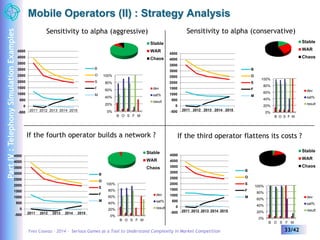

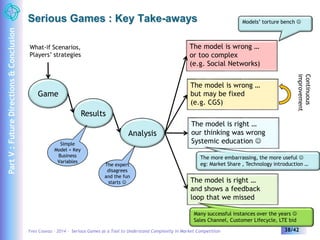

The document discusses the use of serious games and evolutionary game theory to navigate the complexities of market competition, emphasizing the inadequacies of traditional forecasting tools in complex environments. It outlines the development of a game-theoretical evolutionary simulation platform (GTES) to understand interactions in markets like smart grids and telephony, incorporating strategies for various players such as regulators, suppliers, and operators. The platform allows for scenario simulations that aid in strategic decision-making amid uncertainties and dynamic market conditions.

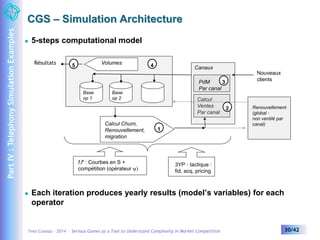

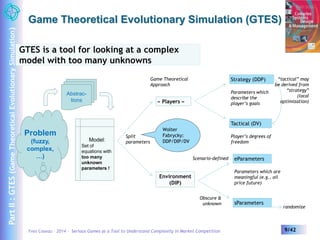

![Sampling

Monte-Carlo

The uncertainty regarding the environment parameters

e is handled through randomization

Each parameter from E is drawn between an min/max

Example: a [1.0, 3.0]

Scenarios

Are used to implement « what-if » analysis (though e)

Boundaries for Monte-Carlo sampling

Experiences

Sample Size x Scenario x Strategies

For each sample, we search for a NE through

a fixed number of iterations

Result is a triplet

Classification (% of stable, war, chaos)

Typical values of key “business” status variable

(mean + confidence intervals)

Stability metric (rate of convergence,

9000

8000

7000

6000

5000

4000

3000

2000

1000

0

1

18

35

52

69

86

103

120

137

154

171

188

205

222

239

256

273

290

7000

6000

5000

4000

3000

2000

1000

0

1

35

69

103

137

171

205

239

273

307

341

375

409

443

477

511

545

579

7000

6000

5000

4000

3000

2000

1000

standard deviation ratios) 0

1

37

73

109

145

181

217

253

289

325

361

397

433

469

505

541

577

Yves Caseau – 2014 – Serious Games as a Tool to Understand Complexity in Market Competition 13/42

Part II : GTES (Game Theoretical Evolutionary Simulation)

stable

chaos

?](https://image.slidesharecdn.com/gtes-utc2014-141127235747-conversion-gate02/85/GTES-UTC-2014-13-320.jpg)

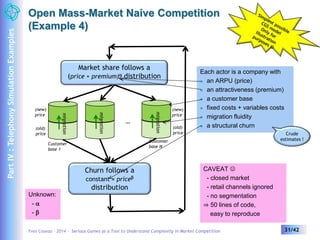

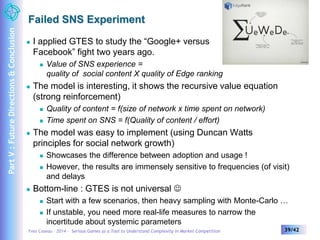

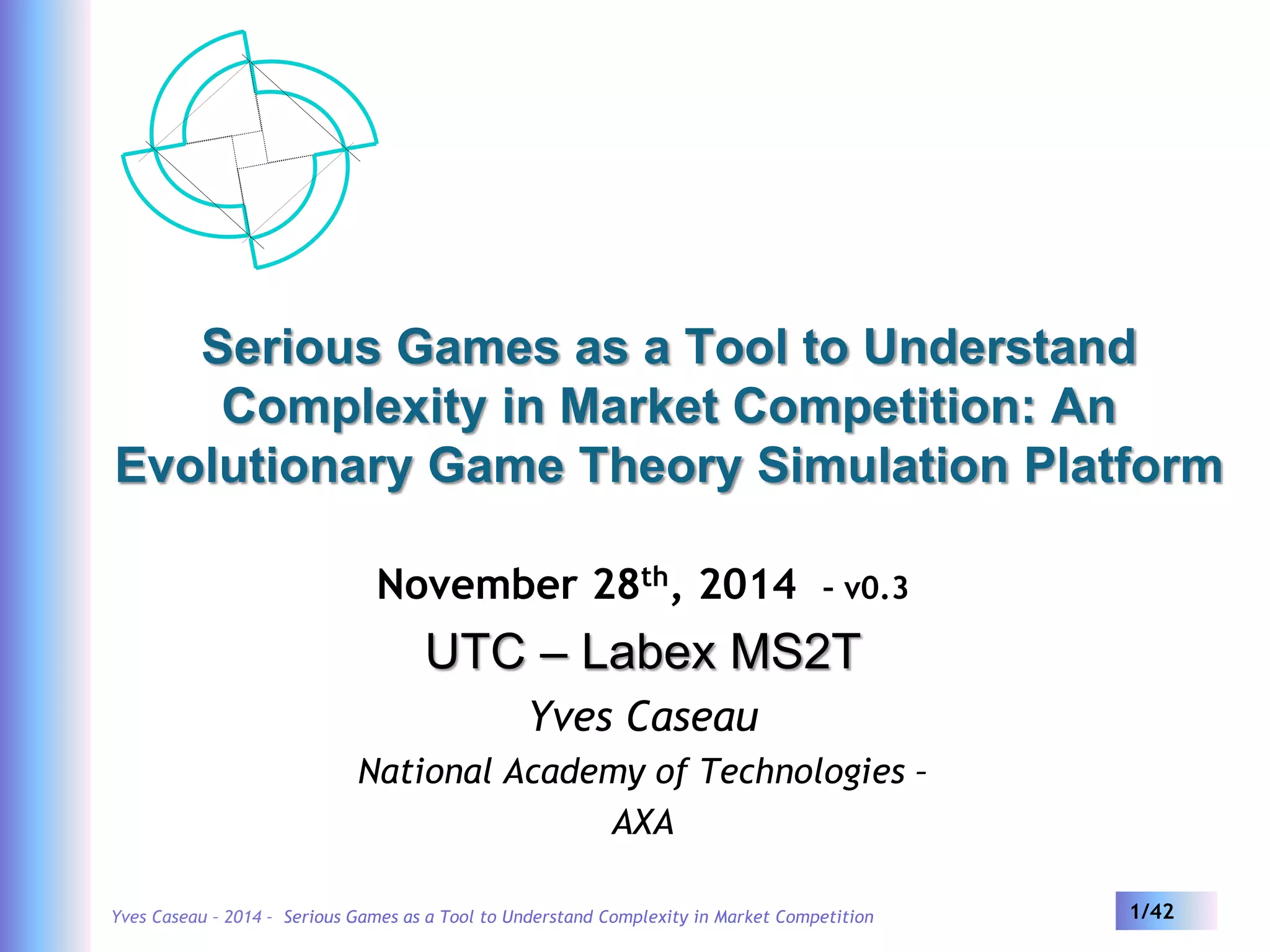

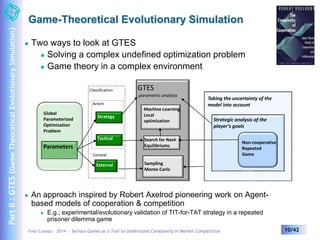

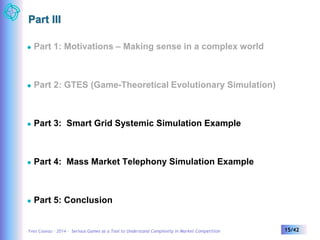

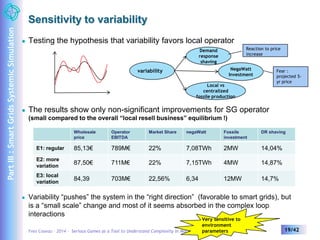

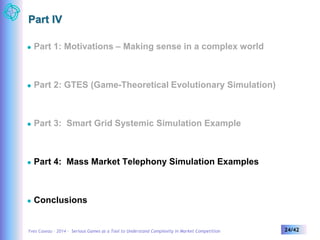

![Carbon Tax, Green Power and Storage Cost

E1

Reference

S3:

CO2 tax

S3a CO2 tax

+ solar

S4 = S3a +cheap

storage

S6 cheap

Solar (100€/MWh)

Carbon Tax

Wholesale

price

Operator

income

Market

Share

Solar

Investment

Storage

Investment

NegaWatt DR

84,12€ 862M€ 21,8% 0MW 0MW 7,3TWh 14,3% 35,8Mt

93,7€ 1106M€ 19,8% 0MW 0MW 9,37TWh 14,5% 24.7Mt

92,3€ 1006M€ 18,8% 1670MW 6,8MW 8,63TWh 14,8% 25.4Mt

87.8€ 992M€ 21% 416MW 50MW 7,7TWh 15,25% 29.3Mt

83,57€ 786M€ 21,7% 2461MW 0MW 6,9TWh 14,2% 35.7Mt

Does not help: reinforces the advantage of nuclear energy

shaving

Carbon tax to Solar subsidy: positive (PV industry ) but marginal

Green Power : still too expensive …

(all economic parameters drawn from Web search – orders of magnitude)

Storage Cost

Local optimization finds the optimal buffer/reserve ratio & when to buy/sell

Efficiency = average difference (buy/sell) price -> depend on price structure !

Yields a price threshold at [50% to 100%] of wholesale price

Resilience (e.g., Japan) or co-usage (electric car) is not factored in

Total

CO2

Yves Caseau – 2014 – Serious Games as a Tool to Understand Complexity in Market Competition 20/42

Part III : Smart Grids Systemic Simulation](https://image.slidesharecdn.com/gtes-utc2014-141127235747-conversion-gate02/85/GTES-UTC-2014-20-320.jpg)

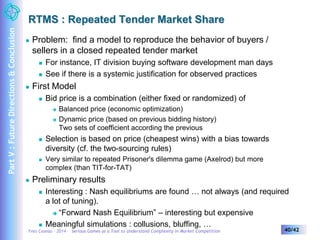

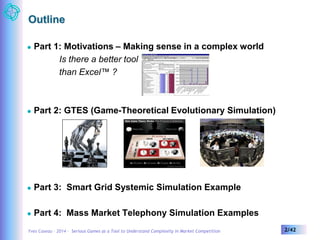

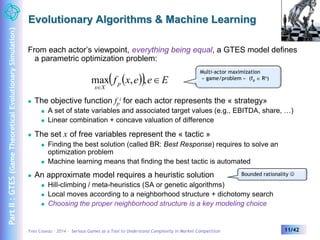

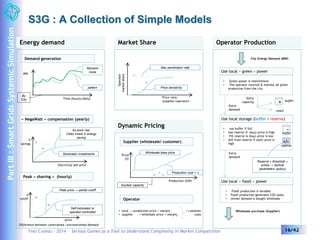

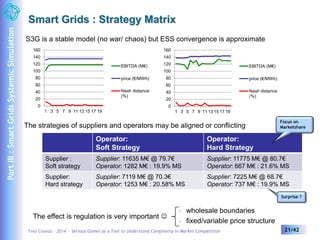

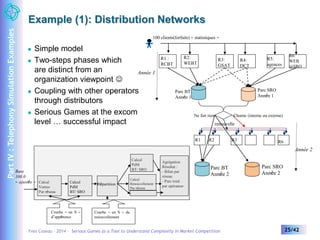

![Example (2) : Commercial Costs Optimization

Problem: resource allocation between different channels …

… while taking competition between distribution channels into

account (hard to evaluate)

Goal (met) : start discussion between channels

method: what-if scenarios

First round : calibration

Second round : global simulation

Adjustment

Optimization

delta

OPEX

2006 data

sales, fixed/

variable costs

delta

CAPEX

result

Euros

C2 @ p2

Dist :

100%

C3 @ p3

Dist :

100%

Competition

Matrix

Par canal

C1 @

p1

Dist :

60%

C2 @ p2

Dist :

100%

Sensibility

Price -> Sales

Flux si p1 < p2

C[1,2] = 50%

C[2,1] =

50%

Yves Caseau – 2014 – Serious Games as a Tool to Understand Complexity in Market Competition 26/42

Part IV : Telephony Simulation Examples](https://image.slidesharecdn.com/gtes-utc2014-141127235747-conversion-gate02/85/GTES-UTC-2014-26-320.jpg)

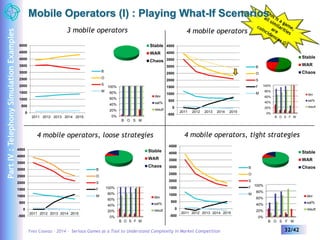

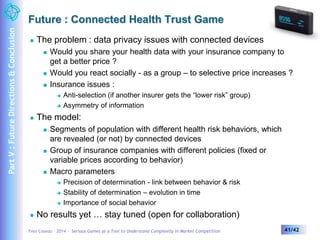

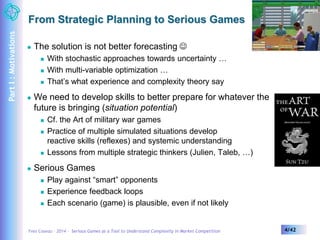

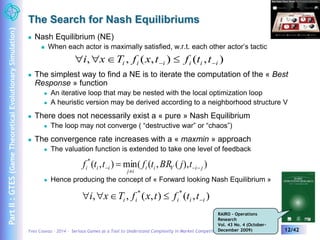

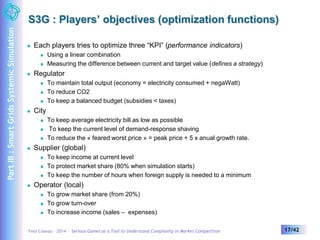

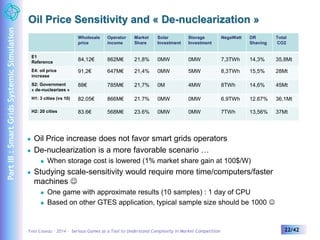

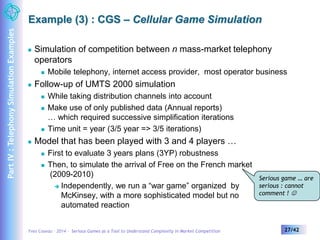

![Coupling

1

2 3 1

Orange

1

2 3

Opérateur

Acquisition/ price relationship →

2 3

SFR

1

2 3

Bouygues

Nouveaux

S-curve to model sensitivity

+ competition model Cf. INRIA

Change / price relationship [churn / renewal] → similar model with

2010 Talk

different parameters

Yves Caseau – 2014 – Serious Games as a Tool to Understand Complexity in Market Competition 29/42

Part IV : Telephony Simulation Examples](https://image.slidesharecdn.com/gtes-utc2014-141127235747-conversion-gate02/85/GTES-UTC-2014-29-320.jpg)