More Related Content

Similar to 2059 2011 11_07_c_tw

Similar to 2059 2011 11_07_c_tw (20)

2059 2011 11_07_c_tw

- 1. f

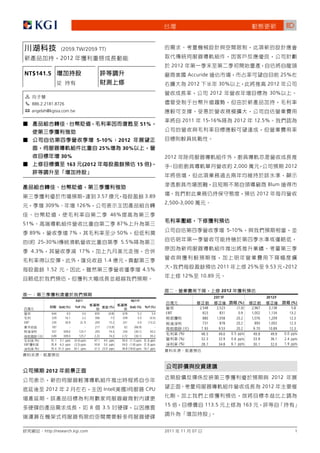

(2059.TW/2059 TT)

2012

2012

NT$141.5 Accuride 25%

2012 30% 2012

2012 30%

1

2 886.2.2181.8726

3 angelah@kgisia.com.tw

2011 15-16% 2012 12.5%

51%

5-10% 2012

25% 30%

30% 2012

163 (2012 15 ) 2,000 2012

Blum

2012

3.57 3.89

2,500-3,000

309% 126%

46%

51% 87%

5-10%

89% 7% 50%

( 25-30%) 5.5%

4.3% 17%

1.4

2011 25% 9.53 2012

1.52 4.5%

12% 10.89

2012

2011F 2012F

3Q11 4Q11F

(%) (%)

QoQ (%) YoY (%) (%) QoQ (%) YoY (%) 2,548 2,523 (1.0) 2,967 3,138 5.8

644 4.5 3.0 650 (0.8) 678 5.2 5.4 EBIT 823 831 0.9 1,002 1,134 13.2

329 16.1 2.2 306 7.5 339 3.0 (4.5) 880 1,058 20.2 1,076 1,209 12.3

EBIT 230 26.9 (3.7) 200 15.2 231 0.0 (13.2) 731 878 20.2 893 1,003 12.3

187 - - 217 (13.9) 62 (66.9) -

( ) 7.93 9.53 20.2 9.70 10.89 12.3

357 309.0 125.7 205 74.3 250 (30.1) 93.2

(%) 48.5 49.0 0.5 ppts 49.8 49.9 0.0 ppts

( ) 3.89 309.0 125.7 2.23 74.3 2.72 (30.1) 93.2

(%) 51.1 5.1 ppts (0.4) ppts 47.1 4.0 ppts 50.0 (1.1) ppts (5.2) ppts (%) 32.3 32.9 0.6 ppts 33.8 36.1 2.4 ppts

EBIT 35.8 6.3 ppts (2.5) ppts 30.8 5.0 ppts 34.0 (1.8) ppts (7.3) ppts (%) 28.7 34.8 6.1 ppts 30.1 32.0 1.9 ppts

(%) 55.4 41.3 ppts 30.1 ppts 31.5 23.9 ppts 36.8 (18.6) ppts 16.7 ppts

2012

2012

2012

2012 2 Intel( ) CPU

15 113.5 163

8 3.5

http://research.kgi.com 2011 11 07 1

- 2. F

(

12 31

)

( ) ( ) ( ) ( ) ( ) ( )

2009A 2,175 1,123 775 648 7.13 7.64

2010A 2,551 1,327 953 704 7.66 8.22

2011F 2,523 1,237 831 878 9.53 10.23

2012F 3,138 1,565 1,134 1,003 10.89 11.69

(

12 31 EV/sales EV/EBITDA EV/Inv. C

)

(x) (x) (x) (x) (x) (%)

2009A 5.4 13.7 19.8 18.5 2.5 22.0

2010A 4.5 10.8 18.5 17.2 2.3 20.7

2011F 4.4 11.6 14.8 13.8 2.0 22.8

2012F 3.4 8.3 13.0 12.1 1.7 22.9

52 ( / ): 98 - 151.4

12 ( ) 163.0 ( / ): 13.0/433

/ (%) 15.2 ( ): 92

(percentile, %) 57 ( ): 92

-12/11 (%) 3.9 ( ): 4

-12/11 (NT$) 44.9 3 ( ): 0.5

-12/11 (x) 3.2 % (3,6,12 ) 16.9; 6.2; 3.6

-12/11 (%) % (3,6,12 ) 14.9; 25.7; 14.6

:

1Q11A 2Q11A 3Q11A 4Q11F 1Q12F 2Q12F 3Q12F 4Q12F 2011F 2012F

(NT$ )

583 617 644 678 651 703 830 954 2,523 3,138

298 334 315 339 332 359 415 467 1,285 1,573

286 283 329 339 319 344 415 487 1,237 1,565

97 102 99 108 102 102 108 119 406 431

188 182 230 231 217 243 307 367 831 1,134

30 31 32 28 38 38 38 38 120 150

1 1 1 0 1 1 1 1 3 3

EBITDA 219 214 263 259 255 281 345 406 954 1,287

3 3 4 6 4 4 4 4 15 18

0 0 0 0 0 0 0 0 0 0

29 (38) 192 67 25 25 25 25 250 100

31 (35) 196 73 29 29 29 29 265 118

9 9 9 12 11 11 11 11 39 43

9 9 9 12 11 11 11 11 39 43

211 137 417 292 236 261 326 386 1,058 1,209

( ) 27 50 60 43 51 51 51 51 180 206

184 87 357 250 184 210 274 335 878 1,003

0 0 0 0 0 0 0 0 0 0

184 87 357 250 184 210 274 335 878 1,003

EPS 2.29 1.49 4.54 3.18 2.56 2.84 3.54 4.20 11.48 13.12

EPS 2.00 0.95 3.89 2.72 2.00 2.28 2.98 3.64 9.53 10.89

(%)

49.0 45.9 51.1 50.0 49.0 49.0 50.0 51.0 49.0 49.9

32.3 29.4 35.8 34.0 33.3 34.5 37.0 38.5 32.9 36.1

EBITDA Margin 37.5 34.6 40.8 38.1 39.2 39.9 41.6 42.5 37.8 41.0

36.1 22.3 64.8 43.1 36.2 37.2 39.3 40.5 41.9 38.5

31.5 14.2 55.4 36.8 28.3 29.9 33.1 35.1 34.8 32.0

(%)

(9.4) 5.8 4.5 5.2 (4.0) 8.0 18.0 15.0 (1.1) 24.4

(19.5) (0.8) 16.1 3.0 (5.9) 8.0 20.4 17.3 (6.7) 26.5

(29.0) (3.6) 26.9 0.0 (6.0) 11.9 26.6 19.7 (12.8) 36.4

EBITDA (25.8) (2.3) 23.2 (1.7) (1.4) 10.1 22.9 17.5 (10.0) 34.9

36.0 (34.7) 203.7 (29.9) (19.4) 10.9 24.6 18.5 23.6 14.3

42.0 (52.4) 309.0 (30.1) (26.2) 14.0 30.7 22.0 24.6 14.3

http://research.kgi.com 2011 11 07 2

- 3. f

2012

1986

2001 3.89

2005

2.98

48% 2.72

2.28

2007 2.00 2.00

2008 1.41

0.95

4Q10 1Q11 2Q11 3Q11 4Q11F 1Q12F 2Q12F 3Q12F

|1| 85 20

80

5 10

7 75

8 70 0

65

60 (10)

55

(20)

79 50

45 (30)

Nov-10 Jan-11 Mar-11 May-11 Jul-11 Sep-11 Nov-11

2012

900 24.0x 21.3x 18.6x

200

800

700 15.9x

160

600

13.2x

500

120

400 10.5x

300

80 7.8x

200

100

0 40

4Q10 1Q11 2Q11 3Q11 4Q11F 1Q12F 2Q12F 3Q12F 2007 2008 2009 2010 2011

2012

55.2 6.5x 5.7x 4.9x

200 4.1x

51.1

50.0 50.0 160 3.3x

49.0 49.0 49.0

2.5x

45.9 120

1.7x

80

40

4Q10 1Q11 2Q11 3Q11 4Q11F 1Q12F 2Q12F 3Q12F 2007 2008 2009 2010 2011

http://research.kgi.com 2011 11 07 3

- 4. f

12 31 ( ) 2008A 2009A 2010A 2011F 2012F 12 31 ( ) 2008A 2009A 2010A 2011F 2012F

4,126 5,199 5,401 6,083 6,826 2,561 2,175 2,551 2,523 3,138

2,733 3,571 3,745 4,333 5,046 1,323 1,051 1,224 1,285 1,573

1,842 2,669 2,857 3,314 3,883 1,238 1,123 1,327 1,237 1,565

342 270 310 321 315

323 349 374 406 431

485 562 504 622 774

916 775 953 831 1,134

64 69 74 75 75

7 (16) (26) (23) (25)

1,394 1,628 1,656 1,750 1,780

0 0 0 0 0 32 11 10 15 18

1,384 1,618 1,643 1,740 1,770 25 27 36 39 43

9 10 12 10 10 0 0 0 0 0

1,469 1,968 1,827 1,945 2,192 35 53 (71) 250 100

555 1,480 520 625 686 0 0 0 0 0

167 195 166 229 280 958 812 856 1,058 1,209

86 956 7 66 76 172 164 151 180 206

303 329 347 330 330 786 648 704 878 1,003

914 488 1,306 1,319 1,506 EBITDA 991 851 1,060 954 1,287

866 435 1,251 1,259 1,441

( ) 8.70 7.13 7.66 9.53 10.89

49 53 56 60 65

2,657 3,231 3,574 4,138 4,635

785 871 921 921 921

136 289 361 361 361

1,736 2,070 2,292 2,856 3,353

0 0 0 0 0 12 31 ( ) 2008A 2009A 2010A 2011F 2012F

887 768 814 916 1,063

786 648 704 878 1,003

75 76 107 123 153

26 44 3 (84) (94)

12 31 ( ) 2008A 2009A 2010A 2011F 2012F 0 0 0 0 0

(% ) (420) (310) (135) (217) (183)

28.0 (15.1) 17.3 (1.1) 24.4 (420) (307) (131) (216) (180)

26.0 (15.4) 23.1 (12.8) 36.4 0 0 0 0 0

EBITDA 23.3 (14.1) 24.7 (10.0) 34.9 0 (3) (4) (1) (3)

18.8 (17.5) 8.6 24.6 14.3

Free Cash Flow 467 458 679 699 880

18.0 (18.1) 7.5 24.4 14.3

(%)

(202) 370 (492) (242) (311)

48.3 51.6 52.0 49.0 49.9 (288) (74) (361) (314) (507)

35.7 35.6 37.4 32.9 36.1 88 440 (133) 68 191

EBITDA 38.7 39.1 41.6 37.8 41.0 (2) 4 3 4 5

30.7 29.8 27.6 34.8 32.0 266 827 188 457 569

20.3 13.9 13.3 15.3 15.5

32.7 22.0 20.7 22.8 22.9

/

(%) 35.8 43.1 35.2 32.0 32.7

(%) Net cash Net cash Net cash Net cash Net cash ROIC (Return on Invested Capital)

(X) 39.2 31.6 24.8 28.3 29.4 12 31 1- + + =

(X) 8.9 0.9 20.6 10.4 10.6

Cash Flow Int. Coverage (X) 35.4 29.0 22.6 23.6 24.9 2008A 48.7% 2.9% 12.6% 35.7%

Cash Flow/Int. & ST Debt (X) 8.0 0.8 18.8 8.7 9.0 2009A 44.9% 3.5% 16.0% 35.6%

(X) 4.9 2.4 7.2 6.9 7.4 2010A 43.8% 4.2% 14.7% 37.4%

2011F 46.1% 4.9% 16.1% 32.9%

(X) 4.3 2.2 6.6 6.4 6.9

2012F 45.2% 4.9% 13.7% 36.1%

(NT$ ) (831) (1,084) (1,438) (1,794) (2,178)

(NT$ ) 12 31 1/ + + =

8.70 7.13 7.66 9.53 10.89

2008A 0.2 0.5 0.0 1.3

9.53 7.96 8.83 10.87 12.56 2009A 0.2 0.7 0.0 1.0

29.33 35.31 38.80 44.92 50.31 2010A 0.2 0.6 0.0 1.2

28.27 23.77 27.69 27.39 34.06 2011F 0.2 0.7 0.0 1.1

EBITDA/shr 10.14 8.52 10.37 9.02 12.30 2012F 0.2 0.6 0.0 1.3

4.00 3.60 3.41 5.50 6.00 12 31 x x 1- = ROIC

2008A 35.7% 1.3 82.1% 38.7%

(X) 0.7 0.5 0.5 0.4 0.5 2009A 35.6% 1.0 79.8% 29.2%

69.1 94.4 72.1 90.0 90.0 2010A 37.4% 1.2 82.3% 36.4%

48.7 45.4 44.3 46.5 36.6 2011F 32.9% 1.1 83.0% 29.5%

23.7 32.7 23.7 33.1 32.6 2012F 36.1% 1.3 83.0% 37.8%

94.1 107.1 92.7 103.4 94.0

http://research.kgi.com 2011 11 07 4

- 5. f

250

200

150

100

50

0

Nov-08 Feb-09 May-09 Aug-09 Nov-09 Feb-10 May-10 Aug-10 Nov-10 Feb-11 May-11 Aug-11 Nov-11

:

( )

07-Nov-11 141.5 113.5 163.0

01-Sep-11 104.5 133.0 113.5

28-Jun-11 120.5 188.0 133.0

29-Sep-10 156 193.0 188.0

26-Jan-10 174.5 187.0 193.0

23-Sep-09 189 110.5 187.0

01-Jul-09 105.5 136.7 110.5

07-May-09 124 128.0 136.7

16-Feb-09 97.8 100.0 128.0

27-Nov-08 85.5 132.0 100.0

13-Oct-08 102.5 240.0 132.0

http://research.kgi.com 2011 11 07 5

- 6. 100 A 1907-1909 104 700

200051 886.2.2181.8888

886.2.8501.1691

2014 A 24D1

518008

852.2878.6888 8th - 11th floors, Asia Centre Building

852.2878.6800 173 South Sathorn Road, Bangkok 10120, Thailand

66.2658.8888

66.2658.8014

(OP) (Excessive Return)

( ) 40%

(N) ( )

40% 40%

(U) ( )

40%

(NR)

(R ) /

* =( / )–1

http://research.kgi.com 2011 11 07 6