2018 Federal Tax Rates, Credits and Limits

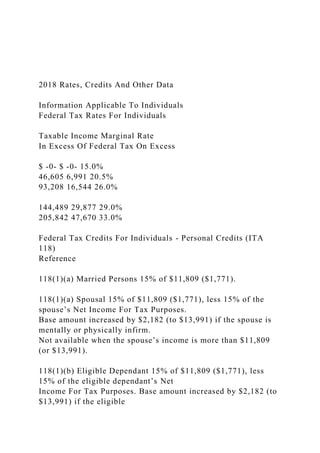

- 1. 2018 Rates, Credits And Other Data Information Applicable To Individuals Federal Tax Rates For Individuals Taxable Income Marginal Rate In Excess Of Federal Tax On Excess $ -0- $ -0- 15.0% 46,605 6,991 20.5% 93,208 16,544 26.0% 144,489 29,877 29.0% 205,842 47,670 33.0% Federal Tax Credits For Individuals - Personal Credits (ITA 118) Reference 118(1)(a) Married Persons 15% of $11,809 ($1,771). 118(1)(a) Spousal 15% of $11,809 ($1,771), less 15% of the spouse’s Net Income For Tax Purposes. Base amount increased by $2,182 (to $13,991) if the spouse is mentally or physically infirm. Not available when the spouse’s income is more than $11,809 (or $13,991). 118(1)(b) Eligible Dependant 15% of $11,809 ($1,771), less 15% of the eligible dependant’s Net Income For Tax Purposes. Base amount increased by $2,182 (to $13,991) if the eligible

- 2. dependant is mentally or physically infirm. Not available when the eligible dependant’s income is more than $11,809 (or $13,991). 118(1)(b.1) Canada Caregiver For Child Under 18 15% of $2,182 ($327). 118(1)(c) Single Persons 15% of $11,809 ($1,771). 118(1)(d) Canada Caregiver 15% of $6,986 ($1,048), reduced by 15% of the dependant's income in excess of $16,405. 118(1)(e) Canada Caregiver - Additional Amount If either the income adjusted infirm spousal credit base or the income adjusted infirm eligible dependant credit base is less than the spouse or eligible dependant's income adjusted credit base ($6,986 - less the spouse or dependant's income in excess of $16,405), an additional Canada caregiver credit is available based on 15% of the deficiency. 118(2) Age 15% of $7,333 ($1,100). The base for this credit is reduced by the lesser of $7,333 and 15% of the individual’s net income in excess of $36,976. Not available when income is more than $85,863. If the individual cannot use this credit, it can be transferred to a spouse or common-law partner. 118(3) Pension 15% of up to $2,000 of eligible pension income for a maximum credit of $300 [(15%)($2,000)]. If the individual cannot use this credit, it can be transferred to a spouse or common-law partner.

- 3. 118(10) Canada Employment Credit 15% of up to $1,195. This produces a maximum credit of $179. 2018 Rates, Credits And Other Data i Information Applicable To Individuals For your convenience, this information, as well as the Chapter 5 Appendix of common CCA rates, is available online as a .PDF file. Other Common Federal Personal Credits (Various ITA) 118.01 Adoption Expenses Credit 15% of eligible expenses (reduced by any reimbursements) up to a maximum of $15,905 per adoption. This results in a maximum credit of $2,386. 118.02 Public Transit Passes Credit Repealed for 2018 and subsequent years. 118.031 Children’s Arts Credit Repealed for 2017 and subsequent years. 118.041 Home Accessibility Credit 15% of lesser of $10,000 and the amount of qualifying expendi- tures for the year. 118.05 First Time Home Buyer’s Credit 15% of $5,000 ($750) of the cost of an eligible home. 118.06 Volunteer Firefighters Credit 15% of $3,000 ($450) for qualifying volunteers.

- 4. 118.07 Volunteer Search And Rescue Workers Credit 15% of $3,000 ($450) for qualifying volunteers. 118.1 Charitable Donations - Regular The general limit on amounts for this credit is 75% of Net Income. There is an addition to this general limit equal to 25% of any taxable capital gains and 25% of any recapture of CCA resulting from a gift of capital property. In addition, the income inclusion on capital gains arising from a gift of some publicly traded shares is reduced from one-half to nil. For individuals, the credit is equal to: [(15%)(A)] + [(33%)(B)] + [(29%)(C)] where: A = The first $200 of eligible gifts. B = The lesser of: • Total gifts, less $200; and • Taxable Income, less $205,842. C = The excess, if any, by which the individual's total gifts exceed the sum of $200 plus the amount determined in B. 118.1(3.1) Charitable Donations - First-Time Donor's Super Credit Not available after 2017. 118.2 Medical Expenses The medical expense tax credit is determined by the following formula: [15%] [(B - C) + D], where: B is the total of an individual’s medical expenses for himself,

- 5. his spouse or common-law partner, and any of his children who have not reached 18 years of age at the end of the year. C is the lesser of 3% of the individual’s Net Income For Tax Purposes and $2,302 (2018 figure). D is the total of all amounts each of which is, in respect of a dependant of the indi- vidual (other than a child of the individual who has not attained the age of 18 years before the end of the taxation year), an amount determined by the formula: E - F, where: E is the total of the dependant’s medical expenses F is the lesser of 3% of the dependant’s Net Income For Tax Purposes and $2,302 (2018 figure). 118.3 Disability - All Ages 15% of $8,235 ($1,235). If not used by the disabled individual, it can be transferred to a person claiming that individual as a dependant. ii 2018 Rates, Credits And Other Data Information Applicable To Individuals 118.3 Disability Supplement - Under 18 And Qualifies For The Disability Tax Credit 15% of

- 6. $4,804 ($721), reduced by the total of amounts paid for attendant care or supervision in excess of $2,814 that are deducted as child care costs, deducted as a disability support amount, or claimed as a medical expense in calculating the medical expense tax credit. Education Related Credits 118.5 • Tuition Fees Which Includes Examination And Ancillary Fees • 15% of qualifying tuition fees • 15% of examination fees for both post-secondary examinations and examinations required in a professional program • 15% of ancillary fees that are imposed by a post-secondary educational institution on all of their full or part-time students. Up to $250 in such ancillary fees can be claimed even if not required of all students. 118.6(2) • Education Repealed for 2017 and subsequent years. 118.6(2.1) • Textbook Repealed for 2017 and subsequent years. 118.62 • Interest On Student Loans 15% of interest paid on qualifying student loans. 118.9 • Transfer Of Tuition Credit If the individual cannot use the credit, is not claimed as a dependant by his spouse, and does not transfer the unused credit to a spouse or common-law partner, then a parent or grandparent of the individual can claim

- 7. up to $750 [(15%)($5,000)] of any unused tuition credit. The amount that can be transferred is reduced by the amount of the credit claimed by the student for the year. 118.7 Employment Insurance 15% of amounts paid by employees up to the maximum Employ- ment Insurance premium of $858 (1.66% of $51,700). This produces a maximum tax credit of $129 [(15%)($858)]. 118.7 Canada Pension Plan 15% of amounts paid by employees up to the maximum Canada Pension Plan contribution of $2,594 [4.95% of ($55,900 less $3,500)]. This produces a maximum tax credit of $389 [(15%)($2,594)]. For self- employed individuals, the payment is $5,188 ($2,594 times 2). 122.51 Refundable Medical Expense Supplement The individual claiming this amount must be over 17 and have earned income of at least $3,566. The amount is equal to the lesser of $1,222 and 25/15 of the medical expense tax credit. The refundable amount is then reduced by 5% of family Net Income in excess of $27,044. Not available when family income is more than $51,484. 122.8 Refundable Child Fitness Credit Repealed for 2017 and subsequent years. 122.9 Refundable Teacher And Early Childhood Educator School Supply Tax Credit A maximum of 15% of up to $1,000 ($150) of eligible

- 8. expenditures that are made by eligible educators. 127(3) Political Donations Three-quarters of the first $400, one- half of the next $350, one-third of the next $525, to a maximum credit of $650 on donations of $1,275. 127.4 Labour Sponsored Venture Capital Corporations (LSVCC) Credit The federal credit is equal to 15 percent of acquisitions of provincially registered LSVCCs. 2018 Rates, Credits And Other Data iii Information Applicable To Individuals ITA 82 and Dividend Tax Credit ITA 121 • Eligible Dividends These dividends are grossed up by 38%. The federal dividend tax credit is equal to 6/11 of the gross up. The credit can also be calculated as 15.02% of the grossed up dividends, or 20.7272% of the actual dividends received. • Non-Eligible Dividends These dividends are grossed up by 16%. The federal dividend tax credit is equal to 8/11 of the gross up. The credit can also be calculated as 10.0313% of the grossed up dividends, or 11.6363% of the actual dividends received.

- 9. Other Data For Individuals ITA 82 Dividend Gross Up Eligible Dividends For these dividends, the gross up is 38% of dividends received. Non-Eligible Dividends For these dividends, the gross up is 16% of dividends received. Chapter 4 OAS Clawback Limits The tax (clawback) on Old Age Security (OAS) benefits is based on the lesser of 100% of OAS benefits received, and 15% of the amount by which "threshold income" (Net Income For Tax Purposes, calculated without the OAS clawback) exceeds $75,910. Chapter 4 EI Clawback Limits The tax (clawback) on Employment Insurance (EI) benefits under the Employment Insurance Act is based on the lesser of 30% of the EI benefits received, and 30% of the amount by which "threshold income" exceeds $64,625 (1.25 times the maximum insur- able earnings of $51,700). For this purpose, "threshold income" is Net Income For Tax Purposes, calculated without the OAS or EI clawbacks. Chapter 9 Child Care Expenses The least of three amounts: 1. The amount actually paid for child care services. If the child is at a camp or boarding school, this amount is limited to a weekly amount $275 (any age if eligible for disability tax credit), $200 (under 7 year of age), or $125 (age 7 through 16 or over 16 with a mental or physical impairment).

- 10. 2. The sum of the Annual Child Care Expense Amounts for the taxpayer’s eligible children. The per child amounts are $11,000 (any age if eligible for disability tax credit), $8,000 (under 7 year of age), or $5,000 (age 7 through 16 or over 16 with a mental or physical impairment). 3. 2/3 of the taxpayer’s Earned Income (for child care expenses purposes). Chapter 10 RRSP Deduction Room For 2018, the addition to RRSP deduction room is equal to: • the lesser of $26,230 and 18% of 2017 Earned Income, • reduced by the 2017 Pension Adjustment and any 2018 Past Service Pension Adjustment, • and increased by any 2018 Pension Adjustment Reversal. Chapter 11 Lifetime Capital Gains Deduction For 2018, the deduction limit for dispositions of shares of qualified small business corporations is $848,252. There is an additional amount for farm or fishing properties of $151,748, providing a total of $1,000,000 for such properties. Provincial Tax Rates And Provincial Credits For Individuals Provincial taxes are based on Taxable Income, with most provinces adopting multiple rates. The number of brackets range from three to five. Provincial tax credits are generally based on the minimum provincial rate applied to a credit base that is similar to that used for federal credits. In addition to regular rates, two provinces use surtaxes.

- 11. iv 2018 Rates, Credits And Other Data Information Applicable To Individuals Information Applicable To Individuals And Corporations ITR 4301 Prescribed Rate The following figures show the base rate that would be used in calculations such as imputed interest on loans. It also shows the rates applicable on amounts owing to and from the CRA. For recent quarters, the interest rates were as follows: Year Quarter Base Rate Owing From* Owing To 2016 All 1% 3% 5% 2017 All 1% 3% 5% 2018 I 1% 3% 5% 2018 II 2% 4% 6% *The rate on refunds to corporations is limited to the base rate, without the additional 2%. Automobile Deduction Limits • CCA is limited to the first $30,000 of the automobiles cost, plus applicable GST/HST/PST (not including amounts that will be refunded through input tax credits). • Interest on financing of automobiles is limited to $10 per day.

- 12. • Deductible leasing costs are limited to $800 per month (other constraints apply). • Operating Cost Benefit = $0.26 per kilometre. • Deductible Rates = $0.55 for first 5,000 kilometres, $0.49 for additional kilometres. CCA Rates See Appendix to Chapter 5. Quick Method Rates (GST Only) Percentage On GST Included Sales First $30,000 On Excess Retailers And Wholesalers 0.8% 1.8% Service Providers And Manufacturers 2.6% 3.6% Note Different rates apply in the provinces that have adopted an HST system. Information Applicable To Corporations Federal Corporate Tax Rates are as follows (federal tax abatement removed): General Business (Before General Rate Reduction) 28% General Business (After General Rate Reduction Of 13%) 15% Income Eligible For M&P Deduction 15% Income Eligible For Small Business Deduction 10% Part IV Refundable Tax 38-1/3% Part I Refundable Tax On Investment Income Of CCPC (ART) 10-2/3% Reference 125(1) Small Business Deduction is equal to 18% of the least of:

- 13. A. Net Canadian active business income. B. Taxable Income, less: 1. 100/28 times the ITA 126(1) credit for taxes paid on foreign non-business income, calculated without consideration of the additional refundable tax under ITA 123.3 or the general rate reduction under ITA 123.4; and 2. 4 times the ITA 126(2) credit for taxes paid on foreign business income, calculated without consideration of the general rate reduction under ITA 123.4. C. The annual business limit of $500,000, less any portion allocated to associated corpo- rations, less the reduction for large corporations. 2018 Rates, Credits And Other Data v Information Applicable To Corporations 125.1 Manufacturing And Processing Deduction is equal to 13% of the lesser of: A. Manufacturing and processing profits, less amounts eligible for the small business deduction; and B. Taxable Income, less the sum of: 1. the amount eligible for the small business deduction;

- 14. 2. 4 times the foreign tax credit for business income calculated without consider- ation of the ITA 123.4 general rate reduction; and 3. "aggregate investment income" (of CCPCs) as defined in ITA 129(4). 123.4(2) General Rate Reduction is equal to 13% of Full Rate Taxable Income. This is Taxable Income, reduced by; income eligible for the small business deduction, income eligible for the M&P deduction and the corporation’s "aggregate investment income" for the year. 126(1) Foreign Tax Credits For Corporations The Foreign Non- Business Income Tax Credit is the lesser of: • The tax paid to the foreign government (for corporations, there is no 15% limit on the foreign non-business taxes paid); and • An amount determined by the following formula: Foreign Non usiness Income Adjusted Division B Inc � B ome Tax Otherwise Payable � �

- 15. � � � � [ ] 126(2) The Foreign Business Income Tax Credit is equal to the least of: • The tax paid to the foreign government; • An amount determined by the following formula: Foreign Business Income Adjusted Division B Income � � � � � � [ ]Tax Otherwise Payable ; and • Tax Otherwise Payable for the year, less any foreign tax credit taken on non-business income under ITA 126(1). 129(4) Aggregate Investment Income is the sum of: • net taxable capital gains for the year, reduced by any net capital loss carry overs

- 16. deducted during the year; and • income from property including interest, rents, and royalties, but excluding divi- dends that are deductible in computing Taxable Income. Since foreign dividends are generally not deductible, they would be included in aggregate investment income. 123.3 Additional Refundable Tax On Investment Income (ART) is equal to 10-2/3% of the lesser of: • the corporation’s “aggregate investment income” for the year [as defined in ITA 129(4)]; and • the amount, if any, by which the corporation’s Taxable Income for the year exceeds the amount that is eligible for the small business deduction. 186(1) Part IV Tax is assessed at a rate of 38-1/3% of portfolio dividends, plus dividends received from a connected company that gave rise to a dividend refund for the connected company as a result of the payment. vi 2018 Rates, Credits And Other Data Information Applicable To Corporations 129(3)(a) Refundable Portion Of Part I Tax Payable is defined

- 17. as the least of three items: 1. the amount determined by the formula A - B, where A is 30-2/3% of the corporation’s aggregate investment income for the year, and B is the amount, if any, by which the foreign non-business income tax credit exceeds 8% of its foreign investment income for the year. 2. 30-2/3% of the amount, if any, by which the corporation’s taxable income for the year exceeds the total of: • the amount eligible for the small business deduction; • 100 ÷ 38-2/3 of the tax credit for foreign non-business income; and • 4 times the tax credit for foreign business income. 3. the corporation’s tax for the year payable under Part I. 129(3) Refundable Dividend Tax On Hand (RDTOH) is defined as follows: • The corporation’s RDTOH at the end of the preceding year; less • The corporation’s dividend refund for its preceding taxation year; plus • The Refundable Portion Of Part I tax for the year; plus • The total of the taxes under Part IV for the year. 89(1) General Rate Income Pool A CCPC’s General Rate Income Pool (GRIP) is defined as follows:

- 18. • The GRIP balance at the end of the preceding year; plus • 72% of the CCPC’s Taxable Income after it has been reduced by amounts eligible for the small business deduction and aggregate investment income; plus • 100% of eligible dividends received during the year; plus • adjustments related to amalgamations and wind-ups; less • eligible dividends paid during the preceding year. Tax Related Web Sites GOVERNMENT Canada Revenue Agency www.cra.gc.ca Department of Finance Canada www.fin.gc.ca CPA FIRMS BDO www.bdo.ca/en-ca/services/tax/domestic-tax- services/overview/ Deloitte. www2.deloitte.com/ca/en/pages/tax/topics/tax.html Ernst & Young www.ey.com/CA/en/Services/Tax KPMG www.kpmg .com/ca/en/services/tax PricewaterhouseCoopers www.pwc.com/ca/en/tax/publications.jhtml OTHER CPA Canada www.CPAcanada.ca Canadian Tax Foundation www.ctf.ca ProFile Tax Suite www.intuit.ca/professional-tax-

- 19. software/index.jsp 2018 Rates, Credits And Other Data vii Tax Related Web Sites Appendix - CCA Rates For Selected Assets This Appendix lists the CCA Class and rate for assets commonly used in business. Restrictions and transitional rules may apply in certain situations. ITR Part XI contains detailed descrip- tions of the CCA Classes. Asset Class Rate Aircraft (including components) 9 25% Airplane runways 17 8% Automobiles, passenger • Cost < or = Prescribed amount ($30,000 in 2018) 10 30% • Cost > Prescribed amount 10.1 30% Automotive equipment 10 30% Bar code scanners 8 20% Billboards 8 20% Boats, canoes and other vessels 7 15% Bridges, canals, culverts and dams 1 4% Buildings Acquired Before 1988 3 5% Buildings Acquired After 1987 - No Separate Class 1 4% Buildings (New Only) Acquired After March 18, 2007: • Manufacturing and Processing In Separate Class 1 1 10%

- 20. • Non-Residential In Separate Class 1 1 6% Buses 10 30% Calculators 8 20% Cash registers 8 20% China, cutlery and tableware 12 100% Communications equipment (including cellphones too dumb to be smartphones) 8 20% Computer hardware and systems software, (including smartphones and tablets) acquired after March 18, 2007 50 55% Computer software (applications) 12 100% Copyrights 14 Straight-line Data network infrastructure equipment acquired after March 22, 2004 46 30% Dies, jigs, patterns, and molds 12 100% Docks, breakwaters and trestles 3 5% Electrical advertising billboards 8 20% Electronic point-of-sale equipment 8 20% Equipment (not specifically listed elsewhere) 8 20% Fences 6 10% Films 10 30% Franchises (limited life) 14 Straight-line Franchises (unlimited life) 14.1 5% Furniture and fixtures (not specifically listed elsewhere) 8 20%

- 21. Goodwill 14.1 5% Instruments, dental or medical (See Tools) Kitchen utensils (See Tools) viii 2018 Rates, Credits And Other Data Tax Related Web Sites Asset Class Rate Land N/A N/A Landscaping N/A Deductible Leasehold improvements 13 Straight-line Licences (limited life) 14 Straight-line Licences (unlimited life) 14.1 5% Linen 12 100% Machinery and equipment (not specifically listed elsewhere) 8 20% Manufacturing and processing equipment • acquired before March 19, 2007 43 30% • acquired after March 18, 2007 and before 2016 29 50% Straight-Line • acquired after 2015 53 50% Office equipment (not specifically listed elsewhere) 8 20% Outdoor advertising billboards 8 20% Parking area and similar surfaces 17 8% Patents (limited life) 44 25%

- 22. Patents (unlimited life) 14.1 5% Photocopy machines 8 20% Portable buildings and equipment used in a construction business 10 30% Power operated movable equipment 38 30% Radio communication equipment 8 20% Railway cars • acquired after February 27, 2000 7 15% • acquired before February 28, 2000 35 7% Roads 17 8% Sidewalks 17 8% Software (applications) 12 100% Software (systems) 10 30% Storage area 17 8% Storage tanks, oil or water 6 10% Tangible Capital Assets (not specifically listed elsewhere) 8 20% Taxicabs 16 40% Telephone systems 8 20% Television commercials 12 100% Tools • acquired after May 1, 2006 (under $500) 12 100% • acquired after May 1, 2006 ($500 or over) 8 20% Trailers 10 30% Trucks and tractors for hauling freight 16 40% Trucks (automotive), tractors and vans 10 30%

- 23. Uniforms 12 100% Video games (coin operated) 16 40% Video tapes 10 30% Video tapes for renting 12 100% Wagons 10 30% 2018 Rates, Credits And Other Data ix Tax Related Web Sites Evidence Based Nursing Project Spring 2019 Group members: Be sure to list the names of those who participated in the project. 1 Knowledge Discovery Do not add anything to this slide. 2 Nursing problem

- 24. Desired outcome 4 Background questions with answers May need to put answers here 5 Background questions with answers (con’t) May need to put answers here 6 PICOT question

- 25. Keywords used for literature search Databases used for literature search 9 Search strategy to find systematic reviews 10 Search strategy to find practice guidelines 11 Number and types of studies

- 26. This should be the number that you found that studied both the same intervention and outcome since these are the “keeper” studies. Note: this number may be more then you actually end up critiquing. 12 Level of evidence of studies found See page 11 in the textbook 13 Evidence Summary Give author (s) date of research article Study design: Sample size: Sample characteristics: Setting: Intervention studied: Outcome studied: Measurement of outcome: Study findings: Strength/quality of study: Level of evidence:

- 27. Quantitative research individual study critical analysis Name of group member who did critique: _________________________ Give the permalink for the article you are analyzing in space below: Is there a comparison? (yes or no): If there is a comparison what is it? (put N/A if there is no comparison) If there is a comparison is it the same as you noted for the comparison above? (yes/no or N/A): What is the study question(s) or hypotheses? (Use a direct quote. If neither of these are not stated put not stated) Is the design appropriate for testing an intervention? (yes or no) Is the setting similar to your setting/population of interest? (yes or no) What was/were the sampling inclusion criteria? What was/were the sampling exclusion criteria?

- 28. “Were the subjects randomly assigned to the experimental and control groups?” (Melynk & Fineout-Overholt, 2015, p. 118) (enter yes or no – note: if this is no then the study is not as strong and it is not a randomized controlled trial) If the subjects were randomly assigned “was random assignment concealed from the individuals who were first enrolling subjects into the study?” (Melynk & Fineout-Overholt, 2015, p. 118) (yes or no) “Were the subjects and providers kept blind to study group?” (Melynk & Fineout-Overholt, 2015, p. 118) yes or no – also note this is the blinding and an randomized controlled trial is strong but it is very strong if it is double blinded) “Were reasons given to explain why subject did not complete the study?” (Melynk & Fineout-Overholt, 2015, p. 118) (yes or no) “Were the subjects analyzed in the group to which they were … assigned?” (Melynk & Fineout-Overholt, 2015, p. 118) put yes or no “Was the control group appropriate?” (Melynk & Fineout- Overholt, 2015, p. 118) Put yes or no “Were the subjects in each of the groups similar on demographic and baseline clinical variables?” (Melynk & Fineout-Overholt, 2015, p. 118) Put yes or no

- 29. Did the researcher use power analysis to determine the appropriate sample size? Put yes or no Is the same size adequate? Put yes, no, or unknown) Are you convinced that everyone received the same intervention? Yes or no – explain why or why not “Were the follow-up assessments conducted long enough to fully study the effects of the intervention?” (Melynk & Fineout- Overholt, 2015, p. 118) Yes or no – explain why or why not After reading how the outcome was measured do you think this is the same as your O in your PICO question? Yes or no and explain What type of validity was used to make sure that the measurement tool really measured what it was intended to measure? (put an X next to all that apply below) Experts reviewed the tool to determine that it was valid _____ The tool was compared to a similar tool _____ Equipment commonly utilized to measure the outcome such as thermometers, sphygmomanometers, scales etc. were used and properly calibrated. _____ Other (specify) _________________________ Did researcher convince you of the validity (the method really measured what it was supposed to measure) of the outcome

- 30. measure? Yes or no What type of reliability (tool would get the same results each time it was used under the same conditions) was reported? Check below and give value: Chronbach alpha ______ value reported ________ Item to total ______ value reported _______ Test retest _______ value reported ______ Interrater reliability ______ value reported _____ Other (specify) ______ value reported ______ Did the researcher convince you that the measurement was reliable? Yes or no and explain why or why not “What are the results?” (Melnyk & Fineout-Overholt, 2015, p. 96) “How were the data analyzed?” (Melynk & Fineout-Overholt, 2015, p. 88) “How large is the intervention or treatment effect (NNT, NNH, effect size, level of significance)?” (Melynk & Fineout- Overholt, 2015, p. 118) Note: give results (direct quotes are OK but you should also explain what this means).

- 31. Was there a statistically significant difference between the intervention group and control group? Yes or no ”How precise is the intervention or treatment (CI)?” (Melynk & Fineout-Overholt, 2015, p. 118) (if not given just indicate that) Did the findings show that the intervention will produce the outcome? Yes or no “Will the results help me in caring for my patients?” (Melnyk & Fineout-Overholt, 2015, p. 107) “Were all clinically important outcomes measured?” (Melynk & Fineout-Overholt, 2015, p. 118) yes or no “What are the risks and benefits of the treatment?” (Melynk & Fineout-Overholt, 2015, p. 118) “Were there any untoward events during the conduct of the study? “ (Melynk & Fineout-Overholt, 2015, p. 88) If so explain and if not just say no. “Is the treatment feasible in my clinical setting?” (Melynk & Fineout-Overholt, 2015, p. 118) Yes or no

- 32. “What are my patients/family’s values and expectations for the outcome that is trying to be prevented and the treatment itself?” (Melynk & Fineout-Overholt, 2015, p. 118) Overall how confident are you that this intervention will work in your setting (as indicated in the PICOT question) and produce the outcome you desire? Give rationale for your answer. Include the full reference citation on your reference list. Reference Melnyk, B.M., & Fineout-Overholt, E. (2015). Evidence-based practice in nursing and healthcare: A guide to best practice (3rd ed.). Philadelphia, PA: Wolters Kluwer. 15 Give author (s) date of research article Study design: Sample size: Sample characteristics: Setting:

- 33. Intervention studied: Quantitative research individual study critical analysis Name of group member who did critique: _________________________ Give the permalink for the article you are analyzing in space below: Is there a comparison? (yes or no): If there is a comparison what is it? (put N/A if there is no comparison) If there is a comparison is it the same as you noted for the comparison above? (yes/no or N/A): What is the study question(s) or hypotheses? (Use a direct quote. If neither of these are not stated put not stated) Is the design appropriate for testing an intervention? (yes or no) Is the setting similar to your setting/population of interest? (yes or no)

- 34. What was/were the sampling inclusion criteria? What was/were the sampling exclusion criteria? “Were the subjects randomly assigned to the experimental and control groups?” (Melynk & Fineout-Overholt, 2015, p. 118) (enter yes or no – note: if this is no then the study is not as strong and it is not a randomized controlled trial) If the subjects were randomly assigned “was random assignment concealed from the individuals who were first enrolling subjects into the study?” (Melynk & Fineout-Overholt, 2015, p. 118) (yes or no) “Were the subjects and providers kept blind to study group?” (Melynk & Fineout-Overholt, 2015, p. 118) yes or no – also note this is the blinding and an randomized controlled trial is strong but it is very strong if it is double blinded) “Were reasons given to explain why subject did not complete the study?” (Melynk & Fineout-Overholt, 2015, p. 118) (yes or no) “Were the subjects analyzed in the group to which they were … assigned?” (Melynk & Fineout-Overholt, 2015, p. 118) put yes or no “Was the control group appropriate?” (Melynk & Fineout- Overholt, 2015, p. 118) Put yes or no

- 35. “Were the subjects in each of the groups similar on demographic and baseline clinical variables?” (Melynk & Fineout-Overholt, 2015, p. 118) Put yes or no Did the researcher use power analysis to determine the appropriate sample size? Put yes or no Is the same size adequate? Put yes, no, or unknown) Are you convinced that everyone received the same intervention? Yes or no – explain why or why not “Were the follow-up assessments conducted long enough to fully study the effects of the intervention?” (Melynk & Fineout- Overholt, 2015, p. 118) Yes or no – explain why or why not Include the full reference citation on your reference list. Reference Melnyk, B.M., & Fineout-Overholt, E. (2015). Evidence-based practice in nursing and healthcare: A guide to best practice (3rd ed.). Philadelphia, PA: Wolters Kluwer. 16 Give author(s) dates con’t

- 36. Outcome studied: Measurement of outcome: Study findings: Strength/quality of study: Level of evidence: After reading how the outcome was measured do you think this is the same as your O in your PICO question? Yes or no and explain What type of validity was used to make sure that the measurement tool really measured what it was intended to measure? (put an X next to all that apply below) Experts reviewed the tool to determine that it was valid _____ The tool was compared to a similar tool _____ Equipment commonly utilized to measure the outcome such as thermometers, sphygmomanometers, scales etc. were used and properly calibrated. _____ Other (specify) _________________________ Did researcher convince you of the validity (the method really measured what it was supposed to measure) of the outcome measure? Yes or no

- 37. What type of reliability (tool would get the same results each time it was used under the same conditions) was reported? Check below and give value: Chronbach alpha ______ value reported ________ Item to total ______ value reported _______ Test retest _______ value reported ______ Interrater reliability ______ value reported _____ Other (specify) ______ value reported ______ Did the researcher convince you that the measurement was reliable? Yes or no and explain why or why not “What are the results?” (Melnyk & Fineout-Overholt, 2015, p. 96) “How were the data analyzed?” (Melynk & Fineout-Overholt, 2015, p. 88) “How large is the intervention or treatment effect (NNT, NNH, effect size, level of significance)?” (Melynk & Fineout- Overholt, 2015, p. 118) Note: give results (direct quotes are OK but you should also explain what this means). Was there a statistically significant difference between the intervention group and control group? Yes or no

- 38. ”How precise is the intervention or treatment (CI)?” (Melynk & Fineout-Overholt, 2015, p. 118) (if not given just indicate that) Did the findings show that the intervention will produce the outcome? Yes or no “Will the results help me in caring for my patients?” (Melnyk & Fineout-Overholt, 2015, p. 107) “Were all clinically important outcomes measured?” (Melynk & Fineout-Overholt, 2015, p. 118) yes or no “What are the risks and benefits of the treatment?” (Melynk & Fineout-Overholt, 2015, p. 118) “Were there any untoward events during the conduct of the study? “ (Melynk & Fineout-Overholt, 2015, p. 88) If so explain and if not just say no. “Is the treatment feasible in my clinical setting?” (Melynk & Fineout-Overholt, 2015, p. 118) Yes or no

- 39. “What are my patients/family’s values and expectations for the outcome that is trying to be prevented and the treatment itself?” (Melynk & Fineout-Overholt, 2015, p. 118) Overall how confident are you that this intervention will work in your setting (as indicated in the PICOT question) and produce the outcome you desire? Give rationale for your answer. Include the full reference citation on your reference list. Reference Melnyk, B.M., & Fineout-Overholt, E. (2015). Evidence-based practice in nursing and healthcare: A guide to best practice (3rd ed.). Philadelphia, PA: Wolters Kluwer. 17 Author(s) year (use if critique is of a systematic review). Inclusion criteria for studies: Exclusion criteria for the studies Number of studies reviewed: Intervention studied: Outcome studied:

- 40. Systematic review conclusions: Quantitative systematic review critical analysis Name of group member who did critique: _________________________ Give the permalink (if article accessed thru EBSCO) or the URL/web address (if the article is open access) to the article below. Is the intervention the same as (or very similar to) the intervention in your PICOT? (yes or no) “Are the studies contained in the review all Randomized Controlled Trials (RCTs)?” (Melnyk & Fineout-Overholt, 2015, p. 127) Yes or no “Does the review include a detailed description of the search strategy to find all relevant studies?” (Melnyk & Fineout- Overholt, 2015, p. 127) Yes or no

- 41. Did the search include a strategy to find unpublished research studies? Yes or no Do you feel confident that the search was comprehensive and found all relevant studies? Yes or no and explain your rationale for your answer to this below: “Does the review describe how validity of the individual studies was assessed (e.g., methodological quality, including the use of random assignment to study groups and complete follow-up of the subjects?” (Melnyk & Fineout-Overholt, 2015, p. 127) Yes or no Was the validity (quality) of the studies assessed independently by at least two members of the research team? Yes or no Were conclusions of the review based on only high quality studies? Yes or no “Were the results consistent across studies?” (Melnyk & Fineout-Overholt, 2015, p. 127) Yes or no Did the review include a table showing the results of the studies which were included in the review?

- 42. Yes or no “Were individual patient data or aggregate data used in the analysis?” (Melnyk & Fineout-Overholt, 2015, p. 127) Individual _______ Aggregate _________ Was a meta-analysis statistical test done? Yes or no If a meta-analysis was calculated what was the combined sample size used? (if not done put N/A) If a meta-analysis was calculated what were the results? (if not done put N/A) “How large is the intervention or treatment effect (NNT, NNH, effect size, level of significance)?” (Melynk & Fineout- Overholt, 2015, p. 127) Note: give results (direct quotes are OK but you should also explain what this means). ”How precise is the intervention or treatment (CI)?” (Melnyk & Fineout-Overholt, 2015, p. 127) Did the findings show that the intervention will produce the outcome? Yes or no

- 43. “Are my patients similar to the ones included in the review?” (Melnyk & Fineout-Overholt, 2015, p. 127) Yes or no “Is it feasible to implement the findings in my practice setting?” (Melnyk & Fineout-Overholt, 2015, p. 127) Yes or no “Were all clinically important outcomes considered including, risks and benefits of the treatment?” (Melnyk & Fineout- Overholt, 2015, p. 127) yes or no “What is my clinical assessment of the patient and are there any contraindications or circumstances that would inhibit me from implementing the treatment?” (Melnyk & Fineout-Overholt, 2015, p. 127) Note: for this discuss any contraindications or circumstances that would prevent you from implementing the treatment. “What are my patient’s and his or her family’s preferences and values about the treatment under consideration?” (Melnyk & Fineout-Overholt, 2015, p. 127) Note for this discuss the values and preferences which you would need to consider when deciding whether or not to implement the intervention/treatment.

- 44. Overall how confident are you that this intervention will work in your setting and produce the outcome you desire? Give rationale for your answer. Include the full reference citation on your reference list. Reference Melnyk, B. M., & Fineout-Overholt, E. (2015). Evidence-based practice in nursing and healthcare: A guide to best practice (3rd ed.). Philadelphia, PA: Wolters Kluwer. Adapted from: Melnyk, B. M., & Fineout-Overholt, E. (2015). Evidence-based practice in nursing and healthcare: A guide to best practice (3rd ed.). Philadelphia, PA: Wolters Kluwer. By Mary Ann Notarianni, PhD, RN Sentara College of Health Sciences 18 Practice guideline recommendations If you did not find any practice guidelines just put none found

- 45. here. If you found a practice guideline then - only put the recommendations that are related to your PICOT question - put the author(s), year, p. number in parentheses at the bottom - be sure to put the full citation on the reference list - strength of evidence 19 Synthesis DesignSampleOutcomeStudies Note: each column only needs basic, concise information. See example in the textbook on page 553. 20 DesignSampleOutcomeStudies Synthesis (con’t) 21 DesignSampleOutcomeStudies Synthesis (con’t) 22

- 46. DesignSampleOutcomeStudies Synthesis (con’t) 23 Summary of Synthesis Translation and Integration of Evidence into Practice Practice change supported by evidence 26 Format of practice change

- 47. A clear and comprehensive explanation of the format. 27 Clinical problems that may be a contraindication Patient preferences that need consideration 29 Patient value considerations 30 Planning the change Plans for implementing change (such as what will need to be done – education, equipment etc. as appropriate) clearly discussed.

- 48. 31 Anticipated barriers to change 32 Strategies to overcome barriers to this change 33 Evaluation and dissemination Evaluating if the change worked Data to be collected Method of data collection Discuss what resources you will need for measuring the outcomes 35

- 49. Time frame for evaluating change Give rationale for why you picked this time frame 36 Disseminating the results of the project 37 References References (con’t) References (con’t)

- 50. References (con’t) 41 Identifies the nursing problem and states the clinical question in PICO(T) format. 10% 10 points Answers correctly address all required elements as listed in the instructions for the assignment and concepts are fully developed and correct. Content is well organized. Earns 10% 9 points Answers correctly address all required elements as listed in the instructions for the assignment but lacks full development of concepts. Content is logically organized. Earns 9% 8 points Answers correctly address all but one of the required elements as listed in the instructions for the assignment and/ or lacks full development of concepts and/or content is not logically organized Earns 8% 7 points Answers correctly address all but two required elements as listed in the instructions for the assignment and/or the discussion is superficial and/or there is no clear or logical organizational structure - just lots of facts. Earns 7% 0 points Answers correctly address all but three or more required

- 51. elements as listed in the instructions for the assignment. OR Does not address OR Submits more than 72 hours after the due date and time. Earns 0% Searches for and collects the evidence 15% 15 points Answers correctly address all required elements as listed in the instructions for the assignment and concepts are fully developed and correct. Content is well organized. Earns 15% 13.5 points Answers correctly address all required elements as listed in the instructions for the assignment but lacks full development of concepts. Content is logically organized. Earns 13.5% 12 points Answers correctly address all but one of the required elements as listed in the instructions for the assignment and/ or lacks full development of concepts and/or content is not logically organized. Earns 12% 10.5 points Answers correctly address all but two required elements as listed in the instructions for the assignment and/or the discussion is superficial and/or there is no clear or logical organizational structure - just lots of facts.

- 52. Earns 10.5% 0 points Answers correctly address all but three or more required elements as listed in the instructions for the assignment. OR Does not address or submits more than 72 hours after the due date and time. Earns 0% Critically appraises the evidence 30% 30 points Answers correctly address all required elements as listed in the instructions for the assignment and concepts are fully developed and correct. Content is well organized. Earns 30% 27 points Answers correctly address all required elements as listed in the instructions for the assignment but lacks full development of concepts. Content is logically organized. Earns 27% 24 points Answers correctly address all but one of the required elements as listed in the instructions for the assignment and/ or lacks full development of concepts and/or content is not logically organized Earns 24% 21 points Answers correctly address all but two required elements as

- 53. listed in the instructions for the assignment and/or the discussion is superficial and/or there is no clear or logical organizational structure - just lots of facts. Earns 21% 0 points Answers correctly address all but three or more required elements as listed in the instructions for the assignment. OR Does not address or submits more than 72 hours after the due date and time. Earns 0% Translates/ integrates evidence into Practice Recommendation and plans for implementation of recommendation. 25% 25 points Answers correctly address all required elements as listed in the instructions for the assignment and concepts are fully developed and correct. Content is well organized. Earns 25% 22.5 points Answers correctly address all required elements as listed in the instructions for the assignment but lacks full development of concepts. Content is logically organized. Earns 22.5% 20 points Answers correctly address all but one of the required elements as listed in the instructions for the assignment and/ or lacks full development of concepts and/or content is not logically

- 54. organized Earns 20% 17.5 points Answers correctly address all but two required elements as listed in the instructions for the assignment and/or the discussion is superficial and/or there is no clear or logical organizational structure - just lots of facts. Earns 17.5% 0 points Answers correctly address all but three or more required elements as listed in the instructions for the assignment. OR Does not address or submits more than 72 hours after the due date and time. Earns 0% Plans evaluation and dissemination 10% 10 points Answers correctly address all required elements as listed in the instructions for the assignment and concepts are fully developed and correct. Content is well organized. Earns 10% 9 points Answers correctly address all required elements as listed in the instructions for the assignment but lacks full development of concepts. Content is logically organized. Earns 9% 8 points

- 55. Answers correctly address all but one of the required elements as listed in the instructions for the assignment and/ or lacks full development of concepts and/or content is not logically organized Earns 8% 7 points Answers correctly address all but two required elements as listed in the instructions for the assignment and/or the discussion is superficial and/or there is no clear or logical organizational structure - just lots of facts. Earns 7% 0 points Answers correctly address all but three or more required elements as listed in the instructions for the assignment. OR Does not address or submits more than 72 hours after the due date and time. Earns 0% Criteria for Section VIII Grammar/ Spelling/References- APA Citations 5% 5 points Submission is free of grammatical, spelling and/or punctuation errors. Earns 5% 4.4 points Submission is relatively free of grammatical and/or spelling/APA errors (less than 2) Earns 4.5%

- 56. 4 points Submission contains 2 grammatical, spelling, and/or APA errors Earns 4% 3.5 points Submission contains 3 grammatical or spelling errors and/or contains 3 APA errors. Earns 3.5% 0 points Submission contains 4 or more grammatical and/or 4 or more APA errors. OR Submits more than 72 hours after the due date and time. Earns 0% Net Employment IncomeNet Employment IncomeAP 3-4Gross salary120000.0Add Taxable Benefits:Auto Benefit 3628.0743851229754Stock Option Benefit 13000.0Personal Fitness Trainer Fees 700.0137328.07438512298Deductions from Employment Income: Union Dues-100.0Computer Related Supplies-550.0Net Employment Income136678.07438512298NON-Income items:Private Health Care employee900.0Private Health Care employer1800.0Cash Award2000.0income in 2019Discounts on Merchandise560.0Take out meals 1200.0 Auto benefit AP 3-4CALCULATION OF STANDBY CHARGE - FOR PURCHASED AND LEASED VEHICLESPURCHASEDLEASED(expect a combination)Personal Km driven6000.0Total kilometres driven81000.0- 0Business portion as a %0.9259259259259259ER pays 100% of operating costs1.0Capital Cost of vehicle including GST/HST33600.0- 0Monthly Lease payment including GST/HSTEE paid ER0.0EE had the vehicle for 365 days (convert to months)12.0STANDBY CHARGE CALCULATION 6(1)(e)Lesser of:1) 2% X cost of vehicle X months vehicle available8064.0- 0 or 2/3 X

- 57. monthly lease cost X months vehicle available0.0- 02) Standby Charge Reduction (A/B) A=Personal KM divided by B=(1,667km X months vehicle available)0.299940011997600456000/(1667*12) Standby Charge Reduction Amount (calculation in 1 x % in 2)2418.7162567486503- 0 Total standby charge (lesser of 1 & 2)A2418.7162567486503- 0OPERATING BENEFIT 6(1)(k)Lesser of:1) 1/2 of standby charge if applicable1209.3581283743251- 02) $.26 x personal KM driven1560.0- 0 Operating Benefit - elected (lesser of 1 & 2)1560.0- 0 Less EE payments to ER0.0- 0 Total Operating BenefitB1560.0- 0 Taxable benefit-automobileA + B3628.0743851229754- 0 Stock optionsSTOCK OPTIONSAP 3- 4PUBLICPRIVATECORPORATIONCORPORATION1) Issuance Date -1,000 sharesNO TAX EFFECTNO TAX EFFECTFMV @ issuance @OPTION PRICE @ 2) Exercise DateNO TAX EFFECTFMV @ exerciseOPTION PRICE or ACBadd to net employment income 50% Deduction permitted deducted between NITP & TI Net inclusion to taxable income3) Disposal DatePOD48000.0Adjusted Cost35000.0Capital Gain (Loss)13000.0add to net employment income50% Rate 0.5deducted between NIFTP & TITaxable Capital Gain/(Loss)6500.0 NIFTPAP 1-12 (CASE ONE)Net Income For Tax Purposes - TemplateIncome Under ITA 3(a)- 0Employment Income62350.0(cannot be negative)Business Income (if loss see ITA 3(d))(cannot be negative)Property Income-interest, dividends,rental(cannot be negative)Other Income62350.0(cannot be negative)Income Under ITA 3(b)Taxable capital gains48825.0Allowable capital losses2715.046110.0(cannot be negative)Balance from ITA 3(a) and (b)108460.0Subdivision e deductions-4560.0Balance under ITA 3(c )103900.0Deductions under ITA 3(d)Business Loss- 115600.0Rental loss0.0-115600.0Net income for Tax Purposes (NITP - Div B Income)NIL(cannot be negative) NET

- 58. CAPITAL LOSS CARRY FORWARD NON CAPITAL LOSS CARRY FORWARD-11700.0AP 1-12 (CASE TWO)Income Under ITA 3(a)Employment Income45600.0Business Income (if loss see ITA 3(d))27310.072910.0Property Income-interest, dividends,rentalOther IncomeIncome Under ITA 3(b)Taxable capital gains15810.0Allowable capital losses20825.00.072910.0Balance from ITA 3(a) and (b)Subdivision e deductions-7200.0Balance under ITA 3(c )65710.0Deductions under ITA 3(d)Business LossRental loss- 4600.0Net income for Tax Purposes (NITP - Div B Income)61110.0 NET CAPITAL LOSS CARRY FORWARD NON CAPITAL LOSS CARRY FORWARD-5015.0 Sch 1 (2018) TemplateStep 1 - Federal non-refundable tax credits Schedule 1Basic personal amount Claim $11,809300Age amount (if you were born in 1950 or earlier) (use federal worksheet)(maximum $7,333)301Spouse or common-law partner amount (if negative, enter "0")$11,809 minus (_______ his or her net income from page 1 of your return)303Amount for an eligible dependant (attach Schedule 5) (if negative, enter "0")$11,809 minus (__________ his or her net income)305Family caregiver amount for children born under 18 years of age 352_____ x $2,182367Amount for infirm dependants age 18 or older (use federal worksheet and attach Schedule 5)306CPP or QPP contributions:through employment from box 16 and box 17 on all T4 slips(maximum $2,594)308on self-employment and other earnings (attach Schedule 8)310Employment Insurance permiums from box 18 and box 55 on all T4 slips(maximum $858)312on self-employment and other eligible earnings (attach schedule 13) 317Volunteer firefighters' amount362Search and rescue volunteers' amount395Canada employment amount(if you reported employment income on line 101 or line 104, see line 363 in guide)(maximum $1,195)363Public transit amount364Children's arts amount370Home Buyers'

- 59. Amount369Home Accessibility (maximum $10,000)Adoption expenses313Pension income amount (use federal worksheet)(maximum $2,000)314Caregiver amount (use federal worksheet and attach Schedule 5) (maximum $6,986)315Disability amount (for self) (claim $8,235 or, if you were under age 18, use federal worksheet)316Disablility amount transferred from a dependant (use federal worksheet)318Interest paid on your student loans319Your Tuition, education, and textbook amounts (attach Schedule 11)323Tuition, education, and textbook amounts transferred from a child324Amounts transferred from your spouse or common-law partner (attach Schedule 2)326Medical expenses for self, spouse or common-law partner, and yourdependent children born in 1999 or later33026Minus: $2,302 or 3% of line 236, whichever is less27Subtotal (if negative, enter "0")28Allowable amount of medical expenses for other dependants(do the calculation at line 331 in the guide and attach Schedule 5)33129Add lines 28 and 29332Add lines 1 to 30335Federal non-refundable tax credit rate15%Multiply line 31 by line 32338Donations and gifts (15% on first $200 and 29% thereafter)or (15% on first $200 and 33% thereafter)349(Enter amount on line 47 on next page)Total federal non-refundable tax credits: add lines 33 and 34.350Step 2 - Federal Tax on Taxable Income Schedule 1Enter your taxable income from line 260 of your return- 036If line 37 is >If line 37 is >If line 37 is >Use the amount on line 39 to determine which If line 37 is $46,605 but <$93208 but <$144,489 but <If line 37 is >one of the following columns you have to complete$46,605 or less$93,208$144,489$205,842$205,842 Enter the amount from line 36- 0- 037 Base amount- 046,60593,208144,489205,84238 Line 37 minus line 38 (cannot be negative)- 0- 039 Rate X15%20.5%26%29%33%40 Multiply line 39 by line 40- 0- 041 Tax on base amountNIL6,99116,54429,87747,67042Add lines 41 and 42- 0- 043 Go to Step 3 Go to Step 3 Go to Step 3 Go to Step 3 Go to Step 3Step 3 - Net Federal TaxEnter the amount

- 60. from line 43 above- 044Federal tax on split income (from line 5 of Form T1206)42445Add lines 44 and 45404- 0- 046Enter the amount from line 35 from prior page (Non-refundable Tax Credit)3504742348Federal dividend tax credit (see line 425 in the guide)42549Overseas employment tax credit (attach Form T626)42650Minimum tax carryover (attach Form T691)42751Add lines 47 to 5152Basic federal tax: Line 46 minus line 51 (if negative, enter "0")42953Federal foreign tax credit (attach FormT2209)40554Federal logging tax creditFederal tax: Line 53 minus line 54 (if negative, enter"0")40655Total federal political contributions (attach receipts)40956 Federal political contribution tax credit (use federal worksheet)(max $650)41057Investment tax credit (attach Form T2038(IND))41258Labour sponsored funds tax credit413Net cost Allowable credit41459Add lines 57, 58 and 5941660Line 55 minus line 60 (if negative, enter "0")41761(if you have an amount on line 45 above, see Form T1206)Working income tax benefit (WITB) advance payments received (box 10 on the RC210 slip)41562Additional tax on RESP accumulated income payments (attach Form T1172)41863Net Federal Tax: add line 61, 62 and 6342064 Enter this amount on line 420 of your returnCPP PayableFederal Tax WithheldPayable (Refund) Net Employment IncomeNet Employment IncomeAP 3-12Gross salary82500Add Taxable Benefits:Bonus 20000Auto Benefit 7460Stock Option Benefit 3000imputted Interest Benefit 375Councelling fees1500114835Deductions from Employment Income: Professional Dues -3200Professional Dues -1800Net Employment Income109835NON-Income items:Income tax 16000CPP & EI3452Donations2000 Auto benefit AP 3-10CALCULATION OF STANDBY CHARGE - FOR PURCHASED AND LEASED VEHICLESPURCHASEDLEASED(expect a combination)Personal Km driven6000Total kilometres driven10000- 0Business portion as a %0.4ER pays 100% of

- 61. operating costs1Capital Cost of vehicle including GST/HST47500- 0Monthly Lease payment including GST/HSTEE paid ER0EE had the vehicle for 365 days (convert to months)10STANDBY CHARGE CALCULATION 6(1)(e)Lesser of:1) 2% X cost of vehicle X months vehicle available9500- 0 or 2/3 X monthly lease cost X months vehicle available0- 02) Standby Charge Reduction (A/B) A=Personal KM divided by B=(1,667km X months vehicle available)6000/(1667*10) Standby Charge Reduction Amount (calculation in 1 x % in 2)0- 0 Total standby charge (lesser of 1 & 2)A9500- 0OPERATING BENEFIT 6(1)(k)Lesser of:1) 1/2 of standby charge if applicable0- 02) $.26 x personal KM driven1560- 0 Operating Benefit - elected (lesser of 1 & 2)1560- 0 Less EE payments to ER3600- 0 Total Operating BenefitB5160- 0 Taxable benefit- automobileA + B7460- 0 Stock optionsSTOCK OPTIONSAP 3- 10PUBLICPRIVATECORPORATIONCORPORATION1) Issuance Date -1,000 sharesNO TAX EFFECTNO TAX EFFECTFMV @ issuance @OPTION PRICE @ 2) Exercise DateNO TAX EFFECTFMV @ exercise18OPTION PRICE or ACB153add to net employment income 50% Deduction permitted deducted between NITP & TI Net inclusion to taxable income30003) Disposal DatePOD20000Adjusted Cost18000Capital Gain (Loss)20000add to net employment income50% Rate 0.50.5deducted between NIFTP & TITaxable Capital Gain/(Loss)10000 Sch 1 (2018) TemplateStep 1 - Federal non-refundable tax credits Schedule 1Tax Software problem - AP 4-1Basic personal amount Claim $11,80930011,809Age amount (if you were born in 1950 or earlier) (use federal worksheet)(maximum $7,333)3017,333Spouse or common-law partner amount (if negative, enter "0")$11,809 minus (3,200_ his or her net income from page 1 of your return)3038,609Amount for an eligible dependant (attach Schedule 5) (if negative, enter "0")$11,809

- 62. minus (__________ his or her net income)305Family caregiver amount for children born under 18 years of age 352_____ x $2,1823676,986Amount for infirm dependants age 18 or older (use federal worksheet and attach Schedule 5)306CPP or QPP contributions:through employment from box 16 and box 17 on all T4 slips(maximum $2,594)308on self- employment and other earnings (attach Schedule 8)310Employment Insurance permiums from box 18 and box 55 on all T4 slips(maximum $858)312273on self-employment and other eligible earnings (attach schedule 13) 317Volunteer firefighters' amount362Search and rescue volunteers' amount395Canada employment amount(if you reported employment income on line 101 or line 104, see line 363 in guide)(maximum $1,195)3631,195Public transit amount364Children's arts amount370Home Buyers' Amount369Home Accessibility (maximum $10,000)3985,800Adoption expenses313Pension income amount (use federal worksheet)(maximum $2,000)314Caregiver amount (use federal worksheet and attach Schedule 5) (maximum $6,986)315Disability amount (for self) (claim $8,235 or, if you were under age 18, use federal worksheet)316Disablility amount transferred from a dependant (use federal worksheet)3188,235Interest paid on your student loans319Your Tuition, education, and textbook amounts (attach Schedule 11)323Tuition, education, and textbook amounts transferred from a child324Amounts transferred from your spouse or common-law partner (attach Schedule 2)326Medical expenses for self, spouse or common-law partner, and yourdependent children born in 1999 or later3302,80026Minus: $2,302 or 3% of line 236, whichever is less49527Subtotal (if negative, enter "0")2,30528Allowable amount of medical expenses for other dependants(do the calculation at line 331 in the guide and attach Schedule 5)3311,12529Add lines 28 and 293,4303323,430Add lines 1 to 3033553,943.00Federal non- refundable tax credit rate15%Multiply line 31 by line 323388,091Donations and gifts (15% on first $200 and 29%

- 63. thereafter)or (15% on first $200 and 33% thereafter)349(Enter amount on line 47 on next page)Total federal non-refundable tax credits: add lines 33 and 34.350Step 2 - Federal Tax on Taxable Income Schedule 1Enter your taxable income from line 260 of your return- 036If line 37 is >If line 37 is >If line 37 is >Use the amount on line 39 to determine which If line 37 is $46,605 but <$93208 but <$144,489 but <If line 37 is >one of the following columns you have to complete$46,605 or less$93,208$144,489$205,842$205,842 Enter the amount from line 3616,500- 0- 037 Base amount- 046,60593,208144,489205,84238 Line 37 minus line 38 (cannot be negative)- 0- 039 Rate X15%20.5%26%29%33%40 Multiply line 39 by line 40- 0- 041 Tax on base amountNIL6,99116,54429,87747,67042Add lines 41 and 422,475- 0- 043 Go to Step 3 Go to Step 3 Go to Step 3 Go to Step 3 Go to Step 3Step 3 - Net Federal TaxEnter the amount from line 43 above2,47544Federal tax on split income (from line 5 of Form T1206)42445Add lines 44 and 454042,4752,47546Enter the amount from line 35 from prior page (Non-refundable Tax Credit)3508,0914742348Federal dividend tax credit (see line 425 in the guide)42549Overseas employment tax credit (attach Form T626)42650Minimum tax carryover (attach Form T691)42751Add lines 47 to 518,09152Basic federal tax: Line 46 minus line 51 (if negative, enter "0")42953Federal foreign tax credit (attach FormT2209)40554Federal logging tax creditFederal tax: Line 53 minus line 54 (if negative, enter"0")40655Total federal political contributions (attach receipts)40956 Federal political contribution tax credit (use federal worksheet)(max $650)41057Investment tax credit (attach Form T2038(IND))41258Labour sponsored funds tax credit413Net cost Allowable credit41459Add lines 57, 58 and 5941660Line 55 minus line 60 (if negative, enter "0")41761(if you have an amount on line 45 above, see Form T1206)Working income tax benefit (WITB) advance payments received (box 10 on the RC210 slip)41562Additional tax on

- 64. RESP accumulated income payments (attach Form T1172)41863Net Federal Tax: add line 61, 62 and 6342064 Enter this amount on line 420 of your returnEI Payable20Refundable tax benefitsmedical Exp supplement857Federal Tax Withheld500Refundable tax benefitsWorking income tax benefit 1,624Installments4,000Provincial Credits116Payable (Refund)7,117 Sch 1 (2018) Template2Tax Software problem - AP 4-3Step 1 - Federal non-refundable tax credits Schedule 1Basic personal amount Claim $11,80930011,809Age amount (if you were born in 1950 or earlier) (use federal worksheet)(maximum $7,333)30111,809Spouse or common-law partner amount (if negative, enter "0")$11,809 minus (_______ his or her net income from page 1 of your return)303Amount for an eligible dependant (attach Schedule 5) (if negative, enter "0")$11,809 minus (__________ his or her net income)305Family caregiver amount for children born under 18 years of age 352_____ x $2,182367Amount for infirm dependants age 18 or older (use federal worksheet and attach Schedule 5)306CPP or QPP contributions:through employment from box 16 and box 17 on all T4 slips(maximum $2,594)3082,594on self-employment and other earnings (attach Schedule 8)310Employment Insurance permiums from box 18 and box 55 on all T4 slips(maximum $858)312858on self-employment and other eligible earnings (attach schedule 13) 317Volunteer firefighters' amount362Search and rescue volunteers' amount395Canada employment amount(if you reported employment income on line 101 or line 104, see line 363 in guide)(maximum $1,195)3631,195Public transit amount364Children's arts amount370Home Buyers' Amount369Home Accessibility (maximum $10,000)Adoption expenses313Pension income amount (use federal worksheet)(maximum $2,000)314Caregiver amount (use federal worksheet and attach Schedule 5)

- 65. (maximum $6,986)315Disability amount (for self) (claim $8,235 or, if you were under age 18, use federal worksheet)316Disablility amount transferred from a dependant (use federal worksheet)318Interest paid on your student loans319Your Tuition, education, and textbook amounts (attach Schedule 11)323Tuition, education, and textbook amounts transferred from a child324Amounts transferred from your spouse or common-law partner (attach Schedule 2)326Medical expenses for self, spouse or common-law partner, and yourdependent children born in 1999 or later33026Minus: $2,302 or 3% of line 236, whichever is less27Subtotal (if negative, enter "0")28Allowable amount of medical expenses for other dependants(do the calculation at line 331 in the guide and attach Schedule 5)33129Add lines 28 and 2933228,265Add lines 1 to 30335Federal non-refundable tax credit rate15%Multiply line 31 by line 323384,240Donations and gifts (15% on first $200 and 29% thereafter)or (15% on first $200 and 33% thereafter)349479(Enter amount on line 47 on next page)Total federal non-refundable tax credits: add lines 33 and 34.3504,719Step 2 - Federal Tax on Taxable Income Schedule 1Enter your taxable income from line 260 of your return- 036If line 37 is >If line 37 is >If line 37 is >Use the amount on line 39 to determine which If line 37 is $46,605 but <$93208 but <$144,489 but <If line 37 is >one of the following columns you have to complete$46,605 or less$93,208$144,489$205,842$205,842 Enter the amount from line 36152,866- 037 Base amount- 046,60593,208144,489205,84238 Line 37 minus line 38 (cannot be negative)8,377- 039 Rate X15%20.5%26%29%33%40 Multiply line 39 by line 40- 0- 02,429- 041 Tax on base amountNIL6,99116,54429,87747,67042Add lines 41 and 422,429- 043 Go to Step 3 Go to Step 3 Go to Step 3 Go to Step 3 Go to Step 3Step 3 - Net Federal TaxEnter the amount from line 43 above32,30644Federal tax on split income (from line 5 of Form T1206)42445Add lines 44 and

- 66. 4540432,30632,30646Enter the amount from line 350 from prior page (Non-refundable Tax Credit)3504,7194742348Federal dividend tax credit (see line 425 in the guide)42549Overseas employment tax credit (attach Form T626)42650Minimum tax carryover (attach Form T691)42751Add lines 47 to 514,71952Basic federal tax: Line 46 minus line 51 (if negative, enter "0")42953Federal foreign tax credit (attach FormT2209)40554Federal logging tax creditFederal tax: Line 53 minus line 54 (if negative, enter"0")40627,58755Total federal political contributions (attach receipts)40956 Federal political contribution tax credit (use federal worksheet)(max $650)41057Investment tax credit (attach Form T2038(IND))41258Labour sponsored funds tax credit413Net cost Allowable credit41459Add lines 57, 58 and 5941660Line 55 minus line 60 (if negative, enter "0")41761(if you have an amount on line 45 above, see Form T1206)Working income tax benefit (WITB) advance payments received (box 10 on the RC210 slip)41562Additional tax on RESP accumulated income payments (attach Form T1172)41863Net Federal Tax: add line 61, 62 and 6342064 Enter this amount on line 420 of your returnProvincial tax 19,494Federal Tax Withheld48,665Climate Action Incentive224Payable (Refund)(1,808) Net Employment IncomeNet Employment IncomeAP 3-4Gross salary120000.0Add Taxable Benefits:Auto Benefit 3628.0743851229754Stock Option Benefit 13000.0Personal Fitness Trainer Fees 700.0137328.07438512298Deductions from Employment Income: Union Dues-100.0Computer Related Supplies-550.0Net Employment Income136678.07438512298NON-Income items:Private Health Care employee900.0Private Health Care employer1800.0Cash Award2000.0income in 2019Discounts on Merchandise560.0Take out meals 1200.0 Auto benefit AP 3-4CALCULATION OF STANDBY CHARGE - FOR PURCHASED AND LEASED

- 67. VEHICLESPURCHASEDLEASED(expect a combination)Personal Km driven6000.0Total kilometres driven81000.0- 0Business portion as a %0.9259259259259259ER pays 100% of operating costs1.0Capital Cost of vehicle including GST/HST33600.0- 0Monthly Lease payment including GST/HSTEE paid ER0.0EE had the vehicle for 365 days (convert to months)12.0STANDBY CHARGE CALCULATION 6(1)(e)Lesser of:1) 2% X cost of vehicle X months vehicle available8064.0- 0 or 2/3 X monthly lease cost X months vehicle available0.0- 02) Standby Charge Reduction (A/B) A=Personal KM divided by B=(1,667km X months vehicle available)0.299940011997600456000/(1667*12) Standby Charge Reduction Amount (calculation in 1 x % in 2)2418.7162567486503- 0 Total standby charge (lesser of 1 & 2)A2418.7162567486503- 0OPERATING BENEFIT 6(1)(k)Lesser of:1) 1/2 of standby charge if applicable1209.3581283743251- 02) $.26 x personal KM driven1560.0- 0 Operating Benefit - elected (lesser of 1 & 2)1560.0- 0 Less EE payments to ER0.0- 0 Total Operating BenefitB1560.0- 0 Taxable benefit-automobileA + B3628.0743851229754- 0 Stock optionsSTOCK OPTIONSAP 3- 4PUBLICPRIVATECORPORATIONCORPORATION1) Issuance Date -1,000 sharesNO TAX EFFECTNO TAX EFFECTFMV @ issuance @OPTION PRICE @ 2) Exercise DateNO TAX EFFECTFMV @ exerciseOPTION PRICE or ACBadd to net employment income 50% Deduction permitted deducted between NITP & TI Net inclusion to taxable income3) Disposal DatePOD48000.0Adjusted Cost35000.0Capital Gain (Loss)13000.0add to net employment income50% Rate 0.5deducted between NIFTP & TITaxable Capital Gain/(Loss)6500.0 NIFTPAP 1-12 (CASE ONE)Net Income For Tax Purposes - TemplateIncome Under ITA 3(a)- 0Employment Income62350.0(cannot be negative)Business Income (if loss see

- 68. ITA 3(d))(cannot be negative)Property Income-interest, dividends,rental(cannot be negative)Other Income62350.0(cannot be negative)Income Under ITA 3(b)Taxable capital gains48825.0Allowable capital losses2715.046110.0(cannot be negative)Balance from ITA 3(a) and (b)108460.0Subdivision e deductions-4560.0Balance under ITA 3(c )103900.0Deductions under ITA 3(d)Business Loss- 115600.0Rental loss0.0-115600.0Net income for Tax Purposes (NITP - Div B Income)NIL(cannot be negative) NET CAPITAL LOSS CARRY FORWARD NON CAPITAL LOSS CARRY FORWARD-11700.0AP 1-12 (CASE TWO)Income Under ITA 3(a)Employment Income45600.0Business Income (if loss see ITA 3(d))27310.072910.0Property Income-interest, dividends,rentalOther IncomeIncome Under ITA 3(b)Taxable capital gains15810.0Allowable capital losses20825.00.072910.0Balance from ITA 3(a) and (b)Subdivision e deductions-7200.0Balance under ITA 3(c )65710.0Deductions under ITA 3(d)Business LossRental loss- 4600.0Net income for Tax Purposes (NITP - Div B Income)61110.0 NET CAPITAL LOSS CARRY FORWARD NON CAPITAL LOSS CARRY FORWARD-5015.0 Sch 1 (2018) TemplateStep 1 - Federal non-refundable tax credits Schedule 1Basic personal amount Claim $11,809300Age amount (if you were born in 1950 or earlier) (use federal worksheet)(maximum $7,333)301Spouse or common-law partner amount (if negative, enter "0")$11,809 minus (_______ his or her net income from page 1 of your return)303Amount for an eligible dependant (attach Schedule 5) (if negative, enter "0")$11,809 minus (__________ his or her net income)305Family caregiver amount for children born under 18 years of age 352_____ x $2,182367Amount for infirm dependants age 18 or older (use federal worksheet and attach Schedule 5)306CPP or QPP contributions:through employment from box 16 and box 17 on all T4 slips(maximum $2,594)308on self-employment and

- 69. other earnings (attach Schedule 8)310Employment Insurance permiums from box 18 and box 55 on all T4 slips(maximum $858)312on self-employment and other eligible earnings (attach schedule 13) 317Volunteer firefighters' amount362Search and rescue volunteers' amount395Canada employment amount(if you reported employment income on line 101 or line 104, see line 363 in guide)(maximum $1,195)363Public transit amount364Children's arts amount370Home Buyers' Amount369Home Accessibility (maximum $10,000)Adoption expenses313Pension income amount (use federal worksheet)(maximum $2,000)314Caregiver amount (use federal worksheet and attach Schedule 5) (maximum $6,986)315Disability amount (for self) (claim $8,235 or, if you were under age 18, use federal worksheet)316Disablility amount transferred from a dependant (use federal worksheet)318Interest paid on your student loans319Your Tuition, education, and textbook amounts (attach Schedule 11)323Tuition, education, and textbook amounts transferred from a child324Amounts transferred from your spouse or common-law partner (attach Schedule 2)326Medical expenses for self, spouse or common-law partner, and yourdependent children born in 1999 or later33026Minus: $2,302 or 3% of line 236, whichever is less27Subtotal (if negative, enter "0")28Allowable amount of medical expenses for other dependants(do the calculation at line 331 in the guide and attach Schedule 5)33129Add lines 28 and 29332Add lines 1 to 30335Federal non-refundable tax credit rate15%Multiply line 31 by line 32338Donations and gifts (15% on first $200 and 29% thereafter)or (15% on first $200 and 33% thereafter)349(Enter amount on line 47 on next page)Total federal non-refundable tax credits: add lines 33 and 34.350Step 2 - Federal Tax on Taxable Income Schedule 1Enter your taxable income from line 260 of your return- 036If line 37 is >If line 37 is >If line 37 is >Use the amount on line 39 to determine which If line 37 is $46,605 but <$93208 but

- 70. <$144,489 but <If line 37 is >one of the following columns you have to complete$46,605 or less$93,208$144,489$205,842$205,842 Enter the amount from line 36- 0- 037 Base amount- 046,60593,208144,489205,84238 Line 37 minus line 38 (cannot be negative)- 0- 039 Rate X15%20.5%26%29%33%40 Multiply line 39 by line 40- 0- 041 Tax on base amountNIL6,99116,54429,87747,67042Add lines 41 and 42- 0- 043 Go to Step 3 Go to Step 3 Go to Step 3 Go to Step 3 Go to Step 3Step 3 - Net Federal TaxEnter the amount from line 43 above- 044Federal tax on split income (from line 5 of Form T1206)42445Add lines 44 and 45404- 0- 046Enter the amount from line 35 from prior page (Non-refundable Tax Credit)3504742348Federal dividend tax credit (see line 425 in the guide)42549Overseas employment tax credit (attach Form T626)42650Minimum tax carryover (attach Form T691)42751Add lines 47 to 5152Basic federal tax: Line 46 minus line 51 (if negative, enter "0")42953Federal foreign tax credit (attach FormT2209)40554Federal logging tax creditFederal tax: Line 53 minus line 54 (if negative, enter"0")40655Total federal political contributions (attach receipts)40956 Federal political contribution tax credit (use federal worksheet)(max $650)41057Investment tax credit (attach Form T2038(IND))41258Labour sponsored funds tax credit413Net cost Allowable credit41459Add lines 57, 58 and 5941660Line 55 minus line 60 (if negative, enter "0")41761(if you have an amount on line 45 above, see Form T1206)Working income tax benefit (WITB) advance payments received (box 10 on the RC210 slip)41562Additional tax on RESP accumulated income payments (attach Form T1172)41863Net Federal Tax: add line 61, 62 and 6342064 Enter this amount on line 420 of your returnCPP PayableFederal Tax WithheldPayable (Refund)

- 71. Solution to Assignment Problem One - 12 Case One The Case One solution would be calculated as follows: Income Under ITA 3(a): Net Employment Income$62,350 Income Under ITA 3(b): Taxable Capital Gains [(1/2)($97,650)]$48,825 Allowable Capital Losses [(1/2)($5,430)]( 2,715)46,110 Balance From ITA 3(a) And (b)$108,460 Subdivision e Deduction: Deductible RRSP Contribution( 4,560) Balance From ITA 3(c)$103,900 Deduction Under ITA 3(d): Net Business Loss( 115,600) Net Income For Tax Purposes (Division B Income) Nil In this Case, Karla has an unused business loss carry over of

- 72. $11,700 ($103,900 - $115,600). Case Two The Case Two solution would be calculated as follows: Income Under ITA 3(a): Net Employment Income$45,600 Net Business Income 27,310 $72,910 Income Under ITA 3(b): Taxable Capital Gains [(1/2)($31,620)]$15,810 Allowable Capital Losses [(1/2)($41,650)]( 20,825)Nil Balance From ITA 3(a) And (b)$72,910 Subdivision e Deduction: Spousal Support Payments [(12)($600)]( 7,200) Balance From ITA 3(c)$65,710 Deduction Under ITA 3(d): Net Rental Loss( 4,600) Net Income For Tax Purposes (Division B Income) $61,110 In this Case, Karla has an unused allowable capital loss carry over of $5,015 ($20,825 - $15,810). As Karla’s gambling

- 73. activity does not appear to be substantial enough to be considered a business, the $46,000 in winnings would not be taxable.