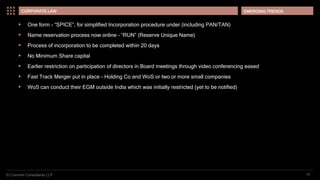

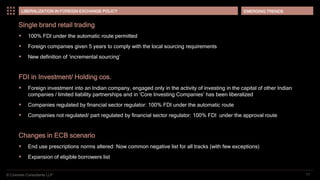

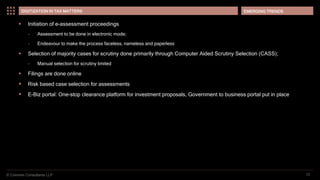

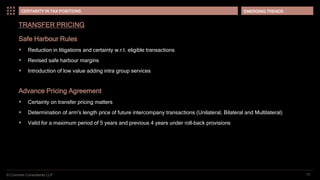

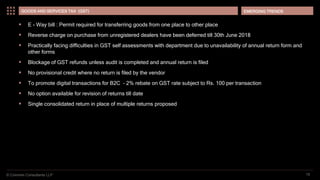

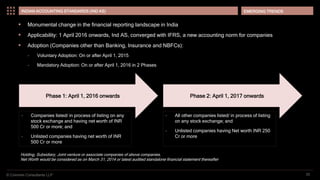

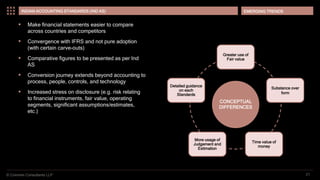

The document discusses emerging trends in India's finance, tax, and regulatory framework. It outlines macroeconomic factors like GDP growth and improvements to ease of doing business. Key government initiatives promoting digitization, tax reform through GST, a new insolvency code, and liberalized FDI are summarized. Changes aligning tax and regulatory practices with international standards like the OECD's BEPS project are also covered at a high-level.