Pros and cons of Self Manged Super Funds (SMSF)

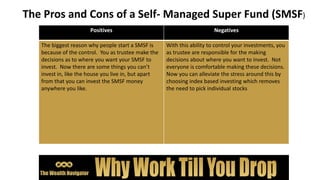

- 1. The Pros and Cons of a Self- Managed Super Fund (SMSF) Positives Negatives The biggest reason why people start a SMSF is because of the control. You as trustee make the decisions as to where you want your SMSF to invest. Now there are some things you can’t invest in, like the house you live in, but apart from that you can invest the SMSF money anywhere you like. With this ability to control your investments, you as trustee are responsible for the making decisions about where you want to invest. Not everyone is comfortable making these decisions. Now you can alleviate the stress around this by choosing index based investing which removes the need to pick individual stocks

- 2. The Pros and Cons of a Self- Managed Super Fund (SMSF) Positives Negatives Another reason for a lot of people is cost. Most costs for SMSF’s are typically flat. An audit costs pretty much the same if you have $100,000 0r $1,000,000 in your SMSF. A typical SMSF would cost between $2,000 and $5,000 for audit, tax returns, financial statements, supervisory fees and ASIC fees. For our last SMSF year, our costs were $3,750. As the annual costs are fixed, costs as a % of your super balance will be high if you don’t have enough super. So a low balance SMSF will have high costs relative to industry or retail funds. Also, SMSF’s can have a high set up cost, depending on how you do this. This will probably include a statement of advice from a financial planner, which ASIC has focused on to ensure people are being properly advised about the pros and cons or SMSF particular to their own circumstances.

- 3. The Pros and Cons of a Self- Managed Super Fund (SMSF) Positives Negatives Some people think they will get better returns. Most experts struggle to outperform the market over the long term. So if they can’t, what makes you think you can?

- 4. The Pros and Cons of a Self- Managed Super Fund (SMSF) Positives Negatives SMSF’s are able to gear via what is known as a limited recourse borrowing arrangement (LRBA). There are rules (and extra costs) associated with this but can leverage your gains (and your losses). For example we have these in our SMSF. In one case we purchased a property for $550,000, with about $350,000 of borrowings. So our net investment was $200,000 and the return so far is over $300,000. A 150% return over 5 years, hence why you can make better returns. LRBA’s come with extra cost and extra risk. As was mentioned if you buy the wrong asset, it can leverage your losses. And today the banks are tightening their rules around this, so it is currently harder to access LRBA lending.

- 5. The Pros and Cons of a Self- Managed Super Fund (SMSF) Positives Negatives You as trustee are responsible for managing your SMSF and the associated paperwork. This will take up your time. And there may be fines and penalties for non-compliance. So you have to be prepared for this. There are new platforms being released all the time that can handle the administration of your fund to save you time, but these will be at a cost.

- 6. The Pros and Cons of a Self- Managed Super Fund (SMSF) Positives Negatives Ability to apply specialist knowledge if you have it. We for example understand property and have leveraged this knowledge inside our SMSF. Some people argue that SMSF’s are less diversified than retail or industry funds. Our SMSF for example is heavily into property. But we are diversified by having property in 3 different cities in 2 different countries. And the truth be told about a lot of growth funds, they are heavily invested in share markets, which minimises risks if one company underperforms. But does nothing to reduce the risk of the whole share market crashing, which has happened many times.

- 7. The Pros and Cons of a Self- Managed Super Fund (SMSF) Positives Negatives Whilst there are limits to what a SMSF can invest in, it still can invest your money directly into some asset classes that retail and industry funds don’t offer. For example direct residential or commercial real estate. Indeed for business owners, it often makes sense for them to have a SMSF that owns the premises they operate out of. The rent the business pays effectively becomes the business owner’s superannuation. Industry and retail funds will argue that they offer investments in areas that individuals can’t. For example large infrastructure projects. A SMSF can generally find a wholesale provider of these classes and can invest in them, albeit having to pay the wholesaler a fee for this.

- 8. The Pros and Cons of a Self- Managed Super Fund (SMSF) Positives Negatives SMSF’s have a far better ability to manage taxation impacts on the fund. For example they can use franking credits, or other deductions to reduce the tax paid on contributions below 15%. In a retail or industry fund, you will pay 15% tax on your contributions. Another example is when moving from accumulation to pension mode. You can do this often in a SMSF without triggering any capital gains tax. Whilst in retail and industry funds, you often end up paying this. .

- 9. The Pros and Cons of a Self- Managed Super Fund (SMSF) Positives Negatives As a SMSF you can decide your own insurance levels and only take out appropriate cover, which you can shop around and get the best deal for you. In a retail or industry fund, you have to take their insurance provider. This may not always be the best deal for you. Last time I looked my life insurance cover per $ of coverage was only beaten by 10 other superfunds. So my insurance was cheaper than over 200 other funds.

- 10. The Pros and Cons of a Self- Managed Super Fund (SMSF) Positives Negatives In my view SMSF’s really come into their own when dealing with pensions. There are rules around pensions, such as the maximum you can have in a tax free pension mode, and minimum annual amounts you need to take out. But as long as you comply with these rules in your SMSF you have the flexibility to vary your pension payments to suit your needs. For example if you want an overseas holiday every two years, you can increase your pension in these years to cover your holiday without having to deal with the rules and admin of a retail or industry fund. You could take that part of the pension as a once off amount at the time you book your holiday. Or, if you decide to go back to work, you can convert your pension back to accumulation. Or you can withdraw all of your balance.

- 11. The Pros and Cons of a Self- Managed Super Fund (SMSF) Positives Negatives SMSF’s are accumulation fund. If your super is in a defined benefit fund, you may not want to swap over as the pension payments you get may end up being lower.

- 12. The Pros and Cons of a Self- Managed Super Fund (SMSF) Positives Negatives SMSF’s can help save your kids super when they first start work. For instance my children joined our SMSF when they first started working. Very little extra fees for the SMSF for them to join, but saved them the regressive administration fees that hurt low super balances. If you are in pension mode, this becomes more hassle to have separate accumulation and pension modes. So at this stage, I suggest your kids either set up their own SMSF (if they have enough money), or put them into a retail / industry fund till they build it up. I would then keep the SMSF till they are ready and they can simply transfer their money back to it. And funnily enough, people need advice to set up a SMSF, but don’t need advice to transfer into one. Saves them thousands in set up costs and you thousands in wind up costs!