Provided by the Greater Boston Association of REALTORS® and the Massachusetts Association of REALTORS®. Powered by 10K Research and Marketing. | Click for Cover Page | 11

- 12. New Listings A count of the properties that have been newly listed on the market in a given month. November Year to Date Single-Family YoY Change Condominium YoY Change Dec-2011 459 + 6.0% 389 - 20.4% 746 712 Jan-2012 975 + 14.4% 958 - 1.8% 682 15,426 14,927 15,448 656 14,558 Feb-2012 1,336 + 51.3% 1,145 + 5.8% 628 13,260 Mar-2012 2,023 1,741 564 + 3.1% - 12.0% 12,194 Apr-2012 1,812 - 9.3% 1,504 - 13.1% May-2012 1,810 - 4.1% 1,391 - 7.5% Jun-2012 1,371 - 15.2% 1,155 - 14.1% Jul-2012 1,036 - 13.1% 905 - 7.6% Aug-2012 1,012 - 8.5% 792 - 7.4% Sep-2012 1,440 - 9.4% 1,156 - 9.8% Oct-2012 1,087 - 6.2% 883 - 2.1% 2010 2011 2012 2010 2011 2012 2010 2011 2012 2010 2011 2012 Nov-2012 656 - 3.8% 564 - 10.2% -8.6% -3.8% -11.8% -10.2% -3.2% -2.5% -14.2% -8.0% Total 15,017 - 2.2% 12,583 - 8.5% Single-Family Condominium Single-Family Condominium Historical New Listing Activity Single-Family Condominium 2,750 2,500 2,250 2,000 1,750 1,500 1,250 1,000 750 500 250 Jan-2003 Jan-2004 Jan-2005 Jan-2006 Jan-2007 Jan-2008 Jan-2009 Jan-2010 Jan-2011 Jan-2012 All data from MLS Property Information Network, Inc. Provided by the Greater Boston Association of REALTORS® and the Massachusetts Association of REALTORS®. Powered by 10K Research and Marketing. | Click for Cover Page | 12

- 13. City of Boston – Market Overview Key market metrics for the current month and year-to-date figures for the City of Boston. Key Metrics Historical Sparklines Nov-2011 Nov-2012 +/– YTD 2011 YTD 2012 +/– Closed Sales 327 436 + 33.3% 4,031 5,007 + 24.2% 11-2009 11-2010 11-2011 11-2012 Median Sales Price $376,750 $400,000 + 6.2% $375,000 $400,000 + 6.7% 11-2009 11-2010 11-2011 11-2012 Housing Affordability Index 108 112 + 3.7% 102 110 + 7.8% 11-2009 11-2010 11-2011 11-2012 Inventory of Homes for Sale 1,883 959 - 49.1% -- -- -- 11-2009 11 2009 11-2010 11 2010 11-2011 11 2011 11-2012 11 2012 Months Supply of Inventory 5.8 2.2 - 61.8% -- -- -- 11-2009 11-2010 11-2011 11-2012 Days on Market Until Sale 108 69 - 36.1% 100 82 - 17.9% 11-2009 11-2010 11-2011 11-2012 Percent of Original 93.4% 96.0% + 2.7% 93.8% 95.6% + 1.9% List Price Received 11-2009 11-2010 11-2011 11-2012 Pending Sales 325 411 + 26.5% 4,174 5,261 + 26.0% 11-2009 11-2010 11-2011 11-2012 New Listings 347 299 - 13.8% 7,482 6,856 - 8.4% 11-2009 11-2010 11-2011 11-2012 All data from MLS Property Information Network, Inc. Provided by the Greater Boston Association of REALTORS® and the Massachusetts Association of REALTORS®. Powered by 10K Research and Marketing. | Click for Cover Page | 13